Key Insights

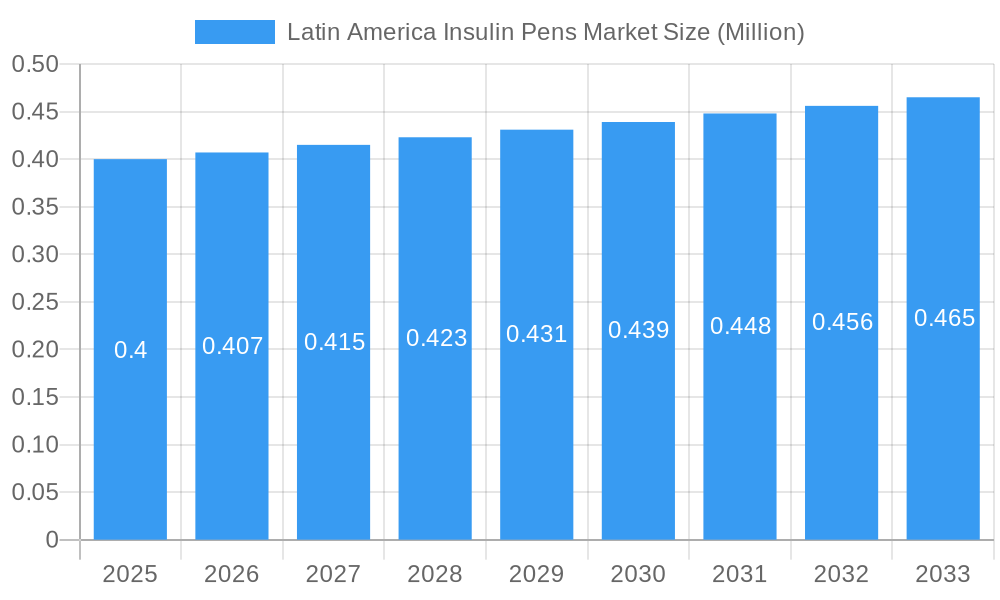

The Latin America Insulin Pens Market is poised for significant expansion, driven by the escalating prevalence of diabetes across the region and a growing preference for convenient insulin delivery methods. With a current estimated market size of $0.4 million in 2025, the market is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 1.80% throughout the forecast period of 2025-2033. This expansion is primarily fueled by increasing awareness of diabetes management, a rising adoption of advanced insulin delivery systems like insulin pens due to their ease of use and accuracy compared to traditional syringes, and favorable healthcare policies aimed at improving chronic disease management in countries like Brazil and Mexico. The growing demand for disposable insulin pens, offering unparalleled convenience, and the increasing penetration of cartridges in reusable pens, presenting a more sustainable and cost-effective option for long-term users, are key market drivers.

Latin America Insulin Pens Market Market Size (In Million)

Despite the promising growth trajectory, certain factors may present challenges. Economic fluctuations and varying healthcare infrastructure across different Latin American countries could impact market accessibility and affordability. However, the long-term outlook remains exceptionally positive. The market segmentation by device type, encompassing Disposable Insulin Pens and Cartridges in Reusable Pens, highlights the diverse needs of the patient population. Geographically, Brazil and Mexico are expected to lead the market due to their larger populations and higher diabetes burdens, while the "Rest of Latin America" segment also presents substantial untapped potential. Key players such as Ultimed, Trividia Health, Becton Dickinson, Cardinal Health, and Arkray are actively investing in market penetration and product innovation to capture a significant share of this burgeoning market.

Latin America Insulin Pens Market Company Market Share

This comprehensive market research report delves into the Latin America Insulin Pens Market, a rapidly evolving sector driven by increasing diabetes prevalence and advancements in drug delivery systems. Our analysis covers the study period of 2019–2033, with a base year of 2025, an estimated year of 2025, and a forecast period from 2025–2033, examining the historical period of 2019–2024. We provide granular insights into market dynamics, competitive landscapes, and future growth trajectories, making it an indispensable resource for stakeholders seeking to capitalize on this burgeoning market.

Latin America Insulin Pens Market Market Structure & Competitive Dynamics

The Latin America Insulin Pens Market exhibits a moderately concentrated structure, with key players like Trividia Health, Becton Dickinson, Cardinal Health, and Arkray holding significant market shares. While Ultimed is also a notable player, the market is characterized by strategic alliances and a focus on innovation rather than outright consolidation. The innovation ecosystem is vibrant, with ongoing research and development aimed at enhancing user convenience, accuracy, and connectivity in insulin pen technology. Regulatory frameworks across Latin American countries are progressively aligning with international standards, facilitating market access for advanced medical devices. Product substitutes, such as traditional insulin vials and syringes, still exist but are gradually being phased out in favor of the more user-friendly insulin pens. End-user trends are strongly leaning towards disposable pens for their convenience and reusable pens for their cost-effectiveness and sustainability. Mergers and acquisitions, while not a dominant feature, are strategic moves to acquire innovative technologies or expand geographical reach. For instance, anticipated M&A activities are expected to center around companies with strong R&D pipelines for smart insulin pens.

Latin America Insulin Pens Market Industry Trends & Insights

The Latin America Insulin Pens Market is poised for substantial growth, projected to expand at a robust Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period. This growth is primarily fueled by the escalating incidence of type 1 and type 2 diabetes across the region, coupled with a growing awareness of the benefits of modern insulin delivery devices. Technological disruptions are playing a pivotal role, with the emergence of smart connected insulin pens that offer data logging, dose tracking, and smartphone integration, enhancing patient self-management and treatment adherence. Consumer preferences are shifting towards these user-friendly and discreet devices, especially among younger populations and those with active lifestyles. Competitive dynamics are intensifying, with established global manufacturers actively seeking to penetrate emerging markets within Latin America. The increasing disposable income in many Latin American countries is also contributing to the higher adoption rates of premium insulin pen products. Furthermore, government initiatives and healthcare reforms aimed at improving diabetes care infrastructure are creating a more conducive environment for market expansion. The penetration of insulin pens is expected to rise significantly as healthcare providers increasingly recommend these devices over traditional methods.

Dominant Markets & Segments in Latin America Insulin Pens Market

Brazil stands out as the dominant market within the Latin America Insulin Pens Market, driven by its large population, high diabetes prevalence, and a relatively well-developed healthcare infrastructure. The economic policies in Brazil have been supportive of medical device imports and domestic manufacturing, further bolstering the market. Mexico also represents a significant market, with a growing emphasis on chronic disease management. The Rest of Latin America, encompassing countries like Argentina, Colombia, and Chile, presents substantial untapped potential, with increasing healthcare investments and a rising middle class.

Device Segment Dominance:

- Disposable Insulin Pens: This segment is currently the largest and is expected to maintain its lead due to its inherent convenience, ease of use, and lower upfront cost, making it highly accessible to a broad patient demographic across Latin America.

- Cartridges in Reusable Pens: This segment is witnessing robust growth, fueled by increasing environmental consciousness and a desire for long-term cost savings among patients. The availability of a wider range of insulin formulations in cartridge formats also contributes to its expansion.

Geographical Dominance:

- Brazil: Its sheer market size, coupled with aggressive government campaigns for diabetes awareness and management, makes it the undisputed leader. The country's healthcare system is increasingly integrating advanced diabetes care solutions.

- Mexico: A strong contender with a significant diabetic population and a growing demand for technologically advanced medical devices. Supportive regulatory pathways are facilitating market entry for global players.

- Rest of Latin America: This segment offers significant growth opportunities due to its expanding economies and increasing healthcare expenditure. Countries like Colombia and Peru are showing promising market penetration for insulin pens.

Latin America Insulin Pens Market Product Innovations

Product innovations in the Latin America Insulin Pens Market are primarily focused on enhancing user experience and therapeutic outcomes. The development of smart connected insulin pens, equipped with Bluetooth connectivity for seamless data transfer to mobile applications, is a key trend. These devices offer advanced features such as dose tracking, reminders, and integration with continuous glucose monitoring (CGM) systems, empowering patients with better self-management tools. Miniaturization and ergonomic designs are also being prioritized to improve patient comfort and portability. Furthermore, advancements in materials science are leading to more durable and cost-effective pen components. These innovations directly address the growing demand for convenient, accurate, and personalized diabetes management solutions in the region.

Report Segmentation & Scope

This report segments the Latin America Insulin Pens Market into key categories for comprehensive analysis.

- Device: The market is analyzed across Disposable Insulin Pens and Cartridges in Reusable Pens. Disposable pens are characterized by their single-use nature, offering utmost convenience, while cartridges for reusable pens provide a more sustainable and potentially cost-effective long-term solution.

- Geography: The geographical segmentation includes the leading markets of Brazil and Mexico, along with the collective Rest of Latin America. This breakdown allows for a nuanced understanding of regional market dynamics, economic influences, and healthcare infrastructure variations.

Key Drivers of Latin America Insulin Pens Market Growth

The Latin America Insulin Pens Market growth is propelled by several key factors. The rising global and regional prevalence of diabetes, particularly type 2 diabetes, is a primary driver, necessitating advanced insulin delivery solutions. Technological advancements, including the development of smart and connected insulin pens, are enhancing patient convenience and treatment adherence, thereby driving adoption. Increasing disposable incomes and a growing middle class across Latin America are also contributing to the demand for premium diabetes management devices. Furthermore, government initiatives and increasing healthcare expenditure aimed at improving chronic disease management infrastructure are creating a favorable market environment.

Challenges in the Latin America Insulin Pens Market Sector

Despite the positive growth outlook, the Latin America Insulin Pens Market faces several challenges. High import duties and complex regulatory approval processes in some countries can hinder market entry and increase product costs. Price sensitivity among a significant portion of the population, especially in developing economies, can limit the adoption of more expensive insulin pen devices. The underdeveloped healthcare infrastructure in certain rural areas may also pose a barrier to widespread access. Additionally, fierce competition from established players and the continuous need for product innovation to stay ahead of market trends present ongoing challenges for manufacturers.

Leading Players in the Latin America Insulin Pens Market Market

- Ultimed

- Trividia Health

- Becton Dickinson

- Cardinal Health

- Arkray

Key Developments in Latin America Insulin Pens Market Sector

- July 2023: Gan & Lee emerged as the successful bidder for the insulin aspart injections and reusable insulin pen products developed by the company to Brazil. The initial consignment of these products has already been dispatched to brazil, signifying the fulfillment of the initial round of deliveries. The shipment encompasses a total of 1.34 million cartridges of 3 mL insulin aspart injections and 67,000 reusable insulin pens.

- March 2022: Novo Nordisk announced that two smart connected insulin pens, NovoPen 6 and NovoPen Echo Plus, were available on prescription for people with diabetes treated with Novo Nordisk insulin in the United Kingdom.

Strategic Latin America Insulin Pens Market Market Outlook

The strategic outlook for the Latin America Insulin Pens Market is highly promising, fueled by sustained growth accelerators. The increasing adoption of smart insulin pens, offering enhanced connectivity and data management capabilities, is expected to be a significant growth engine. Expansion into underserved regions within Latin America, coupled with strategic partnerships with local distributors and healthcare providers, will be crucial for market penetration. Furthermore, continued investment in research and development to introduce innovative, cost-effective, and user-friendly insulin delivery systems will enable manufacturers to capture a larger market share. The focus on patient education and awareness programs surrounding the benefits of insulin pens will also be instrumental in driving market demand and ensuring long-term success.

Latin America Insulin Pens Market Segmentation

-

1. Device

- 1.1. Disposable Insulin Pens

- 1.2. Cartridges in Reusable Pens

-

2. Geography

- 2.1. Brazil

- 2.2. Mexico

- 2.3. Rest of Latin America

Latin America Insulin Pens Market Segmentation By Geography

- 1. Brazil

- 2. Mexico

- 3. Rest of Latin America

Latin America Insulin Pens Market Regional Market Share

Geographic Coverage of Latin America Insulin Pens Market

Latin America Insulin Pens Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 1.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Early Diagnosis of Chronic Conditions; Increasing Incidence of Trauma and Accidents; Surge in the Number of Surgical Procedures Carried Out Worldwide

- 3.3. Market Restrains

- 3.3.1. Blood Contaminations and Other Complications; Injury Caused During Blood Collection

- 3.4. Market Trends

- 3.4.1. Rising diabetes prevalence in Latin America is driving the market in the forecast period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Insulin Pens Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device

- 5.1.1. Disposable Insulin Pens

- 5.1.2. Cartridges in Reusable Pens

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Brazil

- 5.2.2. Mexico

- 5.2.3. Rest of Latin America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.3.2. Mexico

- 5.3.3. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Device

- 6. Brazil Latin America Insulin Pens Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Device

- 6.1.1. Disposable Insulin Pens

- 6.1.2. Cartridges in Reusable Pens

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Brazil

- 6.2.2. Mexico

- 6.2.3. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Device

- 7. Mexico Latin America Insulin Pens Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Device

- 7.1.1. Disposable Insulin Pens

- 7.1.2. Cartridges in Reusable Pens

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Brazil

- 7.2.2. Mexico

- 7.2.3. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Device

- 8. Rest of Latin America Latin America Insulin Pens Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Device

- 8.1.1. Disposable Insulin Pens

- 8.1.2. Cartridges in Reusable Pens

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Brazil

- 8.2.2. Mexico

- 8.2.3. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Device

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Ultimed*List Not Exhaustive 7 2 Company Share Analysi

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Trividia Health

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Becton Dickinson

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 7 COMPETITIVE LANDSCAPE7 1 Company profiles

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Cardinal Health

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Arkray

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.1 Ultimed*List Not Exhaustive 7 2 Company Share Analysi

List of Figures

- Figure 1: Latin America Insulin Pens Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Insulin Pens Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Insulin Pens Market Revenue Million Forecast, by Device 2020 & 2033

- Table 2: Latin America Insulin Pens Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: Latin America Insulin Pens Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Latin America Insulin Pens Market Revenue Million Forecast, by Device 2020 & 2033

- Table 5: Latin America Insulin Pens Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Latin America Insulin Pens Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Latin America Insulin Pens Market Revenue Million Forecast, by Device 2020 & 2033

- Table 8: Latin America Insulin Pens Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 9: Latin America Insulin Pens Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Latin America Insulin Pens Market Revenue Million Forecast, by Device 2020 & 2033

- Table 11: Latin America Insulin Pens Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Latin America Insulin Pens Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Insulin Pens Market?

The projected CAGR is approximately > 1.80%.

2. Which companies are prominent players in the Latin America Insulin Pens Market?

Key companies in the market include Ultimed*List Not Exhaustive 7 2 Company Share Analysi, Trividia Health, Becton Dickinson, 7 COMPETITIVE LANDSCAPE7 1 Company profiles, Cardinal Health, Arkray.

3. What are the main segments of the Latin America Insulin Pens Market?

The market segments include Device, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.4 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Early Diagnosis of Chronic Conditions; Increasing Incidence of Trauma and Accidents; Surge in the Number of Surgical Procedures Carried Out Worldwide.

6. What are the notable trends driving market growth?

Rising diabetes prevalence in Latin America is driving the market in the forecast period.

7. Are there any restraints impacting market growth?

Blood Contaminations and Other Complications; Injury Caused During Blood Collection.

8. Can you provide examples of recent developments in the market?

July 2023: Gan & Lee emerged as the successful bidder for the insulin aspart injections and reusable insulin pen products developed by the company to Brazil. The initial consignment of these products has already been dispatched to brazil, signifying the fulfillment of the initial round of deliveries. The shipment encompasses a total of 1.34 million cartridges of 3 mL insulin aspart injections and 67,000 reusable insulin pens.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Insulin Pens Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Insulin Pens Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Insulin Pens Market?

To stay informed about further developments, trends, and reports in the Latin America Insulin Pens Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence