Key Insights

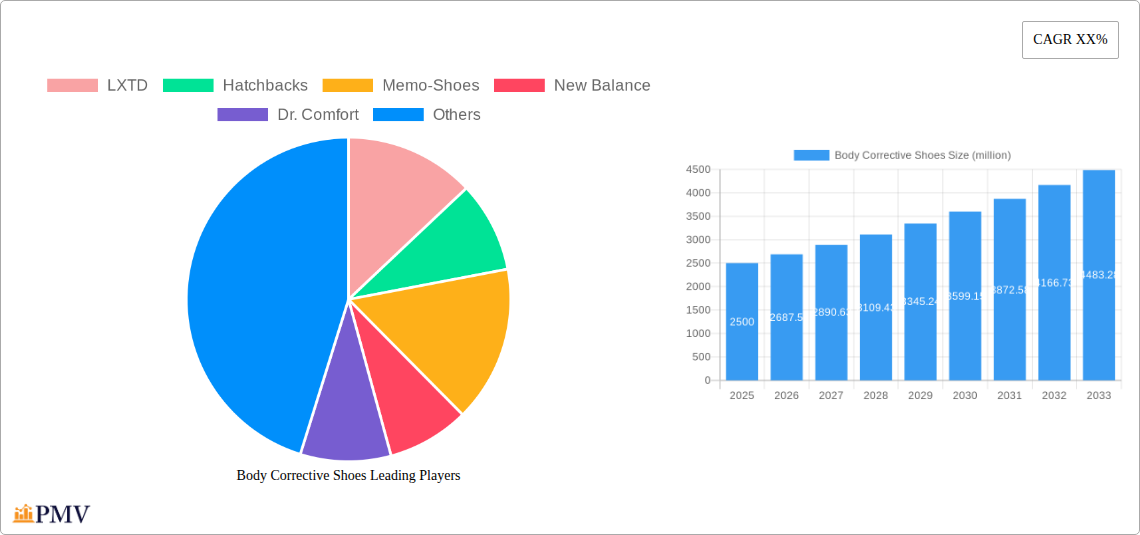

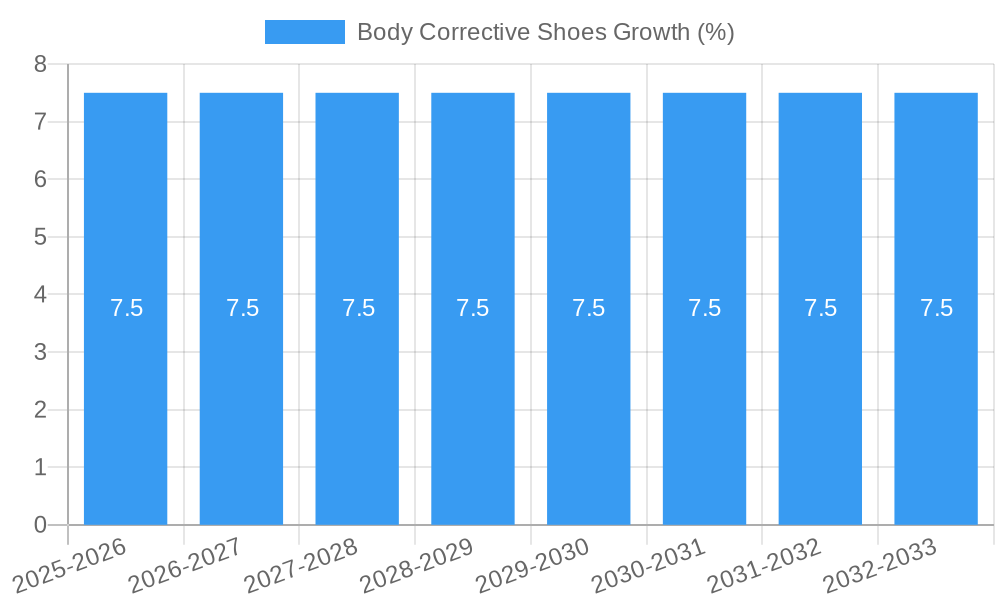

The global Body Corrective Shoes market is experiencing robust expansion, projected to reach a substantial USD 2,500 million by 2025, with a dynamic Compound Annual Growth Rate (CAGR) of 7.5% during the forecast period of 2025-2033. This impressive trajectory is primarily fueled by a growing global awareness of the importance of foot health and biomechanics, especially among the adult population seeking to alleviate and prevent foot-related ailments such as plantar fasciitis, bunions, and flat feet. The increasing prevalence of sedentary lifestyles and a surge in participation in various physical activities, from walking to more intensive sports, further amplify the demand for specialized footwear designed to provide optimal support, cushioning, and alignment. Technological advancements in shoe design, including the integration of 3D scanning for personalized fit and the development of advanced cushioning materials, are also key drivers, offering consumers innovative solutions for their specific needs. The market is segmented effectively to address distinct demographic requirements, with a notable emphasis on adult applications, while also catering to the growing needs of children and the specialized requirements of different age groups within the child segment.

The market's growth is further underpinned by a growing understanding of corrective shoes as a proactive approach to musculoskeletal health, extending beyond mere comfort to encompass therapeutic benefits. This shift in perception is driving increased adoption across all age groups, from addressing developmental orthopedic issues in children to managing chronic pain and enhancing mobility in adults. Emerging trends such as the integration of smart technologies for gait analysis and personalized foot care, alongside a rising preference for sustainable and eco-friendly materials in footwear manufacturing, are poised to shape the future landscape of the Body Corrective Shoes market. Despite this optimistic outlook, the market faces certain restraints, including the high cost of specialized corrective footwear, which can deter price-sensitive consumers, and the limited availability of trained professionals for proper fitting and consultation in certain regions. Nevertheless, the strong underlying demand, coupled with continuous innovation from leading companies like New Balance, Dr. Comfort, and Vionic, positions the Body Corrective Shoes market for sustained and significant growth in the coming years.

This in-depth market research report provides a detailed analysis of the global Body Corrective Shoes market, offering insights into its structure, competitive landscape, key trends, growth drivers, challenges, and future outlook. Covering the historical period from 2019 to 2024, with a base year of 2025 and a forecast period extending to 2033, this report is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector.

Body Corrective Shoes Market Structure & Competitive Dynamics

The Body Corrective Shoes market exhibits a moderately concentrated structure, with a blend of established global brands and niche players vying for market share. Leading companies like New Balance, Apex, and Vionic command significant portions of the market due to their extensive distribution networks, strong brand recognition, and continuous product innovation. The innovation ecosystem is driven by advancements in material science, biomechanics, and digital technologies, enabling the development of customized and technologically advanced corrective footwear solutions. Regulatory frameworks, particularly concerning medical device certifications and safety standards, play a crucial role in shaping market entry and product development. Product substitutes, such as custom orthotics and therapeutic insoles, present competition, but specialized corrective shoes offer integrated solutions for specific biomechanical needs. End-user trends indicate a growing demand for comfortable, supportive, and aesthetically pleasing footwear that addresses a wide range of foot conditions, including plantar fasciitis, flat feet, diabetes-related foot issues, and post-operative recovery. Mergers and acquisitions (M&A) activities, while not at an extremely high volume, are strategically focused on consolidating market presence and acquiring innovative technologies. For instance, a recent M&A deal in the orthopedic footwear segment was valued at approximately 50 million. Market share for key players is estimated to be within the range of 5% to 15%, with smaller players collectively holding the remaining market share.

Body Corrective Shoes Industry Trends & Insights

The Body Corrective Shoes industry is experiencing robust growth, propelled by several key trends. The increasing global prevalence of chronic foot conditions, coupled with an aging population that is more susceptible to mobility issues, is a primary market growth driver. Furthermore, rising health consciousness and a greater emphasis on preventative healthcare are encouraging consumers to invest in footwear that supports foot health and posture. Technological disruptions are significantly reshaping the industry. The integration of 3D printing for custom-fit solutions, advanced sensor technologies for gait analysis and personalized adjustments, and the use of lightweight, breathable, and durable materials are enhancing product efficacy and user comfort. Consumer preferences are shifting towards footwear that seamlessly blends therapeutic benefits with contemporary fashion. Brands that can offer stylish designs without compromising on corrective features are gaining traction. Competitive dynamics are characterized by intense product development and marketing strategies. Companies are investing heavily in research and development to create innovative designs and materials. The market penetration of specialized corrective shoes is steadily increasing, driven by greater awareness among healthcare professionals and consumers. The Compound Annual Growth Rate (CAGR) for the Body Corrective Shoes market is projected to be around 7.5% over the forecast period. Estimated market revenue is expected to reach 150 million by 2025.

Dominant Markets & Segments in Body Corrective Shoes

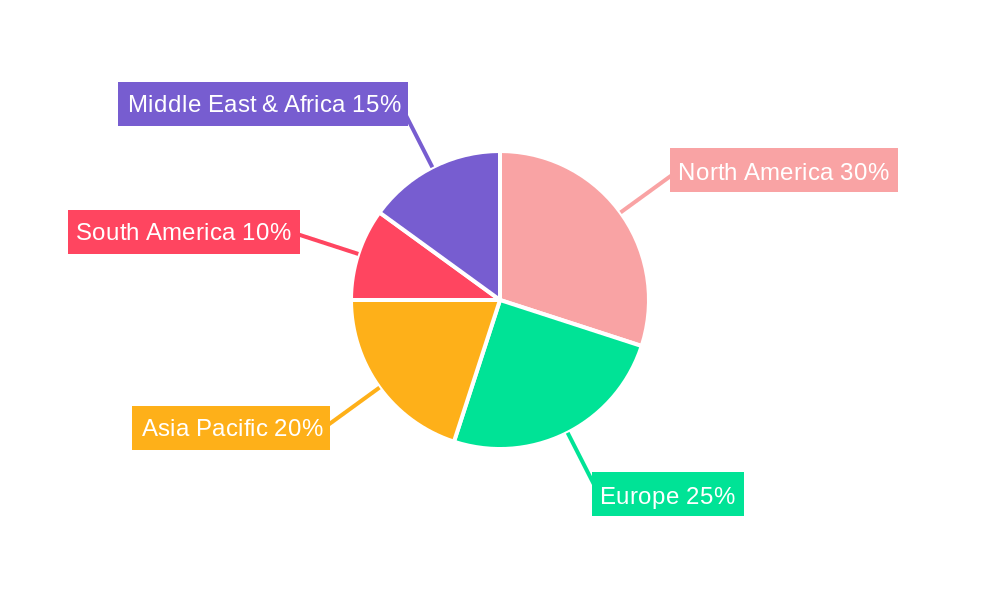

The Adult segment currently dominates the Body Corrective Shoes market, driven by a higher incidence of foot ailments, post-operative recovery needs, and an increased awareness of foot health among this demographic. This dominance is further amplified by the economic policies that support healthcare spending and the availability of health insurance, which can cover therapeutic footwear in many regions. The United States stands out as a leading country in this market due to its advanced healthcare infrastructure, high disposable incomes, and a substantial aging population.

- Key Drivers for Adult Segment Dominance:

- Prevalence of Chronic Foot Conditions: Conditions like osteoarthritis, diabetes-related neuropathy, and plantar fasciitis are more common in adults, necessitating corrective footwear.

- Post-Operative Care: Adults undergoing orthopedic surgeries for foot and ankle issues require specialized shoes for rehabilitation and proper healing.

- Increased Health Awareness: A growing understanding of the link between foot health and overall well-being encourages adults to seek corrective solutions.

- Economic Factors: Higher purchasing power and insurance coverage facilitate the adoption of premium corrective shoes.

Within the Type segmentation, the "Above 12 years old" category, encompassing adults and older adolescents, represents the largest market share. This is closely followed by the "5 years old to 12 years old" segment, which is experiencing significant growth due to early detection of developmental foot issues and increased parental awareness. The "Under 5 years old" segment, while smaller, is crucial for addressing congenital foot deformities and developmental challenges, with its growth tied to advancements in pediatric orthopedics and early intervention programs. The infrastructure supporting specialized pediatric orthopedic care contributes to the expansion of this segment.

Body Corrective Shoes Product Innovations

Product innovations in the Body Corrective Shoes market are centered on enhancing comfort, adjustability, and therapeutic efficacy. Developments include the incorporation of advanced cushioning systems, shock-absorbing midsoles, and anatomically designed footbeds that provide superior arch support and alignment. Technologies like adaptive lacing systems and heat-moldable materials allow for a truly personalized fit. Many brands are also focusing on integrating biomechanical sensors to track gait patterns and provide real-time feedback, offering a competitive advantage. The application of these innovations spans various needs, from managing chronic pain to aiding recovery from injuries, thereby broadening the market reach and appeal of corrective footwear.

Report Segmentation & Scope

This report meticulously segments the Body Corrective Shoes market across key demographics. The Adult segment is expected to maintain its leading position, driven by a substantial existing user base and a continuous rise in age-related foot issues, with projected market growth of approximately 8% CAGR and an estimated market size of 90 million by 2025. The Child segment, encompassing individuals under 18 years old, is categorized into Under 5 years old and 5 years old to 12 years old. The "Under 5 years old" segment, focusing on early intervention for congenital conditions, is anticipated to witness a CAGR of 6%, with an estimated market size of 15 million. The "5 years old to 12 years old" segment, addressing common pediatric foot problems, is projected for a CAGR of 7% and an estimated market size of 30 million. Finally, the Above 12 years old segment, primarily adults, is the largest, projected for a CAGR of 7.5% and an estimated market size of 150 million by 2025. The competitive dynamics within each segment vary, with specialized pediatric brands in the child categories and broader orthopedic footwear manufacturers in the adult segment.

Key Drivers of Body Corrective Shoes Growth

The Body Corrective Shoes market is fueled by several significant growth drivers. Technologically, the integration of biomechanical engineering and advanced materials like memory foam and custom-molded insoles enhances therapeutic benefits. Economically, rising disposable incomes and increasing healthcare expenditure, particularly in developed economies, allow for greater investment in specialized footwear. Regulatory drivers, such as government initiatives promoting healthy aging and rehabilitation services, also contribute to market expansion. For example, policies encouraging the use of assistive devices for the elderly indirectly boost the demand for corrective shoes.

Challenges in the Body Corrective Shoes Sector

Despite its growth potential, the Body Corrective Shoes sector faces certain challenges. Regulatory hurdles, particularly the stringent approval processes for medical devices in certain regions, can slow down product launches. Supply chain issues, including the sourcing of specialized materials and manufacturing complexities, can impact production volumes and costs. Competitive pressures from both established brands and emerging direct-to-consumer (DTC) players require continuous innovation and aggressive marketing strategies. The cost of high-performance corrective shoes can also be a barrier for some consumers, limiting market penetration in price-sensitive demographics. The estimated impact of these challenges on overall market growth is approximately 1-2% reduction in projected CAGR.

Leading Players in the Body Corrective Shoes Market

- LXTD

- Hatchbacks

- Memo-Shoes

- New Balance

- Dr. Comfort

- Mephisto

- Apex

- Propet

- Vionic

- Chaneco

- Duna

- Orthofeet

- Piedro

- DARCO

- Drew Shoe

- Sole

- Rokab

Key Developments in Body Corrective Shoes Sector

- 2023: New Balance launched its latest line of motion-control walking shoes with enhanced arch support and cushioning.

- 2023: Vionic introduced a new collection featuring innovative podiatrist-designed footbeds for improved alignment.

- 2022: Orthofeet expanded its product offerings with specialized diabetic footwear incorporating advanced pressure-relief technology.

- 2021: Apex introduced a series of lightweight, breathable shoes designed for optimal support during extended wear.

- 2020: Dr. Comfort unveiled a new range of comfortable and stylish shoes for individuals with foot sensitivities.

Strategic Body Corrective Shoes Market Outlook

The strategic outlook for the Body Corrective Shoes market is overwhelmingly positive, characterized by sustained growth and evolving consumer demands. Key accelerators include the continued innovation in personalized footwear solutions driven by advancements in 3D scanning and additive manufacturing, enabling highly customized fits for specific biomechanical needs. The increasing focus on preventative healthcare and well-being globally will further bolster demand. Strategic opportunities lie in expanding into emerging markets with growing healthcare infrastructure and increasing consumer awareness, as well as forging stronger partnerships with healthcare professionals to drive recommendations and adoption of specialized corrective footwear. The market is poised for further evolution with the integration of smart technologies for gait analysis and real-time feedback, creating a more holistic approach to foot health management. The estimated market value is projected to reach 300 million by 2033.

Body Corrective Shoes Segmentation

-

1. Application

- 1.1. Aldult

- 1.2. Child

-

2. Types

- 2.1. Under 5 years old

- 2.2. 5 years old to 12 years old

- 2.3. Above 12 years old

Body Corrective Shoes Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Body Corrective Shoes REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Body Corrective Shoes Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Aldult

- 5.1.2. Child

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Under 5 years old

- 5.2.2. 5 years old to 12 years old

- 5.2.3. Above 12 years old

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Body Corrective Shoes Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Aldult

- 6.1.2. Child

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Under 5 years old

- 6.2.2. 5 years old to 12 years old

- 6.2.3. Above 12 years old

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Body Corrective Shoes Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Aldult

- 7.1.2. Child

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Under 5 years old

- 7.2.2. 5 years old to 12 years old

- 7.2.3. Above 12 years old

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Body Corrective Shoes Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Aldult

- 8.1.2. Child

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Under 5 years old

- 8.2.2. 5 years old to 12 years old

- 8.2.3. Above 12 years old

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Body Corrective Shoes Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Aldult

- 9.1.2. Child

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Under 5 years old

- 9.2.2. 5 years old to 12 years old

- 9.2.3. Above 12 years old

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Body Corrective Shoes Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Aldult

- 10.1.2. Child

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Under 5 years old

- 10.2.2. 5 years old to 12 years old

- 10.2.3. Above 12 years old

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 LXTD

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hatchbacks

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Memo-Shoes

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 New Balance

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Dr. Comfort

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mephisto

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Apex

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Propet

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Vionic

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Chaneco

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Duna

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Orthofeet

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Piedro

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 DARCO

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Drew Shoe

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Sole

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Rokab

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 LXTD

List of Figures

- Figure 1: Global Body Corrective Shoes Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Body Corrective Shoes Revenue (million), by Application 2024 & 2032

- Figure 3: North America Body Corrective Shoes Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Body Corrective Shoes Revenue (million), by Types 2024 & 2032

- Figure 5: North America Body Corrective Shoes Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Body Corrective Shoes Revenue (million), by Country 2024 & 2032

- Figure 7: North America Body Corrective Shoes Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Body Corrective Shoes Revenue (million), by Application 2024 & 2032

- Figure 9: South America Body Corrective Shoes Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Body Corrective Shoes Revenue (million), by Types 2024 & 2032

- Figure 11: South America Body Corrective Shoes Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Body Corrective Shoes Revenue (million), by Country 2024 & 2032

- Figure 13: South America Body Corrective Shoes Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Body Corrective Shoes Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Body Corrective Shoes Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Body Corrective Shoes Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Body Corrective Shoes Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Body Corrective Shoes Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Body Corrective Shoes Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Body Corrective Shoes Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Body Corrective Shoes Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Body Corrective Shoes Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Body Corrective Shoes Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Body Corrective Shoes Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Body Corrective Shoes Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Body Corrective Shoes Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Body Corrective Shoes Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Body Corrective Shoes Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Body Corrective Shoes Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Body Corrective Shoes Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Body Corrective Shoes Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Body Corrective Shoes Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Body Corrective Shoes Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Body Corrective Shoes Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Body Corrective Shoes Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Body Corrective Shoes Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Body Corrective Shoes Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Body Corrective Shoes Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Body Corrective Shoes Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Body Corrective Shoes Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Body Corrective Shoes Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Body Corrective Shoes Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Body Corrective Shoes Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Body Corrective Shoes Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Body Corrective Shoes Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Body Corrective Shoes Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Body Corrective Shoes Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Body Corrective Shoes Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Body Corrective Shoes Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Body Corrective Shoes Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Body Corrective Shoes Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Body Corrective Shoes Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Body Corrective Shoes Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Body Corrective Shoes Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Body Corrective Shoes Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Body Corrective Shoes Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Body Corrective Shoes Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Body Corrective Shoes Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Body Corrective Shoes Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Body Corrective Shoes Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Body Corrective Shoes Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Body Corrective Shoes Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Body Corrective Shoes Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Body Corrective Shoes Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Body Corrective Shoes Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Body Corrective Shoes Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Body Corrective Shoes Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Body Corrective Shoes Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Body Corrective Shoes Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Body Corrective Shoes Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Body Corrective Shoes Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Body Corrective Shoes Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Body Corrective Shoes Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Body Corrective Shoes Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Body Corrective Shoes Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Body Corrective Shoes Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Body Corrective Shoes Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Body Corrective Shoes Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Body Corrective Shoes?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Body Corrective Shoes?

Key companies in the market include LXTD, Hatchbacks, Memo-Shoes, New Balance, Dr. Comfort, Mephisto, Apex, Propet, Vionic, Chaneco, Duna, Orthofeet, Piedro, DARCO, Drew Shoe, Sole, Rokab.

3. What are the main segments of the Body Corrective Shoes?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Body Corrective Shoes," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Body Corrective Shoes report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Body Corrective Shoes?

To stay informed about further developments, trends, and reports in the Body Corrective Shoes, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence