Key Insights

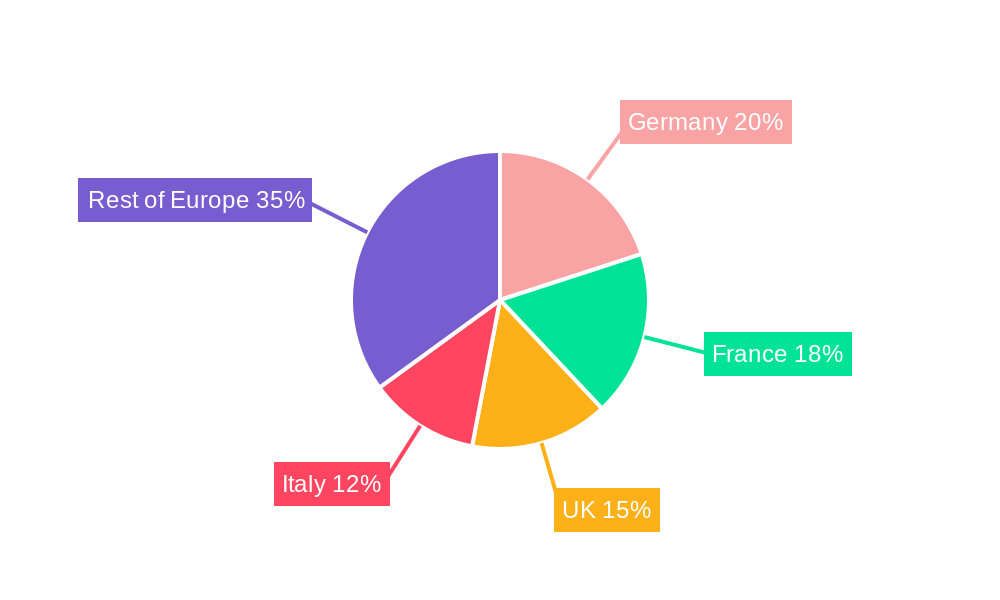

The European domestic courier market, valued at 103.62 million in 2025, is poised for significant expansion with a projected Compound Annual Growth Rate (CAGR) of 6.5% through 2033. This growth is primarily driven by the escalating e-commerce sector across diverse end-user industries, including BFSI, healthcare, and manufacturing. The increasing consumer demand for expedited delivery, particularly express services, further fuels market dynamism. While the market is segmented by delivery speed (express, non-express), shipment weight (light, medium, heavy), and business models (B2B, B2C, C2C), the B2C segment, propelled by e-commerce, holds a dominant share. Leading players such as Post NL, UPS, DHL, and FedEx are engaged in intense competition, utilizing advanced logistics and technology to optimize delivery networks and elevate customer experiences. Key challenges include volatile fuel prices, rising labor costs, and the necessity for robust infrastructure to manage escalating delivery volumes, especially in densely populated urban centers. Regional market leaders include Germany, France, the UK, and Italy, each presenting distinct regulatory frameworks and consumer preferences.

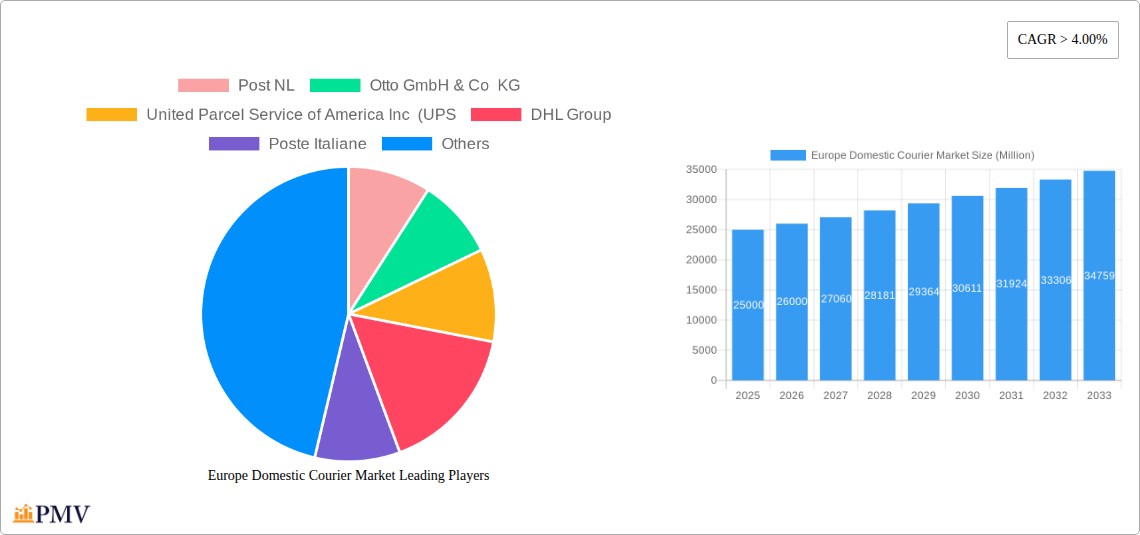

Europe Domestic Courier Market Market Size (In Million)

Macroeconomic influences and evolving consumer behaviors are critical determinants of the projected growth trajectory. The sustained expansion of e-commerce, combined with heightened expectations for rapid delivery, creates substantial opportunities for courier companies to invest in infrastructure and technological innovation. Successfully navigating this market requires strategic management of operational costs, adaptability to evolving regulations, and tailored services for diverse customer segments across Europe. The continued growth of cross-border e-commerce will invariably impact the domestic courier market, presenting both challenges and opportunities. Companies prioritizing sustainable and eco-friendly delivery solutions are expected to gain a competitive advantage, reflecting growing consumer environmental consciousness.

Europe Domestic Courier Market Company Market Share

Europe Domestic Courier Market Analysis: Size, Trends, and Forecast (2019-2033)

This comprehensive report offers an in-depth analysis of the Europe Domestic Courier Market, providing critical insights for businesses, investors, and stakeholders aiming to understand and capitalize on this dynamic sector. The study encompasses the period from 2019 to 2033, with 2025 designated as the base and estimated year, and a forecast period spanning 2025 to 2033. The historical analysis covers 2019-2024. The market is meticulously segmented by end-user industry, business model, country, delivery speed, and shipment weight, offering a granular perspective on market dynamics and growth potential. The estimated market size in 2025 is 103.62 million, with a projected CAGR of 6.5% during the forecast period.

Europe Domestic Courier Market Market Structure & Competitive Dynamics

The Europe Domestic Courier market exhibits a moderately consolidated structure, dominated by established players like DHL Group, UPS, FedEx, and Post NL. However, regional players and niche providers also hold significant market share within specific segments. Market concentration is influenced by factors such as economies of scale, network infrastructure, and regulatory frameworks. The competitive landscape is characterized by intense rivalry, with companies vying for market share through strategic initiatives such as M&A activities, technological innovation, and service differentiation.

- Market Concentration: The top 5 players hold an estimated xx% of the market share in 2025.

- Innovation Ecosystems: Significant investments are being made in automation, AI-powered logistics, and sustainable delivery solutions.

- Regulatory Frameworks: Varying regulations across European countries impact operational efficiency and costs.

- Product Substitutes: While traditional courier services remain dominant, alternative delivery models such as crowdsourced delivery and drone delivery are emerging.

- End-User Trends: Growth in e-commerce, increasing demand for faster delivery options, and rising consumer expectations are reshaping market dynamics.

- M&A Activities: Recent years have witnessed several significant mergers and acquisitions, with deal values exceeding xx Million in the past three years. These mergers often focus on expanding delivery networks and enhancing service capabilities. For example, DPD UK's acquisition of a final-mile courier company in 2023 strengthened its last-mile delivery capabilities.

Europe Domestic Courier Market Industry Trends & Insights

The Europe Domestic Courier market is experiencing robust growth driven by a multitude of factors. The expanding e-commerce sector fuels demand for efficient and reliable delivery services, particularly in B2C segments. Technological advancements such as AI-powered route optimization, automated sorting facilities, and the integration of IoT devices are enhancing operational efficiency and reducing costs. Changing consumer preferences, including an increased preference for faster and more convenient delivery options, are also driving market growth. However, increasing fuel costs, labor shortages, and regulatory complexities present significant challenges. Market penetration for express delivery services is expected to reach xx% by 2033, while the overall market CAGR is projected to be xx%. Furthermore, the rising adoption of sustainable logistics practices is influencing operational strategies.

Dominant Markets & Segments in Europe Domestic Courier Market

The German and UK markets represent the largest segments within the European domestic courier market, driven by high e-commerce penetration, robust infrastructure, and a large consumer base. The B2C segment is witnessing significant growth due to the booming e-commerce sector, whereas B2B remains a substantial and stable portion of the overall market. Express delivery services hold the largest market share due to increasing consumer demand for speed.

Key Drivers for Dominant Markets:

- Germany: Strong e-commerce sector, well-developed infrastructure, and high purchasing power.

- United Kingdom: Large consumer base, high online shopping rates, and sophisticated logistics networks.

- B2C Segment: Growth driven by expanding e-commerce, increasing consumer expectations for speed and convenience.

- Express Delivery: Demand driven by time-sensitive deliveries and increased consumer expectations.

Dominance Analysis: The dominance of Germany and the UK is attributed to high consumer spending, established e-commerce ecosystems, and efficient logistics infrastructure. The B2C segment's dominance stems from the e-commerce boom. The preference for express delivery reflects the priority consumers place on speed and convenience.

Europe Domestic Courier Market Product Innovations

The European domestic courier market is witnessing significant product innovations, driven by technological advancements and evolving customer expectations. Companies are investing heavily in automation, including the use of robots and AI-powered systems, to improve efficiency and reduce operational costs. The focus is also shifting towards sustainable delivery solutions, such as electric vehicles and optimized delivery routes to minimize environmental impact. These innovations are enhancing delivery speed, reliability, and traceability while also addressing growing concerns about sustainability.

Report Segmentation & Scope

This report segments the Europe domestic courier market across several key parameters:

End-User Industry: E-commerce, Financial Services (BFSI), Healthcare, Manufacturing, Primary Industry, Wholesale and Retail Trade (Offline), Others. Each segment's growth is influenced by industry-specific factors. E-commerce displays the highest growth.

Business Model: Business-to-Business (B2B), Business-to-Consumer (B2C), Consumer-to-Consumer (C2C). B2C is experiencing the fastest growth, followed by B2B.

Country: Albania, Bulgaria, Croatia, Czech Republic, Denmark, Estonia, Finland, France, Germany, Hungary, Iceland, Italy, Latvia, Lithuania, Netherlands, Norway, Poland, Romania, Russia, Slovak Republic, Slovenia, Spain, Sweden, Switzerland, United Kingdom, Rest of Europe. Growth varies significantly across countries due to economic conditions and infrastructure.

Speed of Delivery: Express, Non-Express. Express delivery services command a premium price and are rapidly growing in adoption.

Shipment Weight: Heavy Weight Shipments, Light Weight Shipments, Medium Weight Shipments. The weight categories reflect the diversity of goods transported.

Key Drivers of Europe Domestic Courier Market Growth

The European domestic courier market's growth is propelled by several key factors: the rapid expansion of e-commerce, necessitating efficient delivery solutions; increasing consumer demand for faster and more convenient delivery options; technological advancements such as AI and automation, optimizing delivery processes; and government initiatives promoting digitalization and e-commerce adoption across the European Union. These factors contribute to a robust and expanding market.

Challenges in the Europe Domestic Courier Market Sector

The Europe Domestic Courier market faces several key challenges: fluctuations in fuel prices directly impacting operational costs; labor shortages in the logistics sector limiting capacity and efficiency; increasing competition from both established players and new entrants; and varying regulatory frameworks across different European countries leading to complexities in operations. These challenges influence profitability and competitiveness within the sector.

Leading Players in the Europe Domestic Courier Market Market

- Post NL

- Otto GmbH & Co KG

- United Parcel Service of America Inc (UPS)

- DHL Group

- Poste Italiane

- GEODIS

- FedEx

- International Distributions Services (including GLS)

- La Poste Group

- Logista

Key Developments in Europe Domestic Courier Market Sector

September 2023: The Otto Group plans to deploy Covariant robots to increase operational efficiency, build resilience against labor market challenges, and improve the overall quality of work within their fulfillment centers. This signals a significant investment in automation within the industry.

February 2023: DHL Global Forwarding successfully implemented sustainable logistics solutions for its customer Grundfos. This highlights a growing focus on environmentally friendly practices.

February 2023: DPD UK acquired a final-mile courier company, expanding its delivery network and market reach. This illustrates ongoing consolidation within the market.

Strategic Europe Domestic Courier Market Market Outlook

The future of the Europe Domestic Courier market appears bright, with continued growth driven by the sustained expansion of e-commerce and the increasing adoption of technological advancements. Opportunities exist for companies to leverage automation, AI, and sustainable practices to enhance efficiency, reduce costs, and meet the evolving demands of consumers. Strategic partnerships, acquisitions, and expansions into new markets will be crucial for sustained success in this dynamic sector. The market's future potential is considerable, particularly in underserved regions and segments.

Europe Domestic Courier Market Segmentation

-

1. Speed Of Delivery

- 1.1. Express

- 1.2. Non-Express

-

2. Shipment Weight

- 2.1. Heavy Weight Shipments

- 2.2. Light Weight Shipments

- 2.3. Medium Weight Shipments

-

3. End User Industry

- 3.1. E-Commerce

- 3.2. Financial Services (BFSI)

- 3.3. Healthcare

- 3.4. Manufacturing

- 3.5. Primary Industry

- 3.6. Wholesale and Retail Trade (Offline)

- 3.7. Others

-

4. Model

- 4.1. Business-to-Business (B2B)

- 4.2. Business-to-Consumer (B2C)

- 4.3. Consumer-to-Consumer (C2C)

Europe Domestic Courier Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Domestic Courier Market Regional Market Share

Geographic Coverage of Europe Domestic Courier Market

Europe Domestic Courier Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle

- 3.3. Market Restrains

- 3.3.1. Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Domestic Courier Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 5.1.1. Express

- 5.1.2. Non-Express

- 5.2. Market Analysis, Insights and Forecast - by Shipment Weight

- 5.2.1. Heavy Weight Shipments

- 5.2.2. Light Weight Shipments

- 5.2.3. Medium Weight Shipments

- 5.3. Market Analysis, Insights and Forecast - by End User Industry

- 5.3.1. E-Commerce

- 5.3.2. Financial Services (BFSI)

- 5.3.3. Healthcare

- 5.3.4. Manufacturing

- 5.3.5. Primary Industry

- 5.3.6. Wholesale and Retail Trade (Offline)

- 5.3.7. Others

- 5.4. Market Analysis, Insights and Forecast - by Model

- 5.4.1. Business-to-Business (B2B)

- 5.4.2. Business-to-Consumer (B2C)

- 5.4.3. Consumer-to-Consumer (C2C)

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Post NL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Otto GmbH & Co KG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 United Parcel Service of America Inc (UPS

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DHL Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Poste Italiane

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 GEODIS

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 FedEx

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 International Distributions Services (including GLS)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 La Poste Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Logista

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Post NL

List of Figures

- Figure 1: Europe Domestic Courier Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Domestic Courier Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Domestic Courier Market Revenue million Forecast, by Speed Of Delivery 2020 & 2033

- Table 2: Europe Domestic Courier Market Revenue million Forecast, by Shipment Weight 2020 & 2033

- Table 3: Europe Domestic Courier Market Revenue million Forecast, by End User Industry 2020 & 2033

- Table 4: Europe Domestic Courier Market Revenue million Forecast, by Model 2020 & 2033

- Table 5: Europe Domestic Courier Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: Europe Domestic Courier Market Revenue million Forecast, by Speed Of Delivery 2020 & 2033

- Table 7: Europe Domestic Courier Market Revenue million Forecast, by Shipment Weight 2020 & 2033

- Table 8: Europe Domestic Courier Market Revenue million Forecast, by End User Industry 2020 & 2033

- Table 9: Europe Domestic Courier Market Revenue million Forecast, by Model 2020 & 2033

- Table 10: Europe Domestic Courier Market Revenue million Forecast, by Country 2020 & 2033

- Table 11: United Kingdom Europe Domestic Courier Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Germany Europe Domestic Courier Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: France Europe Domestic Courier Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Italy Europe Domestic Courier Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Spain Europe Domestic Courier Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Netherlands Europe Domestic Courier Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Belgium Europe Domestic Courier Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Sweden Europe Domestic Courier Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Norway Europe Domestic Courier Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Poland Europe Domestic Courier Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Denmark Europe Domestic Courier Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Domestic Courier Market?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the Europe Domestic Courier Market?

Key companies in the market include Post NL, Otto GmbH & Co KG, United Parcel Service of America Inc (UPS, DHL Group, Poste Italiane, GEODIS, FedEx, International Distributions Services (including GLS), La Poste Group, Logista.

3. What are the main segments of the Europe Domestic Courier Market?

The market segments include Speed Of Delivery, Shipment Weight, End User Industry, Model.

4. Can you provide details about the market size?

The market size is estimated to be USD 103.62 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits.

8. Can you provide examples of recent developments in the market?

September 2023: The Otto Group plans to deploy Covariant robots to increase operational efficiency, build resilience against labor market challenges, and improve the overall quality of work within their fulfillment centers.February 2023: DHL Global Forwarding, the air and ocean freight specialist of Deutsche Post DHL Group, successfully implemented sustainable logistics solutions for its customer Grundfos.February 2023: DPD UK, part of the DPDgroup, announced the acquisition of a longstanding final mile courier company with a fleet of circa 200 couriers serving more than 2,500 clients.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Domestic Courier Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Domestic Courier Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Domestic Courier Market?

To stay informed about further developments, trends, and reports in the Europe Domestic Courier Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence