Key Insights

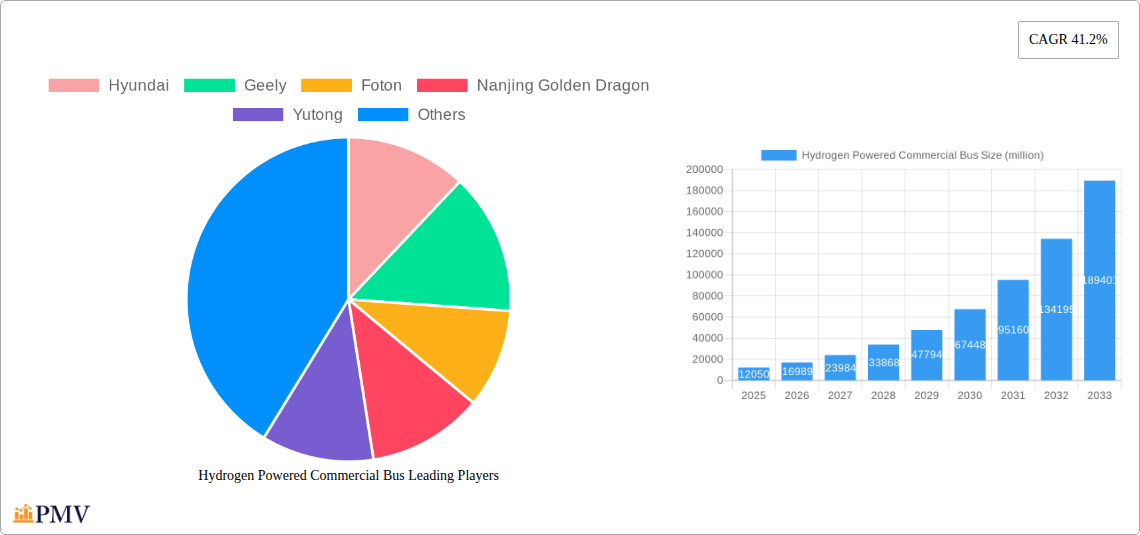

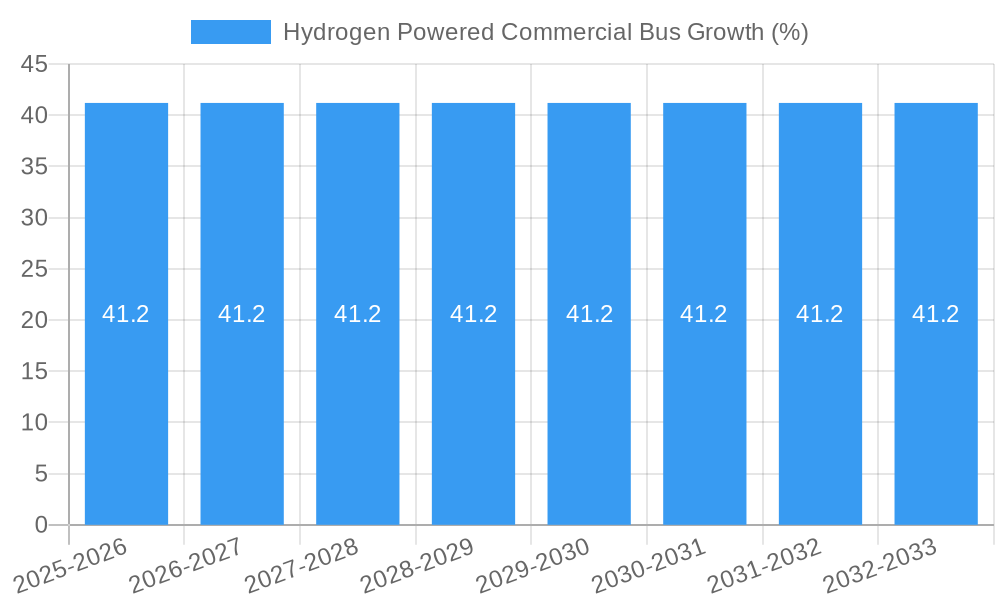

The global Hydrogen Powered Commercial Bus market is poised for exceptional growth, projected to reach a market size of approximately USD 12,050 million by 2025, with an astonishing Compound Annual Growth Rate (CAGR) of 41.2% anticipated during the forecast period of 2025-2033. This robust expansion is primarily driven by a confluence of factors, including escalating environmental regulations demanding cleaner transportation alternatives, significant government initiatives and subsidies promoting hydrogen fuel cell technology, and a growing awareness among fleet operators regarding the long-term operational cost benefits of hydrogen buses, such as reduced fuel expenses and lower maintenance needs compared to their internal combustion engine counterparts. The market's trajectory is further bolstered by continuous advancements in hydrogen fuel cell technology, leading to improved efficiency, increased durability, and enhanced safety features, all of which contribute to greater adoption across diverse applications, from public transportation fleets to commercial logistics.

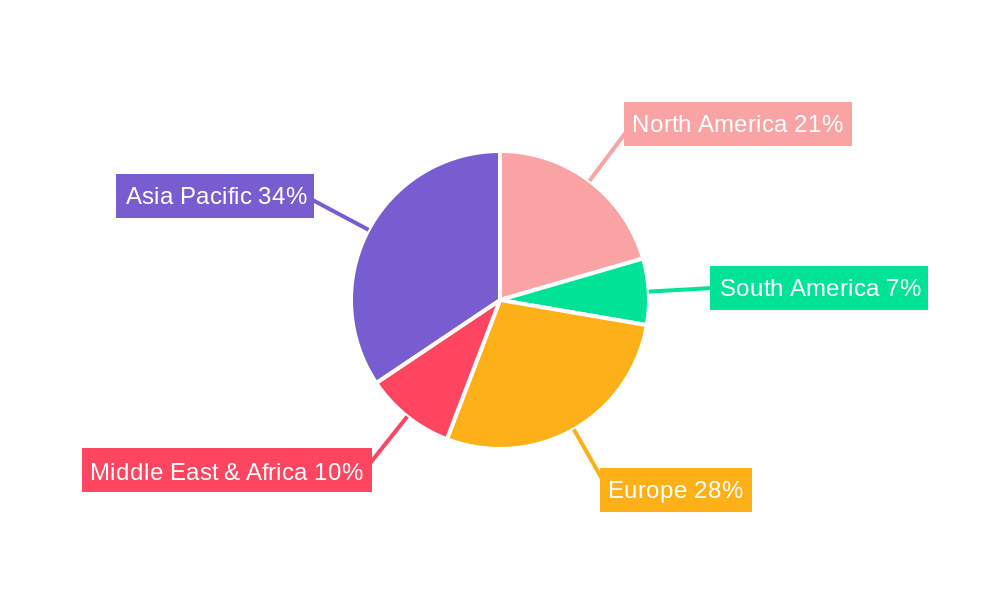

Key trends shaping the hydrogen-powered commercial bus landscape include the increasing development of hydrogen refueling infrastructure, which is crucial for overcoming range anxiety and enabling widespread deployment. Furthermore, the emergence of large vehicle segments, particularly for public transit and long-haul freight, is a significant development, alongside growing interest in smaller and medium-sized hydrogen buses for niche applications and last-mile delivery services. While the market is experiencing rapid growth, some restraints, such as the relatively high initial purchase cost of hydrogen buses and the ongoing challenges in establishing a comprehensive and widespread hydrogen production and distribution network, remain. However, strategic collaborations between manufacturers, energy providers, and government bodies are actively addressing these challenges, paving the way for a sustainable and eco-friendly future in commercial mobility. Companies like Hyundai, Geely, Foton, and Yutong are at the forefront of this innovation, actively developing and deploying advanced hydrogen bus solutions across key regions like Asia Pacific, Europe, and North America.

Comprehensive Report: Global Hydrogen Powered Commercial Bus Market - Forecast to 2033

This in-depth report provides a detailed analysis of the global Hydrogen Powered Commercial Bus market, offering critical insights into its structure, trends, competitive landscape, and future outlook. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this research is designed for industry stakeholders seeking to understand the evolving dynamics and capitalize on emerging opportunities within this transformative sector.

Hydrogen Powered Commercial Bus Market Structure & Competitive Dynamics

The global Hydrogen Powered Commercial Bus market exhibits a moderately consolidated structure, characterized by the strategic presence of established automotive giants and burgeoning specialized hydrogen technology firms. Key players like Hyundai, Geely, Foton, Nanjing Golden Dragon, Yutong, Feichi Bus, Zhongtong Bus, Hyzon Motors, Xiamen Golden Dragon, Yunnan Wulong, Dongfeng Motor, and Renault Group are actively shaping the market's competitive landscape. Innovation ecosystems are rapidly developing, driven by significant R&D investments in fuel cell technology, hydrogen storage, and powertrain efficiency. Regulatory frameworks, though varying by region, are increasingly favoring zero-emission transportation solutions, influencing market entry and expansion strategies. Product substitutes, primarily battery-electric buses and advanced internal combustion engine buses, continue to pose a competitive challenge, but the superior range, faster refueling times, and reduced lifecycle emissions of hydrogen buses are driving their adoption in specific applications. End-user trends indicate a growing demand from public transportation authorities and fleet operators seeking sustainable and cost-effective mobility solutions. Merger and acquisition (M&A) activities are anticipated to increase as companies seek to strengthen their technological capabilities, expand their market reach, and achieve economies of scale. The estimated total M&A deal value in the historical period reached approximately $100 million, with projections suggesting a substantial increase in the forecast period as strategic partnerships and consolidations become more prevalent. Market share is currently fragmented, with leading manufacturers holding estimated market shares of 10% to 20% individually, reflecting the early stages of widespread commercialization.

Hydrogen Powered Commercial Bus Industry Trends & Insights

The Hydrogen Powered Commercial Bus industry is poised for significant expansion, driven by a confluence of accelerating market growth drivers. A primary catalyst is the global push towards decarbonization and stringent emission regulations, compelling governments and municipalities to invest in cleaner public transportation. Technological disruptions are at the forefront, with continuous advancements in fuel cell efficiency, hydrogen production methods (including green hydrogen), and onboard storage solutions enhancing the viability and performance of these vehicles. Consumer preferences are shifting towards sustainability and corporate social responsibility, creating a favorable environment for the adoption of hydrogen-powered buses by public and private entities. Competitive dynamics are intensifying as traditional automakers and new entrants vie for market dominance, fostering innovation and driving down costs. The market penetration of hydrogen buses, while currently nascent, is projected to grow exponentially, with an estimated Compound Annual Growth Rate (CAGR) of 25% during the forecast period (2025–2033). This growth trajectory is supported by substantial government incentives, public-private partnerships for infrastructure development (hydrogen refueling stations), and the increasing focus on Total Cost of Ownership (TCO), which is becoming more favorable for hydrogen buses as economies of scale are achieved and fuel cell technology matures. The demand for long-range, high-capacity transit solutions, particularly in urban and intercity routes, further bolsters the appeal of hydrogen buses over battery-electric alternatives in certain operational contexts. Investments in research and development are also crucial, focusing on improving the durability of fuel cell systems, optimizing the energy management of hydrogen powertrains, and developing robust hydrogen supply chains. The projected market size is expected to reach over $50 billion by 2033, underscoring the transformative potential of this sector.

Dominant Markets & Segments in Hydrogen Powered Commercial Bus

Asia Pacific, particularly China, currently stands as the dominant region in the Hydrogen Powered Commercial Bus market. This leadership is largely attributed to proactive government policies, substantial subsidies for new energy vehicles, and aggressive targets for hydrogen fuel cell deployment.

Leading Region: Asia Pacific (China)

- Economic Policies: Favorable industrial policies, tax incentives, and significant direct financial support for hydrogen infrastructure development and bus procurement have created an unparalleled growth environment.

- Infrastructure Development: Extensive investment in building hydrogen refueling stations and supporting the entire hydrogen value chain, from production to distribution.

- Government Mandates: Ambitious targets for the electrification of public transport fleets, with a strong emphasis on hydrogen fuel cell technology for commercial buses due to its suitability for longer routes and heavier loads.

Dominant Application Segment: For Sales

- This segment, representing direct purchases by transit authorities and private operators, drives the market. The large-scale procurement of hydrogen buses for public transportation networks in China and other pioneering regions significantly contributes to market value. The total market value for buses sold is projected to exceed $30 billion by 2033.

Dominant Type Segment: Large Vehicle

- Large vehicles, including city buses, intercity coaches, and specialized transit buses, represent the primary focus of the hydrogen powered commercial bus market. Their operational requirements, such as extended range and high passenger capacity, align perfectly with the advantages offered by hydrogen fuel cell technology. The market share for large vehicles is estimated to be over 80% of the total market revenue.

Emerging Application Segment: For Public Lease

- While currently smaller, the "For Public Lease" segment is gaining traction. This involves leasing arrangements for hydrogen buses, often facilitated by government initiatives or specialized leasing companies. This model reduces the upfront capital burden for transit agencies, thereby accelerating adoption.

Emerging Type Segment: Small and Medium Vehicle

- The development of smaller hydrogen-powered commercial vehicles, such as shuttle buses and specialized delivery vans, is an emerging trend. As the technology matures and costs decrease, these segments are expected to witness increased adoption, catering to niche applications and localized transit needs.

Hydrogen Powered Commercial Bus Product Innovations

Product innovations in the Hydrogen Powered Commercial Bus sector are primarily focused on enhancing efficiency, extending range, and reducing the overall cost of ownership. Manufacturers are actively developing advanced fuel cell stacks with higher power density and longer lifespans. Significant strides are being made in hydrogen storage technologies, including the development of lighter and more robust composite tanks capable of holding greater volumes of hydrogen at higher pressures. The integration of intelligent energy management systems that optimize the use of the fuel cell and battery hybrid powertrain is another key area of innovation, improving fuel economy and performance. These advancements not only improve the operational capabilities of hydrogen buses but also enhance their competitive advantage against other zero-emission technologies.

Report Segmentation & Scope

This report segments the Hydrogen Powered Commercial Bus market across key dimensions to provide a granular understanding of its dynamics.

Application: For Sales: This segment encompasses the direct sale of hydrogen-powered commercial buses to end-users, including public transit agencies, private fleet operators, and logistics companies. The market size for this segment is estimated to be over $40 billion by 2033, driven by large-scale fleet renewals and the transition to zero-emission transportation.

Application: For Public Lease: This segment focuses on leasing models where buses are made available for public use through rental or long-term leasing agreements. This approach is gaining traction to lower the initial financial barrier for adoption. Projections indicate a CAGR of 20% for this segment in the forecast period.

Type: Large Vehicle: This segment includes buses with a higher passenger capacity and longer range, such as city buses and intercity coaches. It represents the most significant segment by market value, estimated to reach over $35 billion by 2033, due to the operational advantages of hydrogen technology for these applications.

Type: Small and Medium Vehicle: This segment encompasses smaller hydrogen-powered buses and shuttles. While currently a smaller portion of the market, it is expected to grow as technology becomes more accessible and cost-effective for diverse transit needs, with an estimated market size of $5 billion by 2033.

Key Drivers of Hydrogen Powered Commercial Bus Growth

The growth of the Hydrogen Powered Commercial Bus sector is propelled by a multi-faceted set of drivers. Technologically, advancements in fuel cell durability and efficiency, coupled with improvements in hydrogen storage, are making these vehicles more practical and cost-effective. Economically, the decreasing cost of hydrogen production, particularly green hydrogen, and government incentives such as subsidies and tax credits are reducing the total cost of ownership. Regulatory tailwinds, including stringent emission standards and ambitious decarbonization targets set by governments worldwide, are compelling transit authorities to adopt zero-emission solutions. The increasing demand for sustainable urban mobility and the desire to reduce air pollution in cities are further fueling adoption.

Challenges in the Hydrogen Powered Commercial Bus Sector

Despite its promising outlook, the Hydrogen Powered Commercial Bus sector faces several significant challenges. The high upfront cost of hydrogen fuel cell buses remains a barrier, although this is gradually decreasing. The availability and widespread accessibility of hydrogen refueling infrastructure are critical limitations; developing a robust network requires substantial investment and coordinated efforts. The cost and efficiency of green hydrogen production are still areas of active development, impacting the overall sustainability and economic viability of the hydrogen ecosystem. Furthermore, the supply chain for fuel cell components and hydrogen storage tanks is still maturing, potentially leading to longer lead times and higher prices. Competitive pressures from rapidly advancing battery-electric vehicle technology also pose a challenge.

Leading Players in the Hydrogen Powered Commercial Bus Market

- Hyundai

- Geely

- Foton

- Nanjing Golden Dragon

- Yutong

- Feichi Bus

- Zhongtong Bus

- Hyzon Motors

- Xiamen Golden Dragon

- Yunnan Wulong

- Dongfeng Motor

- Renault Group

Key Developments in Hydrogen Powered Commercial Bus Sector

- 2023: Hyundai launches its next-generation XCIENT Fuel Cell truck, showcasing advancements in fuel cell technology relevant to commercial vehicles.

- 2023: Geely subsidiary, Farizon Auto, unveils its new range of hydrogen-powered commercial vehicles, including buses.

- 2023: Foton Motor announces significant investments in hydrogen fuel cell technology and plans for expanded hydrogen bus production.

- 2022: Yutong Bus pilots new hydrogen fuel cell bus models in multiple Chinese cities, demonstrating real-world performance.

- 2022: Hyzon Motors secures new orders for hydrogen fuel cell trucks and buses in North America and Europe.

- 2021: Nanjing Golden Dragon receives large orders for its hydrogen fuel cell city buses.

- 2021: Feichi Bus expands its hydrogen bus product line, targeting diverse public transportation needs.

- 2020: Zhongtong Bus introduces advanced hydrogen fuel cell bus designs with improved range and efficiency.

- 2019: Xiamen Golden Dragon showcases its latest hydrogen fuel cell bus prototypes at international exhibitions.

Strategic Hydrogen Powered Commercial Bus Market Outlook

The strategic outlook for the Hydrogen Powered Commercial Bus market is overwhelmingly positive, characterized by accelerating growth and significant expansion opportunities. The ongoing transition to cleaner energy sources in transportation, coupled with supportive government policies and continuous technological advancements, will act as powerful growth accelerators. The development of robust hydrogen refueling infrastructure and the increasing focus on green hydrogen production will further solidify the market's long-term viability. Companies that invest strategically in R&D, forge strong partnerships across the hydrogen value chain, and focus on cost optimization will be well-positioned to capture substantial market share. The expanding application in public transportation, logistics, and potentially new mobility services presents a vast landscape for innovation and market penetration, promising a sustained period of growth and transformation.

Hydrogen Powered Commercial Bus Segmentation

-

1. Application

- 1.1. For Sales

- 1.2. For Public Lease

-

2. Type

- 2.1. Large Vehicle

- 2.2. Small and Medium Vehicle

Hydrogen Powered Commercial Bus Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Hydrogen Powered Commercial Bus REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 41.2% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hydrogen Powered Commercial Bus Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. For Sales

- 5.1.2. For Public Lease

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Large Vehicle

- 5.2.2. Small and Medium Vehicle

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Hydrogen Powered Commercial Bus Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. For Sales

- 6.1.2. For Public Lease

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Large Vehicle

- 6.2.2. Small and Medium Vehicle

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Hydrogen Powered Commercial Bus Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. For Sales

- 7.1.2. For Public Lease

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Large Vehicle

- 7.2.2. Small and Medium Vehicle

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Hydrogen Powered Commercial Bus Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. For Sales

- 8.1.2. For Public Lease

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Large Vehicle

- 8.2.2. Small and Medium Vehicle

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Hydrogen Powered Commercial Bus Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. For Sales

- 9.1.2. For Public Lease

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Large Vehicle

- 9.2.2. Small and Medium Vehicle

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Hydrogen Powered Commercial Bus Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. For Sales

- 10.1.2. For Public Lease

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Large Vehicle

- 10.2.2. Small and Medium Vehicle

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Hyundai

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Geely

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Foton

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nanjing Golden Dragon

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Yutong

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Feichi Bus

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Zhongtong Bus

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hyzon Motors

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Xiamen Golden Dragon

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Yunnan Wulong

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Dongfeng Motor

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Renault Group

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Hyundai

List of Figures

- Figure 1: Global Hydrogen Powered Commercial Bus Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Hydrogen Powered Commercial Bus Revenue (million), by Application 2024 & 2032

- Figure 3: North America Hydrogen Powered Commercial Bus Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Hydrogen Powered Commercial Bus Revenue (million), by Type 2024 & 2032

- Figure 5: North America Hydrogen Powered Commercial Bus Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Hydrogen Powered Commercial Bus Revenue (million), by Country 2024 & 2032

- Figure 7: North America Hydrogen Powered Commercial Bus Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Hydrogen Powered Commercial Bus Revenue (million), by Application 2024 & 2032

- Figure 9: South America Hydrogen Powered Commercial Bus Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Hydrogen Powered Commercial Bus Revenue (million), by Type 2024 & 2032

- Figure 11: South America Hydrogen Powered Commercial Bus Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Hydrogen Powered Commercial Bus Revenue (million), by Country 2024 & 2032

- Figure 13: South America Hydrogen Powered Commercial Bus Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Hydrogen Powered Commercial Bus Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Hydrogen Powered Commercial Bus Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Hydrogen Powered Commercial Bus Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Hydrogen Powered Commercial Bus Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Hydrogen Powered Commercial Bus Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Hydrogen Powered Commercial Bus Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Hydrogen Powered Commercial Bus Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Hydrogen Powered Commercial Bus Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Hydrogen Powered Commercial Bus Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Hydrogen Powered Commercial Bus Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Hydrogen Powered Commercial Bus Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Hydrogen Powered Commercial Bus Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Hydrogen Powered Commercial Bus Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Hydrogen Powered Commercial Bus Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Hydrogen Powered Commercial Bus Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Hydrogen Powered Commercial Bus Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Hydrogen Powered Commercial Bus Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Hydrogen Powered Commercial Bus Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Hydrogen Powered Commercial Bus Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Hydrogen Powered Commercial Bus Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Hydrogen Powered Commercial Bus Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Hydrogen Powered Commercial Bus Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Hydrogen Powered Commercial Bus Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Hydrogen Powered Commercial Bus Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Hydrogen Powered Commercial Bus Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Hydrogen Powered Commercial Bus Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Hydrogen Powered Commercial Bus Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Hydrogen Powered Commercial Bus Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Hydrogen Powered Commercial Bus Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Hydrogen Powered Commercial Bus Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Hydrogen Powered Commercial Bus Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Hydrogen Powered Commercial Bus Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Hydrogen Powered Commercial Bus Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Hydrogen Powered Commercial Bus Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Hydrogen Powered Commercial Bus Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Hydrogen Powered Commercial Bus Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Hydrogen Powered Commercial Bus Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Hydrogen Powered Commercial Bus Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Hydrogen Powered Commercial Bus Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Hydrogen Powered Commercial Bus Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Hydrogen Powered Commercial Bus Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Hydrogen Powered Commercial Bus Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Hydrogen Powered Commercial Bus Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Hydrogen Powered Commercial Bus Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Hydrogen Powered Commercial Bus Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Hydrogen Powered Commercial Bus Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Hydrogen Powered Commercial Bus Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Hydrogen Powered Commercial Bus Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Hydrogen Powered Commercial Bus Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Hydrogen Powered Commercial Bus Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Hydrogen Powered Commercial Bus Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Hydrogen Powered Commercial Bus Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Hydrogen Powered Commercial Bus Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Hydrogen Powered Commercial Bus Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Hydrogen Powered Commercial Bus Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Hydrogen Powered Commercial Bus Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Hydrogen Powered Commercial Bus Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Hydrogen Powered Commercial Bus Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Hydrogen Powered Commercial Bus Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Hydrogen Powered Commercial Bus Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Hydrogen Powered Commercial Bus Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Hydrogen Powered Commercial Bus Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Hydrogen Powered Commercial Bus Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Hydrogen Powered Commercial Bus Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Hydrogen Powered Commercial Bus Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hydrogen Powered Commercial Bus?

The projected CAGR is approximately 41.2%.

2. Which companies are prominent players in the Hydrogen Powered Commercial Bus?

Key companies in the market include Hyundai, Geely, Foton, Nanjing Golden Dragon, Yutong, Feichi Bus, Zhongtong Bus, Hyzon Motors, Xiamen Golden Dragon, Yunnan Wulong, Dongfeng Motor, Renault Group.

3. What are the main segments of the Hydrogen Powered Commercial Bus?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 12050 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hydrogen Powered Commercial Bus," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hydrogen Powered Commercial Bus report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hydrogen Powered Commercial Bus?

To stay informed about further developments, trends, and reports in the Hydrogen Powered Commercial Bus, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence