Key Insights

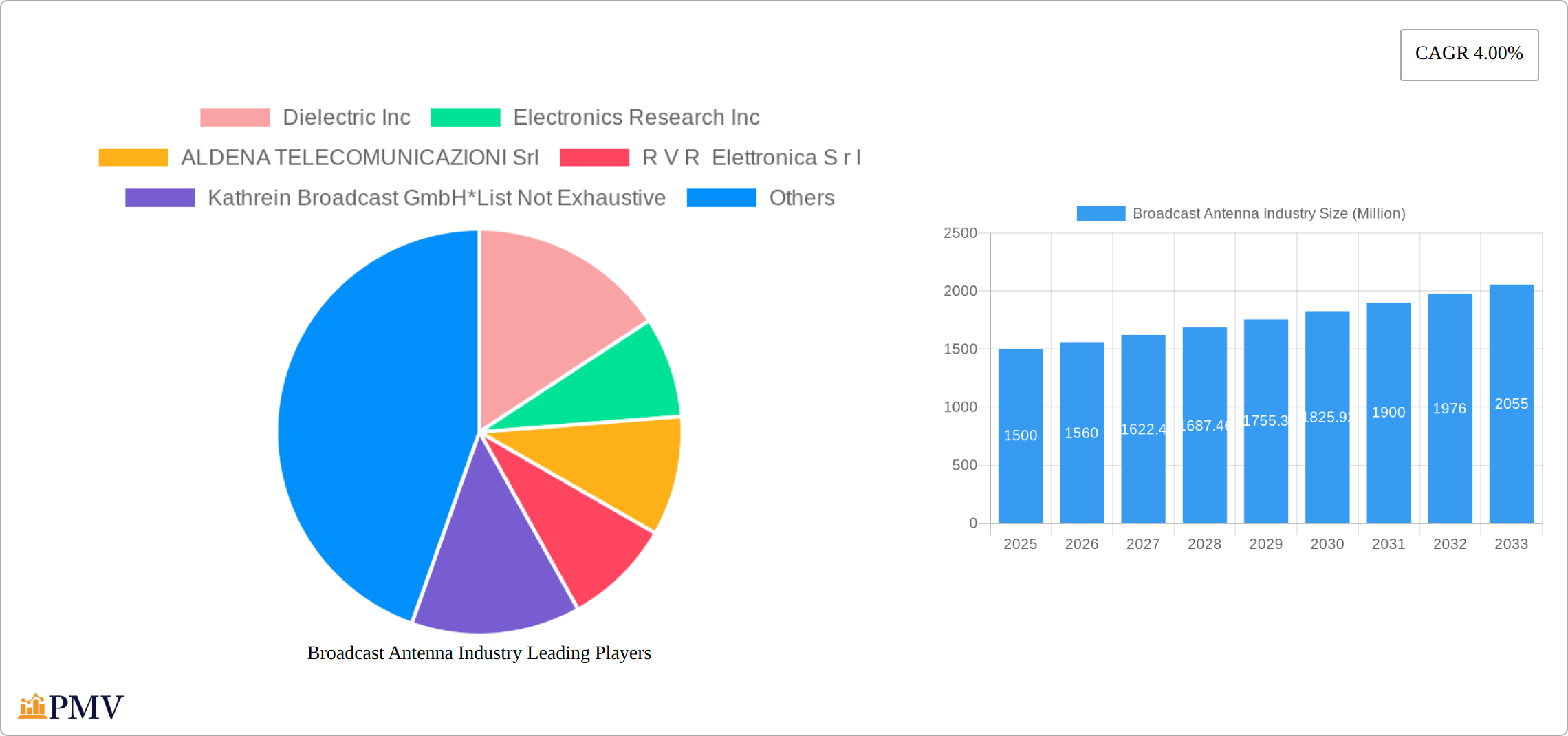

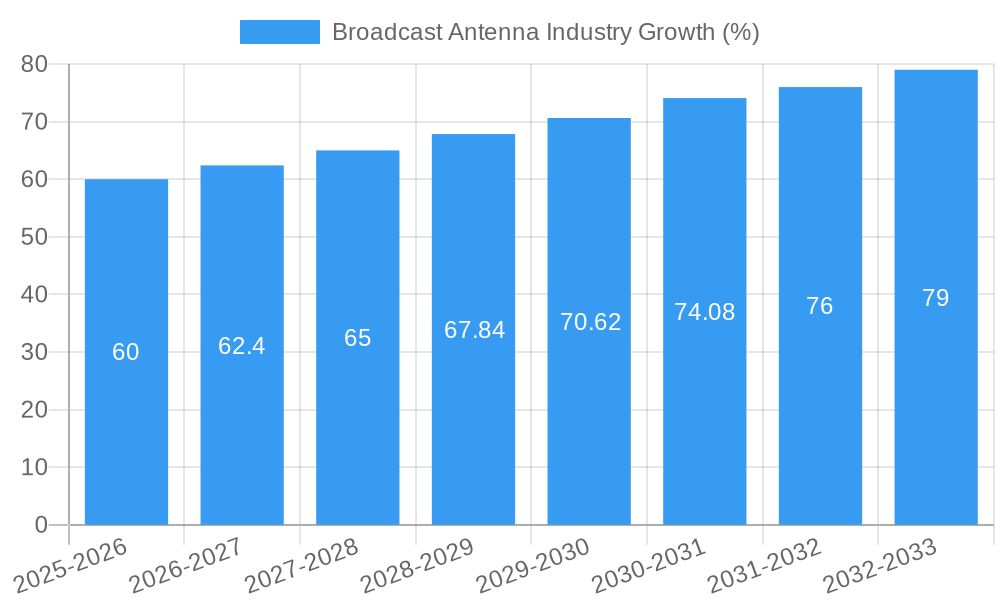

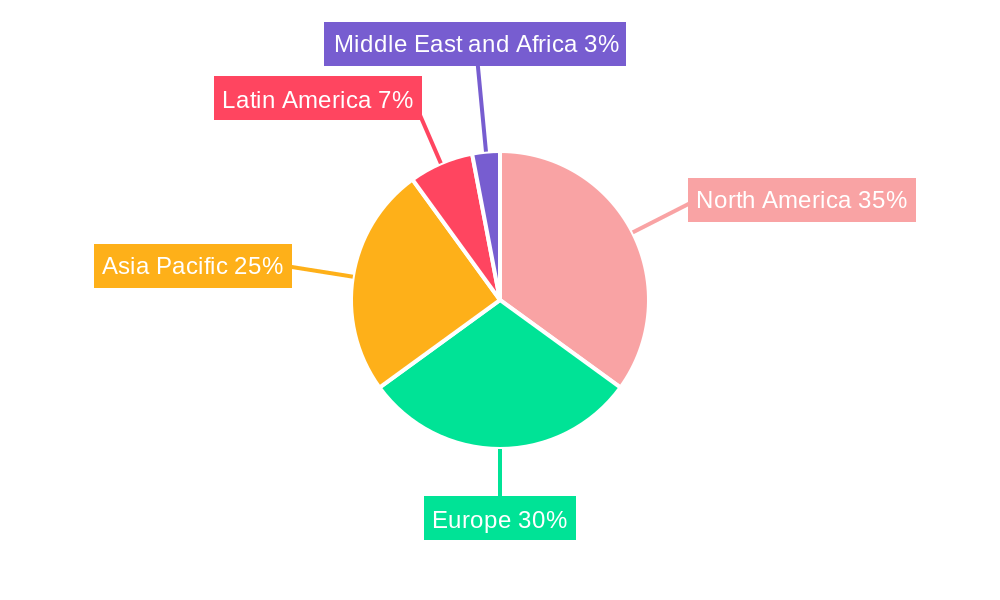

The broadcast antenna industry, currently valued at approximately $XX million (estimated based on the provided CAGR and market size), is projected to experience steady growth, with a compound annual growth rate (CAGR) of 4.00% from 2025 to 2033. This growth is fueled by several key drivers. The increasing demand for high-quality television and radio broadcasts, particularly in emerging economies with expanding digital infrastructure, is a significant factor. Furthermore, the ongoing transition to digital broadcasting technologies, including High Definition (HD) television and digital radio, necessitates the deployment of advanced antenna systems. Technological advancements in antenna design, such as the development of more efficient and cost-effective solutions, further contribute to market expansion. However, the market faces certain restraints, including the high initial investment costs associated with infrastructure upgrades and the potential for regulatory hurdles in certain regions. The market is segmented by broadcast type (Television and FM), with television antennas currently dominating due to the wider reach and higher technological requirements. Key players like Dielectric Inc, Kathrein Broadcast GmbH, and Jampro Antennas Inc are driving innovation and competition within the industry. Geographic distribution reveals significant opportunities in rapidly developing regions of Asia Pacific and Latin America, while North America and Europe maintain substantial market shares due to established broadcast infrastructure. Over the forecast period, we anticipate a continued shift towards digital broadcasting technologies, leading to a higher demand for specialized antennas capable of supporting higher bandwidths and improved signal quality.

The competitive landscape is characterized by a mix of established players and emerging companies, leading to both opportunities and challenges. Established players possess significant market share due to their brand recognition and technological expertise. However, smaller companies are innovating rapidly, introducing cost-effective solutions and niche products that cater to specific market segments. The ongoing technological evolution and increasing demand for higher bandwidths necessitate continuous innovation within the broadcast antenna industry, leading to a dynamic and evolving competitive landscape. Future growth will depend on factors including government support for digital broadcasting initiatives, technological advancements in antenna design, and the overall economic growth in key regions.

Broadcast Antenna Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Broadcast Antenna Industry, covering market size, competitive landscape, technological advancements, and future growth prospects from 2019 to 2033. The report utilizes data from the historical period (2019-2024), the base year (2025), and offers detailed forecasts for the period 2025-2033. The analysis focuses on key segments – Television and FM broadcast antennas – and includes insights into market drivers, challenges, and key players shaping the industry's trajectory. The total market size is estimated to reach xx Million by 2033.

Broadcast Antenna Industry Market Structure & Competitive Dynamics

The Broadcast Antenna industry exhibits a moderately concentrated market structure, with several key players commanding significant market share. The industry is characterized by both intense competition and strategic collaborations. Market share data from 2024 indicates that the top five players (Dielectric Inc, Kathrein Broadcast GmbH, Jampro Antennas Inc, TE Connectivity Ltd, and TCI International Inc) collectively hold approximately xx% of the global market. This high concentration is driven by factors such as substantial R&D investments, economies of scale, and established brand recognition.

Innovation Ecosystems: The industry is witnessing a growing emphasis on technological innovation, particularly in areas such as 5G integration, improved antenna designs for higher bandwidths, and the incorporation of smart features for remote monitoring and control. Collaborative ventures between antenna manufacturers and telecom providers are becoming increasingly common.

Regulatory Frameworks: Stringent regulatory standards concerning signal quality, interference mitigation, and environmental compliance significantly influence the industry’s operations. Variations in these regulations across different regions lead to diverse market dynamics.

Product Substitutes: While traditional broadcast antennas remain dominant, emerging technologies such as satellite broadcasting and over-the-top (OTT) streaming services present competitive alternatives. The impact of these substitutes on the market share of broadcast antennas is currently estimated at xx% annually.

End-User Trends: The increasing demand for high-quality video and audio content, driven by the rising adoption of high-definition television (HDTV) and digital radio, fuels the demand for advanced broadcast antennas. Furthermore, the transition towards digital broadcasting technologies is a significant factor shaping industry trends.

M&A Activities: The broadcast antenna industry has seen a moderate level of mergers and acquisitions (M&A) activity in recent years. While precise deal values are not publicly available for all transactions, notable acquisitions have involved companies seeking to expand their product portfolios and geographic reach. Total M&A deal value in 2024 was estimated to be xx Million.

Broadcast Antenna Industry Industry Trends & Insights

The Broadcast Antenna industry is experiencing steady growth, driven by multiple factors. The global market is expected to exhibit a compound annual growth rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily fueled by:

Increased Demand for High-Quality Broadcasting: Consumers’ growing preference for high-definition (HD) and ultra-high-definition (UHD) television and digital radio broadcasts is driving the adoption of advanced broadcast antennas capable of supporting these higher bandwidth requirements.

Digital Transition and Technological Advancements: The ongoing global shift towards digital broadcasting necessitates the deployment of new antenna technologies optimized for digital signal transmission. Innovations in antenna materials, design, and signal processing are enhancing performance and efficiency.

Expansion of Broadcasting Infrastructure: Investments in new broadcasting infrastructure, particularly in emerging markets, are creating significant growth opportunities for broadcast antenna manufacturers. Market penetration in these regions is projected to increase by xx% by 2033.

Technological Disruptions: The integration of 5G technology into broadcast systems is presenting both opportunities and challenges for antenna manufacturers, leading to the development of antennas capable of efficiently handling the higher frequencies and data rates associated with 5G.

Competitive Dynamics: The competitive landscape is characterized by both collaboration and rivalry. Partnerships between antenna manufacturers and telecom operators are facilitating the development of integrated solutions for broadcasting and wireless communication. Simultaneously, competition in terms of pricing, product features, and innovation continues to push the industry forward.

Dominant Markets & Segments in Broadcast Antenna Industry

The North American region currently holds the largest market share in the broadcast antenna industry, driven by factors such as high penetration rates of digital broadcasting, substantial investment in broadcasting infrastructure, and the early adoption of new broadcasting technologies. Within this region, the United States is the dominant market.

- Key Drivers in North America:

- Robust broadcasting infrastructure investments.

- High adoption rate of digital TV and radio.

- Favorable regulatory frameworks supporting broadcasting innovation.

- Strong demand for high-quality broadcasting services.

- Early adoption of NEXTGEN TV and other technological advancements.

The Television segment constitutes a significantly larger portion of the market compared to the FM segment, driven by the increased demand for higher-resolution video broadcasting. The Television segment is expected to maintain its dominant position throughout the forecast period.

Market Dominance Analysis for Television Antennas: Television antennas command a larger market share due to the increased demand for HDTV and UHDTV broadcasting, which necessitates more advanced antenna systems.

Market Dominance Analysis for FM Antennas: While the FM segment is smaller, consistent demand for digital radio broadcasting continues to provide a steady market for FM broadcast antennas.

Broadcast Antenna Industry Product Innovations

Recent product innovations in the broadcast antenna industry include the development of highly directional antennas optimized for digital broadcasting, advanced antenna arrays for increased signal coverage and efficiency, and the incorporation of smart functionalities into antenna systems for remote monitoring and control. These innovations offer significant competitive advantages by improving signal quality, reducing interference, and lowering operational costs. The integration of AI and machine learning capabilities for predictive maintenance and signal optimization is an emerging trend.

Report Segmentation & Scope

This report segments the Broadcast Antenna industry based on antenna type: Television and FM.

Television Broadcast Antennas: This segment encompasses antennas designed for transmitting television signals across various frequency bands. Growth projections suggest a substantial increase in demand due to ongoing digital migration and the rising adoption of high-definition television broadcasting. Competitive dynamics are characterized by intense innovation in antenna design, materials, and signal processing techniques. Market size in 2025 is estimated at xx Million.

FM Broadcast Antennas: This segment includes antennas used for transmitting FM radio signals. While the market share is smaller than the Television segment, steady demand from radio broadcasters and advancements in digital radio technology are driving consistent growth. Competitive dynamics in this segment are focused on improving signal efficiency and optimizing antenna designs for specific geographic conditions. Market size in 2025 is estimated at xx Million.

Key Drivers of Broadcast Antenna Industry Growth

Several factors contribute to the growth of the broadcast antenna industry. Technological advancements such as the development of more efficient and higher-bandwidth antennas are pivotal. Furthermore, the ongoing transition to digital broadcasting necessitates new infrastructure and antenna upgrades. Favorable regulatory environments that encourage investment in broadcasting technology also play a key role. Finally, the increasing demand for high-quality audio and video content among consumers fuels this market growth.

Challenges in the Broadcast Antenna Industry Sector

The Broadcast Antenna industry faces challenges such as stringent regulatory compliance requirements, which necessitate significant investment in testing and certification. Supply chain disruptions, particularly for specialized components, can lead to production delays and increased costs. Moreover, intense competition among established players and emerging companies exerts downward pressure on prices, impacting profitability. The overall impact of these challenges is estimated to reduce the market CAGR by approximately xx%.

Leading Players in the Broadcast Antenna Industry Market

- Dielectric Inc

- Electronics Research Inc

- ALDENA TELECOMUNICAZIONI Srl

- R V R Elettronica S r l

- Kathrein Broadcast GmbH

- OMB Sistemas Electrónicos S A

- ELETEC Broadcast Transmitters Sarl

- Jampro Antennas Inc

- TE Connectivity Ltd

- TCI International Inc

- Twin Engineers Private Limited

- Propagation Systems Inc (PSI Antenna)

- ABE Elettronica s r l

Key Developments in Broadcast Antenna Industry Sector

June 2021: Hiltron Communications completed a satellite uplink and downlink system for a German television news broadcaster, showcasing advancements in antenna control technology and international broadcasting infrastructure. This highlights the demand for sophisticated antenna systems in global news broadcasting operations.

January 2022: The launch of NEXTGEN TV by four San Antonio television stations demonstrates the transition to advanced digital broadcasting technologies, emphasizing the need for compatible antenna systems and fueling demand for upgraded infrastructure. This signals a shift towards enhanced broadcasting capabilities and improved viewer experience.

Strategic Broadcast Antenna Industry Market Outlook

The Broadcast Antenna industry presents a promising outlook driven by ongoing digitalization efforts in broadcasting, increasing demand for high-quality video and audio content, and emerging opportunities in next-generation broadcasting technologies. Strategic investments in R&D, focusing on innovative antenna designs and integration with 5G networks, will be crucial for success. The market's growth potential is further enhanced by expanding broadcasting infrastructure in emerging markets and the ongoing adoption of advanced broadcast standards.

Broadcast Antenna Industry Segmentation

-

1. Type

- 1.1. Television

- 1.2. FM

Broadcast Antenna Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Broadcast Antenna Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increased Usage in Construction Industry; Increasing Adoption of Automation

- 3.3. Market Restrains

- 3.3.1. Evolution of Optic Fiber is Expected to Challenge the Antenna Adoption

- 3.4. Market Trends

- 3.4.1. Television Type to Hold Highest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Broadcast Antenna Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Television

- 5.1.2. FM

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Broadcast Antenna Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Television

- 6.1.2. FM

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Broadcast Antenna Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Television

- 7.1.2. FM

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Broadcast Antenna Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Television

- 8.1.2. FM

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Broadcast Antenna Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Television

- 9.1.2. FM

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Broadcast Antenna Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Television

- 10.1.2. FM

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Broadcast Antenna Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Broadcast Antenna Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Broadcast Antenna Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Broadcast Antenna Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Broadcast Antenna Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Dielectric Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Electronics Research Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 ALDENA TELECOMUNICAZIONI Srl

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 R V R Elettronica S r l

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Kathrein Broadcast GmbH*List Not Exhaustive

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 OMB Sistemas Electrónicos S A

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 ELETEC Broadcast Transmitters Sarl

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Jampro Antennas Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 TE Connectivity Ltd

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 TCI International Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Twin Engineers Private Limited

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Propagation Systems Inc (PSI Antenna)

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 ABE Elettronica s r l

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.1 Dielectric Inc

List of Figures

- Figure 1: Global Broadcast Antenna Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Broadcast Antenna Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Broadcast Antenna Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Broadcast Antenna Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Broadcast Antenna Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Broadcast Antenna Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Broadcast Antenna Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Broadcast Antenna Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Broadcast Antenna Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Broadcast Antenna Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Broadcast Antenna Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Broadcast Antenna Industry Revenue (Million), by Type 2024 & 2032

- Figure 13: North America Broadcast Antenna Industry Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America Broadcast Antenna Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Broadcast Antenna Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Broadcast Antenna Industry Revenue (Million), by Type 2024 & 2032

- Figure 17: Europe Broadcast Antenna Industry Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Broadcast Antenna Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Broadcast Antenna Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Broadcast Antenna Industry Revenue (Million), by Type 2024 & 2032

- Figure 21: Asia Pacific Broadcast Antenna Industry Revenue Share (%), by Type 2024 & 2032

- Figure 22: Asia Pacific Broadcast Antenna Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Broadcast Antenna Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Latin America Broadcast Antenna Industry Revenue (Million), by Type 2024 & 2032

- Figure 25: Latin America Broadcast Antenna Industry Revenue Share (%), by Type 2024 & 2032

- Figure 26: Latin America Broadcast Antenna Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Latin America Broadcast Antenna Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East and Africa Broadcast Antenna Industry Revenue (Million), by Type 2024 & 2032

- Figure 29: Middle East and Africa Broadcast Antenna Industry Revenue Share (%), by Type 2024 & 2032

- Figure 30: Middle East and Africa Broadcast Antenna Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Middle East and Africa Broadcast Antenna Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Broadcast Antenna Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Broadcast Antenna Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Broadcast Antenna Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Broadcast Antenna Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Broadcast Antenna Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Broadcast Antenna Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Broadcast Antenna Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Broadcast Antenna Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Broadcast Antenna Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Broadcast Antenna Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Broadcast Antenna Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Broadcast Antenna Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Broadcast Antenna Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Broadcast Antenna Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 15: Global Broadcast Antenna Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Broadcast Antenna Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 17: Global Broadcast Antenna Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Broadcast Antenna Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global Broadcast Antenna Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Broadcast Antenna Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 21: Global Broadcast Antenna Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Broadcast Antenna Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Global Broadcast Antenna Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Broadcast Antenna Industry?

The projected CAGR is approximately 4.00%.

2. Which companies are prominent players in the Broadcast Antenna Industry?

Key companies in the market include Dielectric Inc, Electronics Research Inc, ALDENA TELECOMUNICAZIONI Srl, R V R Elettronica S r l, Kathrein Broadcast GmbH*List Not Exhaustive, OMB Sistemas Electrónicos S A, ELETEC Broadcast Transmitters Sarl, Jampro Antennas Inc, TE Connectivity Ltd, TCI International Inc, Twin Engineers Private Limited, Propagation Systems Inc (PSI Antenna), ABE Elettronica s r l.

3. What are the main segments of the Broadcast Antenna Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increased Usage in Construction Industry; Increasing Adoption of Automation.

6. What are the notable trends driving market growth?

Television Type to Hold Highest Market Share.

7. Are there any restraints impacting market growth?

Evolution of Optic Fiber is Expected to Challenge the Antenna Adoption.

8. Can you provide examples of recent developments in the market?

January 2022: Four television stations serving the San Antonio market in the US began broadcasting with NEXTGEN TV, a new digital broadcast technology. Based on the same fundamental technology as the Internet and digital apps, NEXTGEN TV can support a wide range of features that are currently in development. In addition to providing an improved way for broadcasters to reach viewers with advanced emergency alerts, NEXTGEN TV features videos with good color, sharper images, and a deeper contrast to create a more life-like experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Broadcast Antenna Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Broadcast Antenna Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Broadcast Antenna Industry?

To stay informed about further developments, trends, and reports in the Broadcast Antenna Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence