Key Insights

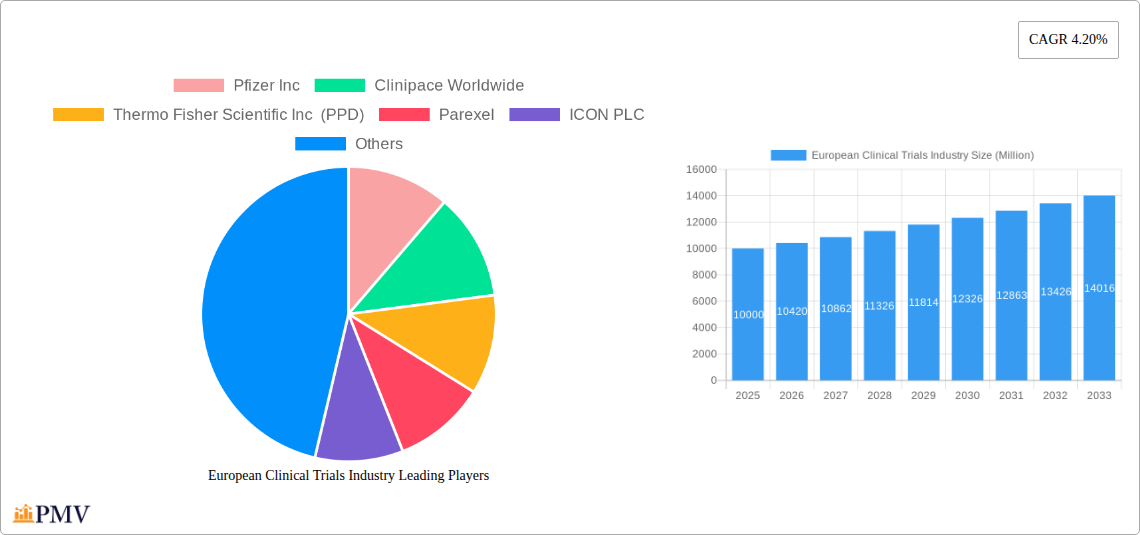

The European clinical trials market, encompassing Phases I-IV and study designs ranging from Treatment Studies to Observational Studies, is experiencing robust growth. Driven by an aging population, increasing prevalence of chronic diseases, and a strong regulatory framework, the market is projected to maintain a Compound Annual Growth Rate (CAGR) of 4.20% from 2025 to 2033. Key players like Pfizer, Sanofi, Roche, and IQVIA are significantly contributing to this growth through their extensive research and development activities and advanced technologies. The market is segmented by phase and study design, with a notable focus on late-stage trials (Phase III and IV) due to the increasing demand for effective treatments and post-market surveillance. Germany, France, and the UK remain leading markets within Europe, benefiting from established infrastructure, experienced researchers, and attractive regulatory environments. However, challenges remain, including high clinical trial costs, lengthy regulatory approval processes, and patient recruitment difficulties. These factors can influence the overall growth trajectory, though the continued investment in innovative therapies and technologies suggests a positive outlook for the long term.

The competitive landscape is characterized by a mix of large pharmaceutical companies and specialized Contract Research Organizations (CROs) like Parexel, ICON PLC, and Clinipace Worldwide. These CROs play a crucial role in streamlining trial processes, managing logistics, and ensuring data integrity. Technological advancements in areas such as telehealth and digital biomarkers are transforming the clinical trial landscape, accelerating recruitment, improving data quality, and reducing overall costs. While the market faces challenges, the increasing prevalence of chronic conditions such as cancer, cardiovascular diseases, and neurodegenerative disorders is fueling demand for new treatments. This, coupled with the continuous investment in research and development, points to a sustained and expanding European clinical trials market throughout the forecast period. The integration of advanced technologies and strategic collaborations within the industry further bolsters its growth potential.

European Clinical Trials Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the European clinical trials industry, covering market structure, competitive dynamics, key trends, and future growth prospects from 2019 to 2033. The study incorporates historical data (2019-2024), a base year of 2025, and forecasts until 2033, offering actionable insights for stakeholders across the pharmaceutical, biotech, and CRO sectors. The report segments the market by Phase (I, II, III, IV), Design (Treatment Studies, Observational Studies), and key players, providing a granular view of this dynamic landscape. The projected market value in 2025 is estimated at xx Million and is expected to grow at a CAGR of xx% during the forecast period (2025-2033).

European Clinical Trials Industry Market Structure & Competitive Dynamics

The European clinical trials market is characterized by a complex interplay of large pharmaceutical companies, Contract Research Organizations (CROs), and specialized service providers. Market concentration is relatively high, with a few multinational pharmaceutical companies such as Pfizer Inc, Sanofi, Eli Lilly and Company, and F Hoffmann-La Roche AG holding significant market share. However, a vibrant ecosystem of smaller CROs, like Clinipace Worldwide, Parexel, ICON PLC, and IQVIA, also plays a vital role, offering specialized services across various trial phases and designs. The regulatory framework, primarily driven by the European Medicines Agency (EMA), plays a significant role, impacting timelines and costs. Mergers and acquisitions (M&A) are prevalent, driven by the desire for scale, technological advancements, and geographical expansion. Recent M&A deal values have ranged from xx Million to xx Million, significantly impacting the market structure.

- Market Concentration: High, with top players holding xx% of market share.

- Innovation Ecosystems: Strong presence of academic institutions and biotech startups fostering innovation.

- Regulatory Frameworks: Primarily governed by EMA, influencing trial designs and approvals.

- Product Substitutes: Limited direct substitutes, but alternative research methods may emerge.

- End-user Trends: Increasing focus on personalized medicine and real-world evidence.

- M&A Activity: Significant activity in recent years, driving market consolidation.

European Clinical Trials Industry Industry Trends & Insights

The European clinical trials market is witnessing robust growth, driven by several key factors. The rising prevalence of chronic diseases, coupled with an aging population, fuels the demand for new therapies. Technological advancements, particularly in digital health and AI, are streamlining clinical trial processes, improving efficiency, and reducing costs. Moreover, the increasing adoption of decentralized clinical trials (DCTs) is expanding access to participants and improving patient engagement. This sector shows a significant market penetration rate of xx% in 2025 and is expected to experience a substantial increase by the end of the forecast period. Competitive dynamics are shaped by the constant innovation of CROs and the relentless pursuit of cost-effectiveness and faster timelines by pharmaceutical companies. The market is expected to reach xx Million by 2033, reflecting a robust growth trajectory. This expansion is fueled by several factors, including advancements in personalized medicine driving specialized trial designs, and increased investment in digital health technologies which are transforming the way clinical trials are conducted.

Dominant Markets & Segments in European Clinical Trials Industry

Germany, the United Kingdom, and France represent the largest markets within Europe, driven by robust healthcare infrastructure, a significant patient pool, and established regulatory frameworks. Phase III trials dominate the market due to their importance in securing regulatory approvals. Treatment studies, focusing on novel therapies, also represent a significant portion of the market.

- Key Drivers in Dominant Regions:

- Germany: Strong pharmaceutical industry, well-developed healthcare infrastructure.

- UK: Significant investment in life sciences, established regulatory frameworks.

- France: Large patient population, growing investment in R&D.

- Dominant Segments:

- Phase III Trials: Largest market share due to regulatory requirements.

- Treatment Studies: Focus on new therapies drives market growth.

- Observational Studies: Growing importance for real-world data generation.

European Clinical Trials Industry Product Innovations

Recent advancements in digital health technologies, such as electronic data capture (EDC) systems, wearable sensors, and telehealth platforms, are transforming clinical trials. These innovations are improving data quality, reducing costs, and accelerating trial timelines. The integration of artificial intelligence (AI) and machine learning (ML) is enhancing trial design, patient recruitment, and data analysis. These advancements are leading to improved efficiency and faster drug development, impacting the competitive landscape significantly.

Report Segmentation & Scope

This report segments the European clinical trials market by trial phase (Phase I, II, III, IV) and study design (Treatment Studies, Observational Studies). Each segment's growth projections, market size (in Millions), and competitive dynamics are analyzed in detail.

- Phase I Trials: Focus on safety and dosage. Market size in 2025: xx Million.

- Phase II Trials: Assess efficacy and safety. Market size in 2025: xx Million.

- Phase III Trials: Confirm efficacy and safety in a large population. Market size in 2025: xx Million.

- Phase IV Trials: Post-market surveillance. Market size in 2025: xx Million.

- Treatment Studies: Evaluation of new therapies. Market size in 2025: xx Million.

- Observational Studies: Real-world data collection. Market size in 2025: xx Million.

Key Drivers of European Clinical Trials Industry Growth

The growth of the European clinical trials market is driven by several factors: the rising prevalence of chronic diseases, increased funding for research and development, technological advancements, supportive regulatory environments, and the increasing adoption of personalized medicine approaches. The EU’s commitment to innovation in healthcare further supports the growth in this sector.

Challenges in the European Clinical Trials Industry Sector

The industry faces several challenges, including high costs, stringent regulatory requirements, lengthy trial timelines, difficulties in patient recruitment, and ethical considerations. Supply chain disruptions can also impact timelines and budgets. Competition among CROs and pharmaceutical companies further adds to the complexity of the market. These challenges collectively impact the overall efficiency and speed of drug development in Europe.

Leading Players in the European Clinical Trials Industry Market

- Pfizer Inc

- Clinipace Worldwide

- Thermo Fisher Scientific Inc (PPD)

- Parexel

- ICON PLC

- Sanofi

- Eli Lilly and Company

- F Hoffmann-La Roche AG

- IQVIA

- Novo Nordisk

Key Developments in European Clinical Trials Industry Sector

- June 2022: Eli Lilly and Company released phase III clinical trial AWARDS-PEDS results for Trulicity (dulaglutide), showing superior A1C reductions in youth and adolescents with type 2 diabetes. This positively impacts the market by highlighting the efficacy of a key drug.

- January 2022: Pfizer-BioNTech launched a clinical trial for a COVID-19 Omicron variant-specific vaccine, demonstrating the industry's responsiveness to emerging threats and driving further research and development.

Strategic European Clinical Trials Industry Market Outlook

The future of the European clinical trials market is bright, driven by continued technological advancements, increasing R&D investment, and the growing focus on personalized medicine. Strategic opportunities exist for companies that can effectively leverage digital health technologies, improve patient engagement, and streamline trial processes. The market is poised for continued growth, presenting lucrative opportunities for both established players and new entrants.

European Clinical Trials Industry Segmentation

-

1. Phase

- 1.1. Phase I

- 1.2. Phase II

- 1.3. Phase III

- 1.4. Phase IV

-

2. Design

-

2.1. Treatment Studies

- 2.1.1. Randomized Control Trial

- 2.1.2. Adaptive Clinical Trial

- 2.1.3. Non-randomized Control Trial

-

2.2. Observational Studies

- 2.2.1. Cohort Study

- 2.2.2. Case Control Study

- 2.2.3. Cross Sectional Study

- 2.2.4. Ecological Study

-

2.1. Treatment Studies

European Clinical Trials Industry Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Spain

- 5. Italy

- 6. Rest of Europe

European Clinical Trials Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Research and Development Spending of the Healthcare Industry; Increasing Prevalence of Chronic and Infectious Diseases; Rising Focus on Rare Diseases and Multiple Orphan Drugs

- 3.3. Market Restrains

- 3.3.1. Lower Healthcare Reimbursement in Developing Countries; Stringent Regulations for Patient Enrollment

- 3.4. Market Trends

- 3.4.1. Phase III Segment is Expected to Hold the Major Revenue Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Phase

- 5.1.1. Phase I

- 5.1.2. Phase II

- 5.1.3. Phase III

- 5.1.4. Phase IV

- 5.2. Market Analysis, Insights and Forecast - by Design

- 5.2.1. Treatment Studies

- 5.2.1.1. Randomized Control Trial

- 5.2.1.2. Adaptive Clinical Trial

- 5.2.1.3. Non-randomized Control Trial

- 5.2.2. Observational Studies

- 5.2.2.1. Cohort Study

- 5.2.2.2. Case Control Study

- 5.2.2.3. Cross Sectional Study

- 5.2.2.4. Ecological Study

- 5.2.1. Treatment Studies

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Spain

- 5.3.5. Italy

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Phase

- 6. Germany European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Phase

- 6.1.1. Phase I

- 6.1.2. Phase II

- 6.1.3. Phase III

- 6.1.4. Phase IV

- 6.2. Market Analysis, Insights and Forecast - by Design

- 6.2.1. Treatment Studies

- 6.2.1.1. Randomized Control Trial

- 6.2.1.2. Adaptive Clinical Trial

- 6.2.1.3. Non-randomized Control Trial

- 6.2.2. Observational Studies

- 6.2.2.1. Cohort Study

- 6.2.2.2. Case Control Study

- 6.2.2.3. Cross Sectional Study

- 6.2.2.4. Ecological Study

- 6.2.1. Treatment Studies

- 6.1. Market Analysis, Insights and Forecast - by Phase

- 7. United Kingdom European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Phase

- 7.1.1. Phase I

- 7.1.2. Phase II

- 7.1.3. Phase III

- 7.1.4. Phase IV

- 7.2. Market Analysis, Insights and Forecast - by Design

- 7.2.1. Treatment Studies

- 7.2.1.1. Randomized Control Trial

- 7.2.1.2. Adaptive Clinical Trial

- 7.2.1.3. Non-randomized Control Trial

- 7.2.2. Observational Studies

- 7.2.2.1. Cohort Study

- 7.2.2.2. Case Control Study

- 7.2.2.3. Cross Sectional Study

- 7.2.2.4. Ecological Study

- 7.2.1. Treatment Studies

- 7.1. Market Analysis, Insights and Forecast - by Phase

- 8. France European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Phase

- 8.1.1. Phase I

- 8.1.2. Phase II

- 8.1.3. Phase III

- 8.1.4. Phase IV

- 8.2. Market Analysis, Insights and Forecast - by Design

- 8.2.1. Treatment Studies

- 8.2.1.1. Randomized Control Trial

- 8.2.1.2. Adaptive Clinical Trial

- 8.2.1.3. Non-randomized Control Trial

- 8.2.2. Observational Studies

- 8.2.2.1. Cohort Study

- 8.2.2.2. Case Control Study

- 8.2.2.3. Cross Sectional Study

- 8.2.2.4. Ecological Study

- 8.2.1. Treatment Studies

- 8.1. Market Analysis, Insights and Forecast - by Phase

- 9. Spain European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Phase

- 9.1.1. Phase I

- 9.1.2. Phase II

- 9.1.3. Phase III

- 9.1.4. Phase IV

- 9.2. Market Analysis, Insights and Forecast - by Design

- 9.2.1. Treatment Studies

- 9.2.1.1. Randomized Control Trial

- 9.2.1.2. Adaptive Clinical Trial

- 9.2.1.3. Non-randomized Control Trial

- 9.2.2. Observational Studies

- 9.2.2.1. Cohort Study

- 9.2.2.2. Case Control Study

- 9.2.2.3. Cross Sectional Study

- 9.2.2.4. Ecological Study

- 9.2.1. Treatment Studies

- 9.1. Market Analysis, Insights and Forecast - by Phase

- 10. Italy European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Phase

- 10.1.1. Phase I

- 10.1.2. Phase II

- 10.1.3. Phase III

- 10.1.4. Phase IV

- 10.2. Market Analysis, Insights and Forecast - by Design

- 10.2.1. Treatment Studies

- 10.2.1.1. Randomized Control Trial

- 10.2.1.2. Adaptive Clinical Trial

- 10.2.1.3. Non-randomized Control Trial

- 10.2.2. Observational Studies

- 10.2.2.1. Cohort Study

- 10.2.2.2. Case Control Study

- 10.2.2.3. Cross Sectional Study

- 10.2.2.4. Ecological Study

- 10.2.1. Treatment Studies

- 10.1. Market Analysis, Insights and Forecast - by Phase

- 11. Rest of Europe European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Phase

- 11.1.1. Phase I

- 11.1.2. Phase II

- 11.1.3. Phase III

- 11.1.4. Phase IV

- 11.2. Market Analysis, Insights and Forecast - by Design

- 11.2.1. Treatment Studies

- 11.2.1.1. Randomized Control Trial

- 11.2.1.2. Adaptive Clinical Trial

- 11.2.1.3. Non-randomized Control Trial

- 11.2.2. Observational Studies

- 11.2.2.1. Cohort Study

- 11.2.2.2. Case Control Study

- 11.2.2.3. Cross Sectional Study

- 11.2.2.4. Ecological Study

- 11.2.1. Treatment Studies

- 11.1. Market Analysis, Insights and Forecast - by Phase

- 12. Germany European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 13. France European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 14. Italy European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 15. United Kingdom European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 16. Netherlands European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 17. Sweden European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Europe European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Pfizer Inc

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 Clinipace Worldwide

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Thermo Fisher Scientific Inc (PPD)

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 Parexel

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 ICON PLC

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Sanofi

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 Eli Lilly and Company

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 F Hoffmann-La Roche AG

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 IQVIA

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Novo Nordisk

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.1 Pfizer Inc

List of Figures

- Figure 1: European Clinical Trials Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: European Clinical Trials Industry Share (%) by Company 2024

List of Tables

- Table 1: European Clinical Trials Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: European Clinical Trials Industry Revenue Million Forecast, by Phase 2019 & 2032

- Table 3: European Clinical Trials Industry Revenue Million Forecast, by Design 2019 & 2032

- Table 4: European Clinical Trials Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: European Clinical Trials Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany European Clinical Trials Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France European Clinical Trials Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy European Clinical Trials Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom European Clinical Trials Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands European Clinical Trials Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden European Clinical Trials Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe European Clinical Trials Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: European Clinical Trials Industry Revenue Million Forecast, by Phase 2019 & 2032

- Table 14: European Clinical Trials Industry Revenue Million Forecast, by Design 2019 & 2032

- Table 15: European Clinical Trials Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: European Clinical Trials Industry Revenue Million Forecast, by Phase 2019 & 2032

- Table 17: European Clinical Trials Industry Revenue Million Forecast, by Design 2019 & 2032

- Table 18: European Clinical Trials Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: European Clinical Trials Industry Revenue Million Forecast, by Phase 2019 & 2032

- Table 20: European Clinical Trials Industry Revenue Million Forecast, by Design 2019 & 2032

- Table 21: European Clinical Trials Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: European Clinical Trials Industry Revenue Million Forecast, by Phase 2019 & 2032

- Table 23: European Clinical Trials Industry Revenue Million Forecast, by Design 2019 & 2032

- Table 24: European Clinical Trials Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: European Clinical Trials Industry Revenue Million Forecast, by Phase 2019 & 2032

- Table 26: European Clinical Trials Industry Revenue Million Forecast, by Design 2019 & 2032

- Table 27: European Clinical Trials Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: European Clinical Trials Industry Revenue Million Forecast, by Phase 2019 & 2032

- Table 29: European Clinical Trials Industry Revenue Million Forecast, by Design 2019 & 2032

- Table 30: European Clinical Trials Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Clinical Trials Industry?

The projected CAGR is approximately 4.20%.

2. Which companies are prominent players in the European Clinical Trials Industry?

Key companies in the market include Pfizer Inc, Clinipace Worldwide, Thermo Fisher Scientific Inc (PPD), Parexel, ICON PLC, Sanofi, Eli Lilly and Company, F Hoffmann-La Roche AG, IQVIA, Novo Nordisk.

3. What are the main segments of the European Clinical Trials Industry?

The market segments include Phase, Design.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

High Research and Development Spending of the Healthcare Industry; Increasing Prevalence of Chronic and Infectious Diseases; Rising Focus on Rare Diseases and Multiple Orphan Drugs.

6. What are the notable trends driving market growth?

Phase III Segment is Expected to Hold the Major Revenue Share During the Forecast Period.

7. Are there any restraints impacting market growth?

Lower Healthcare Reimbursement in Developing Countries; Stringent Regulations for Patient Enrollment.

8. Can you provide examples of recent developments in the market?

In June 2022, Eli Lilly and Company released phase III clinicals trail AWARDS-PEDS results for the drug Trulicity (dulaglutide) that it led to the superior A1C reductions at 26 weeks versus placebo in youth and adolescents with type 2 diabetes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Clinical Trials Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Clinical Trials Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Clinical Trials Industry?

To stay informed about further developments, trends, and reports in the European Clinical Trials Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence