Key Insights

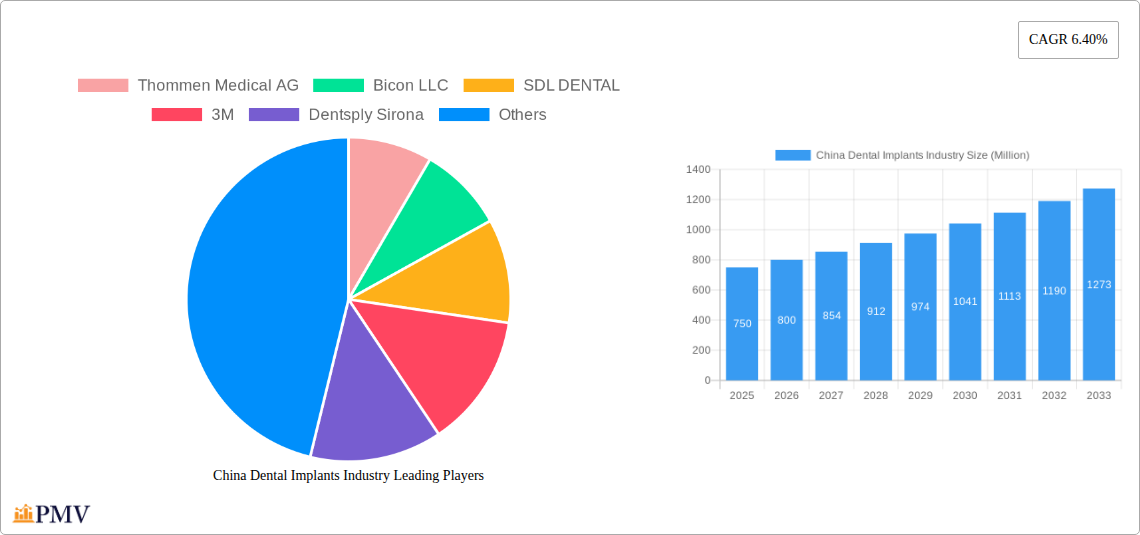

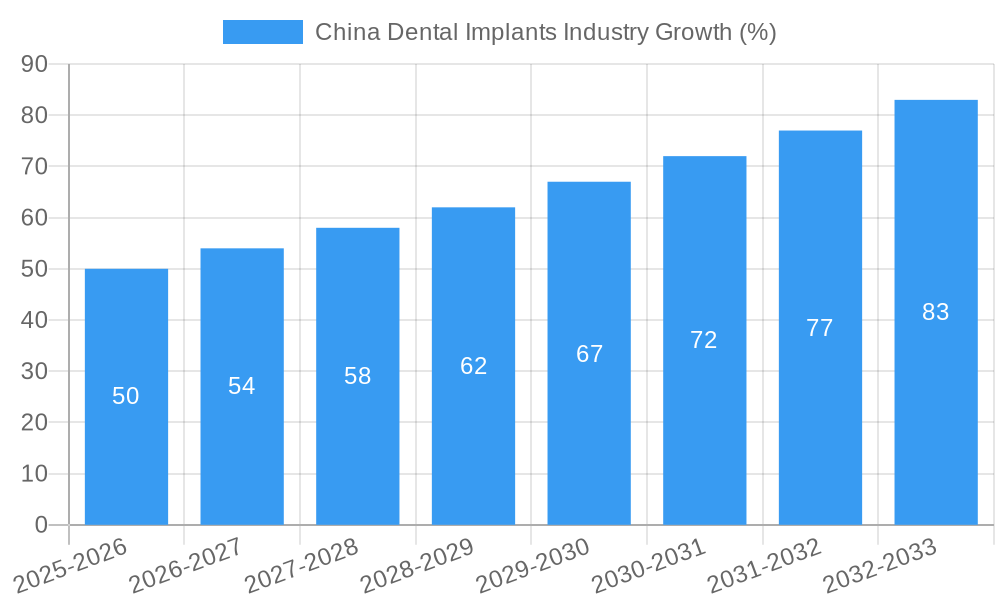

The China dental implants market, valued at $750 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.40% from 2025 to 2033. This expansion is driven by several key factors. Firstly, a rising prevalence of periodontal diseases and tooth loss, coupled with an increasingly aging population, fuels demand for restorative dental solutions. Secondly, enhanced affordability and accessibility of dental implants, driven by government initiatives and private sector investment in dental infrastructure, are making this treatment option more viable for a wider segment of the population. Technological advancements, leading to more effective, durable, and aesthetically pleasing implants, further contribute to market growth. The market is segmented by fixture and abutment types, as well as implant materials like titanium and zirconium, each exhibiting unique growth trajectories based on factors such as biocompatibility, cost, and longevity. Leading players, such as Thommen Medical AG, Bicon LLC, and Dentsply Sirona, are leveraging their technological prowess and brand recognition to secure market share. However, challenges exist; these include the relatively high cost of treatment compared to other alternatives, regional variations in access to quality dental care, and the potential for regulatory hurdles impacting market entry and product adoption. The increasing focus on minimally invasive procedures and digital dentistry is expected to shape the future of the Chinese dental implants market.

The competitive landscape is characterized by both domestic and international players. While established global companies maintain a strong presence, domestic manufacturers are actively investing in research and development, aiming to capture a larger slice of the market by offering competitive pricing and localized solutions tailored to the specific needs of the Chinese population. Future growth will likely be influenced by factors such as the evolving preferences of Chinese consumers, the expansion of dental insurance coverage, and the ongoing development of innovative implant technologies. Successful companies will need to adapt to the dynamic market dynamics, focusing on strategic partnerships, technological innovation, and effective marketing to maintain a competitive edge in this rapidly growing sector.

China Dental Implants Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the booming China dental implants market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033, this report meticulously examines market dynamics, competitive landscapes, and future growth prospects. The report leverages extensive data analysis, covering market size (in Millions), CAGR, and detailed segment analysis across various parameters.

China Dental Implants Industry Market Structure & Competitive Dynamics

The China dental implants market exhibits a moderately concentrated structure, with both multinational giants and domestic players vying for market share. Key players such as Thommen Medical AG, Bicon LLC, SDL DENTAL, 3M, Dentsply Sirona, Dentium, AB Dental Devices Ltd, Ivoclar Vivadent, Nobel Biocare Services AG, and Zimmer Biomet contribute significantly to the market volume, though their exact market shares are subject to variation due to market dynamics. The market's innovation ecosystem is vibrant, driven by continuous advancements in implant materials and surgical techniques. Regulatory frameworks play a crucial role in market access and product approval, impacting both domestic and international companies. Substitute products, like dentures, exist but are generally less preferred due to inferior functionality and aesthetics. End-user trends show a growing preference for minimally invasive procedures and longer-lasting, aesthetically pleasing implants. M&A activities are relatively frequent, reflecting the competitive landscape and strategic ambitions of key players. For example, Neoss Group's acquisition of Legend Life Tech in January 2022 signaled an increase in foreign investment in the Chinese market. The total value of M&A deals in the last 5 years is estimated at xx Million.

China Dental Implants Industry Industry Trends & Insights

The China dental implants market is experiencing robust growth, driven by several key factors. Rising disposable incomes and increasing awareness of oral health are fueling demand for advanced dental treatments, including implants. Technological advancements, including the introduction of digitally guided implant placement and innovative implant materials like Zirconium, are transforming the industry. Consumer preferences are shifting towards aesthetically superior and minimally invasive procedures. The market's competitive dynamics are characterized by both intense rivalry among existing players and the emergence of new entrants offering innovative solutions. The market is projected to maintain a CAGR of xx% during the forecast period (2025-2033), with market penetration expected to increase significantly across various demographics. The inclusion of dental implants in China's bulk-buy program in February 2022 presents a major growth catalyst, increasing affordability and accessibility. The market size in 2025 is estimated at xx Million, showing significant growth from the historical period of 2019-2024.

Dominant Markets & Segments in China Dental Implants Industry

The coastal regions of China, particularly major metropolitan areas, represent the dominant market segment due to higher disposable incomes, better dental infrastructure, and increased awareness. Within the product segments:

- Part: Fixtures constitute the largest segment due to their fundamental role in implant procedures. Abutments represent a significant but slightly smaller segment.

- Material: Titanium implants currently dominate due to their biocompatibility and established track record. However, Zirconium implants are gaining traction owing to their aesthetic advantages.

Key drivers for dominance include:

- Economic policies: Government initiatives promoting healthcare access and affordability.

- Infrastructure: Development of advanced dental clinics and hospitals in major cities.

- Technological advancements: Adoption of digital technologies in dental practices.

China Dental Implants Industry Product Innovations

Significant innovations in the Chinese dental implants market include the development of biocompatible materials, advancements in implant design for improved osseointegration, and the integration of digital technologies into surgical planning and placement. These developments enable minimally invasive procedures, reduce recovery times, and improve the overall patient experience, contributing significantly to market growth. The market is witnessing increased adoption of zirconia implants, particularly for aesthetic reasons, driven by their superior cosmetic appeal.

Report Segmentation & Scope

This report provides a granular segmentation of the China dental implants market.

By Part: The report analyzes the Fixture and Abutment segments, providing market size estimations and growth projections for each. The Fixture segment is projected to grow at a CAGR of xx% during the forecast period, while the Abutment segment is projected to grow at a CAGR of xx%.

By Material: The market is segmented into Titanium Implants and Zirconium Implants. Titanium Implants currently hold a larger market share due to their established use, but Zirconium implants are showing strong growth due to increasing aesthetic demands. The Titanium segment is forecast to grow at a CAGR of xx%, while Zirconium Implants are predicted to show a CAGR of xx%.

Competitive dynamics within each segment are analyzed, highlighting key players and their strategies.

Key Drivers of China Dental Implants Industry Growth

The China dental implants market's rapid expansion is driven by multiple factors: increasing disposable incomes and healthcare spending, a growing middle class with greater access to dental care, rising awareness of oral health and aesthetics, technological advancements in implant materials and surgical techniques, and supportive government policies including the inclusion of dental implants in the bulk-buy program. These factors collectively contribute to a favorable market environment, propelling sustained growth.

Challenges in the China Dental Implants Industry Sector

The China dental implants market faces challenges including regulatory hurdles for new product approvals, potential supply chain disruptions impacting the availability of materials and components, and intense competition among both domestic and international players, which can compress profit margins. Furthermore, price sensitivity among consumers requires manufacturers to balance affordability with quality. These challenges require strategic navigation for long-term market success.

Leading Players in the China Dental Implants Industry Market

- Thommen Medical AG

- Bicon LLC

- SDL DENTAL

- 3M

- Dentsply Sirona

- Dentium

- AB Dental Devices Ltd

- Ivoclar Vivadent

- Nobel Biocare Services AG

- Zimmer Biomet

Key Developments in China Dental Implants Industry Sector

- February 2022: Inclusion of dental implants in China's bulk-buy program, significantly increasing affordability and accessibility.

- January 2022: Neoss Group's acquisition of Legend Life Tech, marking a significant foreign investment and expansion in the Chinese market. This acquisition brought established technology and expertise into the Chinese market.

Strategic China Dental Implants Industry Market Outlook

The China dental implants market presents substantial growth opportunities in the coming years, driven by sustained economic growth, increased healthcare spending, and technological advancements. Strategic focus should include developing innovative implant technologies, establishing strong distribution networks, and adapting to the evolving regulatory landscape. Companies that can effectively leverage these opportunities are poised for significant market share gains. The market's future potential is substantial, promising high returns on investments for businesses strategically positioned to capitalize on market trends.

China Dental Implants Industry Segmentation

-

1. Part

- 1.1. Fixture

- 1.2. Abutment

-

2. Material

- 2.1. Titanium Implants

- 2.2. Zirconium Implants

China Dental Implants Industry Segmentation By Geography

- 1. China

China Dental Implants Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Burden of Dental Diseases and Geriatric Population; Increasing Application of CAD/CAM Technologies

- 3.3. Market Restrains

- 3.3.1. Reimbursement Issues and High Cost of Dental Implants

- 3.4. Market Trends

- 3.4.1. Titanium Implants Segment is Expected to have Largest Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Dental Implants Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Part

- 5.1.1. Fixture

- 5.1.2. Abutment

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Titanium Implants

- 5.2.2. Zirconium Implants

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Part

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Thommen Medical AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bicon LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SDL DENTAL

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 3M

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dentsply Sirona

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Dentium

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AB Dental Devices Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ivoclar Vivadent

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nobel Biocare Services AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Zimmer Biomet

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Thommen Medical AG

List of Figures

- Figure 1: China Dental Implants Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Dental Implants Industry Share (%) by Company 2024

List of Tables

- Table 1: China Dental Implants Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Dental Implants Industry Revenue Million Forecast, by Part 2019 & 2032

- Table 3: China Dental Implants Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 4: China Dental Implants Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: China Dental Implants Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Dental Implants Industry Revenue Million Forecast, by Part 2019 & 2032

- Table 7: China Dental Implants Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 8: China Dental Implants Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Dental Implants Industry?

The projected CAGR is approximately 6.40%.

2. Which companies are prominent players in the China Dental Implants Industry?

Key companies in the market include Thommen Medical AG, Bicon LLC, SDL DENTAL, 3M, Dentsply Sirona, Dentium, AB Dental Devices Ltd, Ivoclar Vivadent, Nobel Biocare Services AG, Zimmer Biomet.

3. What are the main segments of the China Dental Implants Industry?

The market segments include Part, Material.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.75 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Burden of Dental Diseases and Geriatric Population; Increasing Application of CAD/CAM Technologies.

6. What are the notable trends driving market growth?

Titanium Implants Segment is Expected to have Largest Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Reimbursement Issues and High Cost of Dental Implants.

8. Can you provide examples of recent developments in the market?

In February 2022, China expanded the list of drugs and medical consumables included in China's bulk-buy program and included dental implants in the list.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Dental Implants Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Dental Implants Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Dental Implants Industry?

To stay informed about further developments, trends, and reports in the China Dental Implants Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence