Key Insights

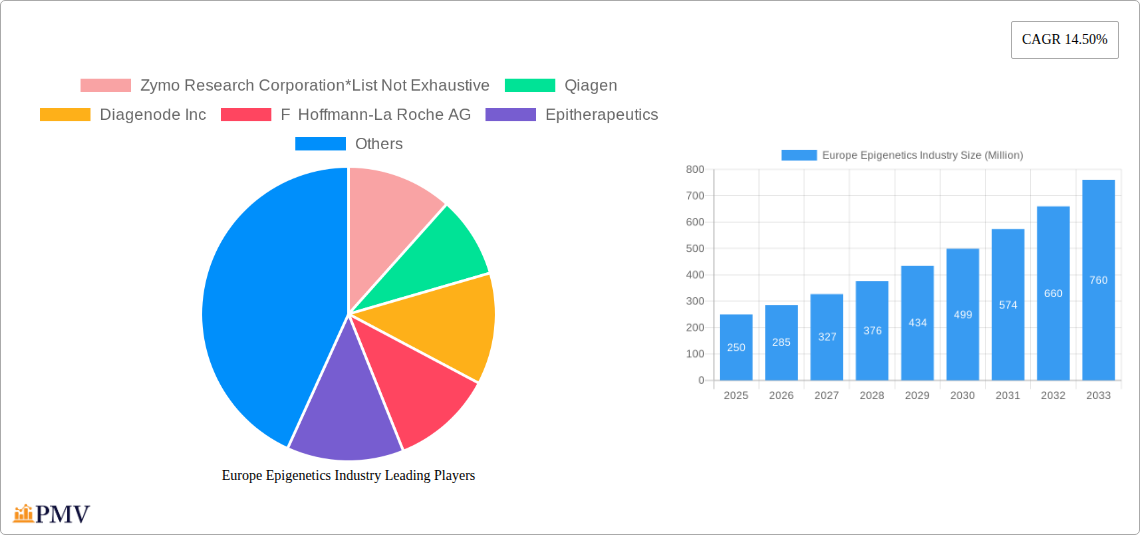

The European epigenetics market, valued at approximately €[Estimate based on market size XX and assuming a reasonable proportion for Europe; for example, if XX is 1000 million and Europe constitutes 25% of the global market, then this would be 250 million] in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 14.50% from 2025 to 2033. This expansion is fueled by several key factors. The increasing prevalence of chronic diseases like cancer, coupled with advancements in research techniques such as next-generation sequencing and CRISPR-Cas9 gene editing, are driving the demand for epigenetic testing and therapies. Furthermore, substantial investments in research and development by pharmaceutical and biotechnology companies, alongside supportive government initiatives promoting personalized medicine, are contributing to market growth. The market segmentation reveals a strong preference for DNA methylation and histone modification technologies, alongside a growing adoption of epigenetic kits and reagents for research purposes. Oncology remains the largest application segment, reflecting the significant potential of epigenetic therapies in cancer treatment. Germany, France, and the United Kingdom are currently leading the European market due to well-established research infrastructure and healthcare systems. However, other nations within the region are expected to witness considerable growth, driven by rising awareness about epigenetic factors in health and disease.

The market's growth, however, is not without constraints. The high cost of epigenetic technologies and the complexity involved in their application can limit market penetration. Moreover, the regulatory landscape surrounding epigenetic therapies requires careful navigation, potentially affecting market entry and expansion. Despite these challenges, the continued advancements in technology, coupled with a growing understanding of epigenetic mechanisms, suggest a promising future for the European epigenetics market. The expanding knowledge of epigenetic biomarkers and their potential for early disease detection and targeted therapies is projected to further fuel this growth trajectory over the forecast period. The increasing adoption of personalized medicine strategies promises to broaden the application of epigenetics across various therapeutic areas, driving sustained market expansion.

Europe Epigenetics Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe epigenetics industry, covering market size, segmentation, growth drivers, challenges, competitive landscape, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period is 2025-2033, and the historical period covers 2019-2024. The report offers actionable insights for stakeholders, including companies, investors, and researchers, operating within this dynamic sector. The European epigenetics market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Europe Epigenetics Industry Market Structure & Competitive Dynamics

The European epigenetics market is characterized by a moderately consolidated structure, with a few major players holding significant market share. Qiagen, Illumina Inc, Thermo Fisher Scientific, F Hoffmann-La Roche AG, and Merck & Co. are among the leading companies, collectively accounting for an estimated xx% of the market in 2025. However, numerous smaller players and startups are contributing to innovation and market expansion.

The market's competitive dynamics are shaped by intense R&D activities, strategic partnerships, mergers and acquisitions (M&A), and the introduction of novel technologies. Recent M&A activities, while not publicly disclosed in detail, suggest a consolidation trend, with deal values averaging approximately xx Million per transaction in the past five years. The regulatory landscape in Europe, although relatively favorable to the industry, involves navigating various approvals and compliance requirements. Product substitution is a potential threat, with emerging technologies constantly challenging existing methodologies. End-user trends are driven by increasing demand for personalized medicine and growing awareness of epigenetics' role in various diseases.

Europe Epigenetics Industry Industry Trends & Insights

The European epigenetics market is experiencing robust growth, propelled by several key factors. The rising prevalence of chronic diseases like cancer, the increasing adoption of advanced technologies, and substantial investments in research and development are major drivers. The market's CAGR is projected at xx% between 2025 and 2033. The increasing understanding of epigenetic mechanisms in disease pathogenesis is fueling the development of novel diagnostics and therapeutics. Market penetration of epigenetic testing is growing steadily, with significant expansion anticipated in oncology and other therapeutic areas. This growth is also supported by favorable government funding and increasing public awareness of the field. However, the market faces challenges including high testing costs, the complexity of epigenetic analysis, and the need for standardized analytical methods. The market's competitive landscape is dynamic, with both established players and emerging companies vying for market share through technological innovations and strategic collaborations. Technological disruptions, such as advancements in next-generation sequencing (NGS) and CRISPR-Cas9 technology, are continuously reshaping the landscape and driving innovation.

Dominant Markets & Segments in Europe Epigenetics Industry

- Leading Region: Germany holds the largest market share in Europe, driven by strong research infrastructure, a large pharmaceutical industry, and substantial government funding.

- Dominant Technology Segments: DNA methylation and histone modification assays (methylation and acetylation) currently dominate the technology segment, fueled by the availability of robust methodologies and well-established applications. Chromatin structure analysis is also exhibiting considerable growth.

- Leading Product Segments: Kits represent the largest product segment due to their convenience and ease of use for various applications. The reagent segment shows significant potential for growth, particularly RNA modifying enzymes, as research expands into RNA-based epigenetic modifications.

- Dominant Application Segment: Oncology holds the largest market share due to the significant role of epigenetics in cancer development and treatment. Non-oncology applications are expanding rapidly, especially in developmental biology.

Key drivers in these dominant segments include government funding for research, advancements in technology, and the increasing use of epigenetics in drug discovery and personalized medicine. The strong presence of research institutions and pharmaceutical companies within these regions provides further support.

Europe Epigenetics Industry Product Innovations

Recent years have witnessed significant advancements in epigenetic technologies, including the development of highly sensitive and specific assays, improved data analysis tools, and the integration of artificial intelligence (AI) for faster and more accurate results. These innovations have expanded the range of applications and improved the clinical utility of epigenetic testing. The market is also seeing the emergence of novel therapeutic approaches targeting epigenetic mechanisms, promising to revolutionize the treatment of various diseases. Companies are focusing on developing user-friendly and cost-effective products to broaden market access and improve the affordability of epigenetic testing.

Report Segmentation & Scope

This report segments the European epigenetics market by technology (DNA Methylation, Histone Methylation, Histone Acetylation, Large noncoding RNA, MicroRNA modification, Chromatin Structures), product (Kits, Reagents, Enzymes, Instruments), and application (Oncology, Non-Oncology, including Developmental Biology and Other Research Areas). Each segment's growth projections, market size, and competitive dynamics are analyzed in detail. The report provides granular data on market size and forecasts for each segment, projecting substantial growth across all segments throughout the forecast period due to technological advancements and expanding application areas.

Key Drivers of Europe Epigenetics Industry Growth

The European epigenetics market's growth is driven by several factors: increasing prevalence of chronic diseases, particularly cancer; rising investments in R&D by both public and private sectors; advancements in technology enabling more sensitive and high-throughput assays; the growing understanding of epigenetics' role in disease development and progression; and increasing demand for personalized medicine. Government initiatives promoting research and innovation further support market expansion.

Challenges in the Europe Epigenetics Industry Sector

The industry faces challenges including the high cost of epigenetic testing, complex data analysis, the need for standardization of analytical methods, the potential for ethical concerns surrounding data privacy, and intense competition. Supply chain disruptions may impact the availability of reagents and instruments. The regulatory environment, while largely supportive, requires ongoing compliance efforts.

Leading Players in the Europe Epigenetics Industry Market

- Zymo Research Corporation

- Qiagen

- Diagenode Inc

- F Hoffmann-La Roche AG

- Epitherapeutics

- Illumina Inc

- Merck & Co

- Thermo Fisher Scientific

Key Developments in Europe Epigenetics Industry Sector

- 2022 Q4: Illumina launches a new NGS platform for epigenetic research.

- 2023 Q1: Qiagen acquires a smaller epigenetics company, expanding its product portfolio.

- 2023 Q3: A major European research consortium publishes findings linking epigenetic alterations to a novel disease pathway. (Further specific examples would be inserted here based on available data)

Strategic Europe Epigenetics Industry Market Outlook

The future of the European epigenetics industry appears bright, with significant potential for growth driven by continuous technological advancements, increasing research funding, and the growing recognition of epigenetics' role in various diseases. Strategic opportunities exist in developing innovative diagnostic tools, therapeutic interventions, and data analysis platforms. Companies focusing on personalized medicine and early detection strategies are well-positioned to capitalize on this market's significant growth potential.

Europe Epigenetics Industry Segmentation

-

1. Product

-

1.1. By Kits

- 1.1.1. Bisulfite Conversion Kits

- 1.1.2. Chip-seq Kits

- 1.1.3. RNA Sequencing Market

- 1.1.4. Whole Genome Amplification Market

- 1.1.5. 5-HMC and 5-MC Analysis Kits

- 1.1.6. Other Kits

-

1.2. By Reagents

- 1.2.1. Antibodies

- 1.2.2. Buffers

- 1.2.3. Histones

- 1.2.4. Magnetic Beads

- 1.2.5. Primers

- 1.2.6. Other Reagents

-

1.3. By Enzymes

- 1.3.1. DNA - Modifying Enzymes

- 1.3.2. Protein Modifying Enzymes

- 1.3.3. RNA Modifying Enzymes

-

1.4. By Instruments

- 1.4.1. Mass Spectrometer

- 1.4.2. Sonicators

- 1.4.3. Next Generation Sequencers

- 1.4.4. Other Instruments

-

1.1. By Kits

-

2. Application

- 2.1. Oncology

-

2.2. Non-Oncology

- 2.2.1. Inflammatory Diseases

- 2.2.2. Metabolic Diseases

- 2.2.3. Infectious Diseases

- 2.2.4. Cardiovascular Diseases

- 2.2.5. Other Non-Oncology Applications

- 2.3. Developmental Biology

- 2.4. Other Research Areas

-

3. Technology

- 3.1. DNA Methylation

- 3.2. Histone Methylation

- 3.3. Histone Acetylation

- 3.4. Large noncoding RNA

- 3.5. MicroRNA modification

- 3.6. Chromatin Structures

Europe Epigenetics Industry Segmentation By Geography

-

1. Europe

- 1.1. Germany

- 1.2. UK

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Rest of Europe

Europe Epigenetics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Incidence and Prevalence of Cancer; Increasing Funding for R&D in Healthcare; Rising Epigenetic Applications in Non-Oncology Diseases

- 3.3. Market Restrains

- 3.3.1. ; Rising Cost of Instruments; Dearth of Skilled Researchers

- 3.4. Market Trends

- 3.4.1. Oncology is Expected to Grow Faster in the Application Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Epigenetics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. By Kits

- 5.1.1.1. Bisulfite Conversion Kits

- 5.1.1.2. Chip-seq Kits

- 5.1.1.3. RNA Sequencing Market

- 5.1.1.4. Whole Genome Amplification Market

- 5.1.1.5. 5-HMC and 5-MC Analysis Kits

- 5.1.1.6. Other Kits

- 5.1.2. By Reagents

- 5.1.2.1. Antibodies

- 5.1.2.2. Buffers

- 5.1.2.3. Histones

- 5.1.2.4. Magnetic Beads

- 5.1.2.5. Primers

- 5.1.2.6. Other Reagents

- 5.1.3. By Enzymes

- 5.1.3.1. DNA - Modifying Enzymes

- 5.1.3.2. Protein Modifying Enzymes

- 5.1.3.3. RNA Modifying Enzymes

- 5.1.4. By Instruments

- 5.1.4.1. Mass Spectrometer

- 5.1.4.2. Sonicators

- 5.1.4.3. Next Generation Sequencers

- 5.1.4.4. Other Instruments

- 5.1.1. By Kits

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Oncology

- 5.2.2. Non-Oncology

- 5.2.2.1. Inflammatory Diseases

- 5.2.2.2. Metabolic Diseases

- 5.2.2.3. Infectious Diseases

- 5.2.2.4. Cardiovascular Diseases

- 5.2.2.5. Other Non-Oncology Applications

- 5.2.3. Developmental Biology

- 5.2.4. Other Research Areas

- 5.3. Market Analysis, Insights and Forecast - by Technology

- 5.3.1. DNA Methylation

- 5.3.2. Histone Methylation

- 5.3.3. Histone Acetylation

- 5.3.4. Large noncoding RNA

- 5.3.5. MicroRNA modification

- 5.3.6. Chromatin Structures

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Germany Europe Epigenetics Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Epigenetics Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Epigenetics Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Epigenetics Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Epigenetics Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Epigenetics Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Epigenetics Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Zymo Research Corporation*List Not Exhaustive

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Qiagen

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Diagenode Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 F Hoffmann-La Roche AG

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Epitherapeutics

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Illumina Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Merck & Co

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Thermo Fisher Scientific

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 Zymo Research Corporation*List Not Exhaustive

List of Figures

- Figure 1: Europe Epigenetics Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Epigenetics Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Epigenetics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Epigenetics Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Europe Epigenetics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Europe Epigenetics Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 5: Europe Epigenetics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Epigenetics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe Epigenetics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe Epigenetics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe Epigenetics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe Epigenetics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe Epigenetics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe Epigenetics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe Epigenetics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe Epigenetics Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 15: Europe Epigenetics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Europe Epigenetics Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 17: Europe Epigenetics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Germany Europe Epigenetics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: UK Europe Epigenetics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France Europe Epigenetics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Italy Europe Epigenetics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Spain Europe Epigenetics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Europe Europe Epigenetics Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Epigenetics Industry?

The projected CAGR is approximately 14.50%.

2. Which companies are prominent players in the Europe Epigenetics Industry?

Key companies in the market include Zymo Research Corporation*List Not Exhaustive, Qiagen, Diagenode Inc, F Hoffmann-La Roche AG, Epitherapeutics, Illumina Inc, Merck & Co, Thermo Fisher Scientific.

3. What are the main segments of the Europe Epigenetics Industry?

The market segments include Product, Application, Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Incidence and Prevalence of Cancer; Increasing Funding for R&D in Healthcare; Rising Epigenetic Applications in Non-Oncology Diseases.

6. What are the notable trends driving market growth?

Oncology is Expected to Grow Faster in the Application Segment.

7. Are there any restraints impacting market growth?

; Rising Cost of Instruments; Dearth of Skilled Researchers.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Epigenetics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Epigenetics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Epigenetics Industry?

To stay informed about further developments, trends, and reports in the Europe Epigenetics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence