Key Insights

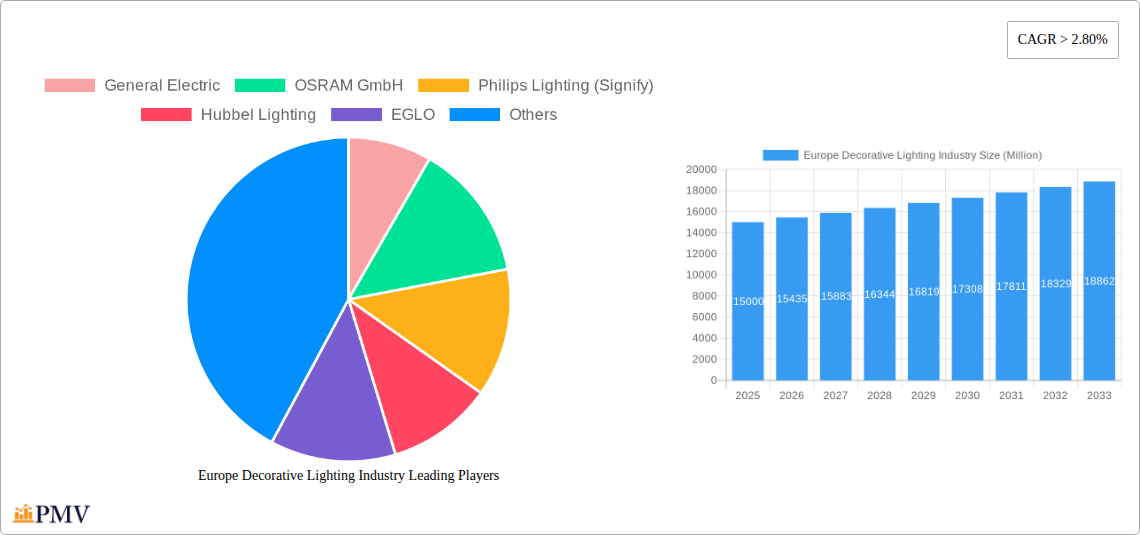

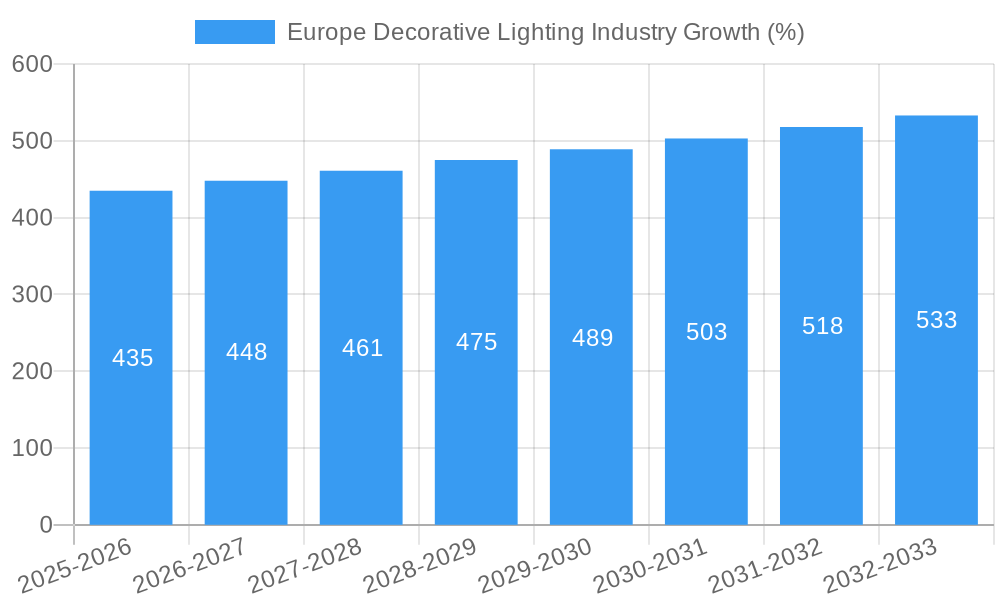

The European decorative lighting market, valued at approximately €[Estimate based on market size XX and value unit Million; let's assume €15 Billion in 2025 for example], is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 2.80% from 2025 to 2033. This expansion is fueled by several key drivers. The rising popularity of smart home technology and the integration of connected lighting solutions are significantly impacting consumer preferences. Furthermore, a growing emphasis on interior design and home improvement projects, coupled with increasing disposable incomes in several European countries, is stimulating demand for aesthetically pleasing and functional decorative lighting. The shift towards sustainable and energy-efficient LED lighting also contributes to market growth, replacing traditional incandescent and fluorescent options. However, economic fluctuations and potential supply chain disruptions pose challenges to sustained growth.

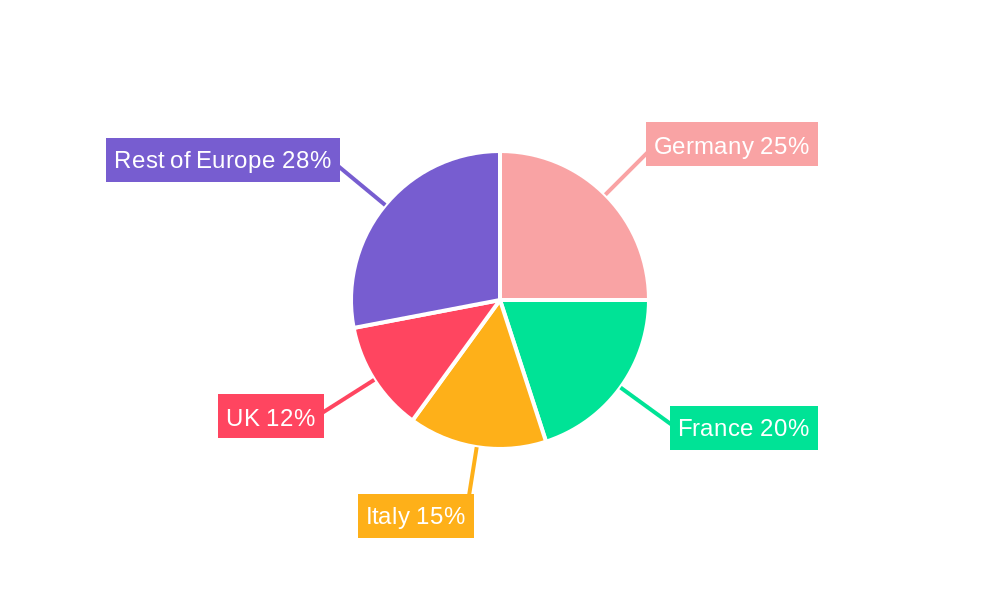

Segment analysis reveals a diverse market landscape. LED lighting dominates the lighting type segment due to its energy efficiency and design flexibility. The commercial sector holds a substantial market share, driven by the increasing need for visually appealing and functional lighting in offices, restaurants, and retail spaces. Sconce and pendant lighting are popular mount types, reflecting evolving interior design trends. Online retailing is gaining traction as a distribution channel, providing convenient access to a wide range of products. Germany, France, and Italy represent the largest national markets, benefiting from a strong consumer base and established infrastructure. Key players such as General Electric, OSRAM, Philips Lighting (Signify), and Hubbel Lighting are shaping market dynamics through innovation and strategic partnerships. The competitive landscape remains dynamic with both established multinational corporations and smaller, specialized players vying for market share. Future growth will depend on successfully navigating economic uncertainty, fostering innovation in lighting technology, and adapting to evolving consumer preferences in a sustainable manner.

Europe Decorative Lighting Industry: A Comprehensive Market Analysis (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe decorative lighting industry, offering invaluable insights for businesses, investors, and stakeholders seeking to navigate this dynamic market. The report covers the period from 2019 to 2033, with a focus on the estimated year 2025 and a forecast period spanning 2025-2033. The historical period analyzed is 2019-2024. The European decorative lighting market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Europe Decorative Lighting Industry Market Structure & Competitive Dynamics

The European decorative lighting market exhibits a moderately consolidated structure, with several key players vying for market share. Major players such as General Electric, OSRAM GmbH, Philips Lighting (Signify), Hubbel Lighting, EGLO, Flos S p A, Briloner, and Acuity Brands Lighting dominate the landscape. Market share analysis reveals that these companies collectively hold approximately xx% of the market, with Signify and OSRAM holding the largest individual shares.

The industry is characterized by a vibrant innovation ecosystem, fueled by advancements in LED technology, smart lighting solutions, and design aesthetics. Stringent regulatory frameworks, particularly concerning energy efficiency and environmental sustainability, are shaping product development and market dynamics. The rising popularity of energy-efficient LED lighting is a key factor influencing market growth, while the increasing demand for smart home integrations and customized lighting solutions presents significant opportunities. The market also faces competitive pressures from emerging players and product substitutes. M&A activity in the sector has been relatively moderate in recent years, with deal values averaging xx Million per transaction. Key M&A trends include consolidation among smaller players and strategic acquisitions to expand product portfolios and geographical reach. End-user trends such as increased preference for personalized lighting experiences and a greater focus on sustainability are driving innovation and shaping market demand.

Europe Decorative Lighting Industry Industry Trends & Insights

The European decorative lighting market is experiencing significant growth driven by several factors. The increasing adoption of energy-efficient LED lighting, coupled with technological advancements in smart lighting systems, is a primary driver. Consumer preferences are shifting towards aesthetically pleasing and functional lighting solutions that enhance the ambiance and improve energy efficiency. The market penetration of LED lighting continues to rise, currently exceeding xx%, and is projected to reach xx% by 2033. The growing popularity of smart homes and the integration of lighting with other smart home devices also contribute to market growth.

The CAGR for the European decorative lighting market during the forecast period (2025-2033) is estimated to be xx%. This growth is fueled by the rising disposable incomes in several European countries, increasing urbanization, and the growing preference for energy-efficient and sustainable lighting solutions. However, challenges remain, including price competition from low-cost manufacturers and fluctuations in raw material prices. The competitive dynamics are characterized by both collaboration and competition, with established players investing in innovation and expansion while facing the challenge of new entrants.

Dominant Markets & Segments in Europe Decorative Lighting Industry

By Country: Germany, France, and Italy represent the largest national markets within Europe, accounting for approximately xx% of the total market value. Germany's dominance stems from its robust economy, high consumer spending, and well-established infrastructure. France and Italy exhibit strong demand driven by a thriving design sector and a sophisticated consumer base.

By Lighting Type: LED lighting dominates the market, accounting for over xx% of the total volume, due to its energy efficiency and long lifespan. Fluorescent lighting maintains a niche market, while incandescent lighting is steadily declining due to its inefficiency.

By Application: The household segment represents the largest application area, driven by the rising demand for aesthetically pleasing and functional lighting in homes. The commercial sector is also experiencing growth, with a rising demand for energy-efficient and customized lighting solutions in offices and retail spaces.

By Mount Type: Pendant lights and flush mount lights maintain significant market share, with the demand driven by their versatility and suitability for diverse interior design styles. Sconces cater to niche segments while other mount types contribute to the market share.

By Distribution Channel: Online retailing is growing significantly, driven by the increasing e-commerce penetration and the convenience offered to consumers. Specialty light stores and lifestyle retailers also contribute significantly to sales, reflecting the focus on design and quality.

Europe Decorative Lighting Industry Product Innovations

Recent product developments emphasize smart lighting solutions, energy efficiency, and customizable designs. LED technology continues to advance, with improved brightness, color rendering, and lifespan. The integration of smart home functionalities and remote control capabilities are key features driving market growth. Product innovation focuses on offering customers greater control over lighting ambiance and energy consumption. The development of sustainable and eco-friendly lighting solutions that use recycled materials also contributes to the market's competitiveness.

Report Segmentation & Scope

This report provides detailed segmentation analysis across various parameters:

By Lighting Type: LED, Fluorescent, Incandescent, Others. Growth projections and market sizes are provided for each segment, highlighting the dominance of LED lighting.

By Application: Commercial and Household. The report analyzes the different lighting needs and preferences of each segment, showing the significant contribution of household lighting.

By Mount Type: Sconce, Flush Mount, Pendant, Others. Market share analysis and growth projections are included for each mount type, based on consumer preferences and design trends.

By Distribution Channel: Specialty Light Stores, Lifestyle Retailers, Wholesale Stores, DIY, Online Retailing. The analysis assesses the growth of e-commerce and the continued role of traditional retail channels.

By Country: Germany, France, Italy, Rest of Europe. The report explores the unique market dynamics of each country, considering economic conditions, consumer preferences, and regulatory environments.

Key Drivers of Europe Decorative Lighting Industry Growth

Key growth drivers include:

Technological advancements: Energy-efficient LED lighting, smart home integration, and innovative design aesthetics are boosting market growth.

Economic factors: Rising disposable incomes in several European countries are leading to increased consumer spending on home improvement and interior design.

Regulatory support: Policies promoting energy efficiency and sustainability are driving the adoption of energy-saving lighting technologies.

Challenges in the Europe Decorative Lighting Industry Sector

Challenges include:

Intense competition: The market is characterized by intense competition from both established and emerging players, impacting profitability.

Supply chain disruptions: Global supply chain uncertainties can lead to price fluctuations and product shortages, affecting market stability.

Regulatory hurdles: Compliance with stringent energy efficiency standards and environmental regulations can impose additional costs on manufacturers.

Leading Players in the Europe Decorative Lighting Industry Market

- General Electric

- OSRAM GmbH

- Philips Lighting (Signify)

- Hubbel Lighting

- EGLO

- Flos S p A

- Briloner

- Acuity Brands Lighting

Key Developments in Europe Decorative Lighting Industry Sector

- 2022 Q4: Signify launches a new range of smart LED bulbs with advanced color-tuning capabilities.

- 2023 Q1: OSRAM announces a strategic partnership with a smart home technology provider to expand its smart lighting offerings.

- 2023 Q3: New EU regulations on energy efficiency in lighting come into effect, impacting market dynamics.

Strategic Europe Decorative Lighting Industry Market Outlook

The future of the European decorative lighting market appears bright. Continued technological innovation, coupled with growing consumer demand for energy-efficient and smart lighting solutions, will drive market expansion. Strategic opportunities exist for companies to focus on smart home integration, sustainable product development, and innovative design solutions to cater to evolving consumer preferences. The market is poised for significant growth, with potential for consolidation and increased competition among key players.

Europe Decorative Lighting Industry Segmentation

-

1. Lighting Type

- 1.1. LED

- 1.2. Fluorescent

- 1.3. Incandescent

- 1.4. Others

-

2. Application

- 2.1. Commercial

- 2.2. Household

-

3. Mount Type

- 3.1. Sconce

- 3.2. Flush Mount

- 3.3. Pendant

- 3.4. Others

-

4. Distribution Channel

- 4.1. Specialty Light Stores

- 4.2. Lifestyle Retailers

- 4.3. Wholesale Stores

- 4.4. DIY

- 4.5. Online Retailing

Europe Decorative Lighting Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Decorative Lighting Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Major innovations in lighting design and trend towards premiumization expected to drive growth in Europe; Growing focus on energy-efficient ambient lighting and LED-based lights

- 3.3. Market Restrains

- 3.3.1. Regulator and Legal Challenges; Growing Concentration of FM Vendors to Impact Margins

- 3.4. Market Trends

- 3.4.1. Growing focus on energy-efficient ambient lighting and LED-based lights

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Decorative Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Lighting Type

- 5.1.1. LED

- 5.1.2. Fluorescent

- 5.1.3. Incandescent

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Commercial

- 5.2.2. Household

- 5.3. Market Analysis, Insights and Forecast - by Mount Type

- 5.3.1. Sconce

- 5.3.2. Flush Mount

- 5.3.3. Pendant

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.4.1. Specialty Light Stores

- 5.4.2. Lifestyle Retailers

- 5.4.3. Wholesale Stores

- 5.4.4. DIY

- 5.4.5. Online Retailing

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Lighting Type

- 6. Germany Europe Decorative Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Decorative Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Decorative Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Decorative Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Decorative Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Decorative Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Decorative Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 General Electric

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 OSRAM GmbH

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Philips Lighting (Signify)

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Hubbel Lighting

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 EGLO

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Flos S p A

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Briloner

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Acuity Brands Lighting

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 General Electric

List of Figures

- Figure 1: Europe Decorative Lighting Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Decorative Lighting Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Decorative Lighting Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Decorative Lighting Industry Revenue Million Forecast, by Lighting Type 2019 & 2032

- Table 3: Europe Decorative Lighting Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Europe Decorative Lighting Industry Revenue Million Forecast, by Mount Type 2019 & 2032

- Table 5: Europe Decorative Lighting Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: Europe Decorative Lighting Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Europe Decorative Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Germany Europe Decorative Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: France Europe Decorative Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Italy Europe Decorative Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Europe Decorative Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Netherlands Europe Decorative Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Sweden Europe Decorative Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Europe Europe Decorative Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Europe Decorative Lighting Industry Revenue Million Forecast, by Lighting Type 2019 & 2032

- Table 16: Europe Decorative Lighting Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Europe Decorative Lighting Industry Revenue Million Forecast, by Mount Type 2019 & 2032

- Table 18: Europe Decorative Lighting Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 19: Europe Decorative Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Europe Decorative Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Germany Europe Decorative Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: France Europe Decorative Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Italy Europe Decorative Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Spain Europe Decorative Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Netherlands Europe Decorative Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Belgium Europe Decorative Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Sweden Europe Decorative Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Norway Europe Decorative Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Poland Europe Decorative Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Denmark Europe Decorative Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Decorative Lighting Industry?

The projected CAGR is approximately > 2.80%.

2. Which companies are prominent players in the Europe Decorative Lighting Industry?

Key companies in the market include General Electric, OSRAM GmbH, Philips Lighting (Signify), Hubbel Lighting, EGLO, Flos S p A, Briloner, Acuity Brands Lighting.

3. What are the main segments of the Europe Decorative Lighting Industry?

The market segments include Lighting Type, Application, Mount Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Major innovations in lighting design and trend towards premiumization expected to drive growth in Europe; Growing focus on energy-efficient ambient lighting and LED-based lights.

6. What are the notable trends driving market growth?

Growing focus on energy-efficient ambient lighting and LED-based lights .

7. Are there any restraints impacting market growth?

Regulator and Legal Challenges; Growing Concentration of FM Vendors to Impact Margins.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Decorative Lighting Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Decorative Lighting Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Decorative Lighting Industry?

To stay informed about further developments, trends, and reports in the Europe Decorative Lighting Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence