Key Insights

The Saudi Arabia automotive lubricant market is projected for robust growth, fueled by an expanding vehicle fleet and escalating demand for premium lubricants. With an estimated market size of 746.5 million in the base year 2024, the sector is anticipated to achieve a Compound Annual Growth Rate (CAGR) of 2.3% through 2033. This expansion is driven by significant economic development in the Kingdom, a continuous influx of new vehicles, and an increasing focus on vehicle maintenance and extended lifespan. The market is segmented by vehicle type, including passenger vehicles, commercial vehicles, and motorcycles, with passenger vehicles expected to lead due to high personal transportation adoption. By product, engine oils are forecast to hold the largest market share, followed by transmission & gear oils, hydraulic fluids, and greases, aligning with fundamental automotive lubrication needs.

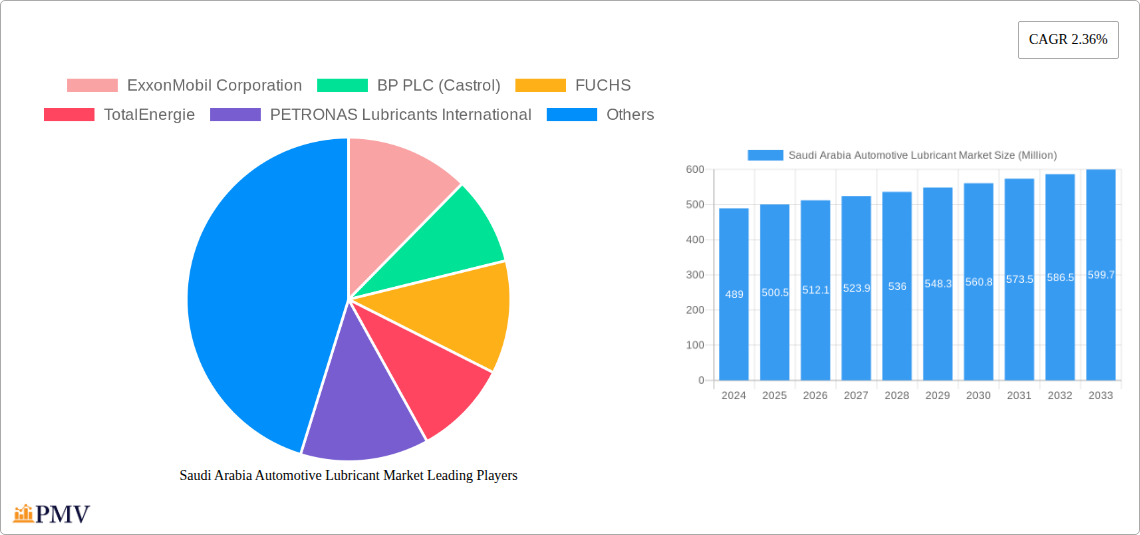

Saudi Arabia Automotive Lubricant Market Market Size (In Million)

Key growth catalysts include ongoing infrastructure development and economic diversification initiatives, which are bolstering the commercial vehicle segment and driving demand for industrial-grade lubricants. Furthermore, the increasing integration of advanced automotive technologies requiring specialized synthetic lubricants, coupled with growing consumer awareness of the benefits of high-quality lubricants for engine performance and fuel efficiency, are significant growth enablers. Potential challenges include the volatility of crude oil prices impacting production costs and the rising prevalence of electric vehicles (EVs) necessitating different lubrication solutions. Nevertheless, supportive government policies promoting localization and technological advancement in the automotive sector are expected to foster a favorable market environment. The market features prominent global players such as ExxonMobil Corporation, BP PLC (Castrol), FUCHS, and Royal Dutch Shell PLC, alongside domestic and regional competitors, all vying for market share through product innovation and strategic distribution.

Saudi Arabia Automotive Lubricant Market Company Market Share

This comprehensive report provides an authoritative analysis of the Saudi Arabia automotive lubricant market, offering critical insights for stakeholders navigating this dynamic sector. Covering the historical period (2019-2024), base year (2024), and an extensive forecast period (2025-2033), this study examines market structure, competitive dynamics, industry trends, product innovations, and future growth prospects. Key segments analyzed include Commercial Vehicles, Motorcycles, and Passenger Vehicles, alongside product categories such as Engine Oils, Greases, Hydraulic Fluids, and Transmission & Gear Oils. Gain actionable intelligence to inform strategic decisions and capitalize on emerging opportunities within the Kingdom.

Saudi Arabia Automotive Lubricant Market Market Structure & Competitive Dynamics

The Saudi Arabia automotive lubricant market exhibits a moderately concentrated structure, with a few dominant global players alongside a growing number of regional and local manufacturers. Key players like ExxonMobil Corporation, BP PLC (Castrol), FUCHS, TotalEnergie, PETRONAS Lubricants International, Royal Dutch Shell PLC, AMSOIL Inc, Eni SpA, Petromin Corporation, and CHEVRON CORPORATION hold significant market share, driven by strong brand recognition, extensive distribution networks, and advanced product portfolios. Innovation ecosystems are robust, with substantial investment in research and development focused on high-performance, fuel-efficient, and environmentally friendly lubricant formulations. Regulatory frameworks, primarily overseen by Saudi standards organizations, emphasize product quality and safety, influencing product development and market entry strategies. Product substitutes, such as synthetic and semi-synthetic lubricants, are gaining traction, challenging the dominance of conventional mineral oils. End-user trends are shifting towards premium lubricants that offer enhanced engine protection and extended drain intervals, particularly within the passenger vehicle segment. Mergers and acquisitions (M&A) activities, while less prevalent in recent years, have played a crucial role in market consolidation and expansion, with deal values ranging in the tens to hundreds of millions of dollars, shaping the competitive intensity. Understanding these dynamics is crucial for any participant seeking to establish or enhance their presence in this evolving market.

Saudi Arabia Automotive Lubricant Market Industry Trends & Insights

The Saudi Arabia automotive lubricant market is poised for significant expansion, projected to achieve a compound annual growth rate (CAGR) of approximately 5.8% during the forecast period. This growth is propelled by a confluence of factors, including the robust expansion of the automotive sector, with increasing vehicle parc across passenger and commercial segments. Technological disruptions are a key theme, with a notable shift towards advanced lubricant formulations such as fully synthetic engine oils, which offer superior protection, improved fuel economy, and extended drain intervals. The increasing adoption of electric vehicles (EVs) is also beginning to influence the market, driving demand for specialized EV fluids that cater to the unique thermal management and lubrication needs of electric powertrains. Consumer preferences are evolving, with a growing awareness of the benefits of premium lubricants and a willingness to invest in products that ensure vehicle longevity and optimal performance. Competitive dynamics are characterized by intense rivalry among global lubricant giants and the strategic positioning of local players, such as Petromin Corporation, who leverage their understanding of the domestic market and established distribution channels. Furthermore, government initiatives aimed at boosting the automotive manufacturing and servicing sectors, coupled with infrastructure development projects, are indirectly fueling the demand for automotive lubricants. The market penetration of high-performance lubricants is steadily increasing, reflecting a maturing consumer base that prioritizes quality and advanced technological solutions.

Dominant Markets & Segments in Saudi Arabia Automotive Lubricant Market

Within the Saudi Arabia automotive lubricant market, Passenger Vehicles represent a dominant segment, driven by the Kingdom's large and growing car ownership rates. This segment accounts for an estimated 45% of the total market volume. The increasing disposable income, coupled with government initiatives to diversify the economy and promote tourism, fuels a consistent demand for passenger vehicles, thereby boosting the consumption of passenger car motor oils (PCMOs). Engine Oils emerge as the largest product type, commanding over 60% of the market share, a direct consequence of their essential role in all internal combustion engine vehicles. The demand for high-performance synthetic and semi-synthetic engine oils is particularly strong, reflecting end-user preferences for enhanced engine protection and fuel efficiency.

- Passenger Vehicles: The dominance of this segment is underpinned by favorable economic policies, a young demographic with a high propensity to own personal vehicles, and continuous infrastructure development, including new road networks and urban expansion. The market penetration of premium engine oils in this segment is notably high.

- Engine Oils: The sheer volume of vehicles necessitates a constant supply of engine oils. Economic growth and increased vehicle usage directly translate into higher engine oil consumption. Technological advancements in engine design also push the demand for sophisticated engine oil formulations.

The Commercial Vehicles segment also demonstrates significant growth potential, contributing approximately 35% to the overall market. This is largely attributed to the expansion of logistics, e-commerce, and construction industries, which rely heavily on heavy-duty trucks, buses, and other commercial fleets. The demand for heavy-duty engine oils (HDEOs), transmission fluids, and hydraulic fluids for these vehicles is substantial.

- Commercial Vehicles: Growth drivers include large-scale infrastructure projects funded by Vision 2030, a burgeoning logistics sector, and increased inter-city transportation. The lifecycle of commercial vehicles often involves more rigorous usage, leading to higher lubricant replacement frequencies.

Motorcycles represent a smaller but growing segment, estimated at 10% of the market. The increasing popularity of motorcycles for commuting and leisure activities, especially in urban areas, is contributing to the demand for motorcycle-specific engine oils.

- Motorcycles: Urbanization and the need for cost-effective personal transportation are key drivers. The market is also witnessing a rise in premium motorcycle segments, influencing the demand for higher-quality lubricants.

In terms of product types beyond engine oils, Transmission & Gear Oils and Hydraulic Fluids are also crucial, serving the specific lubrication needs of vehicle drivetrains and machinery, respectively. Greases find application in various automotive components requiring high-viscosity lubrication. The dominance of Engine Oils is projected to continue, but significant growth is anticipated in specialized lubricants for newer vehicle technologies.

Saudi Arabia Automotive Lubricant Market Product Innovations

Product innovations in the Saudi Arabia automotive lubricant market are primarily focused on enhancing performance, efficiency, and sustainability. Key developments include the formulation of advanced synthetic engine oils that offer superior protection against wear, deposit formation, and extreme temperatures, crucial for the region's climate. There's a growing emphasis on lubricants designed for extended drain intervals, reducing maintenance costs and environmental impact. The emergence of electric vehicles is driving the development of specialized EV fluids, including coolants, gear oils, and transmission fluids, tailored to the unique requirements of electric powertrains. These innovations aim to improve thermal management, reduce friction, and ensure the longevity of EV components. Competitive advantages are being built around fuel economy improvements, reduced emissions, and enhanced engine cleanliness. The market is also witnessing the introduction of bio-based and biodegradable lubricants, aligning with global sustainability trends and the Kingdom's own environmental initiatives.

Report Segmentation & Scope

This comprehensive report segments the Saudi Arabia automotive lubricant market across key categories to provide granular insights. The Vehicle Type segmentation includes Commercial Vehicles, Motorcycles, and Passenger Vehicles. For Commercial Vehicles, the market is driven by fleet expansion and infrastructure projects, with an estimated growth rate of 4.5% CAGR during the forecast period. The Motorcycles segment is expected to grow at 5.0% CAGR, influenced by urban mobility trends. Passenger Vehicles, the largest segment, is projected to expand at 6.2% CAGR, fueled by a growing vehicle parc and consumer preference for premium products.

The Product Type segmentation encompasses Engine Oils, Greases, Hydraulic Fluids, and Transmission & Gear Oils. Engine Oils dominate the market, with synthetic variants experiencing the highest growth. Greases are essential for components requiring sustained lubrication and are projected to grow at 4.0% CAGR. Hydraulic Fluids are critical for specialized vehicle functions and industrial applications, with an estimated CAGR of 4.8%. Transmission & Gear Oils are vital for drivetrain efficiency and are expected to witness a CAGR of 5.2%, with increasing demand for specialized formulations for automatic and manual transmissions. The scope of this report is to provide a detailed market analysis, competitive intelligence, and future outlook for the Saudi Arabian automotive lubricant industry.

Key Drivers of Saudi Arabia Automotive Lubricant Market Growth

Several factors are significantly driving the Saudi Arabia automotive lubricant market. Economically, the Kingdom's Vision 2030 initiative continues to stimulate growth across various sectors, including automotive manufacturing, logistics, and transportation, all of which directly impact lubricant demand. Increased disposable incomes and a growing population contribute to a higher vehicle ownership rate, particularly in the passenger vehicle segment. Technologically, advancements in engine technology and the transition towards more fuel-efficient vehicles necessitate the use of higher-performance synthetic and semi-synthetic lubricants, offering better protection and extended drain intervals. Regulatory frameworks that promote vehicle safety and emissions standards indirectly encourage the use of quality lubricants. Furthermore, a robust aftermarket service sector, with a growing number of authorized service centers and independent workshops, ensures consistent demand for lubricants as part of regular vehicle maintenance.

Challenges in the Saudi Arabia Automotive Lubricant Market Sector

Despite the promising growth, the Saudi Arabia automotive lubricant market faces certain challenges. Fluctuations in crude oil prices, the primary feedstock for lubricant production, can impact profitability and pricing strategies. Intensifying competition among both global and local players leads to price pressures and a need for continuous product differentiation and innovation. Supply chain disruptions, though less pronounced, can affect the availability of raw materials and finished products, particularly during global economic volatilities. The nascent but growing adoption of electric vehicles presents a long-term challenge to the traditional internal combustion engine lubricant market, requiring lubricant manufacturers to adapt and diversify their product portfolios into specialized EV fluids. Furthermore, counterfeiting of lubricant products remains a concern, impacting brand reputation and customer trust, necessitating robust anti-counterfeiting measures and consumer awareness campaigns.

Leading Players in the Saudi Arabia Automotive Lubricant Market Market

- ExxonMobil Corporation

- BP PLC (Castrol)

- FUCHS

- TotalEnergie

- PETRONAS Lubricants International

- Royal Dutch Shell PLC

- AMSOIL Inc

- Eni SpA

- Petromin Corporation

- CHEVRON CORPORATION

Key Developments in Saudi Arabia Automotive Lubricant Market Sector

- January 2022: Effective April 1, ExxonMobil Corporation was organized along three business lines - ExxonMobil Upstream Company, ExxonMobil Product Solutions and ExxonMobil Low Carbon Solutions, streamlining operations and potentially impacting its lubricant business strategies.

- November 2021: PETRONAS Lubricants International Sdn Bhd (PLI) announced the debut of PETRONAS iona Electric Vehicle (EV) Fluids solutions at its Global Research & Technology Centre in Turin, Italy, marking another milestone in fluid technology innovation and signaling a focus on the emerging EV market.

- July 2021: Taajeer Group and APSCO agreed to work together on a long-term strategic relationship to deliver engine oil change services for MG automobiles at "Mobil Service" locations across the Kingdom, enhancing service offerings and brand presence.

Strategic Saudi Arabia Automotive Lubricant Market Market Outlook

The strategic outlook for the Saudi Arabia automotive lubricant market remains highly positive, driven by the ongoing expansion of the automotive sector and the Kingdom's ambitious economic diversification plans. Growth accelerators include the increasing adoption of advanced lubricant technologies that offer improved fuel efficiency and extended service life, aligning with consumer demand for cost-effectiveness and performance. The development of specialized lubricants for the burgeoning electric vehicle market presents a significant opportunity for players who can innovate and adapt quickly. Furthermore, the focus on local manufacturing and value addition within the petrochemical industry could lead to increased domestic production and supply chain resilience. Strategic partnerships and collaborations between lubricant manufacturers, automotive OEMs, and service providers will be crucial for capturing market share and meeting evolving customer needs. The market is expected to witness a sustained demand for high-quality, performance-driven lubricants, with a growing emphasis on sustainability and environmental responsibility.

Saudi Arabia Automotive Lubricant Market Segmentation

-

1. Vehicle Type

- 1.1. Commercial Vehicles

- 1.2. Motorcycles

- 1.3. Passenger Vehicles

-

2. Product Type

- 2.1. Engine Oils

- 2.2. Greases

- 2.3. Hydraulic Fluids

- 2.4. Transmission & Gear Oils

Saudi Arabia Automotive Lubricant Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Automotive Lubricant Market Regional Market Share

Geographic Coverage of Saudi Arabia Automotive Lubricant Market

Saudi Arabia Automotive Lubricant Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Automotive Production and Sales; Increasing Adoption of High-performance Lubricants

- 3.3. Market Restrains

- 3.3.1. Extended Drain Intervals; Modest Impact of Electric Vehicles (EVs) in the Future

- 3.4. Market Trends

- 3.4.1. Largest Segment By Vehicle Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Automotive Lubricant Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Commercial Vehicles

- 5.1.2. Motorcycles

- 5.1.3. Passenger Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Engine Oils

- 5.2.2. Greases

- 5.2.3. Hydraulic Fluids

- 5.2.4. Transmission & Gear Oils

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ExxonMobil Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BP PLC (Castrol)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 FUCHS

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 TotalEnergie

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PETRONAS Lubricants International

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Royal Dutch Shell PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AMSOIL Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Eni SpA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Petromin Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 CHEVRON CORPORATION

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ExxonMobil Corporation

List of Figures

- Figure 1: Saudi Arabia Automotive Lubricant Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Automotive Lubricant Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Automotive Lubricant Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Saudi Arabia Automotive Lubricant Market Volume Million Forecast, by Vehicle Type 2020 & 2033

- Table 3: Saudi Arabia Automotive Lubricant Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 4: Saudi Arabia Automotive Lubricant Market Volume Million Forecast, by Product Type 2020 & 2033

- Table 5: Saudi Arabia Automotive Lubricant Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: Saudi Arabia Automotive Lubricant Market Volume Million Forecast, by Region 2020 & 2033

- Table 7: Saudi Arabia Automotive Lubricant Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 8: Saudi Arabia Automotive Lubricant Market Volume Million Forecast, by Vehicle Type 2020 & 2033

- Table 9: Saudi Arabia Automotive Lubricant Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 10: Saudi Arabia Automotive Lubricant Market Volume Million Forecast, by Product Type 2020 & 2033

- Table 11: Saudi Arabia Automotive Lubricant Market Revenue million Forecast, by Country 2020 & 2033

- Table 12: Saudi Arabia Automotive Lubricant Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Automotive Lubricant Market?

The projected CAGR is approximately 2.3%.

2. Which companies are prominent players in the Saudi Arabia Automotive Lubricant Market?

Key companies in the market include ExxonMobil Corporation, BP PLC (Castrol), FUCHS, TotalEnergie, PETRONAS Lubricants International, Royal Dutch Shell PLC, AMSOIL Inc, Eni SpA, Petromin Corporation, CHEVRON CORPORATION.

3. What are the main segments of the Saudi Arabia Automotive Lubricant Market?

The market segments include Vehicle Type, Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 746.5 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Automotive Production and Sales; Increasing Adoption of High-performance Lubricants.

6. What are the notable trends driving market growth?

Largest Segment By Vehicle Type : <span style="font-family: 'regular_bold';color:#0e7db3;">Passenger Vehicles</span>.

7. Are there any restraints impacting market growth?

Extended Drain Intervals; Modest Impact of Electric Vehicles (EVs) in the Future.

8. Can you provide examples of recent developments in the market?

January 2022: Effective April 1, ExxonMobil Corporation was organized along three business lines - ExxonMobil Upstream Company, ExxonMobil Product Solutions and ExxonMobil Low Carbon Solutions.November 2021: PETRONAS Lubricants International Sdn Bhd (PLI) announced the debut of PETRONAS iona Electric Vehicle (EV) Fluids solutions at its Global Research & Technology Centre in Turin, Italy, marking another milestone in fluid technology innovation.July 2021: Taajeer Group and APSCO agreed to work together on a long-term strategic relationship to deliver engine oil change services for MG automobiles at "Mobil Service" locations across the Kingdom.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Automotive Lubricant Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Automotive Lubricant Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Automotive Lubricant Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Automotive Lubricant Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence