Key Insights

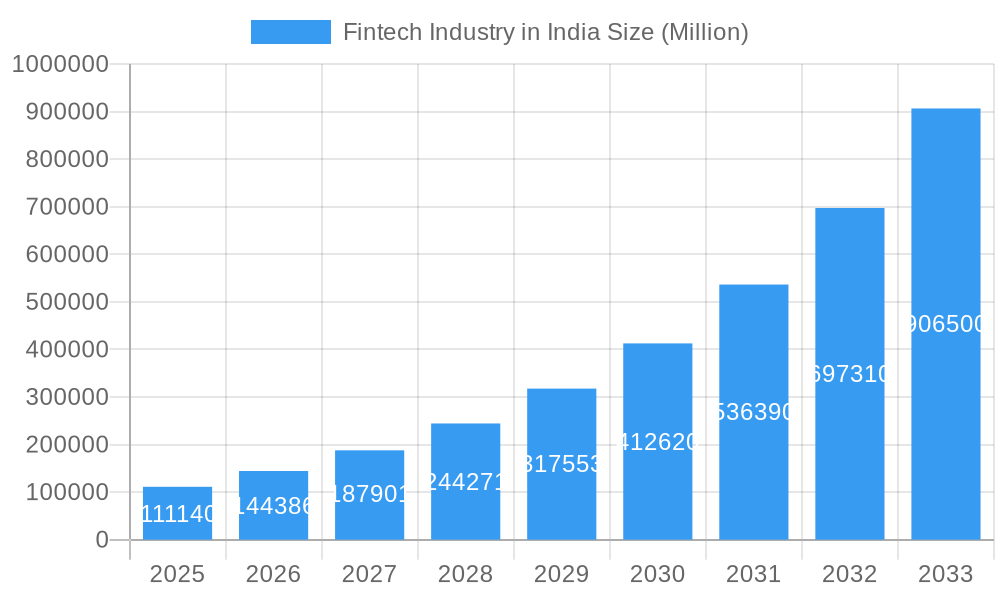

The Indian Fintech industry is experiencing explosive growth, projected to reach a market size of $111.14 billion in 2025 and exhibiting a remarkable Compound Annual Growth Rate (CAGR) of 30.55%. This surge is driven by several key factors. Increasing smartphone penetration and internet access across diverse demographics have fueled a massive adoption of digital payment systems and financial services. Government initiatives promoting digitalization, such as the Unified Payments Interface (UPI), have further accelerated this growth. Furthermore, the burgeoning startup ecosystem is constantly innovating with new products and services catering to underserved populations, creating a highly competitive yet dynamic market. The rise of Buy Now Pay Later (BNPL) schemes and the expanding use of embedded finance within various sectors are also significant contributors. This growth is not uniform across all segments; while digital payments are mature, areas like insurtech and wealthtech are showing significant potential for future expansion. The dominance of major players like Paytm, PhonePe, and PolicyBazaar indicates a consolidation trend, although smaller niche players also continue to find success.

Fintech Industry in India Market Size (In Billion)

Challenges remain, however. Regulatory hurdles, data security concerns, and the need for robust financial literacy programs to ensure inclusive growth continue to be important considerations. The industry also faces the constant challenge of adapting to evolving technological advancements and consumer preferences. Despite these challenges, the long-term outlook for the Indian Fintech sector remains exceptionally positive, with continued expansion expected throughout the forecast period (2025-2033). The industry is poised to significantly reshape the Indian financial landscape, driving financial inclusion and fostering economic development.

Fintech Industry in India Company Market Share

Fintech Industry in India: A Comprehensive Market Report (2019-2033)

This exhaustive report provides a deep dive into the dynamic Indian Fintech landscape, analyzing market structure, competitive dynamics, key players, and future growth prospects. Spanning the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this report offers invaluable insights for investors, industry professionals, and strategic decision-makers. The study encompasses a market size of xx Million in the estimated year 2025, with projections reaching xx Million by 2033. Key segments analyzed include payments, lending, and wealth management, with a focus on leading players like Paytm, PhonePe, Policy Bazaar, and more.

Fintech Industry in India Market Structure & Competitive Dynamics

The Indian Fintech market exhibits a complex interplay of established players and disruptive startups. Market concentration is moderate, with a few dominant players capturing significant market share, while numerous smaller players cater to niche segments. The regulatory framework, while evolving, plays a crucial role in shaping market dynamics. The rapid pace of innovation and technological advancements fuels intense competition, leading to frequent mergers and acquisitions (M&A) activity.

- Market Concentration: Paytm and PhonePe hold significant market share in digital payments, while players like Policy Bazaar dominate the insurance sector. The overall market concentration is estimated at xx%, with the top 5 players controlling approximately xx% of the market.

- Innovation Ecosystems: India boasts a thriving startup ecosystem, with numerous Fintech incubators and accelerators fostering innovation. The government's initiatives to promote digitalization have further fueled this growth.

- Regulatory Frameworks: The Reserve Bank of India (RBI) and other regulatory bodies actively shape the regulatory landscape, influencing product development, compliance, and market access. Recent regulatory changes have focused on data security and consumer protection.

- M&A Activity: The Fintech sector witnesses frequent M&A activity, driven by strategic expansion, technological integration, and market consolidation. Recent examples include the acquisition of CreditVidya by CRED (November 2022), although the exact deal value remains undisclosed. The total value of M&A deals in the Fintech sector during the study period is estimated at xx Million.

- Product Substitutes: Traditional financial institutions continue to offer competing services, although the Fintech sector is gradually gaining market share due to its convenience and accessibility.

- End-User Trends: The increasing adoption of smartphones and internet penetration is a key driver of Fintech growth in India. Consumers are increasingly seeking digital financial solutions that offer convenience, transparency, and cost-effectiveness.

Fintech Industry in India Industry Trends & Insights

The Indian Fintech industry is experiencing exponential growth, driven by several factors. Technological advancements, particularly in mobile payments and AI, are disrupting traditional financial services. Shifting consumer preferences towards digital solutions, coupled with supportive government policies, further fuel this expansion. The industry exhibits a high Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by increased smartphone penetration, rising internet usage, and financial inclusion initiatives. Market penetration in key segments is projected to reach xx% by 2033. Competitive dynamics remain intense, with continuous innovation and strategic partnerships shaping the industry landscape. The rise of super-apps offering integrated financial services is also a significant trend to watch. The increasing focus on embedded finance further integrates financial services within various non-financial platforms, expanding market reach. Challenges such as regulatory hurdles and cybersecurity concerns persist, but the overall outlook remains positive.

Dominant Markets & Segments in Fintech Industry in India

The Indian Fintech market demonstrates robust growth across various regions and segments. While urban areas exhibit higher penetration, rural regions are witnessing rapid adoption, driven by government initiatives promoting financial inclusion. The digital payments segment dominates, followed by lending and wealth management.

- Key Drivers of Dominance:

- Favorable Demographics: A large young population with high smartphone penetration fuels the demand for digital financial services.

- Government Initiatives: Policies promoting digitalization and financial inclusion create a conducive environment for Fintech growth.

- Technological Advancements: Innovation in mobile payments, AI, and blockchain technology enhances efficiency and access.

- Infrastructure Development: Improvements in digital infrastructure, including internet connectivity and mobile networks, support widespread adoption.

The dominance of the digital payments segment is primarily due to factors such as affordability, accessibility, and convenience. Lending and wealth management segments also show substantial growth potential.

Fintech Industry in India Product Innovations

The Indian Fintech sector is witnessing continuous product innovation. New payment solutions leveraging UPI (Unified Payments Interface) are gaining traction, while lending platforms are employing advanced credit scoring models and AI-powered risk assessment. Wealth management platforms are offering personalized investment advice and robo-advisory services. The focus is on user-friendly interfaces, personalized experiences, and seamless integration with other digital platforms. These innovations enhance convenience, efficiency, and accessibility, driving wider adoption.

Report Segmentation & Scope

This report segments the Indian Fintech market based on product type (payments, lending, wealth management, etc.), user type (individuals, businesses), and deployment mode (mobile, web, etc.). Growth projections, market sizes, and competitive dynamics are analyzed for each segment. The payment segment holds the largest market share, followed by lending and wealth management. The growth of each segment is influenced by unique factors – the payment segment thrives on UPI adoption, while the lending segment hinges on credit scoring models and regulations.

Key Drivers of Fintech Industry in India Growth

Several key factors fuel the growth of the Indian Fintech industry. Technological advancements, including mobile payments and AI-powered solutions, are driving innovation and efficiency. Government initiatives promoting digitalization and financial inclusion are creating a favorable regulatory environment. Increasing smartphone penetration and internet access are expanding the potential customer base. Furthermore, the changing consumer preferences toward convenience and digital solutions are driving the adoption of Fintech services. The favorable demographic profile of India, with a large young population, contributes significantly to the industry's growth potential.

Challenges in the Fintech Industry in India Sector

Despite its impressive growth, the Indian Fintech sector faces several challenges. Regulatory uncertainty and evolving compliance requirements can hinder innovation and investment. Cybersecurity threats and data privacy concerns represent significant risks. Competition from established players and the emergence of new entrants create a dynamic and challenging competitive landscape. Addressing these challenges requires collaboration between Fintech companies, regulators, and other stakeholders. The estimated cost of addressing cybersecurity threats alone is projected at xx Million annually.

Key Developments in Fintech Industry in India Sector

- September 2023: PayU partnered with WhatsApp to enhance the Indian purchasing experience, potentially expanding its user base significantly.

- November 2022: CRED acquired CreditVidya, a Hyderabad-based SaaS company, in a deal involving cash and stock. The acquisition highlights CRED's strategic expansion into credit scoring and risk assessment.

Strategic Fintech Industry in India Market Outlook

The Indian Fintech market holds immense potential for future growth. Continued technological advancements, increasing digital adoption, and supportive government policies are expected to drive further expansion. Strategic opportunities lie in leveraging emerging technologies like AI and blockchain, expanding into underserved markets, and developing innovative financial products tailored to specific consumer needs. The focus on financial inclusion and the potential for cross-border payments will shape the future of the sector. The market is poised for continued growth, with projections indicating a significant expansion in market size and penetration over the forecast period.

Fintech Industry in India Segmentation

-

1. Service Proposition

- 1.1. Money Transfer and Payments

- 1.2. Savings and Investments

- 1.3. Digital Lending and Lending Marketplaces

- 1.4. Online Insurance and Insurance Marketplaces

-

2. Application

- 2.1. E-Commerce

- 2.2. Utilities

- 2.3. Travel

Fintech Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Fintech Industry in India Regional Market Share

Geographic Coverage of Fintech Industry in India

Fintech Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 30.55% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Digital Services; Rapid Advancement in Technology is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Increasing Demand for Digital Services; Rapid Advancement in Technology is Driving the Market

- 3.4. Market Trends

- 3.4.1. Increase in Mobile Banking Payments is Surging the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fintech Industry in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Proposition

- 5.1.1. Money Transfer and Payments

- 5.1.2. Savings and Investments

- 5.1.3. Digital Lending and Lending Marketplaces

- 5.1.4. Online Insurance and Insurance Marketplaces

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. E-Commerce

- 5.2.2. Utilities

- 5.2.3. Travel

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service Proposition

- 6. North America Fintech Industry in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Proposition

- 6.1.1. Money Transfer and Payments

- 6.1.2. Savings and Investments

- 6.1.3. Digital Lending and Lending Marketplaces

- 6.1.4. Online Insurance and Insurance Marketplaces

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. E-Commerce

- 6.2.2. Utilities

- 6.2.3. Travel

- 6.1. Market Analysis, Insights and Forecast - by Service Proposition

- 7. South America Fintech Industry in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Proposition

- 7.1.1. Money Transfer and Payments

- 7.1.2. Savings and Investments

- 7.1.3. Digital Lending and Lending Marketplaces

- 7.1.4. Online Insurance and Insurance Marketplaces

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. E-Commerce

- 7.2.2. Utilities

- 7.2.3. Travel

- 7.1. Market Analysis, Insights and Forecast - by Service Proposition

- 8. Europe Fintech Industry in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Proposition

- 8.1.1. Money Transfer and Payments

- 8.1.2. Savings and Investments

- 8.1.3. Digital Lending and Lending Marketplaces

- 8.1.4. Online Insurance and Insurance Marketplaces

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. E-Commerce

- 8.2.2. Utilities

- 8.2.3. Travel

- 8.1. Market Analysis, Insights and Forecast - by Service Proposition

- 9. Middle East & Africa Fintech Industry in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Proposition

- 9.1.1. Money Transfer and Payments

- 9.1.2. Savings and Investments

- 9.1.3. Digital Lending and Lending Marketplaces

- 9.1.4. Online Insurance and Insurance Marketplaces

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. E-Commerce

- 9.2.2. Utilities

- 9.2.3. Travel

- 9.1. Market Analysis, Insights and Forecast - by Service Proposition

- 10. Asia Pacific Fintech Industry in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Proposition

- 10.1.1. Money Transfer and Payments

- 10.1.2. Savings and Investments

- 10.1.3. Digital Lending and Lending Marketplaces

- 10.1.4. Online Insurance and Insurance Marketplaces

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. E-Commerce

- 10.2.2. Utilities

- 10.2.3. Travel

- 10.1. Market Analysis, Insights and Forecast - by Service Proposition

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Paytm

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 MobiKwik

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Policy Bazaar

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 PayU

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kissht

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Shubh Loans

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Lending Kart

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Phonepe

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Faircent

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ET money**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Paytm

List of Figures

- Figure 1: Global Fintech Industry in India Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Fintech Industry in India Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Fintech Industry in India Revenue (Million), by Service Proposition 2025 & 2033

- Figure 4: North America Fintech Industry in India Volume (Billion), by Service Proposition 2025 & 2033

- Figure 5: North America Fintech Industry in India Revenue Share (%), by Service Proposition 2025 & 2033

- Figure 6: North America Fintech Industry in India Volume Share (%), by Service Proposition 2025 & 2033

- Figure 7: North America Fintech Industry in India Revenue (Million), by Application 2025 & 2033

- Figure 8: North America Fintech Industry in India Volume (Billion), by Application 2025 & 2033

- Figure 9: North America Fintech Industry in India Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Fintech Industry in India Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Fintech Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Fintech Industry in India Volume (Billion), by Country 2025 & 2033

- Figure 13: North America Fintech Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Fintech Industry in India Volume Share (%), by Country 2025 & 2033

- Figure 15: South America Fintech Industry in India Revenue (Million), by Service Proposition 2025 & 2033

- Figure 16: South America Fintech Industry in India Volume (Billion), by Service Proposition 2025 & 2033

- Figure 17: South America Fintech Industry in India Revenue Share (%), by Service Proposition 2025 & 2033

- Figure 18: South America Fintech Industry in India Volume Share (%), by Service Proposition 2025 & 2033

- Figure 19: South America Fintech Industry in India Revenue (Million), by Application 2025 & 2033

- Figure 20: South America Fintech Industry in India Volume (Billion), by Application 2025 & 2033

- Figure 21: South America Fintech Industry in India Revenue Share (%), by Application 2025 & 2033

- Figure 22: South America Fintech Industry in India Volume Share (%), by Application 2025 & 2033

- Figure 23: South America Fintech Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 24: South America Fintech Industry in India Volume (Billion), by Country 2025 & 2033

- Figure 25: South America Fintech Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Fintech Industry in India Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Fintech Industry in India Revenue (Million), by Service Proposition 2025 & 2033

- Figure 28: Europe Fintech Industry in India Volume (Billion), by Service Proposition 2025 & 2033

- Figure 29: Europe Fintech Industry in India Revenue Share (%), by Service Proposition 2025 & 2033

- Figure 30: Europe Fintech Industry in India Volume Share (%), by Service Proposition 2025 & 2033

- Figure 31: Europe Fintech Industry in India Revenue (Million), by Application 2025 & 2033

- Figure 32: Europe Fintech Industry in India Volume (Billion), by Application 2025 & 2033

- Figure 33: Europe Fintech Industry in India Revenue Share (%), by Application 2025 & 2033

- Figure 34: Europe Fintech Industry in India Volume Share (%), by Application 2025 & 2033

- Figure 35: Europe Fintech Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 36: Europe Fintech Industry in India Volume (Billion), by Country 2025 & 2033

- Figure 37: Europe Fintech Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Fintech Industry in India Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa Fintech Industry in India Revenue (Million), by Service Proposition 2025 & 2033

- Figure 40: Middle East & Africa Fintech Industry in India Volume (Billion), by Service Proposition 2025 & 2033

- Figure 41: Middle East & Africa Fintech Industry in India Revenue Share (%), by Service Proposition 2025 & 2033

- Figure 42: Middle East & Africa Fintech Industry in India Volume Share (%), by Service Proposition 2025 & 2033

- Figure 43: Middle East & Africa Fintech Industry in India Revenue (Million), by Application 2025 & 2033

- Figure 44: Middle East & Africa Fintech Industry in India Volume (Billion), by Application 2025 & 2033

- Figure 45: Middle East & Africa Fintech Industry in India Revenue Share (%), by Application 2025 & 2033

- Figure 46: Middle East & Africa Fintech Industry in India Volume Share (%), by Application 2025 & 2033

- Figure 47: Middle East & Africa Fintech Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East & Africa Fintech Industry in India Volume (Billion), by Country 2025 & 2033

- Figure 49: Middle East & Africa Fintech Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa Fintech Industry in India Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific Fintech Industry in India Revenue (Million), by Service Proposition 2025 & 2033

- Figure 52: Asia Pacific Fintech Industry in India Volume (Billion), by Service Proposition 2025 & 2033

- Figure 53: Asia Pacific Fintech Industry in India Revenue Share (%), by Service Proposition 2025 & 2033

- Figure 54: Asia Pacific Fintech Industry in India Volume Share (%), by Service Proposition 2025 & 2033

- Figure 55: Asia Pacific Fintech Industry in India Revenue (Million), by Application 2025 & 2033

- Figure 56: Asia Pacific Fintech Industry in India Volume (Billion), by Application 2025 & 2033

- Figure 57: Asia Pacific Fintech Industry in India Revenue Share (%), by Application 2025 & 2033

- Figure 58: Asia Pacific Fintech Industry in India Volume Share (%), by Application 2025 & 2033

- Figure 59: Asia Pacific Fintech Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 60: Asia Pacific Fintech Industry in India Volume (Billion), by Country 2025 & 2033

- Figure 61: Asia Pacific Fintech Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Fintech Industry in India Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Fintech Industry in India Revenue Million Forecast, by Service Proposition 2020 & 2033

- Table 2: Global Fintech Industry in India Volume Billion Forecast, by Service Proposition 2020 & 2033

- Table 3: Global Fintech Industry in India Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Fintech Industry in India Volume Billion Forecast, by Application 2020 & 2033

- Table 5: Global Fintech Industry in India Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Fintech Industry in India Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global Fintech Industry in India Revenue Million Forecast, by Service Proposition 2020 & 2033

- Table 8: Global Fintech Industry in India Volume Billion Forecast, by Service Proposition 2020 & 2033

- Table 9: Global Fintech Industry in India Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Fintech Industry in India Volume Billion Forecast, by Application 2020 & 2033

- Table 11: Global Fintech Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Fintech Industry in India Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United States Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Canada Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Global Fintech Industry in India Revenue Million Forecast, by Service Proposition 2020 & 2033

- Table 20: Global Fintech Industry in India Volume Billion Forecast, by Service Proposition 2020 & 2033

- Table 21: Global Fintech Industry in India Revenue Million Forecast, by Application 2020 & 2033

- Table 22: Global Fintech Industry in India Volume Billion Forecast, by Application 2020 & 2033

- Table 23: Global Fintech Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Fintech Industry in India Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Brazil Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Brazil Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Argentina Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Argentina Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Global Fintech Industry in India Revenue Million Forecast, by Service Proposition 2020 & 2033

- Table 32: Global Fintech Industry in India Volume Billion Forecast, by Service Proposition 2020 & 2033

- Table 33: Global Fintech Industry in India Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global Fintech Industry in India Volume Billion Forecast, by Application 2020 & 2033

- Table 35: Global Fintech Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Fintech Industry in India Volume Billion Forecast, by Country 2020 & 2033

- Table 37: United Kingdom Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Germany Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Germany Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: France Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: France Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Italy Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Italy Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: Spain Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Spain Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Russia Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Russia Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 49: Benelux Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Benelux Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 51: Nordics Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Nordics Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: Global Fintech Industry in India Revenue Million Forecast, by Service Proposition 2020 & 2033

- Table 56: Global Fintech Industry in India Volume Billion Forecast, by Service Proposition 2020 & 2033

- Table 57: Global Fintech Industry in India Revenue Million Forecast, by Application 2020 & 2033

- Table 58: Global Fintech Industry in India Volume Billion Forecast, by Application 2020 & 2033

- Table 59: Global Fintech Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Fintech Industry in India Volume Billion Forecast, by Country 2020 & 2033

- Table 61: Turkey Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Turkey Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: Israel Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Israel Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 65: GCC Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: GCC Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 67: North Africa Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: North Africa Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 69: South Africa Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: South Africa Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 73: Global Fintech Industry in India Revenue Million Forecast, by Service Proposition 2020 & 2033

- Table 74: Global Fintech Industry in India Volume Billion Forecast, by Service Proposition 2020 & 2033

- Table 75: Global Fintech Industry in India Revenue Million Forecast, by Application 2020 & 2033

- Table 76: Global Fintech Industry in India Volume Billion Forecast, by Application 2020 & 2033

- Table 77: Global Fintech Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 78: Global Fintech Industry in India Volume Billion Forecast, by Country 2020 & 2033

- Table 79: China Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: China Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 81: India Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: India Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 83: Japan Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: Japan Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 85: South Korea Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: South Korea Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 87: ASEAN Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: ASEAN Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 89: Oceania Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Oceania Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fintech Industry in India?

The projected CAGR is approximately 30.55%.

2. Which companies are prominent players in the Fintech Industry in India?

Key companies in the market include Paytm, MobiKwik, Policy Bazaar, PayU, Kissht, Shubh Loans, Lending Kart, Phonepe, Faircent, ET money**List Not Exhaustive.

3. What are the main segments of the Fintech Industry in India?

The market segments include Service Proposition, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 111.14 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Digital Services; Rapid Advancement in Technology is Driving the Market.

6. What are the notable trends driving market growth?

Increase in Mobile Banking Payments is Surging the Growth of the Market.

7. Are there any restraints impacting market growth?

Increasing Demand for Digital Services; Rapid Advancement in Technology is Driving the Market.

8. Can you provide examples of recent developments in the market?

September 2023: PayU, an Indian payments company, partnered with WhatsApp to considerably improve Indians' purchasing experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fintech Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fintech Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fintech Industry in India?

To stay informed about further developments, trends, and reports in the Fintech Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence