Key Insights

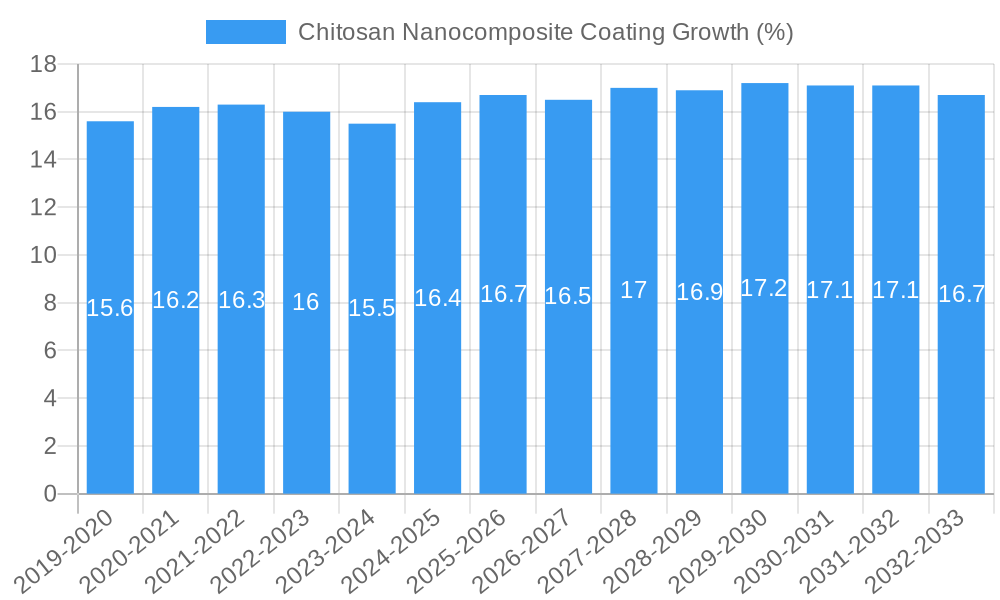

The global Chitosan Nanocomposite Coating market is poised for substantial growth, projected to reach an estimated USD 450 million by 2025, with a remarkable Compound Annual Growth Rate (CAGR) of 18.5% anticipated to extend through 2033. This robust expansion is primarily fueled by the inherent bio-compatibility, antimicrobial properties, and biodegradability of chitosan, making it a highly sought-after material across diverse applications. The burgeoning demand for sustainable and eco-friendly packaging solutions is a significant driver, particularly within the food packaging sector, where chitosan nanocomposite coatings offer enhanced barrier properties and extended shelf life. Furthermore, the biomedical field is witnessing increasing adoption due to chitosan's wound healing capabilities and its potential in drug delivery systems and tissue engineering. Growing awareness and adoption of advanced materials in agriculture for crop protection and in water treatment for purification are also contributing to market momentum.

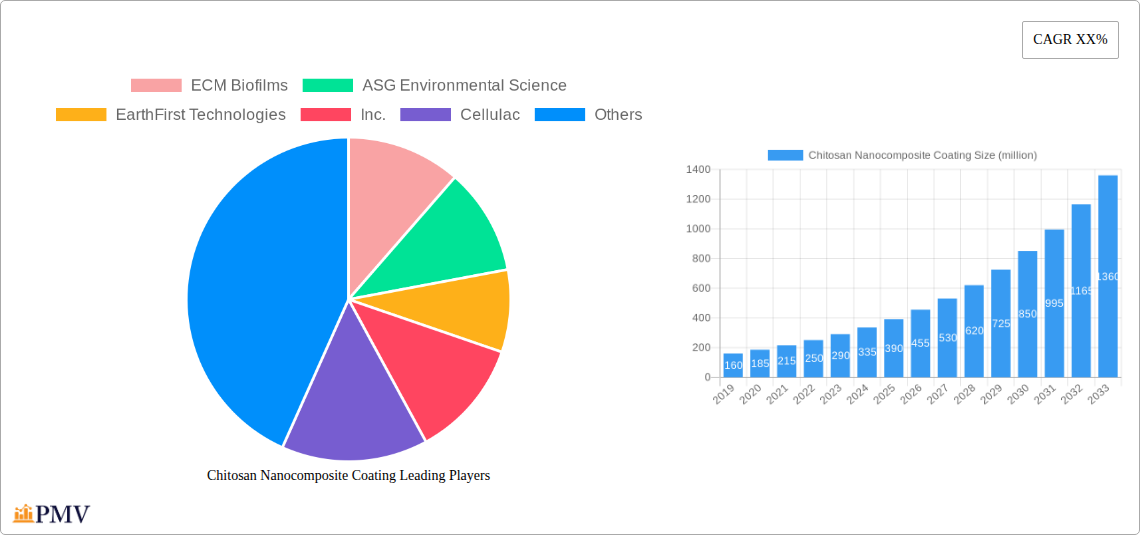

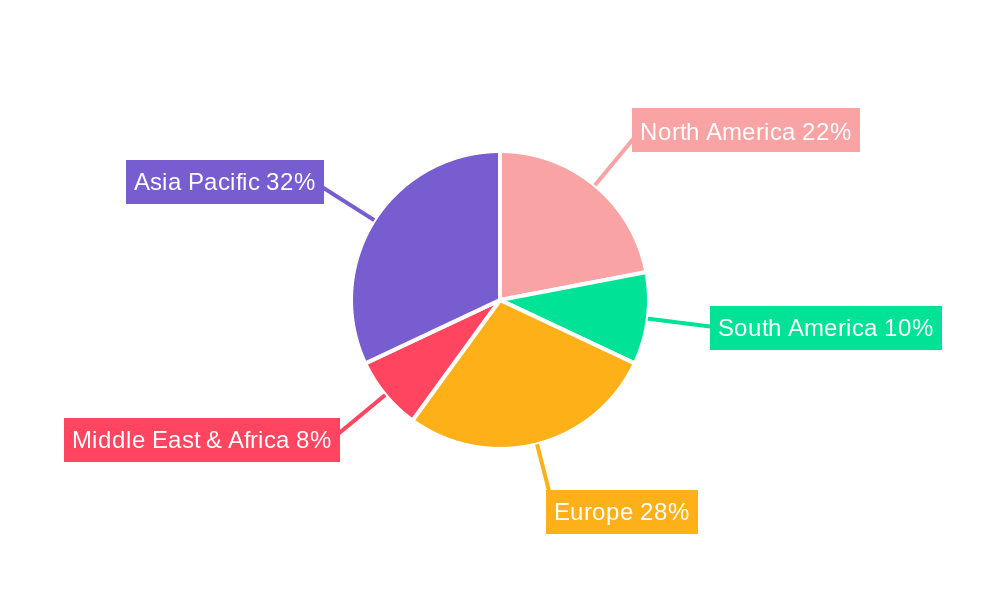

The market landscape is characterized by a strong focus on innovation and the development of advanced nanocomposite formulations. Graphene-chitosan and silver-chitosan nanocomposite coatings are emerging as key segments, offering superior mechanical strength, electrical conductivity, and potent antimicrobial efficacy. While the market presents immense opportunities, certain restraints, such as the relatively high cost of production for some nanocomposite variants and the need for standardization in manufacturing processes, could temper growth in the short term. However, ongoing research and development efforts aimed at cost reduction and performance enhancement are expected to mitigate these challenges. Key players like ECM Biofilms, ASG Environmental Science, and Nano Care are actively investing in R&D and strategic collaborations to capture a larger market share and introduce novel product offerings across regions like Asia Pacific and Europe, which are leading the adoption of these advanced materials.

This comprehensive market research report offers a detailed analysis of the global Chitosan Nanocomposite Coating market, providing actionable insights for industry stakeholders. The study covers the historical period from 2019 to 2024, the base and estimated year of 2025, and a robust forecast period extending from 2025 to 2033. We delve into market structure, competitive dynamics, emerging trends, dominant segments, product innovations, growth drivers, challenges, and strategic outlooks, equipping you with the knowledge to navigate this rapidly evolving landscape. The report targets key industry audiences including researchers, manufacturers, investors, and policymakers.

Chitosan Nanocomposite Coating Market Structure & Competitive Dynamics

The Chitosan Nanocomposite Coating market exhibits a moderate level of concentration, with a dynamic interplay between established players and emerging innovators. The innovation ecosystem is characterized by significant research and development in novel nanocomposite formulations and their application across diverse sectors. Regulatory frameworks, particularly concerning food contact materials and biomedical devices, are evolving and influence market entry and product development. Product substitutes, such as traditional coatings and alternative bio-based materials, present a competitive challenge, although the unique antimicrobial and biocompatible properties of chitosan nanocomposites offer distinct advantages. End-user trends are increasingly favoring sustainable, high-performance, and functional coatings, driving demand for advanced chitosan-based solutions. Mergers and acquisitions (M&A) activities, with estimated deal values in the range of xx million to xx million, are observed as companies seek to consolidate market share, acquire advanced technologies, and expand their product portfolios. Key players are focusing on strategic partnerships and vertical integration to secure supply chains and enhance their competitive positions.

Chitosan Nanocomposite Coating Industry Trends & Insights

The Chitosan Nanocomposite Coating industry is poised for significant expansion, driven by increasing awareness of sustainability, the demand for enhanced material properties, and the drive for novel functionalities in coatings. Market growth is fueled by the inherent biodegradability and biocompatibility of chitosan, coupled with the superior performance characteristics imparted by nanomaterials such as silver, graphene, titanium dioxide, and copper oxide. These nanocomposites offer enhanced antimicrobial activity, improved mechanical strength, UV resistance, and barrier properties, making them highly attractive for a wide range of applications. Technological disruptions, including advancements in nanoparticle synthesis, surface functionalization techniques, and scalable coating application methods, are continuously pushing the boundaries of what is achievable. Consumer preferences are leaning towards eco-friendly and safe products, particularly in the food packaging and biomedical sectors, where chitosan nanocomposites offer compelling alternatives to conventional materials. The competitive landscape is intensifying, with companies investing heavily in R&D to develop proprietary formulations and secure intellectual property. The compound annual growth rate (CAGR) for the Chitosan Nanocomposite Coating market is projected to be robust, estimated between xx% and xx%, reflecting substantial market penetration opportunities across existing and new application areas. Key industry players are focusing on cost-effective production methods and demonstrating the tangible benefits of these advanced coatings to accelerate adoption.

Dominant Markets & Segments in Chitosan Nanocomposite Coating

The Chitosan Nanocomposite Coating market demonstrates significant regional and segmental dominance, driven by specific economic policies, infrastructure development, and the pressing needs within various industries. North America and Europe are currently leading markets, attributed to stringent regulations promoting sustainable materials, robust R&D infrastructure, and a strong presence of end-user industries with a high demand for advanced coatings.

Within Application segments, Food Packaging stands out as a dominant sector. This is propelled by the increasing consumer demand for extended shelf life, reduced food waste, and enhanced food safety. Chitosan nanocomposite coatings offer superior barrier properties against oxygen and moisture, along with potent antimicrobial action, effectively preventing spoilage. Economic policies supporting food security and sustainable packaging solutions further bolster this segment. The market size for food packaging applications is estimated to be in the range of xx million to xx million in the base year.

The Biomedical segment is also a significant growth area, driven by the need for biocompatible, antimicrobial, and wound-healing materials. Chitosan's inherent bioactivity, combined with the targeted functionalities of nanomaterials, makes it ideal for applications in drug delivery systems, tissue engineering scaffolds, and antimicrobial medical device coatings. The growing healthcare expenditure and an aging population contribute to the demand in this sector.

Agriculture is emerging as a prominent segment, with chitosan nanocomposites offering potential as bio-pesticides, fertilizers, and seed coatings, promoting plant growth and disease resistance while reducing reliance on harmful chemicals. Water Treatment is another critical application, where these coatings can be utilized in filtration membranes and adsorbents for contaminant removal due to their chelating and antimicrobial properties.

In terms of Types, Silver-chitosan Nanocomposite Coating currently holds a leading position due to its exceptional broad-spectrum antimicrobial efficacy, making it highly sought after in food packaging, biomedical, and surface disinfection applications. The market size for silver-chitosan nanocomposites is estimated to be in the range of xx million to xx million. Graphene-chitosan Nanocomposite Coating is rapidly gaining traction for its enhanced mechanical properties and electrical conductivity, finding applications in advanced composites and electronic materials. Titanium Dioxide-chitosan Nanocomposite Coating is recognized for its photocatalytic and UV-blocking properties, making it valuable for self-cleaning surfaces and protective coatings. Copper Oxide-chitosan Nanocomposite Coating offers strong antimicrobial activity and is being explored for similar applications as silver-chitosan. The continued innovation and diversification of nanomaterials incorporated into chitosan matrices will shape the future dominance of these types.

Chitosan Nanocomposite Coating Product Innovations

Recent product innovations in Chitosan Nanocomposite Coatings are revolutionizing material science. Developments include advanced formulations with enhanced biodegradability, improved antimicrobial spectrum, and tailored mechanical properties. Applications are expanding from traditional uses to novel areas like smart packaging with embedded sensors, regenerative medicine scaffolds, and eco-friendly agrochemicals. Competitive advantages stem from superior functionality, reduced environmental impact, and cost-effectiveness compared to conventional alternatives. Technological trends are focused on optimizing nanoparticle dispersion, surface functionalization for specific applications, and scalable manufacturing processes.

Report Segmentation & Scope

This report segments the Chitosan Nanocomposite Coating market based on critical parameters to provide a granular understanding of market dynamics. The segmentation encompasses the following:

Application:

- Food Packaging: Expected to witness substantial growth driven by food safety concerns and sustainability initiatives. Projected market size: xx million to xx million.

- Biomedical: A high-value segment driven by advancements in healthcare and the demand for biocompatible materials. Projected market size: xx million to xx million.

- Agriculture: Emerging as a significant growth area with applications in sustainable crop protection and growth enhancement. Projected market size: xx million to xx million.

- Water Treatment: Critical for addressing water scarcity and pollution, with significant potential for innovative filtration and purification solutions. Projected market size: xx million to xx million.

- Others: Encompasses diverse applications such as textiles, coatings for electronics, and construction materials. Projected market size: xx million to xx million.

Types:

- Silver-chitosan Nanocomposite Coating: Leading segment due to its potent antimicrobial properties. Projected market size: xx million to xx million.

- Graphene-chitosan Nanocomposite Coating: Rapidly growing segment driven by demand for enhanced mechanical and electrical properties. Projected market size: xx million to xx million.

- Titanium Dioxide-chitosan Nanocomposite Coating: Significant potential in self-cleaning and UV-protective applications. Projected market size: xx million to xx million.

- Copper Oxide-chitosan Nanocomposite Coating: Strong antimicrobial efficacy driving adoption in various sectors. Projected market size: xx million to xx million.

- Others: Includes other nanoparticle-chitosan combinations and novel composite structures. Projected market size: xx million to xx million.

The scope of this report covers global market analysis, regional insights, and detailed segmentation to provide a holistic view of the Chitosan Nanocomposite Coating industry.

Key Drivers of Chitosan Nanocomposite Coating Growth

The growth of the Chitosan Nanocomposite Coating market is propelled by a confluence of compelling factors. Foremost among these is the increasing global emphasis on sustainability and the demand for eco-friendly materials, a trend strongly supported by government regulations and consumer preference. Technological advancements in nanoparticle synthesis and dispersion, alongside the development of novel application techniques, are continuously expanding the functional capabilities and market reach of these coatings. The inherent antimicrobial, biocompatible, and biodegradable properties of chitosan, amplified by the synergistic effects of incorporated nanomaterials, offer unique advantages in sectors like food packaging, biomedical devices, and agriculture. For instance, the ability to extend food shelf life and reduce spoilage significantly contributes to food security initiatives. Furthermore, the development of cost-effective production methods is crucial for widespread adoption.

Challenges in the Chitosan Nanocomposite Coating Sector

Despite its promising trajectory, the Chitosan Nanocomposite Coating sector faces several significant challenges. Regulatory hurdles remain a concern, particularly concerning the approval processes for novel nanomaterials in food contact and medical applications, leading to extended market entry timelines and increased development costs. Supply chain complexities, including the consistent availability and quality control of raw chitosan and various nanomaterials at competitive prices, can impact production scalability and cost-effectiveness. Competitive pressures from established traditional coatings and the emergence of alternative bio-based materials necessitate continuous innovation and clear demonstration of performance advantages. Furthermore, public perception and concerns regarding the long-term safety and environmental impact of nanomaterials, though often unsubstantiated, can influence market acceptance and require concerted efforts in education and transparent communication. The cost of production for highly specialized nanocomposite formulations can also be a barrier to widespread adoption in price-sensitive markets, with estimated production cost increases of xx% to xx% for advanced variants.

Leading Players in the Chitosan Nanocomposite Coating Market

- ECM Biofilms

- ASG Environmental Science

- EarthFirst Technologies, Inc.

- Cellulac

- Nano Care

- Bio-nanotech

- Novamatrix

- JRS Pharma

- Nanovetores Technology SA

- FMC Health and Nutrition

- BioLumic

- Nanobiomatters Industries

- Chitinor AS

- Nanocs

Key Developments in Chitosan Nanocomposite Coating Sector

- 2023 February: Launch of a new silver-chitosan nanocomposite coating with enhanced broad-spectrum antimicrobial activity for medical device applications.

- 2022 October: Collaboration between Nanovetores Technology SA and a major food packaging manufacturer to develop biodegradable and antimicrobial food wrap solutions.

- 2022 April: Nano Care introduces a graphene-chitosan nanocomposite coating for improved anti-corrosion properties in industrial applications.

- 2021 September: JRS Pharma announces expansion of its production capacity for chitosan-based excipients and coatings for the pharmaceutical industry.

- 2021 March: BioLumic patents a novel titanium dioxide-chitosan nanocomposite coating for agricultural applications, enhancing plant resilience to UV stress.

- 2020 November: FMC Health and Nutrition enters into a strategic partnership to accelerate the development and commercialization of chitosan-based drug delivery systems.

Strategic Chitosan Nanocomposite Coating Market Outlook

The strategic outlook for the Chitosan Nanocomposite Coating market is exceptionally bright, driven by an escalating demand for sustainable, high-performance materials across diverse industries. Growth accelerators include the continued innovation in nanoparticle integration, leading to coatings with enhanced functionalities such as advanced antimicrobial properties, superior barrier characteristics, and stimuli-responsive behaviors. The expansion into emerging markets, coupled with supportive government initiatives promoting circular economy principles and bio-based solutions, will further fuel market penetration. Strategic opportunities lie in the development of cost-effective, scalable manufacturing processes, fostering collaborations between research institutions and industry players to bridge the gap between laboratory discoveries and commercial applications, and in educating end-users about the tangible benefits and safety profiles of these advanced coatings. The increasing focus on personalized medicine and smart packaging presents significant avenues for specialized, high-value chitosan nanocomposite applications.

Chitosan Nanocomposite Coating Segmentation

-

1. Application

- 1.1. Food Packaging

- 1.2. Biomedical

- 1.3. Agriculture

- 1.4. Water Treatment

- 1.5. Others

-

2. Types

- 2.1. Silver-chitosan Nanocomposite Coating

- 2.2. Graphene-chitosan Nanocomposite Coating

- 2.3. Titanium Dioxide-chitosan Nanocomposite Coating

- 2.4. Copper Oxide-chitosan Nanocomposite Coating

- 2.5. Others

Chitosan Nanocomposite Coating Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Chitosan Nanocomposite Coating REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Chitosan Nanocomposite Coating Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Food Packaging

- 5.1.2. Biomedical

- 5.1.3. Agriculture

- 5.1.4. Water Treatment

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Silver-chitosan Nanocomposite Coating

- 5.2.2. Graphene-chitosan Nanocomposite Coating

- 5.2.3. Titanium Dioxide-chitosan Nanocomposite Coating

- 5.2.4. Copper Oxide-chitosan Nanocomposite Coating

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Chitosan Nanocomposite Coating Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Food Packaging

- 6.1.2. Biomedical

- 6.1.3. Agriculture

- 6.1.4. Water Treatment

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Silver-chitosan Nanocomposite Coating

- 6.2.2. Graphene-chitosan Nanocomposite Coating

- 6.2.3. Titanium Dioxide-chitosan Nanocomposite Coating

- 6.2.4. Copper Oxide-chitosan Nanocomposite Coating

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Chitosan Nanocomposite Coating Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Food Packaging

- 7.1.2. Biomedical

- 7.1.3. Agriculture

- 7.1.4. Water Treatment

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Silver-chitosan Nanocomposite Coating

- 7.2.2. Graphene-chitosan Nanocomposite Coating

- 7.2.3. Titanium Dioxide-chitosan Nanocomposite Coating

- 7.2.4. Copper Oxide-chitosan Nanocomposite Coating

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Chitosan Nanocomposite Coating Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Food Packaging

- 8.1.2. Biomedical

- 8.1.3. Agriculture

- 8.1.4. Water Treatment

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Silver-chitosan Nanocomposite Coating

- 8.2.2. Graphene-chitosan Nanocomposite Coating

- 8.2.3. Titanium Dioxide-chitosan Nanocomposite Coating

- 8.2.4. Copper Oxide-chitosan Nanocomposite Coating

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Chitosan Nanocomposite Coating Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Food Packaging

- 9.1.2. Biomedical

- 9.1.3. Agriculture

- 9.1.4. Water Treatment

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Silver-chitosan Nanocomposite Coating

- 9.2.2. Graphene-chitosan Nanocomposite Coating

- 9.2.3. Titanium Dioxide-chitosan Nanocomposite Coating

- 9.2.4. Copper Oxide-chitosan Nanocomposite Coating

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Chitosan Nanocomposite Coating Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Food Packaging

- 10.1.2. Biomedical

- 10.1.3. Agriculture

- 10.1.4. Water Treatment

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Silver-chitosan Nanocomposite Coating

- 10.2.2. Graphene-chitosan Nanocomposite Coating

- 10.2.3. Titanium Dioxide-chitosan Nanocomposite Coating

- 10.2.4. Copper Oxide-chitosan Nanocomposite Coating

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 ECM Biofilms

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ASG Environmental Science

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 EarthFirst Technologies

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Inc.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cellulac

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nano Care

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bio-nanotech

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Novamatrix

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 JRS Pharma

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Nanovetores Technology SA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 FMC Health and Nutrition

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 BioLumic

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Nanobiomatters Industries

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Chitinor AS

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Nanocs

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 ECM Biofilms

List of Figures

- Figure 1: Global Chitosan Nanocomposite Coating Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Chitosan Nanocomposite Coating Revenue (million), by Application 2024 & 2032

- Figure 3: North America Chitosan Nanocomposite Coating Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Chitosan Nanocomposite Coating Revenue (million), by Types 2024 & 2032

- Figure 5: North America Chitosan Nanocomposite Coating Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Chitosan Nanocomposite Coating Revenue (million), by Country 2024 & 2032

- Figure 7: North America Chitosan Nanocomposite Coating Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Chitosan Nanocomposite Coating Revenue (million), by Application 2024 & 2032

- Figure 9: South America Chitosan Nanocomposite Coating Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Chitosan Nanocomposite Coating Revenue (million), by Types 2024 & 2032

- Figure 11: South America Chitosan Nanocomposite Coating Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Chitosan Nanocomposite Coating Revenue (million), by Country 2024 & 2032

- Figure 13: South America Chitosan Nanocomposite Coating Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Chitosan Nanocomposite Coating Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Chitosan Nanocomposite Coating Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Chitosan Nanocomposite Coating Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Chitosan Nanocomposite Coating Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Chitosan Nanocomposite Coating Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Chitosan Nanocomposite Coating Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Chitosan Nanocomposite Coating Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Chitosan Nanocomposite Coating Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Chitosan Nanocomposite Coating Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Chitosan Nanocomposite Coating Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Chitosan Nanocomposite Coating Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Chitosan Nanocomposite Coating Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Chitosan Nanocomposite Coating Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Chitosan Nanocomposite Coating Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Chitosan Nanocomposite Coating Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Chitosan Nanocomposite Coating Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Chitosan Nanocomposite Coating Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Chitosan Nanocomposite Coating Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Chitosan Nanocomposite Coating Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Chitosan Nanocomposite Coating Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Chitosan Nanocomposite Coating Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Chitosan Nanocomposite Coating Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Chitosan Nanocomposite Coating Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Chitosan Nanocomposite Coating Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Chitosan Nanocomposite Coating Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Chitosan Nanocomposite Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Chitosan Nanocomposite Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Chitosan Nanocomposite Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Chitosan Nanocomposite Coating Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Chitosan Nanocomposite Coating Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Chitosan Nanocomposite Coating Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Chitosan Nanocomposite Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Chitosan Nanocomposite Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Chitosan Nanocomposite Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Chitosan Nanocomposite Coating Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Chitosan Nanocomposite Coating Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Chitosan Nanocomposite Coating Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Chitosan Nanocomposite Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Chitosan Nanocomposite Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Chitosan Nanocomposite Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Chitosan Nanocomposite Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Chitosan Nanocomposite Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Chitosan Nanocomposite Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Chitosan Nanocomposite Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Chitosan Nanocomposite Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Chitosan Nanocomposite Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Chitosan Nanocomposite Coating Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Chitosan Nanocomposite Coating Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Chitosan Nanocomposite Coating Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Chitosan Nanocomposite Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Chitosan Nanocomposite Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Chitosan Nanocomposite Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Chitosan Nanocomposite Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Chitosan Nanocomposite Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Chitosan Nanocomposite Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Chitosan Nanocomposite Coating Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Chitosan Nanocomposite Coating Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Chitosan Nanocomposite Coating Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Chitosan Nanocomposite Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Chitosan Nanocomposite Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Chitosan Nanocomposite Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Chitosan Nanocomposite Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Chitosan Nanocomposite Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Chitosan Nanocomposite Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Chitosan Nanocomposite Coating Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chitosan Nanocomposite Coating?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Chitosan Nanocomposite Coating?

Key companies in the market include ECM Biofilms, ASG Environmental Science, EarthFirst Technologies, Inc., Cellulac, Nano Care, Bio-nanotech, Novamatrix, JRS Pharma, Nanovetores Technology SA, FMC Health and Nutrition, BioLumic, Nanobiomatters Industries, Chitinor AS, Nanocs.

3. What are the main segments of the Chitosan Nanocomposite Coating?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chitosan Nanocomposite Coating," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chitosan Nanocomposite Coating report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chitosan Nanocomposite Coating?

To stay informed about further developments, trends, and reports in the Chitosan Nanocomposite Coating, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence