Key Insights

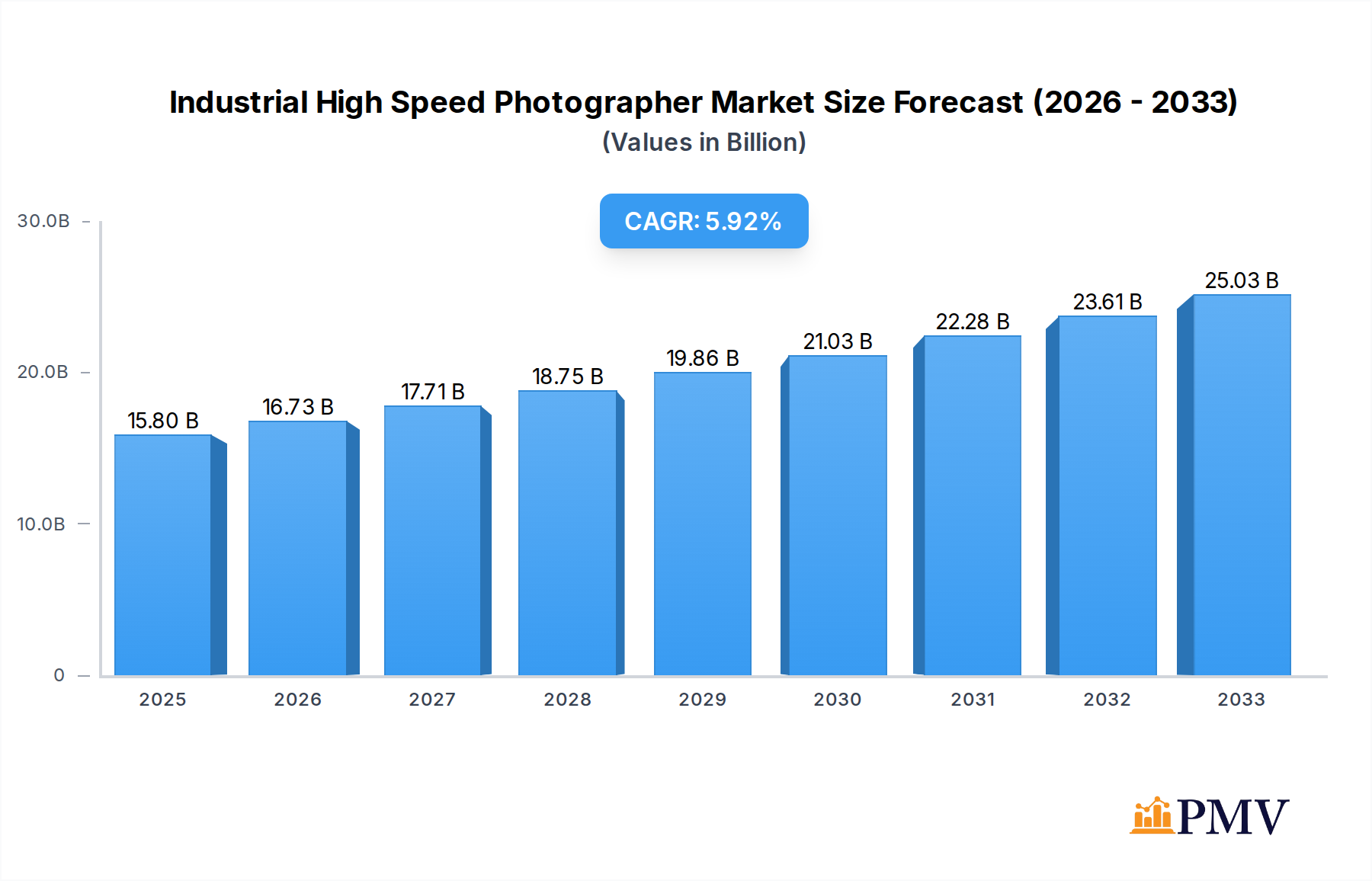

The Industrial High-Speed Photographer market is poised for significant expansion, projected to reach approximately $15.8 billion by 2025, driven by a robust CAGR of 5.8% throughout the forecast period of 2025-2033. This growth is fueled by the increasing demand for meticulous visual documentation and analysis across a spectrum of industrial applications. Key drivers include the imperative for enhanced industrial inspection, where high-speed photography captures fleeting defects, anomalies, and process intricacies that are otherwise imperceptible to the human eye. This capability is crucial for quality control, predictive maintenance, and safety compliance in sectors like manufacturing, automotive, aerospace, and energy. Furthermore, the military analysis segment is leveraging high-speed imaging for threat assessment, surveillance, and tactical planning, where the precise capture of dynamic events is paramount. The "Other" application segment likely encompasses emerging uses in scientific research, sports analytics, and forensic investigations, all contributing to the market's upward trajectory.

Industrial High Speed Photographer Market Size (In Billion)

The market's evolution is further shaped by advancements in technology and evolving industry needs. Trends such as the integration of AI and machine learning with high-speed imaging for automated analysis and defect identification are gaining traction. The increasing adoption of optoelectronics in camera systems allows for higher resolution, faster frame rates, and improved light sensitivity, enabling the capture of incredibly fast phenomena. While the market benefits from these technological leaps, it also faces certain restraints. The high initial investment cost for sophisticated high-speed camera equipment and associated software can be a barrier for smaller enterprises. Additionally, the specialized expertise required for operating and interpreting data from high-speed photographic systems may present a challenge in workforce development. However, the persistent need for precise, detailed visual data across critical industrial operations, coupled with ongoing technological innovations, strongly indicates sustained and healthy market growth for industrial high-speed photography.

Industrial High Speed Photographer Company Market Share

This comprehensive report offers an unparalleled deep dive into the Industrial High Speed Photographer market, dissecting critical aspects from market structure and competitive dynamics to emerging trends, dominant segments, and future outlook. Leveraging billions in data and expert analysis, this study provides actionable intelligence for stakeholders navigating the rapidly evolving landscape of high-speed industrial imaging, industrial inspection photography, and military analysis photography. Our extensive coverage spans from 2019 to 2033, with a base and estimated year of 2025 and a forecast period from 2025 to 2033, building upon historical data from 2019 to 2024.

Industrial High Speed Photographer Market Structure & Competitive Dynamics

The Industrial High Speed Photographer market exhibits a moderate to high level of concentration, with key players investing billions in research and development to maintain competitive advantages. Innovation ecosystems are thriving, driven by advancements in optomechanics, optoelectronics, and visibility technology. Regulatory frameworks, particularly in sectors like military analysis, play a significant role in shaping market entry and product compliance, requiring adherence to stringent standards and specifications often valued in the billions. The presence of robust product substitutes, while present, are increasingly challenged by the superior capabilities and specialized applications offered by dedicated high-speed industrial photography solutions. End-user trends are gravitating towards greater automation, precision, and real-time data acquisition, fueling demand for advanced imaging technologies. Mergers and Acquisitions (M&A) activities, with deal values frequently reaching billions, are strategic maneuvers employed by larger entities to consolidate market share, acquire cutting-edge technologies, and expand their global reach. Analyzing market share percentages and M&A deal values in the billions provides a clear picture of the competitive landscape and the strategic imperatives of leading organizations.

Industrial High Speed Photographer Industry Trends & Insights

The Industrial High Speed Photographer industry is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of approximately 8.5% over the forecast period. This impressive trajectory is propelled by a confluence of powerful market growth drivers, including the increasing demand for high-speed industrial inspection across critical sectors such as manufacturing, aerospace, and automotive. Technological disruptions, particularly in sensor technology, processing power, and AI-driven image analysis, are continuously enhancing the capabilities and applications of high-speed industrial photography. These advancements are enabling unprecedented levels of detail and speed, crucial for tasks like detecting microscopic defects, monitoring rapid industrial processes, and conducting in-depth military analysis. Consumer preferences are increasingly aligned with the need for verifiable, high-resolution visual data for quality control, safety compliance, and forensic purposes, translating into a growing market penetration of advanced imaging solutions. Competitive dynamics are characterized by a fierce race for innovation, with companies investing billions to develop proprietary technologies and offer comprehensive service packages. The market penetration of specialized high-speed industrial imaging solutions is expected to surge, as industries recognize the long-term return on investment and the critical role these technologies play in optimizing operations and mitigating risks, with the overall market valuation projected to surpass several billion by 2033.

Dominant Markets & Segments in Industrial High Speed Photographer

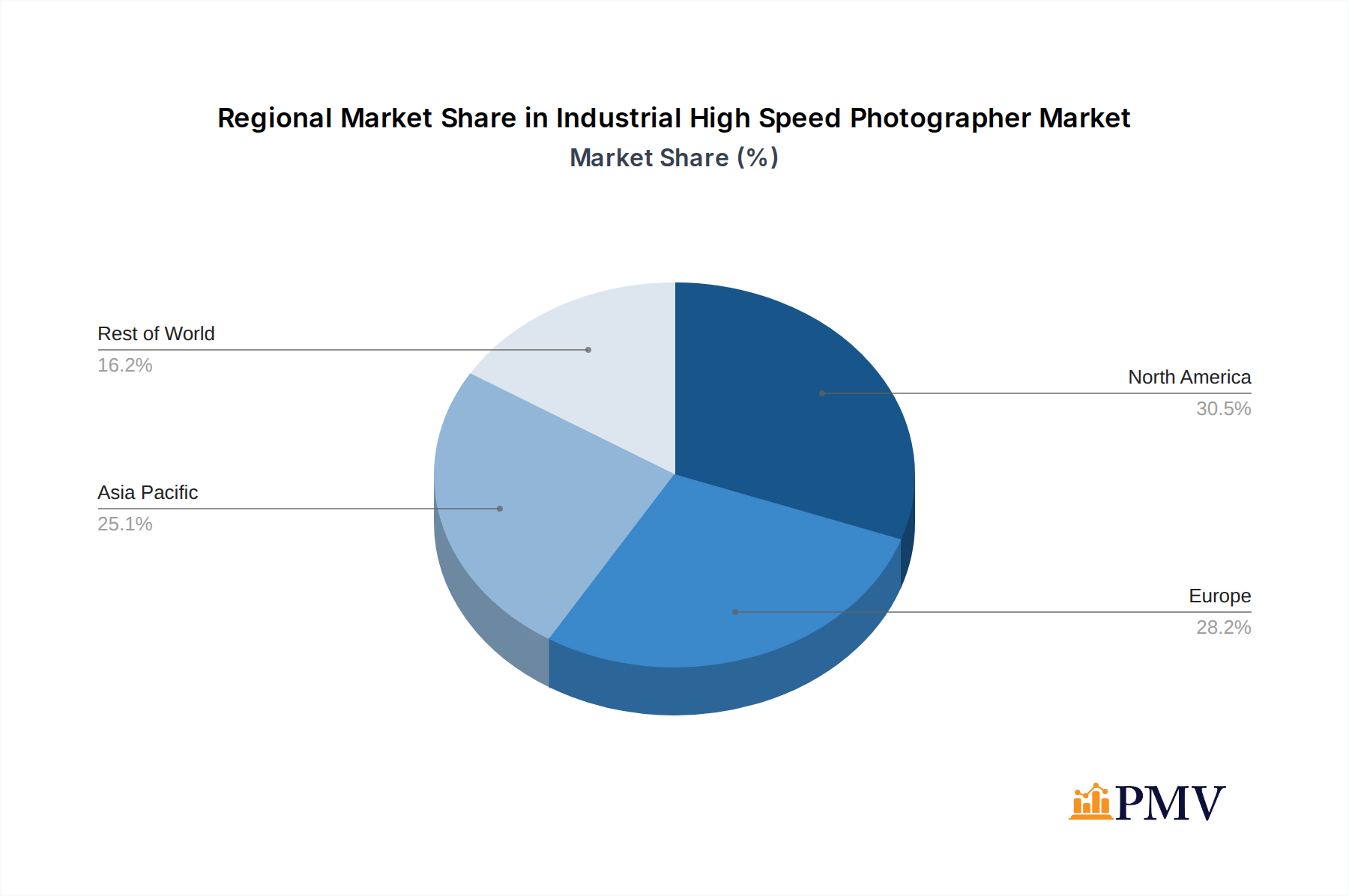

The Industrial High Speed Photographer market is significantly influenced by regional economic policies, infrastructure development, and the strategic importance of specific applications.

Application: Industrial Inspection

- Key Drivers: The burgeoning manufacturing sector globally, coupled with stringent quality control mandates across industries such as automotive, aerospace, and electronics, are primary growth catalysts. The increasing adoption of Industry 4.0 principles and smart manufacturing technologies, requiring precise, real-time data capture, further bolsters this segment. Economic policies that incentivize technological adoption and R&D spending within manufacturing hubs also contribute significantly.

- Dominance Analysis: This segment represents the largest share of the market, with billions invested annually in advanced imaging solutions for defect detection, process monitoring, and predictive maintenance. Countries with strong manufacturing bases, such as Germany, the United States, and China, exhibit particularly high demand. The economic benefits derived from reduced scrap rates and improved product quality are substantial, making this a vital area of investment for businesses.

Application: Military Analysis

- Key Drivers: National security imperatives, ongoing geopolitical tensions, and the modernization of defense capabilities are the driving forces behind this segment. Governments are investing billions in advanced surveillance, reconnaissance, and intelligence-gathering technologies, where high-speed industrial photography plays a crucial role in capturing and analyzing high-velocity events and tactical maneuvers.

- Dominance Analysis: While perhaps not the largest in terms of sheer volume of units, this segment commands significant value due to the specialized, high-performance nature of the equipment and the critical, often sensitive, applications. Nations with substantial defense budgets consistently drive demand. The need for accurate, high-resolution imagery for threat assessment and strategic planning makes this a non-negotiable investment area, often involving billions in procurement.

Application: Other

- Key Drivers: This broad category encompasses emerging applications in scientific research, sports analytics, forensic investigations, and high-speed consumer product testing. The continuous exploration of new use cases for high-speed imaging fuels growth in this diverse segment.

- Dominance Analysis: While individually smaller than the primary applications, the aggregate growth of the 'Other' segment is substantial. Advancements in areas like medical imaging, biomechanics research, and advanced material science are opening up new avenues for high-speed industrial photographers. The potential for disruptive innovation in these niche areas can lead to significant market shifts, with investment often in the hundreds of millions.

Types: Optomechanical

- Key Drivers: The demand for precise mechanical component analysis, motion studies, and the inspection of intricate machinery drives the optomechanical segment. Innovations in lens design, sensor integration, and robust housing for industrial environments are key.

- Dominance Analysis: This type is foundational for many industrial applications, enabling detailed visual inspection of moving parts and mechanical systems. Industries reliant on precision engineering, such as aerospace and manufacturing, are major consumers. The ability to capture data on mechanical stress, vibration, and wear at high speeds is invaluable, with investments often in the billions for comprehensive inspection systems.

Types: Optoelectronics

- Key Drivers: The rapid advancements in optoelectronics, including sophisticated sensor arrays, high-resolution detectors, and efficient data acquisition systems, are powering this segment. The need to capture and analyze phenomena at the atomic and sub-atomic levels in industrial processes is a key driver.

- Dominance Analysis: This segment is at the forefront of technological innovation in high-speed imaging. Applications range from inspecting semiconductor manufacturing processes to analyzing the behavior of light-emitting diodes (LEDs) and other electronic components. The demand for capturing incredibly fast optical events drives significant R&D and investment, with the value of advanced optoelectronic imaging solutions often reaching billions.

Types: Visibility Technology

- Key Drivers: The development and integration of advanced lighting techniques, including strobing, illumination control, and specialized spectral imaging, fall under visibility technology. Enhancing the ability to visualize fast-moving objects and subtle details in challenging industrial environments is the primary goal.

- Dominance Analysis: This type is crucial for unlocking the full potential of high-speed photography in diverse settings. From illuminating dark industrial spaces to capturing clear images of objects moving at extreme velocities, sophisticated visibility solutions are indispensable. Their application in forensic science, scientific research, and challenging industrial inspections contributes billions to the overall market value.

Industrial High Speed Photographer Product Innovations

Product innovations in the Industrial High Speed Photographer market are focused on enhancing resolution, frame rates, and data processing capabilities, often exceeding billions in R&D investment. Developments include smaller, more robust camera systems capable of withstanding harsh industrial environments, advanced AI-powered image analysis software for automated defect detection and anomaly identification, and integrated solutions for real-time data streaming and cloud connectivity. These innovations provide a significant competitive advantage by enabling faster, more accurate, and more comprehensive inspections and analyses, directly impacting operational efficiency and safety across numerous industries.

Report Segmentation & Scope

This report segments the Industrial High Speed Photographer market across key applications and technology types. The Application segments include Industrial Inspection, Military Analysis, and Other. The Type segments encompass Optomechanical, Optoelectronics, and Visibility Technology. Each segment is analyzed for its projected market size in billions, growth trajectory, and the competitive dynamics shaping its evolution. The scope extends to understanding how advancements within each segment contribute to the overall market expansion and the specific needs they address for end-users.

Key Drivers of Industrial High Speed Photographer Growth

Several key drivers are fueling the growth of the Industrial High Speed Photographer market, with projected investments in the billions.

- Technological Advancements: Continuous innovation in sensor technology, processing power, and AI algorithms is enabling higher frame rates, greater resolution, and more sophisticated image analysis, making high-speed industrial imaging indispensable for complex tasks.

- Industrial Automation & Industry 4.0: The widespread adoption of automation and smart manufacturing principles across industries necessitates precise, real-time data capture for quality control, process optimization, and predictive maintenance.

- Stringent Quality & Safety Standards: Increasing regulatory requirements and industry best practices for product quality, safety, and compliance drive the demand for advanced inspection and analysis tools.

- Growth in Defense & Aerospace: Significant government investments in national security, defense modernization, and aerospace research and development continue to propel the need for sophisticated military analysis and high-speed imaging capabilities.

Challenges in the Industrial High Speed Photographer Sector

Despite its robust growth, the Industrial High Speed Photographer sector faces several challenges, with potential financial impacts in the billions.

- High Initial Investment Costs: The sophisticated nature of high-speed industrial photography equipment and software translates to substantial upfront costs, which can be a barrier for smaller enterprises.

- Technical Expertise Requirements: Operating and interpreting data from advanced high-speed imaging systems requires specialized technical knowledge and trained personnel, creating a skills gap for some organizations.

- Data Management & Storage: The immense volume of data generated by high-speed cameras necessitates robust data management solutions, including storage, processing, and analysis infrastructure, adding to operational costs.

- Rapid Technological Obsolescence: The fast pace of technological advancement means that equipment can become outdated quickly, requiring continuous investment to maintain cutting-edge capabilities.

Leading Players in the Industrial High Speed Photographer Market

The Industrial High Speed Photographer market is characterized by the presence of several influential companies, including:

- Buddenbrock Foto Gruppe

- Bottom-Line Productions

- Dockside Diving

- Ron McCoy Photography

- Aden Photography & Video Productions

- Forensic Digital Imaging

- ProductPhotography.com

- Positive Image Corp.

- Deltron Designs

- Moviemedia Video Productions

- Bob Perzel Photography

- Matthew Lause Photography

- ColdCreek Studios

- Baker Imaging & Photography

Key Developments in Industrial High Speed Photographer Sector

- 2023: Launch of new AI-powered image analysis software enabling automated defect detection in real-time for automotive manufacturing.

- 2022: Major defense contractor announces multi-billion dollar investment in advanced high-speed imaging systems for aerial surveillance.

- 2021: Development of a compact, ruggedized high-speed camera for extreme industrial environments, enhancing industrial inspection capabilities.

- 2020: Integration of advanced optoelectronic sensors leading to unprecedented frame rates in scientific research imaging.

- 2019: Merger of two leading visibility technology firms, creating a powerhouse in specialized industrial illumination solutions.

Strategic Industrial High Speed Photographer Market Outlook

The future outlook for the Industrial High Speed Photographer market is exceptionally bright, with significant growth accelerators and opportunities for strategic market expansion, projecting market valuations in the billions. The continuous evolution of AI and machine learning will further automate data analysis and enhance predictive capabilities. Increased adoption of cloud-based platforms will facilitate remote monitoring and collaboration. Emerging applications in areas like additive manufacturing, renewable energy inspection, and advanced materials science will unlock new revenue streams. Companies that can offer integrated solutions, focusing on end-to-end image acquisition, processing, and analysis, will be best positioned to capitalize on the burgeoning demand for high-speed industrial imaging.

Industrial High Speed Photographer Segmentation

-

1. Application

- 1.1. Industrial Inspection

- 1.2. Military Analysis

- 1.3. Other

-

2. Types

- 2.1. Optomechanical

- 2.2. Optoelectronics

- 2.3. Visibility Technology

Industrial High Speed Photographer Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Industrial High Speed Photographer Regional Market Share

Geographic Coverage of Industrial High Speed Photographer

Industrial High Speed Photographer REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial High Speed Photographer Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Industrial Inspection

- 5.1.2. Military Analysis

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Optomechanical

- 5.2.2. Optoelectronics

- 5.2.3. Visibility Technology

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Industrial High Speed Photographer Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Industrial Inspection

- 6.1.2. Military Analysis

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Optomechanical

- 6.2.2. Optoelectronics

- 6.2.3. Visibility Technology

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Industrial High Speed Photographer Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Industrial Inspection

- 7.1.2. Military Analysis

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Optomechanical

- 7.2.2. Optoelectronics

- 7.2.3. Visibility Technology

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Industrial High Speed Photographer Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Industrial Inspection

- 8.1.2. Military Analysis

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Optomechanical

- 8.2.2. Optoelectronics

- 8.2.3. Visibility Technology

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Industrial High Speed Photographer Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Industrial Inspection

- 9.1.2. Military Analysis

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Optomechanical

- 9.2.2. Optoelectronics

- 9.2.3. Visibility Technology

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Industrial High Speed Photographer Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Industrial Inspection

- 10.1.2. Military Analysis

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Optomechanical

- 10.2.2. Optoelectronics

- 10.2.3. Visibility Technology

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Buddenbrock Foto Gruppe

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bottom-Line Productions

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dockside Diving

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ron McCoy Photography

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Aden Photography & Video Productions

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Forensic Digital Imaging

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ProductPhotography.com

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Positive Image Corp.

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Deltron Designs

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Moviemedia Video Productions

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Bob Perzel Photography

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Matthew Lause Photography

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 ColdCreek Studios

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Baker Imaging & Photography

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Buddenbrock Foto Gruppe

List of Figures

- Figure 1: Global Industrial High Speed Photographer Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Industrial High Speed Photographer Revenue (billion), by Application 2025 & 2033

- Figure 3: North America Industrial High Speed Photographer Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Industrial High Speed Photographer Revenue (billion), by Types 2025 & 2033

- Figure 5: North America Industrial High Speed Photographer Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Industrial High Speed Photographer Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Industrial High Speed Photographer Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Industrial High Speed Photographer Revenue (billion), by Application 2025 & 2033

- Figure 9: South America Industrial High Speed Photographer Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Industrial High Speed Photographer Revenue (billion), by Types 2025 & 2033

- Figure 11: South America Industrial High Speed Photographer Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Industrial High Speed Photographer Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Industrial High Speed Photographer Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Industrial High Speed Photographer Revenue (billion), by Application 2025 & 2033

- Figure 15: Europe Industrial High Speed Photographer Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Industrial High Speed Photographer Revenue (billion), by Types 2025 & 2033

- Figure 17: Europe Industrial High Speed Photographer Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Industrial High Speed Photographer Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Industrial High Speed Photographer Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Industrial High Speed Photographer Revenue (billion), by Application 2025 & 2033

- Figure 21: Middle East & Africa Industrial High Speed Photographer Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Industrial High Speed Photographer Revenue (billion), by Types 2025 & 2033

- Figure 23: Middle East & Africa Industrial High Speed Photographer Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Industrial High Speed Photographer Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Industrial High Speed Photographer Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Industrial High Speed Photographer Revenue (billion), by Application 2025 & 2033

- Figure 27: Asia Pacific Industrial High Speed Photographer Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Industrial High Speed Photographer Revenue (billion), by Types 2025 & 2033

- Figure 29: Asia Pacific Industrial High Speed Photographer Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Industrial High Speed Photographer Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Industrial High Speed Photographer Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Industrial High Speed Photographer Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Industrial High Speed Photographer Revenue billion Forecast, by Types 2020 & 2033

- Table 3: Global Industrial High Speed Photographer Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Industrial High Speed Photographer Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Global Industrial High Speed Photographer Revenue billion Forecast, by Types 2020 & 2033

- Table 6: Global Industrial High Speed Photographer Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Industrial High Speed Photographer Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Industrial High Speed Photographer Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Industrial High Speed Photographer Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Industrial High Speed Photographer Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Global Industrial High Speed Photographer Revenue billion Forecast, by Types 2020 & 2033

- Table 12: Global Industrial High Speed Photographer Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Industrial High Speed Photographer Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Industrial High Speed Photographer Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Industrial High Speed Photographer Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Industrial High Speed Photographer Revenue billion Forecast, by Application 2020 & 2033

- Table 17: Global Industrial High Speed Photographer Revenue billion Forecast, by Types 2020 & 2033

- Table 18: Global Industrial High Speed Photographer Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Industrial High Speed Photographer Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Industrial High Speed Photographer Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Industrial High Speed Photographer Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Industrial High Speed Photographer Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Industrial High Speed Photographer Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Industrial High Speed Photographer Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Industrial High Speed Photographer Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Industrial High Speed Photographer Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Industrial High Speed Photographer Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Industrial High Speed Photographer Revenue billion Forecast, by Application 2020 & 2033

- Table 29: Global Industrial High Speed Photographer Revenue billion Forecast, by Types 2020 & 2033

- Table 30: Global Industrial High Speed Photographer Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Industrial High Speed Photographer Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Industrial High Speed Photographer Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Industrial High Speed Photographer Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Industrial High Speed Photographer Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Industrial High Speed Photographer Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Industrial High Speed Photographer Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Industrial High Speed Photographer Revenue billion Forecast, by Application 2020 & 2033

- Table 38: Global Industrial High Speed Photographer Revenue billion Forecast, by Types 2020 & 2033

- Table 39: Global Industrial High Speed Photographer Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Industrial High Speed Photographer Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Industrial High Speed Photographer Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Industrial High Speed Photographer Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Industrial High Speed Photographer Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Industrial High Speed Photographer Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Industrial High Speed Photographer Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Industrial High Speed Photographer Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial High Speed Photographer?

The projected CAGR is approximately 5.8%.

2. Which companies are prominent players in the Industrial High Speed Photographer?

Key companies in the market include Buddenbrock Foto Gruppe, Bottom-Line Productions, Dockside Diving, Ron McCoy Photography, Aden Photography & Video Productions, Forensic Digital Imaging, ProductPhotography.com, Positive Image Corp., Deltron Designs, Moviemedia Video Productions, Bob Perzel Photography, Matthew Lause Photography, ColdCreek Studios, Baker Imaging & Photography.

3. What are the main segments of the Industrial High Speed Photographer?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.8 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial High Speed Photographer," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial High Speed Photographer report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial High Speed Photographer?

To stay informed about further developments, trends, and reports in the Industrial High Speed Photographer, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence