Key Insights

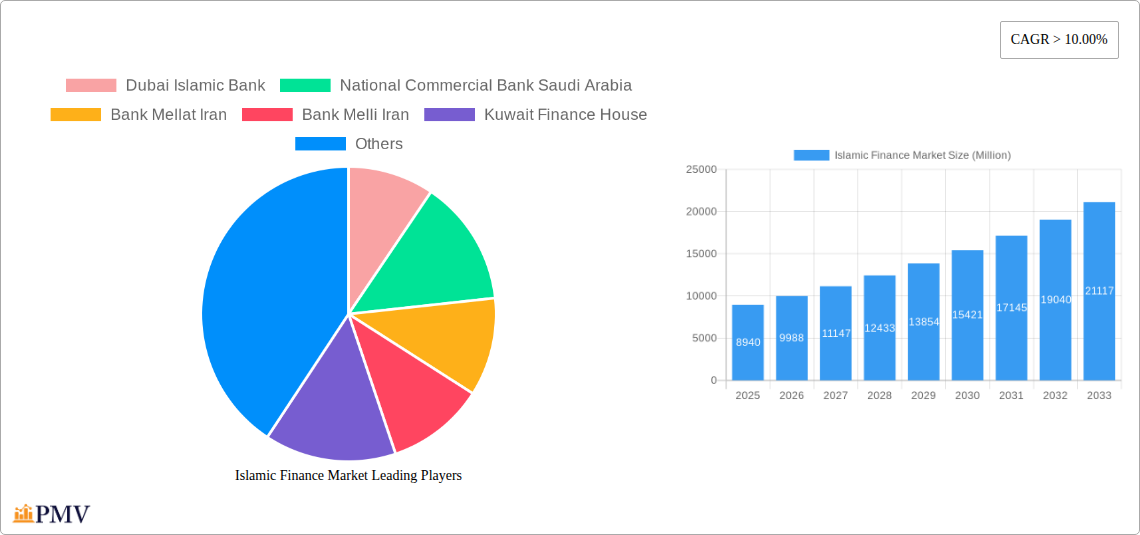

The global Islamic finance market is experiencing robust expansion, projected to reach USD 8.94 billion in 2025 with a compelling Compound Annual Growth Rate (CAGR) of 11.6% over the forecast period of 2025-2033. This significant growth is propelled by a confluence of factors including increasing demand for Sharia-compliant financial products, growing awareness and acceptance of Islamic finance principles globally, and supportive government initiatives in key regions. The market's dynamism is further fueled by innovation within its core segments, such as Islamic banking, which offers Sharia-compliant alternatives to conventional banking services, and Takaful (Islamic insurance), providing ethical risk management solutions. The issuance of Islamic bonds, or Sukuk, continues to attract significant investment, demonstrating the market's maturity and its ability to cater to large-scale financing needs. The presence of prominent players like Dubai Islamic Bank and National Commercial Bank Saudi Arabia underscores the established infrastructure and competitive landscape of this burgeoning sector.

Islamic Finance Market Market Size (In Billion)

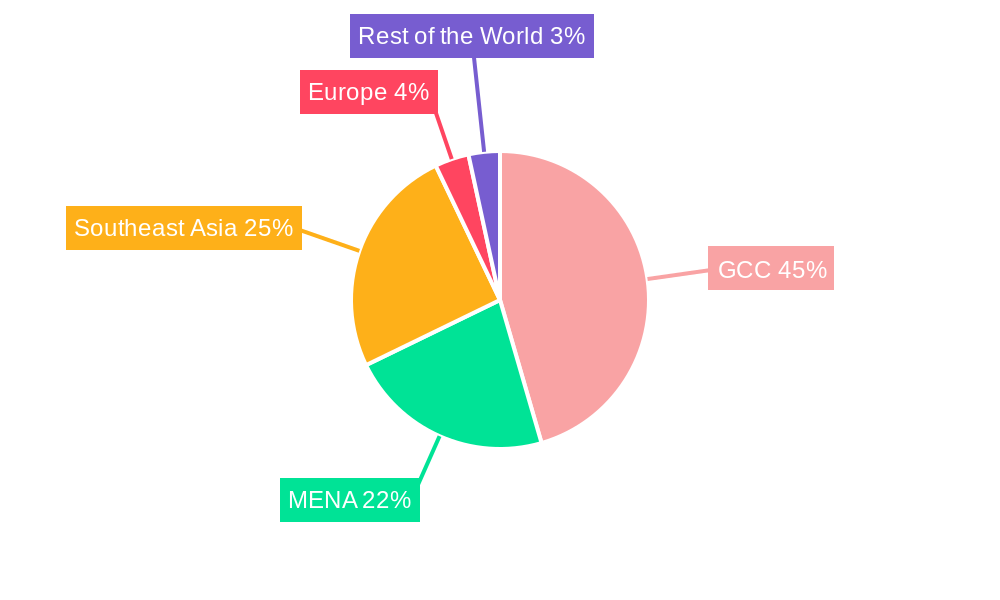

The market's trajectory is also shaped by emerging trends like the digitalization of Islamic financial services, enhancing accessibility and convenience for a wider customer base, and the growing interest from non-Muslim majority countries seeking ethical investment opportunities. While the market exhibits strong growth drivers, certain restraints, such as evolving regulatory frameworks in some jurisdictions and the need for greater standardization across different regions, could influence the pace of expansion. However, the strong performance across established regions like the GCC and Southeast Asia, particularly Malaysia and Indonesia, coupled with the nascent but promising growth in Europe and other emerging markets, indicates a broad-based and sustainable upward trend. The strategic importance of Islamic finance in fostering economic development and financial inclusion is increasingly recognized, positioning it for continued impressive growth in the coming years.

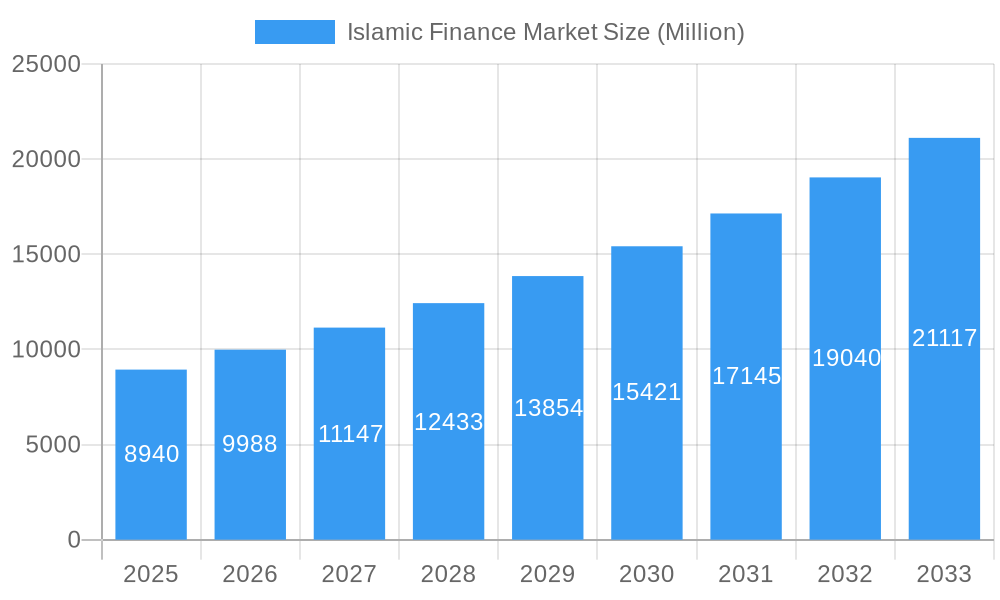

Islamic Finance Market Company Market Share

This comprehensive report delivers an in-depth analysis of the global Islamic Finance Market, providing critical insights into its structure, trends, and future trajectory. Covering the study period of 2019–2033, with 2025 as the base and estimated year, and a forecast period from 2025–2033, this report is indispensable for stakeholders seeking to navigate this rapidly expanding sector. We meticulously examine the historical period from 2019–2024, offering a robust foundation for understanding market evolution.

Islamic Finance Market Market Structure & Competitive Dynamics

The Islamic Finance Market exhibits a dynamic structure characterized by a growing number of specialized institutions and increasing inter-sectoral collaborations. Market concentration varies across regions, with established players in the GCC and emerging opportunities in Southeast Asia. Innovation ecosystems are thriving, driven by technological advancements and a growing demand for Sharia-compliant financial products. Regulatory frameworks are continuously evolving to foster growth and ensure ethical practices, a key differentiator for Islamic Finance. Product substitutes, while present, are challenged by the unique value proposition of Islamic finance, emphasizing ethical investing and risk-sharing. End-user trends show a rising preference for Sharia-compliant solutions, particularly among younger demographics and in regions with significant Muslim populations. Merger and acquisition (M&A) activities are on the rise, signifying consolidation and strategic expansion. For instance, M&A deal values are projected to reach tens of billions of dollars, with major players actively seeking to enhance their market share and service offerings. Key companies such as Dubai Islamic Bank, National Commercial Bank Saudi Arabia, and Kuwait Finance House are at the forefront of these strategic moves.

Islamic Finance Market Industry Trends & Insights

The Islamic Finance Market is poised for significant growth, driven by a confluence of robust market growth drivers, transformative technological disruptions, evolving consumer preferences, and dynamic competitive landscapes. The global market size is expected to reach hundreds of billions of dollars, with a projected Compound Annual Growth Rate (CAGR) of xx%, underscoring its substantial expansion potential. Technological advancements, including blockchain and AI, are revolutionizing Islamic Banking, Takaful (Islamic Insurance), and Sukuk (Islamic Bonds), enhancing operational efficiency and customer experience. The increasing global awareness and adoption of ethical and sustainable investing principles further fuel demand for Islamic Funds and Other Islamic Financial Institutions (OIFI's). Consumer preferences are shifting towards financial solutions that align with religious and ethical values, particularly in key markets like the GCC, Southeast Asia, and increasingly, in Western countries. Competitive dynamics are intensifying, with both conventional and Islamic financial institutions vying for market share, leading to innovative product development and strategic partnerships. Market penetration is steadily increasing, with Sharia-compliant products becoming more accessible and appealing to a broader audience beyond traditional customer segments. The digital transformation within Islamic Finance is a critical trend, enabling enhanced financial inclusion and a more personalized customer journey, further propelling the market forward.

Dominant Markets & Segments in Islamic Finance Market

The Islamic Finance Market is experiencing remarkable dominance in several key regions and segments, driven by a strong interplay of economic policies, robust infrastructure, and favorable demographic trends. The Financial Sector components, including Islamic Banking, Islamic Insurance (Takaful), Islamic Bonds (Sukuk), Other Islamic Financial Institutions (OIFI's), and Islamic Funds, are all exhibiting substantial growth.

Islamic Banking is a cornerstone of the market, particularly in the Gulf Cooperation Council (GCC) countries, where government initiatives and a large Muslim population have fostered its widespread adoption. Banks like Dubai Islamic Bank and National Commercial Bank Saudi Arabia are leading this segment with innovative Sharia-compliant products and extensive branch networks. The market size for Islamic banking is expected to cross hundreds of billions of dollars in the coming years.

Islamic Insurance (Takaful) is another rapidly expanding segment, offering ethical risk management solutions. The increasing awareness of Takaful's principles, such as mutual assistance and shared responsibility, is driving its growth. Key markets include Malaysia and Indonesia, alongside growing interest in the GCC.

Islamic Bonds (Sukuk) have emerged as a crucial instrument for infrastructure financing and corporate funding. The increasing issuance of sovereign and corporate Sukuk globally, including by governments and entities in countries like Malaysia, Saudi Arabia, and the UAE, highlights its significance. Sukuk issuance is projected to reach tens of billions of dollars annually.

Other Islamic Financial Institutions (OIFI's), encompassing entities like Islamic venture capital and microfinance institutions, are playing an increasingly vital role in promoting financial inclusion and supporting small and medium-sized enterprises (SMEs) in alignment with Sharia principles.

Islamic Funds are gaining traction among investors seeking ethical and socially responsible investment options. The diversification of Sharia-compliant fund offerings, from equity to fixed income and real estate, is attracting a broader investor base globally.

The dominance of these segments is underpinned by supportive government regulations, a growing demand for Halal financial products, and the increasing integration of Islamic finance into the mainstream financial system.

Islamic Finance Market Product Innovations

Product innovations in the Islamic Finance Market are significantly enhancing its competitive advantage and market appeal. Development in Islamic Banking includes Sharia-compliant digital wallets and seamless online onboarding processes. Takaful is witnessing innovation in micro-Takaful products tailored for low-income populations and parametric Takaful solutions for specific risks. The Sukuk market is evolving with the introduction of green and social Sukuk, aligning with ESG principles. Islamic Funds are diversifying into niche areas like Sharia-compliant technology and healthcare funds. These innovations are driven by a focus on customer convenience, ethical considerations, and the integration of cutting-edge technology.

Report Segmentation & Scope

This report meticulously segments the Islamic Finance Market into its core components: Islamic Banking, Islamic Insurance (Takaful), Islamic Bonds (Sukuk), Other Islamic Financial Institution (OIFI's), and Islamic Funds.

Islamic Banking: This segment encompasses all banking activities conducted in compliance with Sharia law, including deposits, financing, and investment. Projections indicate market sizes reaching hundreds of billions of dollars, with significant growth driven by digitalization and increasing consumer adoption. Competitive dynamics are characterized by both traditional Islamic banks and Islamic windows of conventional banks.

Islamic Insurance (Takaful): This segment covers Sharia-compliant insurance and reinsurance services. The market is expected to see robust growth, reaching tens of billions of dollars, driven by increasing awareness and regulatory support in key regions. Competition is emerging from both dedicated Takaful operators and conventional insurers offering Takaful products.

Islamic Bonds (Sukuk): This segment analyzes the issuance and trading of Sharia-compliant debt instruments. The market size is projected to expand significantly, with annual issuances reaching tens of billions of dollars, driven by government and corporate funding needs. Competitive dynamics involve various Sukuk structures and issuers.

Other Islamic Financial Institution (OIFI's): This broad segment includes non-banking financial institutions like Islamic investment firms, leasing companies, and microfinance providers adhering to Sharia principles. Growth is anticipated to be strong, particularly in emerging markets, with market sizes reaching billions of dollars. Competition arises from a diverse range of specialized financial entities.

Islamic Funds: This segment focuses on mutual funds and investment vehicles structured according to Sharia law. The market is expected to grow steadily, with assets under management projected to reach tens of billions of dollars, driven by investor demand for ethical and socially responsible investments. Competitive forces include a wide array of fund managers and product offerings.

Key Drivers of Islamic Finance Market Growth

The Islamic Finance Market is propelled by several key drivers. Technological advancements, including digital banking solutions and blockchain integration, enhance accessibility and efficiency. Favorable economic policies in Muslim-majority countries, promoting Sharia-compliant finance, are critical. For instance, government mandates for Islamic banking in certain regions significantly boost growth. Furthermore, increasing global awareness and demand for ethical and socially responsible investments are attracting non-Muslim investors as well. The growing young Muslim population with a preference for Sharia-compliant products also serves as a significant demographic driver.

Challenges in the Islamic Finance Market Sector

Despite its robust growth, the Islamic Finance Market Sector faces several challenges. Regulatory hurdles and inconsistencies across jurisdictions can impede cross-border operations and harmonization. Limited product standardization and complexity in Sharia interpretation can sometimes create barriers for adoption. Supply chain issues, particularly in the context of developing Sharia-compliant supply chains for complex financial products, require ongoing attention. Intense competitive pressures from both conventional and increasingly sophisticated Islamic financial institutions necessitate continuous innovation and strategic adaptation. Quantifiable impacts include slower adoption rates in certain markets and increased operational costs for ensuring Sharia compliance.

Leading Players in the Islamic Finance Market Market

- Dubai Islamic Bank

- National Commercial Bank Saudi Arabia

- Bank Mellat Iran

- Bank Melli Iran

- Kuwait Finance House

- Bank Maskan Iran

- Qatar Islamic Bank

- Abu Dhabi Islamic Bank

- Maybank Islamic

- CIMB Islamic Bank

Key Developments in Islamic Finance Market Sector

January 2023: Abu Dhabi Islamic Bank (ADIB) significantly increased its ownership in ADIB Egypt to over 52% by acquiring 9.6 million shares from the National Investment Bank (NIB). This strategic move, representing 2.4% of ADIB Egypt's share capital, highlights ADIB UAE's commitment to expanding its presence and control in the Egyptian market, reinforcing its position and influence.

July 2022: Kuwait Finance House (KFH) reached an agreement to acquire Bahrain-based Ahli United Bank (AUB) through a share swap deal. This substantial transaction, involving a bank with 115 billion USD in assets, is set to create the seventh-largest bank in the Gulf region. The revised terms of the deal, where KFH will offer one share for every 2.695 shares of AUB at an offer price of USD 1.04 per share, signify a major consolidation within the Islamic Banking sector and a testament to the growing scale of operations in the region.

Strategic Islamic Finance Market Market Outlook

The Strategic Islamic Finance Market Market Outlook is exceptionally positive, fueled by accelerating adoption and expanding opportunities. Growth accelerators include the increasing demand for ethical and sustainable finance globally, the digitalization of financial services, and supportive government initiatives in key markets. The market is expected to witness further consolidation and expansion, with significant investment flowing into innovative Sharia-compliant products and services. Strategic opportunities lie in expanding into new geographical territories, developing advanced digital platforms, and fostering greater collaboration between Islamic financial institutions. The convergence of Islamic finance with ESG principles presents a particularly compelling growth avenue, attracting a diverse investor base and reinforcing its long-term sustainability.

Islamic Finance Market Segmentation

-

1. Financial Sector

- 1.1. Islamic Banking

- 1.2. Islamic Insurance : Takaful

- 1.3. Islamic Bonds 'Sukuk'

- 1.4. Other Islamic Financial Institution (OIFI's)

- 1.5. Islamic Funds

Islamic Finance Market Segmentation By Geography

-

1. GCC

- 1.1. Saudi Arabia

- 1.2. UAE

- 1.3. Qatar

- 1.4. Kuwait

- 1.5. Bahrain

- 1.6. Oman

-

2. MENA

- 2.1. Iran

- 2.2. Egypt

- 2.3. Rest of Middle East

- 3. Southeast Asia

-

4. Malaysia

- 4.1. Indonesia

- 4.2. Brunei

- 4.3. Pakistan

- 4.4. Rest of Southeast Asia and Asia Pacific

-

5. Europe

- 5.1. United Kingdom

- 5.2. Ieland

- 5.3. Italy

- 5.4. Rest of Europe

- 6. Rest of the World

Islamic Finance Market Regional Market Share

Geographic Coverage of Islamic Finance Market

Islamic Finance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Malaysia is the top Score Value for Islamic Finance Development Indicator

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Financial Sector

- 5.1.1. Islamic Banking

- 5.1.2. Islamic Insurance : Takaful

- 5.1.3. Islamic Bonds 'Sukuk'

- 5.1.4. Other Islamic Financial Institution (OIFI's)

- 5.1.5. Islamic Funds

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. GCC

- 5.2.2. MENA

- 5.2.3. Southeast Asia

- 5.2.4. Malaysia

- 5.2.5. Europe

- 5.2.6. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Financial Sector

- 6. GCC Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Financial Sector

- 6.1.1. Islamic Banking

- 6.1.2. Islamic Insurance : Takaful

- 6.1.3. Islamic Bonds 'Sukuk'

- 6.1.4. Other Islamic Financial Institution (OIFI's)

- 6.1.5. Islamic Funds

- 6.1. Market Analysis, Insights and Forecast - by Financial Sector

- 7. MENA Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Financial Sector

- 7.1.1. Islamic Banking

- 7.1.2. Islamic Insurance : Takaful

- 7.1.3. Islamic Bonds 'Sukuk'

- 7.1.4. Other Islamic Financial Institution (OIFI's)

- 7.1.5. Islamic Funds

- 7.1. Market Analysis, Insights and Forecast - by Financial Sector

- 8. Southeast Asia Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Financial Sector

- 8.1.1. Islamic Banking

- 8.1.2. Islamic Insurance : Takaful

- 8.1.3. Islamic Bonds 'Sukuk'

- 8.1.4. Other Islamic Financial Institution (OIFI's)

- 8.1.5. Islamic Funds

- 8.1. Market Analysis, Insights and Forecast - by Financial Sector

- 9. Malaysia Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Financial Sector

- 9.1.1. Islamic Banking

- 9.1.2. Islamic Insurance : Takaful

- 9.1.3. Islamic Bonds 'Sukuk'

- 9.1.4. Other Islamic Financial Institution (OIFI's)

- 9.1.5. Islamic Funds

- 9.1. Market Analysis, Insights and Forecast - by Financial Sector

- 10. Europe Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Financial Sector

- 10.1.1. Islamic Banking

- 10.1.2. Islamic Insurance : Takaful

- 10.1.3. Islamic Bonds 'Sukuk'

- 10.1.4. Other Islamic Financial Institution (OIFI's)

- 10.1.5. Islamic Funds

- 10.1. Market Analysis, Insights and Forecast - by Financial Sector

- 11. Rest of the World Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Financial Sector

- 11.1.1. Islamic Banking

- 11.1.2. Islamic Insurance : Takaful

- 11.1.3. Islamic Bonds 'Sukuk'

- 11.1.4. Other Islamic Financial Institution (OIFI's)

- 11.1.5. Islamic Funds

- 11.1. Market Analysis, Insights and Forecast - by Financial Sector

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Dubai Islamic Bank

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 National Commercial Bank Saudi Arabia

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Bank Mellat Iran

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Bank Melli Iran

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Kuwait Finance House

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Bank Maskan Iran

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Qatar Islamic Bank

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Abu Dhabi Islamic Bank

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 May Bank Islamic

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 CIMB Islamic Bank**List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Dubai Islamic Bank

List of Figures

- Figure 1: Islamic Finance Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Islamic Finance Market Share (%) by Company 2025

List of Tables

- Table 1: Islamic Finance Market Revenue undefined Forecast, by Financial Sector 2020 & 2033

- Table 2: Islamic Finance Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Islamic Finance Market Revenue undefined Forecast, by Financial Sector 2020 & 2033

- Table 4: Islamic Finance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: Saudi Arabia Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: UAE Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Qatar Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Kuwait Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Bahrain Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Oman Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Islamic Finance Market Revenue undefined Forecast, by Financial Sector 2020 & 2033

- Table 12: Islamic Finance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Iran Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Egypt Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of Middle East Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Islamic Finance Market Revenue undefined Forecast, by Financial Sector 2020 & 2033

- Table 17: Islamic Finance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 18: Islamic Finance Market Revenue undefined Forecast, by Financial Sector 2020 & 2033

- Table 19: Islamic Finance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: Indonesia Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Brunei Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Pakistan Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Rest of Southeast Asia and Asia Pacific Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Islamic Finance Market Revenue undefined Forecast, by Financial Sector 2020 & 2033

- Table 25: Islamic Finance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: United Kingdom Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Ieland Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Italy Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Islamic Finance Market Revenue undefined Forecast, by Financial Sector 2020 & 2033

- Table 31: Islamic Finance Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Islamic Finance Market?

The projected CAGR is approximately 11.6%.

2. Which companies are prominent players in the Islamic Finance Market?

Key companies in the market include Dubai Islamic Bank, National Commercial Bank Saudi Arabia, Bank Mellat Iran, Bank Melli Iran, Kuwait Finance House, Bank Maskan Iran, Qatar Islamic Bank, Abu Dhabi Islamic Bank, May Bank Islamic, CIMB Islamic Bank**List Not Exhaustive.

3. What are the main segments of the Islamic Finance Market?

The market segments include Financial Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Malaysia is the top Score Value for Islamic Finance Development Indicator.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2023: Abu Dhabi Islamic Bank (ADIB) has increased its ownership in ADIB Egypt to more than 52%. The UAE-based bank has acquired 9.6 million shares from the National Investment Bank (NIB), representing 2.4% of ADIB Egypt's share capital, the bank told the Abu Dhabi Securities Exchange (ADX). The deal has raised ADIB UAE's ownership in the Egyptian unit to 52.607%.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Islamic Finance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Islamic Finance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Islamic Finance Market?

To stay informed about further developments, trends, and reports in the Islamic Finance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence