Key Insights

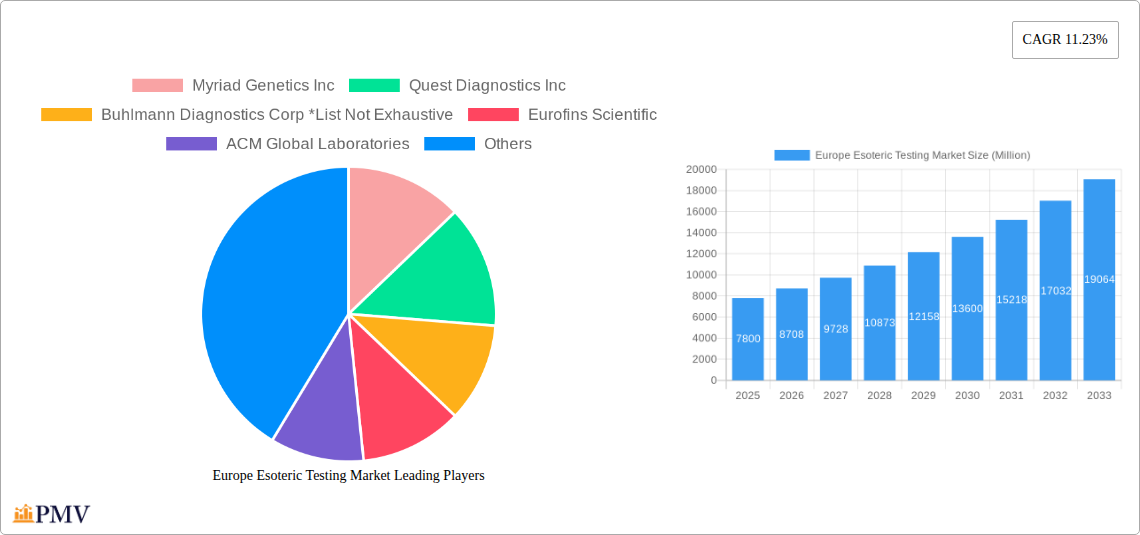

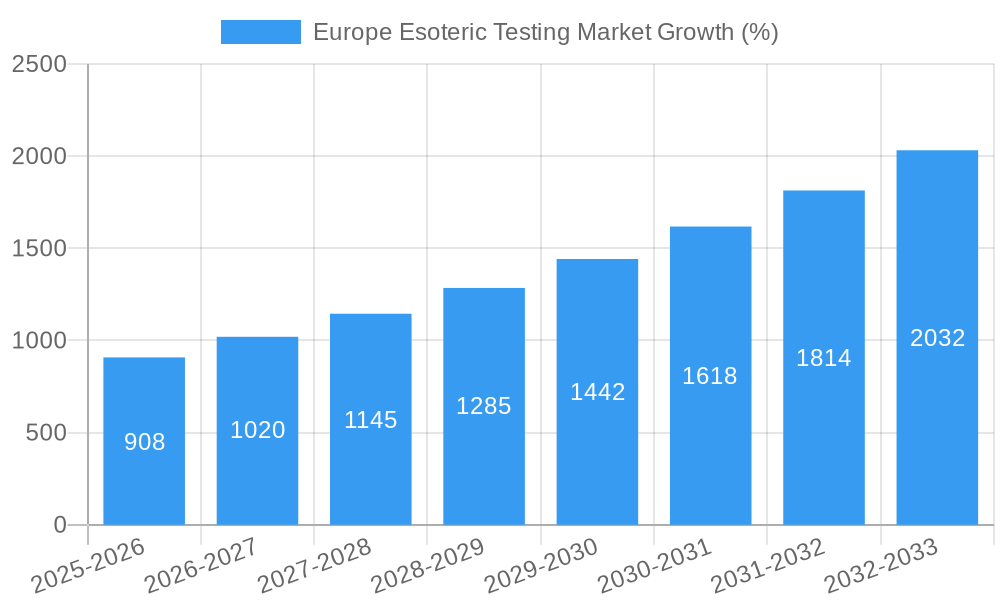

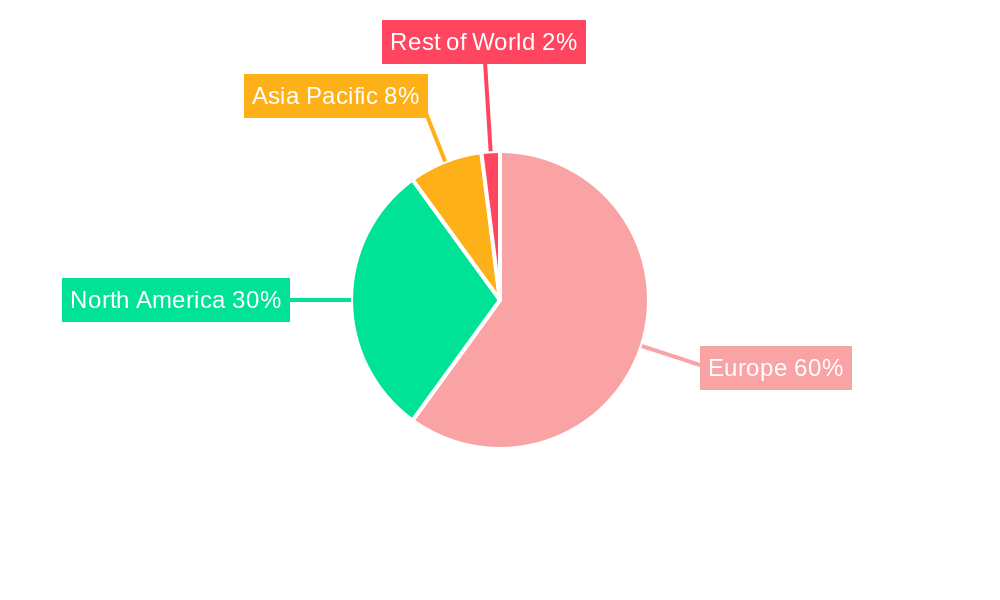

The European esoteric testing market, valued at €7.80 billion in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 11.23% from 2025 to 2033. This expansion is driven by several key factors. Increasing prevalence of chronic diseases like cancer and autoimmune disorders fuels demand for sophisticated diagnostic tests. Technological advancements, particularly in areas like flow cytometry, mass spectrometry, and chemiluminescence immunoassay, are enhancing test accuracy, speed, and efficiency, further stimulating market growth. Furthermore, rising healthcare expenditure across major European nations, coupled with an aging population requiring more specialized medical care, contributes significantly to market expansion. Germany, the United Kingdom, France, and Italy represent the largest market segments within Europe, reflecting their advanced healthcare infrastructure and higher disease prevalence rates. However, regulatory hurdles and high testing costs pose potential restraints to market growth. The market is segmented by test type (endocrinology, infectious disease, oncology, neurology, toxicology, and others) and technology, offering diverse opportunities for market players.

The competitive landscape is dynamic, featuring both large multinational corporations like Quest Diagnostics and Eurofins Scientific, and specialized companies such as Myriad Genetics focusing on specific niche areas within esoteric testing. Smaller, regional laboratories also play a vital role, catering to local healthcare needs. Future growth will be influenced by the ongoing development and adoption of innovative diagnostic tools, personalized medicine approaches, and increased integration of esoteric testing into routine clinical practice. Strategic partnerships and acquisitions are expected to shape the competitive landscape, as companies strive to expand their service offerings and geographic reach within this lucrative and expanding market. The projected growth trajectory indicates a significant expansion of the European esoteric testing market throughout the forecast period.

Europe Esoteric Testing Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe esoteric testing market, covering market size, segmentation, competitive landscape, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers actionable insights for industry stakeholders, including manufacturers, distributors, investors, and regulatory bodies.

Europe Esoteric Testing Market Structure & Competitive Dynamics

The Europe esoteric testing market is characterized by a moderately concentrated structure, with several large multinational players and numerous smaller, specialized companies vying for market share. Market concentration is influenced by factors such as technological capabilities, regulatory compliance, and access to distribution networks. Innovation ecosystems are highly dynamic, driven by advancements in molecular diagnostics, genomics, and proteomics. The regulatory landscape, governed primarily by the In Vitro Diagnostic Regulation (IVDR), significantly impacts market entry and product approvals. Product substitution is a major factor, with newer technologies (e.g., next-generation sequencing) replacing older methods (e.g., ELISA). End-user trends are increasingly towards personalized medicine and early disease detection, demanding more sophisticated and specialized tests.

M&A activity has played a significant role in shaping the market landscape. Recent deals highlight this trend: Bruker Corporation's acquisition of ELITechGroup for USD 938.50 Million exemplifies the ongoing consolidation.

- Market Share: The top 5 players hold an estimated xx% market share in 2025.

- M&A Deal Values (2019-2024): Total deal value estimated at USD xx Million.

- Average Deal Size: USD xx Million

Europe Esoteric Testing Market Industry Trends & Insights

The Europe esoteric testing market is experiencing robust growth, driven by rising prevalence of chronic diseases, increasing demand for early diagnosis and personalized medicine, and ongoing technological advancements. The market is projected to exhibit a CAGR of xx% during the forecast period (2025-2033). Technological disruptions are central to market evolution, with next-generation sequencing, mass spectrometry, and advanced immunoassays gaining significant traction. Consumer preferences are shifting towards faster, more accurate, and less invasive tests. Competitive dynamics are marked by intense innovation, strategic partnerships, and acquisitions. Market penetration of advanced technologies remains relatively low, presenting significant growth opportunities.

Dominant Markets & Segments in Europe Esoteric Testing Market

The Oncology segment is the dominant test type, driven by the increasing incidence of cancer and the growing adoption of targeted therapies. Germany and the UK represent the leading national markets, driven by robust healthcare infrastructure and high per capita healthcare spending.

Leading Segments (2025):

- Test Type: Oncology (xx% market share), Infectious Disease (xx%), Endocrinology (xx%)

- Technology: Mass Spectrometry (xx% market share), Chemiluminescence Immunoassay (xx%), Flow Cytometry (xx%)

Key Drivers:

- Germany: Strong healthcare infrastructure, high R&D spending, favorable regulatory environment.

- UK: National health service investment, advanced medical technology adoption, significant research capabilities.

Europe Esoteric Testing Market Product Innovations

Recent product innovations include improved multiplex assays enabling simultaneous testing for multiple biomarkers, miniaturized devices enhancing point-of-care testing, and AI-powered diagnostic tools for enhanced accuracy and efficiency. These innovations provide competitive advantages through enhanced speed, accuracy, and cost-effectiveness. Technological trends are focusing on automation, digitization, and data analytics to streamline workflows and improve diagnostic capabilities. The market fit for these innovations is excellent, aligning with the growing demand for personalized and precise medicine.

Report Segmentation & Scope

The report segments the Europe esoteric testing market by test type (Endocrinology, Infectious Disease, Oncology, Neurology, Toxicology, Other Test Types) and technology (Flow Cytometry, Chemiluminescence Immunoassay, Mass Spectrometry, Radio Immunoassay, Other Technologies). Each segment is analyzed in terms of historical and projected market size, growth rate, and key players. Growth projections vary across segments, with Oncology and Mass Spectrometry showing the fastest growth, driven by technological advancements and increasing demand. Competitive dynamics differ depending on the segment, reflecting varying levels of technological maturity and the competitive intensity.

Key Drivers of Europe Esoteric Testing Market Growth

Several factors are fueling the growth of the Europe esoteric testing market. Technological advancements such as next-generation sequencing and mass spectrometry enhance diagnostic capabilities. The increasing prevalence of chronic diseases necessitates more sophisticated diagnostic tools. Favorable regulatory environments, such as the implementation of the IVDR, promote innovation and market access. Furthermore, substantial investments in healthcare infrastructure and rising healthcare expenditure are driving market expansion.

Challenges in the Europe Esoteric Testing Market Sector

The Europe esoteric testing market faces several challenges. Regulatory hurdles, particularly around IVDR compliance, increase development and approval times. Supply chain disruptions can impact the availability and cost of reagents and consumables. Intense competition among established and emerging players limits profit margins. These challenges exert a quantifiable negative impact, resulting in xx% reduction in expected market growth in xx region.

Leading Players in the Europe Esoteric Testing Market Market

- Myriad Genetics Inc

- Quest Diagnostics Inc

- Buhlmann Diagnostics Corp

- Eurofins Scientific

- ACM Global Laboratories

- Arup Laboratories

- Nordic Laboratories

- OPKO Health Inc

- Miraca Holdings Inc

- Foundation Medicine

- Exact Sciences

Key Developments in Europe Esoteric Testing Market Sector

- May 2024: Bruker Corporation's acquisition of ELITechGroup for USD 938.50 Million significantly expands its presence in molecular diagnostics and IVD markets, boosting its market share and product portfolio.

- March 2023: OGT's IVDR certification for CytoCell FISH probes strengthens its position in hematological cancer and prenatal diagnostics, enhancing the accuracy and reliability of genetic testing in Europe.

Strategic Europe Esoteric Testing Market Market Outlook

The future of the Europe esoteric testing market appears bright, driven by continued technological innovation, rising prevalence of chronic diseases, and increasing demand for personalized medicine. Strategic opportunities exist in developing and commercializing innovative diagnostic tools, expanding into underserved markets, and leveraging data analytics to improve diagnostic efficiency. Focus on point-of-care diagnostics and digital health solutions will be key growth accelerators.

Europe Esoteric Testing Market Segmentation

-

1. Test Type

- 1.1. Endocrinology

- 1.2. Infectious Disease

- 1.3. Oncology

- 1.4. Neurology

- 1.5. Toxicology

- 1.6. Other Test Types

-

2. Technology

- 2.1. Flow Cytometry

- 2.2. Chemiluminescence Immunoassay

- 2.3. Mass Spectrometry

- 2.4. Radio Immunoassay

- 2.5. Other Technologies

Europe Esoteric Testing Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Spain

- 6. Rest of Europe

Europe Esoteric Testing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.23% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Burden of Chronic Diseases and Rare Diseases; Increasing Research Expenditure

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Oncology Segment is Expected to Exhibit Significant Market Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Esoteric Testing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Test Type

- 5.1.1. Endocrinology

- 5.1.2. Infectious Disease

- 5.1.3. Oncology

- 5.1.4. Neurology

- 5.1.5. Toxicology

- 5.1.6. Other Test Types

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Flow Cytometry

- 5.2.2. Chemiluminescence Immunoassay

- 5.2.3. Mass Spectrometry

- 5.2.4. Radio Immunoassay

- 5.2.5. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Italy

- 5.3.5. Spain

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Test Type

- 6. Germany Europe Esoteric Testing Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Test Type

- 6.1.1. Endocrinology

- 6.1.2. Infectious Disease

- 6.1.3. Oncology

- 6.1.4. Neurology

- 6.1.5. Toxicology

- 6.1.6. Other Test Types

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Flow Cytometry

- 6.2.2. Chemiluminescence Immunoassay

- 6.2.3. Mass Spectrometry

- 6.2.4. Radio Immunoassay

- 6.2.5. Other Technologies

- 6.1. Market Analysis, Insights and Forecast - by Test Type

- 7. United Kingdom Europe Esoteric Testing Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Test Type

- 7.1.1. Endocrinology

- 7.1.2. Infectious Disease

- 7.1.3. Oncology

- 7.1.4. Neurology

- 7.1.5. Toxicology

- 7.1.6. Other Test Types

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Flow Cytometry

- 7.2.2. Chemiluminescence Immunoassay

- 7.2.3. Mass Spectrometry

- 7.2.4. Radio Immunoassay

- 7.2.5. Other Technologies

- 7.1. Market Analysis, Insights and Forecast - by Test Type

- 8. France Europe Esoteric Testing Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Test Type

- 8.1.1. Endocrinology

- 8.1.2. Infectious Disease

- 8.1.3. Oncology

- 8.1.4. Neurology

- 8.1.5. Toxicology

- 8.1.6. Other Test Types

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Flow Cytometry

- 8.2.2. Chemiluminescence Immunoassay

- 8.2.3. Mass Spectrometry

- 8.2.4. Radio Immunoassay

- 8.2.5. Other Technologies

- 8.1. Market Analysis, Insights and Forecast - by Test Type

- 9. Italy Europe Esoteric Testing Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Test Type

- 9.1.1. Endocrinology

- 9.1.2. Infectious Disease

- 9.1.3. Oncology

- 9.1.4. Neurology

- 9.1.5. Toxicology

- 9.1.6. Other Test Types

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Flow Cytometry

- 9.2.2. Chemiluminescence Immunoassay

- 9.2.3. Mass Spectrometry

- 9.2.4. Radio Immunoassay

- 9.2.5. Other Technologies

- 9.1. Market Analysis, Insights and Forecast - by Test Type

- 10. Spain Europe Esoteric Testing Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Test Type

- 10.1.1. Endocrinology

- 10.1.2. Infectious Disease

- 10.1.3. Oncology

- 10.1.4. Neurology

- 10.1.5. Toxicology

- 10.1.6. Other Test Types

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Flow Cytometry

- 10.2.2. Chemiluminescence Immunoassay

- 10.2.3. Mass Spectrometry

- 10.2.4. Radio Immunoassay

- 10.2.5. Other Technologies

- 10.1. Market Analysis, Insights and Forecast - by Test Type

- 11. Rest of Europe Europe Esoteric Testing Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Test Type

- 11.1.1. Endocrinology

- 11.1.2. Infectious Disease

- 11.1.3. Oncology

- 11.1.4. Neurology

- 11.1.5. Toxicology

- 11.1.6. Other Test Types

- 11.2. Market Analysis, Insights and Forecast - by Technology

- 11.2.1. Flow Cytometry

- 11.2.2. Chemiluminescence Immunoassay

- 11.2.3. Mass Spectrometry

- 11.2.4. Radio Immunoassay

- 11.2.5. Other Technologies

- 11.1. Market Analysis, Insights and Forecast - by Test Type

- 12. Germany Europe Esoteric Testing Market Analysis, Insights and Forecast, 2019-2031

- 13. United Kingdom Europe Esoteric Testing Market Analysis, Insights and Forecast, 2019-2031

- 14. France Europe Esoteric Testing Market Analysis, Insights and Forecast, 2019-2031

- 15. Italy Europe Esoteric Testing Market Analysis, Insights and Forecast, 2019-2031

- 16. Spain Europe Esoteric Testing Market Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Europe Europe Esoteric Testing Market Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Myriad Genetics Inc

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Quest Diagnostics Inc

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Buhlmann Diagnostics Corp *List Not Exhaustive

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Eurofins Scientific

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 ACM Global Laboratories

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Arup Laboratories

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Nordic Laboratories

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 OPKO Health Inc

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Miraca Holdings Inc

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Foundation Medicine

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 Exact Sciences

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.1 Myriad Genetics Inc

List of Figures

- Figure 1: Europe Esoteric Testing Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Esoteric Testing Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Esoteric Testing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Esoteric Testing Market Revenue Million Forecast, by Test Type 2019 & 2032

- Table 3: Europe Esoteric Testing Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: Europe Esoteric Testing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Esoteric Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Esoteric Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: United Kingdom Europe Esoteric Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe Esoteric Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe Esoteric Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Spain Europe Esoteric Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Europe Esoteric Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Europe Esoteric Testing Market Revenue Million Forecast, by Test Type 2019 & 2032

- Table 13: Europe Esoteric Testing Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 14: Europe Esoteric Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Europe Esoteric Testing Market Revenue Million Forecast, by Test Type 2019 & 2032

- Table 16: Europe Esoteric Testing Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 17: Europe Esoteric Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Europe Esoteric Testing Market Revenue Million Forecast, by Test Type 2019 & 2032

- Table 19: Europe Esoteric Testing Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 20: Europe Esoteric Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Europe Esoteric Testing Market Revenue Million Forecast, by Test Type 2019 & 2032

- Table 22: Europe Esoteric Testing Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 23: Europe Esoteric Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Europe Esoteric Testing Market Revenue Million Forecast, by Test Type 2019 & 2032

- Table 25: Europe Esoteric Testing Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 26: Europe Esoteric Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Europe Esoteric Testing Market Revenue Million Forecast, by Test Type 2019 & 2032

- Table 28: Europe Esoteric Testing Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 29: Europe Esoteric Testing Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Esoteric Testing Market?

The projected CAGR is approximately 11.23%.

2. Which companies are prominent players in the Europe Esoteric Testing Market?

Key companies in the market include Myriad Genetics Inc, Quest Diagnostics Inc, Buhlmann Diagnostics Corp *List Not Exhaustive, Eurofins Scientific, ACM Global Laboratories, Arup Laboratories, Nordic Laboratories, OPKO Health Inc, Miraca Holdings Inc, Foundation Medicine, Exact Sciences.

3. What are the main segments of the Europe Esoteric Testing Market?

The market segments include Test Type, Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Burden of Chronic Diseases and Rare Diseases; Increasing Research Expenditure.

6. What are the notable trends driving market growth?

Oncology Segment is Expected to Exhibit Significant Market Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

May 2024: Bruker Corporation completed its acquisition of ELITechGroup (ELITech) for a cash consideration of EUR 870 million (USD 938.50 million), excluding the sale of ELITech's clinical chemistry business. ELITech is a specialized, rapidly expanding, and highly profitable provider of systems and assays for molecular diagnostics (MDx), biomedical systems, specialty in vitro diagnostics (IVD), and microbiology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Esoteric Testing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Esoteric Testing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Esoteric Testing Market?

To stay informed about further developments, trends, and reports in the Europe Esoteric Testing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence