Key Insights

The European space propulsion market, projected at 10.21 billion in the base year 2024, is set for substantial expansion. This growth is driven by heightened government investment in space exploration initiatives and the escalating demand for advanced satellite services. A Compound Annual Growth Rate (CAGR) of 11.9% from 2024 to 2033 indicates significant market evolution, largely propelled by the widespread adoption of electric propulsion systems due to their superior fuel efficiency and extended mission capabilities. Key growth catalysts include the increasing deployment of small satellites, a heightened focus on space debris mitigation, and significant advancements in reusable launch vehicle technology. Emerging technological trends, such as the development of high-thrust electric propulsion and enhanced fuel storage solutions, are further accelerating market dynamics. While regulatory complexities and considerable upfront investment costs for novel propulsion technologies may present challenges, the market trajectory remains exceptionally promising. Germany, France, and the United Kingdom are anticipated to lead the European market, capitalizing on their robust aerospace sectors and extensive research and development infrastructure. The electric propulsion segment is poised for the most rapid growth, owing to its environmental advantages and cost efficiencies compared to conventional chemical propulsion methods.

Europe Space Propulsion Market Market Size (In Billion)

The competitive arena within the European space propulsion market features established aerospace leaders such as Ariane Group, Safran SA, and Thales, alongside agile, emerging firms specializing in electric propulsion. This dynamic competitive environment fuels innovation and accelerates the development of next-generation technologies, contributing to sustained market expansion. Increased private sector engagement in space endeavors and growing demand for Earth observation, communication, and navigation satellites present further avenues for market growth. Future market success will be contingent upon continuous technological innovation, strategic collaborations, and supportive governmental policies that encourage investment in space exploration and the advancement of pioneering propulsion systems.

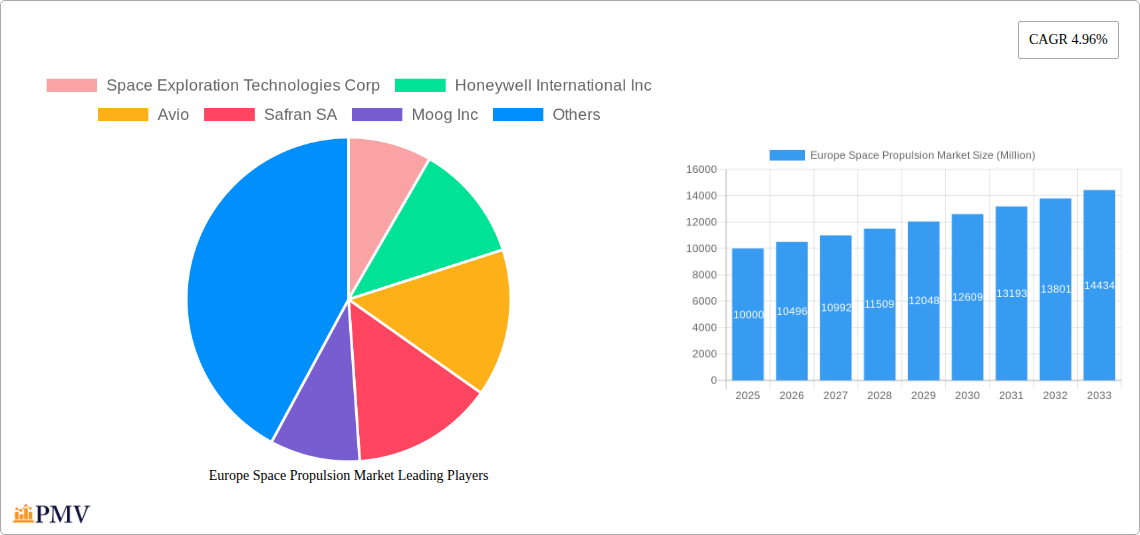

Europe Space Propulsion Market Company Market Share

Europe Space Propulsion Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Space Propulsion Market, offering invaluable insights for stakeholders across the aerospace and defense industry. The study period covers 2019-2033, with a base year of 2025 and a forecast period spanning 2025-2033. This report is crucial for understanding market dynamics, identifying growth opportunities, and making informed strategic decisions. The market is segmented by propulsion technology (Electric, Gas-based, Liquid Fuel) and key European countries (France, Germany, Russia, United Kingdom). The report features a detailed competitive landscape, analyzing key players like Space Exploration Technologies Corp, Honeywell International Inc, Avio, Safran SA, Moog Inc, Ariane Group, OHB SE, Sitael S p A, and Thales. The total market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033.

Europe Space Propulsion Market Market Structure & Competitive Dynamics

The European space propulsion market exhibits a moderately concentrated structure, with several multinational corporations dominating the landscape. Key players leverage their established technological expertise and extensive supply chains to secure substantial market share. The market is influenced by a dynamic innovation ecosystem, driven by both government-funded research initiatives and private sector investments. Stringent regulatory frameworks, particularly concerning safety and environmental compliance, shape the operational landscape. Product substitutes are limited, primarily focusing on alternative propulsion technologies with varying degrees of maturity. End-user trends indicate a growing demand for more efficient, reliable, and cost-effective propulsion systems for various space applications, including satellite launches, deep-space exploration, and in-orbit servicing. M&A activity in this sector remains relatively active, with strategic acquisitions aimed at strengthening technological capabilities, expanding market reach, and securing access to critical resources. The average M&A deal value in the past five years has been approximately xx Million.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share.

- Innovation Ecosystem: Active, fueled by government funding and private sector R&D.

- Regulatory Framework: Stringent safety and environmental standards.

- Product Substitutes: Limited, primarily alternative propulsion technologies.

- End-User Trends: Demand for efficient, reliable, and cost-effective solutions.

- M&A Activity: Active, driven by strategic expansion and technological acquisition.

Europe Space Propulsion Market Industry Trends & Insights

The Europe Space Propulsion Market is experiencing robust growth, driven by several factors. Increasing demand for satellite constellations for communication, Earth observation, and navigation is a significant catalyst. Advancements in electric propulsion technology, offering higher fuel efficiency and extended mission lifetimes, are reshaping the market landscape. Government investments in space exploration programs and initiatives aimed at boosting domestic space capabilities continue to stimulate market growth. The market's CAGR is projected to be xx% during the forecast period (2025-2033). Market penetration of electric propulsion systems is expected to increase significantly, surpassing xx% by 2033. However, challenges remain, such as high initial development costs and the need for robust supply chain infrastructure. Competitive dynamics are characterized by ongoing technological innovation, strategic partnerships, and the emergence of new entrants with disruptive technologies.

Dominant Markets & Segments in Europe Space Propulsion Market

Within Europe, the United Kingdom and France currently represent the dominant markets for space propulsion. Their well-established space industries, robust government support, and presence of major players are key contributors to this dominance.

Key Drivers for UK and France:

- Robust Space Industry Infrastructure: Established manufacturing capabilities, skilled workforce, and strong research institutions.

- Government Funding and Support: Significant investments in national space programs and R&D initiatives.

- Presence of Major Players: Headquarters or significant operations of leading space propulsion companies.

- Favorable Regulatory Environment: Supportive policies that encourage innovation and investment.

Segment Dominance Analysis:

The Liquid Fuel segment currently holds the largest market share due to its established technology and reliability for larger launch vehicles. However, the Electric Propulsion segment is anticipated to experience the fastest growth in the forecast period, driven by technological advancements and increasing demand for cost-effective and efficient satellite operations.

Europe Space Propulsion Market Product Innovations

Recent years have witnessed significant advancements in space propulsion technology, driven by the need for improved efficiency, reduced cost, and enhanced mission capabilities. Electric propulsion systems are gaining prominence, leveraging advancements in electric thrusters and power systems to provide higher specific impulse and longer operational lifetimes. New materials and manufacturing techniques are enhancing the performance and reliability of gas-based and liquid fuel propulsion systems. The market is witnessing the emergence of hybrid propulsion systems, combining the advantages of different technologies to optimize performance for specific missions. These innovations are improving the overall performance and cost-effectiveness of space missions, driving market growth.

Report Segmentation & Scope

This report segments the Europe Space Propulsion Market based on propulsion technology and country.

Propulsion Technology:

- Electric Propulsion: This segment is projected to experience significant growth due to increasing demand for efficient and cost-effective solutions for satellite missions. The competitive landscape is characterized by both established and emerging players developing advanced electric thrusters and power systems.

- Gas-based Propulsion: This segment represents a mature market with established technologies and a strong presence of key players. Growth will be driven by applications in smaller launch vehicles and specific mission requirements.

- Liquid Fuel Propulsion: This segment remains dominant, particularly for large launch vehicles. Innovation focuses on increasing efficiency, reducing cost, and improving environmental impact.

Country:

- France: A strong space industry with a significant presence of major players and government support.

- Germany: A technologically advanced market with a focus on innovation and collaboration.

- Russia: A significant player, particularly in the liquid fuel propulsion segment.

- United Kingdom: A developing market with growing investment and partnerships.

Key Drivers of Europe Space Propulsion Market Growth

The European space propulsion market is experiencing significant growth due to several key drivers. These include rising demand for satellite-based services (communications, navigation, Earth observation), increasing investments in space exploration programs by national space agencies and private entities, technological advancements in electric propulsion resulting in higher efficiency and lower cost, and supportive government policies fostering the development of the space sector. Furthermore, the growing focus on in-space servicing and maintenance is creating a demand for advanced propulsion systems.

Challenges in the Europe Space Propulsion Market Sector

Despite the significant growth opportunities, the European space propulsion market faces several challenges. High development costs associated with new propulsion technologies limit wider adoption. Competition from established players with entrenched positions creates significant barriers to entry for new entrants. Maintaining a robust supply chain, ensuring reliability and managing the complexity of integrating diverse propulsion systems into spacecraft present ongoing challenges. Additionally, regulatory compliance and environmental concerns related to the use of certain propellants pose operational constraints.

Leading Players in the Europe Space Propulsion Market Market

- Space Exploration Technologies Corp

- Honeywell International Inc

- Avio

- Safran SA

- Moog Inc

- Ariane Group

- OHB SE

- Sitael S p A

- Thales

Key Developments in Europe Space Propulsion Market Sector

- February 2023: Thales Alenia Space contracted with the Korea Aerospace Research Institute (KARI) to provide integrated electric propulsion for the GEO-KOMPSAT-3 (GK3) satellite, signifying growing demand for electric propulsion in geostationary satellites.

- December 2022: GKN Aerospace secured a contract with ArianeGroup to supply components for the Ariane 6 launcher, highlighting ongoing production activities and investment in advanced launch vehicle technology.

- September 2022: OHB SE (through its subsidiary OHB Sweden) partnered with Atlantis to supply microsatellites, illustrating collaborations within the European space industry and the growing microsatellite market.

Strategic Europe Space Propulsion Market Market Outlook

The future of the European space propulsion market is bright, with substantial growth opportunities driven by increased demand for satellite constellations, expanding space exploration endeavors, and advancements in propulsion technologies. Strategic partnerships and investments in research and development will play a crucial role in driving innovation and enhancing competitiveness within this dynamic market. The market's potential for growth is significant, particularly within the electric propulsion segment, with opportunities for both established players and innovative startups to capture market share. Focusing on efficiency, reliability, and cost reduction will be paramount to success.

Europe Space Propulsion Market Segmentation

-

1. Propulsion Tech

- 1.1. Electric

- 1.2. Gas based

- 1.3. Liquid Fuel

Europe Space Propulsion Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Space Propulsion Market Regional Market Share

Geographic Coverage of Europe Space Propulsion Market

Europe Space Propulsion Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Space Propulsion Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Tech

- 5.1.1. Electric

- 5.1.2. Gas based

- 5.1.3. Liquid Fuel

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Tech

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Space Exploration Technologies Corp

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Honeywell International Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Avio

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Safran SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Moog Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ariane Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 OHB SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sitael S p A

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Thale

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Space Exploration Technologies Corp

List of Figures

- Figure 1: Europe Space Propulsion Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Space Propulsion Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Space Propulsion Market Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 2: Europe Space Propulsion Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Europe Space Propulsion Market Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 4: Europe Space Propulsion Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United Kingdom Europe Space Propulsion Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Germany Europe Space Propulsion Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: France Europe Space Propulsion Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Italy Europe Space Propulsion Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Spain Europe Space Propulsion Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Netherlands Europe Space Propulsion Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Belgium Europe Space Propulsion Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Sweden Europe Space Propulsion Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Norway Europe Space Propulsion Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Poland Europe Space Propulsion Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Denmark Europe Space Propulsion Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Space Propulsion Market?

The projected CAGR is approximately 11.9%.

2. Which companies are prominent players in the Europe Space Propulsion Market?

Key companies in the market include Space Exploration Technologies Corp, Honeywell International Inc, Avio, Safran SA, Moog Inc, Ariane Group, OHB SE, Sitael S p A, Thale.

3. What are the main segments of the Europe Space Propulsion Market?

The market segments include Propulsion Tech.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.21 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Thales Alenia Space has contracted with the Korea Aerospace Research Institute (KARI) to provide the integrated electric propulsion on their GEO-KOMPSAT-3 (GK3) satellite.December 2022: GKN Aerospace has contracted with ArianeGroup to supply the next stage of the Ariane 6 turbine and Vulcain nozzle. The contract covers the manufacturing and supply of units for the following 14 Ariane 6 launchers, which will go into production by 2025. GKN Aerospace is currently focused on industrializing and integrating novel and innovative technologies into the Ariane 6 product.September 2022: OHB Sweden, a subsidiary of space group OHB SE, and Atlantis, a Spanish space technology company, have signed a contract to jointly supply two microsatellites based on OHB Sweden's InnoSat platformThe satellites will carry four optical channels provided by Satlantis and will be launched in 2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Space Propulsion Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Space Propulsion Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Space Propulsion Market?

To stay informed about further developments, trends, and reports in the Europe Space Propulsion Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence