Key Insights

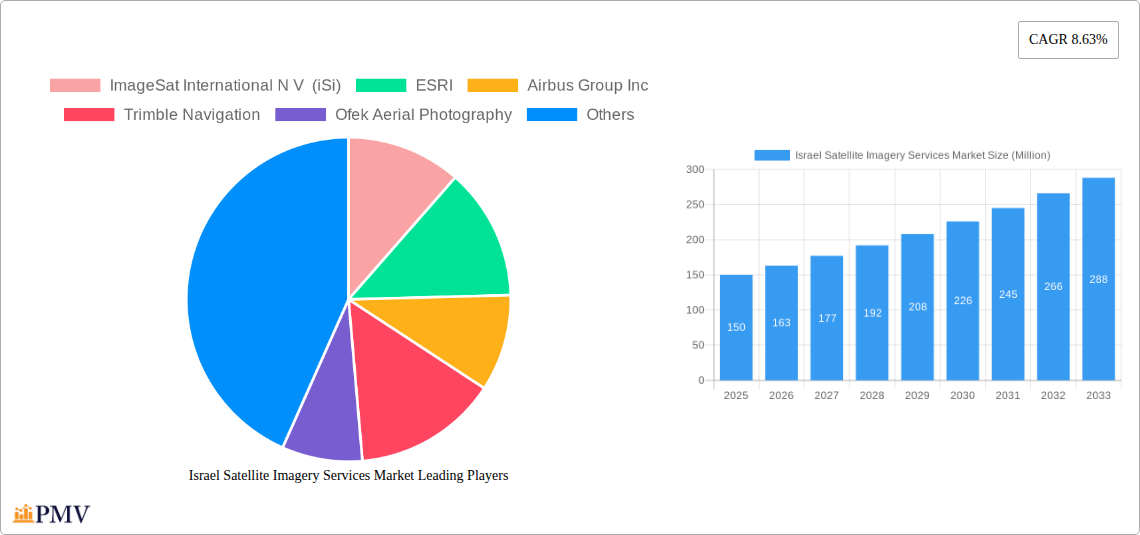

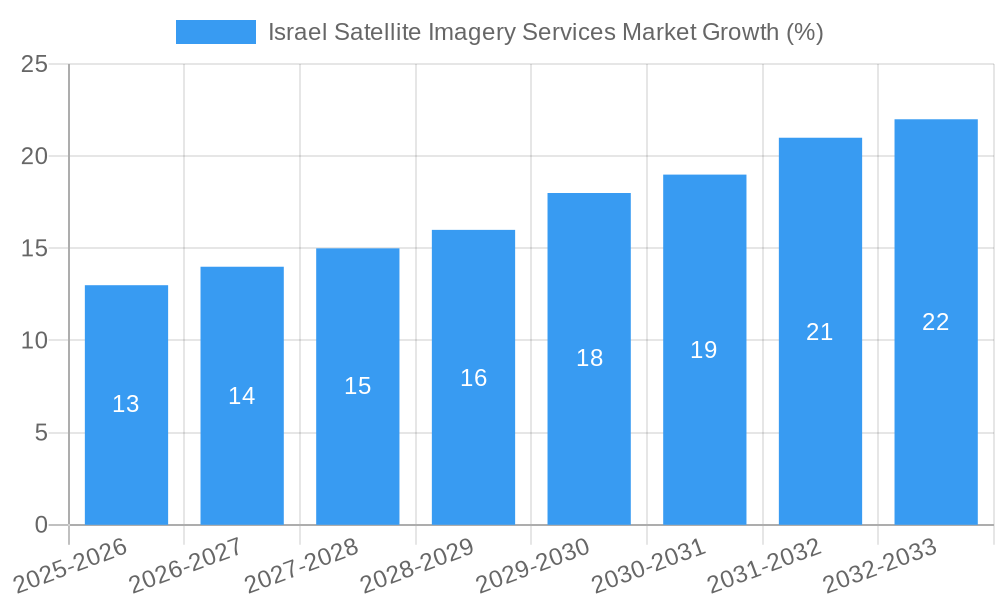

The Israel Satellite Imagery Services market, valued at approximately $150 million in 2025, is projected to experience robust growth, driven by increasing government investment in national security and infrastructure development, coupled with the rising adoption of satellite imagery across diverse sectors like agriculture, construction, and transportation. A Compound Annual Growth Rate (CAGR) of 8.63% from 2025 to 2033 indicates a significant expansion of this market. Key market drivers include the growing demand for high-resolution imagery for precise mapping, effective resource management, and advanced surveillance applications. Furthermore, technological advancements in satellite sensor technology, data processing, and analytics capabilities are fueling market growth. The Geospatial Data Acquisition and Mapping segment currently holds a substantial market share, owing to its critical role in urban planning and infrastructure development. While the Government sector remains the primary end-user, the Construction and Transportation & Logistics sectors are experiencing rapid growth in their reliance on satellite imagery for project planning, monitoring, and efficiency optimization. However, potential restraints include the high cost of satellite imagery acquisition and processing, along with concerns related to data security and privacy.

Despite these challenges, the market's future looks promising. The integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is enabling automated analysis of satellite imagery, leading to faster and more insightful applications. Companies like ImageSat International N.V., ESRI, and Airbus Group Inc. are key players, competing on factors such as image resolution, data processing capabilities, and the breadth of their service offerings. The ongoing development of smaller, more agile satellites also promises to further reduce acquisition costs and enhance accessibility, driving market expansion in the coming years. Israel's strategic location and the country's well-established expertise in technology are contributing to its prominence in this global market. The continued growth of the Israeli satellite imagery services market reflects not only national needs but also a global trend towards sophisticated applications of space-based technologies across various industries.

Israel Satellite Imagery Services Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Israel Satellite Imagery Services market, offering invaluable insights for businesses, investors, and researchers seeking to understand the dynamics of this rapidly evolving sector. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market trends, competitive landscapes, and future growth potential. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Israel Satellite Imagery Services Market Structure & Competitive Dynamics

The Israeli satellite imagery services market exhibits a moderately concentrated structure, with key players like ImageSat International N V (iSi), ESRI, Airbus Group Inc, and Google LLC holding significant market share. The market's competitive landscape is shaped by factors such as technological innovation, stringent regulatory frameworks governing data acquisition and usage, and the emergence of substitute technologies like drone-based imagery. The presence of both established international players and local companies like Ofek Aerial Photography and A TAL Satellite Imagery creates a dynamic mix of competition and collaboration.

Mergers and acquisitions (M&A) activity plays a crucial role in shaping market dynamics. While precise deal values remain confidential for many transactions, observable trends suggest increasing consolidation, with larger companies acquiring smaller firms to expand their technological capabilities and geographic reach. For example, a recent acquisition of a smaller Israeli imagery company by a multinational corporation could be valued at approximately xx Million. Furthermore, strategic partnerships are common, fostering the sharing of resources and expertise. The innovation ecosystem is driven by government investment in research and development, alongside the presence of a robust technology sector within Israel. End-user trends indicate a growing demand for high-resolution imagery across various sectors.

Israel Satellite Imagery Services Market Industry Trends & Insights

The Israeli satellite imagery services market is experiencing robust growth fueled by several key trends. The increasing adoption of advanced technologies such as AI and machine learning for image analysis is significantly driving market expansion. These technologies enable more efficient and accurate extraction of valuable insights from satellite imagery, enhancing application across diverse sectors. The market penetration of high-resolution imagery is increasing, particularly among government and defense agencies, and private sector applications within construction, resource management, and transportation are also gaining traction. This expansion is characterized by a rising demand for real-time data processing and analysis, pushing the market toward cloud-based solutions and improved data accessibility. The growing focus on national security and infrastructure development is bolstering the demand for comprehensive satellite imagery. Furthermore, increasing private sector investment in space technologies contributes to innovation, creating new opportunities within the market. The overall market growth is influenced by a complex interplay of technological advancements, evolving regulations, and the specific demands of different end-user sectors. The CAGR for the period is estimated at xx%, driven largely by increasing demand in the surveillance and security segment and government initiatives.

Dominant Markets & Segments in Israel Satellite Imagery Services Market

Dominant Segments:

- By Application: The Surveillance and Security segment currently holds the largest market share, driven by strong government spending on defense and intelligence gathering. The Geospatial Data Acquisition and Mapping segment is experiencing rapid growth due to increased urbanization and infrastructure projects.

- By End-User: The Government sector is the largest consumer of satellite imagery services, primarily due to national security and defense needs. The Construction sector is emerging as a significant driver, with an increasing demand for precise mapping and project monitoring.

Key Drivers:

- Government Policies: Government investment in R&D, along with supportive regulatory frameworks encouraging innovation within the space sector, plays a pivotal role in driving market growth.

- Infrastructure Development: Ongoing national infrastructure projects and increasing urbanization create significant demand for high-resolution imagery for planning and monitoring.

- Technological Advancements: Continuous improvements in satellite technology, image processing, and analytics capabilities significantly enhance the value proposition of satellite imagery services.

The dominance of the Surveillance and Security segment in the application category and the Government sector in the end-user category is closely linked to the strategic geopolitical location of Israel and the substantial investments in its defense and national security apparatus. The robust Israeli technological sector ensures rapid adoption of cutting-edge technologies to enhance the capabilities of satellite imagery services.

Israel Satellite Imagery Services Market Product Innovations

Recent innovations include the integration of AI and machine learning for automated feature extraction and anomaly detection, enhancing the speed and accuracy of analysis. Cloud-based platforms offering scalable access to imagery and analytics are transforming the accessibility and affordability of satellite data. These innovations are driven by the need for real-time insights and cost-effective solutions. The market is witnessing a shift towards providing value-added services, such as ready-to-use analytical products tailored to specific end-user needs. This shift focuses on simplifying data accessibility and interpretation for less technically skilled users.

Report Segmentation & Scope

The report segments the market by Application (Geospatial Data Acquisition and Mapping, Natural Resource Management, Surveillance and Security, Conservation and Research, Disaster Management, Intelligence) and by End-User (Government, Construction, Transportation and Logistics, Military and Defense, Forestry and Agriculture, Others). Each segment's growth projection, market size (in Millions), and competitive dynamics are analyzed. For example, the Surveillance and Security segment is projected to experience the highest growth during the forecast period, with market size expected to reach xx Million by 2033. This strong growth is driven by continuous demand from government agencies and the private sector. Similarly, the Government sector within the end-user segment displays the highest market share and consistent growth, primarily driven by defense needs and national security.

Key Drivers of Israel Satellite Imagery Services Market Growth

Several factors fuel the market's growth, including: advancements in satellite technology leading to higher resolution and faster data processing; increasing government spending on national security and infrastructure projects; rising demand for precise geospatial data across diverse sectors; and the development of innovative analytical tools leveraging AI and machine learning. The supportive regulatory environment in Israel further encourages market growth by fostering technological advancement and enabling strategic collaborations. The increasing accessibility of cloud-based platforms allows for cost-effective and efficient data acquisition and processing, making satellite imagery more viable for a wider range of applications.

Challenges in the Israel Satellite Imagery Services Market Sector

The market faces challenges including high initial investment costs in satellite technology and infrastructure; strict data privacy regulations impacting data accessibility and use; and intense competition from both domestic and international players. Furthermore, the dependence on reliable satellite infrastructure and the potential for disruptions due to geopolitical factors pose significant risks. These factors affect the overall market growth rate and the ability of individual companies to establish and maintain market share. Addressing these challenges requires proactive strategic management and a focus on technological innovation and regulatory compliance.

Leading Players in the Israel Satellite Imagery Services Market Market

- ImageSat International N V (iSi)

- ESRI

- Airbus Group Inc

- Trimble Navigation

- Ofek Aerial Photography

- A TAL Satellite Imagery

- Google LLC

- L3 Harris corporation

Key Developments in Israel Satellite Imagery Services Market Sector

March 2023: Successful launch of the "Ofek-13" spy satellite, significantly enhancing Israel's intelligence gathering capabilities. This launch highlights the ongoing technological advancements within the Israeli space sector and further solidifies the country's position as a leader in satellite imagery technology.

July 2023: Maxar Technologies launched its Maxar Geospatial Platform (MGP), providing streamlined access to high-resolution satellite imagery and advanced analytics. This development demonstrates a continuing global trend toward more accessible and user-friendly geospatial data platforms, which are likely to impact the accessibility and utilization of data within the Israeli market.

Strategic Israel Satellite Imagery Services Market Outlook

The future of the Israeli satellite imagery services market appears promising, driven by sustained government investment, technological innovation, and increasing private sector demand. Opportunities exist in developing specialized solutions for diverse end-user applications, leveraging AI and machine learning for advanced data analysis, and expanding into new geographic markets. Strategic partnerships and mergers & acquisitions will likely shape the market landscape, leading to further consolidation and the emergence of stronger players. The continuous advancements in satellite technology and the increasing integration of cloud-based solutions will continue to drive market growth and expand the potential applications of satellite imagery.

Israel Satellite Imagery Services Market Segmentation

-

1. Application

- 1.1. Geospatial Data Acquisition and Mapping

- 1.2. Natural Resource Management

- 1.3. Surveillance and Security

- 1.4. Conservation and Research

- 1.5. Disaster Management

- 1.6. Intelligence

-

2. End-User

- 2.1. Government

- 2.2. Construction

- 2.3. Transportation and Logistics

- 2.4. Military and Defense

- 2.5. Forestry and Agriculture

- 2.6. Others

Israel Satellite Imagery Services Market Segmentation By Geography

- 1. Israel

Israel Satellite Imagery Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.63% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Location-based Services; Satellite data usage is increasing

- 3.3. Market Restrains

- 3.3.1. Strict government regulations; High-resolution Images Offered by Other Imaging Technologies

- 3.4. Market Trends

- 3.4.1. Surveillance and Security is Expected to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Israel Satellite Imagery Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Geospatial Data Acquisition and Mapping

- 5.1.2. Natural Resource Management

- 5.1.3. Surveillance and Security

- 5.1.4. Conservation and Research

- 5.1.5. Disaster Management

- 5.1.6. Intelligence

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Government

- 5.2.2. Construction

- 5.2.3. Transportation and Logistics

- 5.2.4. Military and Defense

- 5.2.5. Forestry and Agriculture

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Israel

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 ImageSat International N V (iSi)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ESRI

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Airbus Group Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Trimble Navigation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ofek Aerial Photography

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 A TAL Satellite Imagery

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Google LLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 L3 Harris corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 ImageSat International N V (iSi)

List of Figures

- Figure 1: Israel Satellite Imagery Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Israel Satellite Imagery Services Market Share (%) by Company 2024

List of Tables

- Table 1: Israel Satellite Imagery Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Israel Satellite Imagery Services Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Israel Satellite Imagery Services Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: Israel Satellite Imagery Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Israel Satellite Imagery Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Israel Satellite Imagery Services Market Revenue Million Forecast, by Application 2019 & 2032

- Table 7: Israel Satellite Imagery Services Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 8: Israel Satellite Imagery Services Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Israel Satellite Imagery Services Market?

The projected CAGR is approximately 8.63%.

2. Which companies are prominent players in the Israel Satellite Imagery Services Market?

Key companies in the market include ImageSat International N V (iSi), ESRI, Airbus Group Inc, Trimble Navigation, Ofek Aerial Photography, A TAL Satellite Imagery, Google LLC, L3 Harris corporation.

3. What are the main segments of the Israel Satellite Imagery Services Market?

The market segments include Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Location-based Services; Satellite data usage is increasing.

6. What are the notable trends driving market growth?

Surveillance and Security is Expected to Hold Significant Share.

7. Are there any restraints impacting market growth?

Strict government regulations; High-resolution Images Offered by Other Imaging Technologies.

8. Can you provide examples of recent developments in the market?

July 2023: Maxar Technologies, a leading provider of comprehensive space services and secure, precise geospatial intelligence, officially unveiled its groundbreaking Maxar Geospatial Platform (MGP). This cutting-edge platform revolutionizes the accessibility of advanced Earth intelligence, streamlining the process of discovering, acquiring, and integrating geospatial data and analytics. MGP empowers users with seamless access to Maxar's unparalleled geospatial content, which encompasses high-resolution satellite imagery, visually striking imagery base maps, intricate 3D models, readily analyzable data, and image-based change detection and analytical results.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Israel Satellite Imagery Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Israel Satellite Imagery Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Israel Satellite Imagery Services Market?

To stay informed about further developments, trends, and reports in the Israel Satellite Imagery Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence