Key Insights

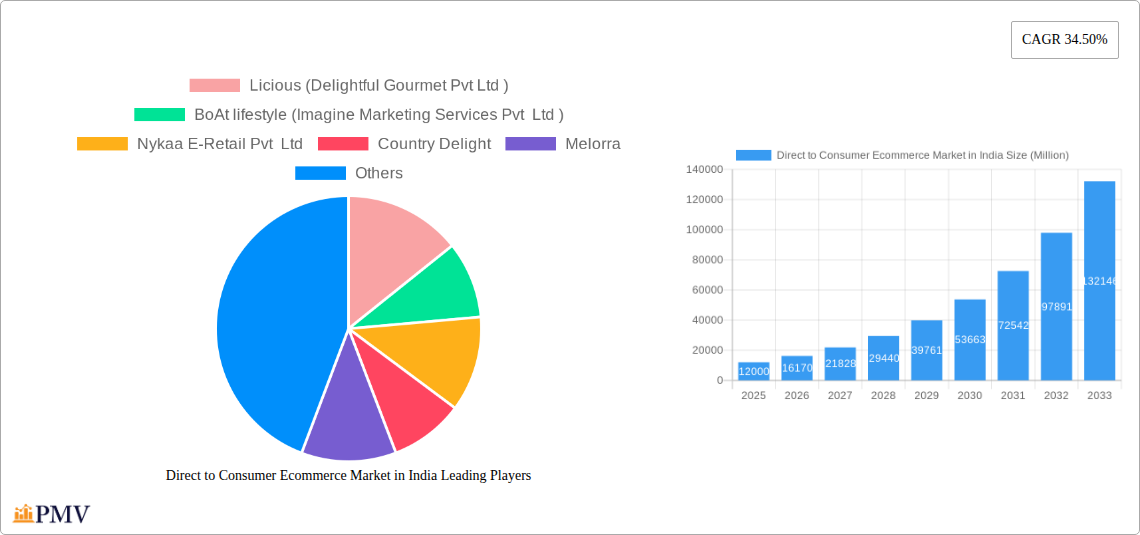

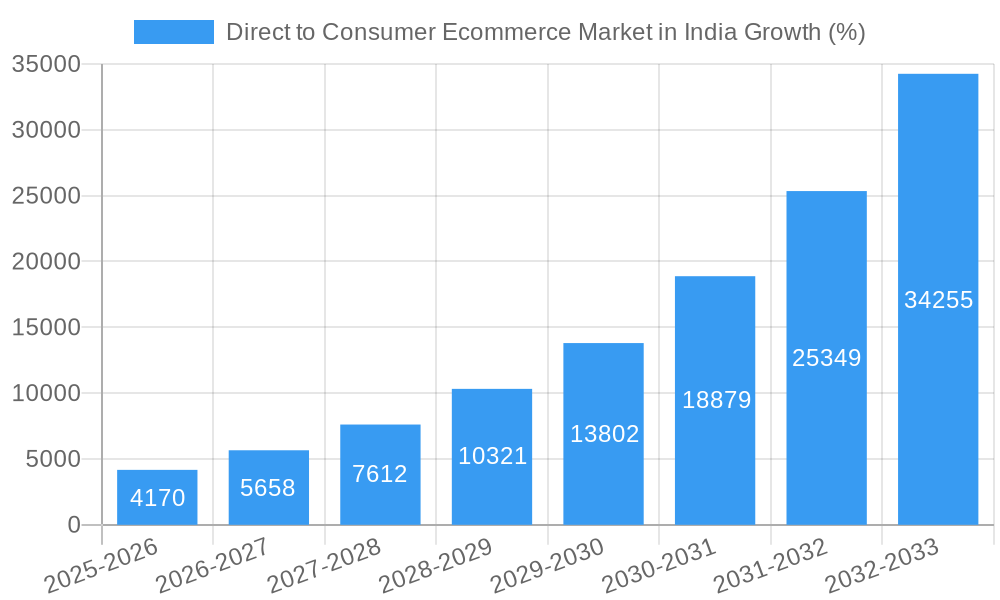

The Indian Direct-to-Consumer (D2C) e-commerce market is experiencing explosive growth, fueled by rising internet and smartphone penetration, increasing disposable incomes, and a shift in consumer preferences towards convenient online shopping. The market's 34.50% CAGR (2019-2024) indicates a robust expansion, projected to continue in the forecast period (2025-2033). While precise market size figures for 2025 aren't provided, extrapolating from the high CAGR and considering the market's current trajectory, a conservative estimate for the 2025 market size would be in the range of ₹100-₹150 billion (approximately $12-18 billion USD). Key growth drivers include the rise of digitally native brands focusing on niche segments, improved logistics infrastructure, and the increasing adoption of digital marketing strategies. The diverse end-user verticals, including apparel, personal care, and groceries, offer substantial growth opportunities. However, challenges such as intense competition, the need for efficient supply chain management, and maintaining brand loyalty are crucial factors influencing market dynamics.

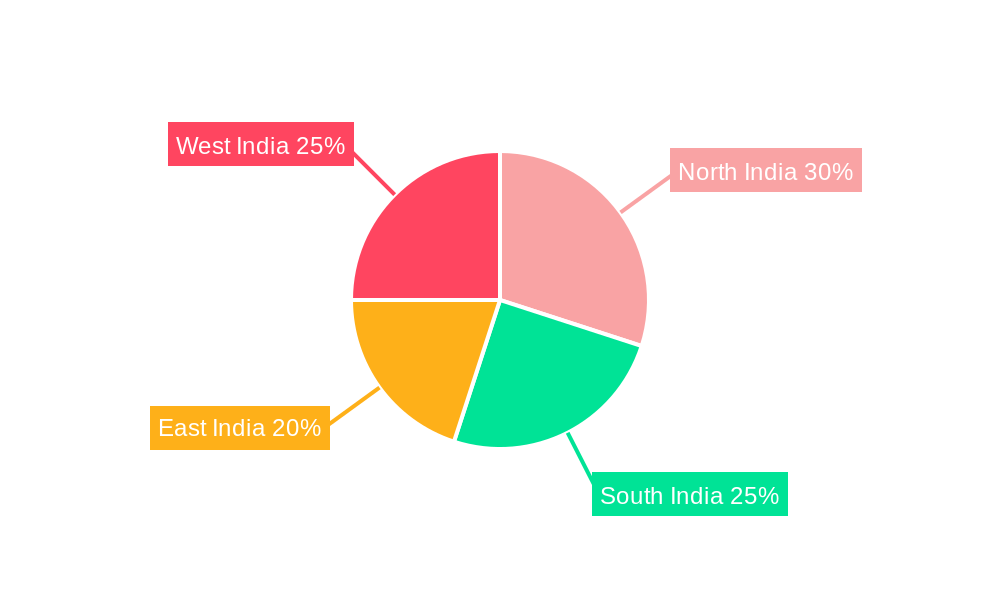

Several factors contribute to the market's continued expansion. The dominance of prominent players like Nykaa, Licious, and BoAt showcases the potential for rapid scaling. However, the market also fosters a thriving ecosystem of smaller, specialized D2C brands catering to specific consumer needs. Geographic expansion remains a key strategic priority, with brands targeting different regions of India – North, South, East, and West – each possessing unique market characteristics and consumer preferences. Further growth will likely hinge on the effective utilization of data analytics to personalize customer experiences, leveraging social media marketing, and addressing evolving consumer demands for sustainable and ethically sourced products. The forecast period promises to witness further consolidation and innovation within the Indian D2C e-commerce landscape.

Direct to Consumer Ecommerce Market in India: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the burgeoning Direct to Consumer (D2C) e-commerce market in India, covering the period 2019-2033. It offers actionable insights into market structure, competitive dynamics, industry trends, dominant segments, product innovations, and future growth potential. The report incorporates data and analysis from the historical period (2019-2024), base year (2025), and estimated year (2025), projecting market trends until 2033.

Direct to Consumer Ecommerce Market in India Market Structure & Competitive Dynamics

The Indian D2C e-commerce market is characterized by a dynamic interplay of established players and emerging startups. Market concentration is moderate, with several key players commanding significant market share, but a large number of smaller players also contributing to overall growth. Innovation ecosystems are thriving, driven by technological advancements and a growing entrepreneurial spirit. The regulatory framework is evolving, presenting both opportunities and challenges for businesses. Product substitutes exist across various segments, influencing competitive dynamics. End-user trends, particularly towards digital-first shopping experiences and personalized products, are shaping market demand. M&A activity is substantial, reflecting the sector’s attractiveness and consolidation trend. For example, the xx Million USD acquisition of ANS Commerce by Flipkart in April 2022 signifies the strategic importance of D2C enablement. Other M&A deals, though their exact values are not publicly available for all, showcase a rapidly consolidating market. Estimates suggest that the total value of M&A deals in the sector in 2024 was approximately xx Million USD, with an expected increase to xx Million USD by 2028.

- Market Concentration: Moderate, with top players holding xx% of market share.

- Innovation Ecosystems: Strong, fueled by technological advancements and entrepreneurial activity.

- Regulatory Frameworks: Evolving, presenting opportunities and challenges.

- Product Substitutes: Present in all segments, influencing competitive intensity.

- End-User Trends: Shift towards digital-first shopping and personalized products.

- M&A Activity: Significant, reflecting sector attractiveness and consolidation.

Direct to Consumer Ecommerce Market in India Industry Trends & Insights

The Indian D2C e-commerce market is experiencing rapid growth, driven by increasing internet and smartphone penetration, rising disposable incomes, and a shift in consumer preferences towards online shopping. Technological disruptions, including advancements in mobile commerce, social commerce, and artificial intelligence (AI), are further accelerating market expansion. Consumer preferences are evolving towards personalized experiences, omnichannel engagement, and sustainable products. Competitive dynamics are intense, with both established players and new entrants vying for market share. The compound annual growth rate (CAGR) for the D2C e-commerce market in India is estimated to be xx% during the forecast period (2025-2033), with market penetration projected to reach xx% by 2033. The market size in 2025 is estimated to be xx Million USD and is predicted to reach xx Million USD by 2033.

Dominant Markets & Segments in Direct to Consumer Ecommerce Market in India

The Indian D2C e-commerce market is witnessing strong growth across various segments, with some sectors exhibiting more dominance than others.

- Apparel and Footwear: This segment benefits from the high fashion consciousness among Indian consumers and strong online presence of many brands. Key drivers include rising disposable incomes, increasing fashion awareness, and the convenience of online shopping.

- Grocery and Gourmet: This is a rapidly growing segment, fueled by increasing demand for convenient and high-quality food products. Key drivers include rising urbanization, busy lifestyles, and the expanding reach of e-grocery platforms.

- Personal Care: This sector thrives on increasing consumer spending on beauty and personal care products, along with the rise of digital marketing and influencer engagement.

- Home Decor and Household Supplies: This segment benefits from rising urbanization and a preference for convenient home improvement options.

- Healthcare: The increasing awareness of health and wellness is driving growth in this segment. The ease of online medicine ordering adds to the convenience.

- Jewellery: Online jewellery shopping appeals to convenience-seeking consumers. Growth is facilitated by digital trust-building mechanisms.

Currently, the Apparel and Footwear segment holds a dominant position due to high consumer spending, widespread adoption of online shopping, and the presence of numerous successful D2C brands. The Grocery and Gourmet segment demonstrates rapid growth potential, driven by a combination of convenience, expanding online infrastructure, and increasing consumer trust in online food delivery.

Direct to Consumer Ecommerce Market in India Product Innovations

The D2C e-commerce market in India is characterized by continuous product innovation, driven by technological advancements and evolving consumer preferences. We are seeing a rise in personalized products, AI-powered recommendations, subscription-based models, and sustainable and ethically sourced products. These innovations enhance the customer experience and provide a competitive advantage.

Report Segmentation & Scope

This report segments the Indian D2C e-commerce market by end-user vertical:

Apparel and Footwear: This segment includes clothing, footwear, and accessories sold directly to consumers through online channels. Growth is projected at xx% CAGR (2025-2033), with a market size of xx Million USD in 2025. Competitive dynamics are high, with many established and emerging brands competing.

Grocery and Gourmet: This segment encompasses online grocery stores and gourmet food delivery services. Growth is projected at xx% CAGR (2025-2033), with a 2025 market size of xx Million USD. The competitive landscape is marked by both large players and niche brands.

Personal Care: This includes cosmetics, skincare, haircare, and other personal care products. Growth is projected at xx% CAGR (2025-2033), with a 2025 market size of xx Million USD. The market is highly competitive, with both established and new brands.

Home Decor and Household Supplies: This segment includes furniture, home furnishings, and other household goods. Growth is projected at xx% CAGR (2025-2033), with a 2025 market size of xx Million USD.

Healthcare: This includes pharmaceuticals, medical devices, and other healthcare products sold directly to consumers. Growth is projected at xx% CAGR (2025-2033), with a 2025 market size of xx Million USD. Regulatory hurdles present a significant challenge.

Jewellery: This segment comprises online jewellery retailers selling directly to consumers. Growth is projected at xx% CAGR (2025-2033), with a 2025 market size of xx Million USD. Trust and security are critical factors.

Key Drivers of Direct to Consumer Ecommerce Market in India Growth

The growth of the Indian D2C e-commerce market is propelled by several key factors: the rapid rise in internet and smartphone penetration, increasing disposable incomes, changing consumer preferences towards online shopping, the proliferation of digital payment options, and government initiatives promoting digital commerce. Technological advancements, such as improved logistics and AI-powered personalization, are also major drivers.

Challenges in the Direct to Consumer Ecommerce Market in India Sector

Despite its significant growth potential, the Indian D2C e-commerce market faces several challenges. These include the complexities of logistics and supply chain management in a geographically diverse country, the need for robust cybersecurity measures to protect consumer data, and increasing competition from both domestic and international players. Regulatory hurdles and the need for strong customer trust in online transactions also pose significant challenges.

Leading Players in the Direct to Consumer Ecommerce Market in India Market

- Licious (Delightful Gourmet Pvt Ltd)

- BoAt lifestyle (Imagine Marketing Services Pvt Ltd)

- Nykaa E-Retail Pvt Ltd

- Country Delight

- Melorra

- Wakefit Innovations Pvt Ltd

- Noise

- Bewakoof Brands Pvt Ltd

- SUGAR Cosmetics

- Mamaearth (Honasa Consumer Private Limited)

Key Developments in Direct to Consumer Ecommerce Market in India Sector

- June 2022: Goat Brand Labs raised USD 50 Million in funding to acquire more premium D2C brands.

- April 2022: Flipkart acquired ANS Commerce, a full-stack e-commerce enabler, enhancing its D2C capabilities.

Strategic Direct to Consumer Ecommerce Market in India Market Outlook

The Indian D2C e-commerce market holds immense future potential, driven by continued growth in internet penetration, rising disposable incomes, and evolving consumer preferences. Strategic opportunities exist for businesses that can effectively leverage technology, build strong brands, and offer personalized and convenient shopping experiences. The market is poised for further consolidation and expansion, presenting significant opportunities for both established players and new entrants.

Direct to Consumer Ecommerce Market in India Segmentation

-

1. End-User Vertical

- 1.1. Apparel and Footwear

- 1.2. Grocery and Gourmet

- 1.3. Personal Care

- 1.4. Home Decor and Household Supplies

- 1.5. Healthcare

- 1.6. Jewelry

Direct to Consumer Ecommerce Market in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Direct to Consumer Ecommerce Market in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 34.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Higher Profit Margins by Cutting Down Intermediaries have Encouraged Several Companies to Enter the Market; Enhanced brand engagement with customers have led to higher retention

- 3.3. Market Restrains

- 3.3.1. High Costs and Operational Drawbacks

- 3.4. Market Trends

- 3.4.1. Fashion is Expected to Hold the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Direct to Consumer Ecommerce Market in India Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-User Vertical

- 5.1.1. Apparel and Footwear

- 5.1.2. Grocery and Gourmet

- 5.1.3. Personal Care

- 5.1.4. Home Decor and Household Supplies

- 5.1.5. Healthcare

- 5.1.6. Jewelry

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End-User Vertical

- 6. North America Direct to Consumer Ecommerce Market in India Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by End-User Vertical

- 6.1.1. Apparel and Footwear

- 6.1.2. Grocery and Gourmet

- 6.1.3. Personal Care

- 6.1.4. Home Decor and Household Supplies

- 6.1.5. Healthcare

- 6.1.6. Jewelry

- 6.1. Market Analysis, Insights and Forecast - by End-User Vertical

- 7. South America Direct to Consumer Ecommerce Market in India Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by End-User Vertical

- 7.1.1. Apparel and Footwear

- 7.1.2. Grocery and Gourmet

- 7.1.3. Personal Care

- 7.1.4. Home Decor and Household Supplies

- 7.1.5. Healthcare

- 7.1.6. Jewelry

- 7.1. Market Analysis, Insights and Forecast - by End-User Vertical

- 8. Europe Direct to Consumer Ecommerce Market in India Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by End-User Vertical

- 8.1.1. Apparel and Footwear

- 8.1.2. Grocery and Gourmet

- 8.1.3. Personal Care

- 8.1.4. Home Decor and Household Supplies

- 8.1.5. Healthcare

- 8.1.6. Jewelry

- 8.1. Market Analysis, Insights and Forecast - by End-User Vertical

- 9. Middle East & Africa Direct to Consumer Ecommerce Market in India Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by End-User Vertical

- 9.1.1. Apparel and Footwear

- 9.1.2. Grocery and Gourmet

- 9.1.3. Personal Care

- 9.1.4. Home Decor and Household Supplies

- 9.1.5. Healthcare

- 9.1.6. Jewelry

- 9.1. Market Analysis, Insights and Forecast - by End-User Vertical

- 10. Asia Pacific Direct to Consumer Ecommerce Market in India Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by End-User Vertical

- 10.1.1. Apparel and Footwear

- 10.1.2. Grocery and Gourmet

- 10.1.3. Personal Care

- 10.1.4. Home Decor and Household Supplies

- 10.1.5. Healthcare

- 10.1.6. Jewelry

- 10.1. Market Analysis, Insights and Forecast - by End-User Vertical

- 11. North India Direct to Consumer Ecommerce Market in India Analysis, Insights and Forecast, 2019-2031

- 12. South India Direct to Consumer Ecommerce Market in India Analysis, Insights and Forecast, 2019-2031

- 13. East India Direct to Consumer Ecommerce Market in India Analysis, Insights and Forecast, 2019-2031

- 14. West India Direct to Consumer Ecommerce Market in India Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Licious (Delightful Gourmet Pvt Ltd )

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 BoAt lifestyle (Imagine Marketing Services Pvt Ltd )

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Nykaa E-Retail Pvt Ltd

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Country Delight

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Melorra

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Wakefit Innovations Pvt Ltd *List Not Exhaustive

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Noise

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 Bewakoof Brands Pvt Ltd

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 SUGAR Cosmetics

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 Mamaearth (Honasa Consumer Private Limited)

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.1 Licious (Delightful Gourmet Pvt Ltd )

List of Figures

- Figure 1: Global Direct to Consumer Ecommerce Market in India Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: India Direct to Consumer Ecommerce Market in India Revenue (Million), by Country 2024 & 2032

- Figure 3: India Direct to Consumer Ecommerce Market in India Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Direct to Consumer Ecommerce Market in India Revenue (Million), by End-User Vertical 2024 & 2032

- Figure 5: North America Direct to Consumer Ecommerce Market in India Revenue Share (%), by End-User Vertical 2024 & 2032

- Figure 6: North America Direct to Consumer Ecommerce Market in India Revenue (Million), by Country 2024 & 2032

- Figure 7: North America Direct to Consumer Ecommerce Market in India Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Direct to Consumer Ecommerce Market in India Revenue (Million), by End-User Vertical 2024 & 2032

- Figure 9: South America Direct to Consumer Ecommerce Market in India Revenue Share (%), by End-User Vertical 2024 & 2032

- Figure 10: South America Direct to Consumer Ecommerce Market in India Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Direct to Consumer Ecommerce Market in India Revenue Share (%), by Country 2024 & 2032

- Figure 12: Europe Direct to Consumer Ecommerce Market in India Revenue (Million), by End-User Vertical 2024 & 2032

- Figure 13: Europe Direct to Consumer Ecommerce Market in India Revenue Share (%), by End-User Vertical 2024 & 2032

- Figure 14: Europe Direct to Consumer Ecommerce Market in India Revenue (Million), by Country 2024 & 2032

- Figure 15: Europe Direct to Consumer Ecommerce Market in India Revenue Share (%), by Country 2024 & 2032

- Figure 16: Middle East & Africa Direct to Consumer Ecommerce Market in India Revenue (Million), by End-User Vertical 2024 & 2032

- Figure 17: Middle East & Africa Direct to Consumer Ecommerce Market in India Revenue Share (%), by End-User Vertical 2024 & 2032

- Figure 18: Middle East & Africa Direct to Consumer Ecommerce Market in India Revenue (Million), by Country 2024 & 2032

- Figure 19: Middle East & Africa Direct to Consumer Ecommerce Market in India Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Direct to Consumer Ecommerce Market in India Revenue (Million), by End-User Vertical 2024 & 2032

- Figure 21: Asia Pacific Direct to Consumer Ecommerce Market in India Revenue Share (%), by End-User Vertical 2024 & 2032

- Figure 22: Asia Pacific Direct to Consumer Ecommerce Market in India Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Direct to Consumer Ecommerce Market in India Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Direct to Consumer Ecommerce Market in India Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Direct to Consumer Ecommerce Market in India Revenue Million Forecast, by End-User Vertical 2019 & 2032

- Table 3: Global Direct to Consumer Ecommerce Market in India Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Direct to Consumer Ecommerce Market in India Revenue Million Forecast, by Country 2019 & 2032

- Table 5: North India Direct to Consumer Ecommerce Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: South India Direct to Consumer Ecommerce Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: East India Direct to Consumer Ecommerce Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: West India Direct to Consumer Ecommerce Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Direct to Consumer Ecommerce Market in India Revenue Million Forecast, by End-User Vertical 2019 & 2032

- Table 10: Global Direct to Consumer Ecommerce Market in India Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United States Direct to Consumer Ecommerce Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Canada Direct to Consumer Ecommerce Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Mexico Direct to Consumer Ecommerce Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Direct to Consumer Ecommerce Market in India Revenue Million Forecast, by End-User Vertical 2019 & 2032

- Table 15: Global Direct to Consumer Ecommerce Market in India Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Brazil Direct to Consumer Ecommerce Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Argentina Direct to Consumer Ecommerce Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of South America Direct to Consumer Ecommerce Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Direct to Consumer Ecommerce Market in India Revenue Million Forecast, by End-User Vertical 2019 & 2032

- Table 20: Global Direct to Consumer Ecommerce Market in India Revenue Million Forecast, by Country 2019 & 2032

- Table 21: United Kingdom Direct to Consumer Ecommerce Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Germany Direct to Consumer Ecommerce Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: France Direct to Consumer Ecommerce Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Italy Direct to Consumer Ecommerce Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Spain Direct to Consumer Ecommerce Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Russia Direct to Consumer Ecommerce Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Benelux Direct to Consumer Ecommerce Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Nordics Direct to Consumer Ecommerce Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe Direct to Consumer Ecommerce Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Direct to Consumer Ecommerce Market in India Revenue Million Forecast, by End-User Vertical 2019 & 2032

- Table 31: Global Direct to Consumer Ecommerce Market in India Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Turkey Direct to Consumer Ecommerce Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Israel Direct to Consumer Ecommerce Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: GCC Direct to Consumer Ecommerce Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Direct to Consumer Ecommerce Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Direct to Consumer Ecommerce Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Direct to Consumer Ecommerce Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Direct to Consumer Ecommerce Market in India Revenue Million Forecast, by End-User Vertical 2019 & 2032

- Table 39: Global Direct to Consumer Ecommerce Market in India Revenue Million Forecast, by Country 2019 & 2032

- Table 40: China Direct to Consumer Ecommerce Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: India Direct to Consumer Ecommerce Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Japan Direct to Consumer Ecommerce Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: South Korea Direct to Consumer Ecommerce Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: ASEAN Direct to Consumer Ecommerce Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Oceania Direct to Consumer Ecommerce Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Rest of Asia Pacific Direct to Consumer Ecommerce Market in India Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Direct to Consumer Ecommerce Market in India?

The projected CAGR is approximately 34.50%.

2. Which companies are prominent players in the Direct to Consumer Ecommerce Market in India?

Key companies in the market include Licious (Delightful Gourmet Pvt Ltd ), BoAt lifestyle (Imagine Marketing Services Pvt Ltd ), Nykaa E-Retail Pvt Ltd, Country Delight, Melorra, Wakefit Innovations Pvt Ltd *List Not Exhaustive, Noise, Bewakoof Brands Pvt Ltd, SUGAR Cosmetics, Mamaearth (Honasa Consumer Private Limited).

3. What are the main segments of the Direct to Consumer Ecommerce Market in India?

The market segments include End-User Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Higher Profit Margins by Cutting Down Intermediaries have Encouraged Several Companies to Enter the Market; Enhanced brand engagement with customers have led to higher retention.

6. What are the notable trends driving market growth?

Fashion is Expected to Hold the Largest Market Share.

7. Are there any restraints impacting market growth?

High Costs and Operational Drawbacks.

8. Can you provide examples of recent developments in the market?

June 2022 - Goat Brand Labs, an Indian direct-to-consumer brand aggregator, announced that it had raised USD 50 million in fresh funding to acquire more premium brands and help them scale globally. The brand acquires lifestyle brands and helps them enhance their business in a continuously changing e-commerce marketplace.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Direct to Consumer Ecommerce Market in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Direct to Consumer Ecommerce Market in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Direct to Consumer Ecommerce Market in India?

To stay informed about further developments, trends, and reports in the Direct to Consumer Ecommerce Market in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence