Key Insights

The North American Modular Construction Industry is poised for significant expansion, projecting a robust market size of $33.99 Million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 4.61% anticipated throughout the forecast period of 2025-2033. This growth is underpinned by a confluence of powerful market drivers, including escalating demand for cost-effective and time-efficient building solutions, a growing emphasis on sustainable construction practices, and increasing adoption in sectors beyond traditional construction. The industry's inherent ability to reduce construction waste, minimize on-site disruptions, and offer greater quality control makes it an increasingly attractive alternative to conventional building methods. Furthermore, advancements in modular design and manufacturing technologies are expanding the aesthetic possibilities and functional capabilities of modular structures, thereby broadening their appeal across a wider range of applications and clientele.

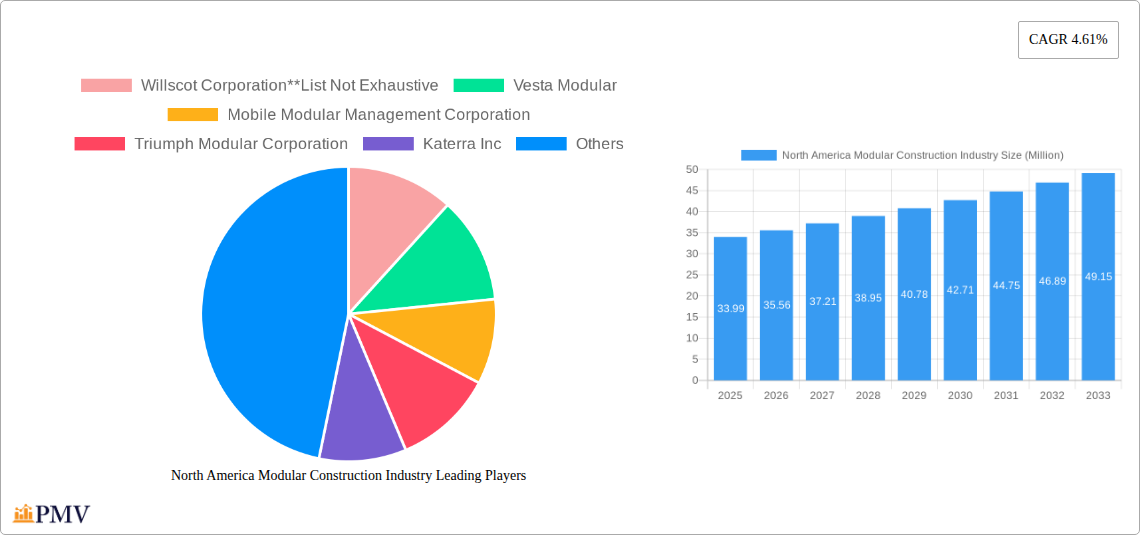

North America Modular Construction Industry Market Size (In Million)

The market's trajectory is further shaped by key trends such as the rise of permanent modular construction, offering permanent, high-quality structures that are indistinguishable from site-built counterparts. Relocatable modular solutions continue to be a vital segment, serving temporary needs in sectors like education, healthcare, and disaster relief. Within the North American region, the United States, Canada, and Mexico are all contributing to the market's dynamism, with each country leveraging modular construction to address specific infrastructure and housing demands. While the industry benefits from strong underlying growth drivers, it also faces certain restraints. These may include initial perception challenges regarding the quality or permanence of modular buildings, though this is rapidly diminishing with technological advancements and successful project completions. Navigating varying building codes and regulations across different jurisdictions can also present a hurdle. Despite these considerations, the overarching trend points towards a substantial and sustained growth phase for the North American modular construction sector.

North America Modular Construction Industry Company Market Share

This in-depth report provides a comprehensive analysis of the North America modular construction industry, covering market size, trends, competitive landscape, and future projections. With a detailed study period from 2019 to 2033 and a base year of 2025, this report offers actionable insights for stakeholders seeking to capitalize on the robust growth of this dynamic sector. The North America modular construction market is expected to reach an estimated value of $XX Million by 2025, with a projected compound annual growth rate (CAGR) of XX% during the forecast period of 2025-2033.

North America Modular Construction Industry Market Structure & Competitive Dynamics

The North America modular construction industry exhibits a moderately fragmented market structure, with a mix of large established players and emerging innovators. Key companies like Willscot Corporation, Vesta Modular, Mobile Modular Management Corporation, Triumph Modular Corporation, Katerra Inc, Vanguard Modular Building Systems, Boxx Modular (Black Diamond Group), Satellite Shelters, Modular Genius, ATCO Ltd, and Aries Building Systems are actively shaping the competitive landscape. Innovation ecosystems are driven by advancements in design software, prefabrication techniques, and sustainable materials. Regulatory frameworks, while generally supportive of offsite construction, can vary significantly by region, influencing project timelines and adoption rates. Product substitutes, primarily traditional stick-built construction methods, are gradually losing ground due to the inherent efficiencies and cost-effectiveness of modular solutions. End-user trends are increasingly favoring speed, sustainability, and predictable cost outcomes, all strengths of modular construction. Merger and acquisition (M&A) activities are on the rise as companies seek to expand their geographic reach, technological capabilities, and service offerings. The total value of M&A deals in the modular construction sector is estimated to be $XX Million over the historical period, indicating significant consolidation and strategic investment.

North America Modular Construction Industry Industry Trends & Insights

The North America modular construction industry is experiencing a period of unprecedented growth, fueled by a confluence of powerful market drivers. Economic policies promoting infrastructure development and affordable housing initiatives are significantly boosting demand for modular solutions across residential and commercial sectors. Technological disruptions, including the widespread adoption of Building Information Modeling (BIM), advanced robotics in manufacturing, and the integration of smart building technologies, are enhancing efficiency, precision, and customization in modular projects. Consumer preferences are rapidly shifting towards sustainable and environmentally conscious building practices, a domain where modular construction excels through reduced waste and energy-efficient designs. The ability to deliver projects faster than traditional methods, coupled with greater cost predictability, is a major draw for developers and end-users alike. Competitive dynamics are characterized by increasing collaboration between modular manufacturers, architects, and developers to streamline the entire construction lifecycle. The market penetration of modular construction, while still evolving, is on a steep upward trajectory, with projections indicating a substantial increase in its share of the overall construction market. The industry is witnessing a growing emphasis on specialized applications, from healthcare facilities and educational institutions to retail spaces and workforce housing. The ongoing evolution of materials science is also contributing to enhanced durability, aesthetic appeal, and performance of modular building components.

Dominant Markets & Segments in North America Modular Construction Industry

The North America modular construction industry is characterized by strong regional and sectoral dominance.

- Leading Region: The United States currently holds the dominant position in the North American modular construction market, driven by significant investment in infrastructure, a robust housing market, and supportive government initiatives. Canada is also emerging as a key growth market, with increasing adoption of modular solutions for various applications.

- Dominant Sector: The Commercial Sector is a major driver of the modular construction market, encompassing a wide range of applications including office buildings, retail spaces, hospitality facilities, healthcare centers, and educational institutions. The demand for rapid deployment of business facilities, coupled with the need for flexible and scalable spaces, makes modular construction an ideal choice. Key drivers in this segment include favorable economic policies, the need for quick project completion to meet business demands, and increasing corporate focus on sustainability.

- Division Dominance: While both Permanent Modular and Relocatable Modular divisions are experiencing robust growth, the Permanent Modular segment is currently leading in terms of market value. This is attributed to the increasing acceptance of modular construction for long-term, permanent structures across various industries. However, the Relocatable Modular segment continues to be vital for temporary housing, construction site offices, and event spaces, demonstrating steady demand.

- Segment Dominance: Within the Permanent Modular division, the Commercial Sector represents the largest market share. The ability to construct high-quality, cost-effective, and rapidly deployable commercial buildings makes it a preferred choice for businesses seeking to expand or renovate. The Residential Sector is also experiencing significant growth, particularly in the multi-family housing segment, where modular construction offers solutions for affordable housing and faster project delivery.

North America Modular Construction Industry Product Innovations

Product innovations in the North America modular construction industry are centered on enhancing sustainability, design flexibility, and integration capabilities. Advances in prefabrication techniques and the use of sustainable materials like cross-laminated timber (CLT) are leading to greener and more energy-efficient building solutions. The integration of smart building technologies and advanced digital design tools is enabling greater customization and precision, allowing for sophisticated architectural designs and improved building performance. Competitive advantages are being gained through the development of standardized modular components that can be easily assembled and reconfigured, reducing construction time and costs.

Report Segmentation & Scope

This report meticulously segments the North America modular construction industry across key divisions and sectors.

- Permanent Modular: This segment encompasses modular buildings designed for long-term, fixed installations. It includes residential, commercial, and industrial applications where durability and permanence are paramount. Growth projections indicate a substantial market size of $XX Million by 2025, with increasing adoption for single-family homes, multi-family dwellings, and commercial facilities.

- Relocatable Modular: This segment focuses on modular buildings designed for temporary use or easy relocation. It serves diverse needs in sectors like construction, education, and disaster relief. Market size is estimated at $XX Million by 2025, with consistent demand for site offices, temporary classrooms, and event structures.

- Residential Sector: This encompasses modular solutions for single-family homes, apartments, student housing, and senior living facilities. The growing demand for affordable and faster housing solutions is a key driver. Market size is projected to reach $XX Million by 2025.

- Commercial Sector: This covers modular buildings for offices, retail stores, healthcare facilities, educational institutions, and hospitality. The need for rapid deployment and flexible space solutions fuels its growth. Market size is estimated at $XX Million by 2025.

Key Drivers of North America Modular Construction Industry Growth

Several key factors are propelling the North America modular construction industry forward. Technological advancements in prefabrication and design software are enhancing efficiency and customization. The increasing demand for sustainable building solutions aligns perfectly with the waste-reduction and energy-efficiency inherent in modular construction. Favorable government initiatives and incentives for affordable housing and infrastructure development are further stimulating market growth. Furthermore, the ongoing labor shortages in the traditional construction sector are driving a shift towards offsite manufacturing, where productivity is higher and workforce management is more streamlined.

Challenges in the North America Modular Construction Industry Sector

Despite its promising outlook, the North America modular construction industry faces certain challenges. Regulatory hurdles and varying building codes across different jurisdictions can create complexities and delays. Supply chain disruptions and the cost of raw materials can impact project timelines and profitability. Intense competitive pressures from both established modular players and traditional construction firms necessitate continuous innovation and cost optimization. Public perception, though improving, still sometimes lags behind the advanced capabilities and quality of modern modular buildings.

Leading Players in the North America Modular Construction Industry Market

- Willscot Corporation

- Vesta Modular

- Mobile Modular Management Corporation

- Triumph Modular Corporation

- Katerra Inc

- Vanguard Modular Building Systems

- Boxx Modular (Black Diamond Group)

- Satellite Shelters

- Modular Genius

- ATCO Ltd

- Aries Building Systems

Key Developments in North America Modular Construction Industry Sector

- 2023: Increased focus on sustainable materials and net-zero energy building certifications for modular projects.

- 2023: Significant advancements in modular design software, enabling greater customization and integration of smart technologies.

- 2022: Rise in M&A activities as larger construction firms acquire specialized modular companies to expand their offerings.

- 2022: Growing adoption of modular construction for large-scale commercial and industrial projects, including manufacturing facilities and distribution centers.

- 2021: Enhanced government incentives and policies supporting affordable housing initiatives, leading to a surge in modular residential projects.

- 2020: Increased demand for temporary healthcare facilities and educational spaces due to global health and safety concerns.

Strategic North America Modular Construction Industry Market Outlook

The strategic outlook for the North America modular construction industry is exceptionally strong, driven by sustained demand for speed, cost-effectiveness, and sustainability. Growth accelerators include ongoing technological advancements in automation and digital design, expanded use of advanced materials, and an increasing preference for green building practices. The industry is poised for significant expansion as more developers and end-users recognize the inherent advantages of modular construction. Opportunities lie in further innovation in design and manufacturing, as well as strategic partnerships to address specific market needs, particularly in sectors like affordable housing, healthcare infrastructure, and climate-resilient buildings.

North America Modular Construction Industry Segmentation

-

1. Division

- 1.1. Permanent Modular

- 1.2. Relocatable Modular

-

2. Sector

- 2.1. Residential

- 2.2. Commercial

North America Modular Construction Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Modular Construction Industry Regional Market Share

Geographic Coverage of North America Modular Construction Industry

North America Modular Construction Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.61% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surging Application of Blue Hydrogen in Fuel Cell Electric Vehicles; Rising Demand from the Chemical Sector

- 3.3. Market Restrains

- 3.3.1. Loss of Energy During Hydrogen Production; Other Market Restraints

- 3.4. Market Trends

- 3.4.1. Hospitality Industry Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Modular Construction Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Division

- 5.1.1. Permanent Modular

- 5.1.2. Relocatable Modular

- 5.2. Market Analysis, Insights and Forecast - by Sector

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Division

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Willscot Corporation**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Vesta Modular

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mobile Modular Management Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Triumph Modular Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Katerra Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Vanguard Modular Building Systems

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Boxx Modular (Black Diamond Group)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Satellite Shelters

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Modular Genius

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ATCO Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Aries Building Systems

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Willscot Corporation**List Not Exhaustive

List of Figures

- Figure 1: North America Modular Construction Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Modular Construction Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Modular Construction Industry Revenue Million Forecast, by Division 2020 & 2033

- Table 2: North America Modular Construction Industry Revenue Million Forecast, by Sector 2020 & 2033

- Table 3: North America Modular Construction Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: North America Modular Construction Industry Revenue Million Forecast, by Division 2020 & 2033

- Table 5: North America Modular Construction Industry Revenue Million Forecast, by Sector 2020 & 2033

- Table 6: North America Modular Construction Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States North America Modular Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Modular Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Modular Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Modular Construction Industry?

The projected CAGR is approximately 4.61%.

2. Which companies are prominent players in the North America Modular Construction Industry?

Key companies in the market include Willscot Corporation**List Not Exhaustive, Vesta Modular, Mobile Modular Management Corporation, Triumph Modular Corporation, Katerra Inc, Vanguard Modular Building Systems, Boxx Modular (Black Diamond Group), Satellite Shelters, Modular Genius, ATCO Ltd, Aries Building Systems.

3. What are the main segments of the North America Modular Construction Industry?

The market segments include Division, Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 33.99 Million as of 2022.

5. What are some drivers contributing to market growth?

Surging Application of Blue Hydrogen in Fuel Cell Electric Vehicles; Rising Demand from the Chemical Sector.

6. What are the notable trends driving market growth?

Hospitality Industry Driving the Market Growth.

7. Are there any restraints impacting market growth?

Loss of Energy During Hydrogen Production; Other Market Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Modular Construction Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Modular Construction Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Modular Construction Industry?

To stay informed about further developments, trends, and reports in the North America Modular Construction Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence