Key Insights

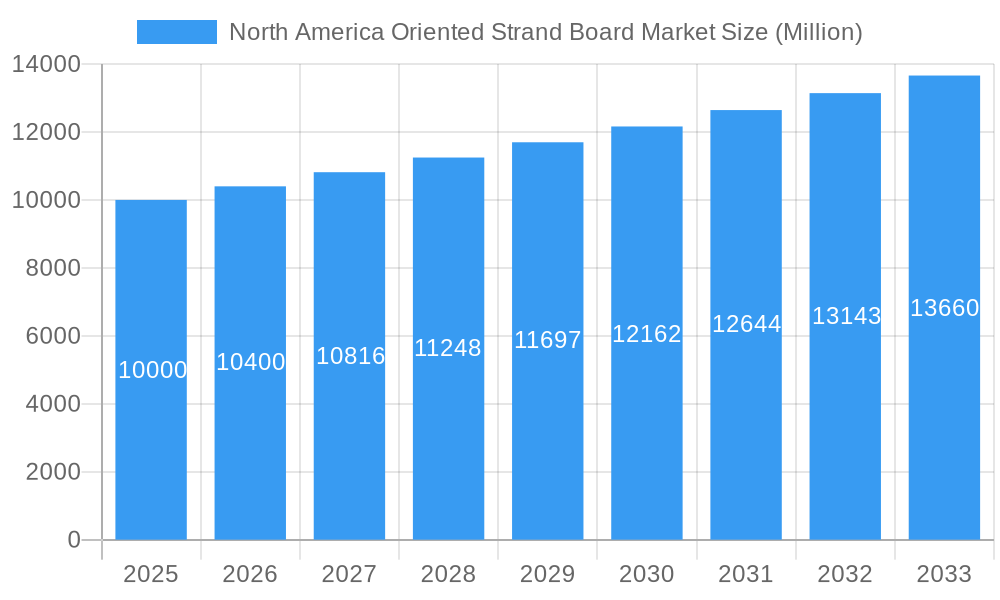

The North American Oriented Strand Board (OSB) market, valued at approximately $10 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 4% through 2033. This expansion is fueled by several key drivers. The burgeoning construction sector, particularly residential building, remains a primary catalyst, with increased demand for affordable and versatile building materials like OSB. Furthermore, the rising popularity of lightweight construction techniques and the growing adoption of OSB in various applications beyond traditional framing, such as roofing and sheathing, contribute significantly to market growth. The industry is also witnessing innovation in OSB manufacturing processes, leading to improved product quality, strength, and durability. However, fluctuations in raw material prices (wood chips, resin) and environmental concerns regarding deforestation and sustainable forestry practices present significant challenges to the market's sustained growth. Competitive pressures from alternative building materials, like plywood and engineered wood products, also influence market dynamics.

North America Oriented Strand Board Market Market Size (In Billion)

Despite these constraints, the North American OSB market is poised for continued expansion. Strategic mergers and acquisitions among major players like Egger Group, Georgia-Pacific, and Weyerhaeuser Co. are reshaping the industry landscape, leading to increased efficiency and market consolidation. The focus on sustainable sourcing and manufacturing practices is becoming increasingly important, with manufacturers investing in technologies to minimize environmental impact and enhance operational efficiency. The regional distribution of the market is likely skewed towards regions with robust construction activities and readily available timber resources, though a more precise breakdown requires additional data. Overall, the market's future prospects are positive, driven by strong construction demand and ongoing technological advancements.

North America Oriented Strand Board Market Company Market Share

North America Oriented Strand Board (OSB) Market: Comprehensive Report, 2019-2033

This in-depth report provides a comprehensive analysis of the North America Oriented Strand Board (OSB) market, covering the period 2019-2033. It delves into market structure, competitive dynamics, industry trends, and future growth projections, offering valuable insights for industry stakeholders, investors, and researchers. The report utilizes data from the historical period (2019-2024), base year (2025), and estimated year (2025) to forecast market trends through 2033. The market size is expressed in Millions (USD).

North America Oriented Strand Board Market Structure & Competitive Dynamics

This section analyzes the competitive landscape of the North America OSB market, examining market concentration, innovation ecosystems, regulatory frameworks, product substitutes, end-user trends, and merger and acquisition (M&A) activities. The market is moderately concentrated, with several major players holding significant market share. Key players include EGGER GROUP, Georgia-Pacific, Innova panel, J M Huber Corporation, Kronospan, Louisiana-Pacific Corporation, Mans Lumber & Millwork, RoyOMartin, SWISS KRONO, West Fraser, and Weyerhaeuser Co. However, the list is not exhaustive, and smaller regional players also contribute to the market.

Market share analysis reveals that the top five players collectively account for approximately xx% of the market. Recent M&A activities have been relatively limited, with deal values averaging xx Million annually in the period 2019-2024. Regulatory frameworks primarily focus on environmental sustainability and worker safety, influencing production processes and material sourcing. The primary substitute for OSB is plywood, although OSB enjoys a competitive advantage due to its cost-effectiveness and performance characteristics. End-user trends indicate increasing demand in residential construction and the expansion of the industrial and commercial sectors, impacting the growth trajectory of the OSB market.

North America Oriented Strand Board Market Industry Trends & Insights

The North America OSB market exhibits a robust growth trajectory, driven primarily by the expansion of the construction industry, especially in residential building. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is projected at xx%, indicating substantial market expansion. Technological advancements in OSB production, leading to improved product quality and efficiency, are also contributing factors. Market penetration in various end-use segments continues to rise, particularly in the residential construction sector, where OSB's versatility and cost-effectiveness are widely appreciated. Competitive dynamics are largely shaped by pricing strategies, product differentiation, and investment in capacity expansion. Consumer preferences are increasingly influenced by sustainability considerations, pushing manufacturers to adopt more environmentally friendly production methods.

Dominant Markets & Segments in North America Oriented Strand Board Market

The United States currently dominates the North America OSB market, driven by robust construction activity and significant demand from residential and commercial construction projects. This dominance is attributed to several key factors:

- Robust Construction Activity: A strong housing market and ongoing infrastructure development projects have fueled significant demand.

- Favorable Economic Policies: Government support for construction initiatives and infrastructure investments contributes to market growth.

- Well-Developed Infrastructure: A comprehensive and efficient infrastructure network facilitates the transportation and distribution of OSB products.

The residential construction segment is the most dominant market segment, holding the largest market share due to the widespread use of OSB in roof sheathing, wall sheathing, and flooring applications.

North America Oriented Strand Board Market Product Innovations

Recent product innovations in the OSB market focus on improving product performance, enhancing sustainability, and expanding application areas. Manufacturers are increasingly focusing on developing OSB products with enhanced strength, durability, and moisture resistance. The integration of recycled materials and sustainable forestry practices is also gaining traction. These innovations cater to the evolving needs of the construction industry and meet the growing demand for environmentally friendly building materials. Technological advancements in manufacturing processes have also resulted in improved efficiency and reduced production costs.

Report Segmentation & Scope

This report segments the North America OSB market based on product type (e.g., thickness, grade), application (e.g., residential, commercial, industrial), and region (e.g., United States, Canada, Mexico). Each segment's growth projections, market size, and competitive dynamics are analyzed in detail. The report provides a granular view of the market, enabling stakeholders to make informed decisions about their investment and strategic planning.

Key Drivers of North America Oriented Strand Board Market Growth

The growth of the North America OSB market is primarily driven by the robust growth in the construction sector, particularly residential building. Furthermore, increasing government investments in infrastructure projects and ongoing housing developments continue to drive demand. Technological advancements leading to improved product quality and efficiency also contribute to market expansion. The rising adoption of sustainable construction practices enhances the demand for OSB, which is a comparatively environmentally friendly material compared to some traditional alternatives.

Challenges in the North America Oriented Strand Board Market Sector

The North America OSB market faces certain challenges, including fluctuating raw material prices, increasing transportation costs, and the potential impact of environmental regulations. Supply chain disruptions can significantly impact production and delivery schedules, leading to cost increases and potential shortages. Intense competition among manufacturers can put pressure on profit margins, requiring companies to invest in innovation and efficiency improvements. Additionally, stringent environmental regulations regarding the use and disposal of OSB can influence operational costs.

Leading Players in the North America Oriented Strand Board Market Market

- EGGER GROUP

- Georgia-Pacific

- Innova panel

- J M Huber Corporation

- Kronospan

- Louisiana-Pacific Corporation

- Mans Lumber & Millwork

- RoyOMartin

- SWISS KRONO

- West Fraser

- Weyerhaeuser Co

Key Developments in North America Oriented Strand Board Market Sector

- August 2021: RoyOMartin announced a USD 211 Million investment for a new OSB plant in Texas, expanding production capacity to meet regional demand.

- October 2022: Martco LLC announced the construction of a second OSB production facility in Corrigan, Texas, further increasing the region's OSB supply.

These developments signify a positive outlook for the North America OSB market, driven by capacity expansion and investments to meet growing demand.

Strategic North America Oriented Strand Board Market Outlook

The North America OSB market holds significant growth potential, driven by continued expansion in the construction industry, increasing demand for sustainable building materials, and ongoing technological advancements. Strategic opportunities exist for manufacturers to focus on product differentiation, capacity expansion, and the adoption of sustainable production practices. Companies that can effectively navigate the challenges of fluctuating raw material prices and supply chain disruptions will be well-positioned to capitalize on the long-term growth prospects of the market.

North America Oriented Strand Board Market Segmentation

-

1. Grade

- 1.1. OSB/1

- 1.2. OSB/2

- 1.3. OSB/3

- 1.4. OSB/4

-

2. End-user Industry

- 2.1. Furniture

- 2.2. Construction

- 2.3. Packaging

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Oriented Strand Board Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Oriented Strand Board Market Regional Market Share

Geographic Coverage of North America Oriented Strand Board Market

North America Oriented Strand Board Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rapidly expanding construction industry; Rise in imports and export

- 3.2.2 leading to increased packaging

- 3.3. Market Restrains

- 3.3.1 Rapidly expanding construction industry; Rise in imports and export

- 3.3.2 leading to increased packaging

- 3.4. Market Trends

- 3.4.1. Rising Demand for Oriented Strand Board (OSB) from the Construction Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global North America Oriented Strand Board Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Grade

- 5.1.1. OSB/1

- 5.1.2. OSB/2

- 5.1.3. OSB/3

- 5.1.4. OSB/4

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Furniture

- 5.2.2. Construction

- 5.2.3. Packaging

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Grade

- 6. United States North America Oriented Strand Board Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Grade

- 6.1.1. OSB/1

- 6.1.2. OSB/2

- 6.1.3. OSB/3

- 6.1.4. OSB/4

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Furniture

- 6.2.2. Construction

- 6.2.3. Packaging

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Grade

- 7. Canada North America Oriented Strand Board Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Grade

- 7.1.1. OSB/1

- 7.1.2. OSB/2

- 7.1.3. OSB/3

- 7.1.4. OSB/4

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Furniture

- 7.2.2. Construction

- 7.2.3. Packaging

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Grade

- 8. Mexico North America Oriented Strand Board Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Grade

- 8.1.1. OSB/1

- 8.1.2. OSB/2

- 8.1.3. OSB/3

- 8.1.4. OSB/4

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Furniture

- 8.2.2. Construction

- 8.2.3. Packaging

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Grade

- 9. Competitive Analysis

- 9.1. Global Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 EGGER GROUP

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Georgia-Pacific-

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Innova panel

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 J M Huber Corporation

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Kronospan

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Louisiana-Pacific Corporation

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Mans Lumber & Millwork

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 RoyOMartin

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 SWISS KRONO

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 West Fraser

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Weyerhaeuser Co *List Not Exhaustive

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.1 EGGER GROUP

List of Figures

- Figure 1: Global North America Oriented Strand Board Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: United States North America Oriented Strand Board Market Revenue (Million), by Grade 2025 & 2033

- Figure 3: United States North America Oriented Strand Board Market Revenue Share (%), by Grade 2025 & 2033

- Figure 4: United States North America Oriented Strand Board Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: United States North America Oriented Strand Board Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: United States North America Oriented Strand Board Market Revenue (Million), by Geography 2025 & 2033

- Figure 7: United States North America Oriented Strand Board Market Revenue Share (%), by Geography 2025 & 2033

- Figure 8: United States North America Oriented Strand Board Market Revenue (Million), by Country 2025 & 2033

- Figure 9: United States North America Oriented Strand Board Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Canada North America Oriented Strand Board Market Revenue (Million), by Grade 2025 & 2033

- Figure 11: Canada North America Oriented Strand Board Market Revenue Share (%), by Grade 2025 & 2033

- Figure 12: Canada North America Oriented Strand Board Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 13: Canada North America Oriented Strand Board Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 14: Canada North America Oriented Strand Board Market Revenue (Million), by Geography 2025 & 2033

- Figure 15: Canada North America Oriented Strand Board Market Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Canada North America Oriented Strand Board Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Canada North America Oriented Strand Board Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Mexico North America Oriented Strand Board Market Revenue (Million), by Grade 2025 & 2033

- Figure 19: Mexico North America Oriented Strand Board Market Revenue Share (%), by Grade 2025 & 2033

- Figure 20: Mexico North America Oriented Strand Board Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 21: Mexico North America Oriented Strand Board Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: Mexico North America Oriented Strand Board Market Revenue (Million), by Geography 2025 & 2033

- Figure 23: Mexico North America Oriented Strand Board Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Mexico North America Oriented Strand Board Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Mexico North America Oriented Strand Board Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global North America Oriented Strand Board Market Revenue Million Forecast, by Grade 2020 & 2033

- Table 2: Global North America Oriented Strand Board Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global North America Oriented Strand Board Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Global North America Oriented Strand Board Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global North America Oriented Strand Board Market Revenue Million Forecast, by Grade 2020 & 2033

- Table 6: Global North America Oriented Strand Board Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 7: Global North America Oriented Strand Board Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Global North America Oriented Strand Board Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global North America Oriented Strand Board Market Revenue Million Forecast, by Grade 2020 & 2033

- Table 10: Global North America Oriented Strand Board Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 11: Global North America Oriented Strand Board Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Global North America Oriented Strand Board Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global North America Oriented Strand Board Market Revenue Million Forecast, by Grade 2020 & 2033

- Table 14: Global North America Oriented Strand Board Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global North America Oriented Strand Board Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Global North America Oriented Strand Board Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Oriented Strand Board Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the North America Oriented Strand Board Market?

Key companies in the market include EGGER GROUP, Georgia-Pacific-, Innova panel, J M Huber Corporation, Kronospan, Louisiana-Pacific Corporation, Mans Lumber & Millwork, RoyOMartin, SWISS KRONO, West Fraser, Weyerhaeuser Co *List Not Exhaustive.

3. What are the main segments of the North America Oriented Strand Board Market?

The market segments include Grade, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rapidly expanding construction industry; Rise in imports and export. leading to increased packaging.

6. What are the notable trends driving market growth?

Rising Demand for Oriented Strand Board (OSB) from the Construction Industry.

7. Are there any restraints impacting market growth?

Rapidly expanding construction industry; Rise in imports and export. leading to increased packaging.

8. Can you provide examples of recent developments in the market?

October 2022: Martco LLC revealed that Corrigan OSB LLC, its Texas subsidiary, would build a second-oriented strand board (OSB) production facility near its present, state-of-the-art OSB factory in Corrigan, Texas. This expansion will meet the region's demand for Oriented strand boards (OSB).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Oriented Strand Board Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Oriented Strand Board Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Oriented Strand Board Market?

To stay informed about further developments, trends, and reports in the North America Oriented Strand Board Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence