Key Insights

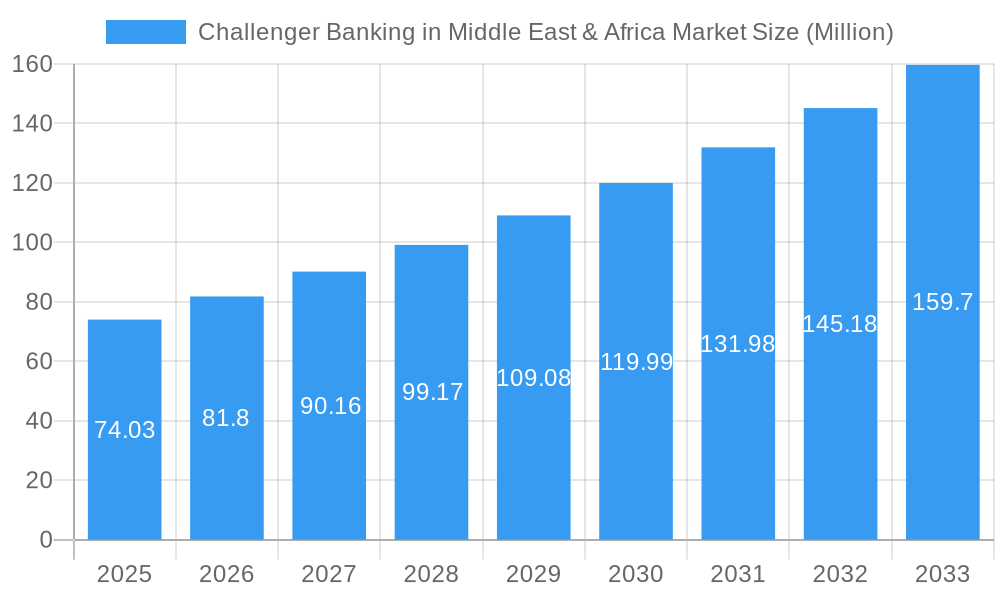

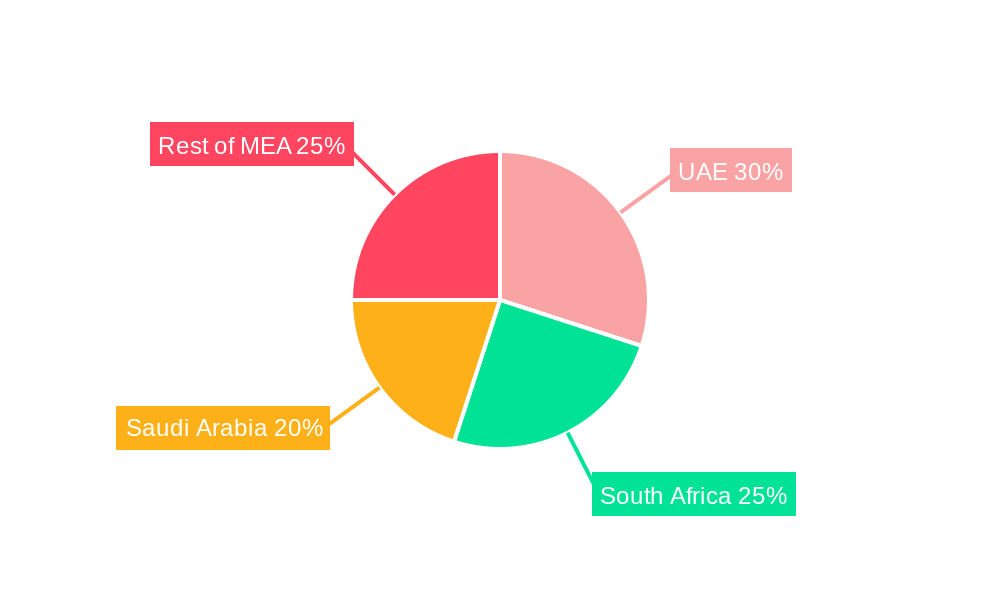

The Challenger Banking sector in the Middle East & Africa (MEA) region is experiencing robust growth, projected to reach a market size of $74.03 million in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 10.50% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing adoption of smartphones and mobile internet penetration across the MEA region is creating a fertile ground for digital-first banking solutions offered by challenger banks. Furthermore, a younger, tech-savvy population is driving demand for convenient, personalized, and transparent financial services, which traditional banks often struggle to provide efficiently. Regulatory support and initiatives aimed at fostering financial inclusion are also contributing to the sector's growth. Competition from established players remains a challenge, however, as traditional banks are investing heavily in their digital offerings to maintain market share. The preference for cash transactions in certain regions also acts as a restraint on immediate, widespread adoption of challenger bank services. Growth is particularly strong in the UAE, South Africa, and Saudi Arabia, which are leading the way in fintech innovation and digital transformation within the region. The segmentation of the market into service types (payments, savings products, etc.) and end-user types (business and personal segments) reveals significant opportunities for targeted growth strategies. The presence of numerous challenger banks, including Pepper, Clearly, Liv Bank, and others, reflects the competitive landscape and indicates a vibrant and evolving market.

Challenger Banking in Middle East & Africa Market Market Size (In Million)

The forecast period of 2025-2033 presents significant opportunities for challenger banks to capture market share by focusing on specific customer segments and service offerings. By leveraging technological advancements, focusing on customer experience, and addressing regulatory requirements effectively, challenger banks in the MEA region are poised for continued success. Strategic partnerships with established players can accelerate market penetration, while addressing the constraints of cash-based economies and digital literacy gaps will be crucial for sustainable growth. Focus should be placed on enhancing financial literacy programs and expanding outreach to underserved populations to maximize the potential of this rapidly growing market. The competitive landscape will continue to evolve, with mergers and acquisitions likely to play a significant role in shaping the future of challenger banking in MEA.

Challenger Banking in Middle East & Africa Market Company Market Share

This in-depth report provides a comprehensive analysis of the rapidly evolving challenger banking landscape in the Middle East and Africa (MEA) region, covering the period 2019-2033. It offers invaluable insights into market dynamics, competitive strategies, and future growth potential, equipping stakeholders with actionable intelligence for informed decision-making. The report leverages extensive primary and secondary research to deliver a nuanced understanding of the MEA challenger banking sector, quantifying market sizes in Millions and providing detailed segmentations.

Challenger Banking in Middle East & Africa Market Market Structure & Competitive Dynamics

The Middle East and Africa (MEA) challenger banking market is a dynamic landscape characterized by a fascinating interplay between established financial institutions and disruptive newcomers. While market concentration remains moderate, with a handful of key players commanding significant shares, the competitive landscape is rapidly evolving due to intensified competition and relentless innovation. This vibrant innovation ecosystem is fueled by a surge in fintech startups and groundbreaking technological advancements. Regulatory frameworks are adapting to the rise of digital banking, although inconsistencies across different MEA countries present ongoing challenges for seamless expansion and operation. The competitive pressure is further amplified by substitute products such as mobile payment platforms and other digital financial services. Crucially, end-user trends strongly favor digital-first solutions, driving an insatiable demand for convenient and personalized banking experiences. Mergers and acquisitions (M&A) activity has been significant, with deal values reaching [Insert Updated Value] Million in the last five years. These transactions predominantly focus on acquiring fintech companies to bolster technological capabilities and expand service offerings, illustrating a clear strategic direction in the market.

- Market Share (2024): Top 5 players hold approximately 60% of the market. [Add detail on market share distribution if available]

- M&A Activity (2019-2024): Total deal value estimated at [Insert Updated Value] Million. [Add a brief description of the M&A trend - e.g., increasing, decreasing, stabilizing]

- Key Mergers & Acquisitions: Details of specific M&A activity, including key players and their impact on the market, will be outlined in the full report.

Challenger Banking in Middle East & Africa Market Industry Trends & Insights

The MEA challenger banking market is experiencing robust growth, driven by increasing smartphone penetration, rising internet usage, and a young, tech-savvy population. The Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) is estimated at xx%, and the forecast period (2025-2033) projects a CAGR of xx%. Technological disruptions, such as the adoption of open banking APIs and the rise of embedded finance, are reshaping the competitive landscape. Consumer preferences are shifting towards personalized, seamless, and omnichannel banking experiences. Competitive dynamics are characterized by intense innovation, strategic partnerships, and aggressive pricing strategies. Market penetration of challenger banks is currently at xx% and is projected to increase significantly in the forecast period.

Dominant Markets & Segments in Challenger Banking in Middle East & Africa Market

The UAE and Nigeria represent the most dominant markets within the MEA region, driven by favorable regulatory environments, robust digital infrastructure, and significant population sizes. Within the service type segments, payments and consumer credit show the highest growth potential, fueled by increased e-commerce activity and demand for accessible lending solutions. The personal segment dominates the end-user type market, however, the business segment is showing significant growth due to the increased adoption of digital banking solutions by SMEs.

Key Drivers:

- UAE: Pro-business policies, advanced digital infrastructure, and a large expatriate population.

- Nigeria: Large and young population, increasing smartphone penetration, and growing fintech ecosystem.

- Payments Segment: High mobile penetration, rise of e-commerce, and demand for convenient payment options.

- Consumer Credit Segment: High demand for personal loans and credit cards, coupled with the increasing accessibility of digital lending platforms.

- Personal Segment: Larger addressable market and greater digital adoption compared to the business segment.

Challenger Banking in Middle East & Africa Market Product Innovations

Challenger banks in the MEA region are aggressively innovating to establish a clear differentiation from traditional financial institutions. Key product developments include sophisticated AI-powered personalization features, seamless and intuitive mobile experiences, the integration of embedded financial services into various platforms, and innovative payment solutions tailored to local needs and preferences. These innovations are strategically focused on delivering superior customer experiences and effectively targeting underserved market segments. The overarching emphasis is on creating products that are not only user-friendly and highly secure but also cost-effective, leveraging the latest technological advancements to gain a sustainable competitive advantage.

Report Segmentation & Scope

This report provides a comprehensive segmentation of the MEA challenger banking market by service type (Payments, Savings Products, Current Accounts, Consumer Credit, Loans, Other Service Types) and by end-user type (Business Segment, Personal Segment). A detailed analysis of each segment's market size, growth projections, and competitive dynamics is included. The report covers the historical period (2019-2024), base year (2025), and forecast period (2025-2033). Detailed information on market sizes (in Millions) for each segment across these periods is provided within the complete report. [Consider adding information about geographic segmentation within MEA if applicable]

Key Drivers of Challenger Banking in Middle East & Africa Market Growth

Several key factors are propelling the remarkable growth of the challenger banking sector within the MEA region:

- Technological advancements: The rapid adoption of mobile technology, coupled with increasing internet penetration and significant advancements in fintech, are collectively fueling innovation and disrupting the traditional banking sector at an unprecedented pace.

- Favorable regulatory environment (with caveats): While many MEA countries are implementing supportive regulatory frameworks that encourage the growth of digital banking and fintech, inconsistencies and variations across the region present both opportunities and challenges.

- Growing demand for digital financial services: Consumers across the MEA region are increasingly demanding more convenient, user-friendly, and accessible banking services, creating a fertile ground for the expansion of challenger banks.

- Financial Inclusion Initiatives: Government-led initiatives aimed at promoting financial inclusion are creating a large untapped market for challenger banks to serve.

Challenges in the Challenger Banking in Middle East & Africa Market Sector

Despite the significant growth potential, the MEA challenger banking market faces several substantial challenges:

- Regulatory hurdles: Variations in regulations across different countries within MEA create complexities for expansion and consistent operations, requiring significant adaptation and compliance efforts.

- Cybersecurity risks: The increased reliance on digital platforms and the handling of sensitive financial data raise significant concerns about data security and the prevention of privacy breaches.

- Competition from established banks: Traditional banks are actively responding to the threat posed by challenger banks through their own digital transformation initiatives, strategic partnerships, and investments in technology.

- Infrastructure limitations: Uneven access to reliable internet and mobile network coverage across the MEA region poses challenges for reaching certain customer segments.

Leading Players in the Challenger Banking in Middle East & Africa Market Market

- Pepper

- Clearly

- Liv Bank

- Xpence

- Mashreq Neo

- Meem Bank

- CBD Now

- Hala

- MoneySmart

- Bank ABC

Key Developments in Challenger Banking in Middle East & Africa Market Sector

- September 2022: Launch of Wio Bank in the UAE, the region's first platform bank. This signifies a significant shift towards platform-based banking models.

- July 2022: Mashreq launched a new supply-chain finance platform, enhancing its digital corporate banking offerings and targeting the business segment.

Strategic Challenger Banking in Middle East & Africa Market Market Outlook

The future of challenger banking in MEA is bright, with significant growth potential driven by continued technological advancements, evolving consumer preferences, and supportive regulatory frameworks. Strategic opportunities lie in focusing on niche segments, leveraging partnerships, and developing innovative products and services. The market is poised for further consolidation through M&A activities, with a focus on expanding regional reach and enhancing technological capabilities. The sector's projected growth signifies significant investment potential and opportunities for disruptive innovation within the financial services landscape.

Challenger Banking in Middle East & Africa Market Segmentation

-

1. Service Type

- 1.1. Payments

- 1.2. Savings Products

- 1.3. Current Accounts

- 1.4. Consumer Credit

- 1.5. Loans

- 1.6. Other Service Types

-

2. End-User Type

- 2.1. Business Segment

- 2.2. Personal Segment

Challenger Banking in Middle East & Africa Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Challenger Banking in Middle East & Africa Market Regional Market Share

Geographic Coverage of Challenger Banking in Middle East & Africa Market

Challenger Banking in Middle East & Africa Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Smartphone Penetration

- 3.3. Market Restrains

- 3.3.1. Competition from Traditional Banks is Restraining the Market

- 3.4. Market Trends

- 3.4.1. Large Unbanked Population in the region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Challenger Banking in Middle East & Africa Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Payments

- 5.1.2. Savings Products

- 5.1.3. Current Accounts

- 5.1.4. Consumer Credit

- 5.1.5. Loans

- 5.1.6. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by End-User Type

- 5.2.1. Business Segment

- 5.2.2. Personal Segment

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Challenger Banking in Middle East & Africa Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Payments

- 6.1.2. Savings Products

- 6.1.3. Current Accounts

- 6.1.4. Consumer Credit

- 6.1.5. Loans

- 6.1.6. Other Service Types

- 6.2. Market Analysis, Insights and Forecast - by End-User Type

- 6.2.1. Business Segment

- 6.2.2. Personal Segment

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. South America Challenger Banking in Middle East & Africa Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Payments

- 7.1.2. Savings Products

- 7.1.3. Current Accounts

- 7.1.4. Consumer Credit

- 7.1.5. Loans

- 7.1.6. Other Service Types

- 7.2. Market Analysis, Insights and Forecast - by End-User Type

- 7.2.1. Business Segment

- 7.2.2. Personal Segment

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Europe Challenger Banking in Middle East & Africa Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Payments

- 8.1.2. Savings Products

- 8.1.3. Current Accounts

- 8.1.4. Consumer Credit

- 8.1.5. Loans

- 8.1.6. Other Service Types

- 8.2. Market Analysis, Insights and Forecast - by End-User Type

- 8.2.1. Business Segment

- 8.2.2. Personal Segment

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Middle East & Africa Challenger Banking in Middle East & Africa Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Payments

- 9.1.2. Savings Products

- 9.1.3. Current Accounts

- 9.1.4. Consumer Credit

- 9.1.5. Loans

- 9.1.6. Other Service Types

- 9.2. Market Analysis, Insights and Forecast - by End-User Type

- 9.2.1. Business Segment

- 9.2.2. Personal Segment

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Asia Pacific Challenger Banking in Middle East & Africa Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Payments

- 10.1.2. Savings Products

- 10.1.3. Current Accounts

- 10.1.4. Consumer Credit

- 10.1.5. Loans

- 10.1.6. Other Service Types

- 10.2. Market Analysis, Insights and Forecast - by End-User Type

- 10.2.1. Business Segment

- 10.2.2. Personal Segment

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Pepper

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Clearly

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Liv Bank

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Xpence

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Mashreq Neo

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Meem Bank

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CBD Now

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hala

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 MoneySmart

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bank ABC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Pepper

List of Figures

- Figure 1: Global Challenger Banking in Middle East & Africa Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Challenger Banking in Middle East & Africa Market Revenue (Million), by Service Type 2025 & 2033

- Figure 3: North America Challenger Banking in Middle East & Africa Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: North America Challenger Banking in Middle East & Africa Market Revenue (Million), by End-User Type 2025 & 2033

- Figure 5: North America Challenger Banking in Middle East & Africa Market Revenue Share (%), by End-User Type 2025 & 2033

- Figure 6: North America Challenger Banking in Middle East & Africa Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Challenger Banking in Middle East & Africa Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Challenger Banking in Middle East & Africa Market Revenue (Million), by Service Type 2025 & 2033

- Figure 9: South America Challenger Banking in Middle East & Africa Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 10: South America Challenger Banking in Middle East & Africa Market Revenue (Million), by End-User Type 2025 & 2033

- Figure 11: South America Challenger Banking in Middle East & Africa Market Revenue Share (%), by End-User Type 2025 & 2033

- Figure 12: South America Challenger Banking in Middle East & Africa Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Challenger Banking in Middle East & Africa Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Challenger Banking in Middle East & Africa Market Revenue (Million), by Service Type 2025 & 2033

- Figure 15: Europe Challenger Banking in Middle East & Africa Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 16: Europe Challenger Banking in Middle East & Africa Market Revenue (Million), by End-User Type 2025 & 2033

- Figure 17: Europe Challenger Banking in Middle East & Africa Market Revenue Share (%), by End-User Type 2025 & 2033

- Figure 18: Europe Challenger Banking in Middle East & Africa Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Challenger Banking in Middle East & Africa Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Challenger Banking in Middle East & Africa Market Revenue (Million), by Service Type 2025 & 2033

- Figure 21: Middle East & Africa Challenger Banking in Middle East & Africa Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 22: Middle East & Africa Challenger Banking in Middle East & Africa Market Revenue (Million), by End-User Type 2025 & 2033

- Figure 23: Middle East & Africa Challenger Banking in Middle East & Africa Market Revenue Share (%), by End-User Type 2025 & 2033

- Figure 24: Middle East & Africa Challenger Banking in Middle East & Africa Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Challenger Banking in Middle East & Africa Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Challenger Banking in Middle East & Africa Market Revenue (Million), by Service Type 2025 & 2033

- Figure 27: Asia Pacific Challenger Banking in Middle East & Africa Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 28: Asia Pacific Challenger Banking in Middle East & Africa Market Revenue (Million), by End-User Type 2025 & 2033

- Figure 29: Asia Pacific Challenger Banking in Middle East & Africa Market Revenue Share (%), by End-User Type 2025 & 2033

- Figure 30: Asia Pacific Challenger Banking in Middle East & Africa Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Challenger Banking in Middle East & Africa Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Challenger Banking in Middle East & Africa Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global Challenger Banking in Middle East & Africa Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 3: Global Challenger Banking in Middle East & Africa Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Challenger Banking in Middle East & Africa Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 5: Global Challenger Banking in Middle East & Africa Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 6: Global Challenger Banking in Middle East & Africa Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Challenger Banking in Middle East & Africa Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Challenger Banking in Middle East & Africa Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Challenger Banking in Middle East & Africa Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Challenger Banking in Middle East & Africa Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 11: Global Challenger Banking in Middle East & Africa Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 12: Global Challenger Banking in Middle East & Africa Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Challenger Banking in Middle East & Africa Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Challenger Banking in Middle East & Africa Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Challenger Banking in Middle East & Africa Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Challenger Banking in Middle East & Africa Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 17: Global Challenger Banking in Middle East & Africa Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 18: Global Challenger Banking in Middle East & Africa Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Challenger Banking in Middle East & Africa Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Challenger Banking in Middle East & Africa Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Challenger Banking in Middle East & Africa Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Challenger Banking in Middle East & Africa Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Challenger Banking in Middle East & Africa Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Challenger Banking in Middle East & Africa Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Challenger Banking in Middle East & Africa Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Challenger Banking in Middle East & Africa Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Challenger Banking in Middle East & Africa Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Challenger Banking in Middle East & Africa Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 29: Global Challenger Banking in Middle East & Africa Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 30: Global Challenger Banking in Middle East & Africa Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Challenger Banking in Middle East & Africa Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Challenger Banking in Middle East & Africa Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Challenger Banking in Middle East & Africa Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Challenger Banking in Middle East & Africa Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Challenger Banking in Middle East & Africa Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Challenger Banking in Middle East & Africa Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Challenger Banking in Middle East & Africa Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 38: Global Challenger Banking in Middle East & Africa Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 39: Global Challenger Banking in Middle East & Africa Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Challenger Banking in Middle East & Africa Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Challenger Banking in Middle East & Africa Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Challenger Banking in Middle East & Africa Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Challenger Banking in Middle East & Africa Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Challenger Banking in Middle East & Africa Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Challenger Banking in Middle East & Africa Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Challenger Banking in Middle East & Africa Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Challenger Banking in Middle East & Africa Market?

The projected CAGR is approximately 10.50%.

2. Which companies are prominent players in the Challenger Banking in Middle East & Africa Market?

Key companies in the market include Pepper, Clearly, Liv Bank, Xpence, Mashreq Neo, Meem Bank, CBD Now, Hala, MoneySmart, Bank ABC.

3. What are the main segments of the Challenger Banking in Middle East & Africa Market?

The market segments include Service Type, End-User Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 74.03 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Smartphone Penetration.

6. What are the notable trends driving market growth?

Large Unbanked Population in the region.

7. Are there any restraints impacting market growth?

Competition from Traditional Banks is Restraining the Market.

8. Can you provide examples of recent developments in the market?

September 2022: New challenger Wio Bank launched in the UAE. Wio Bank, the region's first platform bank, officially launched operations in the UAE, with its headquarters in Abu Dhabi.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Challenger Banking in Middle East & Africa Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Challenger Banking in Middle East & Africa Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Challenger Banking in Middle East & Africa Market?

To stay informed about further developments, trends, and reports in the Challenger Banking in Middle East & Africa Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence