Key Insights

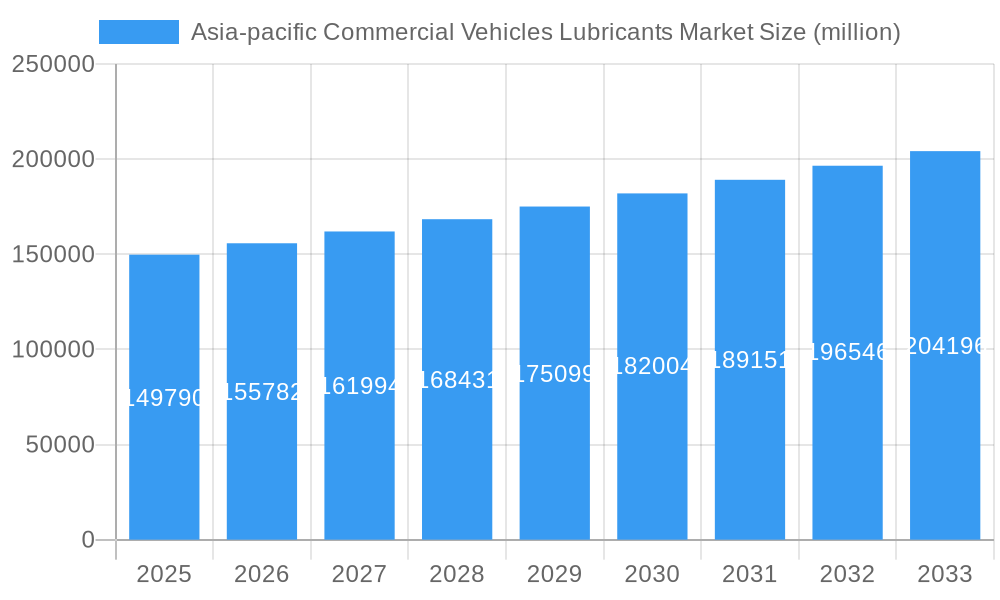

The Asia-Pacific commercial vehicles lubricants market is poised for steady growth, projected to reach $149,790 million by 2025, driven by a Compound Annual Growth Rate (CAGR) of 4% throughout the forecast period. This expansion is primarily fueled by the increasing demand for commercial transportation across the region, spurred by robust economic activity, expanding e-commerce logistics, and significant infrastructure development projects in countries like China, India, and Southeast Asian nations. The substantial volume of goods and passenger movement necessitates continuous fleet upgrades and maintenance, directly translating into a higher consumption of essential lubricants such as engine oils, hydraulic fluids, and transmission and gear oils. Furthermore, advancements in lubricant technology, focusing on enhanced fuel efficiency, extended drain intervals, and improved engine protection against wear and tear in demanding operating conditions, are also acting as key growth catalysts.

Asia-pacific Commercial Vehicles Lubricants Market Market Size (In Billion)

The market's dynamism is further shaped by a few critical trends. The increasing adoption of advanced engine technologies in commercial vehicles, such as turbocharging and emission control systems, requires specialized, high-performance lubricants. Simultaneously, a growing emphasis on sustainability and environmental regulations is driving the demand for eco-friendly and biodegradable lubricant formulations. However, the market faces certain restraints, including the fluctuating prices of crude oil, which directly impact the cost of raw materials for lubricant production. Additionally, the presence of a well-established aftermarket for used lubricants and the increasing adoption of electric commercial vehicles in certain segments, though still nascent in widespread application across the region, could pose long-term challenges to the traditional lubricants market. Despite these hurdles, the sheer volume of existing and new commercial vehicles in the Asia-Pacific region ensures a sustained demand for high-quality lubricants.

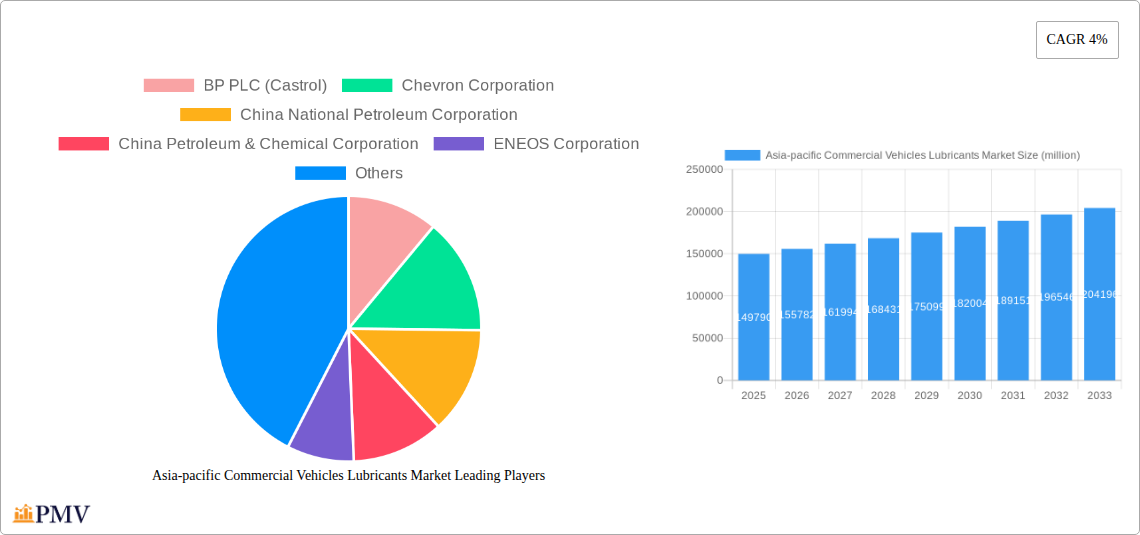

Asia-pacific Commercial Vehicles Lubricants Market Company Market Share

This comprehensive report delves into the dynamic Asia-Pacific Commercial Vehicles Lubricants Market, offering in-depth analysis and actionable insights for industry stakeholders. Covering the period from 2019 to 2033, with a base year of 2025, this study provides a detailed forecast from 2025 to 2033, building upon historical data from 2019 to 2024. The report is meticulously structured to enhance search engine visibility and engage industry professionals seeking to understand market nuances, growth trajectories, and competitive landscapes.

Asia-Pacific Commercial Vehicles Lubricants Market Market Structure & Competitive Dynamics

The Asia-Pacific Commercial Vehicles Lubricants Market is characterized by a moderately concentrated structure, with a few major global players holding significant market share. Innovation ecosystems are flourishing, driven by the continuous need for high-performance lubricants that enhance fuel efficiency and extend engine life in the demanding commercial vehicle sector. Regulatory frameworks, while varying across countries, are increasingly focused on environmental sustainability and emission standards, pushing lubricant manufacturers towards advanced formulations. Product substitutes, such as higher-viscosity greases and specialized synthetic fluids, are emerging but are often tailored for specific applications. End-user trends highlight a growing demand for extended drain intervals, reduced wear, and improved operational efficiency. Mergers and Acquisitions (M&A) activities are a strategic tool for market consolidation and expansion, with significant deal values observed as companies seek to bolster their portfolios and geographic reach. The market share of leading players is estimated to be concentrated among the top 5-7 companies, accounting for approximately 60-70% of the total market value. M&A deal values are projected to reach several hundred million dollars annually, driven by strategic alliances and market penetration efforts.

Asia-Pacific Commercial Vehicles Lubricants Market Industry Trends & Insights

The Asia-Pacific Commercial Vehicles Lubricants Market is experiencing robust growth, propelled by a confluence of factors including burgeoning logistics sectors, increasing commercial vehicle fleet sizes, and a growing emphasis on preventive maintenance to minimize downtime. The compound annual growth rate (CAGR) for the market is estimated to be in the range of 5.5% to 6.5% during the forecast period. Technological disruptions are a significant trend, with a clear shift towards synthetic and semi-synthetic lubricants offering superior performance characteristics, such as enhanced thermal stability, reduced friction, and extended drain intervals. This transition is directly influenced by the evolving demands of modern commercial vehicle engines designed for higher efficiency and lower emissions. Consumer preferences are increasingly skewed towards lubricants that provide longer service life, improved fuel economy, and comprehensive protection against wear and tear, thereby reducing total cost of ownership. Competitive dynamics are intensifying, with established players investing heavily in R&D to develop next-generation lubricant formulations and expanding their distribution networks to cater to the vast and diverse Asia-Pacific market. Emerging markets within the region, driven by rapid industrialization and infrastructure development, are presenting significant growth opportunities, contributing to higher market penetration rates for advanced lubricant products. The market penetration of high-performance synthetic lubricants is expected to increase from approximately 25% in 2024 to over 40% by 2033. The increasing complexity of commercial vehicle powertrains, including hybrid and electric variants, is also creating new avenues for specialized lubricant development, pushing the boundaries of lubrication technology. Furthermore, the growing awareness among fleet operators about the long-term economic benefits of using premium lubricants, despite a potentially higher upfront cost, is a crucial driver of market expansion.

Dominant Markets & Segments in Asia-Pacific Commercial Vehicles Lubricants Market

Engine Oils represent the dominant product type within the Asia-Pacific Commercial Vehicles Lubricants Market, driven by the sheer volume of commercial vehicles and the fundamental need for engine protection and performance enhancement. Countries like China and India, with their massive manufacturing bases and extensive logistics networks, are spearheading this dominance.

- Key Drivers for Engine Oils Dominance:

- Fleet Size: The vast and expanding fleet of trucks, buses, and other commercial vehicles necessitates consistent engine oil replacement.

- Emission Standards: Increasingly stringent emission regulations in countries like Japan, South Korea, and Australia are compelling manufacturers to use advanced, lower-viscosity engine oils that support cleaner combustion.

- Industrial Growth: Rapid industrialization across Southeast Asia and South Asia fuels the demand for commercial vehicles, directly impacting engine oil consumption.

China stands out as the leading country in the Asia-Pacific Commercial Vehicles Lubricants Market, owing to its unparalleled manufacturing output and the largest commercial vehicle fleet globally. Its robust infrastructure development projects and thriving e-commerce sector necessitate a high volume of logistics operations, further amplifying the demand for lubricants. Government initiatives aimed at modernizing transportation and promoting fuel efficiency also play a crucial role in shaping the market.

Transmission & Gear Oils are experiencing significant growth due to the increasing complexity of commercial vehicle powertrains and the demand for enhanced durability and performance in transmissions and differentials. The rise of heavy-duty applications and longer haulage routes puts substantial stress on these components, driving the adoption of specialized gear oils that offer superior protection against extreme pressure and wear.

Hydraulic Fluids are critical for the operation of various hydraulic systems in specialized commercial vehicles such as construction equipment, agricultural machinery, and material handling vehicles. The ongoing infrastructure development projects across the region, particularly in emerging economies, are a major catalyst for the demand in this segment.

Greases are essential for lubricating various chassis components, bearings, and other moving parts in commercial vehicles. While not as high-volume as engine oils, they are indispensable for ensuring the smooth and efficient operation of all mechanical parts, contributing to the overall longevity of the vehicle.

Asia-Pacific Commercial Vehicles Lubricants Market Product Innovations

Product innovations in the Asia-Pacific Commercial Vehicles Lubricants Market are centered around developing advanced formulations that offer superior protection, extended drain intervals, and improved fuel efficiency. Key trends include the rise of fully synthetic engine oils designed to meet stringent Euro VI emission standards, offering enhanced thermal stability and oxidation resistance. Furthermore, there's a growing focus on biodegradable and environmentally friendly lubricant options to address increasing environmental concerns. Lubricants with specialized additives that reduce friction and wear, thereby improving the lifespan of critical components like engines, transmissions, and gears, are also gaining traction. These innovations not only enhance vehicle performance but also contribute to reduced maintenance costs for fleet operators.

Report Segmentation & Scope

The report segments the Asia-Pacific Commercial Vehicles Lubricants Market by Product Type, offering detailed analysis for each category:

- Engine Oils: This segment is expected to exhibit a CAGR of approximately 6.0% during the forecast period, driven by the substantial volume of commercial vehicles and the constant need for engine protection.

- Greases: Accounting for a smaller yet vital share, the greases segment is projected to grow at a CAGR of around 4.5%, driven by their essential role in lubricating various chassis components and bearings.

- Hydraulic Fluids: This segment is anticipated to witness a CAGR of about 5.8%, fueled by the demand from specialized commercial vehicles used in construction, agriculture, and material handling.

- Transmission & Gear Oils: This segment is forecast to grow at a CAGR of approximately 6.2%, reflecting the increasing complexity of commercial vehicle powertrains and the need for enhanced durability in transmissions and differentials.

Key Drivers of Asia-Pacific Commercial Vehicles Lubricants Market Growth

Several key factors are propelling the Asia-Pacific Commercial Vehicles Lubricants Market forward.

- Economic Growth and Industrialization: Rapid economic development across Asia-Pacific nations is leading to increased trade, manufacturing, and infrastructure development, directly boosting the demand for commercial vehicles and, consequently, lubricants.

- Technological Advancements: The development of high-performance synthetic and semi-synthetic lubricants that offer extended drain intervals, improved fuel efficiency, and enhanced engine protection is a significant growth driver.

- Stringent Emission Standards: Increasing regulatory pressure to meet stricter emission norms (e.g., Euro VI) is forcing manufacturers to adopt advanced lubricant technologies that support cleaner combustion and reduce pollution.

- Fleet Modernization and Expansion: Fleet operators are increasingly investing in newer, more fuel-efficient, and technologically advanced commercial vehicles, which often require premium lubricants to maintain their performance and longevity.

- Growth of E-commerce and Logistics: The burgeoning e-commerce sector and the expansion of logistics networks across the region are creating sustained demand for commercial transportation, directly impacting lubricant consumption.

Challenges in the Asia-Pacific Commercial Vehicles Lubricants Market Sector

Despite the positive growth trajectory, the Asia-Pacific Commercial Vehicles Lubricants Market faces several challenges.

- Counterfeit Products: The prevalence of counterfeit lubricants in some developing markets poses a significant threat to both genuine manufacturers and vehicle performance, eroding trust and market value.

- Price Volatility of Raw Materials: Fluctuations in the prices of crude oil and base oils, the primary raw materials for lubricants, can impact profit margins and pricing strategies for manufacturers.

- Infrastructure Gaps: In certain remote or underdeveloped areas, inadequate logistics and distribution infrastructure can hinder the reach of lubricant products, limiting market penetration.

- Intense Competition: The market is highly competitive, with numerous domestic and international players vying for market share, leading to price pressures and the need for continuous innovation.

- Environmental Regulations and Disposal Issues: While driving innovation, increasingly stringent environmental regulations regarding lubricant composition and disposal can also present compliance challenges and add to operational costs.

Leading Players in the Asia-Pacific Commercial Vehicles Lubricants Market Market

- BP PLC (Castrol)

- Chevron Corporation

- China National Petroleum Corporation

- China Petroleum & Chemical Corporation

- ENEOS Corporation

- ExxonMobil Corporation

- Indian Oil Corporation Limited

- PT Pertamina

- PTT Lubricants

- Royal Dutch Shell Plc

- TotalEnergie

Key Developments in Asia-Pacific Commercial Vehicles Lubricants Market Sector

- January 2022: Effective April 1, ExxonMobil Corporation was organized along three business lines - ExxonMobil Upstream Company, ExxonMobil Product Solutions and ExxonMobil Low Carbon Solutions.

- September 2021: Shell partnered with ReadyAssist, a Bengaluru-based 24-hour roadside assistance firm, to provide a seamless oil changing service across the country. Customers can get a free lube change for their vehicles when they buy Shell lubricants through ReadyAssist, which will be accessible at up to 5,500 third-party retail outlets across the country.

- September 2021: ExxonMobil Asia Pacific Pte Ltd established the MobilSM Fleet Care (MFC) program for its lubricant clients, which provides fleet owners and operators with a holistic picture of their fleet's operating performance.

Strategic Asia-Pacific Commercial Vehicles Lubricants Market Market Outlook

The strategic outlook for the Asia-Pacific Commercial Vehicles Lubricants Market is highly promising, driven by sustained economic growth, ongoing industrialization, and the continuous expansion of commercial vehicle fleets. The increasing adoption of advanced technologies, coupled with the growing awareness among fleet operators regarding the benefits of high-performance lubricants, will act as significant growth accelerators. Companies that focus on developing innovative, eco-friendly, and fuel-efficient lubricant solutions, while simultaneously strengthening their distribution networks and adapting to evolving regulatory landscapes, are poised for substantial success. The rising demand for specialized lubricants in emerging economies and the potential for penetration into newer vehicle segments, such as those powered by alternative fuels, present lucrative strategic opportunities for market players.

Asia-pacific Commercial Vehicles Lubricants Market Segmentation

-

1. Product Type

- 1.1. Engine Oils

- 1.2. Greases

- 1.3. Hydraulic Fluids

- 1.4. Transmission & Gear Oils

Asia-pacific Commercial Vehicles Lubricants Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

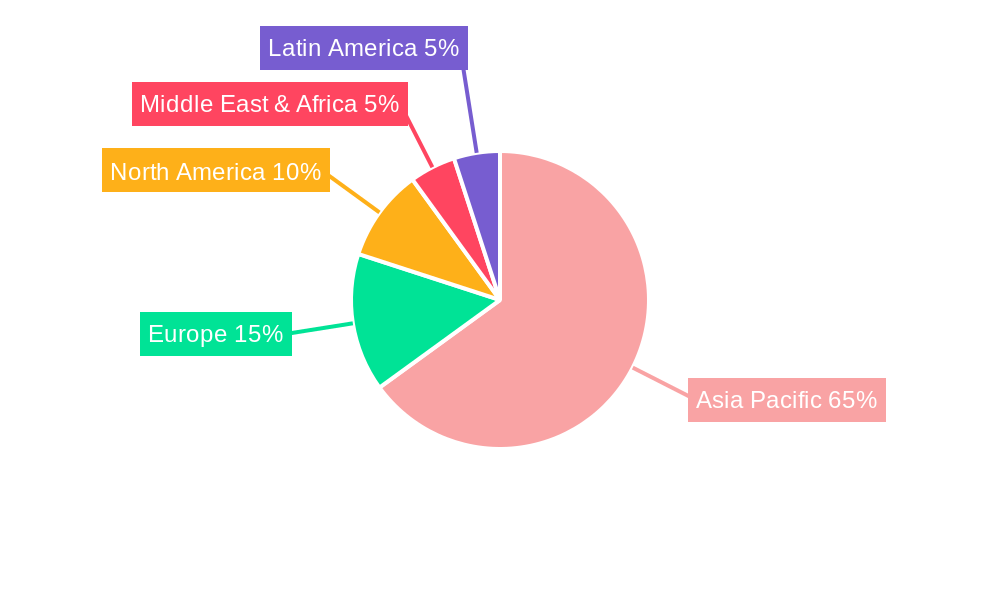

Asia-pacific Commercial Vehicles Lubricants Market Regional Market Share

Geographic Coverage of Asia-pacific Commercial Vehicles Lubricants Market

Asia-pacific Commercial Vehicles Lubricants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Largest Segment By Product Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-pacific Commercial Vehicles Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Engine Oils

- 5.1.2. Greases

- 5.1.3. Hydraulic Fluids

- 5.1.4. Transmission & Gear Oils

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BP PLC (Castrol)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Chevron Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 China National Petroleum Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 China Petroleum & Chemical Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ENEOS Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ExxonMobil Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Indian Oil Corporation Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PT Pertamina

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PTT Lubricants

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Royal Dutch Shell Plc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 TotalEnergie

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 BP PLC (Castrol)

List of Figures

- Figure 1: Asia-pacific Commercial Vehicles Lubricants Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Asia-pacific Commercial Vehicles Lubricants Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-pacific Commercial Vehicles Lubricants Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Asia-pacific Commercial Vehicles Lubricants Market Revenue million Forecast, by Region 2020 & 2033

- Table 3: Asia-pacific Commercial Vehicles Lubricants Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 4: Asia-pacific Commercial Vehicles Lubricants Market Revenue million Forecast, by Country 2020 & 2033

- Table 5: China Asia-pacific Commercial Vehicles Lubricants Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 6: Japan Asia-pacific Commercial Vehicles Lubricants Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 7: South Korea Asia-pacific Commercial Vehicles Lubricants Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: India Asia-pacific Commercial Vehicles Lubricants Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Australia Asia-pacific Commercial Vehicles Lubricants Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: New Zealand Asia-pacific Commercial Vehicles Lubricants Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Indonesia Asia-pacific Commercial Vehicles Lubricants Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Malaysia Asia-pacific Commercial Vehicles Lubricants Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Singapore Asia-pacific Commercial Vehicles Lubricants Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Thailand Asia-pacific Commercial Vehicles Lubricants Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Vietnam Asia-pacific Commercial Vehicles Lubricants Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Philippines Asia-pacific Commercial Vehicles Lubricants Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-pacific Commercial Vehicles Lubricants Market?

The projected CAGR is approximately 4%.

2. Which companies are prominent players in the Asia-pacific Commercial Vehicles Lubricants Market?

Key companies in the market include BP PLC (Castrol), Chevron Corporation, China National Petroleum Corporation, China Petroleum & Chemical Corporation, ENEOS Corporation, ExxonMobil Corporation, Indian Oil Corporation Limited, PT Pertamina, PTT Lubricants, Royal Dutch Shell Plc, TotalEnergie.

3. What are the main segments of the Asia-pacific Commercial Vehicles Lubricants Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 149790 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Largest Segment By Product Type : Engine Oils.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2022: Effective April 1, ExxonMobil Corporation was organized along three business lines - ExxonMobil Upstream Company, ExxonMobil Product Solutions and ExxonMobil Low Carbon Solutions.September 2021: Shell partnered with ReadyAssist, a Bengaluru-based 24-hour roadside assistance firm, to provide a seamless oil changing service across the country. Customers can get a free lube change for their vehicles when they buy Shell lubricants through ReadyAssist, which will be accessible at up to 5,500 third-party retail outlets across the country.September 2021: ExxonMobil Asia Pacific Pte Ltd established the MobilSM Fleet Care (MFC) program for its lubricant clients, which provides fleet owners and operators with a holistic picture of their fleet's operating performance.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-pacific Commercial Vehicles Lubricants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-pacific Commercial Vehicles Lubricants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-pacific Commercial Vehicles Lubricants Market?

To stay informed about further developments, trends, and reports in the Asia-pacific Commercial Vehicles Lubricants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence