Key Insights

The global Finished Vehicles Logistics market is poised for significant expansion, driven by a thriving automotive sector and escalating demand for optimized vehicle transportation and storage. With a projected Compound Annual Growth Rate (CAGR) of 5.6%, the market is anticipated to reach 257.52 billion by 2025. Key accelerators include the burgeoning e-commerce automotive sales landscape, demanding efficient last-mile delivery, and the widespread adoption of cutting-edge logistics technologies like AI-driven route planning and real-time tracking. The global shift towards just-in-time manufacturing further underscores the critical need for dependable finished vehicle logistics. The market encompasses diverse activities including transport (rail, road, air, sea), warehousing, and value-added services, catering to the comprehensive vehicle supply chain needs. Major industry players, including CMA CGM, Nippon Express, and XPO Logistics, are strategically expanding their reach and technological prowess. Significant growth is expected in North America and Asia Pacific, propelled by robust automotive production and consumption. Emerging economies with expanding automotive manufacturing bases are also set to contribute to market expansion.

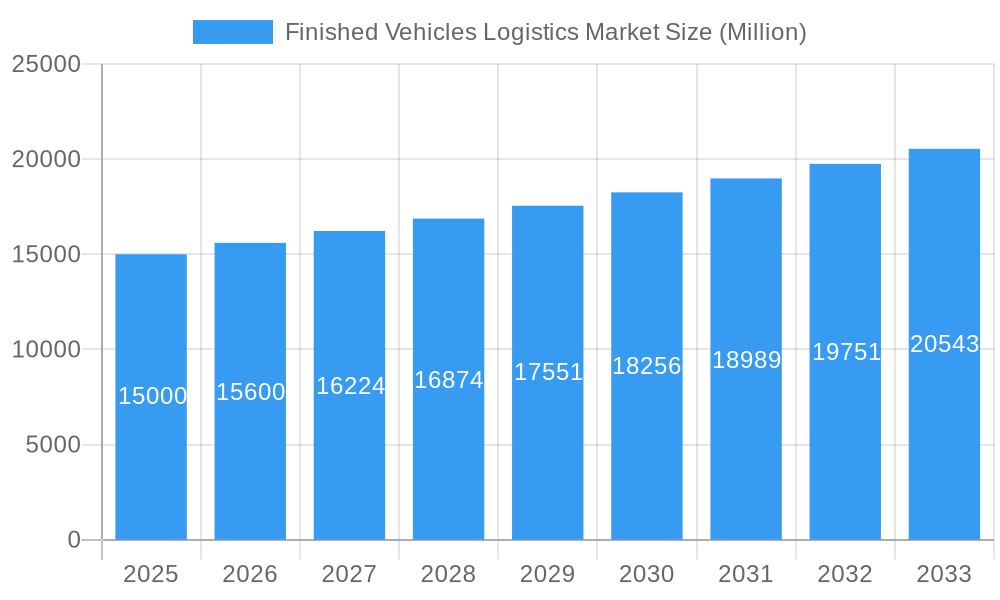

Finished Vehicles Logistics Market Market Size (In Billion)

However, the market faces challenges such as volatile fuel prices, geopolitical uncertainties affecting trade, and potential supply chain disruptions. Mitigation strategies include investments in sustainable transport, diversified logistics networks, and robust risk management frameworks. The growing emphasis on supply chain resilience and carbon footprint reduction presents both hurdles and opportunities. Strategic collaborations and technological integration will be paramount for companies to maintain a competitive advantage in this dynamic environment. The market's future outlook indicates sustained growth, fueled by innovation, evolving consumer demands, and the continued vitality of the global automotive industry. The development of efficient and sustainable logistics solutions will be instrumental in shaping the market's long-term success.

Finished Vehicles Logistics Market Company Market Share

Finished Vehicles Logistics Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the global Finished Vehicles Logistics Market, offering valuable insights for businesses and investors seeking to navigate this dynamic sector. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report leverages extensive data analysis to project market trends and opportunities during the forecast period (2025-2033) and offers a retrospective view of the historical period (2019-2024). The market is segmented by activity: Transport (Rail, Road, Air, Sea), Warehouse, and Value-added Services. Key players profiled include CMA CGM S A, Omsan Logistics, CargoTel Inc, MetroGistics LLC, ARS Altmann, Pound Gates Vehicle Management Services Ltd, CEVA Logistics, Nippon Express Holdings Inc, XPO Logistics, Penske Corporation, and others. The report's detailed analysis covers market structure, competitive dynamics, industry trends, dominant segments, product innovations, and key challenges. The total market size is projected to reach xx Million by 2033.

Finished Vehicles Logistics Market Market Structure & Competitive Dynamics

The Finished Vehicles Logistics Market exhibits a moderately consolidated structure, with a few major players holding significant market share. The market concentration ratio (CR5) is estimated at xx%, indicating the presence of both large multinational corporations and smaller specialized logistics providers. The market is characterized by intense competition, driven by factors such as price pressures, service differentiation, and technological advancements. Innovation plays a pivotal role, with companies investing heavily in technologies like telematics, AI-powered route optimization, and blockchain for enhanced tracking and efficiency. Regulatory frameworks, including environmental regulations and trade policies, significantly influence market dynamics. The existence of substitute modes of transportation (e.g., rail vs. road) also impacts competitive dynamics. Furthermore, end-user preferences for faster, more reliable, and cost-effective logistics solutions are shaping the market. M&A activity has been moderate in recent years, with deal values averaging xx Million per transaction. Notable acquisitions include [insert details of any known recent M&A activity with values if available]. Companies are adopting various strategies, including strategic partnerships and expansion into new markets, to gain a competitive edge.

Finished Vehicles Logistics Market Industry Trends & Insights

The Finished Vehicles Logistics Market is experiencing robust growth, driven by factors such as the expanding automotive industry, rising global trade, and increasing demand for efficient and reliable transportation solutions. The market is projected to register a CAGR of xx% during the forecast period. Technological disruptions, including the adoption of autonomous vehicles and the Internet of Things (IoT), are transforming the industry. Consumer preferences are shifting towards sustainable and transparent logistics solutions, placing pressure on companies to reduce their carbon footprint and improve supply chain visibility. Intense competition necessitates continuous innovation and improvement of service offerings, pushing companies to invest in advanced technology and optimize their operations. The market penetration of advanced logistics technologies, such as telematics and blockchain, is gradually increasing, further enhancing efficiency and transparency. This is leading to improved delivery times, reduced costs, and increased customer satisfaction.

Dominant Markets & Segments in Finished Vehicles Logistics Market

The Asia-Pacific region currently holds the largest market share in the Finished Vehicles Logistics Market, followed by North America and Europe. This dominance is primarily due to the high concentration of automotive manufacturing hubs and robust economic growth in the region.

Key Drivers in Asia-Pacific:

- Rapid economic growth and industrialization.

- Expanding automotive manufacturing base.

- Development of advanced logistics infrastructure.

- Increasing adoption of technology-driven solutions.

Dominant Segment: The Road Transport segment currently dominates the market owing to its widespread accessibility and flexibility. However, the Rail Transport segment is experiencing substantial growth, driven by increasing infrastructure development and government initiatives promoting rail freight.

Detailed Dominance Analysis: The Asia-Pacific region's dominance is attributed to its massive automotive production and its rapidly expanding network of roads and railways. Government initiatives to improve logistics infrastructure and promote efficient transportation further amplify this dominance. The Road Transport segment’s dominance stems from its flexibility, cost-effectiveness for shorter distances, and wide reach. The growth of the Rail Transport segment reflects a growing preference for sustainable and efficient long-haul solutions.

Finished Vehicles Logistics Market Product Innovations

Recent product innovations in the Finished Vehicles Logistics Market focus on enhancing efficiency, transparency, and sustainability. This includes the development of sophisticated vehicle tracking systems leveraging GPS and telematics, as well as the integration of blockchain technology for improved supply chain security and transparency. Companies are also investing in autonomous vehicles and robotics to automate various logistical processes. These technological advancements are designed to reduce costs, improve delivery times, and minimize the environmental impact of the industry. Market fit is determined by factors including cost-effectiveness, ease of implementation, and compatibility with existing infrastructure.

Report Segmentation & Scope

This report segments the Finished Vehicles Logistics Market by activity:

Transport: This segment is further categorized into Rail, Road, Air, and Sea transportation, each with its own growth projections, market size estimates, and competitive landscapes. Road transport is projected to maintain a significant market share driven by its accessibility and flexibility. Rail transport is expected to witness substantial growth due to cost efficiency on longer routes. Air freight remains a niche segment catering to time-sensitive shipments. Sea transport serves as a crucial component of international automotive trade.

Warehouse: This segment encompasses warehousing and storage solutions specifically designed for finished vehicles. Growth is fueled by the need for efficient inventory management and distribution network optimization. Competition is driven by factors such as location, infrastructure, and security measures.

Value-added Services: This includes services like vehicle inspection, pre-delivery inspection, customs clearance, and vehicle preparation. This segment exhibits high growth potential due to increasing demand for customized solutions and enhanced customer experiences. Competitive advantage relies on specialization and efficient service delivery.

Key Drivers of Finished Vehicles Logistics Market Growth

Several key factors are driving the growth of the Finished Vehicles Logistics Market. These include: the rising global demand for automobiles, increased cross-border trade, technological advancements (such as automation and IoT), government initiatives promoting efficient logistics, and the expansion of e-commerce, which has spurred increased demand for last-mile delivery solutions. Furthermore, the ongoing trend towards just-in-time manufacturing emphasizes the need for efficient and reliable logistics networks. Stringent environmental regulations are also pushing the industry toward sustainable practices.

Challenges in the Finished Vehicles Logistics Market Sector

The Finished Vehicles Logistics Market faces several challenges, including volatile fuel prices, fluctuating currency exchange rates, geopolitical instability, and disruptions in the global supply chain. Regulatory hurdles and varying environmental regulations across different countries pose logistical complexities. Furthermore, intense competition amongst providers necessitates continuous innovation and cost optimization. Supply chain disruptions resulting from events like pandemics or natural disasters can have a significant negative impact on market operations, resulting in estimated losses of xx Million annually.

Leading Players in the Finished Vehicles Logistics Market Market

- CMA CGM S A

- Omsan Logistics

- CargoTel Inc

- MetroGistics LLC

- ARS Altmann

- Pound Gates Vehicle Management Services Ltd

- CEVA Logistics

- Nippon Express Holdings Inc

- XPO Logistics

- Penske Corporation

Key Developments in Finished Vehicles Logistics Market Sector

November 2022: Omsan Logistics partnered with METRANS to establish an export-import rail line between Turkey and Slovakia, boosting Turkey's railway exports. This signifies a shift towards more sustainable and efficient transportation solutions.

April 20, 2022: PODS Enterprises, LLC, and ACERTUS formed a strategic partnership to provide nationwide vehicle shipping services, leveraging combined expertise and technology for enhanced customer experience. This highlights the growing importance of strategic alliances in providing comprehensive logistics solutions.

Strategic Finished Vehicles Logistics Market Market Outlook

The Finished Vehicles Logistics Market is poised for sustained growth, driven by continued expansion of the automotive industry, technological advancements, and increasing globalization. Strategic opportunities lie in investing in advanced technologies, expanding into emerging markets, and forming strategic partnerships to offer comprehensive and value-added services. Focusing on sustainability and improving supply chain resilience will be critical for long-term success. Companies that can effectively adapt to evolving customer preferences and technological advancements will be best positioned to capitalize on the market's future potential.

Finished Vehicles Logistics Market Segmentation

-

1. Activity

- 1.1. Transport (Rail, Road, Air, Sea)

- 1.2. Warehouse

- 1.3. Value-added Services

Finished Vehicles Logistics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. France

- 2.3. United Kingdom

- 2.4. Italy

- 2.5. Spain

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Bangladesh

- 3.5. Turkey

- 3.6. South Korea

- 3.7. Australia

- 3.8. Indonesia

- 3.9. Rest of Asia Pacific

- 4. Middle East

-

5. Egypt

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East

-

6. South America

- 6.1. Brazil

- 6.2. Argentina

- 6.3. Rest of South America

Finished Vehicles Logistics Market Regional Market Share

Geographic Coverage of Finished Vehicles Logistics Market

Finished Vehicles Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Export of Fresh Produce4.; Pharmaceutical Industry Growth

- 3.3. Market Restrains

- 3.3.1. 4.; Infrastructure Challenges4.; Costs and Investment

- 3.4. Market Trends

- 3.4.1. Increase in Blockchain Technology Adoption in Finished Vehicle Logistics

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Finished Vehicles Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Activity

- 5.1.1. Transport (Rail, Road, Air, Sea)

- 5.1.2. Warehouse

- 5.1.3. Value-added Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Middle East

- 5.2.5. Egypt

- 5.2.6. South America

- 5.1. Market Analysis, Insights and Forecast - by Activity

- 6. North America Finished Vehicles Logistics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Activity

- 6.1.1. Transport (Rail, Road, Air, Sea)

- 6.1.2. Warehouse

- 6.1.3. Value-added Services

- 6.1. Market Analysis, Insights and Forecast - by Activity

- 7. Europe Finished Vehicles Logistics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Activity

- 7.1.1. Transport (Rail, Road, Air, Sea)

- 7.1.2. Warehouse

- 7.1.3. Value-added Services

- 7.1. Market Analysis, Insights and Forecast - by Activity

- 8. Asia Pacific Finished Vehicles Logistics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Activity

- 8.1.1. Transport (Rail, Road, Air, Sea)

- 8.1.2. Warehouse

- 8.1.3. Value-added Services

- 8.1. Market Analysis, Insights and Forecast - by Activity

- 9. Middle East Finished Vehicles Logistics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Activity

- 9.1.1. Transport (Rail, Road, Air, Sea)

- 9.1.2. Warehouse

- 9.1.3. Value-added Services

- 9.1. Market Analysis, Insights and Forecast - by Activity

- 10. Egypt Finished Vehicles Logistics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Activity

- 10.1.1. Transport (Rail, Road, Air, Sea)

- 10.1.2. Warehouse

- 10.1.3. Value-added Services

- 10.1. Market Analysis, Insights and Forecast - by Activity

- 11. South America Finished Vehicles Logistics Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Activity

- 11.1.1. Transport (Rail, Road, Air, Sea)

- 11.1.2. Warehouse

- 11.1.3. Value-added Services

- 11.1. Market Analysis, Insights and Forecast - by Activity

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 CMA CGM S A

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Omsan Logistics

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 CargoTel Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 MetroGistics LLC

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 ARS Altmann

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Pound Gates Vehicle Management Services Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 CEVA Logistics

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Nippon Express Holdings Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 XPO Logistics**List Not Exhaustive

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Penske Corporation

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 CMA CGM S A

List of Figures

- Figure 1: Global Finished Vehicles Logistics Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Finished Vehicles Logistics Market Revenue (billion), by Activity 2025 & 2033

- Figure 3: North America Finished Vehicles Logistics Market Revenue Share (%), by Activity 2025 & 2033

- Figure 4: North America Finished Vehicles Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Finished Vehicles Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Finished Vehicles Logistics Market Revenue (billion), by Activity 2025 & 2033

- Figure 7: Europe Finished Vehicles Logistics Market Revenue Share (%), by Activity 2025 & 2033

- Figure 8: Europe Finished Vehicles Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Finished Vehicles Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Finished Vehicles Logistics Market Revenue (billion), by Activity 2025 & 2033

- Figure 11: Asia Pacific Finished Vehicles Logistics Market Revenue Share (%), by Activity 2025 & 2033

- Figure 12: Asia Pacific Finished Vehicles Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Finished Vehicles Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East Finished Vehicles Logistics Market Revenue (billion), by Activity 2025 & 2033

- Figure 15: Middle East Finished Vehicles Logistics Market Revenue Share (%), by Activity 2025 & 2033

- Figure 16: Middle East Finished Vehicles Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East Finished Vehicles Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Egypt Finished Vehicles Logistics Market Revenue (billion), by Activity 2025 & 2033

- Figure 19: Egypt Finished Vehicles Logistics Market Revenue Share (%), by Activity 2025 & 2033

- Figure 20: Egypt Finished Vehicles Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Egypt Finished Vehicles Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: South America Finished Vehicles Logistics Market Revenue (billion), by Activity 2025 & 2033

- Figure 23: South America Finished Vehicles Logistics Market Revenue Share (%), by Activity 2025 & 2033

- Figure 24: South America Finished Vehicles Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Finished Vehicles Logistics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Finished Vehicles Logistics Market Revenue billion Forecast, by Activity 2020 & 2033

- Table 2: Global Finished Vehicles Logistics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Finished Vehicles Logistics Market Revenue billion Forecast, by Activity 2020 & 2033

- Table 4: Global Finished Vehicles Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global Finished Vehicles Logistics Market Revenue billion Forecast, by Activity 2020 & 2033

- Table 9: Global Finished Vehicles Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Germany Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: France Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: United Kingdom Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Italy Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Spain Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Russia Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Global Finished Vehicles Logistics Market Revenue billion Forecast, by Activity 2020 & 2033

- Table 18: Global Finished Vehicles Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: China Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Japan Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: India Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Bangladesh Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Turkey Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: South Korea Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Australia Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Indonesia Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Finished Vehicles Logistics Market Revenue billion Forecast, by Activity 2020 & 2033

- Table 29: Global Finished Vehicles Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Global Finished Vehicles Logistics Market Revenue billion Forecast, by Activity 2020 & 2033

- Table 31: Global Finished Vehicles Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: South Africa Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Saudi Arabia Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Rest of Middle East Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Global Finished Vehicles Logistics Market Revenue billion Forecast, by Activity 2020 & 2033

- Table 36: Global Finished Vehicles Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 37: Brazil Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Argentina Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Finished Vehicles Logistics Market?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the Finished Vehicles Logistics Market?

Key companies in the market include CMA CGM S A, Omsan Logistics, CargoTel Inc, MetroGistics LLC, ARS Altmann, Pound Gates Vehicle Management Services Ltd, CEVA Logistics, Nippon Express Holdings Inc, XPO Logistics**List Not Exhaustive, Penske Corporation.

3. What are the main segments of the Finished Vehicles Logistics Market?

The market segments include Activity.

4. Can you provide details about the market size?

The market size is estimated to be USD 257.52 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Export of Fresh Produce4.; Pharmaceutical Industry Growth.

6. What are the notable trends driving market growth?

Increase in Blockchain Technology Adoption in Finished Vehicle Logistics.

7. Are there any restraints impacting market growth?

4.; Infrastructure Challenges4.; Costs and Investment.

8. Can you provide examples of recent developments in the market?

November 2022: Omsan Logistics built an export-import line between Turkey and Slovakia in collaboration with the well-known European logistics firm, METRAS. The first freight train leaves from Dunajska Streda Terminal in Slovakia for Istanbul as part of the collaboration. The containers are delivered by train from the METRANS Terminal in Dunajska Streda, Slovakia, as part of the project's goal of increasing Turkey's railway exports.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Finished Vehicles Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Finished Vehicles Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Finished Vehicles Logistics Market?

To stay informed about further developments, trends, and reports in the Finished Vehicles Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence