Key Insights

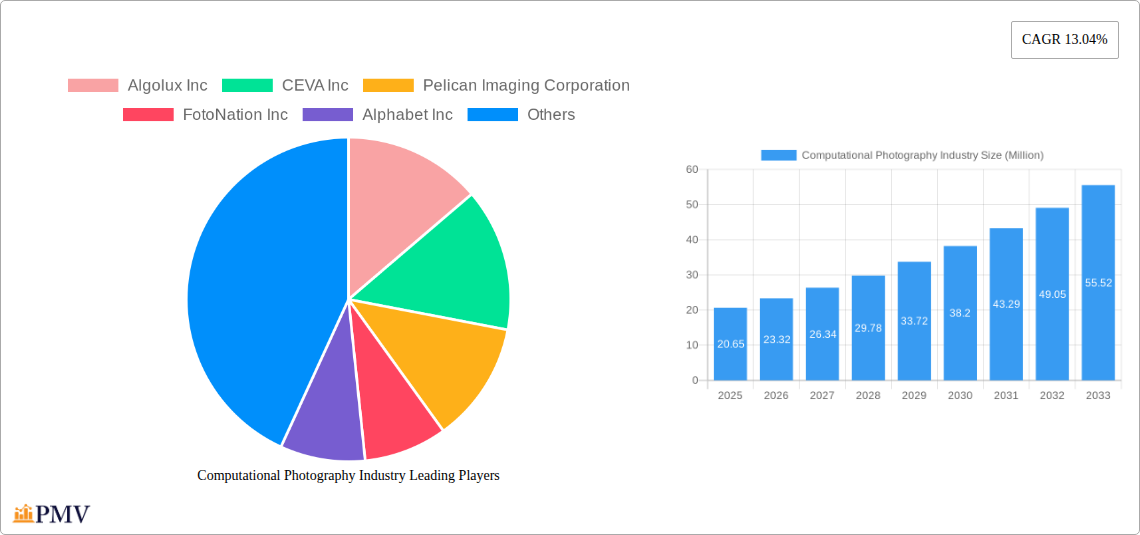

The global Computational Photography market is poised for substantial expansion, with a current market size estimated at $20.65 million. This robust growth is fueled by a projected Compound Annual Growth Rate (CAGR) of 13.04% throughout the forecast period of 2025-2033. The industry's dynamism is primarily driven by the relentless demand for enhanced imaging capabilities across a wide spectrum of applications. Key among these drivers are advancements in smartphone cameras, where computational photography is revolutionizing image quality through sophisticated algorithms that overcome hardware limitations. Machine vision cameras, essential for automation, AI-powered diagnostics, and autonomous systems, also represent a significant growth avenue. The increasing integration of advanced AI and machine learning algorithms within camera systems is further propelling innovation, enabling features like real-time image enhancement, object recognition, and augmented reality experiences. The continuous pursuit of superior visual fidelity, coupled with the expanding use cases in both consumer electronics and industrial sectors, underscores the robust health and promising future of the computational photography landscape.

Computational Photography Industry Market Size (In Million)

The market's growth trajectory is further shaped by significant trends and a few key restraints. The increasing adoption of multi-lens camera systems, particularly dual-lens and even 16-lens configurations, allows for richer data capture, which computational photography then leverages to produce superior results. Software innovations, including advanced image processing algorithms and AI-driven enhancements, are becoming increasingly critical differentiators. Companies are investing heavily in developing proprietary computational photography solutions to gain a competitive edge. However, certain restraints exist. The high cost associated with developing and integrating sophisticated computational photography hardware and software can be a barrier, particularly for smaller players. Additionally, the power consumption requirements for complex image processing can pose challenges, especially in battery-constrained mobile devices. Despite these hurdles, the overarching demand for advanced imaging, coupled with ongoing research and development, is expected to maintain a strong upward trend in market value.

Computational Photography Industry Company Market Share

Computational Photography Industry Market Report: Deep Dive into Innovations, Trends, and Future Outlook (2019-2033)

This comprehensive report offers an in-depth analysis of the global Computational Photography Industry, a rapidly evolving sector revolutionizing image capture and processing. With a study period spanning from 2019 to 2033, a base year of 2025, and a forecast period extending from 2025 to 2033, this report provides critical insights into market dynamics, technological advancements, and future growth opportunities. Our analysis covers historical trends from 2019-2024, offering a robust foundation for understanding the current landscape and predicting future trajectories. This report is meticulously crafted to address the needs of industry stakeholders, including manufacturers, software developers, investors, and researchers seeking to navigate the complexities of this high-growth market. We delve into key segments, innovative offerings, and the strategic imperatives driving the future of image processing.

Computational Photography Industry Market Structure & Competitive Dynamics

The Computational Photography Industry exhibits a dynamic market structure characterized by both concentrated innovation hubs and a growing number of specialized players. The competitive landscape is shaped by significant investments in research and development, leading to a robust innovation ecosystem. Major players are continuously enhancing their AI-powered imaging solutions and advanced image processing software, driving differentiation. Regulatory frameworks, while nascent in certain aspects, are evolving to address data privacy and AI ethics, indirectly influencing product development and market access. Product substitutes, such as traditional photography techniques, are increasingly being augmented or replaced by computational methods, especially in mobile and professional imaging. End-user trends are heavily skewed towards demand for higher image quality, advanced features like AI scene recognition, low-light enhancement, and real-time image manipulation, particularly within the smartphone cameras segment. Mergers and acquisitions (M&A) activities are notable, with strategic acquisitions aimed at consolidating technological capabilities and expanding market reach. Deal values in recent years are estimated to be in the hundreds of millions to low billions, reflecting the strategic importance of acquiring innovative computational imaging technology. Market share distribution is influenced by the proprietary nature of algorithms and hardware integration, with leaders often holding significant sway in specific application areas.

Computational Photography Industry Industry Trends & Insights

The Computational Photography Industry is experiencing a transformative growth phase driven by the relentless pursuit of superior image quality and advanced visual intelligence. Key market growth drivers include the burgeoning demand for AI-driven image enhancement and multi-modal sensing capabilities across consumer electronics, automotive, and industrial sectors. The proliferation of high-resolution sensors and the increasing availability of powerful mobile processors are enabling more sophisticated computational imaging algorithms to be implemented at the edge. Technological disruptions are primarily centered around the advancement of deep learning and machine learning models for image reconstruction, noise reduction, and object recognition. The integration of neural network processing units (NPUs) in modern devices is a significant enabler, allowing for complex image processing tasks to be executed with unprecedented speed and efficiency. Consumer preferences are increasingly leaning towards effortless capture of professional-grade photos and videos, with a strong emphasis on features such as HDR imaging, portrait mode with bokeh effects, and super-resolution zoom. This trend is fueling the adoption of advanced camera modules and intelligent software solutions. Competitive dynamics are characterized by intense innovation, with companies vying for leadership in areas like real-time video processing, 3D imaging, and augmented reality (AR) integration. The market penetration of computational photography solutions is rapidly expanding beyond smartphones into areas like drones, security cameras, and advanced driver-assistance systems (ADAS). The Compound Annual Growth Rate (CAGR) for the computational photography market is projected to be robust, estimated between 15% and 20% over the forecast period, driven by sustained innovation and expanding application verticals. The market size is projected to reach several tens of billions of dollars by 2033, up from an estimated market size in the high single-digit billions for the base year of 2025. The ongoing miniaturization of high-performance computing hardware and the development of more efficient imaging pipelines are further accelerating market adoption. The convergence of imaging and AI is creating new opportunities for personalized visual experiences and intelligent visual data analysis, further solidifying the growth trajectory of this sector.

Dominant Markets & Segments in Computational Photography Industry

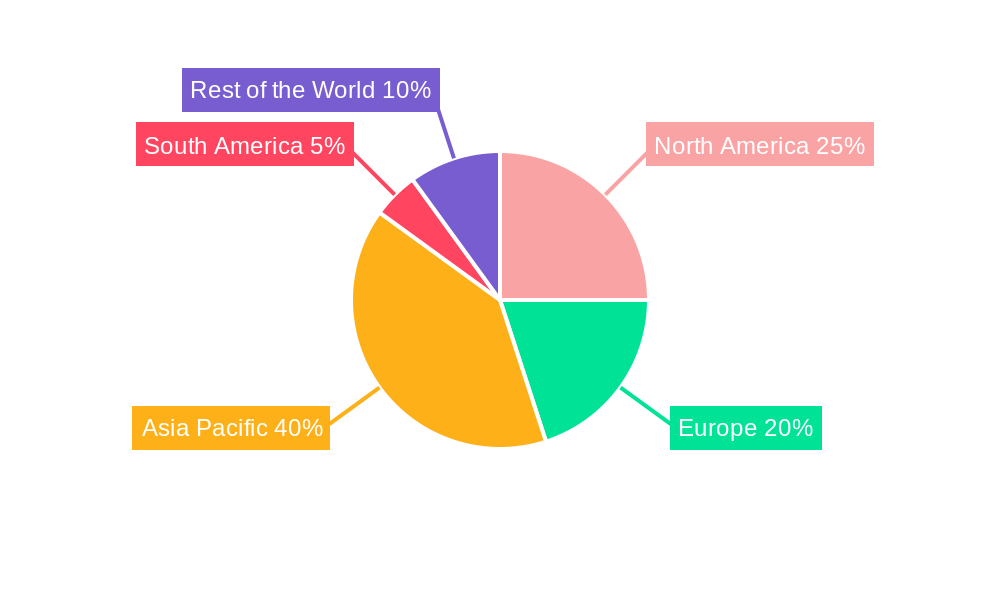

The Computational Photography Industry is witnessing significant dominance from specific regions and segments, driven by technological adoption, consumer demand, and manufacturing capabilities.

Leading Region: North America and Asia-Pacific are emerging as dominant regions, largely due to the strong presence of leading technology companies in R&D and manufacturing, coupled with high consumer spending on advanced electronic devices, particularly smartphones. The concentration of semiconductor fabrication plants and a robust AI research ecosystem in these regions further bolsters their leadership.

Offerings:

- Software: The computational photography software segment is experiencing the fastest growth, with market penetration estimated to exceed 60% of the total market value by 2033. This dominance is fueled by the ability of software to enhance existing hardware capabilities and deliver advanced features like AI scene optimization and image denoising. Companies are heavily investing in developing sophisticated algorithms that can interpret and manipulate image data in real-time.

- Camera Modules: While software leads in growth, camera modules remain a critical component, with market size projected to be in the high single-digit billions by 2025. Innovations in multi-lens camera systems and miniaturized sensor technology are driving demand.

Type:

- Single- and Dual-Lens Cameras: These remain dominant in terms of unit volume due to their widespread adoption in mid-range and budget smartphones. However, the market share is gradually shifting towards multi-lens configurations.

- 16-Lens Cameras: These advanced systems, while niche, are gaining traction in specialized applications and high-end consumer devices, offering unparalleled depth sensing and image quality. Their market share is projected to grow significantly as costs decrease and adoption increases.

Application:

- Smartphone Cameras: This is the largest and most influential application segment, accounting for over 70% of the market revenue. The continuous drive for better mobile photography by consumers fuels innovation and demand for computational imaging features in smartphones. Economic policies supporting consumer electronics manufacturing and a strong demand for connected devices in these regions are key drivers.

- Machine Vision Cameras: This segment is experiencing rapid expansion, driven by the growth of AI in industrial automation, robotics, and autonomous systems. The need for precise image analysis, defect detection, and environmental perception in manufacturing and logistics is fueling adoption. Infrastructure development in smart cities and the increasing deployment of autonomous vehicles are further accelerating growth in this segment.

- Other Applications: This includes drones, AR/VR devices, security systems, and medical imaging, which collectively represent a growing market share, projected to reach over 15% by 2033.

Computational Photography Industry Product Innovations

Product innovations in the Computational Photography Industry are centered on harnessing the power of artificial intelligence and advanced algorithms to overcome the physical limitations of traditional imaging hardware. Key developments include the integration of AI-powered image signal processors (ISPs) that enable real-time scene analysis and optimization, delivering superior dynamic range, color accuracy, and detail. Companies are pushing the boundaries of multi-frame fusion techniques for enhanced low-light performance and noise reduction, offering image quality previously unattainable. The development of light field cameras and advanced depth sensing technologies is enabling novel applications in 3D reconstruction and immersive augmented reality experiences. These innovations provide a significant competitive advantage by enabling the creation of more intelligent, adaptable, and feature-rich imaging systems tailored to specific application needs.

Report Segmentation & Scope

The Computational Photography Industry market is segmented across key areas to provide granular insights.

Offerings: This segmentation includes Camera Modules and Software. The Camera Modules segment, encompassing hardware components like sensors and lenses, is projected to hold a substantial market share, driven by advancements in multi-lens configurations and miniaturization. The Software segment, which includes AI imaging algorithms, image processing pipelines, and cloud-based enhancement tools, is expected to witness the highest growth rate due to its role in enabling advanced computational features and its adaptability to various hardware platforms. Market sizes for these segments are expected to reach tens of billions and high single-digit billions respectively by 2033, with software exhibiting a higher CAGR.

Type: This segmentation categorizes offerings by camera configuration: Single- and Dual-Lens Cameras and 16-Lens Cameras. The Single- and Dual-Lens Cameras segment will continue to dominate in terms of volume, particularly within the smartphone market. However, the 16-Lens Cameras segment, representing advanced multi-lens arrays, is anticipated to see significant growth due to its superior capabilities in depth perception and computational power, expanding into professional photography and emerging applications.

Application: The market is segmented into Smartphone Cameras, Machine Vision Cameras, and Other Applications. Smartphone Cameras represent the largest segment by revenue, driven by consumer demand for enhanced mobile photography. Machine Vision Cameras are projected for robust growth, fueled by the increasing adoption of AI in industrial automation and robotics. Other Applications, including drones, AR/VR, and medical imaging, form a rapidly expanding niche, driven by specialized technological requirements and emerging market opportunities.

Key Drivers of Computational Photography Industry Growth

The Computational Photography Industry is experiencing robust growth driven by several key factors:

- Technological Advancements: The continuous innovation in Artificial Intelligence (AI), particularly deep learning and machine learning, is a primary driver. These technologies enable sophisticated image processing techniques, leading to enhanced image quality and novel functionalities.

- Increasing Demand for High-Quality Imaging: Consumers, particularly in the smartphone market, demand better image quality, advanced features like bokeh effects, and superior low-light performance, which computational photography excels at delivering.

- Proliferation of AI-Enabled Devices: The widespread integration of AI processors (NPUs) in smartphones, cameras, and other devices makes it feasible to perform complex computational photography tasks at the edge.

- Expanding Application Verticals: Beyond smartphones, computational photography is finding critical applications in machine vision cameras, autonomous vehicles, drones, AR/VR, and medical imaging, opening up new market opportunities.

- 5G Connectivity: Enhanced network speeds and reduced latency facilitated by 5G Advanced and future iterations of mobile communication are crucial for real-time image processing and cloud-based enhancement services.

Challenges in the Computational Photography Industry Sector

Despite its rapid growth, the Computational Photography Industry faces several challenges:

- Computational Complexity and Power Consumption: Advanced computational algorithms require significant processing power, which can lead to increased battery consumption in mobile devices and higher costs for dedicated hardware.

- Data Privacy and Security Concerns: The sophisticated data processing involved in computational photography raises concerns regarding user data privacy and the secure storage and transmission of image data.

- Algorithm Bias and Ethical Considerations: AI algorithms can sometimes exhibit biases, leading to unintended or unfair outcomes in image processing. Addressing these ethical considerations and ensuring algorithmic fairness is crucial.

- Standardization and Interoperability: A lack of industry-wide standards for computational photography techniques and data formats can hinder interoperability between different devices and software platforms.

- High R&D Costs: Developing cutting-edge computational photography solutions requires substantial investment in research and development, which can be a barrier for smaller players.

Leading Players in the Computational Photography Industry Market

- Algolux Inc

- CEVA Inc

- Pelican Imaging Corporation

- FotoNation Inc

- Alphabet Inc

- Light Labs Inc

- Qualcomm Technologies Inc

- Almalence Inc

- Nvidia Corporation

- Apple Inc

Key Developments in Computational Photography Industry Sector

- February 2023: Qualcomm Technologies has announced the 6th generation modem-to-antenna solution is the first ready to support 5G Advanced, the next phase of 5G. It introduces a new architecture and software suite and includes numerous world's first features to push the boundaries of connectivity, including coverage, latency, power efficiency, and mobility. Snapdragon X75 technologies and innovations empower OEMs to create next-generation experiences across segments, including smartphones, mobile broadband, automotive, compute, industrial IoT, fixed wireless access, and 5G private networks.

- September 2022: Nvidia Corporation announced introducing new Jetson Orin Nano system-on-modules that give up to 80x the performance of the previous generation, expanding the Nvidia Jetson family and establishing a new benchmark for entry-level edge AI and robotics.

Strategic Computational Photography Industry Market Outlook

The strategic outlook for the Computational Photography Industry is exceptionally strong, driven by the continuous convergence of imaging hardware, advanced software algorithms, and the accelerating integration of Artificial Intelligence. Future growth will be propelled by the increasing demand for intelligent imaging solutions across a widening array of applications, from enhanced consumer experiences in smartphone cameras to critical decision-making in machine vision cameras and autonomous systems. Strategic opportunities lie in developing more efficient and powerful AI imaging pipelines, enabling real-time processing on edge devices with minimal power consumption. Partnerships and collaborations between hardware manufacturers, software developers, and AI specialists will be crucial for unlocking the full potential of computational photography. The ongoing evolution of 5G and beyond connectivity will further enable cloud-enhanced imaging capabilities and facilitate the deployment of sophisticated AI-driven visual analytics, solidifying the industry's trajectory towards a future where "seeing is understanding."

Computational Photography Industry Segmentation

-

1. Offerings

- 1.1. Camera Modules

- 1.2. Software

-

2. Type

- 2.1. Single- and Dual-Lens Cameras

- 2.2. 16-Lens Cameras

-

3. Application

- 3.1. Smartphone Cameras

- 3.2. Machine Vision Cameras

- 3.3. Other Applications

Computational Photography Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Rest of the World

Computational Photography Industry Regional Market Share

Geographic Coverage of Computational Photography Industry

Computational Photography Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.04% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Image Fusion Technique to Achieve High-quality Image; Increasing Demand for High-resolution Computational Cameras in Machine Vision for Autonomous Vehicle

- 3.3. Market Restrains

- 3.3.1. High Manufacturing and Maintenance Costs

- 3.4. Market Trends

- 3.4.1. Smartphone Cameras to Witness Significant Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Computational Photography Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Offerings

- 5.1.1. Camera Modules

- 5.1.2. Software

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Single- and Dual-Lens Cameras

- 5.2.2. 16-Lens Cameras

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Smartphone Cameras

- 5.3.2. Machine Vision Cameras

- 5.3.3. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Offerings

- 6. North America Computational Photography Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Offerings

- 6.1.1. Camera Modules

- 6.1.2. Software

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Single- and Dual-Lens Cameras

- 6.2.2. 16-Lens Cameras

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Smartphone Cameras

- 6.3.2. Machine Vision Cameras

- 6.3.3. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Offerings

- 7. Europe Computational Photography Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Offerings

- 7.1.1. Camera Modules

- 7.1.2. Software

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Single- and Dual-Lens Cameras

- 7.2.2. 16-Lens Cameras

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Smartphone Cameras

- 7.3.2. Machine Vision Cameras

- 7.3.3. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Offerings

- 8. Asia Pacific Computational Photography Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Offerings

- 8.1.1. Camera Modules

- 8.1.2. Software

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Single- and Dual-Lens Cameras

- 8.2.2. 16-Lens Cameras

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Smartphone Cameras

- 8.3.2. Machine Vision Cameras

- 8.3.3. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Offerings

- 9. South America Computational Photography Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Offerings

- 9.1.1. Camera Modules

- 9.1.2. Software

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Single- and Dual-Lens Cameras

- 9.2.2. 16-Lens Cameras

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Smartphone Cameras

- 9.3.2. Machine Vision Cameras

- 9.3.3. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Offerings

- 10. Rest of the World Computational Photography Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Offerings

- 10.1.1. Camera Modules

- 10.1.2. Software

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Single- and Dual-Lens Cameras

- 10.2.2. 16-Lens Cameras

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Smartphone Cameras

- 10.3.2. Machine Vision Cameras

- 10.3.3. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Offerings

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Algolux Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 CEVA Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Pelican Imaging Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 FotoNation Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Alphabet Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Light Labs Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Qualcomm Technologies Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Almalence Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nvidia Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Apple Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Algolux Inc

List of Figures

- Figure 1: Global Computational Photography Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Computational Photography Industry Revenue (Million), by Offerings 2025 & 2033

- Figure 3: North America Computational Photography Industry Revenue Share (%), by Offerings 2025 & 2033

- Figure 4: North America Computational Photography Industry Revenue (Million), by Type 2025 & 2033

- Figure 5: North America Computational Photography Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Computational Photography Industry Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Computational Photography Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Computational Photography Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Computational Photography Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Computational Photography Industry Revenue (Million), by Offerings 2025 & 2033

- Figure 11: Europe Computational Photography Industry Revenue Share (%), by Offerings 2025 & 2033

- Figure 12: Europe Computational Photography Industry Revenue (Million), by Type 2025 & 2033

- Figure 13: Europe Computational Photography Industry Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Computational Photography Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: Europe Computational Photography Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Computational Photography Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Computational Photography Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Computational Photography Industry Revenue (Million), by Offerings 2025 & 2033

- Figure 19: Asia Pacific Computational Photography Industry Revenue Share (%), by Offerings 2025 & 2033

- Figure 20: Asia Pacific Computational Photography Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Asia Pacific Computational Photography Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Asia Pacific Computational Photography Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: Asia Pacific Computational Photography Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Computational Photography Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Computational Photography Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Computational Photography Industry Revenue (Million), by Offerings 2025 & 2033

- Figure 27: South America Computational Photography Industry Revenue Share (%), by Offerings 2025 & 2033

- Figure 28: South America Computational Photography Industry Revenue (Million), by Type 2025 & 2033

- Figure 29: South America Computational Photography Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: South America Computational Photography Industry Revenue (Million), by Application 2025 & 2033

- Figure 31: South America Computational Photography Industry Revenue Share (%), by Application 2025 & 2033

- Figure 32: South America Computational Photography Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Computational Photography Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Rest of the World Computational Photography Industry Revenue (Million), by Offerings 2025 & 2033

- Figure 35: Rest of the World Computational Photography Industry Revenue Share (%), by Offerings 2025 & 2033

- Figure 36: Rest of the World Computational Photography Industry Revenue (Million), by Type 2025 & 2033

- Figure 37: Rest of the World Computational Photography Industry Revenue Share (%), by Type 2025 & 2033

- Figure 38: Rest of the World Computational Photography Industry Revenue (Million), by Application 2025 & 2033

- Figure 39: Rest of the World Computational Photography Industry Revenue Share (%), by Application 2025 & 2033

- Figure 40: Rest of the World Computational Photography Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Rest of the World Computational Photography Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Computational Photography Industry Revenue Million Forecast, by Offerings 2020 & 2033

- Table 2: Global Computational Photography Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global Computational Photography Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Computational Photography Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Computational Photography Industry Revenue Million Forecast, by Offerings 2020 & 2033

- Table 6: Global Computational Photography Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Global Computational Photography Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Computational Photography Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Computational Photography Industry Revenue Million Forecast, by Offerings 2020 & 2033

- Table 10: Global Computational Photography Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Computational Photography Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Computational Photography Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Computational Photography Industry Revenue Million Forecast, by Offerings 2020 & 2033

- Table 14: Global Computational Photography Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 15: Global Computational Photography Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 16: Global Computational Photography Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Computational Photography Industry Revenue Million Forecast, by Offerings 2020 & 2033

- Table 18: Global Computational Photography Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 19: Global Computational Photography Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Global Computational Photography Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Computational Photography Industry Revenue Million Forecast, by Offerings 2020 & 2033

- Table 22: Global Computational Photography Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 23: Global Computational Photography Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Computational Photography Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Computational Photography Industry?

The projected CAGR is approximately 13.04%.

2. Which companies are prominent players in the Computational Photography Industry?

Key companies in the market include Algolux Inc, CEVA Inc, Pelican Imaging Corporation, FotoNation Inc, Alphabet Inc, Light Labs Inc, Qualcomm Technologies Inc, Almalence Inc, Nvidia Corporation, Apple Inc.

3. What are the main segments of the Computational Photography Industry?

The market segments include Offerings, Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 20.65 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Image Fusion Technique to Achieve High-quality Image; Increasing Demand for High-resolution Computational Cameras in Machine Vision for Autonomous Vehicle.

6. What are the notable trends driving market growth?

Smartphone Cameras to Witness Significant Market Growth.

7. Are there any restraints impacting market growth?

High Manufacturing and Maintenance Costs.

8. Can you provide examples of recent developments in the market?

February 2023: Qualcomm Technologies has announced the 6th generation modem-to-antenna solution is the first ready to support 5G Advanced, the next phase of 5G. It introduces a new architecture and software suite and includes numerous world's first features to push the boundaries of connectivity, including coverage, latency, power efficiency, and mobility. Snapdragon X75 technologies and innovations empower OEMs to create next-generation experiences across segments, including smartphones, mobile broadband, automotive, compute, industrial IoT, fixed wireless access, and 5G private networks.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Computational Photography Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Computational Photography Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Computational Photography Industry?

To stay informed about further developments, trends, and reports in the Computational Photography Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence