Key Insights

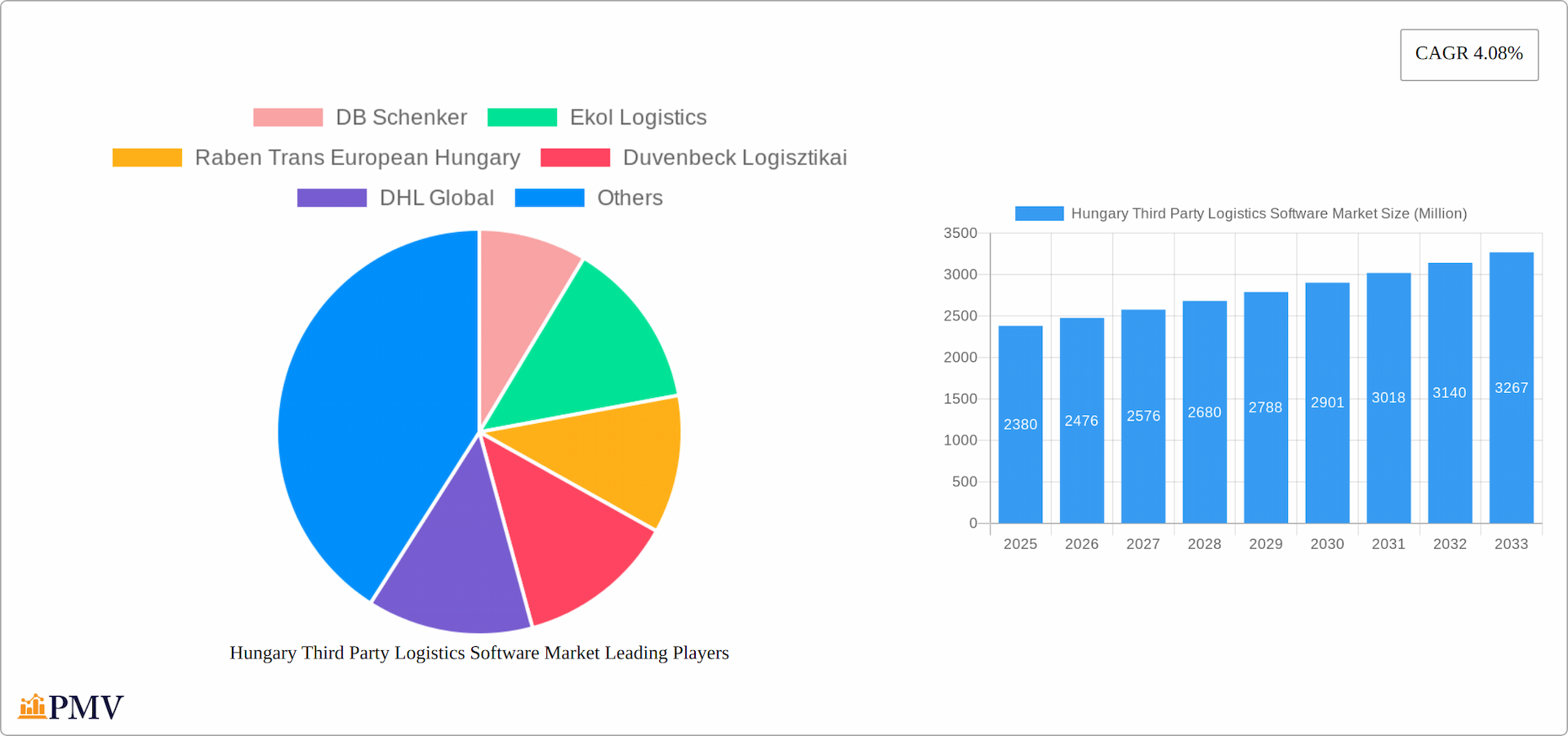

The Hungarian third-party logistics (3PL) software market, valued at €2.38 billion in 2025, is projected to experience robust growth, driven by the increasing adoption of advanced technologies and the rising demand for efficient supply chain management solutions within key sectors like automotive manufacturing, oil & gas, and e-commerce. A compound annual growth rate (CAGR) of 4.08% from 2025 to 2033 indicates a steadily expanding market. This growth is fueled by several factors: the increasing complexity of global supply chains requiring sophisticated software solutions for optimization, the surge in e-commerce necessitating efficient last-mile delivery management, and the growing focus on data-driven decision-making within logistics operations. Furthermore, the expanding manufacturing and distribution sectors in Hungary contribute significantly to the demand for 3PL software capable of handling inventory management, transportation planning, and warehouse automation. While some restraints may exist, such as initial investment costs for software implementation and potential integration challenges with existing systems, the overall market outlook remains positive, driven by the long-term benefits of enhanced efficiency and cost reduction offered by advanced 3PL software.

Hungary Third Party Logistics Software Market Market Size (In Billion)

The competitive landscape is characterized by a mix of international giants like DHL, UPS, and DB Schenker alongside established regional players such as Ekol Logistics and Raben Trans European Hungary. The market segmentation, encompassing services (domestic and international transportation management, value-added warehousing and distribution) and end-users (automotive, oil & gas, construction, distributive trade, and pharmaceuticals), reflects the diverse needs within the Hungarian logistics ecosystem. The ongoing digital transformation within the logistics industry further propels market growth, with companies increasingly adopting cloud-based solutions, artificial intelligence (AI), and machine learning (ML) for improved supply chain visibility and predictive analytics. This trend is likely to continue throughout the forecast period, shaping the future development of the Hungarian 3PL software market.

Hungary Third Party Logistics Software Market Company Market Share

Hungary Third Party Logistics Software Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Hungary Third Party Logistics (3PL) Software Market, offering invaluable insights for stakeholders across the supply chain ecosystem. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) and incorporates current market dynamics to project future growth and opportunities. The report segments the market by services (Domestic Transportation Management, International Transportation Management, Value-added Warehousing and Distribution) and end-users (Automobile & Manufacturing, Oil & Gas and Chemicals, Construction, Distributive Trade, Pharma & Healthcare). The market size is expected to reach xx Million by 2033.

Hungary Third Party Logistics Software Market Structure & Competitive Dynamics

The Hungarian 3PL software market exhibits a moderately concentrated structure, with several key players vying for market share. Major participants include DB Schenker, Ekol Logistics, Raben Trans European Hungary, Duvenbeck Logisztikai, DHL Global, Fiege, UPS Healthcare Hungary Zrt, Waberers International, Karzol - Trans, Liegl & Dachser, TNT Express Hungary Kft, DSV Hungaria, Hunland Trans, and Gartner Intertrans Hungaria. However, the market also accommodates numerous smaller, specialized providers. Market share data for 2024 indicates that DHL Global and DB Schenker hold the largest shares, estimated at xx% and xx%, respectively. The remaining market is fragmented among the other companies mentioned above.

Innovation in the Hungarian 3PL software landscape is driven by the increasing adoption of cloud-based solutions, AI-powered optimization tools, and the integration of IoT devices for real-time tracking and visibility. The regulatory framework, while generally supportive of technological advancement, requires adherence to data privacy regulations (GDPR) and cybersecurity standards. Product substitutes include in-house developed logistics management systems, although the scalability and cost-effectiveness of 3PL software often favor the latter. End-user trends show a growing preference for integrated, end-to-end solutions that streamline operations and improve supply chain visibility.

Mergers and acquisitions (M&A) activity in the global 3PL sector has been robust in recent years. While specific M&A deal values for the Hungarian market are unavailable (xx), the global trend suggests a similar pattern of consolidation in Hungary to increase market share and service offerings.

Hungary Third Party Logistics Software Market Industry Trends & Insights

The Hungarian 3PL software market is experiencing robust growth, driven primarily by the expanding e-commerce sector, the increasing need for efficient supply chain management, and the rising adoption of advanced technologies. The Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) is estimated at xx%, and is projected to remain significantly positive throughout the forecast period (2025-2033), reaching a projected xx% CAGR. Market penetration of 3PL software solutions within the various end-user segments remains relatively low but is expected to increase significantly in the coming years. This growth is fueled by several factors, including increased investments in digital transformation initiatives by Hungarian businesses, growing awareness of the benefits of 3PL software, and a supportive government environment encouraging digitalization. Technological disruptions, such as the rise of blockchain technology for enhanced supply chain transparency and security, are impacting market dynamics. Consumer preferences are shifting towards user-friendly, customizable, and scalable solutions that offer real-time visibility and advanced analytics capabilities. Competitive dynamics are characterized by intense competition amongst established players and the emergence of new, innovative solutions providers.

Dominant Markets & Segments in Hungary Third Party Logistics Software Market

While precise market share data by region is unavailable (xx) for this report, Budapest and other major urban centers are likely to represent the most significant portion of the Hungarian 3PL software market. Dominance in specific segments is also complex, without further specified data.

- By Services:

- Domestic Transportation Management: Growth is fueled by the increasing demand for efficient domestic delivery within Hungary, particularly from the e-commerce sector.

- International Transportation Management: Driven by Hungary's strategic location within the EU and its growing trade relationships with neighboring countries.

- Value-added Warehousing and Distribution: Boosted by the demand for specialized services such as order fulfillment, inventory management, and customized packaging.

- By End-User:

- Automobile & Manufacturing: A key driver due to the complex supply chains and the need for optimized logistics within this sector.

- Oil & Gas and Chemicals: Requires specialized software to manage hazardous materials and complex logistics.

- Construction: The growing construction sector benefits from efficient material management and delivery scheduling.

- Distributive Trade (Wholesale and Retail trade including e-commerce): A major growth driver, powered by the rapid expansion of online retail.

- Pharma & Healthcare: The strict regulations and the need for cold chain management in this sector create demand for specialized solutions.

Hungary Third Party Logistics Software Market Product Innovations

Recent product innovations in the Hungarian 3PL software market are focused on enhancing integration with existing enterprise resource planning (ERP) systems, improving real-time visibility through IoT integration, and incorporating advanced analytics capabilities for improved decision-making. Cloud-based solutions are becoming increasingly prevalent, offering greater scalability and flexibility. These innovations are improving efficiency, reducing costs, and enhancing overall supply chain visibility for end-users.

Report Segmentation & Scope

This report provides a comprehensive segmentation of the Hungarian Third-Party Logistics (3PL) software market, offering granular insights into its current state and future trajectory. The market is meticulously analyzed across key service offerings, including Domestic Transportation Management Systems (TMS), International TMS, and Value-added Warehousing and Distribution Management Systems (WMS). Furthermore, the report examines the market's performance across diverse end-user industries, such as Automotive & Manufacturing, Oil & Gas and Chemicals, Construction, Distributive Trade (Retail & Wholesale), and Pharma & Healthcare. Each segment is dissected individually, presenting a detailed overview of its market size, growth forecasts (supported by rigorous analysis of economic trends, technological advancements, and regulatory changes specific to each sector), and a competitive landscape assessment. The report also explores the interplay between these segments and how their growth trajectories influence the overall market dynamics.

Key Drivers of Hungary Third Party Logistics Software Market Growth

The robust expansion of the Hungarian 3PL software market is fueled by a confluence of factors. The burgeoning e-commerce sector, demanding efficient order fulfillment and delivery, is a primary driver. Simultaneously, the accelerating pace of digital transformation across various industries necessitates sophisticated supply chain management solutions. Proactive government initiatives promoting technological adoption and digitalization within the logistics sector are also instrumental in market growth. The increasing need for optimized supply chain management – driven by the desire for enhanced efficiency, cost reduction, and improved resilience – is another significant factor. Furthermore, continuous improvements in Hungary's logistics infrastructure, such as improved road networks and intermodal facilities, contribute to the market's positive growth trajectory.

Challenges in the Hungary Third Party Logistics Software Market Sector

Despite its significant growth potential, the Hungarian 3PL software market faces several challenges. The substantial initial investment required for implementing new software solutions can be a significant barrier to entry for smaller businesses. The need for skilled IT professionals to manage and maintain these complex systems creates a talent shortage. Data security and privacy concerns, particularly in light of increasing cyber threats, remain paramount. Ensuring seamless integration of new software with existing legacy systems within organizations also presents a technical hurdle. Furthermore, the competitive landscape is intensely dynamic, requiring ongoing innovation, adaptation, and strategic investments to maintain a competitive edge in this rapidly evolving market. These challenges highlight the need for strategic planning, technological expertise, and robust risk management strategies for businesses operating in this space.

Leading Players in the Hungary Third Party Logistics Software Market Market

- DB Schenker

- Ekol Logistics

- Raben Trans European Hungary

- Duvenbeck Logisztikai

- DHL Global (DHL Global)

- Fiege

- UPS Healthcare Hungary Zrt

- Waberers International

- Karzol - Trans

- Liegl & Dachser

- TNT Express Hungary Kft

- DSV Hungaria

- Hunland Trans

- Gartner Intertrans Hungaria

Key Developments in Hungary Third Party Logistics Software Market Sector

- October 2022: Red Arts Capital's acquisition of Flex Logistics highlights the ongoing consolidation within the global 3PL sector, suggesting a similar trend in Hungary, though data is not specifically available for the Hungarian market (xx). This consolidation may lead to increased market concentration and potentially higher prices for software services.

- August 2022: The acquisition of DKI Logistics A/S by Rhenus Warehousing Solutions demonstrates the expansion of international 3PL providers into new markets, which potentially increases competition and influences service offerings within Hungary.

Strategic Hungary Third Party Logistics Software Market Outlook

The future of the Hungarian 3PL software market appears bright, with significant potential for continued growth driven by ongoing digitalization, the expansion of e-commerce, and the increasing complexity of supply chains. Strategic opportunities exist for companies that can offer innovative, integrated, and user-friendly solutions catering to the specific needs of various end-user industries. Focusing on AI-powered optimization, blockchain technology integration, and advanced analytics will be crucial for success in this dynamic market.

Hungary Third Party Logistics Software Market Segmentation

-

1. Services

- 1.1. Domestic Transportation Management

- 1.2. International Transportation Management

- 1.3. Value-added Warehousing and Distribution

-

2. End-User

- 2.1. Automobile & Manufacturing

- 2.2. Oil & Gas and Chemicals

- 2.3. Construction

- 2.4. Distribu

- 2.5. Pharma & Healthcare

Hungary Third Party Logistics Software Market Segmentation By Geography

- 1. Hungary

Hungary Third Party Logistics Software Market Regional Market Share

Geographic Coverage of Hungary Third Party Logistics Software Market

Hungary Third Party Logistics Software Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.08% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing demand for Perishable Goods; Expanding E-commerce Market

- 3.3. Market Restrains

- 3.3.1. Infrastructure Limitations; Skilled Labor Shortage

- 3.4. Market Trends

- 3.4.1. Growth in the Demand for Warehousing Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Hungary Third Party Logistics Software Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Domestic Transportation Management

- 5.1.2. International Transportation Management

- 5.1.3. Value-added Warehousing and Distribution

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Automobile & Manufacturing

- 5.2.2. Oil & Gas and Chemicals

- 5.2.3. Construction

- 5.2.4. Distribu

- 5.2.5. Pharma & Healthcare

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Hungary

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ekol Logistics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Raben Trans European Hungary

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Duvenbeck Logisztikai

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DHL Global

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fiege

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 UPS Healthcare Hungary Zrt

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Waberers International

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Karzol - Trans**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Liegl & Dachser

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 TNT Express Hungary Kft

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 DSV Hungaria

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Hunland Trans

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Gartner Intertrans Hungaria

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Hungary Third Party Logistics Software Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Hungary Third Party Logistics Software Market Share (%) by Company 2025

List of Tables

- Table 1: Hungary Third Party Logistics Software Market Revenue Million Forecast, by Services 2020 & 2033

- Table 2: Hungary Third Party Logistics Software Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: Hungary Third Party Logistics Software Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Hungary Third Party Logistics Software Market Revenue Million Forecast, by Services 2020 & 2033

- Table 5: Hungary Third Party Logistics Software Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: Hungary Third Party Logistics Software Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hungary Third Party Logistics Software Market?

The projected CAGR is approximately 4.08%.

2. Which companies are prominent players in the Hungary Third Party Logistics Software Market?

Key companies in the market include DB Schenker, Ekol Logistics, Raben Trans European Hungary, Duvenbeck Logisztikai, DHL Global, Fiege, UPS Healthcare Hungary Zrt, Waberers International, Karzol - Trans**List Not Exhaustive, Liegl & Dachser, TNT Express Hungary Kft, DSV Hungaria, Hunland Trans, Gartner Intertrans Hungaria.

3. What are the main segments of the Hungary Third Party Logistics Software Market?

The market segments include Services, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.38 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing demand for Perishable Goods; Expanding E-commerce Market.

6. What are the notable trends driving market growth?

Growth in the Demand for Warehousing Sector.

7. Are there any restraints impacting market growth?

Infrastructure Limitations; Skilled Labor Shortage.

8. Can you provide examples of recent developments in the market?

October 2022: Red Arts Capital has announced that its portfolio company, Partners Warehouse, recently finished the add-on acquisition of Flex Logistics, a third-party logistics (3PL) company in Southern California, which holds nearly 900,000 square feet of warehousing space. This was done as part of Red Arts Capital's ongoing effort to acquire top supply chain and logistics companies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hungary Third Party Logistics Software Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hungary Third Party Logistics Software Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hungary Third Party Logistics Software Market?

To stay informed about further developments, trends, and reports in the Hungary Third Party Logistics Software Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence