Key Insights

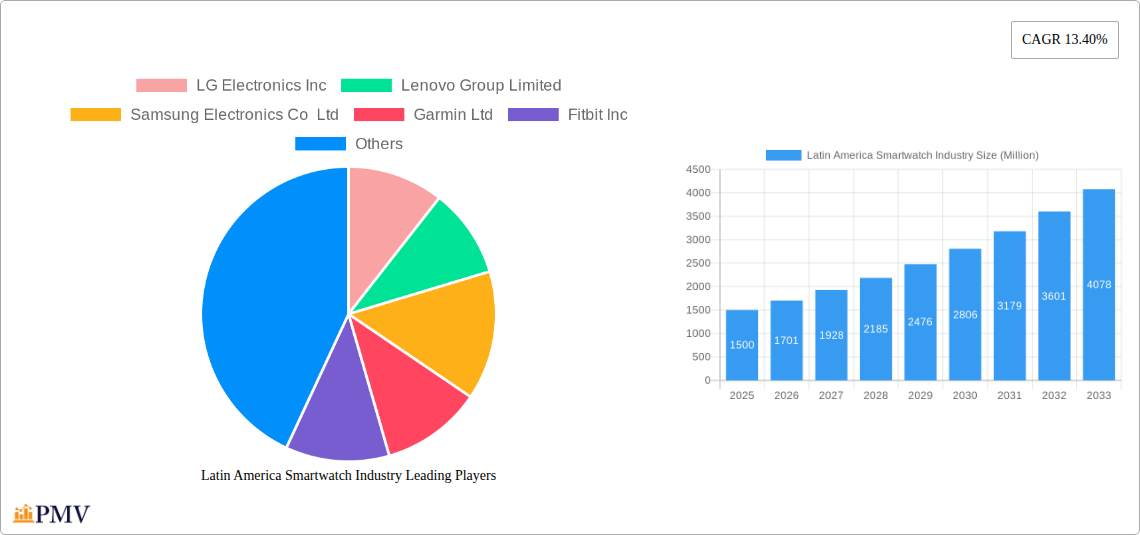

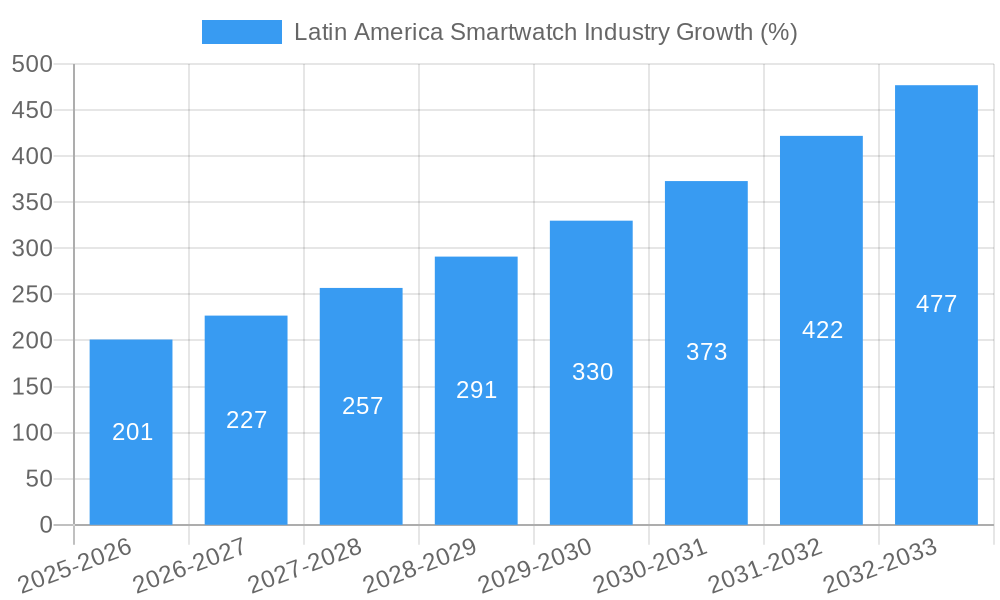

The Latin American smartwatch market, currently experiencing robust growth, is projected to reach a significant value by 2033. Driven by increasing smartphone penetration, rising disposable incomes, and a growing preference for fitness tracking and health monitoring devices, this market demonstrates a strong Compound Annual Growth Rate (CAGR) of 13.40%. Key segments contributing to this growth include AMOLED display smartwatches, those operating on Android/Wear OS, and devices used for personal assistance and fitness tracking. Brazil and Argentina represent the largest national markets within the region, benefiting from a young and tech-savvy population eager to adopt wearable technology. Competition is fierce, with established players like Samsung, Apple, and Garmin vying for market share alongside emerging brands. The market's growth is not without challenges; pricing remains a significant barrier for entry in many segments, limiting broader adoption. Supply chain disruptions and fluctuating currency exchange rates also pose ongoing threats. However, the long-term outlook remains positive, driven by innovation in features like health sensors, longer battery life, and increasingly sophisticated applications tailored to the specific needs of Latin American consumers.

The continued expansion of e-commerce platforms and improved logistics infrastructure will further fuel market penetration. Furthermore, strategic partnerships between technology companies and local distributors are expected to facilitate broader reach within the region. The diversification of smartwatch applications beyond fitness tracking, encompassing areas like contactless payments and augmented reality, presents significant opportunities for future expansion. Understanding the unique cultural preferences and purchasing behaviors of consumers in different Latin American countries will be crucial for companies seeking sustained success in this dynamic and competitive market. The forecast period of 2025-2033 anticipates significant growth, fueled by factors outlined above and supported by a strong historical growth trend (2019-2024).

Latin America Smartwatch Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Latin America smartwatch industry, offering invaluable insights for businesses, investors, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's structure, competitive landscape, trends, and future potential. The report forecasts a market size of xx Million by 2033, driven by key factors analyzed within.

Latin America Smartwatch Industry Market Structure & Competitive Dynamics

The Latin American smartwatch market exhibits a moderately concentrated structure, with key players like Samsung Electronics Co Ltd, Apple Inc, and Huawei Technologies Co Ltd holding significant market share. However, the presence of numerous regional and international brands fosters competition. The market is characterized by a dynamic innovation ecosystem, driven by advancements in wearable technology, health tracking features, and improved user interfaces. Regulatory frameworks concerning data privacy and consumer protection are evolving and influence market practices. Product substitutes, such as fitness trackers and basic smart bands, pose a competitive challenge, particularly in the lower price segments. End-user trends favor smartwatches with advanced health monitoring capabilities, longer battery life, and stylish designs. M&A activities have been relatively limited in recent years, with deal values totaling approximately xx Million in the period 2019-2024. Key players are focusing on organic growth through product innovation and expansion into new markets.

- Market Concentration: Moderate, with a few dominant players and numerous smaller competitors.

- Innovation Ecosystems: Active, driven by technological advancements in display technology, processors, and health sensors.

- Regulatory Frameworks: Evolving, with increasing focus on data privacy and safety standards.

- Product Substitutes: Fitness trackers and basic smart bands compete in lower price segments.

- End-User Trends: Demand for advanced health features, longer battery life, and stylish designs.

- M&A Activities: Limited in recent years, with a total deal value of approximately xx Million (2019-2024).

Latin America Smartwatch Industry Industry Trends & Insights

The Latin American smartwatch market exhibits robust growth, driven by increasing smartphone penetration, rising disposable incomes, and a growing health-conscious population. The Compound Annual Growth Rate (CAGR) is estimated at xx% during the forecast period (2025-2033). Technological disruptions, such as the introduction of advanced sensors, improved battery technology, and enhanced operating systems, fuel market expansion. Consumer preferences are shifting towards feature-rich smartwatches offering seamless integration with smartphones and comprehensive health tracking capabilities. Competitive dynamics are shaping the market with established players investing heavily in R&D to maintain their market positions while new entrants challenge the status quo. Market penetration is projected to reach xx% by 2033.

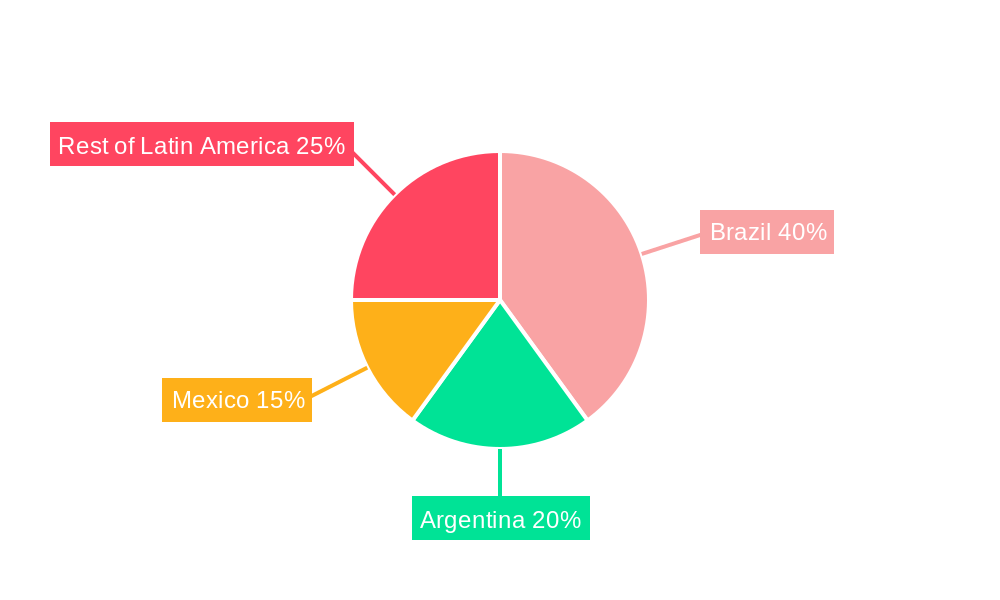

Dominant Markets & Segments in Latin America Smartwatch Industry

Brazil and Argentina represent the largest markets within Latin America, driven by factors such as higher smartphone penetration and disposable income. The Rest of Latin America displays significant potential, with growth projected to accelerate in the coming years.

Dominant Segments:

- Operating Systems: Android/Wear OS currently dominates, followed by other proprietary operating systems. WatchOS holds a smaller, but growing share.

- Display Type: AMOLED displays are gaining traction due to superior quality and energy efficiency compared to PMOLED and TFT LCD.

- Application: Personal assistance remains the primary application, followed by fitness and sports tracking. Medical applications are emerging as a significant growth area.

Key Drivers for Brazil and Argentina:

- Strong Smartphone Penetration: High smartphone usage drives demand for complementary smart devices.

- Growing Middle Class: Rising disposable incomes fuel consumer spending on electronics.

- Improved Infrastructure: Better internet connectivity supports smartwatch functionality.

Latin America Smartwatch Industry Product Innovations

Recent product innovations center around improved health monitoring features (ECG, SpO2), extended battery life, and sleeker, more stylish designs. Integration with fitness apps and seamless smartphone connectivity are also key areas of focus. This reflects the evolving consumer preference for smartwatches that seamlessly integrate into daily life and deliver advanced functionality. Manufacturers are increasingly emphasizing customization options and diverse design choices to cater to varied user preferences.

Report Segmentation & Scope

This report segments the Latin American smartwatch market by:

- Operating Systems: Watch OS, Android/Wear OS, Other Operating Systems (market size, growth projections, competitive dynamics provided for each).

- Display Type: AMOLED, PMOLED, TFT LCD (market size, growth projections, competitive dynamics provided for each).

- Application: Personal Assistance, Medical, Sports, Other Applications (market size, growth projections, competitive dynamics provided for each).

- Country: Brazil, Argentina, Rest of Latin America (market size, growth projections, competitive dynamics provided for each).

Key Drivers of Latin America Smartwatch Industry Growth

The growth of the Latin American smartwatch industry is propelled by several key factors: increasing smartphone penetration, rising disposable incomes, growing health consciousness among consumers, technological advancements in wearable technology, and favorable government policies promoting digitalization. The expanding e-commerce sector further facilitates the sales of smartwatches.

Challenges in the Latin America Smartwatch Industry Sector

Challenges include fluctuating currency exchange rates impacting import costs, inconsistent internet infrastructure limiting functionality in certain regions, and the presence of counterfeit products undercutting legitimate brands. Supply chain disruptions due to global events can also affect market stability.

Leading Players in the Latin America Smartwatch Industry Market

- LG Electronics Inc

- Lenovo Group Limited

- Samsung Electronics Co Ltd

- Garmin Ltd

- Fitbit Inc

- Huawei Technologies Co Ltd

- Fossil Group Inc

- Apple Inc

- Polar Electro OY

- Sony Corporation

Key Developments in Latin America Smartwatch Industry Sector

- January 2022: Fossil and Razer collaborated on a smartwatch, leveraging Fossil's technology and Razer's branding.

- May 2022: Google launched its Pixel Watch, integrating Wear OS 3 with Fitbit's health tracking.

- May 2022: Huawei released several new wearables, including smartwatches and fitness trackers, focusing on user experience and simplified daily life.

- July 2022: Qualcomm announced the Snapdragon W5+ Gen 1 and W5 Gen 1 platforms, emphasizing long battery life and efficiency.

- August 2022: Samsung launched the Galaxy Watch5 and Watch5 Pro, highlighting fitness and wellness features.

Strategic Latin America Smartwatch Industry Market Outlook

The Latin American smartwatch market presents significant growth potential driven by increasing consumer adoption, technological advancements, and the expansion of e-commerce. Strategic opportunities exist for companies to focus on innovative product features, targeted marketing campaigns, and the development of strong distribution networks to capture market share. Expanding into less-penetrated markets within Latin America and focusing on affordable, yet feature-rich smartwatches will also be crucial for success.

Latin America Smartwatch Industry Segmentation

-

1. Operating Systems

- 1.1. Watch OS

- 1.2. Android/Wear OS

- 1.3. Other Operating Systems

-

2. Display Type

- 2.1. AMOLED

- 2.2. PMOLED

- 2.3. TFT LCD

-

3. Application

- 3.1. Personal Assistance

- 3.2. Medical

- 3.3. Sports

- 3.4. Other Applications

Latin America Smartwatch Industry Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Smartwatch Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Technological Advancements in the Wearables Market; Increase in Health Awareness among the Consumer

- 3.3. Market Restrains

- 3.3.1 Growing Complexity of Wearable Devices and Limited Use of Features

- 3.3.2 augmented With Security Risks

- 3.4. Market Trends

- 3.4.1. Medical and Fitness to Account for a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Smartwatch Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Operating Systems

- 5.1.1. Watch OS

- 5.1.2. Android/Wear OS

- 5.1.3. Other Operating Systems

- 5.2. Market Analysis, Insights and Forecast - by Display Type

- 5.2.1. AMOLED

- 5.2.2. PMOLED

- 5.2.3. TFT LCD

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Personal Assistance

- 5.3.2. Medical

- 5.3.3. Sports

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Operating Systems

- 6. Brazil Latin America Smartwatch Industry Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Latin America Smartwatch Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Latin America Smartwatch Industry Analysis, Insights and Forecast, 2019-2031

- 9. Peru Latin America Smartwatch Industry Analysis, Insights and Forecast, 2019-2031

- 10. Chile Latin America Smartwatch Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Latin America Latin America Smartwatch Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 LG Electronics Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Lenovo Group Limited

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Samsung Electronics Co Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Garmin Ltd

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Fitbit Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Huawei Technologies Co Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Fossil Group Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Apple Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Polar Electro OY

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Sony Corporation

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 LG Electronics Inc

List of Figures

- Figure 1: Latin America Smartwatch Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Smartwatch Industry Share (%) by Company 2024

List of Tables

- Table 1: Latin America Smartwatch Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Smartwatch Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Latin America Smartwatch Industry Revenue Million Forecast, by Operating Systems 2019 & 2032

- Table 4: Latin America Smartwatch Industry Volume K Unit Forecast, by Operating Systems 2019 & 2032

- Table 5: Latin America Smartwatch Industry Revenue Million Forecast, by Display Type 2019 & 2032

- Table 6: Latin America Smartwatch Industry Volume K Unit Forecast, by Display Type 2019 & 2032

- Table 7: Latin America Smartwatch Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 8: Latin America Smartwatch Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 9: Latin America Smartwatch Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Latin America Smartwatch Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Latin America Smartwatch Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Latin America Smartwatch Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Brazil Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Brazil Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Argentina Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Mexico Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Peru Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Peru Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Chile Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Chile Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Rest of Latin America Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Latin America Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Latin America Smartwatch Industry Revenue Million Forecast, by Operating Systems 2019 & 2032

- Table 26: Latin America Smartwatch Industry Volume K Unit Forecast, by Operating Systems 2019 & 2032

- Table 27: Latin America Smartwatch Industry Revenue Million Forecast, by Display Type 2019 & 2032

- Table 28: Latin America Smartwatch Industry Volume K Unit Forecast, by Display Type 2019 & 2032

- Table 29: Latin America Smartwatch Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 30: Latin America Smartwatch Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 31: Latin America Smartwatch Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Latin America Smartwatch Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 33: Brazil Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Brazil Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: Argentina Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Argentina Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: Chile Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Chile Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 39: Colombia Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Colombia Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 41: Mexico Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Mexico Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Peru Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Peru Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: Venezuela Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Venezuela Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 47: Ecuador Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Ecuador Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: Bolivia Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Bolivia Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 51: Paraguay Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Paraguay Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Smartwatch Industry?

The projected CAGR is approximately 13.40%.

2. Which companies are prominent players in the Latin America Smartwatch Industry?

Key companies in the market include LG Electronics Inc, Lenovo Group Limited, Samsung Electronics Co Ltd, Garmin Ltd, Fitbit Inc, Huawei Technologies Co Ltd, Fossil Group Inc, Apple Inc, Polar Electro OY, Sony Corporation.

3. What are the main segments of the Latin America Smartwatch Industry?

The market segments include Operating Systems, Display Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Technological Advancements in the Wearables Market; Increase in Health Awareness among the Consumer.

6. What are the notable trends driving market growth?

Medical and Fitness to Account for a Significant Market Share.

7. Are there any restraints impacting market growth?

Growing Complexity of Wearable Devices and Limited Use of Features. augmented With Security Risks.

8. Can you provide examples of recent developments in the market?

August 2022 : Samsung Electronics Co., Ltd. unveiled the Galaxy Watch5 and Galaxy Watch5 Pro, which will help shape fitness and wellness behaviors through intelligent insights, sophisticated features, and significantly more robust capabilities. The Galaxy Watch5 improves aspects that users depend on daily, while the Galaxy Watch5 Pro, the new introduction to the Galaxy Watch series, is Samsung's most robust and feature-packed wristwatch ever.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Smartwatch Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Smartwatch Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Smartwatch Industry?

To stay informed about further developments, trends, and reports in the Latin America Smartwatch Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence