Key Insights

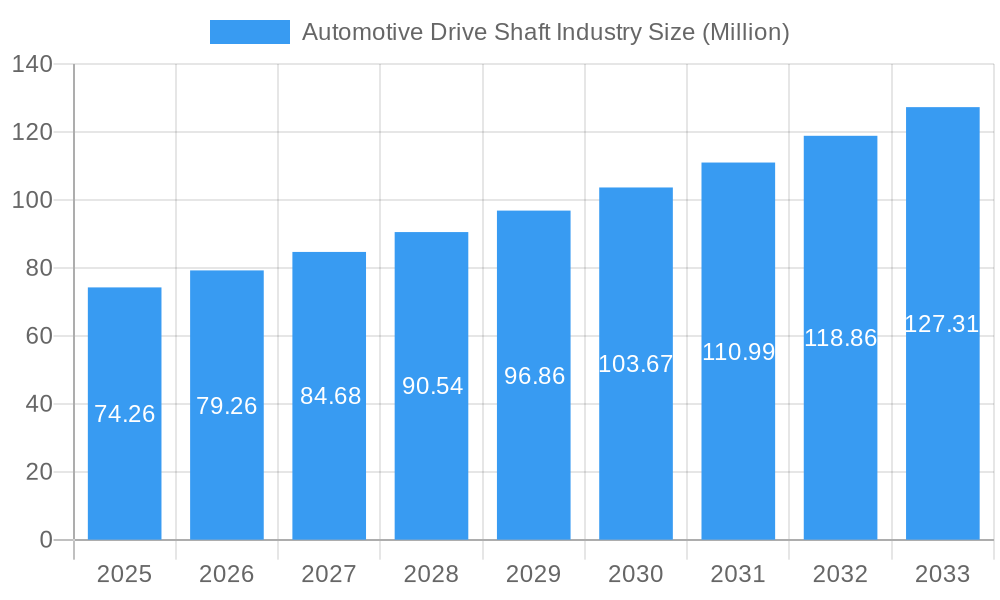

The automotive drive shaft market, valued at $74.26 million in 2025, is projected to experience robust growth, driven by the increasing demand for passenger cars and commercial vehicles globally. A Compound Annual Growth Rate (CAGR) of 6.54% from 2025 to 2033 indicates a significant expansion of this market. Several factors contribute to this growth. The rising adoption of advanced driver-assistance systems (ADAS) and the increasing popularity of electric vehicles (EVs) are key drivers, necessitating sophisticated and efficient drive shaft technologies. Furthermore, the global infrastructure development, particularly in emerging economies, is fueling the demand for commercial vehicles, leading to a subsequent increase in drive shaft requirements. Market segmentation reveals that the passenger car segment currently holds a larger share, but the commercial vehicle segment is expected to witness faster growth due to increasing construction and logistics activities worldwide. The aftermarket segment also presents a significant opportunity for growth, driven by the need for repair and replacement of drive shafts in older vehicles. Leading players like JTEKT Corporation, NTN Corporation, and Dana Holding Corporation are strategically investing in research and development to improve drive shaft durability, efficiency, and lightweight design to meet evolving industry demands. Competition is expected to remain intense as companies focus on innovation and cost optimization to gain market share.

Automotive Drive Shaft Industry Market Size (In Million)

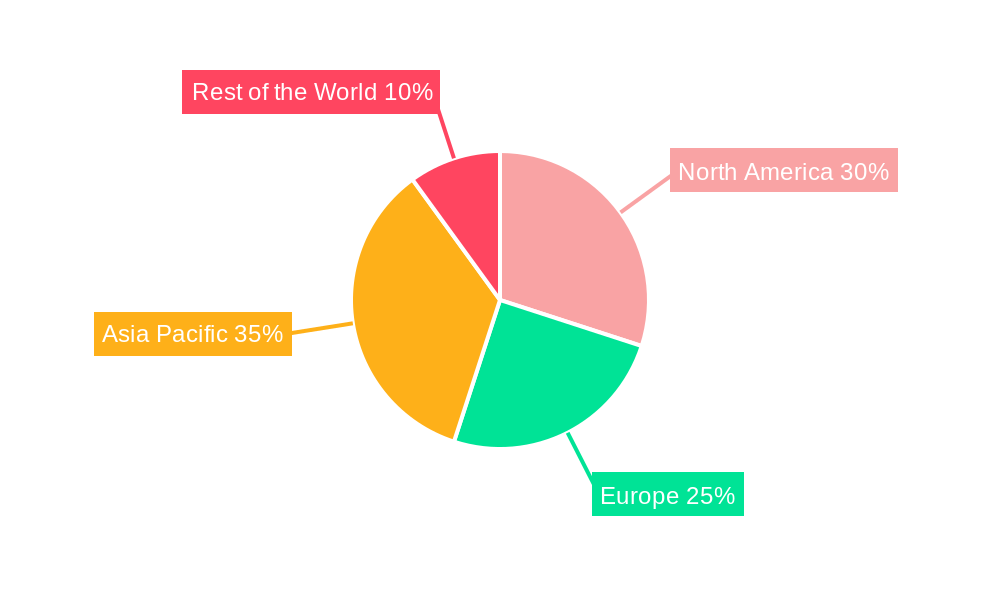

The geographic distribution of the market shows strong presence in North America and Europe, However, Asia-Pacific is expected to witness the most rapid growth, fueled by the burgeoning automotive industries in China and India. This growth in Asia-Pacific is anticipated to continue through the forecast period, driven by rising disposable incomes and increasing vehicle ownership. The regional distribution will continue to evolve, with emerging markets in Latin America and Africa presenting future growth potential. Market restraints include fluctuating raw material prices and stringent emission regulations, which necessitate ongoing innovation and adaptation within the industry. Companies are responding to these challenges by adopting sustainable manufacturing practices and developing lighter, more efficient drive shaft designs. The overall outlook for the automotive drive shaft market remains positive, with significant opportunities for growth across various segments and regions.

Automotive Drive Shaft Industry Company Market Share

Automotive Drive Shaft Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the global automotive drive shaft industry, encompassing market size, segmentation, competitive landscape, and future growth projections from 2019 to 2033. The study period covers historical data (2019-2024), the base year (2025), and a forecast period (2025-2033). Key players such as JTEKT Corporation, NTN Corporation, Dana Holding Corporation, GKN PLC (Melrose Industries PLC), Showa Corporation, Wanxiang Qianchao Co Ltd, American Axle & Manufacturing Co Ltd, Hyundai Wia Corporation, Nexteer Automotive Group Ltd, and Yamada Manufacturing Co Ltd are analyzed extensively. The report offers invaluable insights for industry stakeholders, investors, and strategists seeking to navigate this dynamic market.

Automotive Drive Shaft Industry Market Structure & Competitive Dynamics

The automotive drive shaft market exhibits a moderately consolidated structure with a few dominant players controlling a significant market share. Market concentration is influenced by factors such as economies of scale, technological capabilities, and global reach. Innovation plays a critical role, with companies continuously investing in research and development to improve product performance, durability, and fuel efficiency. Regulatory frameworks, particularly those related to emissions and safety, significantly influence design and manufacturing processes. Product substitutes, such as electric drive systems in EVs, pose a challenge but also present opportunities for diversification. End-user trends, such as the increasing demand for SUVs and commercial vehicles, affect segment-specific growth. M&A activities, while not excessively frequent, occasionally reshape the competitive landscape. For example, although specific M&A deal values for this industry aren't publicly available at this time, we estimate xx Million USD worth of deals occurred in the past five years, largely focused on strategic acquisitions enhancing technological capabilities or geographical reach.

- Market Share: Top 5 players hold an estimated xx% market share.

- M&A Activity: xx major mergers and acquisitions in the last 5 years.

- Innovation Ecosystems: Collaboration between OEMs and component suppliers is crucial for innovation.

- Regulatory Landscape: Stringent emission norms drive demand for lightweight and efficient drive shafts.

Automotive Drive Shaft Industry Industry Trends & Insights

The automotive drive shaft market is experiencing a dynamic period marked by significant growth drivers and transformative technological disruptions. The global market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven primarily by the burgeoning automotive industry, particularly in developing economies. Technological advancements such as lightweight materials, improved designs, and the integration of advanced manufacturing processes are enhancing product performance and efficiency. Consumer preference for fuel-efficient vehicles and enhanced safety features fuels the demand for technologically advanced drive shafts. Competitive dynamics are characterized by intense rivalry among major players, pushing innovation and driving down costs. Market penetration of new technologies, such as those found in electric vehicles, is increasing at a rate of xx% annually, presenting both challenges and opportunities for traditional drive shaft manufacturers. The shift towards electric vehicles is significantly impacting the market, prompting adaptation and innovation among manufacturers.

Dominant Markets & Segments in Automotive Drive Shaft Industry

The automotive drive shaft market shows regional dominance in Asia-Pacific, fueled by the rapid growth of the automotive industry in China, India, and other developing countries. Within segments, the passenger car segment constitutes the largest share of the overall market, followed by the commercial vehicle segment. OEM sales channels remain the most significant revenue stream; however, the aftermarket segment is experiencing substantial growth, driven by the increasing demand for replacement parts.

- Leading Region: Asia-Pacific

- Key Drivers: Rapid industrialization, increasing vehicle production, rising disposable incomes.

- Leading Segment (By Design Type): Hollow Shafts

- Key Drivers: Lightweight design, high strength-to-weight ratio, suitability for high-speed applications.

- Leading Segment (By Position Type): Rear Axle

- Key Drivers: Higher torque transmission requirements for rear-wheel-drive and all-wheel-drive vehicles.

- Leading Segment (By Vehicle Type): Passenger Cars

- Key Drivers: High volume production, extensive use in various car models.

- Leading Sales Channel: OEM (Original Equipment Manufacturers)

- Key Drivers: Long-term contracts, large-scale orders, direct relationships with automakers.

Automotive Drive Shaft Industry Product Innovations

Recent innovations in the automotive drive shaft industry focus on lightweight materials, improved durability, and enhanced efficiency. Companies are incorporating advanced materials like carbon fiber and aluminum alloys to reduce weight and improve fuel economy. Advanced manufacturing techniques, such as precision forging and heat treatment, are enhancing product performance and lifespan. These innovations address the growing demand for fuel-efficient and environmentally friendly vehicles, improving market fit and providing competitive advantages.

Report Segmentation & Scope

This report segments the automotive drive shaft market based on design type (hollow shaft, solid shaft), position type (rear axle, front axle), vehicle type (passenger cars, commercial vehicles), and sales channel (OEM, aftermarket). Each segment provides growth projections, market size estimations, and competitive dynamics analysis. For example, the hollow shaft segment is anticipated to witness a CAGR of xx% due to its inherent lightweight advantages, while the aftermarket segment will grow at a CAGR of xx% due to increased vehicle age and rising repair and maintenance requirements. The passenger car segment is projected to remain the largest segment throughout the forecast period.

Key Drivers of Automotive Drive Shaft Industry Growth

The growth of the automotive drive shaft industry is driven by several factors, including the increasing global vehicle production, particularly in emerging markets. The rising demand for fuel-efficient vehicles is pushing the adoption of lightweight materials and advanced designs in drive shafts. Stringent government regulations on vehicle emissions and safety are prompting the development of advanced drive shaft technologies. Technological advancements such as the use of composite materials and improved manufacturing processes enhance product performance and efficiency. Economic growth in developing countries contributes significantly to the market's expansion.

Challenges in the Automotive Drive Shaft Industry Sector

The automotive drive shaft industry faces challenges such as fluctuating raw material prices, impacting production costs. Stringent regulatory compliance requirements impose significant burdens on manufacturers. Supply chain disruptions caused by geopolitical events or natural disasters can affect production schedules and timelines, leading to cost overruns. Intense competition from established players and new entrants necessitates continuous innovation and cost optimization to maintain profitability. The shift toward electric vehicles presents both opportunities and challenges, requiring manufacturers to adapt their product lines and manufacturing processes.

Leading Players in the Automotive Drive Shaft Industry Market

- JTEKT Corporation

- NTN Corporation

- Dana Holding Corporation

- GKN PLC (Melrose Industries PLC)

- Showa Corporation

- Wanxiang Qianchao Co Ltd

- American Axle & Manufacturing Co Ltd

- Hyundai Wia Corporation

- Nexteer Automotive Group Ltd

- Yamada Manufacturing Co Ltd

Key Developments in Automotive Drive Shaft Industry Sector

- January 2023: Dana Cardenas opened a new USD 21 million plant in Querétaro, Mexico, expanding production capacity for Toyota components. This signifies a significant investment and strengthens their position in the automotive supply chain.

- December 2022: JTEKT Corporation launched its "low-vibration drive shaft," enhancing fuel economy and ride comfort, demonstrating a focus on technological innovation.

- October 2022: JTEKT and Koyo sealing techno developed the JTEKT Ultra Small Seal for BEV eAxles, highlighting adaptation to the growing electric vehicle market.

Strategic Automotive Drive Shaft Industry Market Outlook

The automotive drive shaft market holds significant growth potential, driven by the continued expansion of the automotive industry and technological advancements. Strategic opportunities lie in developing lightweight and efficient drive shafts for electric and hybrid vehicles. Investing in research and development to improve product performance, durability, and fuel efficiency will be crucial for success. Collaborations with OEMs and the adoption of sustainable manufacturing practices are key to navigating the evolving regulatory landscape and remaining competitive. The market is poised for strong growth, offering attractive opportunities for players who can adapt to changing consumer preferences and technological trends.

Automotive Drive Shaft Industry Segmentation

-

1. Design Type

- 1.1. Hollow Shaft

- 1.2. Solid Shaft

-

2. Position Type

- 2.1. Rear Axle

- 2.2. Front Axle

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commercial Vehicles

-

4. Sales Channel

- 4.1. OEM

- 4.2. Aftermarket

Automotive Drive Shaft Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Automotive Drive Shaft Industry Regional Market Share

Geographic Coverage of Automotive Drive Shaft Industry

Automotive Drive Shaft Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Automotive Industry Continues to Witness Steady Growth in Vehicle Production; Growing Awareness of Air Pollution and Health Concerns

- 3.3. Market Restrains

- 3.3.1. Shift towards Disposable Filters

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Electric Vehicles to Drive Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Drive Shaft Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Design Type

- 5.1.1. Hollow Shaft

- 5.1.2. Solid Shaft

- 5.2. Market Analysis, Insights and Forecast - by Position Type

- 5.2.1. Rear Axle

- 5.2.2. Front Axle

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commercial Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Sales Channel

- 5.4.1. OEM

- 5.4.2. Aftermarket

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Design Type

- 6. North America Automotive Drive Shaft Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Design Type

- 6.1.1. Hollow Shaft

- 6.1.2. Solid Shaft

- 6.2. Market Analysis, Insights and Forecast - by Position Type

- 6.2.1. Rear Axle

- 6.2.2. Front Axle

- 6.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.3.1. Passenger Cars

- 6.3.2. Commercial Vehicles

- 6.4. Market Analysis, Insights and Forecast - by Sales Channel

- 6.4.1. OEM

- 6.4.2. Aftermarket

- 6.1. Market Analysis, Insights and Forecast - by Design Type

- 7. Europe Automotive Drive Shaft Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Design Type

- 7.1.1. Hollow Shaft

- 7.1.2. Solid Shaft

- 7.2. Market Analysis, Insights and Forecast - by Position Type

- 7.2.1. Rear Axle

- 7.2.2. Front Axle

- 7.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.3.1. Passenger Cars

- 7.3.2. Commercial Vehicles

- 7.4. Market Analysis, Insights and Forecast - by Sales Channel

- 7.4.1. OEM

- 7.4.2. Aftermarket

- 7.1. Market Analysis, Insights and Forecast - by Design Type

- 8. Asia Pacific Automotive Drive Shaft Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Design Type

- 8.1.1. Hollow Shaft

- 8.1.2. Solid Shaft

- 8.2. Market Analysis, Insights and Forecast - by Position Type

- 8.2.1. Rear Axle

- 8.2.2. Front Axle

- 8.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.3.1. Passenger Cars

- 8.3.2. Commercial Vehicles

- 8.4. Market Analysis, Insights and Forecast - by Sales Channel

- 8.4.1. OEM

- 8.4.2. Aftermarket

- 8.1. Market Analysis, Insights and Forecast - by Design Type

- 9. Rest of the World Automotive Drive Shaft Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Design Type

- 9.1.1. Hollow Shaft

- 9.1.2. Solid Shaft

- 9.2. Market Analysis, Insights and Forecast - by Position Type

- 9.2.1. Rear Axle

- 9.2.2. Front Axle

- 9.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.3.1. Passenger Cars

- 9.3.2. Commercial Vehicles

- 9.4. Market Analysis, Insights and Forecast - by Sales Channel

- 9.4.1. OEM

- 9.4.2. Aftermarket

- 9.1. Market Analysis, Insights and Forecast - by Design Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 JTEKT Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 NTN Corporatio

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Dana Holding Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 GKN PLC (Melrose Industries PLC)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Showa Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Wanxiang Qianchao Co Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 American Axle & Manufacturing Co Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Hyundai Wia Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Nexteer Automotive Group Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Yamada Manufacturing Co Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 JTEKT Corporation

List of Figures

- Figure 1: Global Automotive Drive Shaft Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Automotive Drive Shaft Industry Revenue (Million), by Design Type 2025 & 2033

- Figure 3: North America Automotive Drive Shaft Industry Revenue Share (%), by Design Type 2025 & 2033

- Figure 4: North America Automotive Drive Shaft Industry Revenue (Million), by Position Type 2025 & 2033

- Figure 5: North America Automotive Drive Shaft Industry Revenue Share (%), by Position Type 2025 & 2033

- Figure 6: North America Automotive Drive Shaft Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 7: North America Automotive Drive Shaft Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 8: North America Automotive Drive Shaft Industry Revenue (Million), by Sales Channel 2025 & 2033

- Figure 9: North America Automotive Drive Shaft Industry Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 10: North America Automotive Drive Shaft Industry Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Automotive Drive Shaft Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Automotive Drive Shaft Industry Revenue (Million), by Design Type 2025 & 2033

- Figure 13: Europe Automotive Drive Shaft Industry Revenue Share (%), by Design Type 2025 & 2033

- Figure 14: Europe Automotive Drive Shaft Industry Revenue (Million), by Position Type 2025 & 2033

- Figure 15: Europe Automotive Drive Shaft Industry Revenue Share (%), by Position Type 2025 & 2033

- Figure 16: Europe Automotive Drive Shaft Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 17: Europe Automotive Drive Shaft Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 18: Europe Automotive Drive Shaft Industry Revenue (Million), by Sales Channel 2025 & 2033

- Figure 19: Europe Automotive Drive Shaft Industry Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 20: Europe Automotive Drive Shaft Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe Automotive Drive Shaft Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Automotive Drive Shaft Industry Revenue (Million), by Design Type 2025 & 2033

- Figure 23: Asia Pacific Automotive Drive Shaft Industry Revenue Share (%), by Design Type 2025 & 2033

- Figure 24: Asia Pacific Automotive Drive Shaft Industry Revenue (Million), by Position Type 2025 & 2033

- Figure 25: Asia Pacific Automotive Drive Shaft Industry Revenue Share (%), by Position Type 2025 & 2033

- Figure 26: Asia Pacific Automotive Drive Shaft Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 27: Asia Pacific Automotive Drive Shaft Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 28: Asia Pacific Automotive Drive Shaft Industry Revenue (Million), by Sales Channel 2025 & 2033

- Figure 29: Asia Pacific Automotive Drive Shaft Industry Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 30: Asia Pacific Automotive Drive Shaft Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Automotive Drive Shaft Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Rest of the World Automotive Drive Shaft Industry Revenue (Million), by Design Type 2025 & 2033

- Figure 33: Rest of the World Automotive Drive Shaft Industry Revenue Share (%), by Design Type 2025 & 2033

- Figure 34: Rest of the World Automotive Drive Shaft Industry Revenue (Million), by Position Type 2025 & 2033

- Figure 35: Rest of the World Automotive Drive Shaft Industry Revenue Share (%), by Position Type 2025 & 2033

- Figure 36: Rest of the World Automotive Drive Shaft Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 37: Rest of the World Automotive Drive Shaft Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 38: Rest of the World Automotive Drive Shaft Industry Revenue (Million), by Sales Channel 2025 & 2033

- Figure 39: Rest of the World Automotive Drive Shaft Industry Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 40: Rest of the World Automotive Drive Shaft Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Rest of the World Automotive Drive Shaft Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Drive Shaft Industry Revenue Million Forecast, by Design Type 2020 & 2033

- Table 2: Global Automotive Drive Shaft Industry Revenue Million Forecast, by Position Type 2020 & 2033

- Table 3: Global Automotive Drive Shaft Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 4: Global Automotive Drive Shaft Industry Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 5: Global Automotive Drive Shaft Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Automotive Drive Shaft Industry Revenue Million Forecast, by Design Type 2020 & 2033

- Table 7: Global Automotive Drive Shaft Industry Revenue Million Forecast, by Position Type 2020 & 2033

- Table 8: Global Automotive Drive Shaft Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 9: Global Automotive Drive Shaft Industry Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 10: Global Automotive Drive Shaft Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States Automotive Drive Shaft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Automotive Drive Shaft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of North America Automotive Drive Shaft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Automotive Drive Shaft Industry Revenue Million Forecast, by Design Type 2020 & 2033

- Table 15: Global Automotive Drive Shaft Industry Revenue Million Forecast, by Position Type 2020 & 2033

- Table 16: Global Automotive Drive Shaft Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 17: Global Automotive Drive Shaft Industry Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 18: Global Automotive Drive Shaft Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Germany Automotive Drive Shaft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: United Kingdom Automotive Drive Shaft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Automotive Drive Shaft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Europe Automotive Drive Shaft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global Automotive Drive Shaft Industry Revenue Million Forecast, by Design Type 2020 & 2033

- Table 24: Global Automotive Drive Shaft Industry Revenue Million Forecast, by Position Type 2020 & 2033

- Table 25: Global Automotive Drive Shaft Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 26: Global Automotive Drive Shaft Industry Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 27: Global Automotive Drive Shaft Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 28: India Automotive Drive Shaft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: China Automotive Drive Shaft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Japan Automotive Drive Shaft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: South Korea Automotive Drive Shaft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Asia Pacific Automotive Drive Shaft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Global Automotive Drive Shaft Industry Revenue Million Forecast, by Design Type 2020 & 2033

- Table 34: Global Automotive Drive Shaft Industry Revenue Million Forecast, by Position Type 2020 & 2033

- Table 35: Global Automotive Drive Shaft Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 36: Global Automotive Drive Shaft Industry Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 37: Global Automotive Drive Shaft Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 38: South America Automotive Drive Shaft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Middle East and Africa Automotive Drive Shaft Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Drive Shaft Industry?

The projected CAGR is approximately 6.54%.

2. Which companies are prominent players in the Automotive Drive Shaft Industry?

Key companies in the market include JTEKT Corporation, NTN Corporatio, Dana Holding Corporation, GKN PLC (Melrose Industries PLC), Showa Corporation, Wanxiang Qianchao Co Ltd, American Axle & Manufacturing Co Ltd, Hyundai Wia Corporation, Nexteer Automotive Group Ltd, Yamada Manufacturing Co Ltd.

3. What are the main segments of the Automotive Drive Shaft Industry?

The market segments include Design Type, Position Type, Vehicle Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 74.26 Million as of 2022.

5. What are some drivers contributing to market growth?

Automotive Industry Continues to Witness Steady Growth in Vehicle Production; Growing Awareness of Air Pollution and Health Concerns.

6. What are the notable trends driving market growth?

Increasing Demand for Electric Vehicles to Drive Growth of the Market.

7. Are there any restraints impacting market growth?

Shift towards Disposable Filters.

8. Can you provide examples of recent developments in the market?

January 2023: Dana Cardenas opened a new USD 21 million plant in Querétaro, Mexico, with a production line that will make Toyota components. The first production line, which already began with 110 employees, will be joined by two more lines later in 2023 for a total annual production of 545,000 units with 300 employees. Alejandro Sánchez Alvarado, Operations Director at Dana Cardanes, explained that three production lines are being installed in the new 917-square-meter facility, where cardan shafts (drive shafts) will be manufactured for use in Toyota trucks.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Drive Shaft Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Drive Shaft Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Drive Shaft Industry?

To stay informed about further developments, trends, and reports in the Automotive Drive Shaft Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence