Key Insights

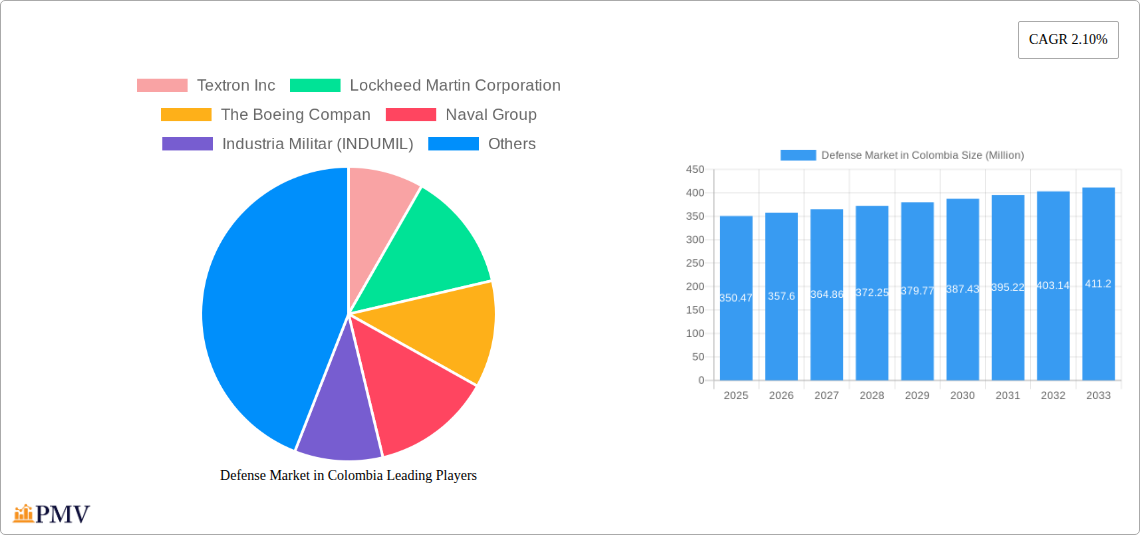

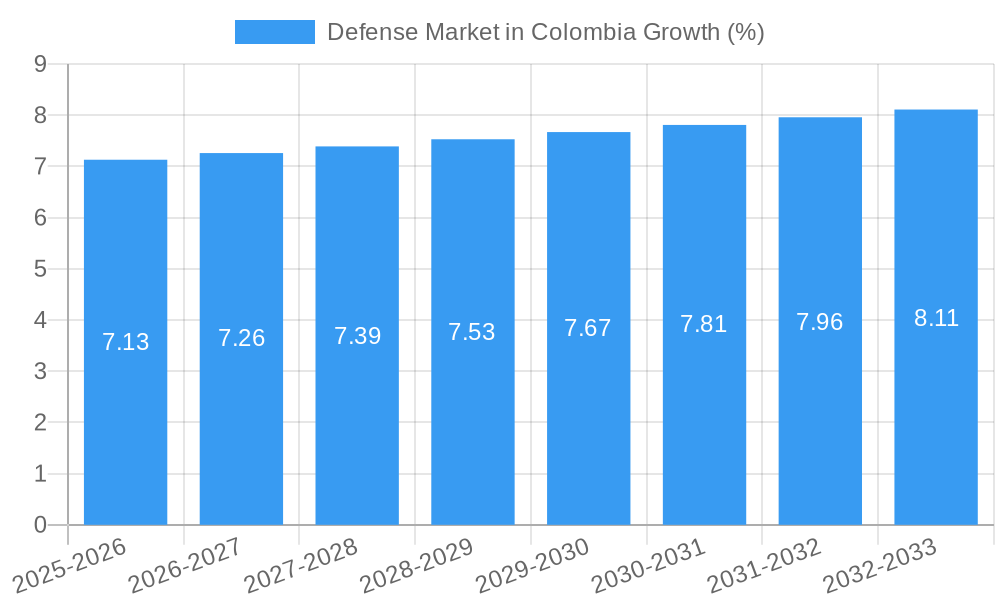

The Colombian defense market, valued at $350.47 million in 2025, is projected to experience steady growth with a Compound Annual Growth Rate (CAGR) of 2.10% from 2025 to 2033. This growth is driven by several factors. Firstly, increasing internal security concerns and the need to counter drug trafficking and insurgent activities necessitate continued investment in military equipment and infrastructure. Secondly, modernization efforts within the Colombian Army, Navy, and Air Force are fueling demand for advanced weaponry, armored vehicles, and sophisticated surveillance technologies. This includes upgrading existing fleets and integrating newer, more technologically advanced systems. Furthermore, strategic partnerships and collaborations with international defense companies are providing access to cutting-edge technologies and enhancing the country's defense capabilities. The market is segmented by armed forces (Army, Navy, Air Force) and equipment type (soldier protective equipment, infantry weapons, armored vehicles, naval vessels, aircraft, missile systems, radar systems, and unmanned systems), offering various opportunities for specialized vendors. Competition is likely to intensify amongst both domestic and international players, with companies such as Textron Inc., Lockheed Martin Corporation, and Boeing vying for significant market share.

While the market exhibits potential for growth, certain restraints exist. Budgetary constraints could limit the scale of military modernization programs. The Colombian government's prioritization of social and economic development over defense spending might impact future procurement plans. Furthermore, geopolitical factors and regional stability play a role; shifts in these areas can affect defense spending allocations. However, the persistent security challenges and the government's long-term commitment to strengthening its national defense are expected to mitigate these restraints, ensuring sustained albeit moderate growth within the Colombian defense market throughout the forecast period. The market's trajectory suggests a gradual expansion fueled by ongoing modernization efforts and security imperatives.

This in-depth report provides a comprehensive analysis of the Colombian defense market, encompassing market size, segmentation, competitive landscape, and future growth projections. The study period covers 2019-2033, with 2025 as the base and estimated year. The report offers actionable insights for industry stakeholders, including manufacturers, suppliers, government agencies, and investors. Expect detailed analysis across various segments, key players, and future trends shaping this dynamic market.

Defense Market in Colombia Market Structure & Competitive Dynamics

The Colombian defense market exhibits a moderate level of concentration, with both domestic and international players vying for market share. The market is characterized by a complex interplay of factors including government regulations, evolving technological advancements, and fluctuating geopolitical dynamics. Domestic players like Industria Militar (INDUMIL), COTECMAR, and CIAC SA play a significant role, while international giants like Textron Inc., Lockheed Martin Corporation, The Boeing Company, and Naval Group compete for large-scale contracts.

The innovation ecosystem is relatively nascent, with ongoing efforts to foster local technological capabilities. Regulatory frameworks influence procurement processes and impact market access for foreign players. Product substitution is a factor, particularly in areas like infantry weapons and armored vehicles, where cost-effectiveness plays a critical role. End-user trends reflect a growing demand for advanced technologies, such as unmanned systems and sophisticated radar systems, alongside modernization of existing equipment.

M&A activity within the Colombian defense sector is currently limited, although potential for consolidation exists. Recent deals have involved partnerships rather than outright acquisitions, reflecting the government's focus on fostering domestic capabilities. The total M&A deal value for the period 2019-2024 is estimated at $XX Million. Market share is highly fragmented, with no single player controlling more than xx%.

Defense Market in Colombia Industry Trends & Insights

The Colombian defense market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by several key factors. Government investment in defense modernization is a major growth driver, spurred by internal security concerns and a desire to enhance the capabilities of the armed forces. Technological advancements, particularly in areas such as unmanned systems and cyber warfare, are also significantly impacting the market landscape. Increased defense spending and procurement initiatives by the Colombian government further contribute to this growth. The market penetration of advanced technologies like AI-powered surveillance systems is expected to increase significantly, improving operational effectiveness and national security. Competitive dynamics are evolving as both domestic and international players strive to offer innovative solutions and secure lucrative contracts. This competitive landscape is expected to spur innovation and increase the efficiency and affordability of solutions available to the Colombian defense forces. The market is also witnessing increasing adoption of advanced materials and technologies in soldier protective equipment and armored vehicles, which is further fueling growth.

Dominant Markets & Segments in Defense Market in Colombia

The Colombian defense market is segmented by armed forces (Army, Navy, Air Force) and by equipment type (Soldier Protective Equipment, Infantry Weapons, Explosives, and Ammunitions, Armored Vehicles, Naval Vessels, Aircraft and Helicopters, Missile and Missile Defense Systems, Radar Systems, Artillery Weapons and Munitions, Unmanned Systems, Military Import and Export Products).

Dominant Armed Force Segment: The Army currently represents the largest segment, driven by ongoing counter-insurgency operations and border security needs.

Dominant Equipment Type Segment: Armored vehicles and infantry weapons currently hold the largest market share due to ongoing modernization and replacement programs within the military.

Key Drivers of Segment Dominance:

- Army: Significant budgetary allocation for ground forces modernization, ongoing counter-insurgency efforts, and border security initiatives.

- Armored Vehicles: Need for enhanced mobility and protection in diverse terrains, replacement of aging fleets.

- Infantry Weapons: Constant demand for reliable and modern small arms to maintain combat effectiveness.

The Navy segment shows potential for substantial growth due to planned acquisitions and modernization programs. The Air Force segment is also expected to see significant growth driven by the government's efforts to replace aging aircraft and increase the country's air defense capabilities, such as the planned replacement of the Kfir fleet, as announced in September 2022.

Defense Market in Colombia Product Innovations

Recent product innovations in the Colombian defense market focus on enhancing situational awareness, improving communication systems, and boosting operational efficiency. This includes the adoption of advanced sensors, communication technologies and integration with AI-powered systems. There is a growing focus on domestically produced solutions, driven by government initiatives aiming to boost the local defense industry. These innovations target improved operational effectiveness, enhanced soldier safety and reduced reliance on foreign suppliers.

Report Segmentation & Scope

The report segments the Colombian defense market comprehensively by armed forces (Army, Navy, Air Force) and by equipment type (Soldier Protective Equipment, Infantry Weapons, Explosives, and Ammunitions, Armored Vehicles, Naval Vessels, Aircraft and Helicopters, Missile and Missile Defense Systems, Radar Systems, Artillery Weapons and Munitions, Unmanned Systems, Military Import and Export Products). Each segment is analyzed in detail, providing insights into market size, growth projections, and competitive dynamics. The forecast period is 2025-2033, and the report includes historical data from 2019-2024. Market size for each segment is provided in Millions of USD.

Key Drivers of Defense Market in Colombia Growth

The Colombian defense market's growth is driven by several factors. Increased government spending on defense modernization, aimed at enhancing the capabilities of the armed forces, is a key driver. Rising security concerns, including threats from drug cartels and insurgent groups, necessitate upgrading military equipment. Technological advancements, such as the adoption of unmanned aerial vehicles (UAVs) and improved communication systems, are also contributing to market growth. Furthermore, government initiatives promoting local defense industry development are stimulating growth within the domestic sector.

Challenges in the Defense Market in Colombia Sector

The Colombian defense market faces several challenges. Budgetary constraints can limit the scale of modernization projects. Supply chain vulnerabilities and dependence on foreign suppliers pose risks. The complexities of procurement processes and regulatory hurdles can delay project implementation. Competition from international players with advanced technologies and established supply chains represents another challenge for domestic companies. These factors can impact project timelines and overall market growth. For instance, delays in contract approvals can lead to cost overruns estimated at $XX Million annually.

Leading Players in the Defense Market in Colombia Market

- Textron Inc

- Lockheed Martin Corporation

- The Boeing Company

- Naval Group

- Industria Militar (INDUMIL)

- Armor International SA

- The High-tech Corporation For Defense (CODALTEC)

- Colombian Aeronautical Industry Corporation CIAC SA

- Antares Aerospace & Defense

- Science And Technology Corporation for the Development of Naval Maritime and Riverine Industry (COTECMAR)

Key Developments in Defense Market in Colombia Sector

- September 2022: COTECMAR and Damen signed a contract for co-developing the next generation of frigates for the Colombian Navy. This signifies a move towards collaborative international partnerships for advanced naval capabilities.

- September 2022: President Gustavo Petro reactivated the process of acquiring new fighter jets to replace the aging Kfir fleet. This significant initiative will reshape the Air Force segment and boost the market for aircraft and related systems.

Strategic Defense Market in Colombia Market Outlook

The Colombian defense market presents significant long-term growth potential. Continued government investment in modernization programs, coupled with the adoption of advanced technologies, will drive market expansion. Opportunities exist for both domestic and international companies that can provide innovative and cost-effective solutions. Strategic partnerships between local and international players are expected to enhance technological capabilities and contribute to market growth. The country’s increasing focus on strengthening its national security, combined with the modernization plans for its armed forces, further assures this positive outlook for long-term growth.

Defense Market in Colombia Segmentation

-

1. Armed Forces

- 1.1. Army

- 1.2. Navy

- 1.3. Air Force

-

2. Type

- 2.1. Soldier Protective Equipment

- 2.2. Infantry Weapons, Explosives, and Ammunitions

- 2.3. Armored Vehicles

- 2.4. Naval Vessels

- 2.5. Aircraft and Helicopters

- 2.6. Missile and Missile Defense Systems

- 2.7. Radar Systems

- 2.8. Artillery Weapons and Munitions

- 2.9. Unmanned Systems

- 2.10. Military Import and Export Products

Defense Market in Colombia Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Defense Market in Colombia REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Army is Projected to Dominate the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Defense Market in Colombia Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Armed Forces

- 5.1.1. Army

- 5.1.2. Navy

- 5.1.3. Air Force

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Soldier Protective Equipment

- 5.2.2. Infantry Weapons, Explosives, and Ammunitions

- 5.2.3. Armored Vehicles

- 5.2.4. Naval Vessels

- 5.2.5. Aircraft and Helicopters

- 5.2.6. Missile and Missile Defense Systems

- 5.2.7. Radar Systems

- 5.2.8. Artillery Weapons and Munitions

- 5.2.9. Unmanned Systems

- 5.2.10. Military Import and Export Products

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Armed Forces

- 6. North America Defense Market in Colombia Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Armed Forces

- 6.1.1. Army

- 6.1.2. Navy

- 6.1.3. Air Force

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Soldier Protective Equipment

- 6.2.2. Infantry Weapons, Explosives, and Ammunitions

- 6.2.3. Armored Vehicles

- 6.2.4. Naval Vessels

- 6.2.5. Aircraft and Helicopters

- 6.2.6. Missile and Missile Defense Systems

- 6.2.7. Radar Systems

- 6.2.8. Artillery Weapons and Munitions

- 6.2.9. Unmanned Systems

- 6.2.10. Military Import and Export Products

- 6.1. Market Analysis, Insights and Forecast - by Armed Forces

- 7. South America Defense Market in Colombia Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Armed Forces

- 7.1.1. Army

- 7.1.2. Navy

- 7.1.3. Air Force

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Soldier Protective Equipment

- 7.2.2. Infantry Weapons, Explosives, and Ammunitions

- 7.2.3. Armored Vehicles

- 7.2.4. Naval Vessels

- 7.2.5. Aircraft and Helicopters

- 7.2.6. Missile and Missile Defense Systems

- 7.2.7. Radar Systems

- 7.2.8. Artillery Weapons and Munitions

- 7.2.9. Unmanned Systems

- 7.2.10. Military Import and Export Products

- 7.1. Market Analysis, Insights and Forecast - by Armed Forces

- 8. Europe Defense Market in Colombia Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Armed Forces

- 8.1.1. Army

- 8.1.2. Navy

- 8.1.3. Air Force

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Soldier Protective Equipment

- 8.2.2. Infantry Weapons, Explosives, and Ammunitions

- 8.2.3. Armored Vehicles

- 8.2.4. Naval Vessels

- 8.2.5. Aircraft and Helicopters

- 8.2.6. Missile and Missile Defense Systems

- 8.2.7. Radar Systems

- 8.2.8. Artillery Weapons and Munitions

- 8.2.9. Unmanned Systems

- 8.2.10. Military Import and Export Products

- 8.1. Market Analysis, Insights and Forecast - by Armed Forces

- 9. Middle East & Africa Defense Market in Colombia Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Armed Forces

- 9.1.1. Army

- 9.1.2. Navy

- 9.1.3. Air Force

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Soldier Protective Equipment

- 9.2.2. Infantry Weapons, Explosives, and Ammunitions

- 9.2.3. Armored Vehicles

- 9.2.4. Naval Vessels

- 9.2.5. Aircraft and Helicopters

- 9.2.6. Missile and Missile Defense Systems

- 9.2.7. Radar Systems

- 9.2.8. Artillery Weapons and Munitions

- 9.2.9. Unmanned Systems

- 9.2.10. Military Import and Export Products

- 9.1. Market Analysis, Insights and Forecast - by Armed Forces

- 10. Asia Pacific Defense Market in Colombia Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Armed Forces

- 10.1.1. Army

- 10.1.2. Navy

- 10.1.3. Air Force

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Soldier Protective Equipment

- 10.2.2. Infantry Weapons, Explosives, and Ammunitions

- 10.2.3. Armored Vehicles

- 10.2.4. Naval Vessels

- 10.2.5. Aircraft and Helicopters

- 10.2.6. Missile and Missile Defense Systems

- 10.2.7. Radar Systems

- 10.2.8. Artillery Weapons and Munitions

- 10.2.9. Unmanned Systems

- 10.2.10. Military Import and Export Products

- 10.1. Market Analysis, Insights and Forecast - by Armed Forces

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Textron Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lockheed Martin Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 The Boeing Compan

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Naval Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Industria Militar (INDUMIL)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Armor International SA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 The High-tech Corporation For Defense (CODALTEC)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Colombian Aeronautical Industry Corporation CIAC SA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Antares Aerospace & Defense

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Science And Technology Corporation for the Development of Naval Maritime and Riverine Industry (COTECMAR)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Textron Inc

List of Figures

- Figure 1: Global Defense Market in Colombia Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Colombia Defense Market in Colombia Revenue (Million), by Country 2024 & 2032

- Figure 3: Colombia Defense Market in Colombia Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Defense Market in Colombia Revenue (Million), by Armed Forces 2024 & 2032

- Figure 5: North America Defense Market in Colombia Revenue Share (%), by Armed Forces 2024 & 2032

- Figure 6: North America Defense Market in Colombia Revenue (Million), by Type 2024 & 2032

- Figure 7: North America Defense Market in Colombia Revenue Share (%), by Type 2024 & 2032

- Figure 8: North America Defense Market in Colombia Revenue (Million), by Country 2024 & 2032

- Figure 9: North America Defense Market in Colombia Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Defense Market in Colombia Revenue (Million), by Armed Forces 2024 & 2032

- Figure 11: South America Defense Market in Colombia Revenue Share (%), by Armed Forces 2024 & 2032

- Figure 12: South America Defense Market in Colombia Revenue (Million), by Type 2024 & 2032

- Figure 13: South America Defense Market in Colombia Revenue Share (%), by Type 2024 & 2032

- Figure 14: South America Defense Market in Colombia Revenue (Million), by Country 2024 & 2032

- Figure 15: South America Defense Market in Colombia Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Defense Market in Colombia Revenue (Million), by Armed Forces 2024 & 2032

- Figure 17: Europe Defense Market in Colombia Revenue Share (%), by Armed Forces 2024 & 2032

- Figure 18: Europe Defense Market in Colombia Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe Defense Market in Colombia Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe Defense Market in Colombia Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Defense Market in Colombia Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa Defense Market in Colombia Revenue (Million), by Armed Forces 2024 & 2032

- Figure 23: Middle East & Africa Defense Market in Colombia Revenue Share (%), by Armed Forces 2024 & 2032

- Figure 24: Middle East & Africa Defense Market in Colombia Revenue (Million), by Type 2024 & 2032

- Figure 25: Middle East & Africa Defense Market in Colombia Revenue Share (%), by Type 2024 & 2032

- Figure 26: Middle East & Africa Defense Market in Colombia Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa Defense Market in Colombia Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Defense Market in Colombia Revenue (Million), by Armed Forces 2024 & 2032

- Figure 29: Asia Pacific Defense Market in Colombia Revenue Share (%), by Armed Forces 2024 & 2032

- Figure 30: Asia Pacific Defense Market in Colombia Revenue (Million), by Type 2024 & 2032

- Figure 31: Asia Pacific Defense Market in Colombia Revenue Share (%), by Type 2024 & 2032

- Figure 32: Asia Pacific Defense Market in Colombia Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Defense Market in Colombia Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Defense Market in Colombia Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Defense Market in Colombia Revenue Million Forecast, by Armed Forces 2019 & 2032

- Table 3: Global Defense Market in Colombia Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Global Defense Market in Colombia Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Defense Market in Colombia Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Global Defense Market in Colombia Revenue Million Forecast, by Armed Forces 2019 & 2032

- Table 7: Global Defense Market in Colombia Revenue Million Forecast, by Type 2019 & 2032

- Table 8: Global Defense Market in Colombia Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Defense Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada Defense Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico Defense Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Defense Market in Colombia Revenue Million Forecast, by Armed Forces 2019 & 2032

- Table 13: Global Defense Market in Colombia Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Global Defense Market in Colombia Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Brazil Defense Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina Defense Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of South America Defense Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Defense Market in Colombia Revenue Million Forecast, by Armed Forces 2019 & 2032

- Table 19: Global Defense Market in Colombia Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Global Defense Market in Colombia Revenue Million Forecast, by Country 2019 & 2032

- Table 21: United Kingdom Defense Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Germany Defense Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: France Defense Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Italy Defense Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Spain Defense Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Russia Defense Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Benelux Defense Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Nordics Defense Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe Defense Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Defense Market in Colombia Revenue Million Forecast, by Armed Forces 2019 & 2032

- Table 31: Global Defense Market in Colombia Revenue Million Forecast, by Type 2019 & 2032

- Table 32: Global Defense Market in Colombia Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Turkey Defense Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Israel Defense Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: GCC Defense Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: North Africa Defense Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: South Africa Defense Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Middle East & Africa Defense Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Defense Market in Colombia Revenue Million Forecast, by Armed Forces 2019 & 2032

- Table 40: Global Defense Market in Colombia Revenue Million Forecast, by Type 2019 & 2032

- Table 41: Global Defense Market in Colombia Revenue Million Forecast, by Country 2019 & 2032

- Table 42: China Defense Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: India Defense Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Japan Defense Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: South Korea Defense Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: ASEAN Defense Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Oceania Defense Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Asia Pacific Defense Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Defense Market in Colombia?

The projected CAGR is approximately 2.10%.

2. Which companies are prominent players in the Defense Market in Colombia?

Key companies in the market include Textron Inc, Lockheed Martin Corporation, The Boeing Compan, Naval Group, Industria Militar (INDUMIL), Armor International SA, The High-tech Corporation For Defense (CODALTEC), Colombian Aeronautical Industry Corporation CIAC SA, Antares Aerospace & Defense, Science And Technology Corporation for the Development of Naval Maritime and Riverine Industry (COTECMAR).

3. What are the main segments of the Defense Market in Colombia?

The market segments include Armed Forces, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 350.47 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Army is Projected to Dominate the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In September 2022, Colombian state-owned shipbuilder COTECMAR and Dutch shipbuilding company Damen signed a contract for the co-development of the contractual design for the next generation of frigates for the Colombian Navy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Defense Market in Colombia," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Defense Market in Colombia report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Defense Market in Colombia?

To stay informed about further developments, trends, and reports in the Defense Market in Colombia, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence