Key Insights

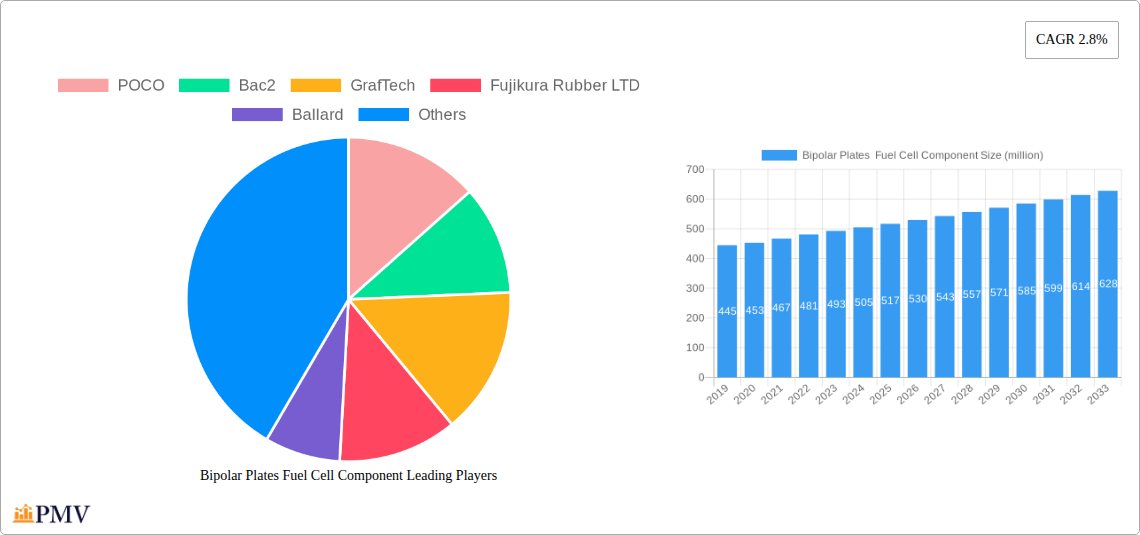

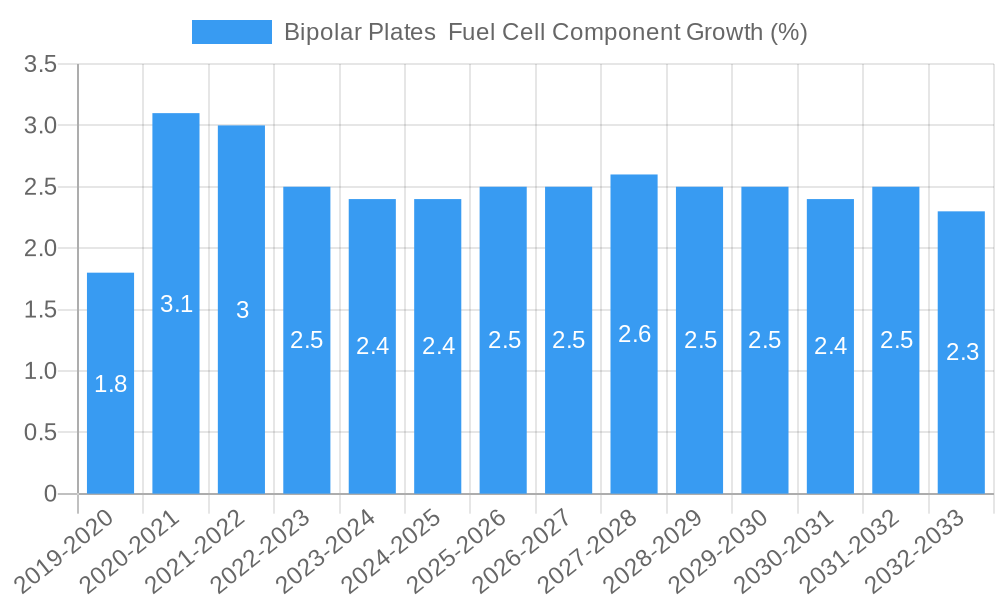

The global Bipolar Plates Fuel Cell Component market is projected to reach a significant valuation, driven by the escalating demand for clean energy solutions and the robust growth of the fuel cell industry. With a current market size of $505 million, the sector is anticipated to expand at a Compound Annual Growth Rate (CAGR) of 2.8% from 2019 to 2033. This steady growth is primarily fueled by advancements in fuel cell technology, particularly in the automotive sector where hydrogen fuel cells are increasingly being adopted for their zero-emission capabilities. The continuous innovation in materials science, leading to more durable, lightweight, and cost-effective bipolar plate designs, is a key driver. Furthermore, governmental initiatives and investments aimed at decarbonization and the promotion of sustainable transportation are creating a favorable environment for market expansion. The integration of fuel cells in various applications beyond transportation, such as stationary power generation and portable electronics, is also contributing to the overall market trajectory.

Despite the positive outlook, the market faces certain restraints, including the high manufacturing costs associated with advanced bipolar plate materials and complex production processes. The limited availability of a robust hydrogen refueling infrastructure in many regions also poses a challenge to widespread fuel cell adoption, indirectly impacting bipolar plate demand. However, ongoing research and development efforts focused on reducing production costs and improving the efficiency and lifespan of fuel cells are expected to mitigate these restraints. Emerging trends such as the development of novel composite materials, 3D-printed bipolar plates, and smart manufacturing techniques are poised to revolutionize the industry, paving the way for enhanced performance and reduced costs. The market is segmented by application, encompassing automotive, stationary power, and portable devices, and by type, including graphite, metal, and polymer composite bipolar plates, each catering to specific performance and cost requirements. Leading companies like POCO, Ballard, and GrafTech are at the forefront of innovation, contributing to the dynamic evolution of this crucial fuel cell component market.

This comprehensive report delves into the dynamic Bipolar Plates Fuel Cell Component market, providing an in-depth analysis of its structure, trends, and future outlook. Covering the Study Period: 2019–2033, with a Base Year: 2025, Estimated Year: 2025, and Forecast Period: 2025–2033, this report offers crucial insights for stakeholders involved in fuel cell component manufacturing, bipolar plate technology, hydrogen fuel cell development, and automotive fuel cell applications.

Bipolar Plates Fuel Cell Component Market Structure & Competitive Dynamics

The bipolar plates fuel cell market exhibits a moderately concentrated structure, with leading players like POCO, GrafTech, and Ballard holding significant market shares, estimated to be over 50% collectively. Innovation ecosystems are robust, driven by continuous R&D in advanced materials and manufacturing processes. Regulatory frameworks, particularly those promoting green hydrogen adoption and zero-emission vehicles, are increasingly shaping market entry and product development. Product substitutes, such as advanced metallic bipolar plates and composites, are emerging, intensifying competition. End-user trends favor lightweight, durable, and cost-effective solutions for a variety of fuel cell applications, including transportation and stationary power. Merger and acquisition (M&A) activities are on the rise, with notable deals contributing to market consolidation and technology acquisition. For instance, strategic partnerships and smaller acquisitions in the graphite bipolar plate and composite bipolar plate segments are anticipated to exceed 100 million in total deal value over the forecast period. The increasing demand for high-performance fuel cell stacks necessitates sophisticated bipolar plate designs, driving collaborative efforts and technological advancements across the value chain.

Bipolar Plates Fuel Cell Component Industry Trends & Insights

The bipolar plates fuel cell component industry is poised for substantial growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 15% during the Forecast Period: 2025–2033. This expansion is primarily fueled by the burgeoning adoption of hydrogen fuel cell technology across diverse sectors, most notably in the automotive industry for electric vehicle (EV) powertrains. Governments worldwide are implementing ambitious decarbonization targets and providing substantial subsidies for hydrogen fuel cell vehicles, directly stimulating demand for critical components like bipolar plates. Technological disruptions are at the forefront, with significant advancements in materials science leading to the development of lighter, more conductive, and corrosion-resistant bipolar plates. These innovations are crucial for enhancing fuel cell efficiency and longevity. Consumer preferences are increasingly leaning towards sustainable and eco-friendly transportation solutions, further accelerating the shift towards fuel cell-powered vehicles. Competitive dynamics are characterized by intense innovation, with companies vying to offer superior performance at competitive price points. The market penetration of fuel cell technology, while still in its nascent stages for some applications, is projected to reach over 25% in the heavy-duty vehicle segment by 2030. The development of novel manufacturing techniques, such as advanced stamping and laser welding for metallic bipolar plates and precision molding for composite variants, is also a key trend, enabling higher production volumes and reduced costs. The integration of advanced coatings and surface treatments is also critical for improving durability and performance under harsh operating conditions.

Dominant Markets & Segments in Bipolar Plates Fuel Cell Component

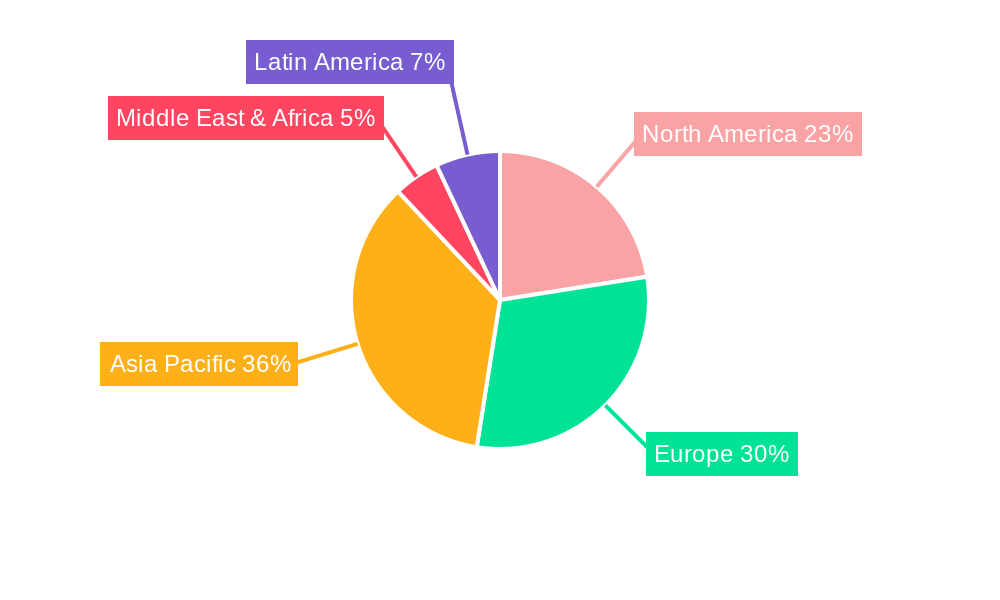

The Application: Transportation Fuel Cells segment is currently the dominant force in the bipolar plates fuel cell component market, driven by the relentless pursuit of zero-emission mobility solutions. Within this segment, Type: Automotive Fuel Cells commands the largest share, accounting for an estimated 70% of the total market value. The Region: Asia Pacific, particularly Country: China, is emerging as a leading market due to robust government support for the hydrogen economy, significant investments in fuel cell manufacturing infrastructure, and the presence of major automotive manufacturers like Chery Automobile and HONDA. Key drivers for this dominance include:

- Economic Policies: Favorable government incentives, tax credits, and subsidies for fuel cell vehicle production and adoption.

- Infrastructure Development: Rapid expansion of hydrogen refueling stations and supporting infrastructure across major cities and industrial hubs.

- Technological Advancements: Localized R&D efforts and collaborations leading to the development of cost-effective and high-performance fuel cell systems.

- Market Size: The sheer scale of the automotive market in Asia Pacific provides a vast potential customer base for fuel cell vehicles.

Furthermore, the Application: Stationary Fuel Cells segment, encompassing backup power and distributed power generation, is also witnessing steady growth, with a projected market size of over 500 million by 2033. Within this, Type: PEMFC (Proton Exchange Membrane Fuel Cell) remains the most prevalent technology, driving demand for specialized bipolar plates. The Region: Europe also holds significant influence, driven by stringent emission regulations and a strong commitment to renewable energy sources, with companies like Ballard and Graebener playing crucial roles.

Bipolar Plates Fuel Cell Component Product Innovations

Product innovations in the bipolar plates fuel cell component sector are primarily focused on enhancing conductivity, reducing weight, improving corrosion resistance, and lowering manufacturing costs. Advances in composite materials, such as carbon fiber reinforced polymers and graphite-polymer composites, are yielding bipolar plates that offer superior mechanical strength and electrical conductivity at a significantly lower cost compared to traditional graphite or stainless steel. For metallic bipolar plates, innovations in stamping techniques and surface treatments are leading to thinner, more robust, and highly conductive designs. These advancements enable fuel cell manufacturers to produce more efficient and durable fuel cell stacks for a wider range of applications, from passenger cars to heavy-duty trucks and stationary power systems. The competitive advantage lies in achieving a balance between performance, durability, and cost-effectiveness.

Report Segmentation & Scope

This report meticulously segments the bipolar plates fuel cell component market across key parameters. The Application segmentation includes Transportation Fuel Cells (e.g., automotive, heavy-duty vehicles, marine, aerospace) and Stationary Fuel Cells (e.g., backup power, distributed generation, micro-CHP). The Type segmentation covers Graphite Bipolar Plates, Metallic Bipolar Plates (e.g., stainless steel, titanium), and Composite Bipolar Plates. The Transportation Fuel Cells segment, driven by the automotive sector, is projected to maintain its leadership position, with an estimated market size of over 3 billion by 2033. The Graphite Bipolar Plates segment is expected to hold a substantial market share due to its established performance characteristics, while Metallic Bipolar Plates are gaining traction due to cost advantages and scalability. The Composite Bipolar Plates segment, with its ongoing material science advancements, is anticipated to witness the highest growth rate, offering a compelling blend of performance and cost.

Key Drivers of Bipolar Plates Fuel Cell Component Growth

The growth of the bipolar plates fuel cell component market is propelled by several key factors. Technological advancements in material science, particularly in lightweight and conductive composites, are enabling the development of more efficient and cost-effective bipolar plates. Economic factors, such as increasing investments in the hydrogen economy and the declining cost of fuel cell systems, are making hydrogen fuel cells a more viable alternative to traditional internal combustion engines. Regulatory drivers, including government mandates for zero-emission vehicles and supportive policies for renewable energy, are creating a favorable market environment. For instance, the European Union's Fit for 55 package and China's New Energy Vehicle (NEV) policy are significant catalysts. The growing demand for cleaner energy solutions across transportation and stationary power applications is creating a substantial market opportunity.

Challenges in the Bipolar Plates Fuel Cell Component Sector

Despite the promising growth trajectory, the bipolar plates fuel cell component sector faces several challenges. Regulatory hurdles related to standardization and certification processes for new materials and designs can slow down market adoption. Supply chain complexities, particularly for raw materials like graphite and specialized alloys, can lead to price volatility and production bottlenecks. Competitive pressures from established automotive manufacturers and alternative powertrain technologies, such as battery electric vehicles, necessitate continuous innovation and cost reduction. The high initial cost of fuel cell systems, although decreasing, remains a barrier for widespread consumer adoption in some segments. Overcoming these challenges requires sustained R&D investment, strategic partnerships, and robust market education initiatives. The estimated impact of these challenges on overall market growth is a potential reduction of 5% in the projected CAGR if not effectively addressed.

Leading Players in the Bipolar Plates Fuel Cell Component Market

- POCO

- Bac2

- GrafTech

- Fujikura Rubber LTD

- Ballard

- Dana

- Cellimpact

- Grabener

- Treadstione

- HONDA

- Porvair

- ORNL

- Chery Automobile

- Shanghai Hongfeng

- SUNRISE POWER

- Kyushu

- Advanced Technology & Materials

- ZHIZHEN NEW ENERGY

Key Developments in Bipolar Plates Fuel Cell Component Sector

- 2023: GrafTech introduces a new line of high-performance graphite bipolar plates for heavy-duty truck applications.

- 2023: Ballard Power Systems announces a strategic partnership with a major automotive OEM to develop next-generation fuel cell stacks, likely involving advanced bipolar plate technology.

- 2022: Cellimpact completes a significant capacity expansion for its advanced composite bipolar plates, responding to increasing demand.

- 2022: HONDA showcases a prototype fuel cell vehicle featuring a redesigned fuel cell stack with potentially novel bipolar plate integration.

- 2021: ORNL publishes research on novel metallic bipolar plate coatings for enhanced durability, potentially impacting the market in the coming years.

- 2020: Chery Automobile announces plans to significantly increase its investment in fuel cell vehicle development, signaling increased demand for components.

- 2019: Fujikura Rubber LTD announces a breakthrough in flexible bipolar plate technology for micro-fuel cell applications.

Strategic Bipolar Plates Fuel Cell Component Market Outlook

- 2023: GrafTech introduces a new line of high-performance graphite bipolar plates for heavy-duty truck applications.

- 2023: Ballard Power Systems announces a strategic partnership with a major automotive OEM to develop next-generation fuel cell stacks, likely involving advanced bipolar plate technology.

- 2022: Cellimpact completes a significant capacity expansion for its advanced composite bipolar plates, responding to increasing demand.

- 2022: HONDA showcases a prototype fuel cell vehicle featuring a redesigned fuel cell stack with potentially novel bipolar plate integration.

- 2021: ORNL publishes research on novel metallic bipolar plate coatings for enhanced durability, potentially impacting the market in the coming years.

- 2020: Chery Automobile announces plans to significantly increase its investment in fuel cell vehicle development, signaling increased demand for components.

- 2019: Fujikura Rubber LTD announces a breakthrough in flexible bipolar plate technology for micro-fuel cell applications.

Strategic Bipolar Plates Fuel Cell Component Market Outlook

The strategic outlook for the bipolar plates fuel cell component market is highly positive, driven by accelerating decarbonization efforts and technological advancements. The increasing demand for sustainable transportation and energy solutions presents significant growth accelerators. Companies that focus on developing lightweight, cost-effective, and highly conductive bipolar plates, particularly those leveraging advanced composite and optimized metallic designs, are well-positioned to capture market share. Strategic opportunities lie in forging strong partnerships with fuel cell system manufacturers and automotive OEMs, investing in advanced manufacturing capabilities, and aligning with evolving regulatory landscapes. The continuous innovation in materials and manufacturing processes will be crucial for unlocking the full potential of the fuel cell market and solidifying the role of bipolar plates as a cornerstone component.

Bipolar Plates Fuel Cell Component Segmentation

-

1. Application

- 1.1. undefined

-

2. Type

- 2.1. undefined

Bipolar Plates Fuel Cell Component Segmentation By Geography

- 1. undefined

- 2. undefined

- 3. undefined

- 4. undefined

- 5. undefined

Bipolar Plates Fuel Cell Component REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.8% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Bipolar Plates Fuel Cell Component Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1.

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1.

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1.

- 5.3.2.

- 5.3.3.

- 5.3.4.

- 5.3.5.

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. undefined Bipolar Plates Fuel Cell Component Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1.

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1.

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. undefined Bipolar Plates Fuel Cell Component Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1.

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1.

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. undefined Bipolar Plates Fuel Cell Component Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1.

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1.

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. undefined Bipolar Plates Fuel Cell Component Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1.

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1.

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. undefined Bipolar Plates Fuel Cell Component Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1.

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1.

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 POCO

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bac2

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 GrafTech

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Fujikura Rubber LTD

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ballard

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dana

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cellimpact

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Grabener

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Treadstione

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 HONDA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Porvair

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 ORNL

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Chery Automobile

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Shanghai Hongfeng

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 SUNRISE POWER

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Kyushu

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Advanced Technology & Materials

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 ZHIZHEN NEW ENERGY

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 POCO

List of Figures

- Figure 1: Global Bipolar Plates Fuel Cell Component Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: undefined Bipolar Plates Fuel Cell Component Revenue (million), by Application 2024 & 2032

- Figure 3: undefined Bipolar Plates Fuel Cell Component Revenue Share (%), by Application 2024 & 2032

- Figure 4: undefined Bipolar Plates Fuel Cell Component Revenue (million), by Type 2024 & 2032

- Figure 5: undefined Bipolar Plates Fuel Cell Component Revenue Share (%), by Type 2024 & 2032

- Figure 6: undefined Bipolar Plates Fuel Cell Component Revenue (million), by Country 2024 & 2032

- Figure 7: undefined Bipolar Plates Fuel Cell Component Revenue Share (%), by Country 2024 & 2032

- Figure 8: undefined Bipolar Plates Fuel Cell Component Revenue (million), by Application 2024 & 2032

- Figure 9: undefined Bipolar Plates Fuel Cell Component Revenue Share (%), by Application 2024 & 2032

- Figure 10: undefined Bipolar Plates Fuel Cell Component Revenue (million), by Type 2024 & 2032

- Figure 11: undefined Bipolar Plates Fuel Cell Component Revenue Share (%), by Type 2024 & 2032

- Figure 12: undefined Bipolar Plates Fuel Cell Component Revenue (million), by Country 2024 & 2032

- Figure 13: undefined Bipolar Plates Fuel Cell Component Revenue Share (%), by Country 2024 & 2032

- Figure 14: undefined Bipolar Plates Fuel Cell Component Revenue (million), by Application 2024 & 2032

- Figure 15: undefined Bipolar Plates Fuel Cell Component Revenue Share (%), by Application 2024 & 2032

- Figure 16: undefined Bipolar Plates Fuel Cell Component Revenue (million), by Type 2024 & 2032

- Figure 17: undefined Bipolar Plates Fuel Cell Component Revenue Share (%), by Type 2024 & 2032

- Figure 18: undefined Bipolar Plates Fuel Cell Component Revenue (million), by Country 2024 & 2032

- Figure 19: undefined Bipolar Plates Fuel Cell Component Revenue Share (%), by Country 2024 & 2032

- Figure 20: undefined Bipolar Plates Fuel Cell Component Revenue (million), by Application 2024 & 2032

- Figure 21: undefined Bipolar Plates Fuel Cell Component Revenue Share (%), by Application 2024 & 2032

- Figure 22: undefined Bipolar Plates Fuel Cell Component Revenue (million), by Type 2024 & 2032

- Figure 23: undefined Bipolar Plates Fuel Cell Component Revenue Share (%), by Type 2024 & 2032

- Figure 24: undefined Bipolar Plates Fuel Cell Component Revenue (million), by Country 2024 & 2032

- Figure 25: undefined Bipolar Plates Fuel Cell Component Revenue Share (%), by Country 2024 & 2032

- Figure 26: undefined Bipolar Plates Fuel Cell Component Revenue (million), by Application 2024 & 2032

- Figure 27: undefined Bipolar Plates Fuel Cell Component Revenue Share (%), by Application 2024 & 2032

- Figure 28: undefined Bipolar Plates Fuel Cell Component Revenue (million), by Type 2024 & 2032

- Figure 29: undefined Bipolar Plates Fuel Cell Component Revenue Share (%), by Type 2024 & 2032

- Figure 30: undefined Bipolar Plates Fuel Cell Component Revenue (million), by Country 2024 & 2032

- Figure 31: undefined Bipolar Plates Fuel Cell Component Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Bipolar Plates Fuel Cell Component Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Bipolar Plates Fuel Cell Component Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Bipolar Plates Fuel Cell Component Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Bipolar Plates Fuel Cell Component Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Bipolar Plates Fuel Cell Component Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Bipolar Plates Fuel Cell Component Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Bipolar Plates Fuel Cell Component Revenue million Forecast, by Country 2019 & 2032

- Table 8: Global Bipolar Plates Fuel Cell Component Revenue million Forecast, by Application 2019 & 2032

- Table 9: Global Bipolar Plates Fuel Cell Component Revenue million Forecast, by Type 2019 & 2032

- Table 10: Global Bipolar Plates Fuel Cell Component Revenue million Forecast, by Country 2019 & 2032

- Table 11: Global Bipolar Plates Fuel Cell Component Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Bipolar Plates Fuel Cell Component Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Bipolar Plates Fuel Cell Component Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Bipolar Plates Fuel Cell Component Revenue million Forecast, by Application 2019 & 2032

- Table 15: Global Bipolar Plates Fuel Cell Component Revenue million Forecast, by Type 2019 & 2032

- Table 16: Global Bipolar Plates Fuel Cell Component Revenue million Forecast, by Country 2019 & 2032

- Table 17: Global Bipolar Plates Fuel Cell Component Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Bipolar Plates Fuel Cell Component Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Bipolar Plates Fuel Cell Component Revenue million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bipolar Plates Fuel Cell Component?

The projected CAGR is approximately 2.8%.

2. Which companies are prominent players in the Bipolar Plates Fuel Cell Component?

Key companies in the market include POCO, Bac2, GrafTech, Fujikura Rubber LTD, Ballard, Dana, Cellimpact, Grabener, Treadstione, HONDA, Porvair, ORNL, Chery Automobile, Shanghai Hongfeng, SUNRISE POWER, Kyushu, Advanced Technology & Materials, ZHIZHEN NEW ENERGY.

3. What are the main segments of the Bipolar Plates Fuel Cell Component?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 505 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bipolar Plates Fuel Cell Component," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bipolar Plates Fuel Cell Component report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bipolar Plates Fuel Cell Component?

To stay informed about further developments, trends, and reports in the Bipolar Plates Fuel Cell Component, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence