Key Insights

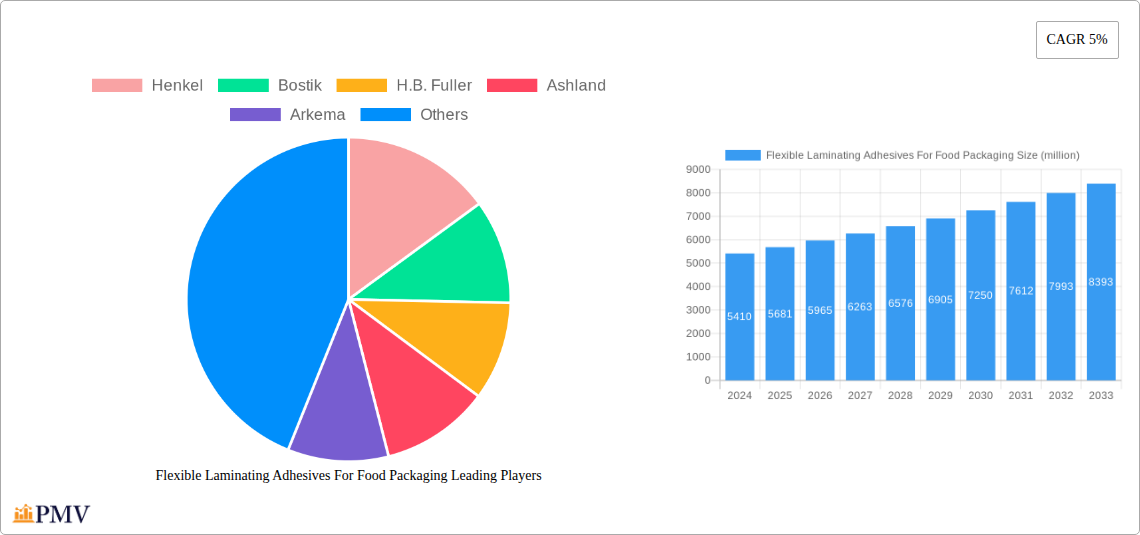

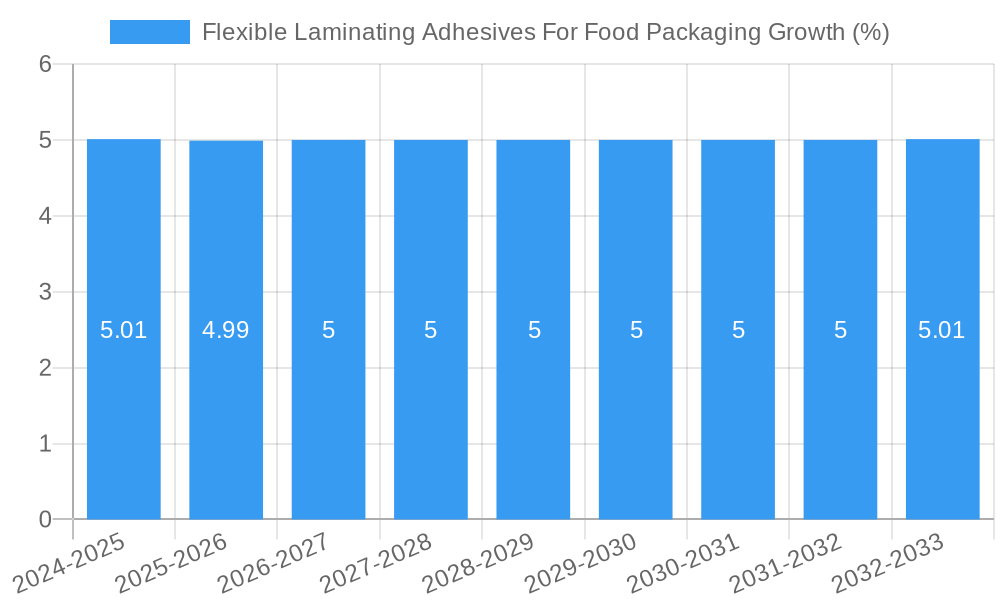

The global market for Flexible Laminating Adhesives for Food Packaging is poised for robust growth, projected to reach approximately \$5,681 million by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 5% through 2033. This expansion is primarily driven by the escalating demand for sophisticated and convenient food packaging solutions that enhance product shelf-life, maintain freshness, and improve barrier properties. The increasing consumer preference for pre-packaged, ready-to-eat meals, alongside a burgeoning e-commerce sector for food products, further fuels the adoption of advanced laminating adhesives. Furthermore, stringent regulations concerning food safety and hygiene are compelling manufacturers to invest in high-performance adhesives that comply with global standards, thereby creating significant market opportunities. The rising disposable incomes in emerging economies are also contributing to a greater consumption of packaged foods, directly impacting the demand for these specialized adhesives.

Key trends shaping the market include a significant shift towards solvent-free and water-based adhesives due to environmental concerns and the need to reduce volatile organic compound (VOC) emissions. This transition is driven by increasing regulatory pressure and growing consumer awareness regarding sustainability. While solvent-based adhesives currently hold a substantial market share, the long-term trajectory favors eco-friendly alternatives. Application segments like Biscuits, Chips and Snacks, and Frozen Foods are leading the demand, owing to their extensive use of multi-layered flexible packaging. The innovation landscape is characterized by the development of adhesives with enhanced bonding strength, improved thermal resistance, and compatibility with a wider range of substrates, including biodegradable and recyclable materials. The competitive landscape features a mix of global giants and regional players, with strategic collaborations, mergers, and acquisitions playing a crucial role in market consolidation and expansion.

This in-depth market research report provides a detailed analysis of the flexible laminating adhesives for food packaging market, offering critical insights for stakeholders, manufacturers, and investors. The study covers the historical period from 2019 to 2024, the base year of 2025, and projects market trends and growth until 2033. With a focus on food packaging adhesive solutions, flexible packaging adhesives, and laminating adhesives for food applications, this report is an indispensable resource for understanding market dynamics, competitive landscapes, and future opportunities.

Flexible Laminating Adhesives For Food Packaging Market Structure & Competitive Dynamics

The flexible laminating adhesives for food packaging market exhibits a moderately concentrated structure, with a significant presence of both global giants and regional specialists. Key players like Henkel, Bostik, H.B. Fuller, Ashland, Arkema, 3M, and Flint Group hold substantial market shares, estimated to be in the range of 10-15% for the top 5 companies. The innovation ecosystem is driven by continuous research and development in areas like solvent-free adhesives and water-based adhesives, aiming to meet stringent regulatory requirements and sustainability demands. Regulatory frameworks globally, particularly those concerning food contact materials and volatile organic compounds (VOCs), significantly shape product development and market entry strategies. Product substitutes, such as alternative packaging materials and sealing technologies, present a competitive challenge, though the performance and versatility of laminating adhesives maintain their dominance. End-user trends lean towards demand for enhanced barrier properties, extended shelf life, and sustainable packaging solutions. Mergers and Acquisitions (M&A) activities are prevalent, with recent transactions valued in the tens to hundreds of millions, aimed at consolidating market presence, expanding product portfolios, and acquiring technological expertise. For instance, the acquisition of a specialty adhesive producer by a major chemical company in the past year, valued at approximately $50 million, exemplifies this trend.

Flexible Laminating Adhesives For Food Packaging Industry Trends & Insights

The flexible laminating adhesives for food packaging industry is experiencing robust growth, driven by several converging factors. The increasing global population, coupled with rising disposable incomes in emerging economies, fuels the demand for packaged foods, directly impacting the need for high-performance food packaging adhesives. The CAGR for the forecast period is estimated at a healthy 5.8%, projecting the market to reach approximately $10 billion by 2033. Technological disruptions are a significant trend, with a notable shift towards solvent-free adhesives and water-based adhesives. This transition is propelled by environmental regulations targeting VOC emissions and growing consumer preference for eco-friendly packaging. For example, advancements in polyurethane and polyolefin-based solvent-free adhesives offer superior adhesion, faster curing times, and reduced environmental impact, gaining significant traction in the flexible packaging adhesive segment. The market penetration of sustainable adhesive technologies is projected to increase from 30% in the base year 2025 to over 50% by 2033.

Consumer preferences are evolving rapidly, with an increased emphasis on food safety, convenience, and sustainability. Consumers are actively seeking products with longer shelf lives, reduced food waste, and packaging materials that are recyclable or compostable. This necessitates the development of laminating adhesives for food applications that can meet these demanding criteria, including excellent barrier properties against oxygen, moisture, and light, while also being compliant with food contact regulations. The aesthetic appeal of packaging also plays a crucial role, with brands investing in innovative designs that require specialized adhesive formulations for multi-layer constructions.

Competitive dynamics within the industry are intensifying. Manufacturers are competing not only on price but also on innovation, product performance, technical support, and sustainability credentials. The development of customized adhesive solutions tailored to specific food product requirements, such as high-temperature resistance for retort pouches or excellent adhesion to challenging substrates like metallized films, is a key differentiator. Strategic partnerships between adhesive manufacturers, film converters, and food brands are becoming more common, fostering collaborative innovation and ensuring that adhesive solutions align with the entire value chain's needs. The investment in R&D is projected to exceed $500 million annually by 2027, underscoring the industry's commitment to technological advancement.

Dominant Markets & Segments in Flexible Laminating Adhesives For Food Packaging

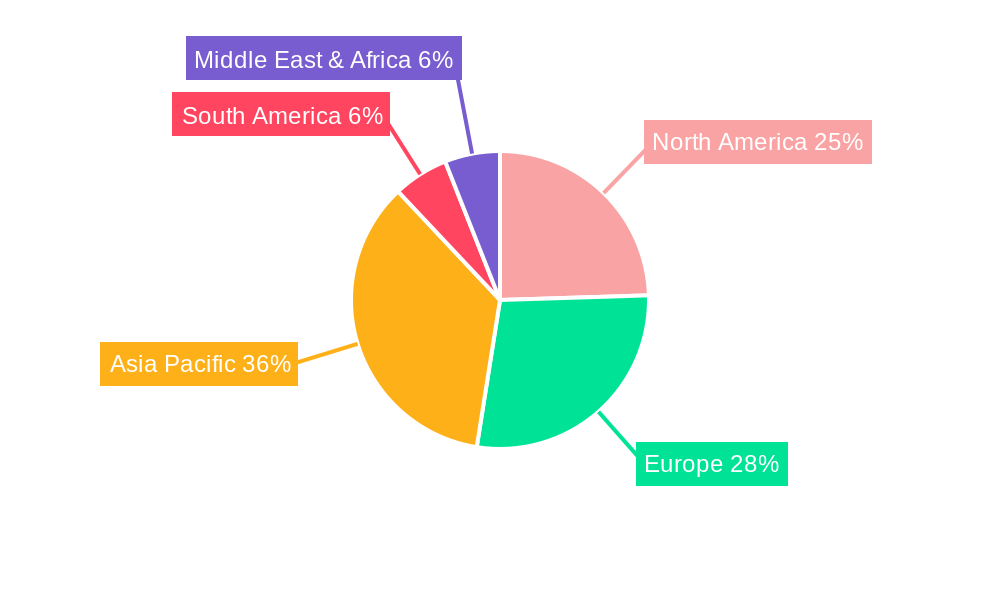

The flexible laminating adhesives for food packaging market is characterized by significant regional dominance and segment leadership. Asia Pacific is the leading region, driven by its large and rapidly growing food processing industry, increasing urbanization, and rising consumer demand for convenience foods. Within Asia Pacific, China, with an estimated market share of over 25%, stands out as a major hub for both production and consumption of flexible packaging adhesives. Key drivers for China's dominance include robust economic policies supporting manufacturing, substantial investments in infrastructure that facilitate efficient supply chains, and a vast domestic market for packaged goods.

Application Segments:

- Biscuits, Chips and Snacks: This segment is a major contributor to the market, demanding adhesives that provide excellent barrier properties to maintain freshness and crispness. The increasing popularity of single-serving and convenience snacks further fuels demand. The market size for adhesives in this application is estimated to be over $1.5 billion annually.

- Frozen Foods: Adhesives in this segment must withstand low temperatures and freezer burn, ensuring the integrity of frozen food packaging. The growth of the frozen food market, driven by convenience and longer shelf life, directly translates to higher adhesive consumption.

- Dehydrated Foods and Beverages: This segment requires adhesives with excellent moisture barrier properties to prevent spoilage. The rising demand for ready-to-eat meals and convenient beverage options contributes to the growth of this segment. Market penetration of specialized adhesives here is projected at 60% by 2028.

- Dairy Products: Adhesives for dairy packaging need to ensure product safety and extend shelf life, often requiring specific regulatory compliance. The increasing consumption of yogurt, cheese, and milk-based beverages supports the demand in this segment.

- Others: This broad category encompasses various niche applications, including confectionery, pet food, and ready-to-cook meals, each with its unique adhesive requirements.

Type Segments:

- Solvent Based Adhesives: While historically dominant, these are gradually declining due to environmental concerns, though they still hold a significant share for specific high-performance applications where fast curing and strong adhesion are paramount. Their market share is projected to decrease from 40% in 2025 to 25% by 2033.

- Solvent-free Adhesives: This segment is experiencing rapid growth, driven by environmental regulations and consumer demand for sustainable packaging. Their ease of use, high performance, and reduced VOC emissions make them a preferred choice. The market share of solvent-free adhesives is projected to rise from 45% in 2025 to 65% by 2033, representing a significant market opportunity. The projected market size for this segment is over $5 billion by 2033.

- Water Based Adhesives: Gaining traction as an eco-friendly alternative, water-based adhesives are particularly suitable for applications where lower bond strengths are acceptable and environmental compliance is critical. Their market share is expected to grow steadily, reaching 20% by 2033.

Flexible Laminating Adhesives For Food Packaging Product Innovations

Product innovations in flexible laminating adhesives for food packaging are primarily focused on enhancing sustainability, improving performance, and meeting evolving regulatory demands. Key developments include the introduction of high-performance solvent-free adhesives with faster cure speeds and improved adhesion to a wider range of substrates, including recyclable films. Advancements in water-based adhesives are also notable, offering competitive performance with significantly reduced environmental impact. Furthermore, the development of specialty laminating adhesives with enhanced barrier properties against oxygen, moisture, and UV light is crucial for extending the shelf life of sensitive food products. These innovations provide competitive advantages by enabling manufacturers to offer more sustainable, cost-effective, and high-performing packaging solutions.

Report Segmentation & Scope

This report segments the flexible laminating adhesives for food packaging market based on key application and adhesive type categories. The scope encompasses a comprehensive analysis of market size, growth projections, and competitive dynamics within each segment.

- Application: The market is analyzed across Biscuits, Chips and Snacks, Frozen Foods, Dehydrated Foods and Beverages, Dairy Products, and Others. Each application segment is evaluated for its specific adhesive requirements, market size, and projected growth, with an estimated market size for Biscuits, Chips and Snacks alone projected to reach $1.8 billion by 2033.

- Type: The report meticulously categorizes the market into Solvent Based Adhesives, Solvent-free Adhesives, and Water Based Adhesives. Detailed analyses of market share, growth rates, and competitive landscapes for each type are provided, with Solvent-free Adhesives projected to exhibit a CAGR of 7.2%.

Key Drivers of Flexible Laminating Adhesives For Food Packaging Growth

The growth of the flexible laminating adhesives for food packaging market is propelled by several key factors. The burgeoning global demand for packaged foods, driven by population growth and urbanization, creates a consistent need for effective food packaging adhesive solutions. Evolving consumer preferences for convenience and longer shelf-life products necessitate advanced laminating adhesives for food applications that offer superior barrier properties. Furthermore, stringent environmental regulations, particularly concerning VOC emissions, are driving the adoption of solvent-free adhesives and water-based adhesives, representing a significant growth opportunity. Technological advancements in adhesive formulations, leading to improved performance, faster processing, and enhanced sustainability, also play a crucial role.

Challenges in the Flexible Laminating Adhesives For Food Packaging Sector

Despite robust growth, the flexible laminating adhesives for food packaging sector faces several challenges. Regulatory hurdles related to food contact safety and sustainability can impact product development timelines and market access. Volatility in raw material prices, particularly for petrochemical derivatives, can affect production costs and profit margins. Supply chain disruptions, exacerbated by geopolitical events and global economic uncertainties, pose a risk to consistent product availability. Intense competitive pressures from both established players and emerging entrants can lead to price erosion and the need for continuous innovation. Quantifiable impacts include potential cost increases of up to 15% due to raw material price fluctuations and extended lead times of 20% during severe supply chain disruptions.

Leading Players in the Flexible Laminating Adhesives For Food Packaging Market

- Henkel

- Bostik

- H.B. Fuller

- Ashland

- Arkema

- 3M

- Vimasco Corporation

- Sika Automotive

- Coim

- Flint Group

- Toyo-Morton

- DIC Corporation

- Huber Group

- Comens Material

- China Neweast

- Jiangsu Lihe

- Morchem SA

- Shanghai Kangda

- Brilliant Polymers

- Sungdo

- UFlex

- Rockpaint

- Mitsui Chemicals

- Sapicci

- Wanhua

Key Developments in Flexible Laminating Adhesives For Food Packaging Sector

- 2024: Launch of a new range of high-barrier solvent-free adhesives by Henkel, offering enhanced protection for sensitive food products.

- 2023: Bostik acquired a leading provider of specialty adhesives, strengthening its flexible packaging adhesive portfolio.

- 2023: H.B. Fuller introduced innovative water-based adhesives with improved recyclability features for food packaging.

- 2022: Arkema developed advanced polyurethane-based laminating adhesives with superior adhesion to bio-based films.

- 2022: 3M unveiled new solvent-free adhesive solutions designed for retort pouch applications, enhancing durability and food safety.

- 2021: Flint Group expanded its food packaging adhesive offerings with a focus on sustainable and recyclable solutions.

- 2021: Toyo-Morton launched a new generation of high-speed curing adhesives for the demanding flexible packaging market.

- 2020: DIC Corporation focused on developing bio-based laminating adhesives to reduce environmental footprint.

- 2019: Huber Group invested significantly in R&D for next-generation food packaging adhesives.

Strategic Flexible Laminating Adhesives For Food Packaging Market Outlook

The strategic outlook for the flexible laminating adhesives for food packaging market is highly positive, driven by sustained demand for packaged foods and a strong push towards sustainable solutions. Key growth accelerators include the ongoing development and adoption of solvent-free and water-based adhesives, which align with global environmental mandates and consumer preferences. Manufacturers who invest in R&D to create high-performance, sustainable, and cost-effective food packaging adhesive solutions will be well-positioned for success. Strategic opportunities lie in expanding market reach in emerging economies, fostering collaborations across the value chain, and developing specialized adhesives for niche applications such as medical food packaging and high-barrier flexible pouches. The market is expected to witness continued innovation, with a focus on recyclability, compostability, and enhanced product protection, ensuring its continued relevance and growth.

Flexible Laminating Adhesives For Food Packaging Segmentation

-

1. Application

- 1.1. Biscuits, Chips and Snacks

- 1.2. Frozen Foods

- 1.3. Dehydrated Foods and Beverages

- 1.4. Dairy Products

- 1.5. Others

-

2. Type

- 2.1. Solvent Based Adhesives

- 2.2. Solvent-free Adhesives

- 2.3. Water Based Adhesives

Flexible Laminating Adhesives For Food Packaging Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Flexible Laminating Adhesives For Food Packaging REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Flexible Laminating Adhesives For Food Packaging Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Biscuits, Chips and Snacks

- 5.1.2. Frozen Foods

- 5.1.3. Dehydrated Foods and Beverages

- 5.1.4. Dairy Products

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Solvent Based Adhesives

- 5.2.2. Solvent-free Adhesives

- 5.2.3. Water Based Adhesives

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Flexible Laminating Adhesives For Food Packaging Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Biscuits, Chips and Snacks

- 6.1.2. Frozen Foods

- 6.1.3. Dehydrated Foods and Beverages

- 6.1.4. Dairy Products

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Solvent Based Adhesives

- 6.2.2. Solvent-free Adhesives

- 6.2.3. Water Based Adhesives

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Flexible Laminating Adhesives For Food Packaging Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Biscuits, Chips and Snacks

- 7.1.2. Frozen Foods

- 7.1.3. Dehydrated Foods and Beverages

- 7.1.4. Dairy Products

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Solvent Based Adhesives

- 7.2.2. Solvent-free Adhesives

- 7.2.3. Water Based Adhesives

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Flexible Laminating Adhesives For Food Packaging Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Biscuits, Chips and Snacks

- 8.1.2. Frozen Foods

- 8.1.3. Dehydrated Foods and Beverages

- 8.1.4. Dairy Products

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Solvent Based Adhesives

- 8.2.2. Solvent-free Adhesives

- 8.2.3. Water Based Adhesives

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Flexible Laminating Adhesives For Food Packaging Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Biscuits, Chips and Snacks

- 9.1.2. Frozen Foods

- 9.1.3. Dehydrated Foods and Beverages

- 9.1.4. Dairy Products

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Solvent Based Adhesives

- 9.2.2. Solvent-free Adhesives

- 9.2.3. Water Based Adhesives

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Flexible Laminating Adhesives For Food Packaging Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Biscuits, Chips and Snacks

- 10.1.2. Frozen Foods

- 10.1.3. Dehydrated Foods and Beverages

- 10.1.4. Dairy Products

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Solvent Based Adhesives

- 10.2.2. Solvent-free Adhesives

- 10.2.3. Water Based Adhesives

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Henkel

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bostik

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 H.B. Fuller

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ashland

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Arkema

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 3M

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Vimasco Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sika Automotive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Coim

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Flint Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Toyo-Morton

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 DIC Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Huber Group

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Comens Material

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 China Neweast

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Jiangsu Lihe

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Morchem SA

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Shanghai Kangda

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Brilliant Polymers

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Sungdo

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 UFlex

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Rockpaint

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Mitsui Chemicals

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Sapicci

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Wanhua

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.1 Henkel

List of Figures

- Figure 1: Global Flexible Laminating Adhesives For Food Packaging Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Flexible Laminating Adhesives For Food Packaging Revenue (million), by Application 2024 & 2032

- Figure 3: North America Flexible Laminating Adhesives For Food Packaging Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Flexible Laminating Adhesives For Food Packaging Revenue (million), by Type 2024 & 2032

- Figure 5: North America Flexible Laminating Adhesives For Food Packaging Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Flexible Laminating Adhesives For Food Packaging Revenue (million), by Country 2024 & 2032

- Figure 7: North America Flexible Laminating Adhesives For Food Packaging Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Flexible Laminating Adhesives For Food Packaging Revenue (million), by Application 2024 & 2032

- Figure 9: South America Flexible Laminating Adhesives For Food Packaging Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Flexible Laminating Adhesives For Food Packaging Revenue (million), by Type 2024 & 2032

- Figure 11: South America Flexible Laminating Adhesives For Food Packaging Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Flexible Laminating Adhesives For Food Packaging Revenue (million), by Country 2024 & 2032

- Figure 13: South America Flexible Laminating Adhesives For Food Packaging Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Flexible Laminating Adhesives For Food Packaging Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Flexible Laminating Adhesives For Food Packaging Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Flexible Laminating Adhesives For Food Packaging Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Flexible Laminating Adhesives For Food Packaging Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Flexible Laminating Adhesives For Food Packaging Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Flexible Laminating Adhesives For Food Packaging Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Flexible Laminating Adhesives For Food Packaging Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Flexible Laminating Adhesives For Food Packaging Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Flexible Laminating Adhesives For Food Packaging Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Flexible Laminating Adhesives For Food Packaging Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Flexible Laminating Adhesives For Food Packaging Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Flexible Laminating Adhesives For Food Packaging Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Flexible Laminating Adhesives For Food Packaging Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Flexible Laminating Adhesives For Food Packaging Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Flexible Laminating Adhesives For Food Packaging Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Flexible Laminating Adhesives For Food Packaging Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Flexible Laminating Adhesives For Food Packaging Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Flexible Laminating Adhesives For Food Packaging Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Flexible Laminating Adhesives For Food Packaging Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Flexible Laminating Adhesives For Food Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Flexible Laminating Adhesives For Food Packaging Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Flexible Laminating Adhesives For Food Packaging Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Flexible Laminating Adhesives For Food Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Flexible Laminating Adhesives For Food Packaging Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Flexible Laminating Adhesives For Food Packaging Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Flexible Laminating Adhesives For Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Flexible Laminating Adhesives For Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Flexible Laminating Adhesives For Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Flexible Laminating Adhesives For Food Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Flexible Laminating Adhesives For Food Packaging Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Flexible Laminating Adhesives For Food Packaging Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Flexible Laminating Adhesives For Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Flexible Laminating Adhesives For Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Flexible Laminating Adhesives For Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Flexible Laminating Adhesives For Food Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Flexible Laminating Adhesives For Food Packaging Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Flexible Laminating Adhesives For Food Packaging Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Flexible Laminating Adhesives For Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Flexible Laminating Adhesives For Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Flexible Laminating Adhesives For Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Flexible Laminating Adhesives For Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Flexible Laminating Adhesives For Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Flexible Laminating Adhesives For Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Flexible Laminating Adhesives For Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Flexible Laminating Adhesives For Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Flexible Laminating Adhesives For Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Flexible Laminating Adhesives For Food Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Flexible Laminating Adhesives For Food Packaging Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Flexible Laminating Adhesives For Food Packaging Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Flexible Laminating Adhesives For Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Flexible Laminating Adhesives For Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Flexible Laminating Adhesives For Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Flexible Laminating Adhesives For Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Flexible Laminating Adhesives For Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Flexible Laminating Adhesives For Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Flexible Laminating Adhesives For Food Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Flexible Laminating Adhesives For Food Packaging Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Flexible Laminating Adhesives For Food Packaging Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Flexible Laminating Adhesives For Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Flexible Laminating Adhesives For Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Flexible Laminating Adhesives For Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Flexible Laminating Adhesives For Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Flexible Laminating Adhesives For Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Flexible Laminating Adhesives For Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Flexible Laminating Adhesives For Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Flexible Laminating Adhesives For Food Packaging?

The projected CAGR is approximately 5%.

2. Which companies are prominent players in the Flexible Laminating Adhesives For Food Packaging?

Key companies in the market include Henkel, Bostik, H.B. Fuller, Ashland, Arkema, 3M, Vimasco Corporation, Sika Automotive, Coim, Flint Group, Toyo-Morton, DIC Corporation, Huber Group, Comens Material, China Neweast, Jiangsu Lihe, Morchem SA, Shanghai Kangda, Brilliant Polymers, Sungdo, UFlex, Rockpaint, Mitsui Chemicals, Sapicci, Wanhua.

3. What are the main segments of the Flexible Laminating Adhesives For Food Packaging?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 5681 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Flexible Laminating Adhesives For Food Packaging," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Flexible Laminating Adhesives For Food Packaging report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Flexible Laminating Adhesives For Food Packaging?

To stay informed about further developments, trends, and reports in the Flexible Laminating Adhesives For Food Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence