Key Insights

The Truck Platooning Technology market is experiencing robust growth, projected to reach a significant size with a Compound Annual Growth Rate (CAGR) of 22.25% from 2025 to 2033. This expansion is driven by several key factors. Firstly, increasing fuel efficiency demands and the consequent cost savings associated with platooning are a major incentive for adoption. Secondly, advancements in autonomous driving technologies, including improved sensor capabilities, sophisticated algorithms, and enhanced vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication, are paving the way for safer and more efficient autonomous truck platooning. The regulatory landscape is also evolving, with governments worldwide recognizing the potential of platooning to alleviate traffic congestion and improve road safety, leading to supportive policies and initiatives. Furthermore, the growth of e-commerce and the resulting surge in freight transportation are creating a strong demand for innovative solutions like truck platooning to optimize logistics and delivery efficiency. The market is segmented by platooning type (driver-assistive and autonomous), technology type (adaptive cruise control, automated emergency braking, etc.), and infrastructure type (V2V, V2I, GPS). Key players in this dynamic market include established automotive manufacturers and technology providers, constantly innovating to enhance the safety and economic viability of truck platooning systems.

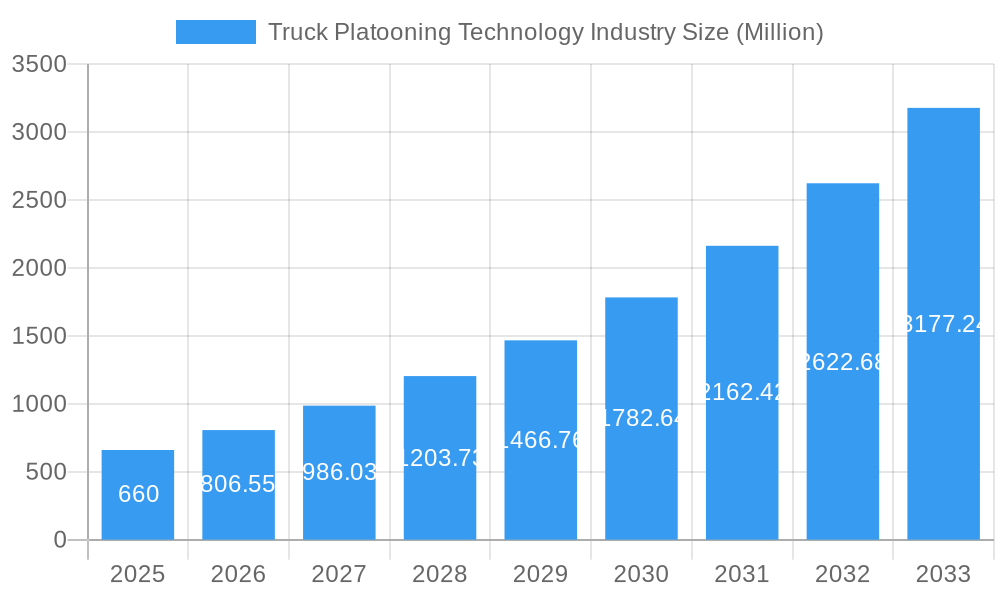

Truck Platooning Technology Industry Market Size (In Million)

The market's segmentation presents both opportunities and challenges. While driver-assistive truck platooning currently dominates the market, the autonomous segment is poised for significant growth in the coming years, driven by technological advancements and decreasing implementation costs. Different regions are also experiencing varying rates of adoption, with North America and Europe leading the way due to supportive regulatory environments and advanced infrastructure. However, the high initial investment costs associated with implementing truck platooning systems, along with concerns about cybersecurity and data privacy, could pose significant restraints on market growth. Nevertheless, overcoming these challenges through collaborative efforts between industry stakeholders and governments will be crucial in unlocking the full potential of truck platooning technology and shaping the future of the freight transportation industry. The ongoing integration of advanced technologies, such as artificial intelligence and machine learning, will further enhance the efficiency, safety, and scalability of this burgeoning market.

Truck Platooning Technology Industry Company Market Share

Truck Platooning Technology Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Truck Platooning Technology industry, offering valuable insights for stakeholders seeking to understand market trends, competitive dynamics, and future growth opportunities. The report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. The market size is projected to reach xx Million by 2033.

Truck Platooning Technology Industry Market Structure & Competitive Dynamics

The Truck Platooning Technology industry is characterized by a moderately concentrated market structure, with several key players dominating the landscape. Market share is primarily divided among established automotive manufacturers like Daimler Truck AG, Daimler Truck AG, Paccar Inc (DAF Trucks), AB Volvo, and Volkswagen Group (MAN Scania), as well as Tier-1 automotive suppliers such as Continental AG, Continental AG, Robert Bosch GmbH, ZF Friedrichshafen, and Wabco Holdings Inc. The industry’s innovation ecosystem is dynamic, with significant R&D investments driving advancements in autonomous driving technologies, connectivity solutions, and sensor technologies. Regulatory frameworks, particularly concerning safety and data privacy, are evolving and play a crucial role in shaping market growth. Product substitutes are limited, with truck platooning primarily competing with traditional trucking methods. End-user trends favor increased efficiency, reduced fuel consumption, and enhanced safety, boosting the adoption of truck platooning technologies. M&A activities have been moderate, with deal values ranging from xx Million to xx Million in recent years, primarily focused on strengthening technological capabilities and expanding market reach.

- Market Concentration: Moderate, with key players holding significant market share.

- Innovation Ecosystem: Dynamic, driven by R&D investments in autonomous driving, connectivity, and sensor technologies.

- Regulatory Frameworks: Evolving, influencing safety standards and data privacy.

- Product Substitutes: Limited, primarily traditional trucking methods.

- End-User Trends: Focus on efficiency, fuel savings, and safety.

- M&A Activity: Moderate, with deal values averaging xx Million.

Truck Platooning Technology Industry Industry Trends & Insights

The Truck Platooning Technology industry is experiencing significant growth, driven by a multitude of factors. The increasing demand for efficient and cost-effective logistics solutions is a primary driver, alongside growing concerns about driver shortages and the need for enhanced road safety. Technological advancements in areas such as AI, sensor technologies, and communication protocols are also fueling market expansion. The adoption of driver-assistive technologies is currently higher than autonomous truck platooning, but the latter is expected to show a higher CAGR over the forecast period. Market penetration is gradually increasing, particularly in developed regions with well-established infrastructure. Competitive dynamics are marked by ongoing innovation, strategic partnerships, and a focus on developing integrated solutions that offer enhanced functionality and improved cost-effectiveness. The industry's CAGR is projected to be xx% from 2025 to 2033, with significant growth anticipated in autonomous truck platooning segments.

Dominant Markets & Segments in Truck Platooning Technology Industry

The North American and European regions currently dominate the Truck Platooning Technology market. However, significant growth potential exists in Asia-Pacific, driven by expanding infrastructure and increasing freight volumes.

By Platooning Type:

- Driver-Assistive Truck Platooning (DATP): Currently holds a larger market share due to higher maturity and faster adoption. Key drivers include lower initial investment costs and ease of integration with existing fleet management systems.

- Autonomous Truck Platooning: Demonstrates significant growth potential due to long-term cost savings and efficiency gains. Key barriers include technological hurdles, regulatory uncertainties, and public acceptance.

By Technology Type:

- Adaptive Cruise Control: Widely adopted, forming the foundation for advanced driver-assistance systems (ADAS).

- Forward Collision Warning/Automated Emergency Braking/Active Brake Assist: Critical safety features with high adoption rates.

- Lane Keep Assist: Contributes to enhanced safety and driver comfort.

- Vehicle-to-Vehicle (V2V) and Vehicle-to-Infrastructure (V2I): Enabling communication and coordination between vehicles and infrastructure, crucial for autonomous platooning.

- Global Positioning System (GPS): Essential for navigation and precise positioning.

Key Drivers:

- Government support and economic policies: Investment in infrastructure development and funding for research and development projects.

- Improved logistics efficiency: Reduced fuel consumption, optimized routing, and faster delivery times.

- Addressing driver shortage: Automation reducing reliance on human drivers.

- Enhanced road safety: Advanced safety features significantly reduce accident rates.

Truck Platooning Technology Industry Product Innovations

Recent product innovations focus on enhancing the reliability and safety of truck platooning systems. This includes the development of more sophisticated sensor technologies, improved communication protocols, and more robust AI algorithms for autonomous driving capabilities. These innovations are improving market fit by addressing concerns about reliability and safety, expanding the applicability of truck platooning to a wider range of operating conditions.

Report Segmentation & Scope

This report segments the Truck Platooning Technology market by Platooning Type (DATP and Autonomous), Technology Type (Adaptive Cruise Control, Forward Collision Warning, Automated Emergency Braking, Active Brake Assist, Lane Keep Assist, Others), and Infrastructure Type (V2V, V2I, GPS). Each segment's growth projections, market sizes, and competitive dynamics are analyzed comprehensively. For example, the DATP segment is expected to grow at a xx% CAGR, while the autonomous segment is expected to demonstrate a higher xx% CAGR over the forecast period. The market size for V2V communication technology is estimated at xx Million in 2025 and projected to reach xx Million by 2033.

Key Drivers of Truck Platooning Technology Industry Growth

Technological advancements, particularly in autonomous driving, sensor technologies, and communication systems, are major drivers of market growth. Furthermore, favorable government policies and economic incentives, such as subsidies and tax breaks, are boosting adoption. The increasing demand for efficient and sustainable transportation solutions is another key driver, along with the growing need to address driver shortages in the trucking industry. These factors collectively are pushing the industry toward broader adoption and significant market expansion.

Challenges in the Truck Platooning Technology Industry Sector

The industry faces several challenges, including high initial investment costs associated with deploying platooning technology, the need for robust and reliable communication infrastructure, and regulatory uncertainties surrounding autonomous driving. Supply chain disruptions can also impact the availability of critical components, while significant competition from established players and new entrants presents an ongoing challenge. The overall impact of these challenges is estimated to reduce the market growth by xx% in the short term.

Leading Players in the Truck Platooning Technology Industry Market

- Daimler Truck AG

- Wabco Holdings Inc

- NXP Semiconductors N V

- Toyota Motor Corporation (Toyota Tsusho)

- ZF Friedrichshafen

- Continental AG

- Peloton Technology

- Hyundai Motor Company

- Paccar Inc (DAF Trucks)

- Robert Bosch GmbH

- Iveco S p A

- Volkswagen Group (MAN Scania)

- Knorr-Bremse AG

- AB Volvo

Key Developments in Truck Platooning Technology Industry Sector

- December 2023: Softbank and West Japan Railway Company partner to research 5G-enabled V2V technology for BRT and truck platooning, aiming to improve logistics and address driver shortages.

- July 2023: FPInnovations collaborates with RRAI to adapt self-driving technology to off-highway forestry, completing initial tests for truck platooning to address driver skill shortages in Canada. Funded by Société du Plan Nord and Natural Resources Canada.

- March 2023: Ohmio collaborates with the Port Authority of New York and New Jersey, demonstrating three-vehicle platooning with driverless shuttles at JFK Airport.

Strategic Truck Platooning Technology Industry Market Outlook

The future of the Truck Platooning Technology industry is promising, with significant potential for growth driven by continuous technological advancements, supportive government policies, and increasing demand for efficient and sustainable transportation solutions. Strategic opportunities exist in developing innovative solutions that address the challenges of autonomous driving, enhancing safety features, and optimizing operational efficiency. The market is expected to witness a sustained period of expansion, fueled by the adoption of both driver-assistive and fully autonomous truck platooning technologies across various sectors.

Truck Platooning Technology Industry Segmentation

-

1. Platooning Type

- 1.1. Driver-Assistive Truck Platooning (DATP)

- 1.2. Autonomous Truck Platooning

-

2. Technology Type

- 2.1. Adaptive Cruise Control

- 2.2. Forward Collision Warning

- 2.3. Automated Emergency Braking

- 2.4. Active Brake Assist

- 2.5. Lane Keep Assist

- 2.6. Others (Blind Spot Warning, etc.)

-

3. Infrastructure Type

- 3.1. Vehicle-to-Vehicle (V2V)

- 3.2. Vehicle-to-Infrastructure (V2I)

- 3.3. Global Positioning System (GPS)

Truck Platooning Technology Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Truck Platooning Technology Industry Regional Market Share

Geographic Coverage of Truck Platooning Technology Industry

Truck Platooning Technology Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 22.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Governments' Aggressive Push Towards Lowering Fuel Consumption and Co2 Emission of Vehicles to Foster the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. High Cost of Platooning Technology Deters Market Growth

- 3.4. Market Trends

- 3.4.1. Adaptive Cruise Control Segment to Gain Traction during the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Truck Platooning Technology Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Platooning Type

- 5.1.1. Driver-Assistive Truck Platooning (DATP)

- 5.1.2. Autonomous Truck Platooning

- 5.2. Market Analysis, Insights and Forecast - by Technology Type

- 5.2.1. Adaptive Cruise Control

- 5.2.2. Forward Collision Warning

- 5.2.3. Automated Emergency Braking

- 5.2.4. Active Brake Assist

- 5.2.5. Lane Keep Assist

- 5.2.6. Others (Blind Spot Warning, etc.)

- 5.3. Market Analysis, Insights and Forecast - by Infrastructure Type

- 5.3.1. Vehicle-to-Vehicle (V2V)

- 5.3.2. Vehicle-to-Infrastructure (V2I)

- 5.3.3. Global Positioning System (GPS)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Platooning Type

- 6. North America Truck Platooning Technology Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Platooning Type

- 6.1.1. Driver-Assistive Truck Platooning (DATP)

- 6.1.2. Autonomous Truck Platooning

- 6.2. Market Analysis, Insights and Forecast - by Technology Type

- 6.2.1. Adaptive Cruise Control

- 6.2.2. Forward Collision Warning

- 6.2.3. Automated Emergency Braking

- 6.2.4. Active Brake Assist

- 6.2.5. Lane Keep Assist

- 6.2.6. Others (Blind Spot Warning, etc.)

- 6.3. Market Analysis, Insights and Forecast - by Infrastructure Type

- 6.3.1. Vehicle-to-Vehicle (V2V)

- 6.3.2. Vehicle-to-Infrastructure (V2I)

- 6.3.3. Global Positioning System (GPS)

- 6.1. Market Analysis, Insights and Forecast - by Platooning Type

- 7. Europe Truck Platooning Technology Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Platooning Type

- 7.1.1. Driver-Assistive Truck Platooning (DATP)

- 7.1.2. Autonomous Truck Platooning

- 7.2. Market Analysis, Insights and Forecast - by Technology Type

- 7.2.1. Adaptive Cruise Control

- 7.2.2. Forward Collision Warning

- 7.2.3. Automated Emergency Braking

- 7.2.4. Active Brake Assist

- 7.2.5. Lane Keep Assist

- 7.2.6. Others (Blind Spot Warning, etc.)

- 7.3. Market Analysis, Insights and Forecast - by Infrastructure Type

- 7.3.1. Vehicle-to-Vehicle (V2V)

- 7.3.2. Vehicle-to-Infrastructure (V2I)

- 7.3.3. Global Positioning System (GPS)

- 7.1. Market Analysis, Insights and Forecast - by Platooning Type

- 8. Asia Pacific Truck Platooning Technology Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Platooning Type

- 8.1.1. Driver-Assistive Truck Platooning (DATP)

- 8.1.2. Autonomous Truck Platooning

- 8.2. Market Analysis, Insights and Forecast - by Technology Type

- 8.2.1. Adaptive Cruise Control

- 8.2.2. Forward Collision Warning

- 8.2.3. Automated Emergency Braking

- 8.2.4. Active Brake Assist

- 8.2.5. Lane Keep Assist

- 8.2.6. Others (Blind Spot Warning, etc.)

- 8.3. Market Analysis, Insights and Forecast - by Infrastructure Type

- 8.3.1. Vehicle-to-Vehicle (V2V)

- 8.3.2. Vehicle-to-Infrastructure (V2I)

- 8.3.3. Global Positioning System (GPS)

- 8.1. Market Analysis, Insights and Forecast - by Platooning Type

- 9. Rest of the World Truck Platooning Technology Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Platooning Type

- 9.1.1. Driver-Assistive Truck Platooning (DATP)

- 9.1.2. Autonomous Truck Platooning

- 9.2. Market Analysis, Insights and Forecast - by Technology Type

- 9.2.1. Adaptive Cruise Control

- 9.2.2. Forward Collision Warning

- 9.2.3. Automated Emergency Braking

- 9.2.4. Active Brake Assist

- 9.2.5. Lane Keep Assist

- 9.2.6. Others (Blind Spot Warning, etc.)

- 9.3. Market Analysis, Insights and Forecast - by Infrastructure Type

- 9.3.1. Vehicle-to-Vehicle (V2V)

- 9.3.2. Vehicle-to-Infrastructure (V2I)

- 9.3.3. Global Positioning System (GPS)

- 9.1. Market Analysis, Insights and Forecast - by Platooning Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Daimler Truck AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Wabco Holdings Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 NXP Semiconductors N V

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Toyota Motor Corporation (Toyota Tsusho)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 ZF Friedrichshafen

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Continental AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Peloton Technology

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Hyundai Motor Company

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Paccar Inc (DAF Trucks)

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Robert Bosch GmbH

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Iveco S p A

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Volkswagen Group (MAN Scania)

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Knorr-Bremse AG

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 AB Volvo

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.1 Daimler Truck AG

List of Figures

- Figure 1: Global Truck Platooning Technology Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Truck Platooning Technology Industry Revenue (Million), by Platooning Type 2025 & 2033

- Figure 3: North America Truck Platooning Technology Industry Revenue Share (%), by Platooning Type 2025 & 2033

- Figure 4: North America Truck Platooning Technology Industry Revenue (Million), by Technology Type 2025 & 2033

- Figure 5: North America Truck Platooning Technology Industry Revenue Share (%), by Technology Type 2025 & 2033

- Figure 6: North America Truck Platooning Technology Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 7: North America Truck Platooning Technology Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 8: North America Truck Platooning Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Truck Platooning Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Truck Platooning Technology Industry Revenue (Million), by Platooning Type 2025 & 2033

- Figure 11: Europe Truck Platooning Technology Industry Revenue Share (%), by Platooning Type 2025 & 2033

- Figure 12: Europe Truck Platooning Technology Industry Revenue (Million), by Technology Type 2025 & 2033

- Figure 13: Europe Truck Platooning Technology Industry Revenue Share (%), by Technology Type 2025 & 2033

- Figure 14: Europe Truck Platooning Technology Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 15: Europe Truck Platooning Technology Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 16: Europe Truck Platooning Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Truck Platooning Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Truck Platooning Technology Industry Revenue (Million), by Platooning Type 2025 & 2033

- Figure 19: Asia Pacific Truck Platooning Technology Industry Revenue Share (%), by Platooning Type 2025 & 2033

- Figure 20: Asia Pacific Truck Platooning Technology Industry Revenue (Million), by Technology Type 2025 & 2033

- Figure 21: Asia Pacific Truck Platooning Technology Industry Revenue Share (%), by Technology Type 2025 & 2033

- Figure 22: Asia Pacific Truck Platooning Technology Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 23: Asia Pacific Truck Platooning Technology Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 24: Asia Pacific Truck Platooning Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Truck Platooning Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Truck Platooning Technology Industry Revenue (Million), by Platooning Type 2025 & 2033

- Figure 27: Rest of the World Truck Platooning Technology Industry Revenue Share (%), by Platooning Type 2025 & 2033

- Figure 28: Rest of the World Truck Platooning Technology Industry Revenue (Million), by Technology Type 2025 & 2033

- Figure 29: Rest of the World Truck Platooning Technology Industry Revenue Share (%), by Technology Type 2025 & 2033

- Figure 30: Rest of the World Truck Platooning Technology Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 31: Rest of the World Truck Platooning Technology Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 32: Rest of the World Truck Platooning Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Truck Platooning Technology Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Truck Platooning Technology Industry Revenue Million Forecast, by Platooning Type 2020 & 2033

- Table 2: Global Truck Platooning Technology Industry Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 3: Global Truck Platooning Technology Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 4: Global Truck Platooning Technology Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Truck Platooning Technology Industry Revenue Million Forecast, by Platooning Type 2020 & 2033

- Table 6: Global Truck Platooning Technology Industry Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 7: Global Truck Platooning Technology Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 8: Global Truck Platooning Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Truck Platooning Technology Industry Revenue Million Forecast, by Platooning Type 2020 & 2033

- Table 13: Global Truck Platooning Technology Industry Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 14: Global Truck Platooning Technology Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 15: Global Truck Platooning Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Truck Platooning Technology Industry Revenue Million Forecast, by Platooning Type 2020 & 2033

- Table 22: Global Truck Platooning Technology Industry Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 23: Global Truck Platooning Technology Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 24: Global Truck Platooning Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: China Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: South Korea Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Truck Platooning Technology Industry Revenue Million Forecast, by Platooning Type 2020 & 2033

- Table 31: Global Truck Platooning Technology Industry Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 32: Global Truck Platooning Technology Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 33: Global Truck Platooning Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: South America Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Middle East and Africa Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Truck Platooning Technology Industry?

The projected CAGR is approximately 22.25%.

2. Which companies are prominent players in the Truck Platooning Technology Industry?

Key companies in the market include Daimler Truck AG, Wabco Holdings Inc, NXP Semiconductors N V, Toyota Motor Corporation (Toyota Tsusho), ZF Friedrichshafen, Continental AG, Peloton Technology, Hyundai Motor Company, Paccar Inc (DAF Trucks), Robert Bosch GmbH, Iveco S p A, Volkswagen Group (MAN Scania), Knorr-Bremse AG, AB Volvo.

3. What are the main segments of the Truck Platooning Technology Industry?

The market segments include Platooning Type, Technology Type, Infrastructure Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.66 Million as of 2022.

5. What are some drivers contributing to market growth?

Governments' Aggressive Push Towards Lowering Fuel Consumption and Co2 Emission of Vehicles to Foster the Growth of the Market.

6. What are the notable trends driving market growth?

Adaptive Cruise Control Segment to Gain Traction during the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Platooning Technology Deters Market Growth.

8. Can you provide examples of recent developments in the market?

In December 2023, Softbank announced its partnership with West Japan Railway Company to research 5G-enabled Vehicle-to-Vehicle (V2V) technology for a Bus Rapid Transit (BRT) system and truck platooning on Japanese highways. The research aims to enhance the country's logistics sector by facilitating advanced communication technology while assisting in addressing the issue of driver shortages.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Truck Platooning Technology Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Truck Platooning Technology Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Truck Platooning Technology Industry?

To stay informed about further developments, trends, and reports in the Truck Platooning Technology Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence