Key Insights

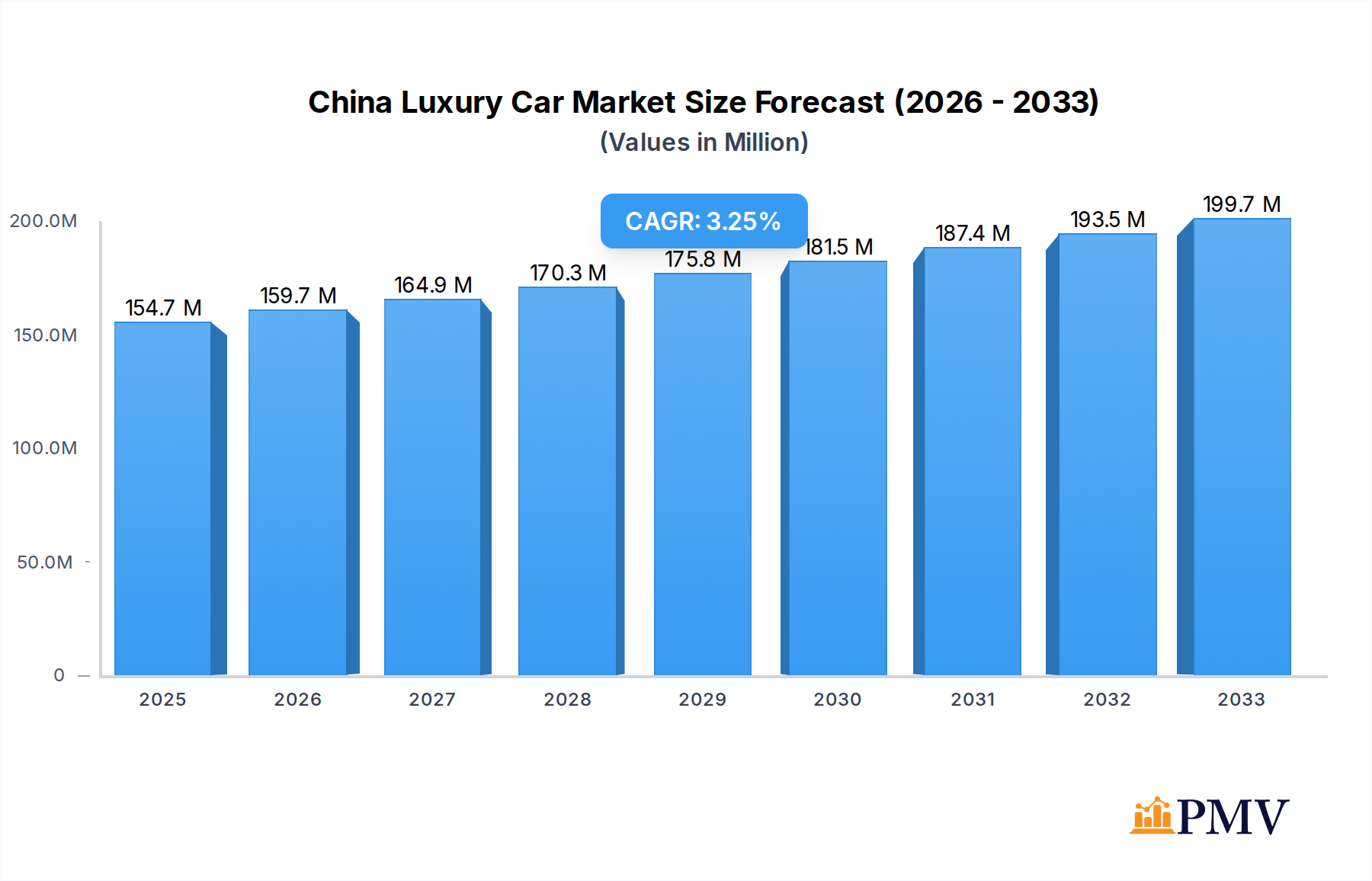

The China Luxury Car Market is poised for significant growth, with an estimated market size of 154.67 Million in 2025. This expansion is driven by a confluence of factors, including the increasing disposable incomes of affluent Chinese consumers, a growing preference for premium brands, and advancements in automotive technology. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 3.25% over the forecast period of 2025-2033, indicating a robust and sustained upward trajectory. Key segments contributing to this growth include Sports Utility Vehicles (SUVs) and Sedans, which continue to dominate consumer preferences. Powertrain diversification is also a critical trend, with Electric Vehicles (EVs) gaining substantial traction, reflecting both government initiatives to promote green transportation and the rising demand for eco-friendly luxury options. This shift towards electrification is a significant driver for market expansion and innovation.

China Luxury Car Market Market Size (In Million)

Several key players are actively shaping the competitive landscape of the China Luxury Car Market. Giants like Mercedes-Benz AG, BMW Group, and Audi AG (part of Volkswagen Group) are vying for market share, leveraging their established brand reputation and extensive product portfolios. Simultaneously, domestic players such as Zhejiang Geely Holding Group and Dongfeng Motor Company are rapidly ascending, introducing compelling luxury offerings that resonate with local consumers. Tesla Inc. continues to be a formidable force, particularly in the EV luxury segment. The market is also characterized by intense competition among other luxury brands including Lexus, Acura, Lincoln, Cadillac, and Jaguar Land Rover. While the market demonstrates strong growth potential, it also faces certain restraints, such as increasing regulatory scrutiny and potential supply chain disruptions, which manufacturers must navigate effectively to capitalize on the burgeoning opportunities in this dynamic market.

China Luxury Car Market Company Market Share

Gain unparalleled insights into the dynamic China Luxury Car Market with this in-depth report. Covering the period from 2019 to 2033, with a base year of 2025, this analysis dissects market structure, industry trends, dominant segments, product innovations, growth drivers, challenges, and a strategic outlook. Discover key developments from leading players like Mercedes-Benz AG, BMW Group, Volkswagen Group (Audi AG), Tesla Inc, Lexus, Infiniti, Acura, Cadillac, Lincoln Motor Company, Zhejiang Geely Holding Group, General Motor Company, China FAW Group Co Ltd, Dongfeng Motor Company, and JAGUAR LAND ROVER LIMITED (Tata Motors Limited). Explore the intricate interplay of Electric Vehicles (EVs), IC Engine Vehicles, SUVs, Sedans, Hatchbacks, and MPVs. This report is essential for stakeholders seeking to capitalize on the burgeoning demand for premium mobility in the world's largest automotive market.

China Luxury Car Market Market Structure & Competitive Dynamics

The China Luxury Car Market exhibits a moderately concentrated market structure, characterized by the strong presence of established global premium automakers alongside ambitious domestic players. Innovation ecosystems are rapidly evolving, driven by significant investments in electric vehicle (EV) technology, autonomous driving, and in-car connectivity. Regulatory frameworks, particularly those promoting new energy vehicles (NEVs) and stringent emissions standards, are shaping competitive advantages. Product substitutes are increasingly prevalent as mainstream brands offer more premium-oriented models, challenging traditional luxury definitions. End-user trends are shifting towards personalized experiences, sustainable mobility, and advanced digital integration. Mergers and acquisitions (M&A) activities, though not always publicly disclosed for their full values, are strategically focused on expanding technological capabilities and market reach, particularly in the EV and intelligent vehicle segments. For instance, partnerships for battery technology and autonomous driving systems represent key M&A-like collaborations. Market share fluctuates based on brand perception, product launches, and pricing strategies, with global giants holding substantial sway, yet domestic brands are rapidly gaining ground, particularly in the EV luxury segment.

China Luxury Car Market Industry Trends & Insights

The China Luxury Car Market is experiencing robust growth, propelled by a burgeoning affluent consumer base and a strong governmental push towards electrification and advanced automotive technologies. The Compound Annual Growth Rate (CAGR) is projected to remain significant throughout the forecast period, fueled by increasing disposable incomes and a growing preference for premium brands and features. Technological disruptions are at the forefront, with Electric Vehicles (EVs) rapidly gaining market penetration, driven by supportive government policies, expanding charging infrastructure, and evolving consumer awareness of environmental sustainability. Leading manufacturers are investing heavily in R&D to develop longer-range EVs, faster charging capabilities, and sophisticated in-car digital experiences. Consumer preferences are evolving beyond traditional luxury attributes like performance and craftsmanship to encompass intelligent features, connectivity, and personalized services. The competitive dynamics are intensifying, with global luxury stalwarts like Mercedes-Benz AG, BMW Group, and Volkswagen Group (Audi AG) facing increasing pressure from both established premium rivals such as Lexus and Infiniti, and aggressive newcomers, most notably Tesla Inc, and emerging domestic luxury EV brands. The integration of advanced driver-assistance systems (ADAS) and the development of autonomous driving capabilities are becoming crucial differentiators. The market penetration of premium SUVs, in particular, continues to rise, reflecting changing lifestyle preferences.

Dominant Markets & Segments in China Luxury Car Market

The Sports Utility Vehicle (SUV) segment is currently the dominant force within the China Luxury Car Market, showcasing exceptional growth and consumer appeal. This dominance is driven by several key factors:

- Economic Policies: Favorable policies supporting the automotive industry and consumer spending on vehicles, coupled with a rising middle and upper class, contribute to the strong demand for premium vehicles.

- Infrastructure Development: Continuous improvements in road networks and urban development make larger, more versatile vehicles like SUVs increasingly practical and desirable for Chinese consumers.

- Consumer Preferences: Chinese consumers associate SUVs with a sense of prestige, spaciousness, and versatility, aligning with evolving lifestyle needs for families and individual expression. The perception of ruggedness and adventurous capability also resonates.

The Electric Vehicle (EV) powertrain type is rapidly emerging as a critical growth segment, challenging the traditional dominance of IC Engine Vehicles. Government incentives, including subsidies and tax exemptions for NEVs, coupled with an expanding charging infrastructure, are significantly accelerating EV adoption within the luxury segment. Brands are aggressively launching new EV models and investing in battery technology to meet consumer demand for sustainable and technologically advanced transportation.

Among vehicle body styles, SUVs consistently outperform Sedans, Hatchbacks, and MPVs in terms of market share and growth projections. This trend is attributed to the aforementioned factors of perceived status, practicality, and lifestyle alignment. While Sedans maintain a significant presence, the allure of higher seating positions and more robust designs has propelled SUVs to the forefront.

China Luxury Car Market Product Innovations

Product innovations in the China Luxury Car Market are heavily focused on electrification, intelligent connectivity, and enhanced user experiences. Manufacturers are prioritizing the development of longer-range Electric Vehicles (EVs) with rapid charging capabilities, alongside advanced driver-assistance systems (ADAS) and sophisticated infotainment systems. Key competitive advantages are being built through seamless integration of digital services, personalized cabin environments, and cutting-edge design aesthetics. The market is witnessing a surge in premium EV offerings and the continuous refinement of autonomous driving technologies, appealing to tech-savvy Chinese consumers who value innovation and a premium, connected lifestyle.

Report Segmentation & Scope

This comprehensive report segments the China Luxury Car Market across two primary dimensions: Vehicle Body Style and Powertrain Type. The Vehicle Body Style segmentation includes: Hatchbacks, Sedans, Sports Utility Vehicles (SUVs), and Multi-purpose Vehicles (MPVs). The Powertrain Type segmentation covers IC Engine Vehicles and Electric Vehicles (EVs). Each segment's growth projections, estimated market sizes in Millions, and competitive dynamics are thoroughly analyzed, providing a granular view of market opportunities and challenges within the broader China Luxury Car Market.

Key Drivers of China Luxury Car Market Growth

Several key drivers are propelling the China Luxury Car Market. The sustained growth of the Chinese economy and the expanding affluent consumer base are paramount, increasing disposable incomes and the demand for premium mobility solutions. Technological advancements, particularly in electric vehicle (EV) technology, autonomous driving, and in-car connectivity, are creating new market segments and enhancing product appeal. Supportive government policies, such as New Energy Vehicle (NEV) mandates and incentives, are accelerating the adoption of sustainable luxury transportation. Furthermore, a rising emphasis on brand status, sophisticated design, and personalized ownership experiences continues to fuel demand for luxury automobiles.

Challenges in the China Luxury Car Market Sector

Despite its robust growth, the China Luxury Car Market faces significant challenges. Intensifying competition from both established global players and increasingly capable domestic manufacturers, especially in the EV luxury segment, is pressuring profit margins. Regulatory hurdles related to emissions standards and evolving safety mandates require continuous adaptation and investment. Supply chain disruptions, particularly for critical components like semiconductors and batteries, can impact production volumes and timelines. Furthermore, geopolitical uncertainties and potential shifts in international trade policies can influence import/export dynamics and overall market stability. The high cost of advanced technologies, such as autonomous driving systems, also presents a barrier to wider adoption.

Leading Players in the China Luxury Car Market Market

- Mercedes-Benz AG

- BMW Group

- Volkswagen Group (Audi AG)

- Tesla Inc

- Lexus (Toyota Motor Corporation)

- Infiniti (Nissan Motor Co Ltd)

- Acura (Honda Motor Co Ltd)

- Cadillac (General Motors Company)

- Lincoln Motor Company (Ford Motor Company)

- Zhejiang Geely Holding Group

- General Motor Company

- China FAW Group Co Ltd

- Dongfeng Motor Company

- JAGUAR LAND ROVER LIMITED (Tata Motors Limited)

Key Developments in China Luxury Car Market Sector

- November 2022: According to BYD's official Weibo account, BYD's new luxury car brand is called "Yangwang." It will have a new and independent team for branding, products, sales and services network, and operation, with products expected to be officially launched in Q1 2023. This signifies a major entry into the luxury segment by a prominent EV player.

- August 2022: Infiniti announced the official launch of the QX55, an all-new luxury SUV, in China at the 2022 Chengdu Motor Show. It will be sold as an imported model in the country. It is available in four variants (one FWD and three AWD), with prices ranging from CNY 389,800 (USD 55,987.36) to CNY 475,300 (USD 68,267.81). This launch highlights the ongoing introduction of new premium SUV models.

- August 2022: In Wuhan, Hubei Province, Dongfeng Motor Company Limited (Dongfeng Motor) held a press conference. Dongfeng Motor introduced Mengshi, a luxury off-road EV (electric vehicle) brand, and its exclusive "M" logo at the conference. The Mengshi brand's first model will hit the market in 2023. This development signals Dongfeng's strategic push into the luxury electric vehicle market with a focus on off-road capabilities.

Strategic China Luxury Car Market Market Outlook

The strategic outlook for the China Luxury Car Market remains exceptionally positive, with significant growth accelerators in play. The continued expansion of the middle and upper-middle class, coupled with an insatiable appetite for premium brands and cutting-edge automotive technology, presents immense opportunities. The rapid advancement and increasing consumer acceptance of Electric Vehicles (EVs), supported by robust government initiatives, will be a primary growth catalyst, driving innovation in battery technology, charging infrastructure, and smart mobility solutions. Strategic partnerships and investments in autonomous driving and connected car technologies will further differentiate brands and cater to the evolving demands of tech-savvy Chinese consumers. The market's focus will increasingly shift towards personalized ownership experiences, advanced digital services, and sustainable luxury. Stakeholders who can effectively navigate the competitive landscape and adapt to these dynamic trends are poised for substantial success in this critical global market.

China Luxury Car Market Segmentation

-

1. Vehicle Body Style

- 1.1. Hatchbacks

- 1.2. Sedans

- 1.3. Sports Utility Vehicles (SUVs)

- 1.4. Multi-purpose Vehicles (MPVs)

-

2. Powertrain Type

- 2.1. IC Engine Vehicles

- 2.2. Electric Vehicles

China Luxury Car Market Segmentation By Geography

- 1. China

China Luxury Car Market Regional Market Share

Geographic Coverage of China Luxury Car Market

China Luxury Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Trend of EV are Likely to Drive the Market

- 3.3. Market Restrains

- 3.3.1. High Cost of Luxury Vehicle May Hamper the Market Growth

- 3.4. Market Trends

- 3.4.1. Premium Automakers and Second-Tier Brands Gaining Target Market Traction

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Luxury Car Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Body Style

- 5.1.1. Hatchbacks

- 5.1.2. Sedans

- 5.1.3. Sports Utility Vehicles (SUVs)

- 5.1.4. Multi-purpose Vehicles (MPVs)

- 5.2. Market Analysis, Insights and Forecast - by Powertrain Type

- 5.2.1. IC Engine Vehicles

- 5.2.2. Electric Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Body Style

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Infinity (Nissan Motor Co Ltd)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lexus (Toyota Motor Corporation)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Acura (Honda Motor Co Ltd)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Volkswagen Group (Audi AG)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Zhejiang Geely Holding Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 General Motor Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Tesla Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Lincoln Motor Company (Ford Motor Company)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Cadillac (General Motors Company)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mercedes-Benz AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 BMW Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 China FAW Group Co Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Dongfeng Motor Company

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 JAGUAR LAND ROVER LIMITED (Tata Motors Limited) *List Not Exhaustive

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Infinity (Nissan Motor Co Ltd)

List of Figures

- Figure 1: China Luxury Car Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Luxury Car Market Share (%) by Company 2025

List of Tables

- Table 1: China Luxury Car Market Revenue Million Forecast, by Vehicle Body Style 2020 & 2033

- Table 2: China Luxury Car Market Revenue Million Forecast, by Powertrain Type 2020 & 2033

- Table 3: China Luxury Car Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: China Luxury Car Market Revenue Million Forecast, by Vehicle Body Style 2020 & 2033

- Table 5: China Luxury Car Market Revenue Million Forecast, by Powertrain Type 2020 & 2033

- Table 6: China Luxury Car Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Luxury Car Market?

The projected CAGR is approximately 3.25%.

2. Which companies are prominent players in the China Luxury Car Market?

Key companies in the market include Infinity (Nissan Motor Co Ltd), Lexus (Toyota Motor Corporation), Acura (Honda Motor Co Ltd), Volkswagen Group (Audi AG), Zhejiang Geely Holding Group, General Motor Company, Tesla Inc, Lincoln Motor Company (Ford Motor Company), Cadillac (General Motors Company), Mercedes-Benz AG, BMW Group, China FAW Group Co Ltd, Dongfeng Motor Company, JAGUAR LAND ROVER LIMITED (Tata Motors Limited) *List Not Exhaustive.

3. What are the main segments of the China Luxury Car Market?

The market segments include Vehicle Body Style, Powertrain Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 154.67 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Trend of EV are Likely to Drive the Market.

6. What are the notable trends driving market growth?

Premium Automakers and Second-Tier Brands Gaining Target Market Traction.

7. Are there any restraints impacting market growth?

High Cost of Luxury Vehicle May Hamper the Market Growth.

8. Can you provide examples of recent developments in the market?

November 2022: According to BYD's official Weibo account, BYD's new luxury car brand is called "Yangwang." It will have a new and independent team for branding, products, sales and services network, and operation, with products expected to be officially launched in Q1 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Luxury Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Luxury Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Luxury Car Market?

To stay informed about further developments, trends, and reports in the China Luxury Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence