Key Insights

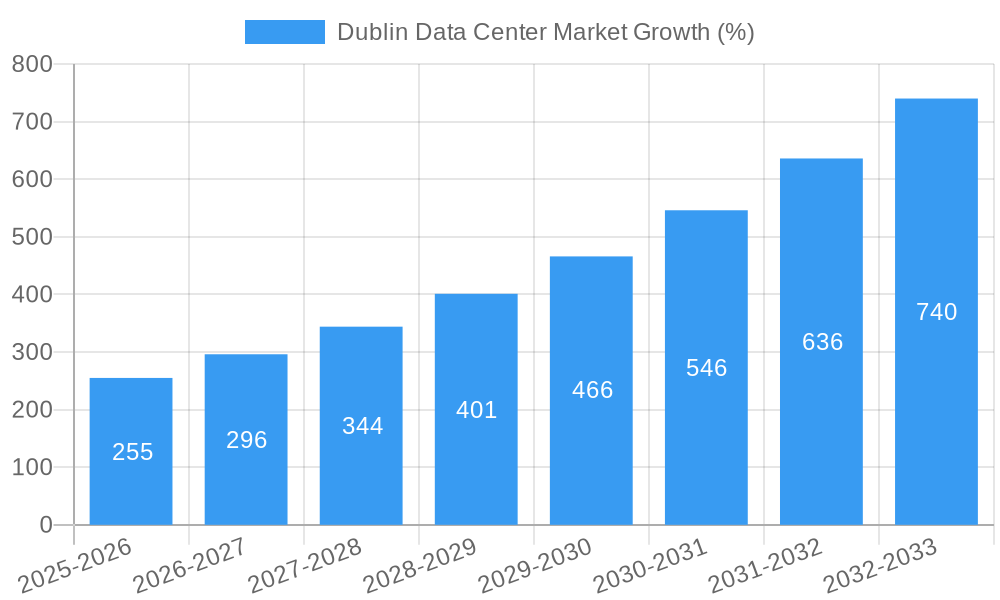

The Dublin data center market exhibits robust growth, driven by Ireland's strategic location as a digital hub within Europe, its strong digital infrastructure, and a supportive government policy environment. The market's Compound Annual Growth Rate (CAGR) of 17.11% from 2019-2024 suggests significant expansion, a trend expected to continue through 2033. Key drivers include the increasing demand for cloud services, the expansion of multinational technology companies in Ireland, and the growth of the financial services sector, all requiring substantial data center capacity. The market is segmented by colocation type (retail, wholesale, hyperscale), end-user industry (cloud & IT, telecom, media & entertainment, etc.), data center size, and tier level, reflecting diverse needs and investment strategies. While specific regional breakdowns are missing, Europe's substantial share, given Dublin's location, is undeniable and likely to be a major contributor to the overall market value. The presence of significant players like Equinix, Digital Realty, and others indicates a mature market with established infrastructure, encouraging further investment and competition. However, constraints might include potential power limitations and the need for ongoing investment in sustainable infrastructure to address environmental concerns. The Dublin data center market is poised for continued growth, fueled by technological advancements and increasing digitalization across various sectors.

The strong CAGR projection signifies a lucrative investment landscape for both established players and new entrants. The diverse segmentations allow for targeted business models catering to various requirements and budget constraints. As the demand for low-latency connectivity and high-capacity data centers intensifies, Dublin's strategic geographic location and regulatory framework position it advantageously to attract significant capital investment in the coming years. Hyperscale data centers are expected to drive substantial market growth due to their extensive capacity needs, while continued expansion in cloud computing, financial services, and media & entertainment sectors will underpin sustained demand. The market's success hinges on managing potential challenges around sustainable energy solutions and addressing the regulatory environment to maintain competitiveness with other data center hubs in Europe.

Dublin Data Center Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Dublin data center market, covering the period 2019-2033. It offers actionable insights into market structure, competitive dynamics, industry trends, and future growth prospects, providing valuable intelligence for investors, operators, and technology providers. With a focus on key segments including retail, wholesale, and hyperscale colocation, as well as detailed end-user analysis across various sectors, this report is an essential resource for navigating this rapidly evolving market. The report uses 2025 as its base year and includes detailed forecasts through 2033. Market values are expressed in Millions.

Dublin Data Center Market Market Structure & Competitive Dynamics

The Dublin data center market exhibits a moderately concentrated structure, with several large multinational players vying for market share alongside smaller, specialized providers. Key players such as Equinix Inc, Digital Realty Trust Inc (Interxion), and Eir evo hold significant market positions, reflecting their established infrastructure and extensive client portfolios. However, the market is also characterized by increasing competition from newer entrants, particularly in the hyperscale segment. This dynamic is further fueled by ongoing mergers and acquisitions (M&A) activity, with deal values reaching xx Million in recent years.

Market share is distributed as follows (estimated 2025): Equinix Inc (xx%), Digital Realty Trust Inc (Interxion) (xx%), Eir evo (xx%), BT Communications Limited (xx%), and others (xx%). Significant M&A activity has reshaped the competitive landscape, including deals valued at xx Million in the past five years, primarily driven by consolidation among smaller providers and strategic acquisitions by larger players seeking to expand their service offerings and geographic reach. The regulatory framework in Ireland is generally supportive of data center development, although there are ongoing discussions regarding energy consumption and environmental impact. Innovation is driven by advancements in cooling technologies, increased network capacity, and the adoption of sustainable practices. Product substitutes are limited, with cloud services representing the primary alternative to on-premise data center solutions. End-user trends indicate a growing demand for colocation services, particularly from cloud and IT service providers, reflecting the increasing reliance on cloud-based solutions and the need for robust data center infrastructure.

Dublin Data Center Market Industry Trends & Insights

The Dublin data center market is experiencing robust growth, driven by several key factors. The increasing adoption of cloud computing, big data analytics, and the Internet of Things (IoT) is fueling the demand for scalable and reliable data center infrastructure. The region's favorable business environment, robust digital infrastructure, and access to renewable energy resources are further attracting significant investments in data center capacity. Furthermore, government initiatives to support the digital economy are fostering industry growth. The market is witnessing a shift towards hyperscale facilities, reflecting the growing needs of large technology companies.

Technological disruptions, such as the deployment of advanced cooling technologies and AI-powered management systems, are enhancing operational efficiency and reducing costs. Consumer preferences are increasingly shifting towards providers offering robust security measures, high levels of service availability, and environmentally sustainable operations. Competitive dynamics are shaped by factors such as pricing strategies, service offerings, and geographic reach. The compound annual growth rate (CAGR) for the Dublin data center market is projected at xx% during the forecast period (2025-2033), with market penetration expected to reach xx% by 2033.

Dominant Markets & Segments in Dublin Data Center Market

- Leading Region: Dublin, Ireland, due to its strategic location, robust infrastructure, and supportive government policies.

- Dominant Colocation Type: The Wholesale segment is currently dominant, driven by large hyperscale deployments, but Retail is projected to see significant growth.

- Leading End User: The Cloud and IT sector leads demand, closely followed by the Telecom sector. Growth in other sectors like BFSI and E-commerce is also contributing to market expansion.

- Dominant DC Size: Large and Mega data centers are leading, reflecting the preference for economies of scale among major operators.

- Dominant Tier Type: Tier III and Tier IV facilities are most prevalent, emphasizing reliability and redundancy.

- Dominant Absorption: Utilized capacity is currently high, underscoring the strong demand for data center space.

Dublin's dominance stems from a combination of factors. The city's strategic geographic location, excellent connectivity to Europe and North America, and skilled workforce make it an attractive hub for data center development. Furthermore, the Irish government's supportive policies, including tax incentives and streamlined regulatory processes, have played a crucial role in attracting significant foreign investment. Robust power infrastructure, supported by access to renewable energy sources, also contributes to the region's attractiveness.

Dublin Data Center Market Product Innovations

Recent innovations focus on energy efficiency, enhanced security features, and advanced management systems. New cooling technologies, such as liquid cooling and AI-powered predictive maintenance, are improving operational efficiency and reducing energy consumption. Advanced security measures, incorporating biometric authentication and threat detection systems, are enhancing data protection. The market is also witnessing the adoption of modular data center designs, offering greater flexibility and scalability. These innovations are enhancing market competitiveness, offering improved operational efficiency, and catering to the evolving demands of end-users.

Report Segmentation & Scope

This report segments the Dublin data center market across several key dimensions:

- Colocation Type: Retail, Wholesale, Hyperscale (Growth projections and market size provided for each segment).

- End User: Cloud and IT, Telecom, Media and Entertainment, Government, BFSI, Manufacturing, E-commerce, Other End User, Non-utilized (Market size and competitive dynamics detailed for each sector).

- DC Size: Small, Medium, Large, Massive, Mega (Market share analysis for each size category).

- Tier Type: Tier I, Tier II, Tier III, Tier IV (Growth projections and market share presented for each tier).

- Absorption: Utilized, Non-utilized (Analysis of capacity utilization trends).

Each segment's detailed analysis includes growth projections, market sizes, and a competitive landscape overview.

Key Drivers of Dublin Data Center Market Growth

Several factors are driving the growth of the Dublin data center market: increased demand for cloud services, the expansion of digital infrastructure, government incentives promoting digital innovation, the growth of data-intensive industries (e.g., FinTech, media), and the strategic location of Dublin within the European Union. Favorable energy costs and a skilled workforce further contribute to the region's attractiveness.

Challenges in the Dublin Data Center Market Sector

Challenges include the increasing energy consumption of data centers, the need for sustainable practices, and potential limitations in land availability. Competition for skilled labor and the potential for regulatory changes related to energy use and environmental impact represent ongoing concerns. Supply chain disruptions and rising construction costs also affect market dynamics.

Leading Players in the Dublin Data Center Market Market

- Eir evo

- Servecentric Ltd

- Equinix Inc

- BT Communications Limited (BT Group PLC)

- K2 STRATEGIC PTE LTD (Kuok Group)

- Web World Ireland

- Zenlayer Inc

- Viatel Ireland Limited

- Digital Realty Trust Inc (Interxion)

- Keppel DC REIT Management Pte Ltd

- Cyrus One Inc

- Sungard Availability Services LP

- EdgeConneX Inc (EQT Infrastructure)

Key Developments in Dublin Data Center Market Sector

- June 2022: Vantage Data Centres Ltd received approval to construct two data centers (40,580 sq. m total floor space) in Profile Park, expanding Ireland's data center cluster. This signifies substantial investment and capacity expansion.

- July 2022: ST Engineering's introduction of Airbitat DC Cooling System, promising a 40% reduction in chiller heat load, showcases technological advancements in energy-efficient cooling solutions, impacting operational costs for data centers.

Strategic Dublin Data Center Market Market Outlook

The Dublin data center market is poised for continued robust growth, driven by ongoing digital transformation across various sectors and sustained investment in data center infrastructure. The region's strategic location, supportive regulatory environment, and access to renewable energy sources present significant opportunities for both existing and new market entrants. Strategic partnerships and technological innovation will be key to success in this increasingly competitive market. The focus on sustainability and energy efficiency will shape future investments and operational strategies.

Dublin Data Center Market Segmentation

-

1. DC Size

- 1.1. Small

- 1.2. Medium

- 1.3. Large

- 1.4. Massive

- 1.5. Mega

-

2. Tier Type

- 2.1. Tier 1 & 2

- 2.2. Tier 3

- 2.3. Tier 4

-

3. Absorption

-

3.1. Utilized

-

3.1.1. Colocation Type

- 3.1.1.1. Retail

- 3.1.1.2. Wholesale

- 3.1.1.3. Hyperscale

-

3.1.2. End User

- 3.1.2.1. Cloud and IT

- 3.1.2.2. Telecom

- 3.1.2.3. Media and Entertainment

- 3.1.2.4. Government

- 3.1.2.5. BFSI

- 3.1.2.6. Manufacturing

- 3.1.2.7. E-commerce

- 3.1.2.8. Other End User

-

3.1.1. Colocation Type

- 3.2. Non-utilized

-

3.1. Utilized

Dublin Data Center Market Segmentation By Geography

- 1. Dublin

Dublin Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 17.11% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Cloud Services is expected to flourish the market; Increasing Growth in Wholesale Datacenter Multi-tenant Spaces to propel demand (albeit from a lower base); Increased Emphasis on Compliance with Data Regulations and Cost-Effective Nature of Multi-tenant Facilities to Drive Adoption among SME's

- 3.3. Market Restrains

- 3.3.1. Dependence on Regulatory Landscape & Stringent Security Requirements

- 3.4. Market Trends

- 3.4.1. Mega Size Data Centers are Expected to Hold a Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Dublin Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 5.1.1. Small

- 5.1.2. Medium

- 5.1.3. Large

- 5.1.4. Massive

- 5.1.5. Mega

- 5.2. Market Analysis, Insights and Forecast - by Tier Type

- 5.2.1. Tier 1 & 2

- 5.2.2. Tier 3

- 5.2.3. Tier 4

- 5.3. Market Analysis, Insights and Forecast - by Absorption

- 5.3.1. Utilized

- 5.3.1.1. Colocation Type

- 5.3.1.1.1. Retail

- 5.3.1.1.2. Wholesale

- 5.3.1.1.3. Hyperscale

- 5.3.1.2. End User

- 5.3.1.2.1. Cloud and IT

- 5.3.1.2.2. Telecom

- 5.3.1.2.3. Media and Entertainment

- 5.3.1.2.4. Government

- 5.3.1.2.5. BFSI

- 5.3.1.2.6. Manufacturing

- 5.3.1.2.7. E-commerce

- 5.3.1.2.8. Other End User

- 5.3.1.1. Colocation Type

- 5.3.2. Non-utilized

- 5.3.1. Utilized

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Dublin

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 6. North America Dublin Data Center Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe Dublin Data Center Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Dublin Data Center Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Australia and New Zealand Dublin Data Center Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Latin America Dublin Data Center Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Middle East and Africa Dublin Data Center Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Eir evo

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Servecentric Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Equinix Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 BT Communications Limited (BT Group PLC)

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 K2 STRATEGIC PTE LTD (Kuok Group)

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Web World Ireland

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Zenlayer Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Viatel Ireland Limited

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Digital Realty Trust Inc (Interxion)

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Keppel DC REIT Management Pte Ltd

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Cyrus One Inc

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Sungard Availability Services LP

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 EdgeConneX Inc (EQT Infrastructure)

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.1 Eir evo

List of Figures

- Figure 1: Dublin Data Center Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Dublin Data Center Market Share (%) by Company 2024

List of Tables

- Table 1: Dublin Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Dublin Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 3: Dublin Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 4: Dublin Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 5: Dublin Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Dublin Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Dublin Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Dublin Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Dublin Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Dublin Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Dublin Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Dublin Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Dublin Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Dublin Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Dublin Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Dublin Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Dublin Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Dublin Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 19: Dublin Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 20: Dublin Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 21: Dublin Data Center Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Dublin Data Center Market?

The projected CAGR is approximately 17.11%.

2. Which companies are prominent players in the Dublin Data Center Market?

Key companies in the market include Eir evo, Servecentric Ltd, Equinix Inc, BT Communications Limited (BT Group PLC), K2 STRATEGIC PTE LTD (Kuok Group), Web World Ireland, Zenlayer Inc, Viatel Ireland Limited, Digital Realty Trust Inc (Interxion), Keppel DC REIT Management Pte Ltd, Cyrus One Inc, Sungard Availability Services LP, EdgeConneX Inc (EQT Infrastructure).

3. What are the main segments of the Dublin Data Center Market?

The market segments include DC Size, Tier Type, Absorption.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Cloud Services is expected to flourish the market; Increasing Growth in Wholesale Datacenter Multi-tenant Spaces to propel demand (albeit from a lower base); Increased Emphasis on Compliance with Data Regulations and Cost-Effective Nature of Multi-tenant Facilities to Drive Adoption among SME's.

6. What are the notable trends driving market growth?

Mega Size Data Centers are Expected to Hold a Significant Share.

7. Are there any restraints impacting market growth?

Dependence on Regulatory Landscape & Stringent Security Requirements.

8. Can you provide examples of recent developments in the market?

June 2022: Vantage Data Centres Ltd was granted permission to demolish an abandoned single-story residence and related outbuilding (206 sq. m) to make way for the construction of two data centers. The relevant 8.7-hectare site is located within Profile Park, regarded as "Ireland's Data Centre Cluster," in the townlands of Ballybane and Kilbride. The idea is to construct two two-story data centers with a plant on the roof of each facility and accompanying auxiliary development with a total floor space of 40,580 sq. m. Building 11, the first data center planned, will be built to the south of the property, while Building 12, the second data center, will be located north.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Dublin Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Dublin Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Dublin Data Center Market?

To stay informed about further developments, trends, and reports in the Dublin Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence