Key Insights

The global large satellites market is poised for significant expansion, projected to reach $79.21 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 9.24% from the base year 2025. This growth trajectory is propelled by escalating demand for high-throughput satellite communications, especially in underserved regions, driving investment in advanced, high-capacity satellites. Innovations in propulsion systems, such as electric and hybrid technologies, are enhancing deployment efficiency and extending satellite operational longevity. Government-led space exploration and national security objectives further stimulate market expansion, particularly within the military and government segments. The market is segmented by orbit (GEO, LEO, MEO), end-user (commercial, military & government, other), propulsion technology (electric, gas-based, liquid fuel), and application (communication, earth observation, navigation, space observation, and others). The commercial sector currently leads, fueled by the growing need for ubiquitous global broadband and superior communication services.

Large Satellites Market Market Size (In Billion)

The competitive landscape features established leaders including Lockheed Martin, Airbus, Boeing, and CASC, alongside emerging players and national space agencies like ISRO, fostering innovation and broadening market dynamics. Despite challenges such as substantial launch expenditures and intricate development processes, the long-term outlook for the large satellites market is highly positive, underpinned by the increasing dependency on satellite-derived services across various industries. Advances in satellite miniaturization and manufacturing techniques are anticipated to improve market accessibility and spur future growth, notably within the LEO segment, which is experiencing rapid development of satellite constellations. Consequently, strategic R&D investments and robust government backing will be pivotal in shaping the future evolution of this dynamic market.

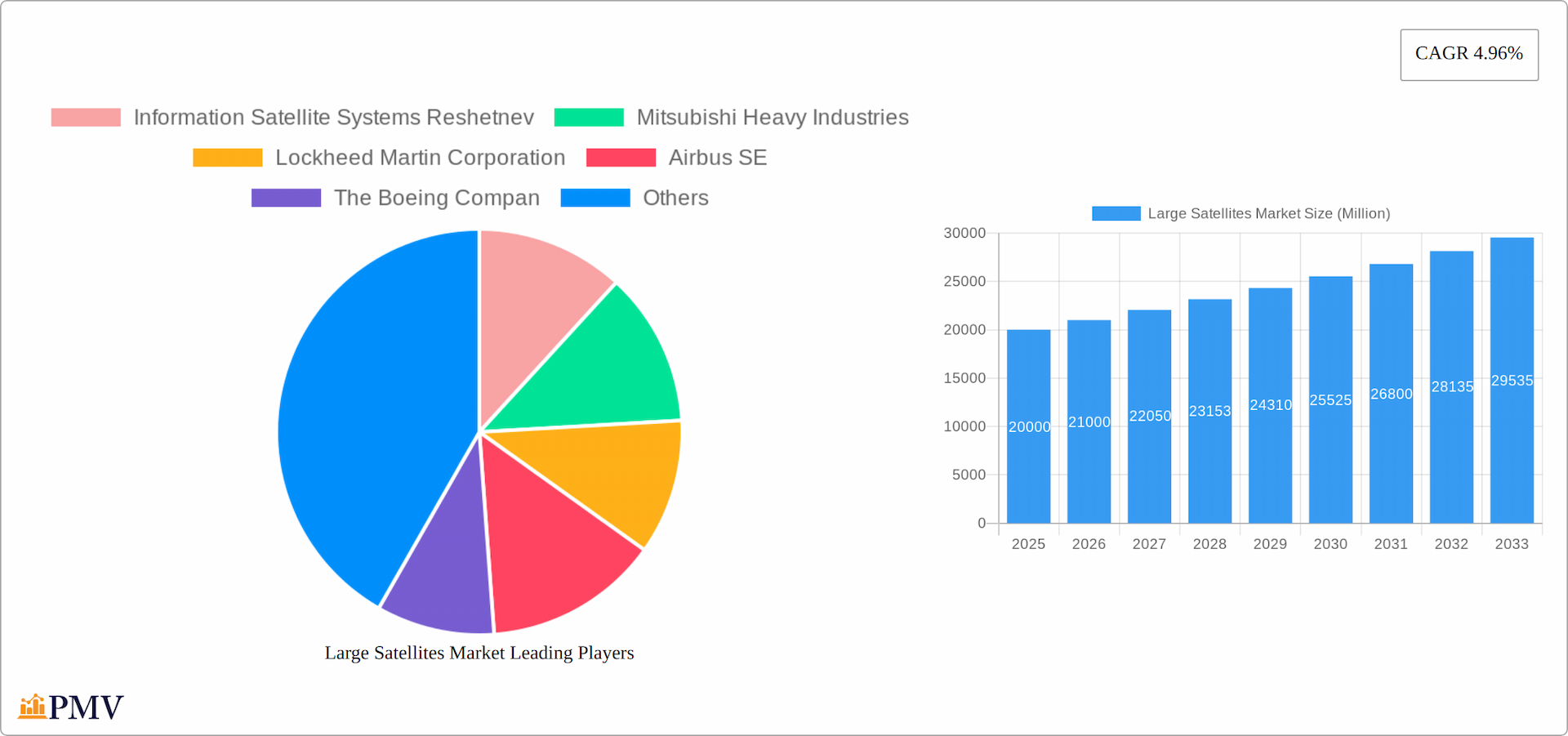

Large Satellites Market Company Market Share

Large Satellites Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the global Large Satellites Market, offering invaluable insights for stakeholders across the space industry. Covering the period from 2019 to 2033, with a base year of 2025, this report meticulously examines market trends, competitive dynamics, and future growth prospects. The report's detailed segmentation by Orbit Class (GEO, LEO, MEO), End User (Commercial, Military & Government, Other), Propulsion Technology (Electric, Gas-based, Liquid Fuel), and Application (Communication, Earth Observation, Navigation, Space Observation, Others) provides granular insights for strategic decision-making. The projected market value for 2025 is estimated at xx Million, with a forecasted CAGR of xx% from 2025 to 2033.

Large Satellites Market Market Structure & Competitive Dynamics

The large satellites market exhibits a moderately consolidated structure, with a few major players holding significant market share. The industry is characterized by high barriers to entry due to substantial R&D investments, complex technological expertise, and stringent regulatory compliance. Innovation ecosystems are dynamic, with constant advancements in propulsion technologies, satellite design, and communication systems driving market evolution. Regulatory frameworks vary across nations, impacting market access and operational costs. While direct product substitutes are limited, competitive pressure arises from smaller satellite constellations offering niche services. Mergers and acquisitions (M&A) activities are frequent, reflecting the industry's pursuit of consolidation, technological expertise acquisition, and expansion into new markets. Recent M&A deals, while not publicly disclosed with exact values in many cases, have generally involved xx Million to xx Million USD in transaction values. Key players constantly strive to improve their market share; for example, Lockheed Martin and The Boeing Company have historically held a substantial portion of the defense and government sector. Market share fluctuates based on successful contract wins and technological advancements, making continuous monitoring crucial.

Large Satellites Market Industry Trends & Insights

The large satellites market is experiencing robust growth, fueled by the escalating demand for high-bandwidth communication, sophisticated earth observation capabilities, and robust navigation systems. This expansion is driven by several key factors: the increasing need for high-speed, reliable global connectivity; the growing reliance on space-based assets for defense, intelligence gathering, and scientific research; and the burgeoning field of space-based internet services. Technological advancements, particularly in electric propulsion, miniaturization, and advanced materials, are significantly reducing launch costs and extending satellite lifespans, further stimulating market growth.

Consumer preferences are shifting towards increased data speeds and reliable connectivity, significantly impacting the demand for high-capacity communication satellites. The market is witnessing intense competitive dynamics, with key players investing heavily in research and development (R&D) to maintain a competitive edge and introduce innovative technologies. The Compound Annual Growth Rate (CAGR) for the period between 2019-2024 was xx%, with projections for 2025-2033 indicating a potential increase to xx%. Market penetration in developing nations is gradually rising as infrastructure improves and awareness of space-based services grows, presenting significant untapped potential.

Dominant Markets & Segments in Large Satellites Market

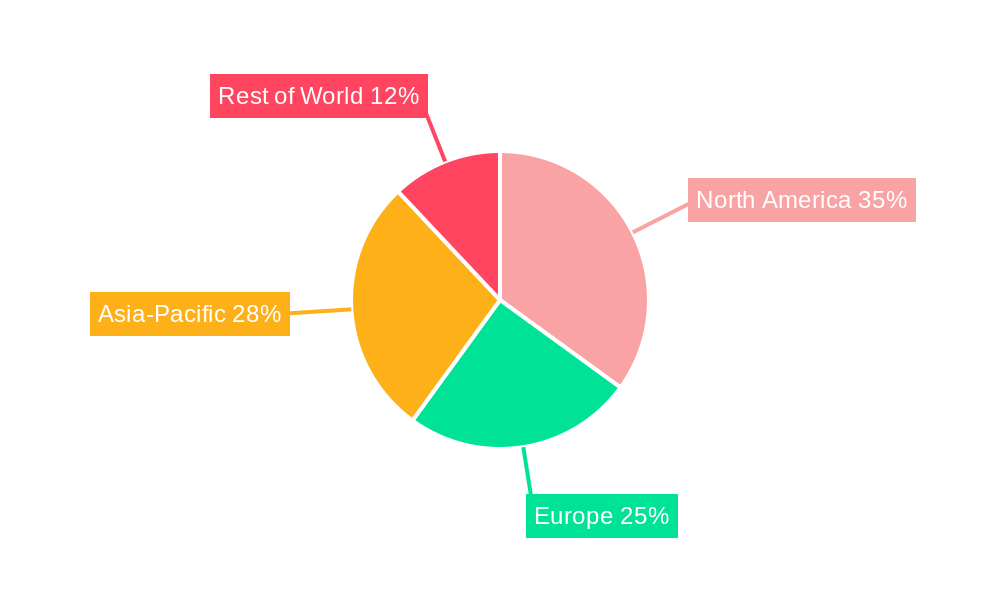

- Leading Region: North America currently dominates the large satellites market, driven by strong government investment in defense and space exploration, along with a robust commercial space sector.

- Dominant Orbit Class: The Geostationary Earth Orbit (GEO) segment holds a significant market share, owing to its advantageous position for continuous coverage of specific geographic areas, vital for communication and broadcasting applications.

- Largest End User: The Military & Government segment constitutes a major portion of market demand, driven by the crucial role of large satellites in national security, intelligence gathering, and strategic communication.

- Primary Propulsion Technology: Gas-based propulsion systems currently dominate the market, owing to their reliability and maturity.

- Leading Application: Communication services form the largest application segment due to the continued demand for high-bandwidth and reliable data transmission.

North America's dominance is attributable to its substantial investments in space technology R&D, a well-established space industry ecosystem, and strong government support for space programs. The GEO segment's dominance stems from its established use in communication applications. Military and government demand continues to grow due to increased reliance on space-based intelligence and communication assets. Gas-based propulsion systems have proven their reliability, while the communication applications segment demonstrates continued growth driven by rising global internet penetration.

Large Satellites Market Product Innovations

Recent innovations focus on enhancing satellite lifespan, improving data transmission speeds, and reducing launch costs. This includes advancements in electric propulsion systems, the development of high-throughput communication payloads, and the integration of advanced onboard processing capabilities. These innovations are aimed at catering to the growing demand for enhanced performance and cost-effectiveness, making large satellites more competitive.

Report Segmentation & Scope

This comprehensive report segments the large satellites market based on several key parameters, providing a granular view of the market landscape:

- Orbit Class: GEO (Geostationary Orbit), LEO (Low Earth Orbit), MEO (Medium Earth Orbit)

- End-User: Commercial, Military & Government, Other

- Propulsion Technology: Electric, Gas-based, Liquid Fuel

- Application: Communication, Earth Observation, Navigation, Space Observation, Others

Each segment includes detailed growth projections, market size estimations, and in-depth analysis of competitive dynamics, incorporating historical data (2019-2024), the base year (2025), and the forecast period (2025-2033). For example, the communication application segment is expected to witness the highest CAGR due to the exponential rise in demand for satellite internet services and the expansion of broadband access globally.

Key Drivers of Large Satellites Market Growth

The market’s growth is propelled by several factors: the increasing demand for high-bandwidth communication, particularly for satellite internet and broadcasting; advancements in satellite technology, including electric propulsion and miniaturization, reducing costs; and the growing importance of space-based assets for national security and defense applications. Government initiatives promoting space exploration and investment in related infrastructure further contribute to market growth.

Challenges in the Large Satellites Market Sector

Despite the significant growth potential, the large satellites market faces several key challenges:

- High Development and Launch Costs: The substantial investment required for satellite design, manufacturing, and launch remains a significant barrier to entry.

- Stringent Regulatory Compliance: Navigating complex international regulations and obtaining necessary permits adds to the overall cost and complexity.

- Space Debris Mitigation: The increasing amount of space debris poses a substantial threat to operational satellites, requiring proactive mitigation strategies.

- Supply Chain Disruptions: Global supply chain vulnerabilities can impact the timely delivery of components and affect project timelines.

- Intense Competition: The competitive landscape is characterized by established players and emerging entrants, creating a highly dynamic and challenging environment.

Leading Players in the Large Satellites Market Market

- Information Satellite Systems Reshetnev

- Mitsubishi Heavy Industries

- Lockheed Martin Corporation

- Airbus SE

- The Boeing Company

- China Aerospace Science and Technology Corporation (CASC)

- Thales

- Maxar Technologies Inc

- Indian Space Research Organisation (ISRO)

Key Developments in Large Satellites Market Sector

- January 2023: The UK government's partnership with Airbus Defence and Space signifies a significant investment in bolstering the UK's space defense capabilities and strengthens Airbus' position in the defense sector.

- January 2023: Airbus' 15-year contract with the Belgian Ministry of Defence for tactical satellite communication services underscores the growing demand for secure communication solutions within Europe and NATO.

- September 2022: China's successful launch of two BeiDou satellites highlights the country's continued advancements in navigation technology and its ambitions for global positioning system dominance.

- [Add more recent key developments here with dates and brief descriptions]

Strategic Large Satellites Market Market Outlook

The large satellites market is poised for sustained growth, driven by technological advancements, increasing demand for space-based services, and significant government investments worldwide. Strategic opportunities lie in developing cost-effective launch systems, enhancing satellite performance, and expanding into new applications, particularly in the burgeoning field of space-based internet services. Focusing on innovation and strategic partnerships will be crucial for players seeking to capture a larger share of this expanding market.

Large Satellites Market Segmentation

-

1. Application

- 1.1. Communication

- 1.2. Earth Observation

- 1.3. Navigation

- 1.4. Space Observation

- 1.5. Others

-

2. Orbit Class

- 2.1. GEO

- 2.2. LEO

- 2.3. MEO

-

3. End User

- 3.1. Commercial

- 3.2. Military & Government

- 3.3. Other

-

4. Propulsion Tech

- 4.1. Electric

- 4.2. Gas based

- 4.3. Liquid Fuel

Large Satellites Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Large Satellites Market Regional Market Share

Geographic Coverage of Large Satellites Market

Large Satellites Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The increasing number of satellites with long lifespans helps the Asia-Pacific region maintain a substantial market share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Large Satellites Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Communication

- 5.1.2. Earth Observation

- 5.1.3. Navigation

- 5.1.4. Space Observation

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Orbit Class

- 5.2.1. GEO

- 5.2.2. LEO

- 5.2.3. MEO

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Commercial

- 5.3.2. Military & Government

- 5.3.3. Other

- 5.4. Market Analysis, Insights and Forecast - by Propulsion Tech

- 5.4.1. Electric

- 5.4.2. Gas based

- 5.4.3. Liquid Fuel

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Large Satellites Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Communication

- 6.1.2. Earth Observation

- 6.1.3. Navigation

- 6.1.4. Space Observation

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Orbit Class

- 6.2.1. GEO

- 6.2.2. LEO

- 6.2.3. MEO

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Commercial

- 6.3.2. Military & Government

- 6.3.3. Other

- 6.4. Market Analysis, Insights and Forecast - by Propulsion Tech

- 6.4.1. Electric

- 6.4.2. Gas based

- 6.4.3. Liquid Fuel

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Large Satellites Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Communication

- 7.1.2. Earth Observation

- 7.1.3. Navigation

- 7.1.4. Space Observation

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Orbit Class

- 7.2.1. GEO

- 7.2.2. LEO

- 7.2.3. MEO

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Commercial

- 7.3.2. Military & Government

- 7.3.3. Other

- 7.4. Market Analysis, Insights and Forecast - by Propulsion Tech

- 7.4.1. Electric

- 7.4.2. Gas based

- 7.4.3. Liquid Fuel

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Large Satellites Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Communication

- 8.1.2. Earth Observation

- 8.1.3. Navigation

- 8.1.4. Space Observation

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Orbit Class

- 8.2.1. GEO

- 8.2.2. LEO

- 8.2.3. MEO

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Commercial

- 8.3.2. Military & Government

- 8.3.3. Other

- 8.4. Market Analysis, Insights and Forecast - by Propulsion Tech

- 8.4.1. Electric

- 8.4.2. Gas based

- 8.4.3. Liquid Fuel

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Large Satellites Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Communication

- 9.1.2. Earth Observation

- 9.1.3. Navigation

- 9.1.4. Space Observation

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Orbit Class

- 9.2.1. GEO

- 9.2.2. LEO

- 9.2.3. MEO

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Commercial

- 9.3.2. Military & Government

- 9.3.3. Other

- 9.4. Market Analysis, Insights and Forecast - by Propulsion Tech

- 9.4.1. Electric

- 9.4.2. Gas based

- 9.4.3. Liquid Fuel

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Large Satellites Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Communication

- 10.1.2. Earth Observation

- 10.1.3. Navigation

- 10.1.4. Space Observation

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Orbit Class

- 10.2.1. GEO

- 10.2.2. LEO

- 10.2.3. MEO

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Commercial

- 10.3.2. Military & Government

- 10.3.3. Other

- 10.4. Market Analysis, Insights and Forecast - by Propulsion Tech

- 10.4.1. Electric

- 10.4.2. Gas based

- 10.4.3. Liquid Fuel

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Information Satellite Systems Reshetnev

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Mitsubishi Heavy Industries

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lockheed Martin Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Airbus SE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 The Boeing Compan

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 China Aerospace Science and Technology Corporation (CASC)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Thales

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Maxar Technologies Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Indian Space Research Organisation (ISRO)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Information Satellite Systems Reshetnev

List of Figures

- Figure 1: Global Large Satellites Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Large Satellites Market Revenue (billion), by Application 2025 & 2033

- Figure 3: North America Large Satellites Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Large Satellites Market Revenue (billion), by Orbit Class 2025 & 2033

- Figure 5: North America Large Satellites Market Revenue Share (%), by Orbit Class 2025 & 2033

- Figure 6: North America Large Satellites Market Revenue (billion), by End User 2025 & 2033

- Figure 7: North America Large Satellites Market Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Large Satellites Market Revenue (billion), by Propulsion Tech 2025 & 2033

- Figure 9: North America Large Satellites Market Revenue Share (%), by Propulsion Tech 2025 & 2033

- Figure 10: North America Large Satellites Market Revenue (billion), by Country 2025 & 2033

- Figure 11: North America Large Satellites Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America Large Satellites Market Revenue (billion), by Application 2025 & 2033

- Figure 13: South America Large Satellites Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: South America Large Satellites Market Revenue (billion), by Orbit Class 2025 & 2033

- Figure 15: South America Large Satellites Market Revenue Share (%), by Orbit Class 2025 & 2033

- Figure 16: South America Large Satellites Market Revenue (billion), by End User 2025 & 2033

- Figure 17: South America Large Satellites Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: South America Large Satellites Market Revenue (billion), by Propulsion Tech 2025 & 2033

- Figure 19: South America Large Satellites Market Revenue Share (%), by Propulsion Tech 2025 & 2033

- Figure 20: South America Large Satellites Market Revenue (billion), by Country 2025 & 2033

- Figure 21: South America Large Satellites Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe Large Satellites Market Revenue (billion), by Application 2025 & 2033

- Figure 23: Europe Large Satellites Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Europe Large Satellites Market Revenue (billion), by Orbit Class 2025 & 2033

- Figure 25: Europe Large Satellites Market Revenue Share (%), by Orbit Class 2025 & 2033

- Figure 26: Europe Large Satellites Market Revenue (billion), by End User 2025 & 2033

- Figure 27: Europe Large Satellites Market Revenue Share (%), by End User 2025 & 2033

- Figure 28: Europe Large Satellites Market Revenue (billion), by Propulsion Tech 2025 & 2033

- Figure 29: Europe Large Satellites Market Revenue Share (%), by Propulsion Tech 2025 & 2033

- Figure 30: Europe Large Satellites Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Europe Large Satellites Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa Large Satellites Market Revenue (billion), by Application 2025 & 2033

- Figure 33: Middle East & Africa Large Satellites Market Revenue Share (%), by Application 2025 & 2033

- Figure 34: Middle East & Africa Large Satellites Market Revenue (billion), by Orbit Class 2025 & 2033

- Figure 35: Middle East & Africa Large Satellites Market Revenue Share (%), by Orbit Class 2025 & 2033

- Figure 36: Middle East & Africa Large Satellites Market Revenue (billion), by End User 2025 & 2033

- Figure 37: Middle East & Africa Large Satellites Market Revenue Share (%), by End User 2025 & 2033

- Figure 38: Middle East & Africa Large Satellites Market Revenue (billion), by Propulsion Tech 2025 & 2033

- Figure 39: Middle East & Africa Large Satellites Market Revenue Share (%), by Propulsion Tech 2025 & 2033

- Figure 40: Middle East & Africa Large Satellites Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East & Africa Large Satellites Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific Large Satellites Market Revenue (billion), by Application 2025 & 2033

- Figure 43: Asia Pacific Large Satellites Market Revenue Share (%), by Application 2025 & 2033

- Figure 44: Asia Pacific Large Satellites Market Revenue (billion), by Orbit Class 2025 & 2033

- Figure 45: Asia Pacific Large Satellites Market Revenue Share (%), by Orbit Class 2025 & 2033

- Figure 46: Asia Pacific Large Satellites Market Revenue (billion), by End User 2025 & 2033

- Figure 47: Asia Pacific Large Satellites Market Revenue Share (%), by End User 2025 & 2033

- Figure 48: Asia Pacific Large Satellites Market Revenue (billion), by Propulsion Tech 2025 & 2033

- Figure 49: Asia Pacific Large Satellites Market Revenue Share (%), by Propulsion Tech 2025 & 2033

- Figure 50: Asia Pacific Large Satellites Market Revenue (billion), by Country 2025 & 2033

- Figure 51: Asia Pacific Large Satellites Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Large Satellites Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Large Satellites Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 3: Global Large Satellites Market Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Global Large Satellites Market Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 5: Global Large Satellites Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Large Satellites Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Global Large Satellites Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 8: Global Large Satellites Market Revenue billion Forecast, by End User 2020 & 2033

- Table 9: Global Large Satellites Market Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 10: Global Large Satellites Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global Large Satellites Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Global Large Satellites Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 16: Global Large Satellites Market Revenue billion Forecast, by End User 2020 & 2033

- Table 17: Global Large Satellites Market Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 18: Global Large Satellites Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Brazil Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Argentina Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Large Satellites Market Revenue billion Forecast, by Application 2020 & 2033

- Table 23: Global Large Satellites Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 24: Global Large Satellites Market Revenue billion Forecast, by End User 2020 & 2033

- Table 25: Global Large Satellites Market Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 26: Global Large Satellites Market Revenue billion Forecast, by Country 2020 & 2033

- Table 27: United Kingdom Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Germany Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: France Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Italy Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Spain Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Russia Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Benelux Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Nordics Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Global Large Satellites Market Revenue billion Forecast, by Application 2020 & 2033

- Table 37: Global Large Satellites Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 38: Global Large Satellites Market Revenue billion Forecast, by End User 2020 & 2033

- Table 39: Global Large Satellites Market Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 40: Global Large Satellites Market Revenue billion Forecast, by Country 2020 & 2033

- Table 41: Turkey Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Israel Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: GCC Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: North Africa Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: South Africa Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: Global Large Satellites Market Revenue billion Forecast, by Application 2020 & 2033

- Table 48: Global Large Satellites Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 49: Global Large Satellites Market Revenue billion Forecast, by End User 2020 & 2033

- Table 50: Global Large Satellites Market Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 51: Global Large Satellites Market Revenue billion Forecast, by Country 2020 & 2033

- Table 52: China Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 53: India Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Japan Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 55: South Korea Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: ASEAN Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 57: Oceania Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Large Satellites Market?

The projected CAGR is approximately 9.24%.

2. Which companies are prominent players in the Large Satellites Market?

Key companies in the market include Information Satellite Systems Reshetnev, Mitsubishi Heavy Industries, Lockheed Martin Corporation, Airbus SE, The Boeing Compan, China Aerospace Science and Technology Corporation (CASC), Thales, Maxar Technologies Inc, Indian Space Research Organisation (ISRO).

3. What are the main segments of the Large Satellites Market?

The market segments include Application, Orbit Class, End User, Propulsion Tech.

4. Can you provide details about the market size?

The market size is estimated to be USD 79.21 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The increasing number of satellites with long lifespans helps the Asia-Pacific region maintain a substantial market share.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2023: The UK government announced its plans to harness the space defense capabilities of Airbus Defense and Space under a new major partnership agreement. The company, one of UK's leading space companies, has become a partner of the UK Department of Defense Missile Defense Center (MDC), the country's center of excellence for missile defense.January 2023: Airbus signed a contract with the Belgian Ministry of Defense to provide tactical satellite communications services to the armed forces for a period of 15 years. Airbus plans to launch a new ultra-high frequency (UHF) communications service by 2024 for the armed forces of other European nations and NATO allies.September 2022: China successfully sent two BeiDou satellites into space from the Xichang Satellite Launch Center. The new satellites and boosters were developed by the China Academy of Space Technology (CAST) and the China Academy of Launch Vehicle Technology, under the China Aerospace Science and Technology Corporation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Large Satellites Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Large Satellites Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Large Satellites Market?

To stay informed about further developments, trends, and reports in the Large Satellites Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence