Key Insights

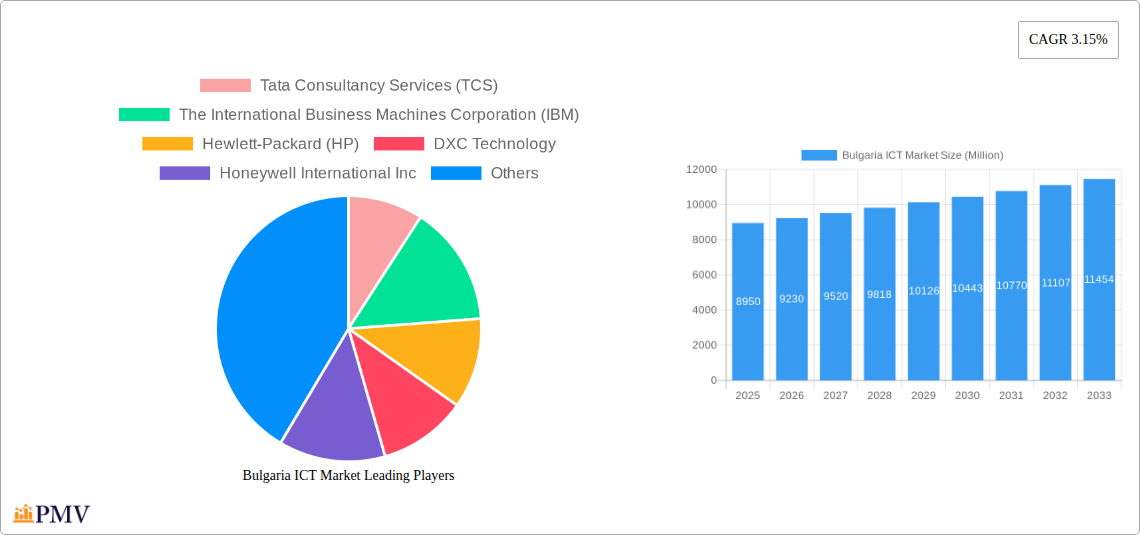

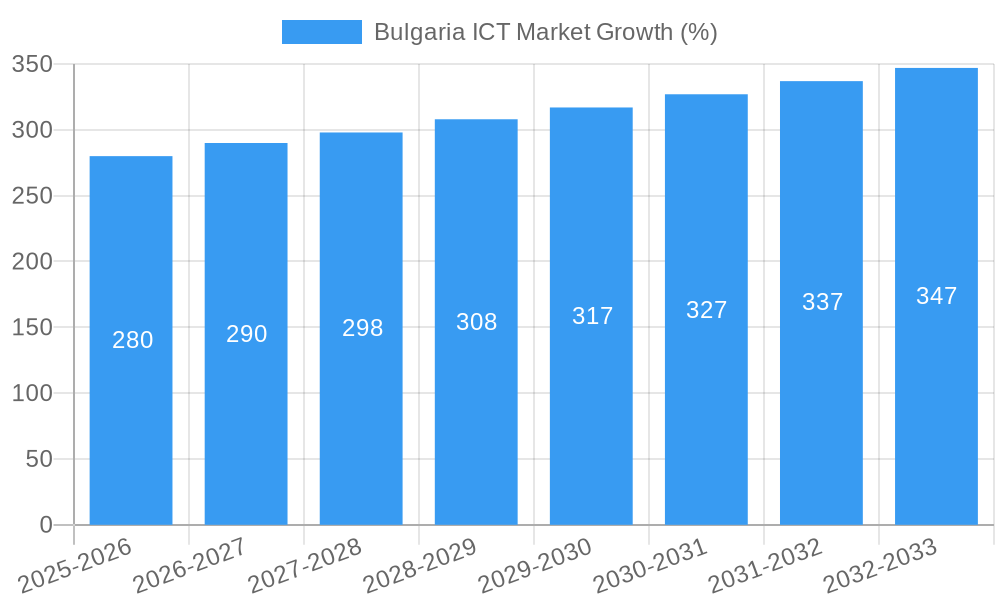

The Bulgarian ICT market, valued at $8.95 billion in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 3.15% from 2025 to 2033. This growth is fueled by several key factors. Increased government investment in digital infrastructure, particularly in expanding high-speed internet access across the country, is a significant driver. Furthermore, the burgeoning adoption of cloud computing services by businesses of all sizes, seeking increased efficiency and scalability, is contributing significantly to market expansion. The growing demand for cybersecurity solutions, driven by increasing cyber threats and stringent data protection regulations, further fuels market expansion. Finally, the increasing digital literacy among the Bulgarian population and the rise of e-commerce are also contributing factors to the market's positive trajectory.

However, the market faces certain challenges. Limited skilled workforce availability, especially in specialized areas like AI and data science, could hinder growth. Competition from larger, international players also poses a challenge for local businesses. Despite these restraints, the long-term outlook for the Bulgarian ICT market remains positive, driven by ongoing digital transformation initiatives within the public and private sectors. The presence of established multinational companies like TCS, IBM, HP, and others, alongside local players, indicates a robust and competitive landscape. Continued investments in R&D and the fostering of a supportive regulatory environment will be crucial in maximizing the market's potential.

Bulgaria ICT Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Bulgaria ICT market, covering the period from 2019 to 2033. It offers valuable insights into market structure, competitive dynamics, industry trends, key players, and future growth prospects. The report is essential for businesses, investors, and policymakers seeking to understand and navigate this dynamic market. The base year for this report is 2025, with estimations for 2025 and forecasts spanning 2025-2033. The historical period covered is 2019-2024.

Bulgaria ICT Market Structure & Competitive Dynamics

The Bulgarian ICT market exhibits a moderately concentrated structure, with a mix of multinational corporations and local players. While multinational giants like Tata Consultancy Services (TCS), IBM, Hewlett-Packard (HP), DXC Technology, Honeywell International Inc, Oracle Corporation, SAP SE, and Cisco Systems Inc hold significant market share, a vibrant ecosystem of smaller, specialized companies like Dreamix Ltd, Accedia JSC, and Scalefocus AD also contribute substantially. Market share data for 2024 suggests TCS holds approximately xx%, followed by IBM at xx%, and HP at xx%. The remaining share is distributed amongst other players, both multinational and local.

Innovation within the Bulgarian ICT sector is fueled by a growing number of startups and a supportive government policy environment. The regulatory framework is largely aligned with EU standards, promoting fair competition and data protection. Product substitution is a constant factor, driven by technological advancements and evolving consumer preferences. The market witnesses regular M&A activity, with deal values in 2024 reaching approximately xx Million, reflecting consolidation and expansion efforts. Key examples include (specific M&A deals with values, if available, should be inserted here). End-user trends show increasing demand for cloud services, cybersecurity solutions, and AI-powered applications.

Bulgaria ICT Market Industry Trends & Insights

The Bulgarian ICT market is experiencing robust growth, driven by factors such as increasing digitalization across various sectors, rising internet penetration, and government initiatives promoting digital transformation. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is projected to be xx%, indicating significant market expansion. Technological disruptions, primarily driven by advancements in AI, cloud computing, and 5G, are reshaping the market landscape. Consumer preferences are shifting towards personalized experiences, greater security, and seamless integration across devices and platforms. This is further amplified by intense competitive dynamics, with companies constantly innovating to meet the evolving needs of businesses and consumers. Market penetration of cloud services has reached approximately xx% in 2024, with expectations for significant growth in the coming years. The increasing adoption of AI and the development of BgGPT represent a key inflection point in the market, driving further demand.

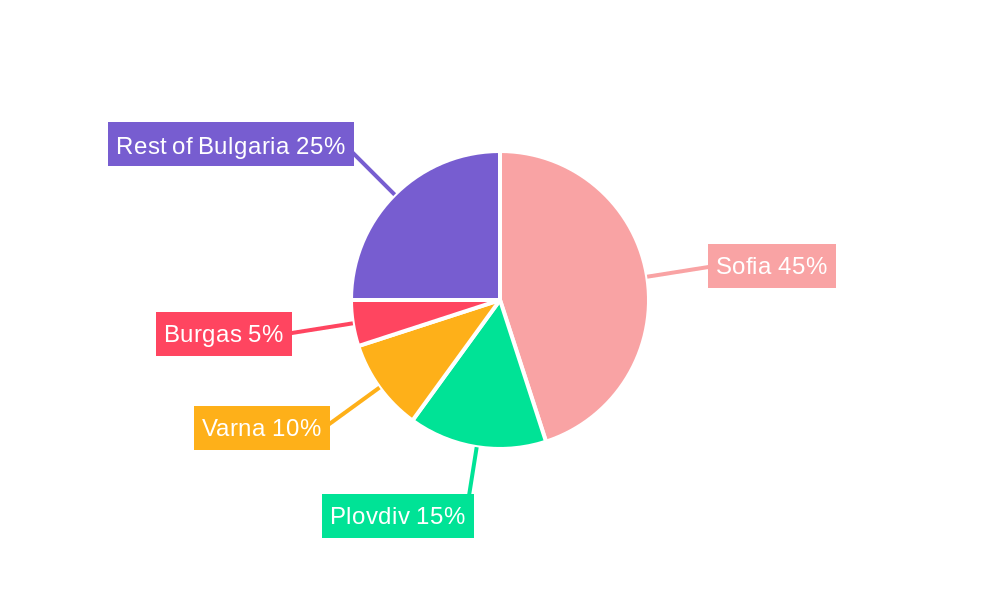

Dominant Markets & Segments in Bulgaria ICT Market

The Sofia region dominates the Bulgarian ICT market due to its concentration of skilled professionals, established infrastructure, and proximity to major European markets. This dominance is further reinforced by supportive government policies and investment in technology infrastructure.

- Key Drivers of Sofia's Dominance:

- High concentration of skilled ICT professionals.

- Well-developed infrastructure, including robust internet connectivity.

- Government incentives and investments in the tech sector.

- Strategic location within Europe, facilitating access to international markets.

The dominant segments within the Bulgarian ICT market include software development, IT services, and telecommunications. Software development benefits from the availability of a skilled workforce and growing demand for customized solutions. IT services cater to the diverse needs of businesses across different industries. The telecommunications sector witnesses continuous upgrades in infrastructure and expanding coverage, driving growth.

Bulgaria ICT Market Product Innovations

Recent product innovations in the Bulgarian ICT market are characterized by a strong focus on AI-powered solutions and cloud-based services. The development of BgGPT, Bulgaria's first open large language model, represents a significant technological leap, potentially creating a competitive advantage for Bulgarian companies in developing AI-driven applications. Furthermore, the establishment of a Redis R&D center highlights the attractiveness of Bulgaria for advanced technology companies and signifies a shift towards more sophisticated product offerings within the market.

Report Segmentation & Scope

This report segments the Bulgarian ICT market based on various factors, providing a granular understanding of its dynamics. These segments include, but are not limited to:

Software: This segment is further divided by software type (e.g., enterprise resource planning (ERP), customer relationship management (CRM), etc.) and deployment model (e.g., cloud, on-premise). Market size in 2024 was approximately xx Million, with projected growth of xx% annually until 2033.

Hardware: This segment encompasses computers, peripherals, networking equipment, and other hardware components. Market size estimates for 2024 were approximately xx Million.

IT Services: This includes consulting, system integration, support, and managed services. The 2024 market size is estimated at xx Million.

Telecommunications: This covers fixed-line, mobile, and internet services. The 2024 market size is estimated at xx Million.

Key Drivers of Bulgaria ICT Market Growth

Several key factors are driving the growth of the Bulgarian ICT market. These include:

- Government Initiatives: Government policies aimed at fostering digital transformation and attracting foreign investment are crucial.

- Technological Advancements: The adoption of AI, cloud computing, and 5G technologies is creating new opportunities.

- Skilled Workforce: The availability of a relatively skilled and cost-effective workforce attracts both local and international companies.

- Growing Digitalization: The increasing adoption of digital technologies across various sectors is fueling demand.

Challenges in the Bulgaria ICT Market Sector

Despite its promising growth trajectory, the Bulgarian ICT market faces several challenges. These include:

- Brain Drain: The emigration of skilled professionals to other countries with higher salaries poses a significant threat. This is estimated to cause an xx% annual loss in potential productivity.

- Infrastructure Gaps: While improving, the infrastructure in some regions remains a constraint to growth.

- Cybersecurity Threats: The increasing reliance on digital technologies increases vulnerability to cyberattacks, requiring continuous investment in security measures.

Leading Players in the Bulgaria ICT Market

- Tata Consultancy Services (TCS)

- The International Business Machines Corporation (IBM)

- Hewlett-Packard (HP)

- DXC Technology

- Honeywell International Inc

- Oracle Corporation

- SAP SE

- Cisco Systems Inc

- Dreamix Ltd

- Accedia JSC

- Scalefocus AD

- List Not Exhaustive

Key Developments in Bulgaria ICT Market Sector

January 2024: INSAIT introduces BgGPT, the first open large language model for the Bulgarian market, impacting various sectors including education, business, healthcare, and public administration. This is expected to drive significant innovation and increase demand for AI-related services.

January 2024: Redis, a US cloud company, opens an R&D center in Sofia, indicating increased foreign investment and confidence in the Bulgarian ICT sector. This is expected to boost employment and technological advancement within the market.

Strategic Bulgaria ICT Market Outlook

The future of the Bulgarian ICT market appears bright, with substantial growth potential driven by continued digital transformation, government support, and the influx of foreign investment. Strategic opportunities exist in areas such as AI-powered solutions, cloud services, cybersecurity, and the development of innovative applications tailored to the specific needs of the Bulgarian market. Companies that can leverage these opportunities and adapt to evolving technological trends are poised to capture significant market share in the years to come. Focus on talent development and infrastructure improvement will be critical to sustaining this growth.

Bulgaria ICT Market Segmentation

-

1. Type

- 1.1. Hardware

- 1.2. Software

- 1.3. Services

- 1.4. Telecommunication Services

-

2. Size of Enterprise

- 2.1. Small and Medium Enterprises

- 2.2. Large Enterprises

-

3. Industry Vertical

- 3.1. BFSI

- 3.2. IT and Telecom

- 3.3. Government

- 3.4. Retail and E-commerce

- 3.5. Manufacturing

- 3.6. Energy and Utilities

- 3.7. Other Industry Verticals

Bulgaria ICT Market Segmentation By Geography

- 1. Bulgaria

Bulgaria ICT Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.15% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Implementation of 5G is Back on Track; Growing demand for Cloud Technology

- 3.3. Market Restrains

- 3.3.1. Implementation of 5G is Back on Track; Growing demand for Cloud Technology

- 3.4. Market Trends

- 3.4.1. Cloud Technology is Expected to Witness a Growing Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Bulgaria ICT Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.1.4. Telecommunication Services

- 5.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 5.2.1. Small and Medium Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. BFSI

- 5.3.2. IT and Telecom

- 5.3.3. Government

- 5.3.4. Retail and E-commerce

- 5.3.5. Manufacturing

- 5.3.6. Energy and Utilities

- 5.3.7. Other Industry Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Bulgaria

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Tata Consultancy Services (TCS)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The International Business Machines Corporation (IBM)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hewlett-Packard (HP)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DXC Technology

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Honeywell International Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Oracle Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SAP SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cisco Systems Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dreamix Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Accedia JSC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Scalefocus AD*List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Tata Consultancy Services (TCS)

List of Figures

- Figure 1: Bulgaria ICT Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Bulgaria ICT Market Share (%) by Company 2024

List of Tables

- Table 1: Bulgaria ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Bulgaria ICT Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Bulgaria ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Bulgaria ICT Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Bulgaria ICT Market Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 6: Bulgaria ICT Market Volume Billion Forecast, by Size of Enterprise 2019 & 2032

- Table 7: Bulgaria ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 8: Bulgaria ICT Market Volume Billion Forecast, by Industry Vertical 2019 & 2032

- Table 9: Bulgaria ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Bulgaria ICT Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Bulgaria ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Bulgaria ICT Market Volume Billion Forecast, by Type 2019 & 2032

- Table 13: Bulgaria ICT Market Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 14: Bulgaria ICT Market Volume Billion Forecast, by Size of Enterprise 2019 & 2032

- Table 15: Bulgaria ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 16: Bulgaria ICT Market Volume Billion Forecast, by Industry Vertical 2019 & 2032

- Table 17: Bulgaria ICT Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Bulgaria ICT Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bulgaria ICT Market?

The projected CAGR is approximately 3.15%.

2. Which companies are prominent players in the Bulgaria ICT Market?

Key companies in the market include Tata Consultancy Services (TCS), The International Business Machines Corporation (IBM), Hewlett-Packard (HP), DXC Technology, Honeywell International Inc, Oracle Corporation, SAP SE, Cisco Systems Inc, Dreamix Ltd, Accedia JSC, Scalefocus AD*List Not Exhaustive.

3. What are the main segments of the Bulgaria ICT Market?

The market segments include Type, Size of Enterprise, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.95 Million as of 2022.

5. What are some drivers contributing to market growth?

Implementation of 5G is Back on Track; Growing demand for Cloud Technology.

6. What are the notable trends driving market growth?

Cloud Technology is Expected to Witness a Growing Demand.

7. Are there any restraints impacting market growth?

Implementation of 5G is Back on Track; Growing demand for Cloud Technology.

8. Can you provide examples of recent developments in the market?

January 2024: INSAIT has introduced BgGPT, the first open large language model tailored specifically for the Bulgarian market. This innovative model caters to a wide spectrum of users, including both public and private entities. The development of BgGPT is mainly a part of INSAIT’s strategy, aiming to create an open and accessible AI for societal and business advancement. BgGPT, tailored for the specifics of the Bulgarian language, empowers the development of applications across various sectors, including education, business, healthcare, and public administration in Bulgaria.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bulgaria ICT Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bulgaria ICT Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bulgaria ICT Market?

To stay informed about further developments, trends, and reports in the Bulgaria ICT Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence