Key Insights

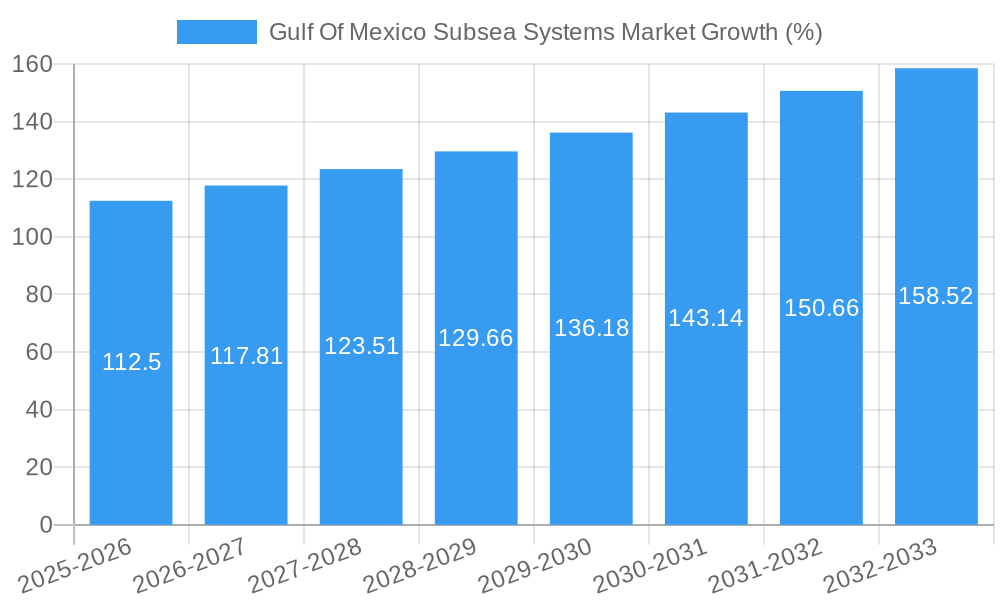

The Gulf of Mexico subsea systems market is experiencing robust growth, driven by increasing offshore oil and gas exploration and production activities. The market, valued at approximately $X million in 2025 (estimated based on the provided CAGR and market size), is projected to maintain a compound annual growth rate (CAGR) exceeding 4.50% from 2025 to 2033. This growth is fueled by several key factors. Firstly, the continued demand for energy resources, particularly in the face of global energy transitions, necessitates increased investment in offshore oil and gas extraction. Secondly, technological advancements in subsea systems, such as improved subsea processing systems and the development of more efficient SURF (Subsea Umbical Riser and Flowlines) technologies, are enhancing operational efficiency and reducing costs. Finally, government initiatives promoting offshore energy exploration and production within the Gulf of Mexico further bolster market expansion.

However, the market's growth trajectory is not without challenges. Restrictive regulatory environments surrounding offshore operations and environmental concerns regarding potential spills are significant restraints. Fluctuations in oil and gas prices pose another risk factor, impacting investment decisions and influencing overall market dynamics. Segmentation within the market reveals that Subsea Producing Systems currently hold the larger share, although Subsea Processing Systems are witnessing significant growth due to advancements allowing for increased processing capacity closer to the wellhead, reducing transportation costs and risks. Major players, including Dril-Quip, Oceaneering, Baker Hughes, Schlumberger, and others, are actively competing to capitalize on these market opportunities, fueling innovation and technological advancements. The market's concentration among several large multinational companies reflects the capital-intensive nature of subsea systems development and deployment.

Gulf of Mexico Subsea Systems Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Gulf of Mexico subsea systems market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033, this report meticulously examines market trends, competitive dynamics, and future growth potential. The total market value in 2025 is estimated at xx Million, with a projected CAGR of xx% during the forecast period.

Gulf Of Mexico Subsea Systems Market Market Structure & Competitive Dynamics

The Gulf of Mexico subsea systems market exhibits a moderately concentrated structure, dominated by several multinational corporations. Key players like Dril-Quip Inc, Oceaneering International Inc, Baker Hughes Co, Schlumberger Ltd, Akastor ASA, Halliburton Co, Subsea 7 SA, National-Oilwell Varco Inc, and TechnipFMC PLC compete fiercely, leveraging their technological expertise and extensive project experience. Market share dynamics are influenced by factors such as technological innovation, capacity utilization, and contract wins. The market witnesses frequent mergers and acquisitions (M&A) activity, with deal values fluctuating based on the strategic fit and market conditions. Recent M&A activities have mainly focused on consolidating expertise in subsea construction and engineering, driving integration and efficiencies. Regulatory frameworks, particularly those governing offshore operations and environmental protection, significantly influence market operations. The substitution effect from emerging technologies, such as advanced robotics and automation, is becoming increasingly noticeable but isn't significantly disrupting the market as yet. End-user trends, driven primarily by energy demand and exploration activities, influence market expansion and the adoption of advanced subsea technologies. The ongoing transition to sustainable energy sources could present both challenges and opportunities for the market in the long term.

- Market Concentration: Moderately concentrated, with a few dominant players controlling a significant portion of the market.

- Innovation Ecosystems: Strong focus on R&D, with companies investing heavily in advanced subsea technologies.

- Regulatory Frameworks: Strict regulations governing offshore operations and environmental protection.

- Product Substitutes: Limited significant substitution at present, but emerging technologies pose a longer-term threat.

- End-User Trends: Demand for energy and offshore exploration drives market growth.

- M&A Activity: Frequent M&A activity, with deal values ranging from xx Million to xx Million in recent years.

Gulf Of Mexico Subsea Systems Market Industry Trends & Insights

The Gulf of Mexico subsea systems market is experiencing significant growth driven by several factors. The increasing demand for oil and gas, coupled with exploration activities in deeper waters, necessitates advanced subsea technologies. Technological advancements such as improved subsea processing systems, enhanced automation, and better materials are driving the efficiency and capacity of these systems. Rising capital expenditure by oil and gas companies and government support for offshore energy exploration are also key market drivers. However, the market is also impacted by fluctuating oil and gas prices, stringent environmental regulations, and technological disruptions that affect competitiveness. The growing adoption of digitalization in the energy sector is influencing operational efficiency and cost reduction. Consumer preferences are shifting towards sustainable and efficient energy solutions, influencing technological choices within the subsea systems market. Competition is intensifying, with existing players and new entrants vying for market share through strategic partnerships, innovations, and cost optimization. The market is expected to continue its growth trajectory, driven by exploration in deepwater areas and the ongoing development of advanced technologies.

Dominant Markets & Segments in Gulf Of Mexico Subsea Systems Market

The Gulf of Mexico remains the dominant market for subsea systems due to significant offshore oil and gas reserves and continued investment in deepwater exploration and production.

Component Segment Dominance:

- Subsea Umbilical Riser and Flowlines (SURF): This segment holds the largest market share due to the extensive network of pipelines and umbilicals required for offshore operations. Key drivers include increasing offshore exploration and production activities.

- Trees: High demand for advanced subsea tree technologies that enable efficient well control and production.

- Wellhead: Significant market share due to the critical role of wellheads in securing and managing subsea wells.

- Manifolds: Growing demand, driven by the need for efficient subsea well interconnection and production management.

- Other Components: This category comprises various other subsea equipment, whose market share varies depending on technological adoption and project requirements.

Type Segment Dominance:

- Subsea Producing Systems: This segment constitutes the majority of the market due to the continuous demand for extraction and production from existing and newly developed offshore fields.

- Subsea Processing Systems: This segment shows moderate growth, driven by the need for efficient processing of oil and gas resources at the seabed before transportation.

Key Drivers (Across Segments):

- Favorable Government Policies: Supporting offshore energy exploration and development.

- Robust Infrastructure: Enabling the efficient installation and operation of subsea systems.

- Technological Advancements: Enhancing efficiency, safety, and environmental performance.

Gulf Of Mexico Subsea Systems Market Product Innovations

Recent product innovations focus on enhancing efficiency, safety, and environmental sustainability. This includes the development of advanced materials for increased durability and corrosion resistance, improved subsea processing technologies for enhanced recovery rates, and integrated automation systems for streamlined operations. These innovations are improving market fit by addressing the needs of deepwater operations and ensuring compliance with strict environmental regulations. The integration of digital technologies and remote monitoring capabilities is also enhancing the operational efficiency and cost-effectiveness of subsea systems.

Report Segmentation & Scope

This report segments the Gulf of Mexico subsea systems market based on component (Subsea Umbilical Riser and Flowlines (SURF), Trees, Wellhead, Manifolds, Other Components) and type (Subsea Producing Systems, Subsea Processing Systems). Each segment is analyzed based on market size, growth projections, and competitive dynamics, offering a comprehensive understanding of the market's structure and potential. The report provides detailed insights into the market's historical performance (2019-2024), current status (2025), and future outlook (2025-2033).

Key Drivers of Gulf Of Mexico Subsea Systems Market Growth

The Gulf of Mexico subsea systems market's growth is fueled by increased demand for offshore oil and gas, investments in deepwater exploration, and technological advancements enabling efficient and safe subsea operations. Government incentives, stringent safety regulations, and rising capital expenditure by major energy players further contribute to market expansion. Specific examples include the increasing adoption of automated subsea systems and the development of advanced materials resistant to harsh deep-sea environments.

Challenges in the Gulf Of Mexico Subsea Systems Market Sector

The market faces challenges including volatile oil and gas prices, stringent environmental regulations leading to increased costs, supply chain disruptions affecting the timely delivery of components, and intense competition among established players. These factors, along with geopolitical uncertainties, can significantly impact project timelines and profitability. For example, a delay in the supply of a critical component can delay a major project by xx months, costing xx Million in potential revenue.

Leading Players in the Gulf Of Mexico Subsea Systems Market Market

- Dril-Quip Inc

- Oceaneering International Inc

- Baker Hughes Co

- Schlumberger Ltd

- Akastor ASA

- Halliburton Co

- Subsea 7 SA

- National-Oilwell Varco Inc

- TechnipFMC PLC

Key Developments in Gulf Of Mexico Subsea Systems Market Sector

- July 2022: Subsea Integration Alliance partners OneSubsea and Subsea 7 secured an EPCI contract with Kosmos Energy for an integrated subsea boosting system in the Odd Job field. This highlights the growing trend towards integrated solutions and large-scale project awards.

- January 2022: Subsea 7 SA won a contract for subsea system installation at Beacon Offshore Energy LLC's Shenandoah facility, demonstrating continued investment in deepwater projects.

Strategic Gulf Of Mexico Subsea Systems Market Market Outlook

The Gulf of Mexico subsea systems market presents significant growth opportunities, particularly in deepwater exploration and the adoption of advanced technologies. Strategic partnerships, technological innovation, and a focus on cost optimization will be crucial for success. The market is expected to witness a continued expansion driven by rising energy demands and investment in new offshore projects. The ongoing focus on sustainability and environmental regulations will further shape technological advancements and market opportunities in the coming years.

Gulf Of Mexico Subsea Systems Market Segmentation

-

1. Type

- 1.1. Subsea Producing Systems

- 1.2. Subsea Processing Systems

-

2. Component

- 2.1. Subsea Umbical Riser and Flowlines (SURF)

- 2.2. Trees

- 2.3. Wellhead

- 2.4. Manifolds

- 2.5. Other Components

-

3. Geography

- 3.1. GOM Federal Offshore or the United States PART

- 3.2. Mexico PART

- 3.3. Cuba PART

Gulf Of Mexico Subsea Systems Market Segmentation By Geography

- 1. GOM Federal Offshore or the United States PART

- 2. Mexico PART

- 3. Cuba PART

Gulf Of Mexico Subsea Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increase in Adoption of Renewable Energy Sources

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Investment Cost and Limited Natural Resources

- 3.4. Market Trends

- 3.4.1. Subsea Production Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Gulf Of Mexico Subsea Systems Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Subsea Producing Systems

- 5.1.2. Subsea Processing Systems

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Subsea Umbical Riser and Flowlines (SURF)

- 5.2.2. Trees

- 5.2.3. Wellhead

- 5.2.4. Manifolds

- 5.2.5. Other Components

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. GOM Federal Offshore or the United States PART

- 5.3.2. Mexico PART

- 5.3.3. Cuba PART

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. GOM Federal Offshore or the United States PART

- 5.4.2. Mexico PART

- 5.4.3. Cuba PART

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. GOM Federal Offshore or the United States PART Gulf Of Mexico Subsea Systems Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Subsea Producing Systems

- 6.1.2. Subsea Processing Systems

- 6.2. Market Analysis, Insights and Forecast - by Component

- 6.2.1. Subsea Umbical Riser and Flowlines (SURF)

- 6.2.2. Trees

- 6.2.3. Wellhead

- 6.2.4. Manifolds

- 6.2.5. Other Components

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. GOM Federal Offshore or the United States PART

- 6.3.2. Mexico PART

- 6.3.3. Cuba PART

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Mexico PART Gulf Of Mexico Subsea Systems Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Subsea Producing Systems

- 7.1.2. Subsea Processing Systems

- 7.2. Market Analysis, Insights and Forecast - by Component

- 7.2.1. Subsea Umbical Riser and Flowlines (SURF)

- 7.2.2. Trees

- 7.2.3. Wellhead

- 7.2.4. Manifolds

- 7.2.5. Other Components

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. GOM Federal Offshore or the United States PART

- 7.3.2. Mexico PART

- 7.3.3. Cuba PART

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Cuba PART Gulf Of Mexico Subsea Systems Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Subsea Producing Systems

- 8.1.2. Subsea Processing Systems

- 8.2. Market Analysis, Insights and Forecast - by Component

- 8.2.1. Subsea Umbical Riser and Flowlines (SURF)

- 8.2.2. Trees

- 8.2.3. Wellhead

- 8.2.4. Manifolds

- 8.2.5. Other Components

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. GOM Federal Offshore or the United States PART

- 8.3.2. Mexico PART

- 8.3.3. Cuba PART

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Dril-Quip Inc *List Not Exhaustive

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Oceaneering International Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Baker Hughes Co

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Schlumberger Ltd

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Akastor ASA

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Halliburton Co

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Subsea 7 SA

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 National-Oilwell Varco Inc

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 TechnipFMC PLC

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 Dril-Quip Inc *List Not Exhaustive

List of Figures

- Figure 1: Gulf Of Mexico Subsea Systems Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Gulf Of Mexico Subsea Systems Market Share (%) by Company 2024

List of Tables

- Table 1: Gulf Of Mexico Subsea Systems Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Gulf Of Mexico Subsea Systems Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Gulf Of Mexico Subsea Systems Market Revenue Million Forecast, by Component 2019 & 2032

- Table 4: Gulf Of Mexico Subsea Systems Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Gulf Of Mexico Subsea Systems Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Gulf Of Mexico Subsea Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Gulf Of Mexico Subsea Systems Market Revenue Million Forecast, by Type 2019 & 2032

- Table 8: Gulf Of Mexico Subsea Systems Market Revenue Million Forecast, by Component 2019 & 2032

- Table 9: Gulf Of Mexico Subsea Systems Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 10: Gulf Of Mexico Subsea Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Gulf Of Mexico Subsea Systems Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Gulf Of Mexico Subsea Systems Market Revenue Million Forecast, by Component 2019 & 2032

- Table 13: Gulf Of Mexico Subsea Systems Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: Gulf Of Mexico Subsea Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Gulf Of Mexico Subsea Systems Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Gulf Of Mexico Subsea Systems Market Revenue Million Forecast, by Component 2019 & 2032

- Table 17: Gulf Of Mexico Subsea Systems Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: Gulf Of Mexico Subsea Systems Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gulf Of Mexico Subsea Systems Market?

The projected CAGR is approximately > 4.50%.

2. Which companies are prominent players in the Gulf Of Mexico Subsea Systems Market?

Key companies in the market include Dril-Quip Inc *List Not Exhaustive, Oceaneering International Inc, Baker Hughes Co, Schlumberger Ltd, Akastor ASA, Halliburton Co, Subsea 7 SA, National-Oilwell Varco Inc, TechnipFMC PLC.

3. What are the main segments of the Gulf Of Mexico Subsea Systems Market?

The market segments include Type, Component, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increase in Adoption of Renewable Energy Sources.

6. What are the notable trends driving market growth?

Subsea Production Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Initial Investment Cost and Limited Natural Resources.

8. Can you provide examples of recent developments in the market?

July 2022: Subsea Integration Alliance partners OneSubsea and Subsea 7 secured an engineering, procurement, construction and installation (EPCI) contract with Kosmos Energy to deliver an integrated subsea boosting system for the Odd Job field in the Gulf of Mexico.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gulf Of Mexico Subsea Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gulf Of Mexico Subsea Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gulf Of Mexico Subsea Systems Market?

To stay informed about further developments, trends, and reports in the Gulf Of Mexico Subsea Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence