Key Insights

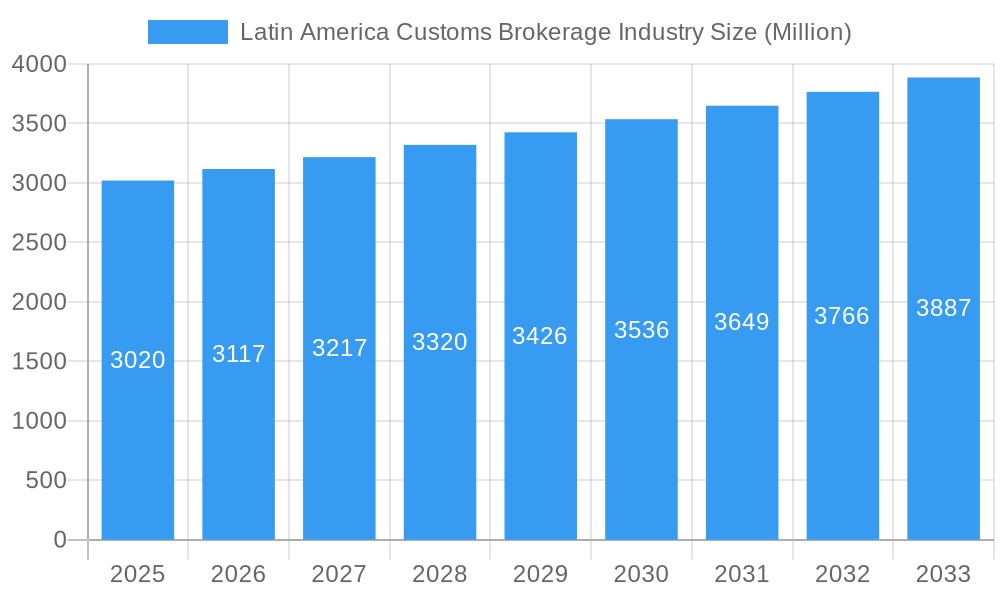

The Latin American customs brokerage industry, valued at $3.02 billion in 2025, is projected to experience steady growth, driven by increasing cross-border trade and e-commerce within the region. A Compound Annual Growth Rate (CAGR) of 3.31% from 2025 to 2033 indicates a significant expansion opportunity. Key growth drivers include the rising demand for efficient logistics solutions within burgeoning sectors like automotive, FMCG, and technology. The expanding middle class in Latin America fuels increased consumer spending, subsequently increasing import and export volumes. Mexico, Brazil, and Chile are expected to remain dominant markets, given their established economies and strategic geographic locations. However, growth in smaller economies like Colombia and Panama should not be underestimated, especially considering the expanding e-commerce market penetrating these regions. While regulatory complexities and fluctuating exchange rates pose challenges, the industry's overall outlook remains positive, particularly with the continued adoption of technological advancements such as automation and digitalization to streamline customs processes.

Latin America Customs Brokerage Industry Market Size (In Billion)

The industry is segmented by mode of transport (ocean, air, and cross-border land transport) and end-user sectors. The automotive and FMCG sectors are major contributors to the industry's revenue. The increasing demand for perishable goods, particularly in the reefer segment (fruits, vegetables, pharmaceuticals, etc.), will likely drive further growth. The rise of e-commerce channels within the retail sector also presents a significant growth driver. Competitive dynamics within the market are shaped by a mix of large multinational companies like DHL and DSV, alongside numerous smaller regional players. The success of individual firms hinges upon their ability to navigate complex regulatory landscapes, offer specialized services, and adapt to evolving technological trends. Consolidation within the industry is possible as larger firms seek to expand their market share.

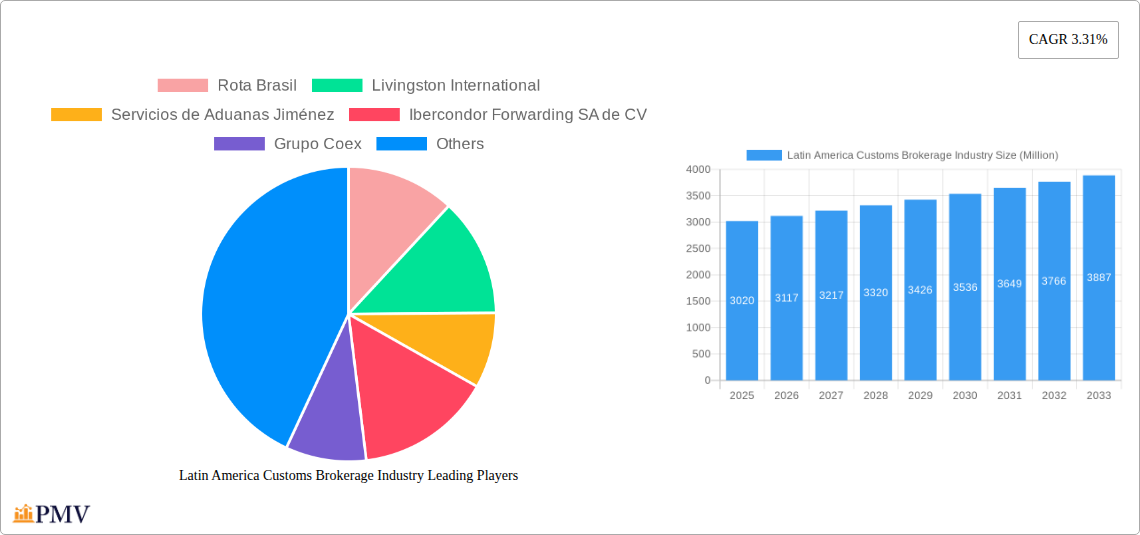

Latin America Customs Brokerage Industry Company Market Share

This comprehensive report provides a detailed analysis of the Latin America Customs Brokerage Industry, offering invaluable insights for businesses operating within and seeking to enter this dynamic market. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report leverages extensive market research to provide a granular view of market trends, competitive dynamics, and future growth prospects, covering key countries including Mexico, Brazil, Chile, Colombia, Panama, and the Rest of Latin America. The estimated market size in 2025 is xx Million.

Latin America Customs Brokerage Industry Market Structure & Competitive Dynamics

The Latin American customs brokerage market exhibits a moderately concentrated structure, with a few large multinational players and numerous smaller, regional firms. Market share is largely distributed amongst players like Livingston International, Expeditors International, Grupo Coex, and Ibercondor Forwarding SA de CV, while numerous smaller players cater to specific niches or geographic regions. The market's competitive landscape is influenced by several factors including:

- Market Concentration: The top 5 players hold an estimated xx% market share in 2025, indicating moderate consolidation.

- Innovation Ecosystems: Technological advancements, such as digital customs platforms and AI-driven solutions, are driving innovation and efficiency gains.

- Regulatory Frameworks: Varying customs regulations across Latin American countries create a complex operational environment. This complexity drives demand for specialized brokerage services.

- Product Substitutes: Limited direct substitutes exist, as customs brokerage requires specialized expertise and regulatory compliance.

- End-User Trends: Shifting consumer preferences and evolving supply chain strategies significantly influence demand for brokerage services, particularly in segments like e-commerce and reefer transportation.

- M&A Activities: Consolidation is expected to continue, driven by the desire for scale and expansion into new markets. The total value of M&A deals in the sector during the historical period (2019-2024) reached approximately xx Million.

Latin America Customs Brokerage Industry Industry Trends & Insights

The Latin American customs brokerage market is characterized by robust growth, driven by a number of key factors. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%. Key trends shaping the industry include:

- E-commerce Boom: The rapid expansion of e-commerce in Latin America is boosting demand for efficient cross-border logistics and customs brokerage services. Market penetration of e-commerce-related brokerage services increased by xx% from 2019 to 2024.

- Infrastructure Development: Investments in port infrastructure and transportation networks across the region are facilitating smoother trade flows and increasing the volume of goods requiring customs clearance.

- Technological Disruptions: The adoption of digital customs platforms and automation technologies is streamlining processes and enhancing efficiency for customs brokers.

- Regional Trade Agreements: Free trade agreements are boosting intra-regional trade, creating further opportunities for customs brokerage firms.

- Regulatory Changes: Government initiatives to simplify customs procedures are contributing to market growth.

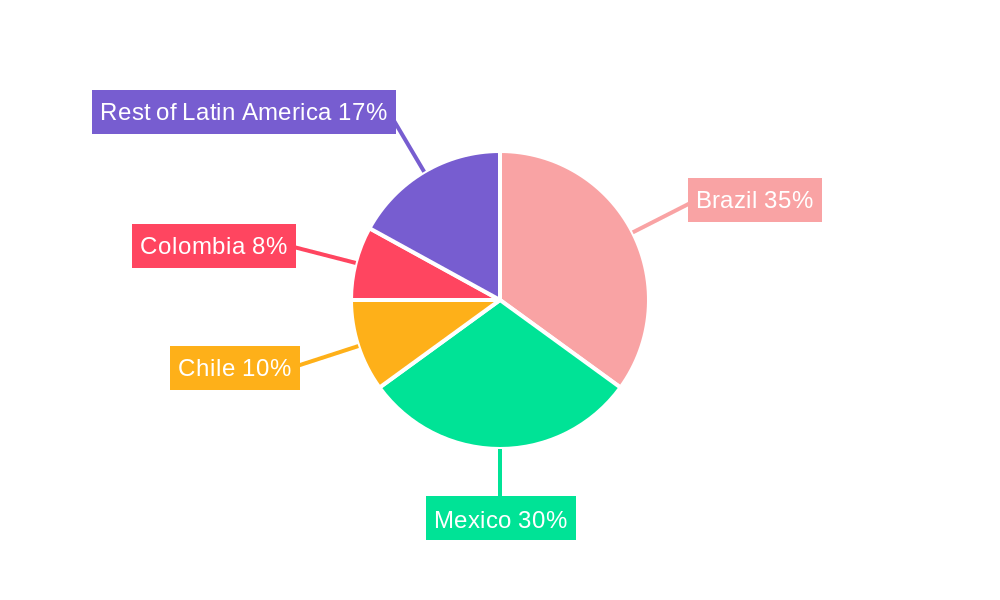

Dominant Markets & Segments in Latin America Customs Brokerage Industry

Mexico and Brazil represent the largest markets within Latin America for customs brokerage services, collectively accounting for an estimated xx% of the total market value in 2025.

Dominant Segments:

- Mode of Transport: Ocean freight remains the dominant mode, driven by substantial import and export volumes, followed by air freight and cross-border land transport.

- End-User: The FMCG sector (including beauty and personal care, soft drinks, and home care) and the retail sector (hypermarkets, supermarkets, convenience stores, and e-commerce channels) are significant drivers of demand, followed by the automotive and technology sectors. The Reefer segment shows strong growth potential due to increased demand for perishable goods.

Key Drivers by Country:

- Mexico: Strong manufacturing sector, proximity to the US market, and robust e-commerce growth.

- Brazil: Large economy, significant import and export volumes, and expanding infrastructure.

- Chile: Well-developed port infrastructure and strategic location for South American trade.

- Colombia: Growing economy, increasing foreign investment, and improving logistics infrastructure.

- Panama: Strategic location as a transit hub and strong maritime sector.

Latin America Customs Brokerage Industry Product Innovations

Recent product innovations in the customs brokerage industry focus on leveraging technology to improve efficiency, accuracy, and transparency. This includes the development of digital platforms for customs clearance, AI-powered solutions for risk management, and blockchain-based systems for secure data sharing. These innovations cater to the growing need for speed, reduced costs, and enhanced compliance in the increasingly complex regulatory landscape.

Report Segmentation & Scope

This report segments the Latin American customs brokerage market by country (Mexico, Brazil, Chile, Colombia, Panama, and Rest of Latin America) and by mode of transport (ocean, air, and cross-border land). Further segmentation is provided by end-user industries (automotive, chemicals, FMCG, retail, fashion and lifestyle, reefer, technology, and other end-users). The report includes growth projections, market size estimations, and competitive analyses for each segment. Each segment showcases unique growth dynamics. For example, the Reefer segment exhibits a higher CAGR than the general market due to increased demand for temperature-sensitive goods, while the e-commerce related portion of the retail segment shows a particularly high growth rate.

Key Drivers of Latin America Customs Brokerage Industry Growth

Growth in the Latin American customs brokerage industry is fueled by several factors:

- Expanding Intra-Regional Trade: Increased trade within Latin America fuels demand for efficient customs brokerage services.

- Growth of E-commerce: The rapid growth of e-commerce is a key driver, requiring specialized customs brokerage expertise for cross-border shipments.

- Improved Infrastructure: Investments in ports and transportation networks enhance trade flows and increase the need for customs clearance.

- Government Initiatives: Regulatory reforms designed to streamline customs processes are fostering growth.

Challenges in the Latin America Customs Brokerage Industry Sector

The Latin American customs brokerage industry faces several challenges:

- Regulatory Complexity: Varying customs regulations across different countries create operational complexity.

- Bureaucracy and Corruption: Bureaucratic hurdles and potential instances of corruption can slow down processes and increase costs.

- Infrastructure Deficiencies: Insufficient infrastructure in some regions can cause delays in shipments.

- Competitive Pressures: Intense competition amongst brokerage firms necessitates ongoing innovation and efficiency improvements. These challenges result in an estimated xx Million in lost revenue annually across the industry.

Leading Players in the Latin America Customs Brokerage Industry Market

- Rota Brasil

- Livingston International

- Servicios de Aduanas Jiménez

- Ibercondor Forwarding SA de CV

- Grupo Coex

- Expeditors International

- Elemar

- Deutsche Post DHL Group

- Aduana Cordero

- Grupo Ei

- Farrow

- DSV Panalpina AS

Key Developments in Latin America Customs Brokerage Industry Sector

- 2022 Q3: Grupo Coex acquired a smaller brokerage firm in Colombia, expanding its regional footprint.

- 2023 Q1: Livingston International launched a new digital customs platform, improving efficiency and transparency for its clients.

- 2024 Q2: New regulations implemented in Mexico streamlined certain customs procedures, reducing processing times.

Strategic Latin America Customs Brokerage Industry Market Outlook

The Latin American customs brokerage market presents significant growth potential in the coming years. Continued investment in infrastructure, the expansion of e-commerce, and ongoing efforts to improve regulatory frameworks will create favorable conditions for market expansion. Strategic opportunities lie in leveraging technological advancements, focusing on niche markets, and expanding regional presence through strategic acquisitions or partnerships. The market is poised for sustained growth, offering substantial opportunities for established players and new entrants alike.

Latin America Customs Brokerage Industry Segmentation

-

1. Mode of Transport

- 1.1. Ocean

- 1.2. Air

- 1.3. Cross-border Land Transport

-

2. End User

- 2.1. Automotive

- 2.2. Chemicals

- 2.3. FMCG (Fa

- 2.4. Retail (

- 2.5. Fashion and Lifestyle (Apparel and Footwear)

- 2.6. Reefer (

- 2.7. Technology (Consumer Electronics, Home Appliances)

- 2.8. Other End Users

Latin America Customs Brokerage Industry Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Customs Brokerage Industry Regional Market Share

Geographic Coverage of Latin America Customs Brokerage Industry

Latin America Customs Brokerage Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rise In Agriculture Sector and Food Industry4.; Rise In Pharmaceutical Industry

- 3.3. Market Restrains

- 3.3.1. 4.; Cost Constraints4.; Infrastructure Accessibility

- 3.4. Market Trends

- 3.4.1. Increase in Ocean Freight

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Customs Brokerage Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 5.1.1. Ocean

- 5.1.2. Air

- 5.1.3. Cross-border Land Transport

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Automotive

- 5.2.2. Chemicals

- 5.2.3. FMCG (Fa

- 5.2.4. Retail (

- 5.2.5. Fashion and Lifestyle (Apparel and Footwear)

- 5.2.6. Reefer (

- 5.2.7. Technology (Consumer Electronics, Home Appliances)

- 5.2.8. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Rota Brasil

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Livingston International

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Servicios de Aduanas Jiménez

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ibercondor Forwarding SA de CV

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Grupo Coex

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Expeditors International**List Not Exhaustive 6 3 Other Companies (Key Information/Overview - List of Key Small to Medium-scale Players in Each Country

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Elemar

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Deutsche Post DHL Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Aduana Cordero

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Grupo Ei

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Farrow

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 DSV Panalpina AS

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Rota Brasil

List of Figures

- Figure 1: Latin America Customs Brokerage Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Customs Brokerage Industry Share (%) by Company 2025

List of Tables

- Table 1: Latin America Customs Brokerage Industry Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 2: Latin America Customs Brokerage Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Latin America Customs Brokerage Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Latin America Customs Brokerage Industry Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 5: Latin America Customs Brokerage Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Latin America Customs Brokerage Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Brazil Latin America Customs Brokerage Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Argentina Latin America Customs Brokerage Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Chile Latin America Customs Brokerage Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Colombia Latin America Customs Brokerage Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Latin America Customs Brokerage Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Peru Latin America Customs Brokerage Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Venezuela Latin America Customs Brokerage Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Ecuador Latin America Customs Brokerage Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Bolivia Latin America Customs Brokerage Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Paraguay Latin America Customs Brokerage Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Customs Brokerage Industry?

The projected CAGR is approximately 3.31%.

2. Which companies are prominent players in the Latin America Customs Brokerage Industry?

Key companies in the market include Rota Brasil, Livingston International, Servicios de Aduanas Jiménez, Ibercondor Forwarding SA de CV, Grupo Coex, Expeditors International**List Not Exhaustive 6 3 Other Companies (Key Information/Overview - List of Key Small to Medium-scale Players in Each Country, Elemar, Deutsche Post DHL Group, Aduana Cordero, Grupo Ei, Farrow, DSV Panalpina AS.

3. What are the main segments of the Latin America Customs Brokerage Industry?

The market segments include Mode of Transport, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.02 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rise In Agriculture Sector and Food Industry4.; Rise In Pharmaceutical Industry.

6. What are the notable trends driving market growth?

Increase in Ocean Freight.

7. Are there any restraints impacting market growth?

4.; Cost Constraints4.; Infrastructure Accessibility.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Customs Brokerage Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Customs Brokerage Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Customs Brokerage Industry?

To stay informed about further developments, trends, and reports in the Latin America Customs Brokerage Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence