Key Insights

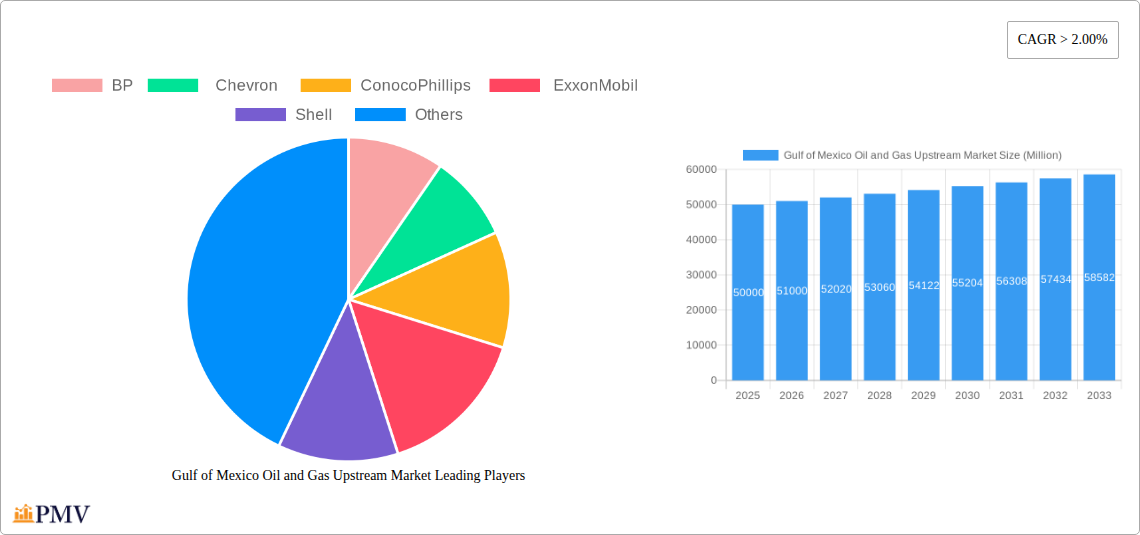

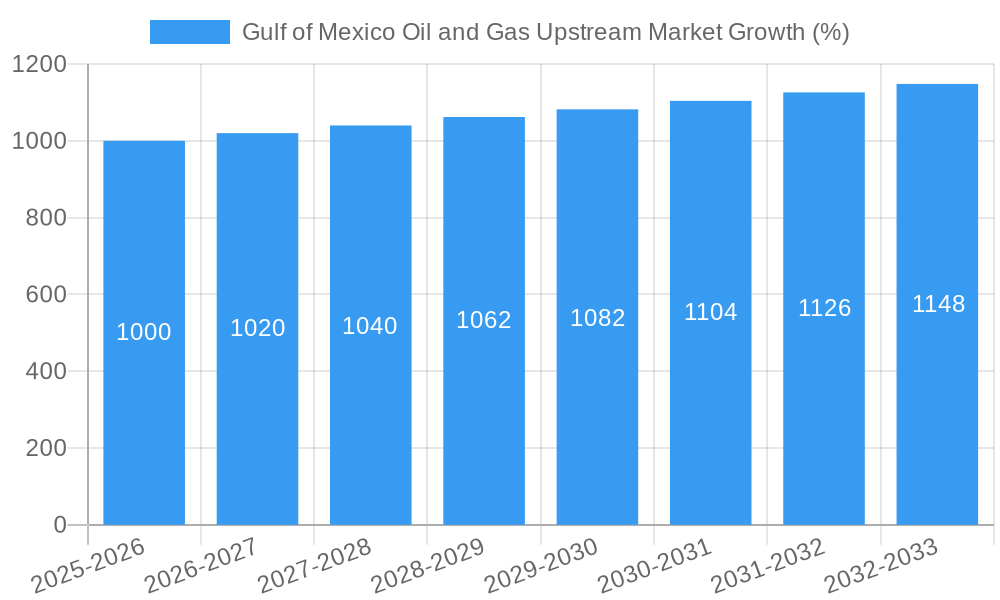

The Gulf of Mexico oil and gas upstream market, encompassing activities like exploration, drilling, and production, presents a dynamic landscape with significant growth potential. The market, valued at approximately $50 billion in 2025 (an estimated figure based on the provided CAGR of >2.00% and a stated market size "XX" implying a substantial market), is projected to experience steady expansion throughout the forecast period (2025-2033). Key drivers include increasing global energy demand, particularly for natural gas, alongside ongoing technological advancements in deepwater drilling and exploration techniques that make previously inaccessible reserves economically viable. While environmental regulations and concerns regarding carbon emissions pose restraints, the region's established infrastructure and proximity to key markets mitigate these challenges. The market segmentation reveals a significant contribution from both wind and hydro sources, with other renewable source types like solar and bioenergy showing increasing traction, indicating a shift towards a more diversified energy mix. Major players like BP, Chevron, ConocoPhillips, ExxonMobil, Shell, and TotalEnergies dominate the market, leveraging their substantial experience and financial resources to capitalize on opportunities.

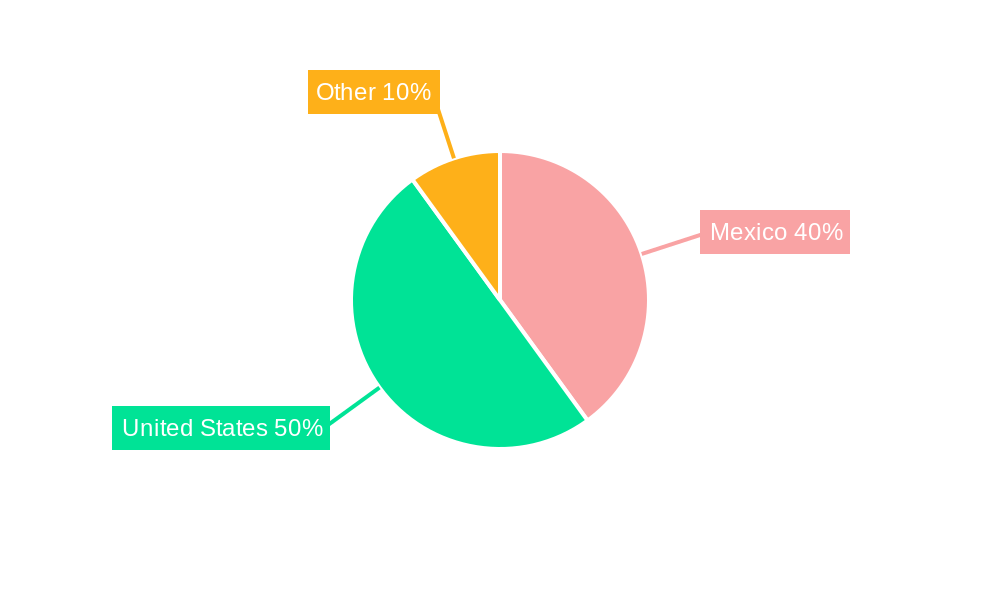

Mexico, as a key regional player, contributes significantly to the overall market size. The historical period (2019-2024) likely witnessed fluctuations influenced by global oil price volatility and evolving government policies. However, the consistent CAGR suggests a relatively stable and upward trajectory. Looking ahead, strategic investments in infrastructure upgrades, coupled with technological innovations to improve efficiency and reduce environmental impact, will shape the future trajectory of the Gulf of Mexico oil and gas upstream sector. The sustained demand for energy alongside efforts to integrate renewable sources within the existing framework will be critical factors determining the market's growth path in the coming years. The robust presence of established energy giants ensures a competitive and innovative market landscape.

Gulf of Mexico Oil and Gas Upstream Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Gulf of Mexico oil and gas upstream market, offering crucial insights for investors, industry professionals, and strategic decision-makers. The study covers the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033. The report meticulously examines market structure, competitive dynamics, industry trends, and growth drivers, providing actionable intelligence for navigating this dynamic sector.

Gulf of Mexico Oil and Gas Upstream Market Structure & Competitive Dynamics

This section analyzes the competitive landscape of the Gulf of Mexico oil and gas upstream market, encompassing market concentration, innovation, regulatory frameworks, substitute products, end-user trends, and mergers & acquisitions (M&A) activities. The analysis reveals a moderately concentrated market dominated by major international oil companies (IOCs).

- Market Share: ExxonMobil and Chevron hold the largest market shares, estimated at xx% and xx% respectively in 2025, followed by Shell (xx%), BP (xx%), ConocoPhillips (xx%), and TotalEnergies (xx%). Smaller independent operators hold the remaining market share.

- M&A Activity: The historical period (2019-2024) witnessed significant M&A activity, with deal values exceeding $xx Million. This activity is primarily driven by the consolidation of assets and exploration opportunities. The forecast period anticipates further consolidation, though at a potentially slower pace due to regulatory scrutiny and market volatility.

- Innovation Ecosystem: The region fosters innovation through collaborative research and development initiatives between IOCs, technology providers, and research institutions. Focus areas include enhanced oil recovery (EOR) techniques, automation, and digitalization of operations.

- Regulatory Frameworks: Strict safety regulations and environmental concerns significantly influence market dynamics, necessitating substantial investments in safety and environmental protection measures. Changes in governmental policies and licensing processes could disrupt the market’s development.

- Product Substitutes: The rise of renewable energy sources such as wind and solar power presents a long-term challenge to the oil and gas sector, potentially impacting future demand. However, natural gas's role as a transition fuel will support the market in the short to medium term.

- End-User Trends: The increasing demand for energy globally influences the Gulf of Mexico oil and gas market. Fluctuations in global energy prices and geopolitical factors significantly impact market dynamics.

Gulf of Mexico Oil and Gas Upstream Market Industry Trends & Insights

This section explores the key trends shaping the Gulf of Mexico oil and gas upstream market. The market experienced a CAGR of xx% during the historical period (2019-2024) driven by factors such as increasing global energy demand, technological advancements, and exploration activities. However, market growth is projected to decelerate to a CAGR of xx% during the forecast period (2025-2033) due to the impact of renewable energy sources and global efforts to mitigate climate change.

Market penetration of new technologies such as automation and artificial intelligence (AI) in upstream operations is gradually increasing, enhancing efficiency and safety. Consumer preferences for cleaner energy sources are influencing investor decisions and prompting companies to explore strategies to reduce their carbon footprint. The competitive landscape is characterized by intense rivalry amongst major players, leading to strategic partnerships and portfolio optimization strategies. The regulatory environment is constantly evolving, imposing tighter environmental constraints and creating challenges for companies to meet compliance standards. Price volatility driven by global events impacts investment decisions and profitability. The market's future depends significantly on the balance between energy demand, regulatory frameworks, and the adoption of sustainable practices.

Dominant Markets & Segments in Gulf of Mexico Oil and Gas Upstream Market

While the report focuses primarily on oil and gas, the inclusion of Wind, Hydro, and Other Source Types (Solar and Bioenergy) reflects a consideration of the broader energy landscape and potential future shifts. Currently, oil and gas dominate the Gulf of Mexico upstream market. However, the other source types are expected to play a increasingly important role over the forecast period.

Key Drivers of Oil and Gas Dominance:

- Established Infrastructure: Extensive existing pipelines, processing facilities, and port infrastructure support existing oil and gas production.

- Resource Abundance: The Gulf of Mexico possesses significant proven reserves of oil and natural gas.

- Government Support (Historically): Past government policies and regulatory frameworks have favored hydrocarbon exploration and production.

- Economic Importance: Oil and gas production contributes significantly to the regional and national economies.

Potential Growth of Renewable Energy: The inclusion of wind, hydro, and other renewable energy sources within the broader context of the report acknowledges the ongoing transition towards cleaner energy. While currently marginal within the upstream context, future development of offshore wind power could significantly alter the market’s character. This segment’s growth will depend heavily on government incentives, technological advancements (particularly in floating offshore wind technology), and grid integration capabilities.

Gulf of Mexico Oil and Gas Upstream Market Product Innovations

Recent innovations in the Gulf of Mexico oil and gas upstream market primarily focus on improving efficiency and reducing environmental impact. These include advancements in EOR technologies, such as chemical injection and CO2 sequestration, and the adoption of digital tools for data analytics and predictive maintenance. Companies are also investing in technologies to reduce methane emissions and improve safety protocols, addressing growing environmental concerns. These innovations offer competitive advantages by enhancing operational efficiency, minimizing environmental risks, and maximizing resource recovery.

Report Segmentation & Scope

This report segments the Gulf of Mexico oil and gas upstream market primarily by source type, which includes:

- Oil: This segment encompasses conventional and unconventional oil production, reflecting the majority of the current market share. Growth projections are moderate given the pressures of renewable energy transition.

- Natural Gas: This segment mirrors the oil segment in terms of importance. Growth projections depend heavily on the energy transition timeline and the ongoing role of natural gas as a transitional fuel.

- Wind: This segment currently represents a small share of the overall market but possesses high growth potential. Significant investments are needed for infrastructure development and technological advancement.

- Hydro: Hydropower’s relevance in the Gulf of Mexico’s upstream market is negligible given the geographic limitations.

- Other Source Types (Solar and Bioenergy): These sources are currently insignificant in the upstream market but their potential should be considered for the long-term picture.

Key Drivers of Gulf of Mexico Oil and Gas Upstream Market Growth

Several factors drive growth in the Gulf of Mexico oil and gas upstream market. Strong global energy demand, especially for natural gas, remains a significant driver. Technological advancements in exploration and production techniques, such as horizontal drilling and hydraulic fracturing, have increased resource accessibility and recovery rates. Favorable regulatory environments (though increasingly stringent on environmental concerns) can encourage investment and exploration. Finally, the strategic geographic location of the Gulf of Mexico and its established infrastructure make it an attractive investment destination.

Challenges in the Gulf of Mexico Oil and Gas Upstream Market Sector

The Gulf of Mexico oil and gas upstream market faces several significant challenges. Stringent environmental regulations and increasing scrutiny concerning greenhouse gas emissions impose considerable costs and operational constraints on companies. Supply chain disruptions, particularly those stemming from global events, can impact production and project timelines. Intense competition amongst established players and the emergence of new technologies present significant pressure on profit margins. Moreover, the growing transition towards renewable energy sources poses a long-term threat to the demand for oil and gas. The combined effect of these factors potentially limits market growth.

Leading Players in the Gulf of Mexico Oil and Gas Upstream Market Market

Key Developments in Gulf of Mexico Oil and Gas Upstream Market Sector

- 2023-Q3: ExxonMobil announced a significant investment in offshore wind energy research and development in the Gulf.

- 2022-Q4: Chevron completed a major acquisition of offshore oil and gas assets, expanding its production capacity.

- 2021-Q2: New stricter emission regulations came into effect, impacting operational costs for several companies.

Strategic Gulf of Mexico Oil and Gas Upstream Market Outlook

The Gulf of Mexico oil and gas upstream market holds significant potential for future growth, albeit with a tempered outlook compared to historical performance. The market will likely experience a transition toward a more balanced portfolio, incorporating renewable energy sources alongside continued hydrocarbon production. Strategic partnerships and investments in advanced technologies will play crucial roles in ensuring the long-term competitiveness of the industry. Successfully navigating environmental regulations and adapting to evolving consumer preferences will be paramount to sustained success in this dynamic market.

Gulf of Mexico Oil and Gas Upstream Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Gulf of Mexico Oil and Gas Upstream Market Segmentation By Geography

- 1. United States

- 2. Mexico

- 3. Others

Gulf of Mexico Oil and Gas Upstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Supportive Government Policies4.; Technological Innovation in Renewable Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Intermittent Nature of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Deep-Water and Ultra Deep-Water Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Gulf of Mexico Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United States

- 5.6.2. Mexico

- 5.6.3. Others

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. United States Gulf of Mexico Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. Mexico Gulf of Mexico Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Others Gulf of Mexico Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 BP

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Chevron

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 ConocoPhillips

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 ExxonMobil

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Shell

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 TotalEnergies

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.1 BP

List of Figures

- Figure 1: Gulf of Mexico Oil and Gas Upstream Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Gulf of Mexico Oil and Gas Upstream Market Share (%) by Company 2024

List of Tables

- Table 1: Gulf of Mexico Oil and Gas Upstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Gulf of Mexico Oil and Gas Upstream Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Gulf of Mexico Oil and Gas Upstream Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Gulf of Mexico Oil and Gas Upstream Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Gulf of Mexico Oil and Gas Upstream Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Gulf of Mexico Oil and Gas Upstream Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Gulf of Mexico Oil and Gas Upstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Gulf of Mexico Oil and Gas Upstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Gulf of Mexico Oil and Gas Upstream Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 10: Gulf of Mexico Oil and Gas Upstream Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 11: Gulf of Mexico Oil and Gas Upstream Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 12: Gulf of Mexico Oil and Gas Upstream Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 13: Gulf of Mexico Oil and Gas Upstream Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 14: Gulf of Mexico Oil and Gas Upstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Gulf of Mexico Oil and Gas Upstream Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 16: Gulf of Mexico Oil and Gas Upstream Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 17: Gulf of Mexico Oil and Gas Upstream Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 18: Gulf of Mexico Oil and Gas Upstream Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 19: Gulf of Mexico Oil and Gas Upstream Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 20: Gulf of Mexico Oil and Gas Upstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Gulf of Mexico Oil and Gas Upstream Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 22: Gulf of Mexico Oil and Gas Upstream Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 23: Gulf of Mexico Oil and Gas Upstream Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 24: Gulf of Mexico Oil and Gas Upstream Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 25: Gulf of Mexico Oil and Gas Upstream Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 26: Gulf of Mexico Oil and Gas Upstream Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gulf of Mexico Oil and Gas Upstream Market?

The projected CAGR is approximately > 2.00%.

2. Which companies are prominent players in the Gulf of Mexico Oil and Gas Upstream Market?

Key companies in the market include BP, Chevron , ConocoPhillips , ExxonMobil , Shell , TotalEnergies.

3. What are the main segments of the Gulf of Mexico Oil and Gas Upstream Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Supportive Government Policies4.; Technological Innovation in Renewable Energy.

6. What are the notable trends driving market growth?

Deep-Water and Ultra Deep-Water Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Intermittent Nature of Renewable Energy.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gulf of Mexico Oil and Gas Upstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gulf of Mexico Oil and Gas Upstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gulf of Mexico Oil and Gas Upstream Market?

To stay informed about further developments, trends, and reports in the Gulf of Mexico Oil and Gas Upstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence