Key Insights

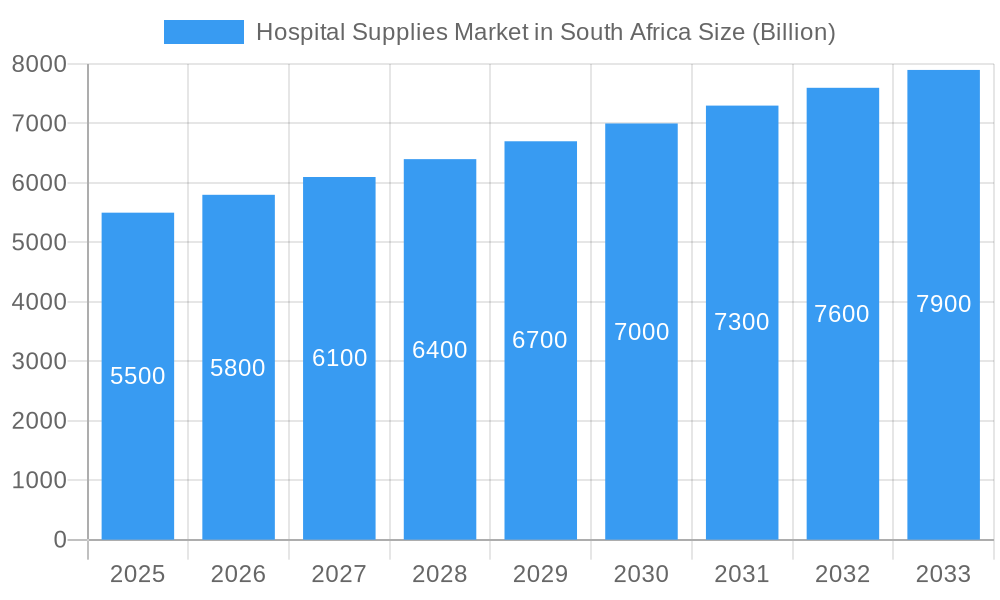

The South African hospital supplies market is anticipated for substantial growth, driven by rising healthcare expenditure and increasing chronic disease prevalence. With a current market size estimated at 0.96 billion, the sector is projected to expand at a Compound Annual Growth Rate (CAGR) of 6.76% during the forecast period of 2025-2033. This expansion is fueled by government initiatives enhancing healthcare infrastructure, the growing private healthcare sector, and the escalating demand for advanced medical devices and disposables. Key segments, including disposable supplies, patient examination devices, and syringes/needles, are expected to see significant demand, reflecting the continuous need for essential healthcare consumables and diagnostic tools. The integration of advanced patient care technologies further supports this market's upward trend.

Hospital Supplies Market in South Africa Market Size (In Million)

While the market exhibits a positive trajectory, it faces challenges such as price sensitivity in public healthcare facilities and logistical complexities in distribution. However, these are being addressed through strategic partnerships and a focus on cost-effective solutions. Emerging trends like telemedicine and remote patient monitoring are indirectly stimulating demand for specialized hospital supplies. Leading companies such as Becton Dickinson and Company, 3M Healthcare, and GE Healthcare are actively contributing to the market through product innovation and expanded distribution networks, catering to the evolving requirements of South African healthcare providers. Growing emphasis on hygiene and infection control is also ensuring sustained demand for sterilization and disinfectant equipment.

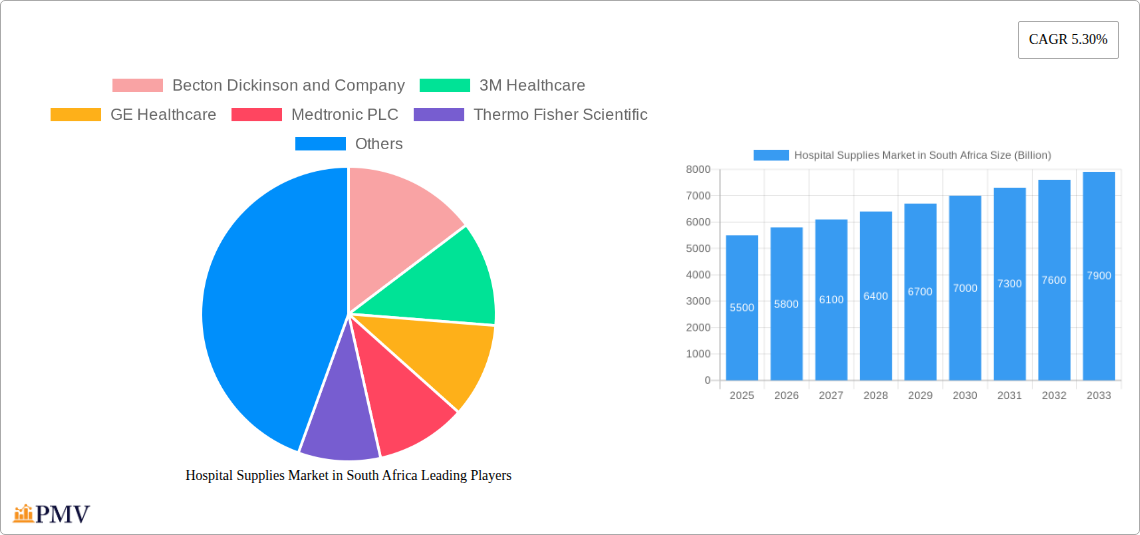

Hospital Supplies Market in South Africa Company Market Share

This comprehensive report offers an in-depth analysis of the South African Hospital Supplies Market. Covering the Base Year: 2025 and extending through the Forecast Period: 2025–2033, this study provides detailed insights into market size, segmentation, key trends, and competitive dynamics. It delivers actionable intelligence for stakeholders navigating the critical South African healthcare industry, offering essential understanding of market drivers, challenges, and future opportunities within the South African medical devices market and healthcare consumables market.

Hospital Supplies Market in South Africa Market Structure & Competitive Dynamics

The South African hospital supplies market exhibits a moderately concentrated structure, with key global players such as Becton Dickinson and Company, 3M Healthcare, GE Healthcare, Medtronic PLC, Thermo Fisher Scientific, Cardinal Health, Johnson & Johnson, and B Braun Melsungen AG holding significant market shares. Innovation ecosystems are driven by both multinational corporations investing in research and development and emerging local manufacturers focusing on cost-effective solutions. The regulatory framework, primarily governed by the South African Health Products Regulatory Authority (SAHPRA), influences product approvals and market access. Product substitutes exist across various segments, particularly in disposable supplies and basic examination devices, necessitating continuous product differentiation and quality assurance. End-user trends are shifting towards demand for advanced diagnostic equipment, minimally invasive surgical tools, and smart medical devices, driven by an increasing burden of chronic diseases and a growing emphasis on preventative care. Mergers and acquisitions (M&A) activities, while not as frequent as in more mature markets, play a role in consolidating market positions and expanding product portfolios. M&A deal values are estimated to be in the hundreds of millions of US dollars.

Hospital Supplies Market in South Africa Industry Trends & Insights

The South African hospital supplies market is experiencing robust growth, propelled by a confluence of factors that are reshaping healthcare delivery across the nation. The market's compound annual growth rate (CAGR) is projected to be approximately 8.5% during the forecast period, indicating a strong upward trajectory. This expansion is primarily fueled by increasing government investment in public healthcare infrastructure, coupled with a rising private healthcare sector catering to a growing middle class. The escalating prevalence of non-communicable diseases (NCDs) such as diabetes, cardiovascular diseases, and cancer necessitates a greater demand for advanced medical equipment, diagnostic tools, and specialized consumables. Furthermore, South Africa's commitment to universal healthcare coverage under its National Health Insurance (NHI) scheme is expected to further stimulate the demand for a wide array of hospital supplies, particularly in underserved rural areas.

Technological disruptions are playing a pivotal role in market evolution. The adoption of telemedicine, artificial intelligence (AI) in diagnostics, and the increasing use of robotic surgery are driving demand for sophisticated and connected medical devices. Companies are investing in digital health solutions and smart devices that offer enhanced patient monitoring, remote diagnostics, and improved operational efficiency for healthcare facilities. Consumer preferences are also evolving, with patients and healthcare providers alike seeking products that offer improved patient outcomes, greater comfort, and reduced invasiveness. This includes a preference for single-use, sterile supplies that minimize infection risks, and advanced surgical instruments that enable quicker recovery times.

The competitive dynamics within the market are characterized by a blend of established global players and a growing number of local distributors and manufacturers. Global companies bring advanced technology and extensive product portfolios, while local players often excel in understanding the specific needs and cost sensitivities of the South African market. Strategic partnerships and collaborations are becoming increasingly common, as seen with the NPH Group and BHA partnership for COVID-19 testing and future health screenings, demonstrating a trend towards pooled resources to address public health challenges. Market penetration for advanced medical technologies is steadily increasing, albeit with regional disparities. The ongoing development of healthcare infrastructure, including the construction of new hospitals and the upgrading of existing facilities, further underpins the sustained growth of the hospital supplies market.

Dominant Markets & Segments in Hospital Supplies Market in South Africa

The Disposable Hospital Supplies segment is currently the dominant force within the Hospital Supplies Market in South Africa, driven by an unwavering demand for sterile, single-use products that are critical for infection control and patient safety. This segment encompasses a broad range of essential items, from gloves, masks, and gowns to sterile drapes and surgical consumables. The increasing focus on hygiene protocols in healthcare settings, coupled with the persistent threat of hospital-acquired infections, makes disposable supplies a non-negotiable requirement for all medical facilities. The sheer volume of consumption for these items, coupled with their relatively frequent replacement cycles, solidifies their leading position.

- Key Drivers for Disposable Hospital Supplies Dominance:

- Infection Control Mandates: Strict adherence to hygiene standards and infection prevention protocols in hospitals and clinics.

- Cost-Effectiveness (for certain items): While advanced disposables can be costly, basic items like gloves and syringes offer a predictable expenditure for high-volume use.

- Patient Safety: Minimizing the risk of cross-contamination and ensuring sterile procedures.

- Convenience and Efficiency: Eliminating the need for sterilization processes for many common medical tools.

Following closely is the Syringes and Needles segment, another high-volume category crucial for drug administration, vaccinations, and blood sampling. The ongoing vaccination campaigns, including routine immunizations and potential future public health initiatives, contribute significantly to the sustained demand for syringes and needles.

The Patient Examination Devices segment is also a substantial contributor, encompassing stethoscopes, blood pressure monitors, thermometers, and diagnostic kits. The growing emphasis on early disease detection and regular health check-ups fuels the consistent demand for these fundamental diagnostic tools across primary care clinics, hospitals, and specialist practices.

Detailed Dominance Analysis: The dominance of Disposable Hospital Supplies is underpinned by the sheer volume and frequency of their use. The ongoing efforts to combat infectious diseases, coupled with the expansion of healthcare services to remote areas, necessitate a continuous supply of these essential items. Economic policies that support healthcare accessibility, such as initiatives aimed at increasing the number of public health facilities, directly translate into increased demand for disposables. The infrastructure development in the healthcare sector, including the establishment of new clinics and the expansion of existing hospital wings, further amplifies the need for these consumables.

The Syringes and Needles segment's strength lies in its critical role in routine medical procedures and public health programs. The government's commitment to disease prevention and control, particularly through widespread vaccination drives, ensures a perpetual demand for these products. Market penetration is high due to their basic necessity across all levels of healthcare.

The Patient Examination Devices segment benefits from the increasing awareness of preventative healthcare. As more individuals seek regular health screenings, the demand for accessible and reliable examination tools grows. This segment is also influenced by technological advancements, with a shift towards digital and connected devices offering enhanced accuracy and data logging capabilities.

Hospital Supplies Market in South Africa Product Innovations

Product innovation in the South African hospital supplies market is increasingly focused on enhancing patient outcomes, improving procedural efficiency, and reducing healthcare costs. Companies are developing advanced wound care products, smart infusion pumps with integrated safety features, and minimally invasive surgical instruments that reduce patient trauma and recovery time. The integration of digital technologies, such as IoT-enabled devices for remote patient monitoring and AI-powered diagnostic tools, is a significant trend, enabling proactive healthcare management. For instance, Hisense's delivery of the Ultrasound HD60 highlights the trend towards advanced, high-resolution diagnostic imaging solutions. These innovations aim to provide greater precision, reduce the risk of human error, and offer more personalized patient care, thus gaining a competitive advantage.

Report Segmentation & Scope

This report meticulously segments the Hospital Supplies Market in South Africa into key categories to provide a granular view of market dynamics. The primary segmentation includes Patient Examination Devices, essential for routine diagnostics; Operating Room Equipment, crucial for surgical procedures; Mobility Aids and Transportation Equipment, supporting patient care and movement; Sterilization and Disinfectant Equipment, vital for infection control; Disposable Hospital Supplies, a high-volume category of single-use items; Syringes and Needles, indispensable for drug administration and sampling; and Other Types, encompassing a diverse range of medical supplies. Each segment's growth projections and market sizes are analyzed, considering their unique drivers and competitive landscapes. For instance, the Disposable Hospital Supplies segment is projected for significant sustained growth due to its fundamental role in daily healthcare operations.

Key Drivers of Hospital Supplies Market in South Africa Growth

The South African hospital supplies market is propelled by several key drivers. The increasing prevalence of chronic diseases like diabetes and cardiovascular conditions necessitates a higher demand for diagnostic equipment, monitoring devices, and specialized consumables. Government initiatives aimed at expanding healthcare access, such as the National Health Insurance (NHI) scheme, are a significant catalyst, driving investment in public healthcare infrastructure and a broader procurement of medical supplies. Technological advancements, including the adoption of telemedicine and AI-driven diagnostics, are creating opportunities for sophisticated medical devices. Furthermore, a growing private healthcare sector, catering to a rising middle class, fuels demand for advanced and high-quality hospital supplies.

Challenges in the Hospital Supplies Market in South Africa Sector

Despite the growth prospects, the Hospital Supplies Market in South Africa faces several challenges. Regulatory hurdles, including lengthy product approval processes by SAHPRA, can delay market entry for new products and technologies. Supply chain disruptions, exacerbated by logistical complexities and import dependencies for certain specialized products, can lead to stockouts and price volatility. Intense price competition, particularly from imported generic products, puts pressure on profit margins for local manufacturers. Furthermore, the uneven distribution of healthcare infrastructure and resources across the country, with a concentration in urban areas, limits market penetration in rural regions, impacting accessibility and consistent demand.

Leading Players in the Hospital Supplies Market in South Africa Market

- Becton Dickinson and Company

- 3M Healthcare

- GE Healthcare

- Medtronic PLC

- Thermo Fisher Scientific

- Cardinal Health

- Johnson & Johnson

- B Braun Melsungen AG

Key Developments in Hospital Supplies Market in South Africa Sector

- August 2022: Hisense, a manufacturer and provider of high-performance electronics and medical devices, delivered a cutting-edge, high-resolution, ultrasound machine, the Hisense Ultrasound HD60, to the Peninsula Maternity Trust for Mowbray Maternity Hospital, South Africa. This gesture denotes the collaboration and contribution to the Mowbray Maternity Hospital and The Western Cape Department of Health.

- January 2022: United Kingdom-based NPH Group signed a partnership with the healthcare equipment supplier, BHA to support the rollout of COVID-19 testing in South Africa. The partnerships are also paving the way for further collaboration with a future focus on health screening for HIV, TB, malaria, yellow fever, and other conditions.

Strategic Hospital Supplies Market in South Africa Market Outlook

The strategic outlook for the Hospital Supplies Market in South Africa is characterized by continued expansion driven by increasing healthcare expenditure, demographic shifts, and technological integration. Opportunities lie in catering to the growing demand for chronic disease management solutions, investing in localized manufacturing to mitigate supply chain risks, and leveraging digital health technologies to enhance service delivery. Strategic partnerships between local and international players can foster innovation and knowledge transfer, while a focus on catering to the needs of public healthcare facilities will be crucial for broad market penetration. The anticipated implementation of NHI is expected to be a significant growth accelerator, creating substantial demand across all segments of the hospital supplies market.

Hospital Supplies Market in South Africa Segmentation

-

1. Type

- 1.1. Patient Examination Devices

- 1.2. Operating Room Equipment

- 1.3. Mobility Aids and Transportation Equipment

- 1.4. Sterilization and Disinfectant Equipment

- 1.5. Disposable Hospital Supplies

- 1.6. Syringes and Needles

- 1.7. Other Types

Hospital Supplies Market in South Africa Segmentation By Geography

-

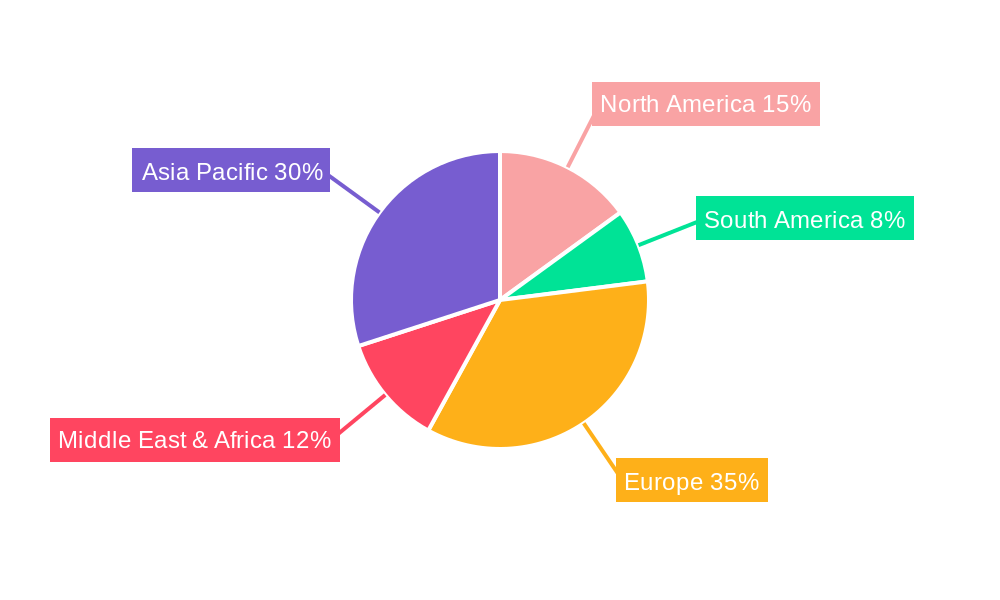

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Hospital Supplies Market in South Africa Regional Market Share

Geographic Coverage of Hospital Supplies Market in South Africa

Hospital Supplies Market in South Africa REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.76% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 South Africa has a well-developed private healthcare system

- 3.2.2 which serves a significant portion of the population

- 3.2.3 particularly those with health insurance. Private hospitals are equipped with advanced medical technologies

- 3.2.4 driving demand for high-quality hospital supplies.

- 3.3. Market Restrains

- 3.3.1 The disparity in the quality of healthcare between the public and private sectors remains a significant challenge. While private hospitals are well-funded and equipped with modern medical devices

- 3.3.2 public hospitals often face shortages of supplies

- 3.3.3 outdated equipment

- 3.3.4 and limited access to advanced technologies.

- 3.4. Market Trends

- 3.4.1 The adoption of home healthcare and telemedicine solutions is increasing

- 3.4.2 driven by the need for more accessible and convenient healthcare services. This shift is influencing the demand for home-use medical supplies

- 3.4.3 such as monitoring devices

- 3.4.4 wound care products

- 3.4.5 and portable diagnostic tools.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hospital Supplies Market in South Africa Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Patient Examination Devices

- 5.1.2. Operating Room Equipment

- 5.1.3. Mobility Aids and Transportation Equipment

- 5.1.4. Sterilization and Disinfectant Equipment

- 5.1.5. Disposable Hospital Supplies

- 5.1.6. Syringes and Needles

- 5.1.7. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Hospital Supplies Market in South Africa Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Patient Examination Devices

- 6.1.2. Operating Room Equipment

- 6.1.3. Mobility Aids and Transportation Equipment

- 6.1.4. Sterilization and Disinfectant Equipment

- 6.1.5. Disposable Hospital Supplies

- 6.1.6. Syringes and Needles

- 6.1.7. Other Types

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Hospital Supplies Market in South Africa Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Patient Examination Devices

- 7.1.2. Operating Room Equipment

- 7.1.3. Mobility Aids and Transportation Equipment

- 7.1.4. Sterilization and Disinfectant Equipment

- 7.1.5. Disposable Hospital Supplies

- 7.1.6. Syringes and Needles

- 7.1.7. Other Types

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Hospital Supplies Market in South Africa Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Patient Examination Devices

- 8.1.2. Operating Room Equipment

- 8.1.3. Mobility Aids and Transportation Equipment

- 8.1.4. Sterilization and Disinfectant Equipment

- 8.1.5. Disposable Hospital Supplies

- 8.1.6. Syringes and Needles

- 8.1.7. Other Types

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Hospital Supplies Market in South Africa Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Patient Examination Devices

- 9.1.2. Operating Room Equipment

- 9.1.3. Mobility Aids and Transportation Equipment

- 9.1.4. Sterilization and Disinfectant Equipment

- 9.1.5. Disposable Hospital Supplies

- 9.1.6. Syringes and Needles

- 9.1.7. Other Types

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Hospital Supplies Market in South Africa Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Patient Examination Devices

- 10.1.2. Operating Room Equipment

- 10.1.3. Mobility Aids and Transportation Equipment

- 10.1.4. Sterilization and Disinfectant Equipment

- 10.1.5. Disposable Hospital Supplies

- 10.1.6. Syringes and Needles

- 10.1.7. Other Types

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Becton Dickinson and Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 3M Healthcare

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 GE Healthcare

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Medtronic PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Thermo Fisher Scientific

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cardinal Health

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Johnson & Johnson

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 B Braun Melsungen AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Global Hospital Supplies Market in South Africa Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Hospital Supplies Market in South Africa Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Hospital Supplies Market in South Africa Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Hospital Supplies Market in South Africa Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Hospital Supplies Market in South Africa Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Hospital Supplies Market in South Africa Revenue (billion), by Type 2025 & 2033

- Figure 7: South America Hospital Supplies Market in South Africa Revenue Share (%), by Type 2025 & 2033

- Figure 8: South America Hospital Supplies Market in South Africa Revenue (billion), by Country 2025 & 2033

- Figure 9: South America Hospital Supplies Market in South Africa Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Hospital Supplies Market in South Africa Revenue (billion), by Type 2025 & 2033

- Figure 11: Europe Hospital Supplies Market in South Africa Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Hospital Supplies Market in South Africa Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Hospital Supplies Market in South Africa Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Hospital Supplies Market in South Africa Revenue (billion), by Type 2025 & 2033

- Figure 15: Middle East & Africa Hospital Supplies Market in South Africa Revenue Share (%), by Type 2025 & 2033

- Figure 16: Middle East & Africa Hospital Supplies Market in South Africa Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East & Africa Hospital Supplies Market in South Africa Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Hospital Supplies Market in South Africa Revenue (billion), by Type 2025 & 2033

- Figure 19: Asia Pacific Hospital Supplies Market in South Africa Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Hospital Supplies Market in South Africa Revenue (billion), by Country 2025 & 2033

- Figure 21: Asia Pacific Hospital Supplies Market in South Africa Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hospital Supplies Market in South Africa Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Hospital Supplies Market in South Africa Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Hospital Supplies Market in South Africa Revenue billion Forecast, by Type 2020 & 2033

- Table 4: Global Hospital Supplies Market in South Africa Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Hospital Supplies Market in South Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Hospital Supplies Market in South Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico Hospital Supplies Market in South Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global Hospital Supplies Market in South Africa Revenue billion Forecast, by Type 2020 & 2033

- Table 9: Global Hospital Supplies Market in South Africa Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Brazil Hospital Supplies Market in South Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Argentina Hospital Supplies Market in South Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Hospital Supplies Market in South Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global Hospital Supplies Market in South Africa Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Hospital Supplies Market in South Africa Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Hospital Supplies Market in South Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Hospital Supplies Market in South Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Hospital Supplies Market in South Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Hospital Supplies Market in South Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain Hospital Supplies Market in South Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Russia Hospital Supplies Market in South Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Benelux Hospital Supplies Market in South Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Nordics Hospital Supplies Market in South Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Hospital Supplies Market in South Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Hospital Supplies Market in South Africa Revenue billion Forecast, by Type 2020 & 2033

- Table 25: Global Hospital Supplies Market in South Africa Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Turkey Hospital Supplies Market in South Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Israel Hospital Supplies Market in South Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: GCC Hospital Supplies Market in South Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: North Africa Hospital Supplies Market in South Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Africa Hospital Supplies Market in South Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Hospital Supplies Market in South Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Hospital Supplies Market in South Africa Revenue billion Forecast, by Type 2020 & 2033

- Table 33: Global Hospital Supplies Market in South Africa Revenue billion Forecast, by Country 2020 & 2033

- Table 34: China Hospital Supplies Market in South Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: India Hospital Supplies Market in South Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Japan Hospital Supplies Market in South Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Korea Hospital Supplies Market in South Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Hospital Supplies Market in South Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Oceania Hospital Supplies Market in South Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Hospital Supplies Market in South Africa Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hospital Supplies Market in South Africa?

The projected CAGR is approximately 6.76%.

2. Which companies are prominent players in the Hospital Supplies Market in South Africa?

Key companies in the market include Becton Dickinson and Company, 3M Healthcare, GE Healthcare, Medtronic PLC, Thermo Fisher Scientific, Cardinal Health, Johnson & Johnson, B Braun Melsungen AG.

3. What are the main segments of the Hospital Supplies Market in South Africa?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.96 billion as of 2022.

5. What are some drivers contributing to market growth?

South Africa has a well-developed private healthcare system. which serves a significant portion of the population. particularly those with health insurance. Private hospitals are equipped with advanced medical technologies. driving demand for high-quality hospital supplies..

6. What are the notable trends driving market growth?

The adoption of home healthcare and telemedicine solutions is increasing. driven by the need for more accessible and convenient healthcare services. This shift is influencing the demand for home-use medical supplies. such as monitoring devices. wound care products. and portable diagnostic tools..

7. Are there any restraints impacting market growth?

The disparity in the quality of healthcare between the public and private sectors remains a significant challenge. While private hospitals are well-funded and equipped with modern medical devices. public hospitals often face shortages of supplies. outdated equipment. and limited access to advanced technologies..

8. Can you provide examples of recent developments in the market?

August 2022: Hisense, a manufacturer, and provider of high-performance electronics and medical devices, delivered a cutting-edge, high-resolution, ultrasound machine, the Hisense Ultrasound HD60, to the Peninsula Maternity Trust for Mowbray Maternity Hospital, South Africa. This gesture denotes the collaboration and contribution to the Mowbray Maternity Hospital and The Western Cape Department of Health.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hospital Supplies Market in South Africa," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hospital Supplies Market in South Africa report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hospital Supplies Market in South Africa?

To stay informed about further developments, trends, and reports in the Hospital Supplies Market in South Africa, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence