Key Insights

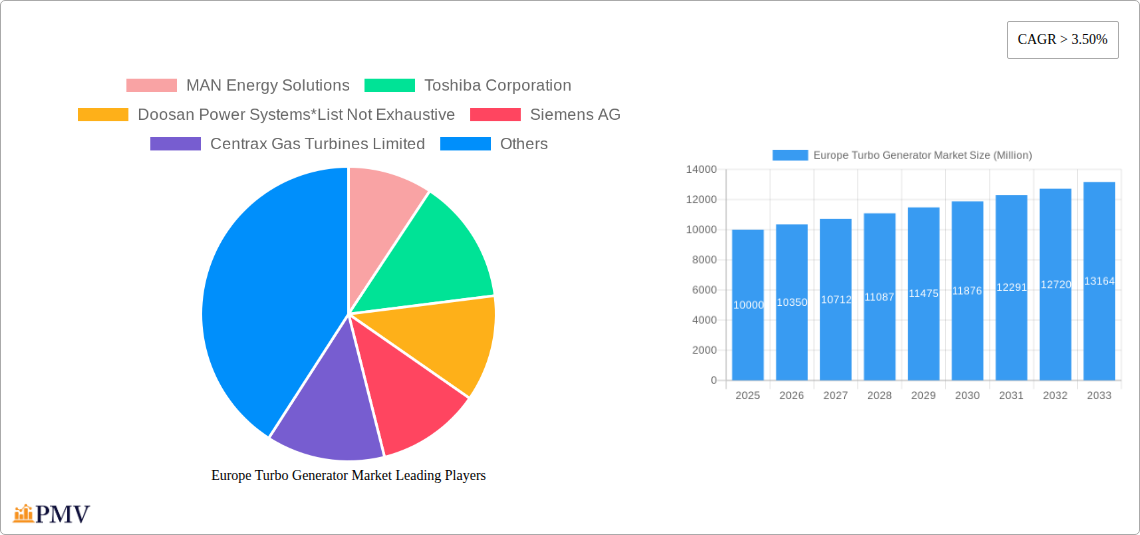

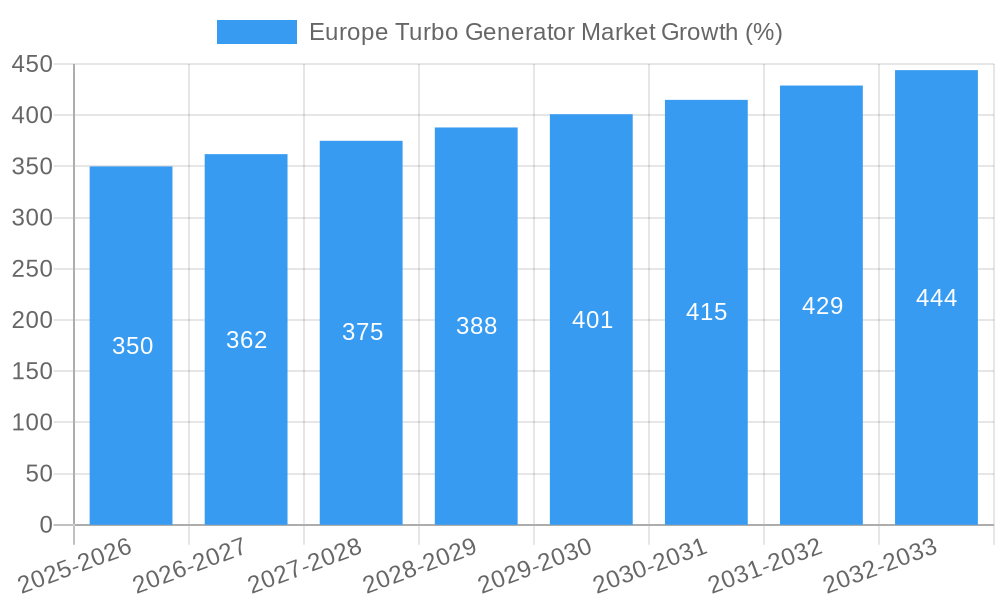

The European turbo generator market, valued at approximately €10 billion in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) exceeding 3.5% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing demand for electricity across Europe, driven by industrialization and population growth, necessitates significant investments in power generation infrastructure. This translates into higher demand for efficient and reliable turbo generators. Secondly, the ongoing shift towards cleaner energy sources, while emphasizing renewable energy integration, also requires sophisticated turbo generators for managing the intermittency of renewables and ensuring grid stability. This includes both gas-fired plants supplementing renewables and continued operation of existing nuclear power plants which utilise steam turbo-generators. Furthermore, technological advancements in turbo generator design, leading to improved efficiency, reduced emissions, and enhanced durability, are contributing to market growth. Germany, France, and the United Kingdom, being major economies with established power generation sectors, are expected to remain key markets within Europe.

However, the market faces certain challenges. Stringent environmental regulations and increasing costs associated with raw materials and manufacturing processes could potentially restrain market growth to some extent. Nevertheless, the continuous drive for energy security and the adoption of advanced technologies, such as digitalization and predictive maintenance, are anticipated to mitigate these constraints and propel the market forward during the forecast period (2025-2033). The diverse range of end-users, including coal-fired, gas-fired, and nuclear power plants, presents various opportunities for different types of turbo generators (steam and gas), contributing to the overall market diversification. Leading players like MAN Energy Solutions, Siemens AG, and General Electric are actively competing, driving innovation and influencing market dynamics.

Europe Turbo Generator Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Turbo Generator Market, offering invaluable insights for stakeholders across the energy sector. The study period spans 2019-2033, with 2025 serving as the base and estimated year. The report meticulously examines market dynamics, competitive landscapes, and future growth projections, empowering informed decision-making and strategic planning.

Europe Turbo Generator Market Market Structure & Competitive Dynamics

The European Turbo Generator market exhibits a moderately concentrated structure, with key players like MAN Energy Solutions, Toshiba Corporation, Doosan Power Systems, Siemens AG, Centrax Gas Turbines Limited, Ansaldo Energia SpA, General Electric Company, Kawasaki Heavy Industries Ltd, Andritz AG, and Mitsubishi Heavy Industries Ltd holding significant market share. However, the presence of several smaller, specialized players fosters a dynamic competitive environment. Market concentration is estimated at xx%, with the top 5 players accounting for approximately xx% of the total revenue in 2024.

Innovation plays a crucial role, with companies investing heavily in R&D to enhance efficiency, reliability, and sustainability. Stringent regulatory frameworks concerning emissions and environmental compliance significantly influence market strategies. The industry witnesses considerable M&A activity, driven by the need for expansion, technological integration, and enhanced market reach. Recent M&A deals, while not publicly disclosed in detail, have added up to an estimated xx Million in total value in the past three years. Furthermore, the market is witnessing a shift towards digitalization, with smart grids and advanced analytics driving demand for connected and data-driven turbo generator systems. The growing adoption of renewable energy sources is creating both opportunities and challenges, with some companies adapting their product portfolios to cater to hybrid energy systems. End-user trends point towards a growing preference for high-efficiency, low-emission solutions, particularly in gas-fired and nuclear power plants.

Europe Turbo Generator Market Industry Trends & Insights

The Europe Turbo Generator market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Several key factors drive this growth. The increasing global energy demand, coupled with aging infrastructure in many European nations, necessitates significant upgrades and replacements of existing turbo generators. This presents a robust opportunity for market expansion. Technological advancements, particularly in the development of more efficient and sustainable gas and steam turbo generators, are further accelerating market growth. These technological innovations are leading to improved efficiency rates and reduced greenhouse gas emissions, making these systems more appealing to environmentally conscious power producers. Furthermore, government initiatives promoting renewable energy integration and energy independence are pushing the demand for advanced turbo-generator solutions capable of seamless integration with renewable sources. The market penetration of advanced gas turbines and steam turbines is increasing rapidly, reaching an estimated xx% in 2024 and expected to surpass xx% by 2033. However, fluctuating energy prices and economic uncertainties pose moderate challenges to consistent growth.

Dominant Markets & Segments in Europe Turbo Generator Market

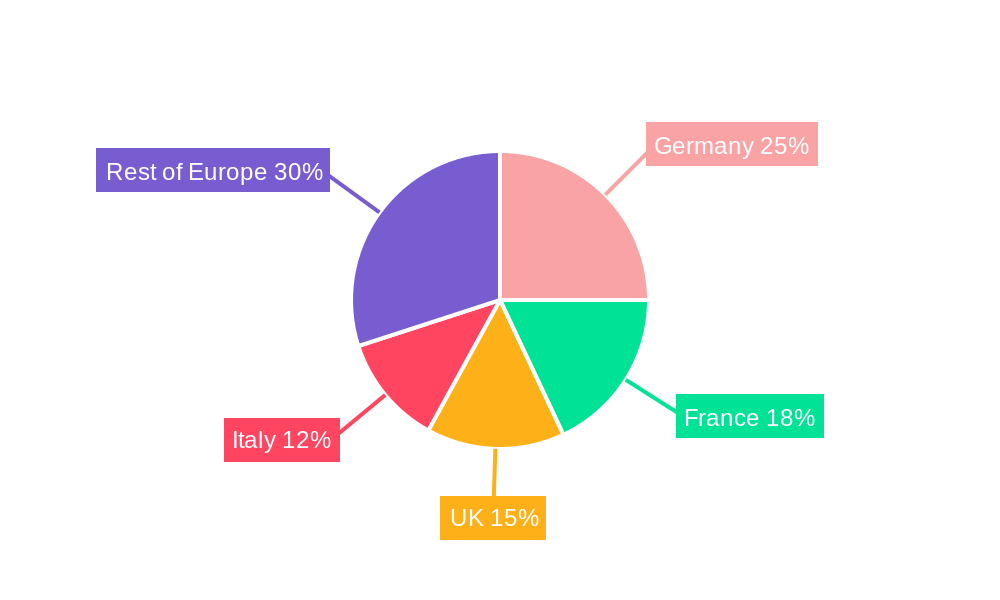

Leading Region: Western Europe dominates the market, driven by high energy consumption, robust industrial infrastructure, and significant investments in power generation upgrades.

Leading Country: Germany, followed by France and the UK, holds the largest market share due to substantial energy demands, considerable investment in power infrastructure development, and supportive government policies toward renewable energy integration.

Leading End User: Gas-fired power plants currently constitute the largest segment, owing to their flexibility and comparatively lower carbon footprint compared to coal-fired plants. This segment is further driven by stringent emission regulations and the increasing prevalence of combined cycle power plants.

Leading Type: Steam turbo generators currently command a larger market share due to their widespread use in conventional power plants. However, gas turbo generators are experiencing significant growth owing to technological advancements and enhanced efficiency.

Key Drivers for Dominant Segments:

- Gas-fired Power Plants: Government incentives for cleaner energy sources, flexible operation capabilities, and relatively lower construction costs.

- Steam Turbo Generators: Established technological maturity and suitability for various power plant types.

- Germany: Robust industrial base, supportive government policies focused on energy transition, and large investment in power infrastructure.

The detailed dominance analysis reveals that the projected growth in the gas-fired power plant segment is mainly attributable to the decommissioning of old coal plants and a push for cleaner energy sources. Germany's dominance is a consequence of the nation's economic strengths and commitment towards transitioning from coal to gas.

Europe Turbo Generator Market Product Innovations

Recent product developments focus on enhancing efficiency, reducing emissions, and improving reliability. This includes advancements in blade design, materials science, and control systems. The integration of digital technologies, such as advanced diagnostics and predictive maintenance, is becoming increasingly prominent. These innovations enable optimized operations, reduced downtime, and enhanced lifespan of turbo generators, making them more competitive and attractive to end users. The market fit is strong, driven by the industry's ongoing pursuit of greater efficiency, sustainability, and cost-effectiveness.

Report Segmentation & Scope

The report segments the Europe Turbo Generator Market by both end-user and type.

End-User Segmentation:

Coal-fired Power Plant: This segment is witnessing a decline due to environmental concerns and the phasing out of coal-fired power plants in several European countries. The market size is expected to contract, with intense competitive pressures among the remaining players.

Gas-fired Power Plant: This segment exhibits robust growth due to the increasing adoption of natural gas as a transitional fuel. Market size is projected to grow significantly over the forecast period.

Nuclear Power Plant: This segment is experiencing moderate growth, driven by the increasing need for baseload power and renewed interest in nuclear energy as a low-carbon alternative. Market size is anticipated to increase gradually.

Other End Users: This segment comprises industrial applications, such as cogeneration plants and combined heat and power (CHP) systems. Growth is moderate, influenced by the expansion of industrial production and government policies.

Type Segmentation:

Steam Turbo Generators: The largest segment, this type remains dominant due to its established technology and applicability to various power plant types. However, growth is expected to slow down somewhat due to increasing preference for gas turbines.

Gas Turbo Generators: This segment is experiencing rapid growth due to higher efficiency and flexibility, making it attractive for both baseload and peak power generation. Market size is projected to expand considerably.

Key Drivers of Europe Turbo Generator Market Growth

Several factors contribute to the growth of the European Turbo Generator market. The aging power infrastructure necessitates upgrades and replacements, driving demand for new and efficient turbo generator systems. Stringent environmental regulations and emission standards are pushing for more sustainable solutions. The increasing demand for electricity, coupled with government incentives for renewable energy integration, provides further impetus to the market. Technological advancements, including improvements in efficiency and reliability, enhance the appeal of turbo generators to power producers.

Challenges in the Europe Turbo Generator Market Sector

The market faces challenges including the high initial investment costs associated with turbo generator installations and the volatility of energy prices that can influence project viability. Supply chain disruptions and material costs can impact production and profitability. Intense competition from established players and the emergence of new technologies require continuous innovation and adaptability. The shift towards renewable energy poses both challenges and opportunities, requiring the sector to adapt to integration and hybridization.

Leading Players in the Europe Turbo Generator Market Market

- MAN Energy Solutions

- Toshiba Corporation

- Doosan Power Systems

- Siemens AG

- Centrax Gas Turbines Limited

- Ansaldo Energia SpA

- General Electric Company

- Kawasaki Heavy Industries Ltd

- Andritz AG

- Mitsubishi Heavy Industries Ltd

Key Developments in Europe Turbo Generator Market Sector

- December 2022: The Netherlands announced plans to build two new nuclear power plants, boosting demand for nuclear-compatible turbo generators.

- July 2022: The UK approved the Sizewell C nuclear power plant, signifying a significant investment in nuclear power generation and a potential surge in demand for related equipment.

Strategic Europe Turbo Generator Market Market Outlook

The Europe Turbo Generator market holds substantial future potential, driven by the ongoing need for efficient and reliable power generation, coupled with the drive towards cleaner energy solutions. Strategic opportunities lie in technological innovation, focusing on developing highly efficient and sustainable turbo generators, tailored to both conventional and renewable energy sources. Expanding into emerging markets and leveraging digitalization strategies to enhance operational efficiency and customer service are also crucial for achieving sustained growth and competitive advantage. The market’s long-term outlook remains positive, anticipating considerable expansion in line with predicted economic growth and a commitment toward modernizing energy infrastructure across Europe.

Europe Turbo Generator Market Segmentation

-

1. End User

- 1.1. Coal-fired Power Plant

- 1.2. Gas-fired Power Plant

- 1.3. Nuclear Power Plant

- 1.4. Other End Users

Europe Turbo Generator Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Rest of Europe

Europe Turbo Generator Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Solar Panel Costs4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Upfront Cost

- 3.4. Market Trends

- 3.4.1. Gas-fired Power Plants to Dominate the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Turbo Generator Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Coal-fired Power Plant

- 5.1.2. Gas-fired Power Plant

- 5.1.3. Nuclear Power Plant

- 5.1.4. Other End Users

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Germany

- 5.2.2. United Kingdom

- 5.2.3. France

- 5.2.4. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. Germany Europe Turbo Generator Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by End User

- 6.1.1. Coal-fired Power Plant

- 6.1.2. Gas-fired Power Plant

- 6.1.3. Nuclear Power Plant

- 6.1.4. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by End User

- 7. United Kingdom Europe Turbo Generator Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by End User

- 7.1.1. Coal-fired Power Plant

- 7.1.2. Gas-fired Power Plant

- 7.1.3. Nuclear Power Plant

- 7.1.4. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by End User

- 8. France Europe Turbo Generator Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by End User

- 8.1.1. Coal-fired Power Plant

- 8.1.2. Gas-fired Power Plant

- 8.1.3. Nuclear Power Plant

- 8.1.4. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by End User

- 9. Rest of Europe Europe Turbo Generator Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by End User

- 9.1.1. Coal-fired Power Plant

- 9.1.2. Gas-fired Power Plant

- 9.1.3. Nuclear Power Plant

- 9.1.4. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by End User

- 10. Germany Europe Turbo Generator Market Analysis, Insights and Forecast, 2019-2031

- 11. France Europe Turbo Generator Market Analysis, Insights and Forecast, 2019-2031

- 12. Italy Europe Turbo Generator Market Analysis, Insights and Forecast, 2019-2031

- 13. United Kingdom Europe Turbo Generator Market Analysis, Insights and Forecast, 2019-2031

- 14. Netherlands Europe Turbo Generator Market Analysis, Insights and Forecast, 2019-2031

- 15. Sweden Europe Turbo Generator Market Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Europe Europe Turbo Generator Market Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 MAN Energy Solutions

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Toshiba Corporation

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Doosan Power Systems*List Not Exhaustive

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Siemens AG

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Centrax Gas Turbines Limited

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Ansaldo Energia SpA

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 General Electric Company

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Kawasaki Heavy Industries Ltd

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Andritz AG

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Mitsubishi Heavy Industries Ltd

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.1 MAN Energy Solutions

List of Figures

- Figure 1: Europe Turbo Generator Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Turbo Generator Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Turbo Generator Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Turbo Generator Market Volume K Units Forecast, by Region 2019 & 2032

- Table 3: Europe Turbo Generator Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Europe Turbo Generator Market Volume K Units Forecast, by End User 2019 & 2032

- Table 5: Europe Turbo Generator Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Turbo Generator Market Volume K Units Forecast, by Region 2019 & 2032

- Table 7: Europe Turbo Generator Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Europe Turbo Generator Market Volume K Units Forecast, by Country 2019 & 2032

- Table 9: Germany Europe Turbo Generator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Germany Europe Turbo Generator Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 11: France Europe Turbo Generator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Europe Turbo Generator Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 13: Italy Europe Turbo Generator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Europe Turbo Generator Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 15: United Kingdom Europe Turbo Generator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United Kingdom Europe Turbo Generator Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 17: Netherlands Europe Turbo Generator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Netherlands Europe Turbo Generator Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 19: Sweden Europe Turbo Generator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Sweden Europe Turbo Generator Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 21: Rest of Europe Europe Turbo Generator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Europe Europe Turbo Generator Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 23: Europe Turbo Generator Market Revenue Million Forecast, by End User 2019 & 2032

- Table 24: Europe Turbo Generator Market Volume K Units Forecast, by End User 2019 & 2032

- Table 25: Europe Turbo Generator Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Europe Turbo Generator Market Volume K Units Forecast, by Country 2019 & 2032

- Table 27: Europe Turbo Generator Market Revenue Million Forecast, by End User 2019 & 2032

- Table 28: Europe Turbo Generator Market Volume K Units Forecast, by End User 2019 & 2032

- Table 29: Europe Turbo Generator Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Europe Turbo Generator Market Volume K Units Forecast, by Country 2019 & 2032

- Table 31: Europe Turbo Generator Market Revenue Million Forecast, by End User 2019 & 2032

- Table 32: Europe Turbo Generator Market Volume K Units Forecast, by End User 2019 & 2032

- Table 33: Europe Turbo Generator Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Europe Turbo Generator Market Volume K Units Forecast, by Country 2019 & 2032

- Table 35: Europe Turbo Generator Market Revenue Million Forecast, by End User 2019 & 2032

- Table 36: Europe Turbo Generator Market Volume K Units Forecast, by End User 2019 & 2032

- Table 37: Europe Turbo Generator Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Europe Turbo Generator Market Volume K Units Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Turbo Generator Market?

The projected CAGR is approximately > 3.50%.

2. Which companies are prominent players in the Europe Turbo Generator Market?

Key companies in the market include MAN Energy Solutions, Toshiba Corporation, Doosan Power Systems*List Not Exhaustive, Siemens AG, Centrax Gas Turbines Limited, Ansaldo Energia SpA, General Electric Company, Kawasaki Heavy Industries Ltd, Andritz AG, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Europe Turbo Generator Market?

The market segments include End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Solar Panel Costs4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Gas-fired Power Plants to Dominate the Market Growth.

7. Are there any restraints impacting market growth?

4.; High Upfront Cost.

8. Can you provide examples of recent developments in the market?

In December 2022, the Government of the Netherlands announced its plans to build two new nuclear power plants in Borssele by 2035. The construction of the power plants is expected to start in 2028.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Turbo Generator Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Turbo Generator Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Turbo Generator Market?

To stay informed about further developments, trends, and reports in the Europe Turbo Generator Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence