Key Insights

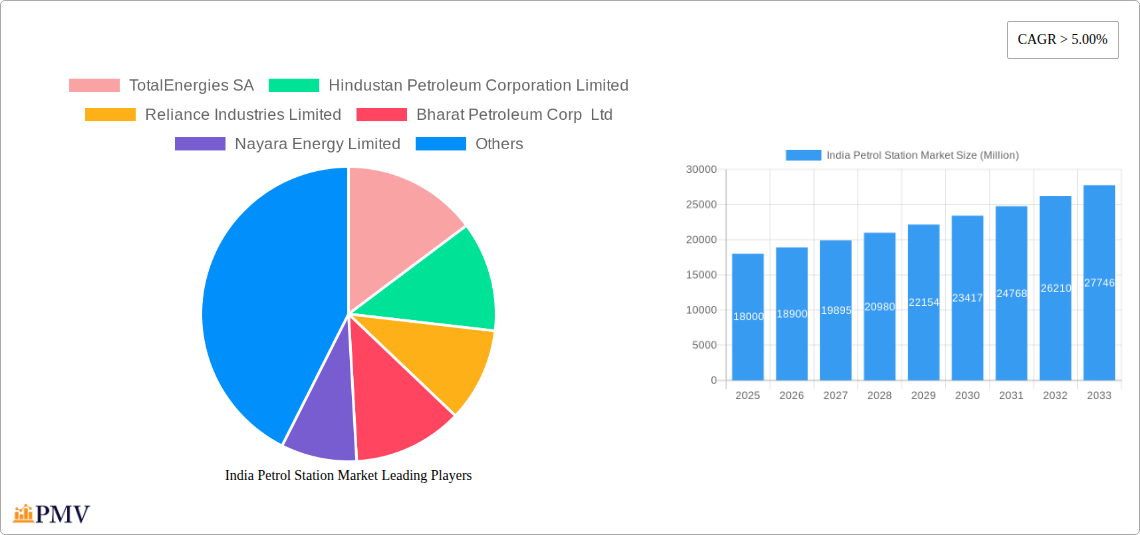

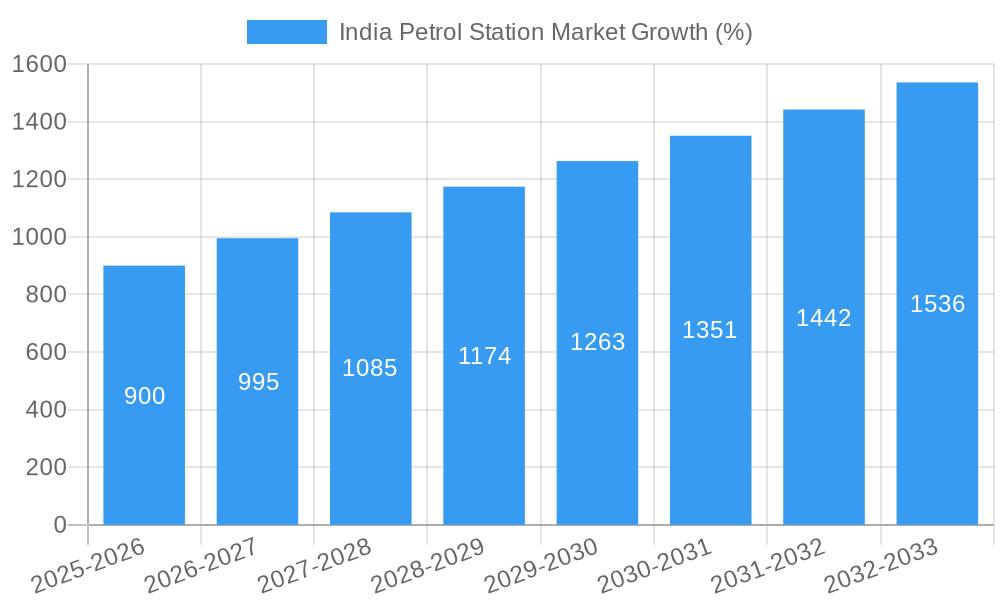

The India petrol station market, valued at approximately ₹150 billion (USD 18 billion) in 2025, exhibits robust growth potential, projected to expand at a CAGR exceeding 5% from 2025 to 2033. This growth is fueled by several key drivers. Rising vehicle ownership, particularly in the private sector, is significantly increasing fuel demand. Furthermore, India's expanding economy and improving infrastructure contribute to higher fuel consumption across both public and private sectors. Government initiatives promoting infrastructure development and easing regulations for private sector participation further enhance market expansion. However, fluctuating global crude oil prices and government regulations regarding fuel pricing present considerable challenges. Competition among major players like Indian Oil Corporation, Reliance Industries, Bharat Petroleum, and international giants such as TotalEnergies and Shell, intensifies market dynamics.

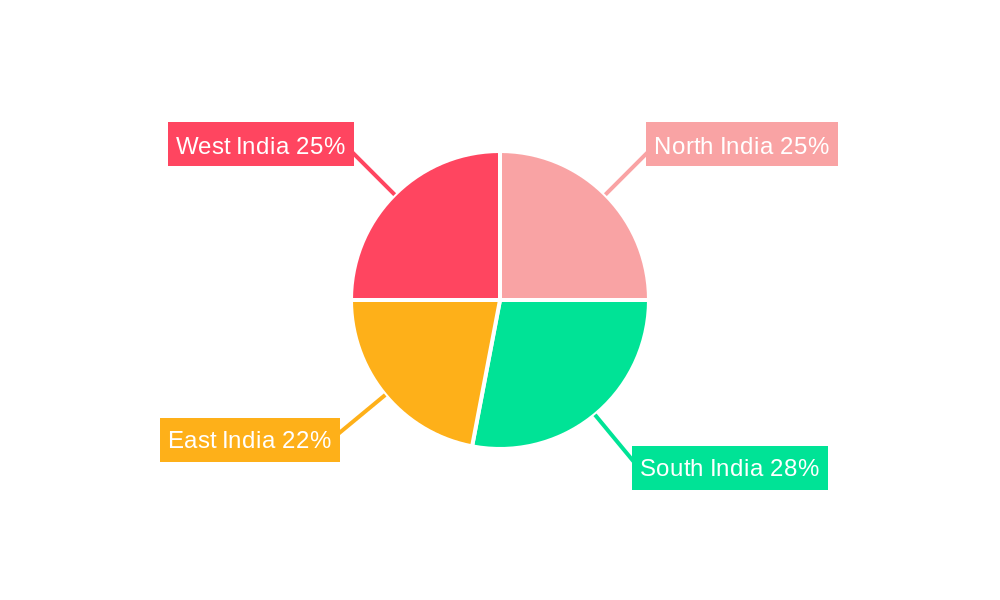

Market segmentation reveals a significant share held by Public Sector Undertakings (PSUs) due to their established presence and extensive network. However, the Private Owned segment is gaining traction, driven by increasing investment and competitive pricing strategies. Regional variations exist, with potentially higher growth in regions experiencing rapid urbanization and industrialization such as West and South India. The forecast period, 2025-2033, anticipates continued market expansion, driven by sustained economic growth and increased vehicle ownership, though the pace of growth might be moderated by global economic uncertainties and government policies. Analyzing regional data from North, South, East, and West India allows for targeted strategies for individual players. Understanding the competitive landscape and leveraging evolving consumer preferences will be crucial for success in this dynamic market.

India Petrol Station Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the India Petrol Station Market, encompassing market structure, competitive dynamics, industry trends, and future growth prospects. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period is 2019-2024. This report is invaluable for industry stakeholders, investors, and strategic planners seeking to understand and capitalize on the opportunities within this dynamic market. The total market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033.

India Petrol Station Market Market Structure & Competitive Dynamics

The Indian petrol station market is characterized by a mix of public sector undertakings (PSUs) and privately owned companies. Market concentration is high, with a few dominant players controlling a significant market share. The market structure is influenced by the regulatory framework set by the government, which includes pricing policies and licensing requirements. Innovation in this sector is driven by the need to improve efficiency, enhance customer experience, and adopt sustainable practices. Product substitutes, such as electric vehicles, are gradually gaining traction, posing a long-term challenge. End-user trends show a shift towards convenience and digitalization, influencing the strategies of petrol station operators. Mergers and acquisitions (M&A) activities have been relatively limited in recent years, but strategic partnerships are becoming more prevalent.

Market Share: Indian Oil Corporation Ltd holds the largest market share, followed by Hindustan Petroleum Corporation Limited and Bharat Petroleum Corp Ltd. Private players like Reliance Industries Limited and Nayara Energy Limited are also significant contributors. Precise market share figures for each player in 2025 are projected to be: Indian Oil Corporation Ltd (xx%), Hindustan Petroleum Corporation Limited (xx%), Bharat Petroleum Corp Ltd (xx%), Reliance Industries Limited (xx%), Nayara Energy Limited (xx%), and others (xx%).

M&A Activity: The total value of M&A deals in the Indian petrol station market during the historical period (2019-2024) was approximately xx Million. Future M&A activity is anticipated to be driven by consolidation and expansion strategies of major players.

India Petrol Station Market Industry Trends & Insights

The India Petrol Station Market is experiencing robust growth, driven by factors such as rising vehicle ownership, increasing fuel consumption, and expanding infrastructure. Technological disruptions, including the adoption of digital payment systems and loyalty programs, are transforming the customer experience. Consumer preferences are shifting towards convenience, cleanliness, and additional services offered at petrol stations. Competitive dynamics are intensifying, with players focusing on differentiation through branding, service quality, and value-added offerings. The Compound Annual Growth Rate (CAGR) for the market during the forecast period (2025-2033) is projected to be xx%. Market penetration of digital payment systems at petrol stations is expected to reach xx% by 2033.

Dominant Markets & Segments in India Petrol Station Market

The Indian Petrol Station Market is dominated by the Public Sector Undertakings (PSUs) segment in terms of market share and network coverage. This dominance is primarily driven by the strong government backing, extensive distribution network, and established brand presence. However, the Private Owned segment is witnessing significant growth fueled by strategic investments, focus on customer experience, and expansion into new geographic areas. In terms of end-users, the Public-Sector segment represents a larger portion of the market due to government fleet and operations. The Private-Sector segment is growing rapidly due to the increasing number of private vehicles and businesses.

Key Drivers for Public Sector Undertakings Dominance:

- Extensive network of fuel stations across the country

- Strong brand recognition and customer loyalty

- Government support and subsidies *Economies of scale *Established infrastructure

Key Drivers for Private Sector Growth:

- Focus on customer experience and service differentiation

- Strategic investments and expansion into underserved areas

- Adoption of advanced technologies and digital solutions

- Competitive pricing and promotional offers

India Petrol Station Market Product Innovations

Recent product innovations in the Indian petrol station market focus on improving fuel efficiency, reducing emissions, and enhancing customer convenience. This includes the introduction of new fuel blends, advanced fuel dispensing systems, and integrated digital platforms for payments and loyalty programs. The market is witnessing a gradual shift towards electric vehicle charging infrastructure at petrol stations, recognizing the growing adoption of electric vehicles. Technological advancements are enabling greater automation, real-time monitoring, and data-driven decision-making in the operations of petrol stations.

Report Segmentation & Scope

The report segments the India Petrol Station Market based on ownership (Public Sector Undertakings and Private Owned) and end-user (Public-Sector and Private-Sector).

Ownership: The Public Sector Undertakings segment is characterized by established players with extensive networks, while the Private Owned segment showcases emerging players focusing on differentiated offerings and advanced technologies. The Public Sector Undertakings segment is expected to hold a larger market share during the forecast period.

End-User: The Public-Sector segment comprises government fleets and related operations, while the Private-Sector segment comprises individual consumers and private businesses. The Private-Sector segment is projected to experience higher growth due to rising private vehicle ownership.

Key Drivers of India Petrol Station Market Growth

The growth of the India Petrol Station Market is driven by several factors, including increasing vehicle ownership, expanding infrastructure, rising disposable incomes, and government initiatives to promote fuel efficiency. The rising urbanization and industrialization also contribute significantly to the market's growth. Technological advancements in fuel dispensing technology and customer service offerings further stimulate market expansion. Favorable government policies aimed at improving fuel infrastructure and promoting energy security also play a crucial role in the market's growth trajectory.

Challenges in the India Petrol Station Market Sector

The India Petrol Station Market faces several challenges, including stringent regulatory compliance, fluctuating fuel prices, intense competition, and infrastructure limitations in certain regions. Supply chain disruptions, particularly during periods of geopolitical instability, can also impact market stability. Maintaining consistent fuel quality and addressing environmental concerns are also key challenges for operators. The increasing adoption of electric vehicles represents a significant long-term challenge to the traditional petrol station business model. These challenges can lead to reduced profit margins and slower market growth in specific areas.

Leading Players in the India Petrol Station Market Market

- TotalEnergies SA

- Hindustan Petroleum Corporation Limited

- Reliance Industries Limited

- Bharat Petroleum Corp Ltd

- Nayara Energy Limited

- Royal Dutch Shell PLC

- Indian Oil Corporation Ltd

Key Developments in India Petrol Station Market Sector

- November 2021: Indian Oil Corporation (IOCL), Bharat Petroleum Corporation Limited (BPCL), and Hindustan Petroleum Corporation Limited (HPCL) launched the Model Retail Outlet Scheme and Digital Customer Feedback Program called Darpan@PetrolPump. This initiative aims to enhance service standards and amenities across their fuel station networks.

Strategic India Petrol Station Market Market Outlook

The future of the India Petrol Station Market looks promising, driven by sustained economic growth, rising vehicle ownership, and infrastructure development. Strategic opportunities exist in expanding into underserved areas, enhancing customer experience through digitalization, and investing in alternative fuels and charging infrastructure. Players focusing on innovation, customer service, and sustainability are well-positioned to capitalize on the market's future growth potential. The market's long-term trajectory will be significantly influenced by the adoption of electric vehicles and government policies supporting sustainable transportation.

India Petrol Station Market Segmentation

-

1. Ownership

- 1.1. Public Sector Undertakings

- 1.2. Private Owned

-

2. End-User

- 2.1. Public-Sector

- 2.2. Private-Sector

India Petrol Station Market Segmentation By Geography

- 1. India

India Petrol Station Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in Renewable Energy Generation 4.; Supportive Government Policies Towards Green Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Challenges In Installing Renewable Power in the Circulated Structure

- 3.4. Market Trends

- 3.4.1. The Private Owned Segment is Expected to be the Fastest-Growing Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Petrol Station Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 5.1.1. Public Sector Undertakings

- 5.1.2. Private Owned

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Public-Sector

- 5.2.2. Private-Sector

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 6. North India India Petrol Station Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Petrol Station Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Petrol Station Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Petrol Station Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 TotalEnergies SA

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Hindustan Petroleum Corporation Limited

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Reliance Industries Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Bharat Petroleum Corp Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Nayara Energy Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Royal Dutch Shell PLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Indian Oil Corporation Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.1 TotalEnergies SA

List of Figures

- Figure 1: India Petrol Station Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Petrol Station Market Share (%) by Company 2024

List of Tables

- Table 1: India Petrol Station Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Petrol Station Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 3: India Petrol Station Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: India Petrol Station Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Petrol Station Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India Petrol Station Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India Petrol Station Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India Petrol Station Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India Petrol Station Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Petrol Station Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 11: India Petrol Station Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 12: India Petrol Station Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Petrol Station Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the India Petrol Station Market?

Key companies in the market include TotalEnergies SA, Hindustan Petroleum Corporation Limited, Reliance Industries Limited, Bharat Petroleum Corp Ltd, Nayara Energy Limited, Royal Dutch Shell PLC, Indian Oil Corporation Ltd.

3. What are the main segments of the India Petrol Station Market?

The market segments include Ownership, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in Renewable Energy Generation 4.; Supportive Government Policies Towards Green Energy.

6. What are the notable trends driving market growth?

The Private Owned Segment is Expected to be the Fastest-Growing Market.

7. Are there any restraints impacting market growth?

4.; Challenges In Installing Renewable Power in the Circulated Structure.

8. Can you provide examples of recent developments in the market?

In November 2021, Indian Oil Corporation (IOCL), Bharat Petroleum Corporation Limited (BPCL), and Hindustan Petroleum Corporation Limited (HPCL) announced the launch of the Model Retail Outlet Scheme and Digital Customer Feedback Program called Darpan@PetrolPump. Three oil PSUs have joined to launch Model Retail Outlets to enhance service standards and amenities across their fuel station networks, serving over six crore consumers daily.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Petrol Station Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Petrol Station Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Petrol Station Market?

To stay informed about further developments, trends, and reports in the India Petrol Station Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence