Key Insights

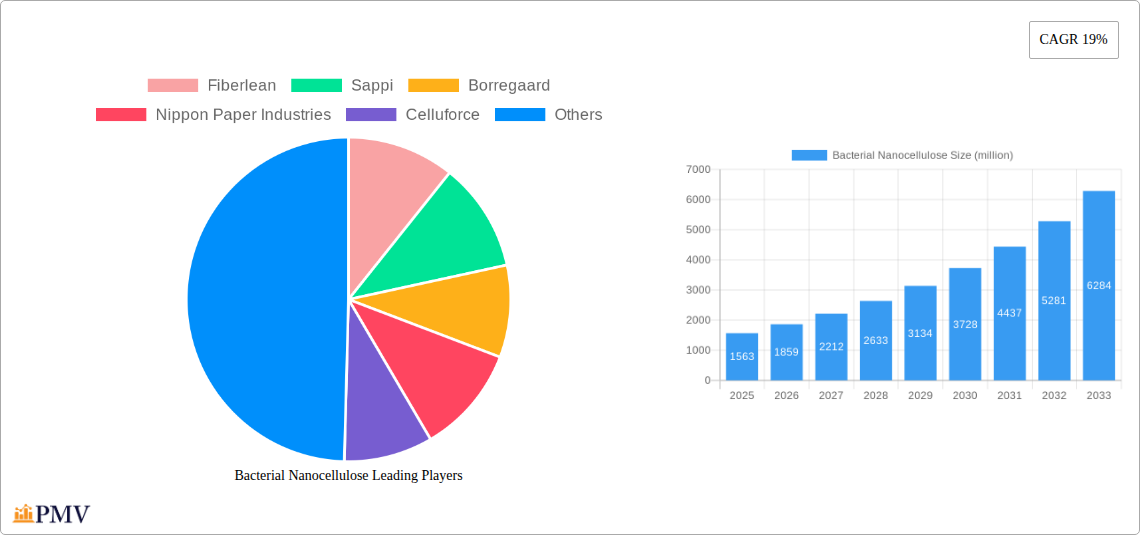

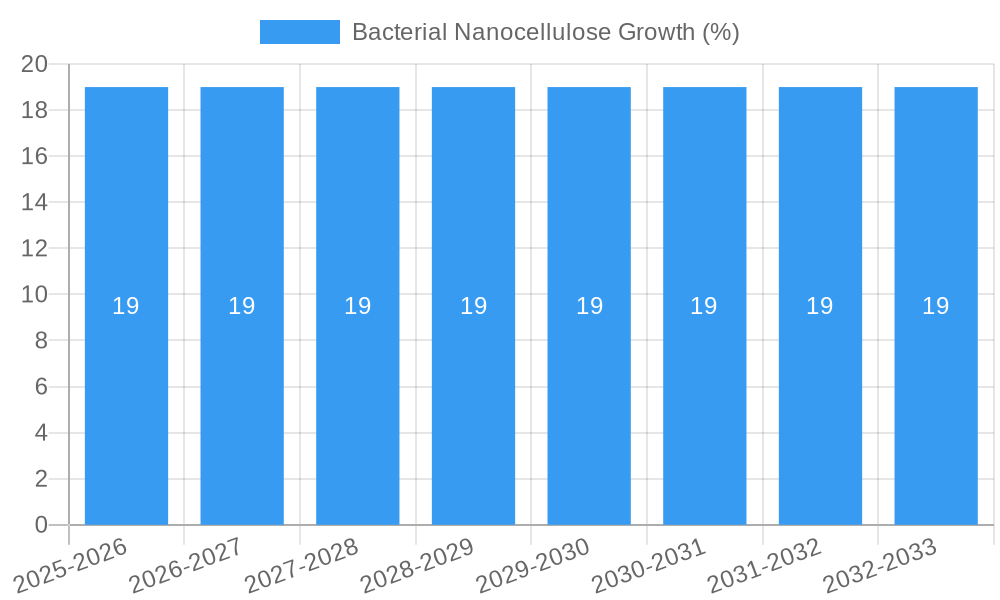

The global Bacterial Nanocellulose market is poised for remarkable expansion, projected to reach a substantial market size of $1563 million by 2025. This robust growth is fueled by an impressive Compound Annual Growth Rate (CAGR) of 19%, indicating a dynamic and rapidly evolving industry. The inherent versatility and superior properties of bacterial nanocellulose, such as its high tensile strength, purity, biocompatibility, and biodegradability, are driving its adoption across a wide array of applications. Key sectors like Paper and Packaging are leveraging its strength and barrier properties for sustainable alternatives, while Composites Materials benefit from its reinforcement capabilities. The Hygiene and Absorbent Products segment is seeing increased use for enhanced absorbency and comfort, and the Paints and Coatings industry is exploring its rheological and film-forming attributes. Furthermore, its biocompatibility makes it a promising material for the advanced Food and Biomedical and Pharmaceutical sectors, driving significant innovation and demand.

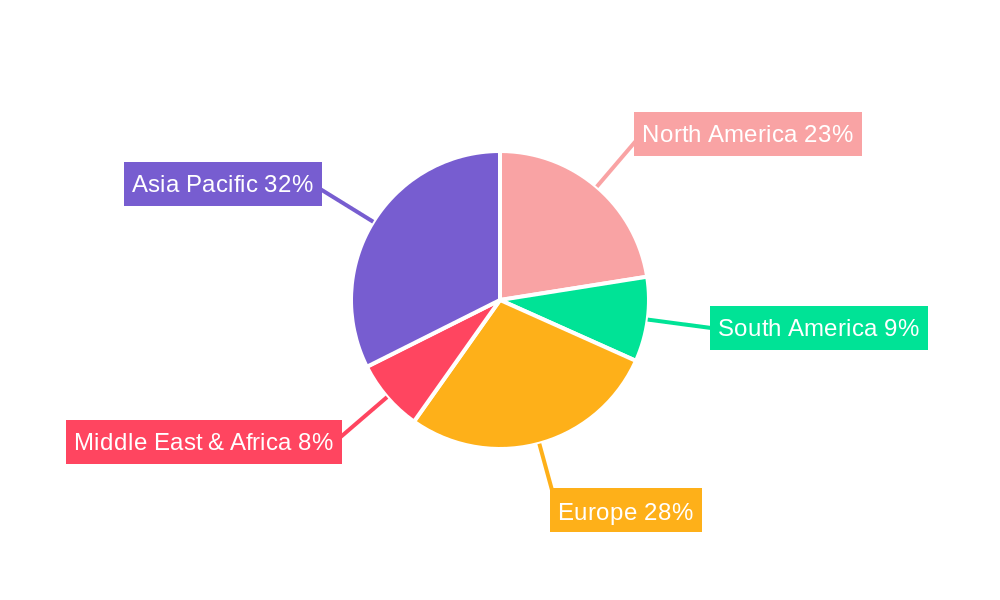

The market's upward trajectory is further propelled by several key drivers, including growing consumer demand for sustainable and eco-friendly materials, stringent government regulations favoring the use of biodegradable products, and continuous advancements in production technologies leading to cost efficiencies and improved material performance. Emerging trends such as the development of functionalized bacterial nanocellulose for specialized applications, its integration into smart materials, and the exploration of novel production methods are also contributing to market vitality. While challenges such as high initial production costs and scalability concerns exist, ongoing research and development, coupled with strategic collaborations among key players like Fiberlean, Sappi, and Borregaard, are expected to mitigate these restraints and pave the way for sustained market dominance. The Asia Pacific region, with its burgeoning industrial base and strong emphasis on sustainable solutions, is anticipated to be a major growth engine for bacterial nanocellulose.

Bacterial Nanocellulose: Comprehensive Market Analysis and Future Outlook (2019–2033)

This in-depth report provides a granular analysis of the global bacterial nanocellulose (BNC) market, a revolutionary biomaterial with burgeoning applications across diverse industries. Covering the historical period from 2019 to 2024, the base and estimated year of 2025, and a comprehensive forecast period from 2025 to 2033, this study delves into market dynamics, key trends, dominant segments, product innovations, strategic outlook, and the competitive landscape. Our analysis incorporates critical nanocellulose market size, bacterial cellulose applications, and biomaterial market trends to offer actionable insights for stakeholders.

Bacterial Nanocellulose Market Structure & Competitive Dynamics

The global bacterial nanocellulose market exhibits a dynamic structure characterized by a growing number of innovative players and increasing market concentration in specific segments. The innovation ecosystem is fueled by robust R&D investments, particularly in the biomedical nanocellulose and high-performance composites sectors. Regulatory frameworks, while still evolving, are becoming more defined, especially for food-grade nanocellulose and pharmaceutical applications. Product substitutes, primarily derived from plant cellulose, present a competitive challenge, necessitating continuous innovation in BNC's unique properties like superior mechanical strength and biocompatibility. End-user trends are increasingly favoring sustainable and bio-based materials, driving demand for BNC in eco-friendly packaging solutions and sustainable coatings. Mergers and acquisitions (M&A) activities are anticipated to shape the market landscape, with projected deal values in the range of hundreds of millions. Key players like Fiberlean, Sappi, Borregaard, Nippon Paper Industries, Celluforce, Oji Paper, and Hainan Guangyu Bio-technology are actively involved in strategic alliances and acquisitions to expand their market reach and product portfolios.

- Market Share Analysis: Detailed market share data for key players will be provided, illustrating the competitive positioning.

- M&A Deal Values: Estimated M&A deal values are projected to reach multi-million dollar figures in the coming years.

- Innovation Ecosystem: Focus on R&D hubs and university-industry collaborations driving BNC advancements.

- Regulatory Landscape: Overview of current and upcoming regulations impacting BNC production and application.

Bacterial Nanocellulose Industry Trends & Insights

The bacterial nanocellulose market growth is propelled by a confluence of technological advancements, escalating demand for sustainable materials, and expanding application horizons. The compound annual growth rate (CAGR) for the nanocellulose industry is projected to be significant, driven by its exceptional properties such as high tensile strength, excellent water-holding capacity, biocompatibility, and biodegradability. Technological disruptions, including advancements in fermentation processes and downstream processing techniques, are making BNC more cost-effective and scalable, thus boosting its market penetration. Consumer preferences are shifting towards bio-based and eco-friendly products across various sectors, from hygiene products to food packaging, directly benefiting BNC. The competitive dynamics are intensifying as new entrants leverage proprietary technologies and established players diversify their offerings. The increasing focus on circular economy principles and the reduction of plastic waste further amplify the appeal of BNC as a sustainable alternative. We project the market penetration of BNC in specialized applications to reach substantial levels by 2033, particularly in high-value segments like medical implants and advanced composites. The estimated market size for bacterial nanocellulose is expected to cross several thousand million by the end of the forecast period, a testament to its transformative potential.

Dominant Markets & Segments in Bacterial Nanocellulose

The bacterial nanocellulose market is experiencing robust growth across multiple regions and application segments. North America and Europe are currently leading in terms of market share, driven by strong R&D initiatives, supportive government policies promoting bio-based materials, and a high consumer demand for sustainable products. However, the Asia-Pacific region, particularly China and Japan, is rapidly emerging as a significant growth engine, fueled by expanding manufacturing capabilities and increasing investments in nanotechnology.

Within application segments, Biomedical and Pharmaceutical applications are a key driver, with BNC being utilized in wound dressings, tissue engineering scaffolds, drug delivery systems, and artificial organs. The biocompatibility and regenerative properties of BNC make it ideal for these high-value applications. The Paper and Packaging segment is also witnessing substantial traction, as manufacturers seek sustainable alternatives to traditional plastics and paper, leading to the development of novel biodegradable packaging materials. The Hygiene and Absorbent Products sector is another prominent area, where BNC's superior absorbency and softness are being leveraged in feminine hygiene products and diapers.

- Key Drivers for Biomedical and Pharmaceutical Dominance:

- Growing prevalence of chronic diseases.

- Advancements in regenerative medicine and tissue engineering.

- Strict regulations favoring biocompatible materials.

- Significant R&D investments by major pharmaceutical companies.

- Key Drivers for Paper and Packaging Dominance:

- Increasing consumer awareness of environmental issues.

- Government initiatives to curb plastic usage.

- Development of BNC-infused papers for enhanced barrier properties.

- Demand for sustainable and compostable packaging solutions.

- Type Segmentation: While plant cellulose remains a dominant source for nanocellulose, bacterial cellulose is carving out a significant niche due to its unique purity, intricate network structure, and ease of modification for specific applications, contributing to an estimated market share of several hundred million within the broader nanocellulose market.

Bacterial Nanocellulose Product Innovations

Recent product innovations in bacterial nanocellulose are focused on enhancing its performance characteristics and expanding its applicability across diverse sectors. Researchers and companies are developing BNC composites with enhanced mechanical strength and thermal stability for use in high-performance materials. Novel BNC formulations are being introduced for advanced wound healing, demonstrating accelerated tissue regeneration and reduced inflammation. In the food industry, BNC is being explored as a natural thickener and stabilizer with improved texture and shelf-life properties. The competitive advantage lies in BNC's inherent sustainability, biocompatibility, and ability to be precisely engineered at the nanoscale, offering unique functionalities not achievable with traditional materials. These advancements are paving the way for widespread adoption and market growth, with projected sales of new BNC-based products reaching hundreds of millions annually.

Report Segmentation & Scope

This report meticulously segments the bacterial nanocellulose market to provide granular insights into its diverse landscape. The primary segmentation is based on Application, encompassing Paper and Packaging, Composites Materials, Hygiene and Absorbent Products, Paints and Coatings, Food, Biomedical and Pharmaceutical, and Others. Each of these segments is analyzed for its current market size, projected growth rates, and key competitive dynamics, with the Biomedical and Pharmaceutical segment expected to witness the highest growth, potentially reaching thousands of millions by 2033. The second key segmentation is based on Type, differentiating between Plant Cellulose and Bacterial Cellulose. While Plant Cellulose forms the larger market share due to its established production methods, Bacterial Cellulose is analyzed for its unique properties and niche applications, with its market size projected to grow significantly and reach hundreds of millions within the forecast period.

- Paper and Packaging Segment: Focus on biodegradable films and coatings.

- Composites Materials Segment: Exploration of BNC in lightweight and high-strength composites.

- Hygiene and Absorbent Products Segment: Innovations in superabsorbent materials.

- Paints and Coatings Segment: Development of eco-friendly and functional coatings.

- Food Segment: Applications as functional food ingredients and packaging.

- Biomedical and Pharmaceutical Segment: Emphasis on wound care, drug delivery, and regenerative medicine.

- Others Segment: Includes electronics, textiles, and other emerging applications.

- Type: Plant Cellulose: Analysis of market share and growth within the broader nanocellulose landscape.

- Type: Bacterial Cellulose: Focus on niche applications and advanced functionalities.

Key Drivers of Bacterial Nanocellulose Growth

The exponential growth of the bacterial nanocellulose market is underpinned by several pivotal drivers. Technological advancements in biosynthesis and downstream processing are making BNC production more efficient and cost-effective, enabling its wider commercialization. The escalating global demand for sustainable and eco-friendly materials, driven by increasing environmental consciousness and stringent regulations against single-use plastics, is a primary catalyst. The exceptional properties of BNC, including its superior mechanical strength, biocompatibility, biodegradability, and high surface area, make it an attractive alternative in numerous applications. Government initiatives promoting bio-based industries and investments in nanotechnology research and development further fuel market expansion. Specific examples include the development of BNC-based hydrogels for advanced wound care and its incorporation into biodegradable food packaging to extend shelf life. The projected market size for bacterial nanocellulose is expected to reach several thousand million by 2033, driven by these factors.

Challenges in the Bacterial Nanocellulose Sector

Despite its promising outlook, the bacterial nanocellulose sector faces several challenges that could impede its widespread adoption. High production costs, particularly for large-scale manufacturing, remain a significant barrier, although ongoing research aims to optimize fermentation and purification processes to reduce costs to within millions for scaled operations. Scaling up production to meet growing market demand while maintaining product consistency and quality presents logistical hurdles. Regulatory hurdles, especially for applications in food and pharmaceuticals, require rigorous testing and approvals, potentially delaying market entry. Furthermore, competition from established and lower-cost materials, including other forms of nanocellulose like microcrystalline cellulose, necessitates continuous innovation and differentiation of BNC's unique value proposition. Supply chain complexities and the need for specialized infrastructure for BNC production and processing also pose challenges.

Leading Players in the Bacterial Nanocellulose Market

- Fiberlean

- Sappi

- Borregaard

- Nippon Paper Industries

- Celluforce

- Oji Paper

- Hainan Guangyu Bio-technology

Key Developments in Bacterial Nanocellulose Sector

- 2023/11: Launch of novel BNC-based wound dressings with enhanced antimicrobial properties, targeting a market segment estimated at tens of millions.

- 2024/02: Significant investment by a major packaging company in BNC-infused films for sustainable food packaging, anticipating a market share of hundreds of millions in the coming years.

- 2024/05: Breakthrough in BNC production scalability, reducing manufacturing costs by an estimated 20%, impacting the overall market size and competitiveness.

- 2024/08: Approval of BNC for a specific pharmaceutical application, opening up a new revenue stream potentially worth millions annually.

- 2025/01: Strategic partnership formed between a BNC producer and a leading automotive component manufacturer to explore lightweight composite materials, with potential applications valued at hundreds of millions.

Strategic Bacterial Nanocellulose Market Outlook

The strategic outlook for the bacterial nanocellulose market is exceptionally strong, characterized by significant growth accelerators. The increasing adoption of BNC in high-value biomedical and pharmaceutical applications, driven by its unparalleled biocompatibility and regenerative potential, will be a major growth engine, contributing an estimated thousands of millions to the overall market. The burgeoning demand for sustainable packaging solutions and the ongoing push for eco-friendly materials across consumer goods will further propel market expansion. Investments in advanced manufacturing technologies and the development of new BNC composites with tailored properties for industries like electronics and textiles represent substantial strategic opportunities. The projected market size for bacterial nanocellulose is expected to reach several thousand million by 2033, presenting a fertile ground for innovation and investment.

Bacterial Nanocellulose Segmentation

-

1. Application

- 1.1. Paper and Packaging

- 1.2. Composites Materials

- 1.3. Hygiene and Absorbent Products

- 1.4. Paints and Coatings

- 1.5. Food

- 1.6. Biomedical and Pharmaceutical

- 1.7. Others

-

2. Type

- 2.1. Plant Cellulose

- 2.2. Bacterial Cellulose

Bacterial Nanocellulose Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Bacterial Nanocellulose REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 19% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Bacterial Nanocellulose Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Paper and Packaging

- 5.1.2. Composites Materials

- 5.1.3. Hygiene and Absorbent Products

- 5.1.4. Paints and Coatings

- 5.1.5. Food

- 5.1.6. Biomedical and Pharmaceutical

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Plant Cellulose

- 5.2.2. Bacterial Cellulose

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Bacterial Nanocellulose Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Paper and Packaging

- 6.1.2. Composites Materials

- 6.1.3. Hygiene and Absorbent Products

- 6.1.4. Paints and Coatings

- 6.1.5. Food

- 6.1.6. Biomedical and Pharmaceutical

- 6.1.7. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Plant Cellulose

- 6.2.2. Bacterial Cellulose

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Bacterial Nanocellulose Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Paper and Packaging

- 7.1.2. Composites Materials

- 7.1.3. Hygiene and Absorbent Products

- 7.1.4. Paints and Coatings

- 7.1.5. Food

- 7.1.6. Biomedical and Pharmaceutical

- 7.1.7. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Plant Cellulose

- 7.2.2. Bacterial Cellulose

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Bacterial Nanocellulose Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Paper and Packaging

- 8.1.2. Composites Materials

- 8.1.3. Hygiene and Absorbent Products

- 8.1.4. Paints and Coatings

- 8.1.5. Food

- 8.1.6. Biomedical and Pharmaceutical

- 8.1.7. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Plant Cellulose

- 8.2.2. Bacterial Cellulose

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Bacterial Nanocellulose Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Paper and Packaging

- 9.1.2. Composites Materials

- 9.1.3. Hygiene and Absorbent Products

- 9.1.4. Paints and Coatings

- 9.1.5. Food

- 9.1.6. Biomedical and Pharmaceutical

- 9.1.7. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Plant Cellulose

- 9.2.2. Bacterial Cellulose

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Bacterial Nanocellulose Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Paper and Packaging

- 10.1.2. Composites Materials

- 10.1.3. Hygiene and Absorbent Products

- 10.1.4. Paints and Coatings

- 10.1.5. Food

- 10.1.6. Biomedical and Pharmaceutical

- 10.1.7. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Plant Cellulose

- 10.2.2. Bacterial Cellulose

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Fiberlean

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sappi

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Borregaard

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nippon Paper Industries

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Celluforce

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Oji Paper

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hainan Guangyu Bio-technology

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Fiberlean

List of Figures

- Figure 1: Global Bacterial Nanocellulose Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Bacterial Nanocellulose Revenue (million), by Application 2024 & 2032

- Figure 3: North America Bacterial Nanocellulose Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Bacterial Nanocellulose Revenue (million), by Type 2024 & 2032

- Figure 5: North America Bacterial Nanocellulose Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Bacterial Nanocellulose Revenue (million), by Country 2024 & 2032

- Figure 7: North America Bacterial Nanocellulose Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Bacterial Nanocellulose Revenue (million), by Application 2024 & 2032

- Figure 9: South America Bacterial Nanocellulose Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Bacterial Nanocellulose Revenue (million), by Type 2024 & 2032

- Figure 11: South America Bacterial Nanocellulose Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Bacterial Nanocellulose Revenue (million), by Country 2024 & 2032

- Figure 13: South America Bacterial Nanocellulose Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Bacterial Nanocellulose Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Bacterial Nanocellulose Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Bacterial Nanocellulose Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Bacterial Nanocellulose Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Bacterial Nanocellulose Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Bacterial Nanocellulose Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Bacterial Nanocellulose Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Bacterial Nanocellulose Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Bacterial Nanocellulose Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Bacterial Nanocellulose Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Bacterial Nanocellulose Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Bacterial Nanocellulose Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Bacterial Nanocellulose Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Bacterial Nanocellulose Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Bacterial Nanocellulose Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Bacterial Nanocellulose Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Bacterial Nanocellulose Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Bacterial Nanocellulose Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Bacterial Nanocellulose Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Bacterial Nanocellulose Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Bacterial Nanocellulose Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Bacterial Nanocellulose Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Bacterial Nanocellulose Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Bacterial Nanocellulose Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Bacterial Nanocellulose Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Bacterial Nanocellulose Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Bacterial Nanocellulose Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Bacterial Nanocellulose Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Bacterial Nanocellulose Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Bacterial Nanocellulose Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Bacterial Nanocellulose Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Bacterial Nanocellulose Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Bacterial Nanocellulose Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Bacterial Nanocellulose Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Bacterial Nanocellulose Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Bacterial Nanocellulose Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Bacterial Nanocellulose Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Bacterial Nanocellulose Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Bacterial Nanocellulose Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Bacterial Nanocellulose Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Bacterial Nanocellulose Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Bacterial Nanocellulose Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Bacterial Nanocellulose Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Bacterial Nanocellulose Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Bacterial Nanocellulose Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Bacterial Nanocellulose Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Bacterial Nanocellulose Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Bacterial Nanocellulose Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Bacterial Nanocellulose Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Bacterial Nanocellulose Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Bacterial Nanocellulose Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Bacterial Nanocellulose Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Bacterial Nanocellulose Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Bacterial Nanocellulose Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Bacterial Nanocellulose Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Bacterial Nanocellulose Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Bacterial Nanocellulose Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Bacterial Nanocellulose Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Bacterial Nanocellulose Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Bacterial Nanocellulose Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Bacterial Nanocellulose Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Bacterial Nanocellulose Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Bacterial Nanocellulose Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Bacterial Nanocellulose Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Bacterial Nanocellulose Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bacterial Nanocellulose?

The projected CAGR is approximately 19%.

2. Which companies are prominent players in the Bacterial Nanocellulose?

Key companies in the market include Fiberlean, Sappi, Borregaard, Nippon Paper Industries, Celluforce, Oji Paper, Hainan Guangyu Bio-technology.

3. What are the main segments of the Bacterial Nanocellulose?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1563 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bacterial Nanocellulose," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bacterial Nanocellulose report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bacterial Nanocellulose?

To stay informed about further developments, trends, and reports in the Bacterial Nanocellulose, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence