Key Insights

The China e-commerce market is poised for substantial expansion, driven by increasing digital connectivity, rising consumer spending power, and a growing affluent population. Projections indicate a robust CAGR of 21.5%, propelling the market size to 885.5 billion by 2024. Key growth accelerators include the widespread adoption of mobile commerce, the influence of social commerce platforms, and the penetration of online retail into emerging urban centers. Despite fierce competition from major players and evolving regulatory frameworks, the market's outlook remains highly positive. Opportunities for specialization and innovation exist within diverse market segments, particularly those leveraging advanced applications.

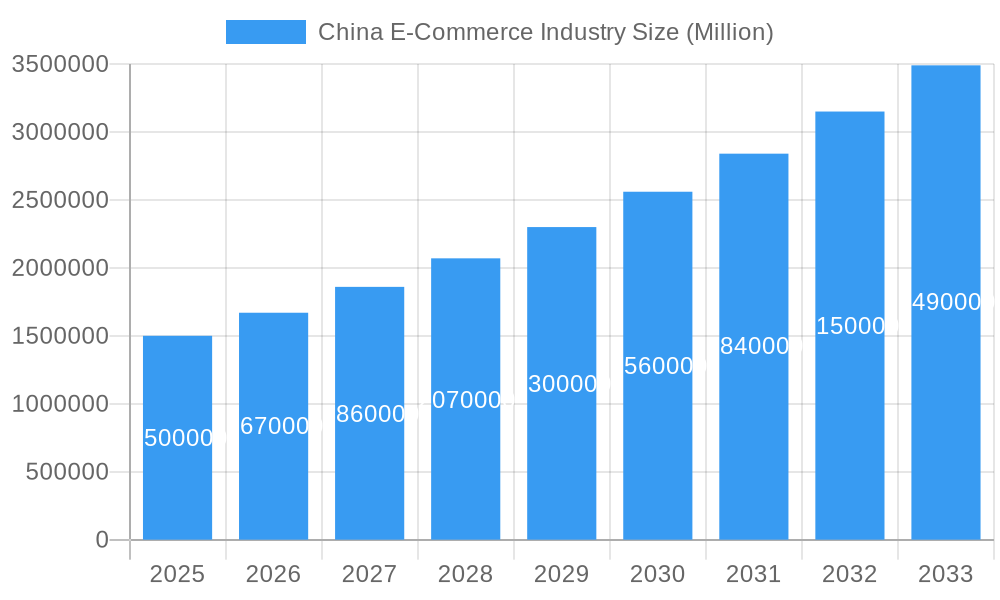

China E-Commerce Industry Market Size (In Million)

The forecast period anticipates sustained, albeit potentially moderated, growth as the market matures. Critical factors for continued expansion include further investment in logistics infrastructure, especially in underdeveloped regions. Evolving consumer demands for personalized shopping experiences will shape strategic adaptations. Success will hinge on agility in response to market dynamics, effective adoption of technological advancements, and adept navigation of regulatory environments. Prioritizing exceptional customer service, optimizing logistics, and cultivating strong brand loyalty will be paramount in this dynamic sector.

China E-Commerce Industry Company Market Share

China E-Commerce Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the China e-commerce industry, covering market structure, competitive dynamics, key trends, and future growth prospects from 2019 to 2033. With a base year of 2025 and a forecast period spanning 2025-2033, this report is an essential resource for businesses, investors, and policymakers seeking to understand and capitalize on opportunities within this dynamic market. The report features detailed analysis of leading players such as Alibaba.com, JD.com, Pinduoduo Inc., and more, offering actionable insights for strategic decision-making. The total market size is projected to reach XX Million by 2033, presenting significant growth potential.

China E-Commerce Industry Market Structure & Competitive Dynamics

The China e-commerce market is characterized by intense competition, with a few dominant players controlling a significant market share. Alibaba.com and JD.com hold the largest portions, followed by Pinduoduo Inc. Market concentration is high, resulting in a challenging landscape for smaller entrants. The industry's innovation ecosystem is robust, fueled by continuous technological advancements and a strong focus on customer experience. Regulatory frameworks, while evolving, play a significant role in shaping market practices. Product substitutes are limited, primarily due to the convenience and extensive selection offered by e-commerce platforms. End-user trends are shifting towards mobile commerce and personalized shopping experiences, driving innovation and competition.

- Market Share: Alibaba.com (XX%), JD.com (XX%), Pinduoduo Inc. (XX%), Others (XX%) (2024 Estimates)

- M&A Activity: In recent years, the industry has witnessed significant M&A activity, with deal values exceeding XX Million in the past five years. These transactions often involve strategic acquisitions to expand market reach and enhance technological capabilities.

- Regulatory Landscape: China's regulatory environment for e-commerce is dynamic, with ongoing adjustments to address issues such as data privacy and antitrust concerns.

China E-Commerce Industry Industry Trends & Insights

The China e-commerce industry is experiencing robust growth, driven by several key factors. Rising disposable incomes, increasing internet and smartphone penetration, and the expanding adoption of mobile payment systems have fueled the market's expansion. Technological disruptions, such as the rise of live-streaming commerce and social commerce platforms like Xiaohongshu (Little Red Book), are continuously reshaping the competitive landscape. Consumer preferences are evolving towards personalized recommendations, faster delivery options, and seamless omnichannel experiences. The market is exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the historical period (2019-2024) and is projected to maintain a strong growth trajectory in the forecast period (2025-2033). Market penetration is high, with a vast majority of the population engaging in online shopping. Competitive dynamics are characterized by intense price competition, innovative product offerings, and strategic partnerships.

Dominant Markets & Segments in China E-Commerce Industry

The China e-commerce market is predominantly driven by Tier 1 and Tier 2 cities, which account for a significant portion of online sales. However, growth in lower-tier cities is rapidly accelerating. Key drivers for this dominance include:

- Robust Infrastructure: Extensive logistics networks, reliable payment systems, and widespread internet access are pivotal.

- Economic Policies: Government initiatives promoting digitalization and e-commerce have stimulated growth.

- Consumer Behavior: Urban consumers are more likely to embrace online shopping due to factors such as convenience and affordability.

The dominance of these regions is underpinned by higher levels of disposable income, tech-savviness, and established infrastructure facilitating efficient e-commerce operations. While other regions demonstrate potential for future growth, the existing concentration in major urban areas is expected to persist in the foreseeable future.

China E-Commerce Industry Product Innovations

The China e-commerce industry is witnessing a surge in product innovation, driven by technological advancements and evolving consumer preferences. This includes the integration of artificial intelligence (AI) for personalized recommendations, the expansion of live-streaming commerce, and the rise of social commerce platforms. These innovations aim to enhance the customer experience, drive sales, and create competitive advantages. The market fit of these innovations is high, as Chinese consumers are increasingly receptive to new technologies and shopping experiences.

Report Segmentation & Scope

This report segments the China e-commerce market by application, covering various sectors such as apparel, electronics, groceries, and more. Each segment exhibits unique growth trajectories and competitive dynamics. For example, the apparel segment is characterized by high competition and rapid innovation, while the grocery segment is witnessing substantial growth fueled by the expansion of online grocery platforms. Growth projections vary across segments, reflecting their individual market characteristics and growth drivers. Market sizes are substantial across all segments, demonstrating the overall size and diversity of the China e-commerce market.

Key Drivers of China E-Commerce Industry Growth

The growth of the China e-commerce industry is propelled by several key factors: rapid technological advancements (e.g., 5G infrastructure, AI-powered personalization), a burgeoning middle class with increasing disposable income, and supportive government policies promoting digitalization. The expansion of mobile payment systems and improved logistics networks further enhance the sector's growth trajectory. Furthermore, the increasing preference for convenient and efficient online shopping experiences amongst Chinese consumers contributes significantly to the industry’s expansion.

Challenges in the China E-Commerce Industry Sector

Despite significant growth, the China e-commerce industry faces certain challenges. Intense competition leads to price wars, impacting profitability. Regulatory uncertainties and evolving data privacy regulations present operational complexities. Supply chain disruptions can affect product availability and delivery times, while counterfeiting remains a persistent issue, impacting consumer trust. These factors pose significant hurdles for businesses operating within the sector and require strategic adaptation to mitigate their impact. The impact of these challenges is estimated to reduce overall industry growth by approximately XX Million annually.

Leading Players in the China E-Commerce Industry Market

- Dangdang Inc

- Xiaohongshu (Little Red Book)

- Pinduoduo Inc

- JD.com

- Suning.com

- JuMei.com

- Mogujie

- Yihaodian

- Alibaba.com

- Vipshop Holdings Ltd

Key Developments in China E-Commerce Industry Sector

- January 2022: JD.com partnered with Shopify to facilitate cross-border e-commerce, expanding access for global and Chinese brands.

- April 2022: SavMobi Technology, Inc. and Dalian Yuanmeng Media Co., Ltd. formed a partnership to explore the Chinese e-commerce market, sharing revenue 50/50.

Strategic China E-Commerce Industry Market Outlook

The future of the China e-commerce industry is bright, with significant growth potential driven by continuous technological advancements, expanding market penetration in lower-tier cities, and increasing consumer adoption of online shopping. Strategic opportunities exist for businesses that can innovate, adapt to evolving consumer preferences, and navigate the regulatory landscape effectively. The market's continued expansion presents promising prospects for both established players and new entrants seeking to capitalize on this dynamic and rapidly growing sector.

China E-Commerce Industry Segmentation

-

1. B2C E-commerce

-

1.1. Market Segmentation - by Application

- 1.1.1. Beauty and Personal Care

- 1.1.2. Consumer Electronics

- 1.1.3. Fashion and Apparel

- 1.1.4. Food and Beverages

- 1.1.5. Furniture and Home

- 1.1.6. Others (Toys, DIY, Media, etc.)

-

1.1. Market Segmentation - by Application

-

2. Application

- 2.1. Beauty and Personal Care

- 2.2. Consumer Electronics

- 2.3. Fashion and Apparel

- 2.4. Food and Beverages

- 2.5. Furniture and Home

- 2.6. Others (Toys, DIY, Media, etc.)

- 3. Beauty and Personal Care

- 4. Consumer Electronics

- 5. Fashion and Apparel

- 6. Food and Beverages

- 7. Furniture and Home

- 8. Others (Toys, DIY, Media, etc.)

- 9. B2B E-commerce

China E-Commerce Industry Segmentation By Geography

- 1. China

China E-Commerce Industry Regional Market Share

Geographic Coverage of China E-Commerce Industry

China E-Commerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 21.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Livestream E-commerce to drive the Market; Growing Penetration of Online Shoppers to Boost the E-commerce Market

- 3.3. Market Restrains

- 3.3.1. Budget Constraints and Technological Limitations; Regulatory and Legal Challenges

- 3.4. Market Trends

- 3.4.1. Livestream E-commerce to drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China E-Commerce Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by B2C E-commerce

- 5.1.1. Market Segmentation - by Application

- 5.1.1.1. Beauty and Personal Care

- 5.1.1.2. Consumer Electronics

- 5.1.1.3. Fashion and Apparel

- 5.1.1.4. Food and Beverages

- 5.1.1.5. Furniture and Home

- 5.1.1.6. Others (Toys, DIY, Media, etc.)

- 5.1.1. Market Segmentation - by Application

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Beauty and Personal Care

- 5.2.2. Consumer Electronics

- 5.2.3. Fashion and Apparel

- 5.2.4. Food and Beverages

- 5.2.5. Furniture and Home

- 5.2.6. Others (Toys, DIY, Media, etc.)

- 5.3. Market Analysis, Insights and Forecast - by Beauty and Personal Care

- 5.4. Market Analysis, Insights and Forecast - by Consumer Electronics

- 5.5. Market Analysis, Insights and Forecast - by Fashion and Apparel

- 5.6. Market Analysis, Insights and Forecast - by Food and Beverages

- 5.7. Market Analysis, Insights and Forecast - by Furniture and Home

- 5.8. Market Analysis, Insights and Forecast - by Others (Toys, DIY, Media, etc.)

- 5.9. Market Analysis, Insights and Forecast - by B2B E-commerce

- 5.10. Market Analysis, Insights and Forecast - by Region

- 5.10.1. China

- 5.1. Market Analysis, Insights and Forecast - by B2C E-commerce

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dangdang Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Xiaohongshu (Little Red Book)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pinduoduo Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 JD com

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Suning com

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 JuMei com

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mogujie*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Yihaodian

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Alibaba com

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vipshop Holdings Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Dangdang Inc

List of Figures

- Figure 1: China E-Commerce Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China E-Commerce Industry Share (%) by Company 2025

List of Tables

- Table 1: China E-Commerce Industry Revenue billion Forecast, by B2C E-commerce 2020 & 2033

- Table 2: China E-Commerce Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: China E-Commerce Industry Revenue billion Forecast, by Beauty and Personal Care 2020 & 2033

- Table 4: China E-Commerce Industry Revenue billion Forecast, by Consumer Electronics 2020 & 2033

- Table 5: China E-Commerce Industry Revenue billion Forecast, by Fashion and Apparel 2020 & 2033

- Table 6: China E-Commerce Industry Revenue billion Forecast, by Food and Beverages 2020 & 2033

- Table 7: China E-Commerce Industry Revenue billion Forecast, by Furniture and Home 2020 & 2033

- Table 8: China E-Commerce Industry Revenue billion Forecast, by Others (Toys, DIY, Media, etc.) 2020 & 2033

- Table 9: China E-Commerce Industry Revenue billion Forecast, by B2B E-commerce 2020 & 2033

- Table 10: China E-Commerce Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 11: China E-Commerce Industry Revenue billion Forecast, by B2C E-commerce 2020 & 2033

- Table 12: China E-Commerce Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 13: China E-Commerce Industry Revenue billion Forecast, by Beauty and Personal Care 2020 & 2033

- Table 14: China E-Commerce Industry Revenue billion Forecast, by Consumer Electronics 2020 & 2033

- Table 15: China E-Commerce Industry Revenue billion Forecast, by Fashion and Apparel 2020 & 2033

- Table 16: China E-Commerce Industry Revenue billion Forecast, by Food and Beverages 2020 & 2033

- Table 17: China E-Commerce Industry Revenue billion Forecast, by Furniture and Home 2020 & 2033

- Table 18: China E-Commerce Industry Revenue billion Forecast, by Others (Toys, DIY, Media, etc.) 2020 & 2033

- Table 19: China E-Commerce Industry Revenue billion Forecast, by B2B E-commerce 2020 & 2033

- Table 20: China E-Commerce Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China E-Commerce Industry?

The projected CAGR is approximately 21.5%.

2. Which companies are prominent players in the China E-Commerce Industry?

Key companies in the market include Dangdang Inc, Xiaohongshu (Little Red Book), Pinduoduo Inc, JD com, Suning com, JuMei com, Mogujie*List Not Exhaustive, Yihaodian, Alibaba com, Vipshop Holdings Ltd.

3. What are the main segments of the China E-Commerce Industry?

The market segments include B2C E-commerce, Application, Beauty and Personal Care, Consumer Electronics, Fashion and Apparel, Food and Beverages, Furniture and Home, Others (Toys, DIY, Media, etc.), B2B E-commerce.

4. Can you provide details about the market size?

The market size is estimated to be USD 885.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Livestream E-commerce to drive the Market; Growing Penetration of Online Shoppers to Boost the E-commerce Market.

6. What are the notable trends driving market growth?

Livestream E-commerce to drive the Market.

7. Are there any restraints impacting market growth?

Budget Constraints and Technological Limitations; Regulatory and Legal Challenges.

8. Can you provide examples of recent developments in the market?

January 2022 - Major Chinese E-commerce company JD.com formed a strategic partnership with Ottawa-based Shopify to help global brands tap China's enormous appetite for imported goods and help Chinese merchants sell overseas. JD.com promises to simplify access and compliance for Chinese brands and merchants looking to reach consumers in Western markets through the partnership.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China E-Commerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China E-Commerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China E-Commerce Industry?

To stay informed about further developments, trends, and reports in the China E-Commerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence