Key Insights

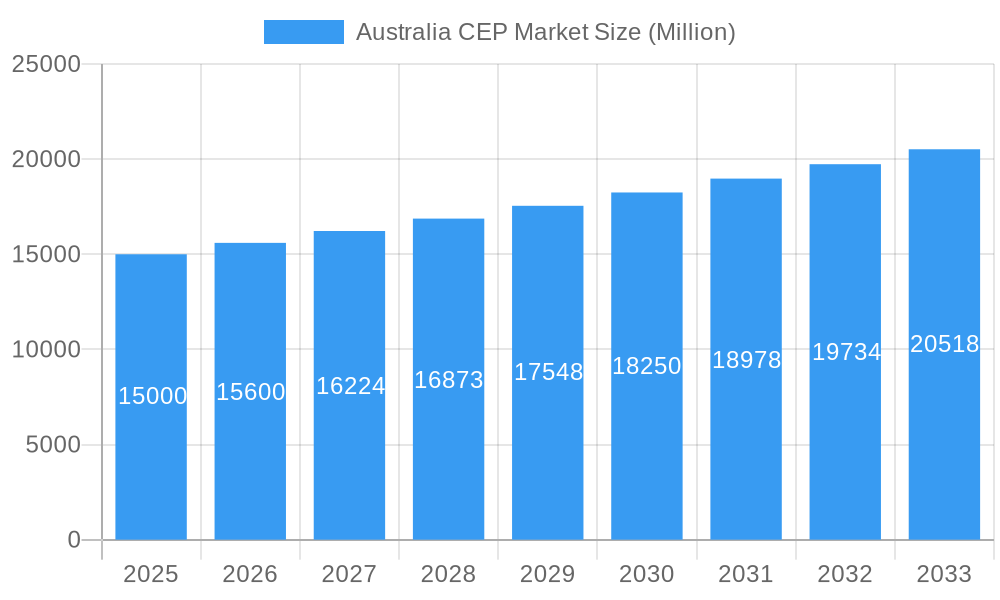

The Australian Courier, Express, and Parcel (CEP) market is projected for substantial growth, propelled by the rapid expansion of e-commerce and a heightened demand for efficient delivery solutions. The market is estimated to reach $13.05 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 5.1%. Key growth accelerators include the sustained surge in online retail, the strategic adoption of omnichannel business models, and an increasing consumer and business preference for faster, more dependable shipping services across B2B and B2C segments. Market segmentation encompasses delivery speed (express vs. non-express), business model (B2B, B2C, C2C), shipment weight, transportation mode (air, road, etc.), and end-user industries such as e-commerce, BFSI, healthcare, manufacturing, and wholesale/retail trade. E-commerce dominance is a primary driver for express delivery, particularly for lighter shipments, while B2B activities foster demand for heavier consignments and tailored logistics.

Australia CEP Market Market Size (In Billion)

Despite its strong growth trajectory, the Australian CEP market faces certain challenges. These include volatility in fuel prices affecting operational costs, intensified competition among market participants, and the imperative for ongoing investment in technological infrastructure to boost efficiency and customer satisfaction. Nevertheless, these constraints are anticipated to be mitigated by the continuous expansion of e-commerce, government initiatives supporting infrastructure development, and the increasing integration of advanced technologies like AI and automation in logistics. This dynamic environment presents significant opportunities for both expansion and market consolidation, favoring companies that can differentiate through specialized services, technological innovation, and superior customer support. The competitive landscape features prominent global players such as UPS, DHL, and FedEx, alongside established local operators like Australia Post, highlighting the sector's dynamism and potential.

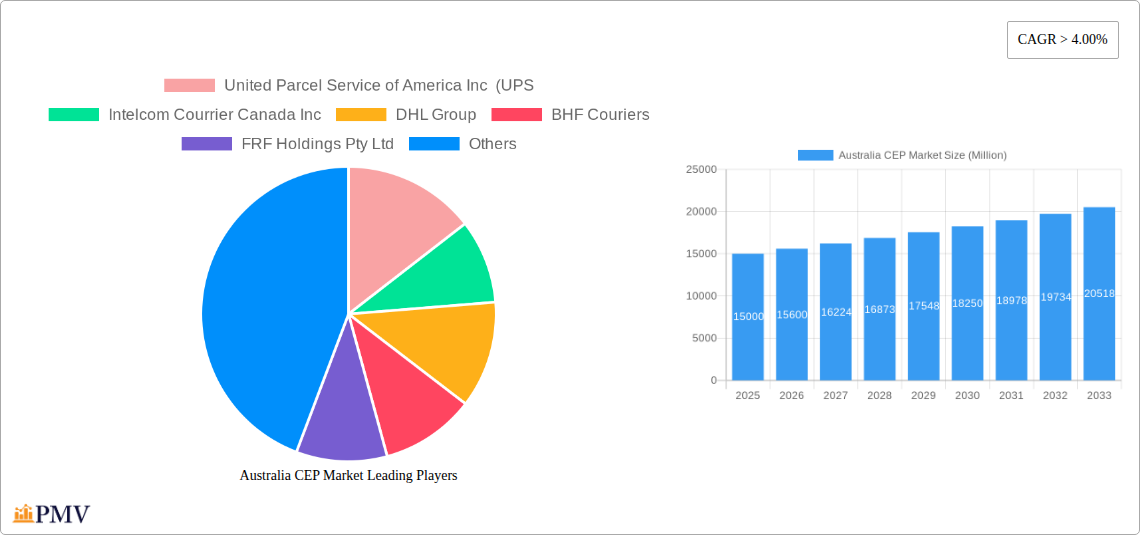

Australia CEP Market Company Market Share

Australia CEP Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Australia CEP (Courier, Express, and Parcel) market, offering invaluable insights for businesses operating within or considering entry into this dynamic sector. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, providing a historical perspective and future projections. The market is segmented by destination (domestic, international), speed of delivery (express, non-express), model (B2B, B2C, C2C), shipment weight (light, medium, heavy), mode of transport (air, road, others), and end-user industry (e-commerce, BFSI, healthcare, manufacturing, primary industry, wholesale & retail trade, others). The report quantifies the market size in Millions for key segments and projects significant future growth.

Australia CEP Market Market Structure & Competitive Dynamics

The Australian CEP market is characterized by a moderately concentrated structure with a few dominant players and numerous smaller niche operators. Market share data for 2024 indicates Australia Post holds the largest share, followed by Toll Group, DHL Group, and FedEx. However, the market exhibits significant competitive intensity, driven by the continuous entry of new players and innovative service offerings. The regulatory framework, while largely supportive of market competition, necessitates compliance with various rules and regulations, influencing operational costs and service delivery. The innovation ecosystem is robust, with companies investing in technological advancements to enhance efficiency and customer experience. Substitutes, such as postal services and specialized freight carriers, compete for market share in specific segments. Recent M&A activities, such as Singapore Post's increased stake in Freight Management Holdings Pty Ltd, indicate consolidation and strategic expansion efforts within the market.

- Market Concentration: Moderately concentrated, with a few key players dominating the market. Australia Post holds an estimated xx% market share in 2024.

- M&A Activity: Significant activity observed in recent years, with deal values totaling approximately xx Million in 2024. Key examples include Singapore Post's acquisition of additional stake in FMH.

- Innovation Ecosystem: Robust, with players focusing on technological improvements in tracking, delivery, and logistics management.

- Regulatory Framework: Largely supportive of competition, but compliance costs and regulations impact operational strategies.

- End-User Trends: Increasing demand for speed, reliability, and transparency in delivery services.

Australia CEP Market Industry Trends & Insights

The Australian CEP market is witnessing robust growth driven by the burgeoning e-commerce sector, increasing globalization, and the expansion of supply chains. The market’s Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) was estimated at xx%, and it is projected to reach xx% during the forecast period (2025-2033). Technological disruptions, including the adoption of AI and automation, are transforming operational efficiency, while consumer preference shifts towards same-day or next-day delivery are creating new opportunities. Competitive dynamics are shaping pricing strategies and service differentiation, leading to innovations such as specialized delivery solutions for temperature-sensitive goods and improved tracking capabilities. Market penetration of express delivery services is steadily increasing, particularly within the B2C segment.

Dominant Markets & Segments in Australia CEP Market

- Leading Region: The report indicates that New South Wales and Victoria are the dominant regions, driven by high population density and robust economic activity. These states contribute approximately xx% of total market revenue.

- Leading Segment (Destination): Domestic shipments represent the largest segment, contributing significantly to overall market revenue.

- Leading Segment (Speed of Delivery): Express delivery remains the dominant segment, reflecting the strong preference for faster delivery times among consumers and businesses.

- Leading Segment (Model): The B2C segment is experiencing the fastest growth, driven by the proliferation of e-commerce.

- Leading Segment (Shipment Weight): Medium-weight shipments currently constitute the largest portion of the market.

- Leading Segment (Mode of Transport): Road transport remains the most commonly used mode, with air freight used primarily for express deliveries and international shipments.

- Leading Segment (End-User Industry): The e-commerce sector is the most significant end-user, driving significant market demand.

Key drivers behind segment dominance include the robust economic growth in Australia, a developed infrastructure network supporting efficient logistics, and government initiatives promoting e-commerce expansion.

Australia CEP Market Product Innovations

Significant advancements are being witnessed in tracking and delivery technologies. Real-time tracking systems, automated sorting facilities, and the integration of Artificial Intelligence (AI) in route optimization and delivery scheduling are improving efficiency and reducing delivery times. The adoption of radio-frequency identification (RFID) chips for package tracking, as demonstrated by UPS's partnership with Google Cloud, highlights the market's embrace of cutting-edge technologies. These innovations are enhancing competitive advantages, allowing companies to offer improved service quality, faster delivery times, and greater transparency to their customers.

Report Segmentation & Scope

This report provides a granular segmentation of the Australia CEP market across various parameters. The Destination segment includes Domestic and International, with specific growth projections for each. Similarly, the Speed of Delivery is broken down into Express and Non-Express. The Model is further divided into Business-to-Business (B2B), Business-to-Consumer (B2C), and Consumer-to-Consumer (C2C), each with its unique market dynamics. Shipment Weight categorizes the market into Light, Medium, and Heavy weight segments. Modes of Transport are categorized as Air, Road, and Others, while End-User Industries include E-commerce, Financial Services (BFSI), Healthcare, Manufacturing, Primary Industry, Wholesale and Retail Trade (Offline), and Others. Each segment’s size and projected growth are analyzed, coupled with a comprehensive competitive landscape assessment.

Key Drivers of Australia CEP Market Growth

Several factors drive the growth of the Australia CEP market, including rapid growth of the e-commerce industry, increased consumer spending, investment in logistics infrastructure, and government initiatives promoting digitalization. Technological advancements such as AI and automation are improving efficiency and reducing costs, while favorable economic conditions fuel business expansion and consumer demand. Relaxed regulatory frameworks encourage market competition and innovation, ultimately enhancing the quality and reach of CEP services.

Challenges in the Australia CEP Market Sector

The Australian CEP market faces challenges including fluctuating fuel prices, increasing labor costs, and maintaining reliable supply chains. Competition remains fierce, demanding continual investments in technology and service optimization. Regulatory compliance, including environmental regulations and data privacy laws, adds to operational complexities. Infrastructure limitations in certain regions can impact timely delivery and coverage. These challenges exert pressure on profitability margins and necessitate strategic adaptation.

Leading Players in the Australia CEP Market Market

- United Parcel Service of America Inc (UPS)

- Intelcom Courrier Canada Inc

- DHL Group

- BHF Couriers

- FRF Holdings Pty Ltd

- FedEx

- Singapore Post

- Freightways

- Direct Couriers Pty Ltd

- Kings Transport and Logistics

- Aramex

- Australia Post

- Toll Group

Key Developments in Australia CEP Market Sector

- November 2023: Singapore Post Limited (SingPost) accelerates its acquisition of a further stake in Freight Management Holdings Pty Ltd (FMH), increasing its ownership to 88%. This signifies consolidation and expansion within the Australian CEP market.

- March 2023: UPS partnered with Google Cloud to integrate RFID chips into packages, enhancing tracking and efficiency. This showcases technological advancements impacting the industry.

- February 2023: BHF Couriers demonstrated efficient large-pallet delivery across a significant distance within a day, highlighting innovative logistics solutions.

Strategic Australia CEP Market Market Outlook

The future of the Australia CEP market appears promising, driven by sustained growth in e-commerce, rising consumer expectations for faster and more reliable deliveries, and increased adoption of advanced technologies. Strategic opportunities lie in developing specialized logistics solutions for emerging sectors, enhancing last-mile delivery networks, and investing in sustainable transportation methods. Companies that successfully adapt to evolving consumer preferences and integrate innovative technologies will be best positioned to capitalize on the market's significant growth potential.

Australia CEP Market Segmentation

-

1. Destination

- 1.1. Domestic

- 1.2. International

-

2. Speed Of Delivery

- 2.1. Express

- 2.2. Non-Express

-

3. Model

- 3.1. Business-to-Business (B2B)

- 3.2. Business-to-Consumer (B2C)

- 3.3. Consumer-to-Consumer (C2C)

-

4. Shipment Weight

- 4.1. Heavy Weight Shipments

- 4.2. Light Weight Shipments

- 4.3. Medium Weight Shipments

-

5. Mode Of Transport

- 5.1. Air

- 5.2. Road

- 5.3. Others

-

6. End User Industry

- 6.1. E-Commerce

- 6.2. Financial Services (BFSI)

- 6.3. Healthcare

- 6.4. Manufacturing

- 6.5. Primary Industry

- 6.6. Wholesale and Retail Trade (Offline)

- 6.7. Others

Australia CEP Market Segmentation By Geography

- 1. Australia

Australia CEP Market Regional Market Share

Geographic Coverage of Australia CEP Market

Australia CEP Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle

- 3.3. Market Restrains

- 3.3.1. Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia CEP Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 5.1.1. Domestic

- 5.1.2. International

- 5.2. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 5.2.1. Express

- 5.2.2. Non-Express

- 5.3. Market Analysis, Insights and Forecast - by Model

- 5.3.1. Business-to-Business (B2B)

- 5.3.2. Business-to-Consumer (B2C)

- 5.3.3. Consumer-to-Consumer (C2C)

- 5.4. Market Analysis, Insights and Forecast - by Shipment Weight

- 5.4.1. Heavy Weight Shipments

- 5.4.2. Light Weight Shipments

- 5.4.3. Medium Weight Shipments

- 5.5. Market Analysis, Insights and Forecast - by Mode Of Transport

- 5.5.1. Air

- 5.5.2. Road

- 5.5.3. Others

- 5.6. Market Analysis, Insights and Forecast - by End User Industry

- 5.6.1. E-Commerce

- 5.6.2. Financial Services (BFSI)

- 5.6.3. Healthcare

- 5.6.4. Manufacturing

- 5.6.5. Primary Industry

- 5.6.6. Wholesale and Retail Trade (Offline)

- 5.6.7. Others

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 United Parcel Service of America Inc (UPS

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Intelcom Courrier Canada Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DHL Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BHF Couriers

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 FRF Holdings Pty Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FedEx

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Singapore Post

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Freightways

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Direct Couriers Pty Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kings Transport and Logistics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Aramex

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Australia Post

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Toll Group

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 United Parcel Service of America Inc (UPS

List of Figures

- Figure 1: Australia CEP Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Australia CEP Market Share (%) by Company 2025

List of Tables

- Table 1: Australia CEP Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 2: Australia CEP Market Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 3: Australia CEP Market Revenue billion Forecast, by Model 2020 & 2033

- Table 4: Australia CEP Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 5: Australia CEP Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 6: Australia CEP Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 7: Australia CEP Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Australia CEP Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 9: Australia CEP Market Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 10: Australia CEP Market Revenue billion Forecast, by Model 2020 & 2033

- Table 11: Australia CEP Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 12: Australia CEP Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 13: Australia CEP Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 14: Australia CEP Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia CEP Market?

The projected CAGR is approximately 5.1%.

2. Which companies are prominent players in the Australia CEP Market?

Key companies in the market include United Parcel Service of America Inc (UPS, Intelcom Courrier Canada Inc, DHL Group, BHF Couriers, FRF Holdings Pty Ltd, FedEx, Singapore Post, Freightways, Direct Couriers Pty Ltd, Kings Transport and Logistics, Aramex, Australia Post, Toll Group.

3. What are the main segments of the Australia CEP Market?

The market segments include Destination, Speed Of Delivery, Model, Shipment Weight, Mode Of Transport, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.05 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits.

8. Can you provide examples of recent developments in the market?

November 2023: Singapore Post Limited (SingPost) announced the acceleration of its acquisition of a further stake in the 51%-owned subsidiary Freight Management Holdings Pty Ltd (FMH). Through its wholly owned subsidiary, SingPost Australia Investments Pty Ltd (SPAI), SingPost would acquire an additional 37% interest in FMH, increasing its total stake to 88% upon completion of the transaction.March 2023: UPS entered a partnership with Google Cloud, where Google will help UPS by putting radio-frequency identification chips on packages to track them efficiently.February 2023: By using innovative logistics solutions, BHF Couriers was able to transport large pallets from Clayton in Vic to Meadowbrook Qld, 1,776 km apart, within less than one day.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia CEP Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia CEP Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia CEP Market?

To stay informed about further developments, trends, and reports in the Australia CEP Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence