Key Insights

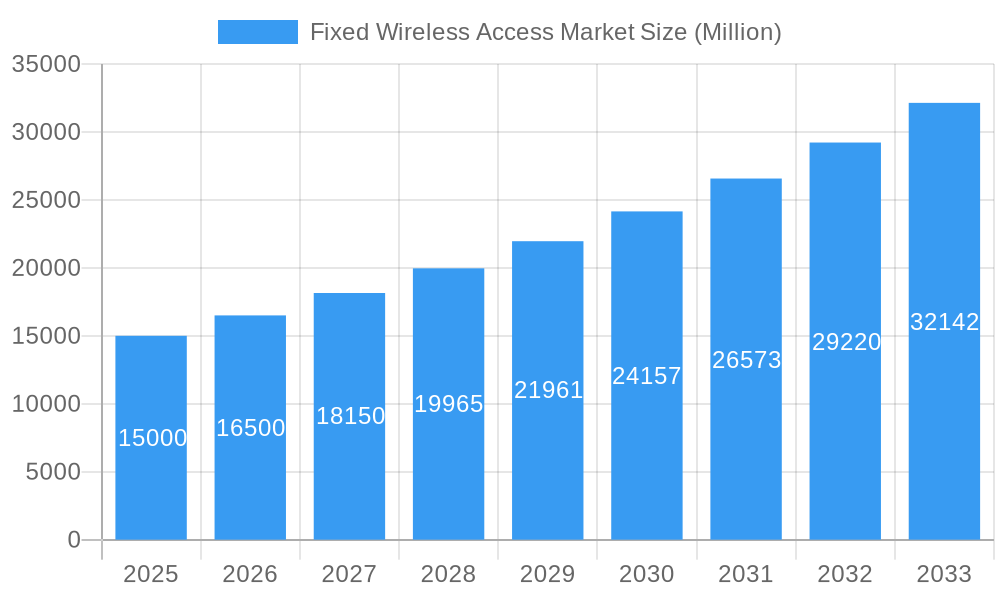

The Fixed Wireless Access (FWA) market is experiencing accelerated expansion, driven by the escalating global demand for high-speed internet in residential and commercial environments. The market is projected to reach $183.78 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 26.7%. This growth is propelled by the widespread adoption of 5G and advanced wireless technologies, delivering superior speed and reduced latency compared to traditional wired solutions, especially in underserved regions. The proliferation of smart devices and bandwidth-intensive applications, such as high-definition video streaming and online gaming, further fuels this demand. Key market segments include hardware (femtocells, picocells), access units, and services. While residential applications currently lead, commercial and industrial sectors present substantial growth potential. Leading industry players, including AT&T, Ericsson, Samsung, and Verizon, are significantly investing in FWA infrastructure and service innovation, fostering a competitive and dynamic market landscape. Despite challenges like regulatory complexities and infrastructure development, the FWA market's trajectory is overwhelmingly positive, supported by continuous technological advancements and the universal need for reliable, high-speed internet.

Fixed Wireless Access Market Market Size (In Billion)

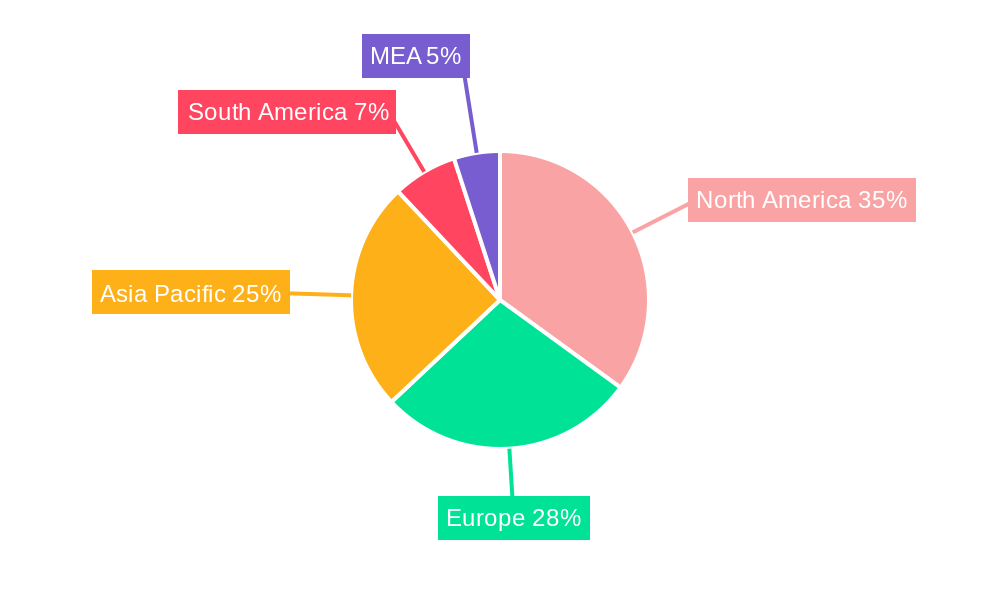

Geographically, the FWA market demonstrates significant penetration across North America, Europe, and Asia Pacific. North America currently leads in market share due to early adoption of advanced wireless technologies and a robust telecom infrastructure. However, Asia Pacific is poised for rapid expansion, driven by increasing internet penetration in emerging economies such as India and China. Europe shows consistent growth, supported by government-led digital connectivity initiatives and 5G network deployment. South America, the Middle East, and Africa are also expected to experience growth, albeit at a potentially slower pace, influenced by infrastructure constraints and varying economic development. Enhancing network coverage, ensuring affordability, and bridging the digital divide will be crucial for sustained growth in these regions. The FWA market offers substantial opportunities for both established and emerging players, with its future shaped by technological evolution and the relentless global demand for seamless connectivity.

Fixed Wireless Access Market Company Market Share

Fixed Wireless Access Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Fixed Wireless Access (FWA) market, offering valuable insights for stakeholders across the value chain. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers actionable intelligence for strategic decision-making. The report meticulously covers market sizing, segmentation, competitive dynamics, technological advancements, and future growth projections, utilizing data from the historical period (2019-2024) and estimates for 2025.

Fixed Wireless Access Market Market Structure & Competitive Dynamics

The Fixed Wireless Access market exhibits a moderately concentrated structure, with key players like AT&T Inc, Verizon Communications Inc, and Nokia Corporation holding significant market share. The market is characterized by intense competition driven by continuous innovation, particularly in 5G technology. Regulatory frameworks, varying across regions, significantly impact market dynamics. The emergence of 5G has spurred considerable M&A activity, with deals valued at an estimated xx Million in 2024. Product substitution from traditional wired broadband is a key factor influencing market growth. End-user trends indicate a growing preference for high-speed, reliable internet access, fueling demand for FWA solutions, particularly in underserved rural and suburban areas.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Innovation Ecosystems: Robust, driven by advancements in 5G, antenna technology, and spectrum efficiency.

- Regulatory Frameworks: Vary across geographies, impacting spectrum allocation and deployment strategies.

- Product Substitutes: Traditional wired broadband remains a primary competitor.

- End-User Trends: Increasing demand for high-speed internet, especially in underserved areas.

- M&A Activity: Significant activity observed, with estimated deal values of xx Million in 2024.

Fixed Wireless Access Market Industry Trends & Insights

The Fixed Wireless Access market is experiencing robust growth, driven by the increasing adoption of 5G technology and the expansion of network coverage into underserved regions. The market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors: the growing demand for high-speed internet access across residential, commercial, and industrial sectors, increasing investments in infrastructure development, and government initiatives promoting broadband penetration. Technological disruptions, such as the introduction of advanced antenna technologies and improved spectrum utilization techniques, are further accelerating market growth. Consumer preferences are shifting towards more flexible and cost-effective internet access solutions, benefiting the FWA market. However, competitive intensity, particularly from existing wired broadband providers, remains a challenge. Market penetration is expected to reach xx% by 2033.

Dominant Markets & Segments in Fixed Wireless Access Market

The North American region is currently the dominant market for Fixed Wireless Access, driven by robust infrastructure investments and increasing demand for high-speed internet connectivity. Within the segments:

- By Type: The Hardware segment holds the largest market share, driven by the continuous demand for advanced access units and network infrastructure. The Services segment is expected to experience significant growth driven by managed services and increased demand for reliable connectivity.

- By Application: The Residential segment is currently the leading application segment, however, the Commercial and Industrial sectors are witnessing substantial growth driven by the rising need for reliable high-speed internet access.

Key Drivers for North American Dominance:

- Significant investments in 5G infrastructure.

- Government initiatives promoting broadband expansion in rural areas.

- High consumer adoption rate of advanced technologies.

Fixed Wireless Access Market Product Innovations

Recent innovations in Fixed Wireless Access focus on improving speed, coverage, and reliability. The introduction of 5G-based solutions with high-gain antennas, as exemplified by Nokia's FastMile 5G receiver, significantly enhances performance in suburban and rural areas. These advancements are aimed at addressing the challenges of delivering high-speed internet to underserved communities, increasing market penetration, and creating competitive advantages.

Report Segmentation & Scope

This report provides a granular segmentation of the Fixed Wireless Access market:

- By Type: Hardware (including access units like Femtocells and Picocells) and Services (installation, maintenance, support). The Hardware segment is expected to grow at a CAGR of xx% during the forecast period, while the Services segment is projected to grow at a CAGR of xx%.

- By Application: Residential, Commercial, and Industrial. Residential currently dominates, but the Commercial and Industrial segments are experiencing faster growth rates due to the increasing demand for reliable, high-speed internet for business operations and industrial automation.

Key Drivers of Fixed Wireless Access Market Growth

Several factors are driving the growth of the Fixed Wireless Access market: the increasing demand for high-speed internet, especially in underserved areas, coupled with advancements in 5G technology providing greater bandwidth and coverage. Government initiatives promoting digital infrastructure development and favorable regulatory policies in many regions also contribute significantly. Finally, the affordability and ease of deployment compared to traditional wired solutions are major factors in the market's expansion.

Challenges in the Fixed Wireless Access Market Sector

Challenges include the cost of deploying and maintaining infrastructure, particularly in remote locations. Competition from traditional wired broadband providers and potential spectrum allocation limitations also pose significant obstacles. Furthermore, ensuring consistent service quality and overcoming interference issues can be challenging, especially in densely populated areas. These factors may restrain market growth to some degree.

Leading Players in the Fixed Wireless Access Market Market

Key Developments in Fixed Wireless Access Market Sector

- June 2023: Nokia launched the FastMile 5G receiver for the North American market, expanding high-speed internet access to underserved areas.

- December 2022: NBN Co Limited and Ericsson partnered for a 10-year agreement to upgrade Australia's fixed wireless access network using 5G technology.

Strategic Fixed Wireless Access Market Market Outlook

The Fixed Wireless Access market presents significant growth opportunities, driven by continuous technological advancements, increasing demand for high-speed internet, and government initiatives. Strategic partnerships, focused R&D, and expansion into emerging markets will be crucial for companies to capitalize on the market's potential and maintain a competitive edge. The focus on providing cost-effective and reliable solutions for underserved communities will be critical for future success.

Fixed Wireless Access Market Segmentation

-

1. Type

-

1.1. Hardware

- 1.1.1. Consumer Premise Equipment (CPE)

- 1.1.2. Access units (Femto & Picocells)

- 1.2. Services

-

1.1. Hardware

-

2. Application

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

Fixed Wireless Access Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Fixed Wireless Access Market Regional Market Share

Geographic Coverage of Fixed Wireless Access Market

Fixed Wireless Access Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 26.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for High-speed Data Connectivity Through Advanced Technologies; Strategic Collaborations Between Various Stakeholders in the 5G Industry to Drive Adoption

- 3.3. Market Restrains

- 3.3.1. ; High Infrastructure Setup Cost During the Initial Rollout Phase; Lack of User Handheld Devices Compatible to 5 GNR Infrastructure

- 3.4. Market Trends

- 3.4.1. Residential Segment Expected to Depict the Maximum Application

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fixed Wireless Access Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.1.1. Consumer Premise Equipment (CPE)

- 5.1.1.2. Access units (Femto & Picocells)

- 5.1.2. Services

- 5.1.1. Hardware

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Fixed Wireless Access Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Hardware

- 6.1.1.1. Consumer Premise Equipment (CPE)

- 6.1.1.2. Access units (Femto & Picocells)

- 6.1.2. Services

- 6.1.1. Hardware

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.2.3. Industrial

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Fixed Wireless Access Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Hardware

- 7.1.1.1. Consumer Premise Equipment (CPE)

- 7.1.1.2. Access units (Femto & Picocells)

- 7.1.2. Services

- 7.1.1. Hardware

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.2.3. Industrial

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Fixed Wireless Access Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Hardware

- 8.1.1.1. Consumer Premise Equipment (CPE)

- 8.1.1.2. Access units (Femto & Picocells)

- 8.1.2. Services

- 8.1.1. Hardware

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.2.3. Industrial

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Fixed Wireless Access Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Hardware

- 9.1.1.1. Consumer Premise Equipment (CPE)

- 9.1.1.2. Access units (Femto & Picocells)

- 9.1.2. Services

- 9.1.1. Hardware

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.2.3. Industrial

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 AT & T Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Telefonaktiebolaget LM Ericsson

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Samsung Electronics Co Ltd*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Verizon Communications Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Siklu Communication Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Qualcomm Technologies

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Arqiva (UK)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Nokia Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Huawei Technologies Co Limited

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Airspan Networks Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 AT & T Inc

List of Figures

- Figure 1: Global Fixed Wireless Access Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Fixed Wireless Access Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Fixed Wireless Access Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Fixed Wireless Access Market Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Fixed Wireless Access Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Fixed Wireless Access Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Fixed Wireless Access Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Fixed Wireless Access Market Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Fixed Wireless Access Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Fixed Wireless Access Market Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe Fixed Wireless Access Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Fixed Wireless Access Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Fixed Wireless Access Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Fixed Wireless Access Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Fixed Wireless Access Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Fixed Wireless Access Market Revenue (billion), by Application 2025 & 2033

- Figure 17: Asia Pacific Fixed Wireless Access Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Fixed Wireless Access Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Fixed Wireless Access Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Fixed Wireless Access Market Revenue (billion), by Type 2025 & 2033

- Figure 21: Rest of the World Fixed Wireless Access Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Rest of the World Fixed Wireless Access Market Revenue (billion), by Application 2025 & 2033

- Figure 23: Rest of the World Fixed Wireless Access Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Rest of the World Fixed Wireless Access Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of the World Fixed Wireless Access Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Fixed Wireless Access Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Fixed Wireless Access Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Fixed Wireless Access Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Fixed Wireless Access Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Fixed Wireless Access Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Fixed Wireless Access Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Fixed Wireless Access Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global Fixed Wireless Access Market Revenue billion Forecast, by Application 2020 & 2033

- Table 9: Global Fixed Wireless Access Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Fixed Wireless Access Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Fixed Wireless Access Market Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global Fixed Wireless Access Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Fixed Wireless Access Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Fixed Wireless Access Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Global Fixed Wireless Access Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fixed Wireless Access Market?

The projected CAGR is approximately 26.7%.

2. Which companies are prominent players in the Fixed Wireless Access Market?

Key companies in the market include AT & T Inc, Telefonaktiebolaget LM Ericsson, Samsung Electronics Co Ltd*List Not Exhaustive, Verizon Communications Inc, Siklu Communication Limited, Qualcomm Technologies, Arqiva (UK), Nokia Corporation, Huawei Technologies Co Limited, Airspan Networks Inc.

3. What are the main segments of the Fixed Wireless Access Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 183.78 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for High-speed Data Connectivity Through Advanced Technologies; Strategic Collaborations Between Various Stakeholders in the 5G Industry to Drive Adoption.

6. What are the notable trends driving market growth?

Residential Segment Expected to Depict the Maximum Application.

7. Are there any restraints impacting market growth?

; High Infrastructure Setup Cost During the Initial Rollout Phase; Lack of User Handheld Devices Compatible to 5 GNR Infrastructure.

8. Can you provide examples of recent developments in the market?

June 2023: Nokia announced the launch of a fixed wireless access receiver for the North American market named FastMile 5G receiver. This receiver uses a high-gain antenna that delivers high-speed internet to suburban and rural underserved communities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fixed Wireless Access Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fixed Wireless Access Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fixed Wireless Access Market?

To stay informed about further developments, trends, and reports in the Fixed Wireless Access Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence