Key Insights

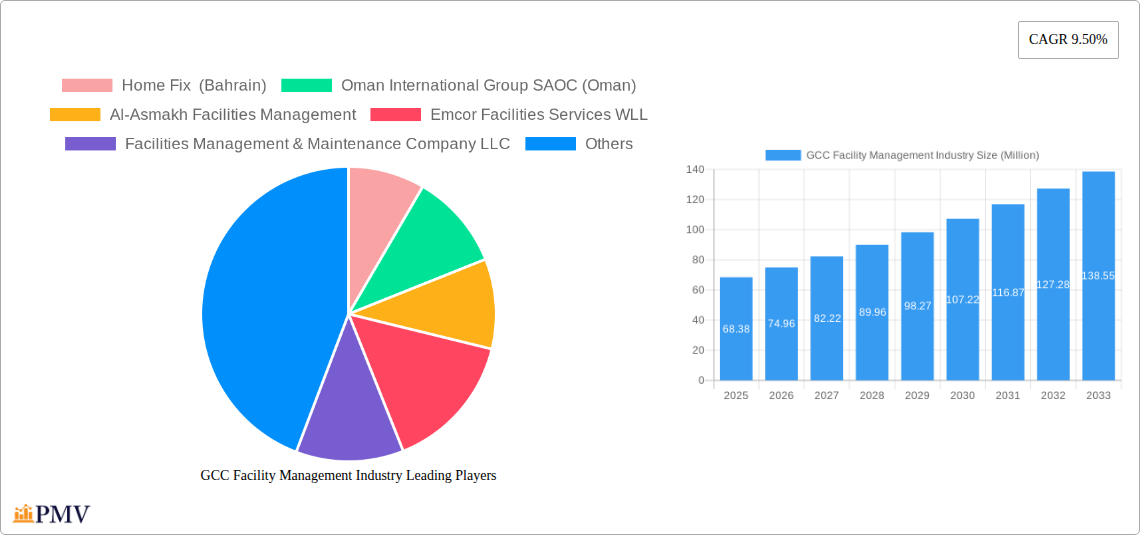

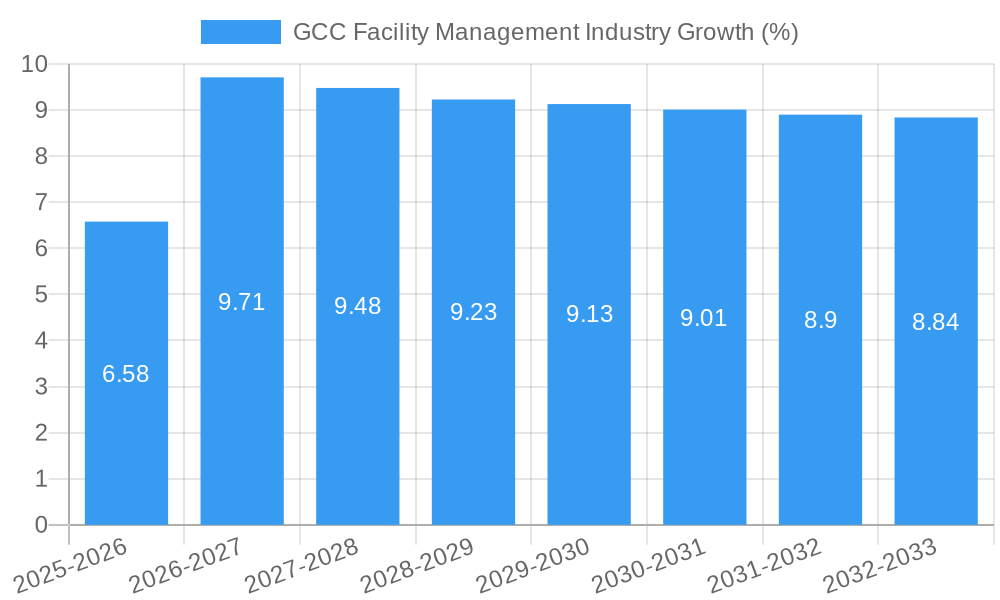

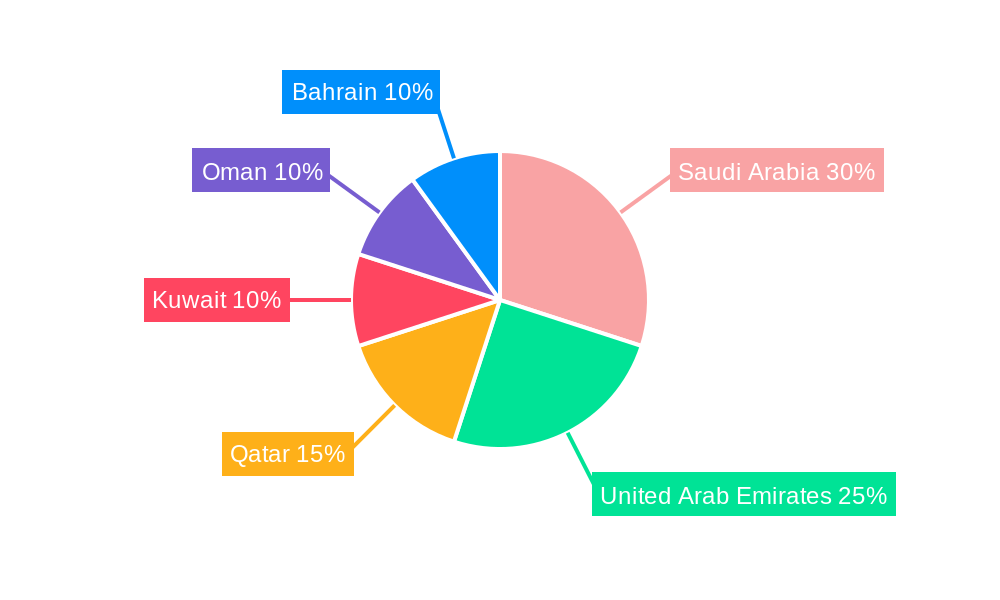

The GCC Facility Management (FM) industry is experiencing robust growth, projected to reach a market size of $68.38 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 9.50% from 2025 to 2033. This expansion is driven by several factors. Firstly, the region's burgeoning construction sector, encompassing commercial, residential, and infrastructural projects, necessitates comprehensive FM services. Secondly, a growing emphasis on sustainability and operational efficiency within businesses across various sectors—manufacturing, healthcare, and government—fuels demand for professional FM solutions. Thirdly, increasing urbanization and a rising middle class are contributing to higher occupancy rates in commercial and residential buildings, further increasing the need for efficient and reliable FM services. The market segmentation reveals a healthy mix between in-house and outsourced FM services, with a significant portion leaning towards outsourcing due to cost-effectiveness and access to specialized expertise. The dominance of specific FM types (hard and soft services) will vary based on the specific needs of different sectors and clients. Finally, Saudi Arabia, the UAE, and Qatar are expected to be the key contributors to overall market growth due to their significant investments in infrastructure development and diversification of their economies.

The competitive landscape within the GCC FM market is marked by a mix of both local and international players. Established international FM companies possess extensive experience and resources, while local firms often offer localized knowledge and competitive pricing. This dynamic competition fosters innovation and ensures that clients have a wide range of choices to suit their individual needs. Future growth will likely be influenced by technological advancements in areas such as smart building technology, predictive maintenance, and data analytics which will enhance operational efficiencies and service delivery. Furthermore, government initiatives promoting sustainability and energy efficiency will play a significant role in shaping the long-term trajectory of the GCC FM sector. The focus will remain on delivering cost-effective, high-quality FM services that cater to the unique needs of diverse industries across the region, ensuring the continued expansion and refinement of the sector.

GCC Facility Management Industry: Market Analysis and Forecast 2019-2033

This comprehensive report provides a detailed analysis of the GCC Facility Management industry, covering market size, segmentation, competitive landscape, and future growth prospects from 2019 to 2033. The study period spans 2019–2024 (historical period), with 2025 as the base and estimated year, and the forecast period extending to 2033. The report is invaluable for industry stakeholders, investors, and anyone seeking to understand the dynamics of this rapidly evolving market, valued at xx Million in 2025 and projected to reach xx Million by 2033.

GCC Facility Management Industry Market Structure & Competitive Dynamics

The GCC facility management market exhibits a moderately concentrated structure with a mix of large multinational corporations and smaller regional players. Market share is distributed among these entities, with the top five players holding an estimated xx% combined market share in 2025. Innovation is driven by a combination of internal R&D efforts and strategic partnerships, particularly in areas like sustainable technologies and smart building solutions. The regulatory framework varies across GCC countries, impacting licensing, safety standards, and environmental regulations. While some degree of substitution exists (e.g., in-house vs. outsourced services), the demand for specialized expertise and integrated solutions limits the impact of substitutes. End-user trends are shifting towards integrated FM services and a focus on sustainability, influencing the strategic choices of market players. M&A activity has been significant, with several large deals recorded in recent years, totaling an estimated value of xx Million over the last five years. These transactions often involve acquiring specialized expertise or expanding into new geographical markets. Examples of successful M&A activities include DUBAL Holding and Imdaad's MoU in 2022 to expand sustainability initiatives.

GCC Facility Management Industry Industry Trends & Insights

The GCC facility management industry is witnessing robust growth, driven by factors like rapid urbanization, increasing construction activity, and a rising focus on sustainability across various sectors. The market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological advancements, such as the Internet of Things (IoT), building automation systems, and AI-powered predictive maintenance, are transforming the industry, improving efficiency, and enhancing service delivery. Consumer preferences are increasingly shifting towards integrated, sustainable, and technology-driven facility management solutions. The heightened competition is driving innovation and improving service offerings, pushing companies to adopt innovative strategies and build stronger customer relationships to gain market share. Market penetration of technology-driven FM services remains relatively low but is expected to increase significantly in the coming years.

Dominant Markets & Segments in GCC Facility Management Industry

By Country: The UAE and Saudi Arabia dominate the GCC facility management market, driven by robust economic growth, large-scale infrastructure projects, and a high concentration of commercial and industrial facilities. Qatar, Oman, Kuwait, and Bahrain show promising growth potential but at a slower pace due to their relative market sizes. Key drivers for these countries include government policies promoting sustainable development and private sector investments in infrastructure.

By Type: Outsourced facility management is the larger segment, reflecting a growing preference for specialized expertise and operational efficiency. However, the in-house segment maintains a significant presence in large organizations with dedicated FM departments.

By End-user: The commercial and retail sector constitutes the largest end-user segment due to the high concentration of shopping malls, office buildings, and hospitality facilities. The manufacturing and industrial sector is also a significant contributor, driven by the need for specialized maintenance and operational support. Government, infrastructure, and public entities demonstrate a strong demand for comprehensive FM solutions.

By FM Type: Hard FM services (building maintenance, repairs) currently hold a larger market share compared to soft FM (catering, cleaning), but soft FM is witnessing faster growth, fueled by the rising demand for enhanced workplace experience and well-being initiatives.

The dominance of specific segments is further influenced by factors such as government regulations, economic conditions, and industry-specific trends.

GCC Facility Management Industry Product Innovations

Recent innovations focus on integrating IoT sensors, AI-powered analytics, and cloud-based platforms to optimize resource allocation, predict maintenance needs, and enhance overall operational efficiency. Products like Bluefinch, launched by Phixe Solutions Technical Services, represent the shift towards pay-as-you-go models, addressing the financial concerns of property owners. These innovations are improving operational efficiency, reducing costs, and enhancing service quality, aligning well with evolving customer demands for sustainable and cost-effective solutions.

Report Segmentation & Scope

This report segments the GCC facility management market by:

Type: In-house vs. outsourced services, with growth projections and competitive analysis for each.

End-user: Commercial and Retail, Manufacturing and Industrial, Government, Infrastructure and Public Entities, Healthcare, and Other End-users, with individual market size estimations and competitive dynamics assessment.

Country: Qatar, UAE, Kuwait, Saudi Arabia, Oman, and Bahrain, providing country-specific market size forecasts and competitive landscapes.

FM Type: Hard FM and Soft FM services, with separate growth projections and detailed competitive analyses.

Key Drivers of GCC Facility Management Industry Growth

The GCC facility management market growth is fueled by several key factors:

Rapid urbanization and infrastructure development: Massive infrastructure projects across the region are creating a surge in demand for FM services.

Growing focus on sustainability: Increasing environmental concerns are driving demand for sustainable FM practices and technologies.

Technological advancements: IoT, AI, and cloud computing are transforming FM operations, enhancing efficiency and service delivery.

Government initiatives and supportive policies: Governments across the GCC are actively promoting sustainable development and investing in infrastructure.

Challenges in the GCC Facility Management Industry Sector

The GCC facility management industry faces several challenges, including:

Regulatory hurdles and compliance complexities: Varying regulations across different countries create compliance complexities.

Supply chain disruptions: Global supply chain challenges can impact the availability of materials and equipment.

Intense competition: The market's competitive nature requires companies to constantly innovate and differentiate their offerings.

Talent acquisition and retention: Finding and retaining skilled professionals remains a challenge for many companies.

Leading Players in the GCC Facility Management Industry Market

- Home Fix (Bahrain)

- Oman International Group SAOC (Oman)

- Al-Asmakh Facilities Management

- Emcor Facilities Services WLL

- Facilities Management & Maintenance Company LLC

- Saudi Emcor Company Limited (Saudi Arabia)

- Ecovert FM Kuwait (Kuwait)

- Enova Facilities Management Services LLC (UAE)

- Al Faisal Holdings (MMG Qatar)

- G4S Qatar SPC

- Initial Saudi Group (Saudi Arabia)

- ENGIE Cofely LLC (Oman)

- Sodexo Qatar Services

- Como Facility Management Services

- Cofely Besix Facility Management

- PIMCO Kuwait (Kuwait)

Key Developments in GCC Facility Management Industry Sector

- September 2022: Phixe Solutions Technical Services launched Bluefinch, a pay-as-you-go facility management solution.

- October 2022: DUBAL Holding and Imdaad signed an MoU to foster recycling and sustainability in the UAE.

- January 2023: Renaissance partnered with SOURCE Global to generate sustainably sourced drinking water in Oman.

Strategic GCC Facility Management Industry Market Outlook

The GCC facility management market presents significant growth opportunities in the coming years, driven by sustained economic expansion, infrastructure investments, and a focus on technological advancements. The increasing adoption of smart building technologies, sustainable solutions, and integrated FM services will shape the future of the market. Strategic opportunities exist for companies that can effectively leverage technology, adapt to evolving customer needs, and build strong partnerships within the ecosystem. The market's future growth hinges on a continued commitment to innovation, sustainability, and service excellence.

GCC Facility Management Industry Segmentation

-

1. FM Type

- 1.1. Hard

- 1.2. Soft

-

2. Type

- 2.1. In-House

-

2.2. Outsourced

- 2.2.1. Single FM

- 2.2.2. Bundled FM

- 2.2.3. Integrated FM

-

3. End-user

- 3.1. Commercial and Retail

- 3.2. Manufacturing and Industrial

- 3.3. Government, Infrastructure, and Public Entities

- 3.4. Healthcare

- 3.5. Other End-users

GCC Facility Management Industry Segmentation By Geography

- 1. GCC

GCC Facility Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Emergence of Qatar as One of the Key Investment Destinations in the GCC; Growing Emphasis on the Outsourcing of Non-core Operations; Increase in Market Concentration Due To The Entry Of Global Firms With Diversified Service Portfolios

- 3.3. Market Restrains

- 3.3.1. Stringent Regulations in the Middle East Have Been a Challenge for Vendors; Traditional Forms of Advertising Continue to Dominate in a Few Countries

- 3.4. Market Trends

- 3.4.1 Government

- 3.4.2 Infrastructure

- 3.4.3 and Public Entities End-user Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. GCC Facility Management Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by FM Type

- 5.1.1. Hard

- 5.1.2. Soft

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. In-House

- 5.2.2. Outsourced

- 5.2.2.1. Single FM

- 5.2.2.2. Bundled FM

- 5.2.2.3. Integrated FM

- 5.3. Market Analysis, Insights and Forecast - by End-user

- 5.3.1. Commercial and Retail

- 5.3.2. Manufacturing and Industrial

- 5.3.3. Government, Infrastructure, and Public Entities

- 5.3.4. Healthcare

- 5.3.5. Other End-users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. GCC

- 5.1. Market Analysis, Insights and Forecast - by FM Type

- 6. Saudi Arabia GCC Facility Management Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. United Arab Emirates GCC Facility Management Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Qatar GCC Facility Management Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Kuwait GCC Facility Management Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. South Africa GCC Facility Management Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Egypt GCC Facility Management Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Nigeria GCC Facility Management Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of Middle East and Africa GCC Facility Management Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Home Fix (Bahrain)

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Oman International Group SAOC (Oman)

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Al-Asmakh Facilities Management

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Emcor Facilities Services WLL

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Facilities Management & Maintenance Company LLC

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Saudi Emcor Company Limited (Saudi Arabia)

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Ecovert FM Kuwait (Kuwait)

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Enova Facilities Management Services LLC (UAE)

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Al Faisal Holdings (MMG Qatar)

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 G4S Qatar SPC

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Initial Saudi Group (Saudi Arabia)

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 ENGIE Cofely LLC (Oman)

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.13 Sodexo Qatar Services

- 14.2.13.1. Overview

- 14.2.13.2. Products

- 14.2.13.3. SWOT Analysis

- 14.2.13.4. Recent Developments

- 14.2.13.5. Financials (Based on Availability)

- 14.2.14 Como Facility Management Services

- 14.2.14.1. Overview

- 14.2.14.2. Products

- 14.2.14.3. SWOT Analysis

- 14.2.14.4. Recent Developments

- 14.2.14.5. Financials (Based on Availability)

- 14.2.15 Cofely Besix Facility Management

- 14.2.15.1. Overview

- 14.2.15.2. Products

- 14.2.15.3. SWOT Analysis

- 14.2.15.4. Recent Developments

- 14.2.15.5. Financials (Based on Availability)

- 14.2.16 PIMCO Kuwait (Kuwait)

- 14.2.16.1. Overview

- 14.2.16.2. Products

- 14.2.16.3. SWOT Analysis

- 14.2.16.4. Recent Developments

- 14.2.16.5. Financials (Based on Availability)

- 14.2.1 Home Fix (Bahrain)

List of Figures

- Figure 1: GCC Facility Management Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: GCC Facility Management Industry Share (%) by Company 2024

List of Tables

- Table 1: GCC Facility Management Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: GCC Facility Management Industry Revenue Million Forecast, by FM Type 2019 & 2032

- Table 3: GCC Facility Management Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: GCC Facility Management Industry Revenue Million Forecast, by End-user 2019 & 2032

- Table 5: GCC Facility Management Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: GCC Facility Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: GCC Facility Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: GCC Facility Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: GCC Facility Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: GCC Facility Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: GCC Facility Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: GCC Facility Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: GCC Facility Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: GCC Facility Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: GCC Facility Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: GCC Facility Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: GCC Facility Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: GCC Facility Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: GCC Facility Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: GCC Facility Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: GCC Facility Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: GCC Facility Management Industry Revenue Million Forecast, by FM Type 2019 & 2032

- Table 23: GCC Facility Management Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 24: GCC Facility Management Industry Revenue Million Forecast, by End-user 2019 & 2032

- Table 25: GCC Facility Management Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC Facility Management Industry?

The projected CAGR is approximately 9.50%.

2. Which companies are prominent players in the GCC Facility Management Industry?

Key companies in the market include Home Fix (Bahrain), Oman International Group SAOC (Oman), Al-Asmakh Facilities Management, Emcor Facilities Services WLL, Facilities Management & Maintenance Company LLC, Saudi Emcor Company Limited (Saudi Arabia), Ecovert FM Kuwait (Kuwait), Enova Facilities Management Services LLC (UAE), Al Faisal Holdings (MMG Qatar), G4S Qatar SPC, Initial Saudi Group (Saudi Arabia), ENGIE Cofely LLC (Oman), Sodexo Qatar Services, Como Facility Management Services, Cofely Besix Facility Management, PIMCO Kuwait (Kuwait).

3. What are the main segments of the GCC Facility Management Industry?

The market segments include FM Type, Type, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 68.38 Million as of 2022.

5. What are some drivers contributing to market growth?

Emergence of Qatar as One of the Key Investment Destinations in the GCC; Growing Emphasis on the Outsourcing of Non-core Operations; Increase in Market Concentration Due To The Entry Of Global Firms With Diversified Service Portfolios.

6. What are the notable trends driving market growth?

Government. Infrastructure. and Public Entities End-user Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Stringent Regulations in the Middle East Have Been a Challenge for Vendors; Traditional Forms of Advertising Continue to Dominate in a Few Countries.

8. Can you provide examples of recent developments in the market?

January 2023: Renaissance, Oman's leading accommodation, services solutions, and integrated facility management company, announced its collaboration with SOURCE Global, PBC to generate sustainably sourced drinking water for Renaissance Village Duqm (RSVD) in Oman's Special Economic Zone at Duqm (SEZAD), with plans to expand to additional sites.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC Facility Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC Facility Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC Facility Management Industry?

To stay informed about further developments, trends, and reports in the GCC Facility Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence