Key Insights

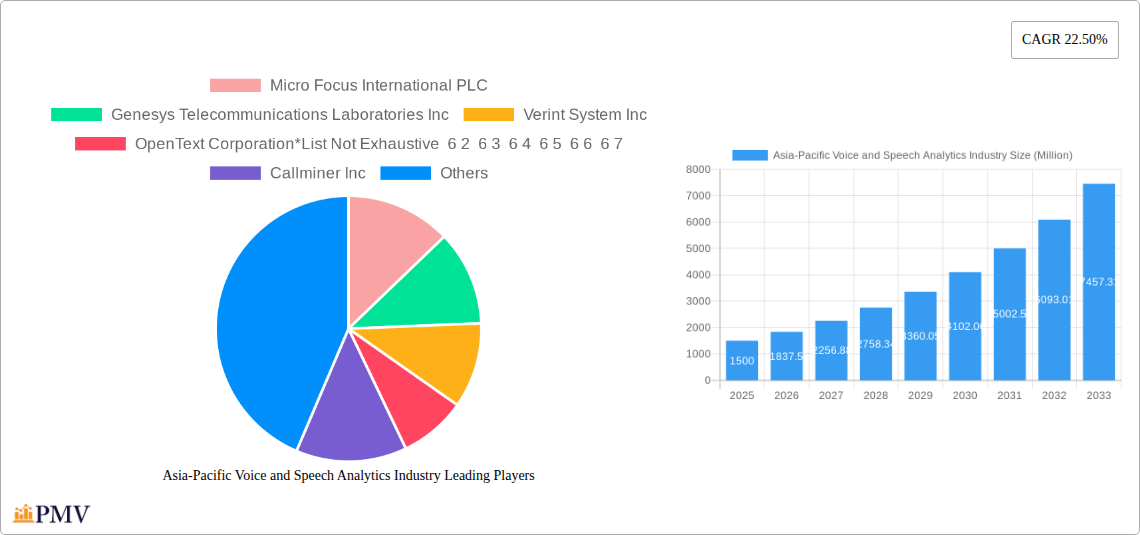

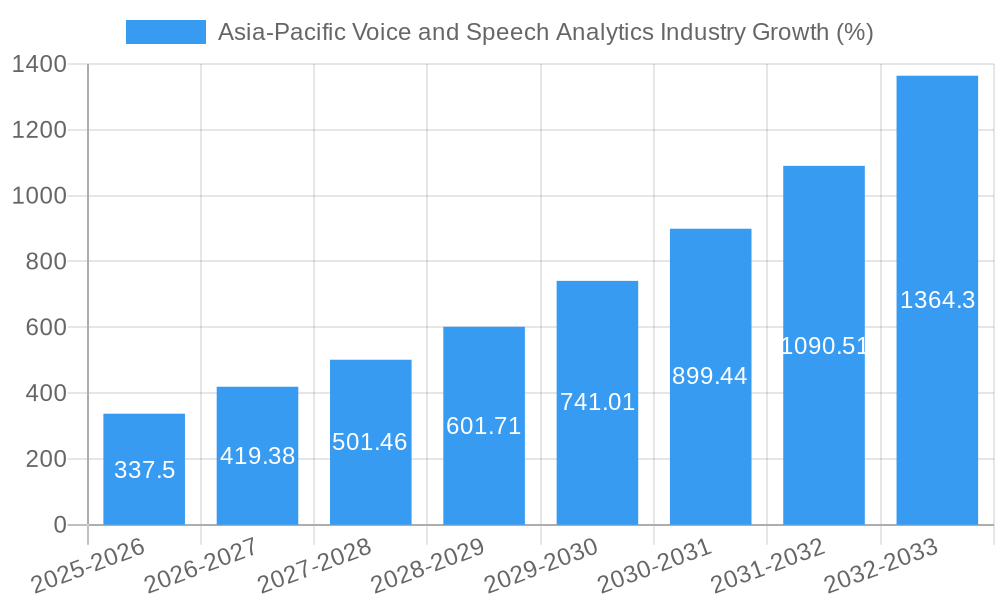

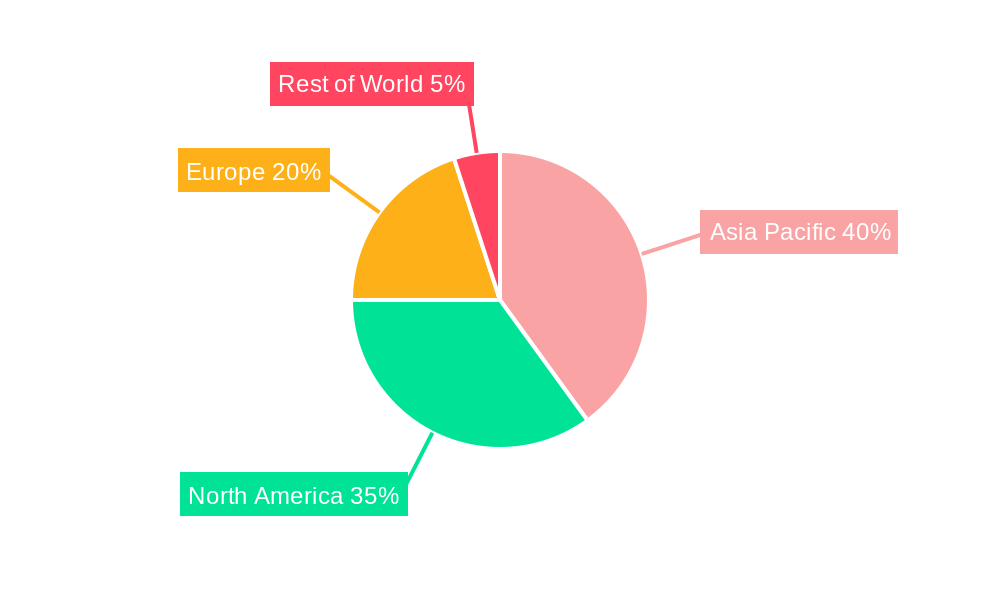

The Asia-Pacific voice and speech analytics market is experiencing robust growth, driven by the increasing adoption of cloud-based solutions, the rising need for improved customer experience, and the expanding use of AI-powered analytics for business intelligence. The region's diverse economic landscape, coupled with the rapid digital transformation across sectors like BFSI, healthcare, and retail, fuels this expansion. The market's CAGR of 22.50% indicates significant potential for continued expansion through 2033. While on-premise deployments still hold a share of the market, the on-demand segment is experiencing the fastest growth, reflecting a preference for scalable and cost-effective solutions. Large enterprises currently dominate the market due to their greater resources and sophisticated analytics needs, but the SME segment is witnessing notable growth as cost-effective solutions become more accessible. China, Japan, India, and South Korea are key contributors to the market's overall size, leveraging voice and speech analytics to improve operational efficiency, enhance customer service, and gain valuable insights from customer interactions. However, data privacy concerns and the need for skilled professionals to manage and interpret the complex data generated remain key challenges.

The competitive landscape is characterized by a mix of established players and emerging vendors. Established companies like Micro Focus, Genesys, Verint, and OpenText are leveraging their existing customer base and technological expertise to maintain market leadership. Simultaneously, smaller, more agile companies are focusing on niche markets and innovative solutions, thereby adding to the market dynamism. The forecast period (2025-2033) anticipates sustained growth propelled by increased government regulations mandating data analysis for compliance and fraud detection, further enhancing market opportunities. Technological advancements like the integration of natural language processing (NLP) and machine learning (ML) will play a crucial role in enhancing the analytical capabilities of voice and speech analytics platforms, driving further market growth and expanding applications across diverse industries.

Asia-Pacific Voice and Speech Analytics Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Asia-Pacific voice and speech analytics industry, offering invaluable insights for businesses, investors, and stakeholders. The study covers the period from 2019 to 2033, with 2025 as the base year and a forecast period of 2025-2033. We delve into market size, segmentation, competitive landscape, growth drivers, and challenges, equipping you with the knowledge to navigate this rapidly evolving sector.

Asia-Pacific Voice and Speech Analytics Industry Market Structure & Competitive Dynamics

The Asia-Pacific voice and speech analytics market is characterized by a moderately concentrated landscape, with several key players holding significant market share. The market structure is influenced by factors such as ongoing technological innovation, varying regulatory frameworks across different countries, and the presence of substitute technologies. End-user trends, particularly the increasing adoption of cloud-based solutions and the growing focus on data-driven decision-making, are also shaping the competitive dynamics. Mergers and acquisitions (M&A) activity has been moderate, with deal values fluctuating based on market conditions and strategic objectives. Key players like Micro Focus International PLC, Genesys Telecommunications Laboratories Inc, Verint System Inc, and OpenText Corporation have strategically employed M&A to expand their market presence and capabilities. The total M&A value for the period 2019-2024 is estimated to be around xx Million. The market share of the top 5 players in 2024 is approximately xx%, indicating a relatively fragmented market with significant growth opportunities for smaller companies.

Asia-Pacific Voice and Speech Analytics Industry Industry Trends & Insights

The Asia-Pacific voice and speech analytics market is experiencing robust growth, driven by factors such as the increasing adoption of digital technologies, growing demand for enhanced customer experience, and the rising need for improved operational efficiency across various industries. The market’s Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%, reaching a market value of xx Million by 2033. Technological advancements, such as the integration of artificial intelligence (AI) and machine learning (ML), are significantly disrupting the market, leading to the development of more sophisticated and accurate analytics solutions. Consumer preferences are shifting towards personalized experiences, driving the demand for solutions that can provide deeper insights into customer behavior and sentiment. Market penetration is increasing across various sectors, with BFSI and telecommunications showing particularly strong adoption rates. The competitive landscape is dynamic, with existing players constantly innovating and new entrants emerging, leading to increased competition and price pressure.

Dominant Markets & Segments in Asia-Pacific Voice and Speech Analytics Industry

Leading Region/Country: China is currently the dominant market in the Asia-Pacific region, driven by its large population, rapid economic growth, and increasing adoption of technology across industries. Japan and India also hold significant market share, fueled by robust technological advancements and growing demand for customer-centric solutions.

Dominant Deployment Segment: On-Demand deployment models are gaining traction, propelled by the scalability, cost-effectiveness, and ease of implementation they offer. This is especially true for SMEs, who prefer to avoid high upfront capital expenditure.

Dominant Size of Organization Segment: Large enterprises are the primary adopters of voice and speech analytics solutions due to their larger budgets and more complex operational needs. However, the SME segment is showing significant growth potential.

Dominant End-User Segment: The BFSI (Banking, Financial Services, and Insurance) sector is the leading end-user, driven by its need for robust fraud detection, risk management, and customer service improvement. Healthcare and retail sectors also demonstrate substantial growth, driven by their focus on improving patient experience and optimizing customer interactions.

Key Drivers: China's strong economic growth, government initiatives promoting digital transformation in various sectors, and investments in advanced technologies are major drivers for the region's dominance. Japan's focus on technological innovation and data security, along with India's burgeoning IT sector, further contribute to the market's overall strength.

Asia-Pacific Voice and Speech Analytics Industry Product Innovations

Recent product innovations focus on enhancing the accuracy and efficiency of speech-to-text conversion, integrating advanced AI and ML algorithms for sentiment analysis and predictive modeling, and developing user-friendly interfaces. The integration of voice biometrics is another notable development, allowing for enhanced security and fraud detection. These innovations cater to the growing demand for real-time insights and data-driven decision-making, strengthening their market fit and offering significant competitive advantages.

Report Segmentation & Scope

The report segments the Asia-Pacific voice and speech analytics market based on deployment (on-premise, on-demand), size of organization (SMEs, large enterprises), end-user (BFSI, healthcare, retail, government, other end-users), and country (China, Japan, India, South Korea, Singapore, Rest of Asia Pacific). Growth projections for each segment vary, with on-demand deployment and large enterprise segments exhibiting the highest growth rates. Market sizes for each segment are provided for the historical period (2019-2024), base year (2025), and forecast period (2025-2033). Competitive dynamics within each segment are also analyzed, identifying key players and their respective market strategies.

Key Drivers of Asia-Pacific Voice and Speech Analytics Industry Growth

Technological advancements in AI, ML, and cloud computing are significantly driving market growth. The increasing need for improved customer experience and operational efficiency across industries is another key factor. Government initiatives promoting digital transformation and favorable regulatory environments in certain countries further contribute to market expansion.

Challenges in the Asia-Pacific Voice and Speech Analytics Industry Sector

Data privacy and security concerns remain significant challenges, especially with the increasing volume of sensitive customer data being processed. The high cost of implementation and maintenance of advanced solutions can be a barrier to entry for smaller companies. Competition among established and emerging players can also create price pressures and impact profitability. The lack of skilled professionals in data analytics and AI can hamper the wider adoption of these technologies.

Leading Players in the Asia-Pacific Voice and Speech Analytics Industry Market

- Micro Focus International PLC

- Genesys Telecommunications Laboratories Inc

- Verint System Inc

- OpenText Corporation

- Callminer Inc

- Nice Ltd

- Avaya Inc

- VoiceBase Inc

- Calabrio Inc

- Raytheon BBN Technologies

Key Developments in Asia-Pacific Voice and Speech Analytics Industry Sector

- January 2023: Genesys launched a new AI-powered customer experience platform.

- March 2022: Verint acquired a smaller speech analytics company, enhancing its product portfolio.

- June 2021: Several key players announced partnerships to integrate their solutions with leading cloud platforms. (Further specific details would be included in the full report).

Strategic Asia-Pacific Voice and Speech Analytics Industry Market Outlook

The Asia-Pacific voice and speech analytics market holds substantial growth potential driven by continued technological innovation, increasing digital adoption across industries, and the growing focus on data-driven decision making. Strategic opportunities exist for companies focused on developing AI-powered solutions, providing customized solutions for specific industry needs, and expanding into emerging markets within the region. The market is poised for further consolidation through mergers and acquisitions, and companies with strong technological capabilities and strategic partnerships are likely to gain a competitive advantage.

Asia-Pacific Voice and Speech Analytics Industry Segmentation

-

1. Deployment

- 1.1. On-Premise

- 1.2. On-Demand

-

2. Size of Organization

- 2.1. Small and Medium Enterprises

- 2.2. Large Enterprises

-

3. End-user

- 3.1. BFSI

- 3.2. Healthcare

- 3.3. Retail

- 3.4. Government

- 3.5. Other En

Asia-Pacific Voice and Speech Analytics Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Voice and Speech Analytics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 22.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Demand of Speech Analytics in Various Industry Verticals; Growing focus on improving and enhancing overall customer experience

- 3.3. Market Restrains

- 3.3.1. High Implementation Costs

- 3.4. Market Trends

- 3.4.1. IT and Telecom Sector is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Voice and Speech Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. On-Premise

- 5.1.2. On-Demand

- 5.2. Market Analysis, Insights and Forecast - by Size of Organization

- 5.2.1. Small and Medium Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by End-user

- 5.3.1. BFSI

- 5.3.2. Healthcare

- 5.3.3. Retail

- 5.3.4. Government

- 5.3.5. Other En

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. China Asia-Pacific Voice and Speech Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Voice and Speech Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Voice and Speech Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Voice and Speech Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific Voice and Speech Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Voice and Speech Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Voice and Speech Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Micro Focus International PLC

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Genesys Telecommunications Laboratories Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Verint System Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 OpenText Corporation*List Not Exhaustive 6 2 6 3 6 4 6 5 6 6 6 7

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Callminer Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Nice Ltd

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Avaya Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 VoiceBase Inc

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Calabrio Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Raytheon BBN Technologies

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Micro Focus International PLC

List of Figures

- Figure 1: Asia-Pacific Voice and Speech Analytics Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Voice and Speech Analytics Industry Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Voice and Speech Analytics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Voice and Speech Analytics Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 3: Asia-Pacific Voice and Speech Analytics Industry Revenue Million Forecast, by Size of Organization 2019 & 2032

- Table 4: Asia-Pacific Voice and Speech Analytics Industry Revenue Million Forecast, by End-user 2019 & 2032

- Table 5: Asia-Pacific Voice and Speech Analytics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Asia-Pacific Voice and Speech Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Asia-Pacific Voice and Speech Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Asia-Pacific Voice and Speech Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Asia-Pacific Voice and Speech Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Asia-Pacific Voice and Speech Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Taiwan Asia-Pacific Voice and Speech Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Asia-Pacific Voice and Speech Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Asia-Pacific Asia-Pacific Voice and Speech Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Asia-Pacific Voice and Speech Analytics Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 15: Asia-Pacific Voice and Speech Analytics Industry Revenue Million Forecast, by Size of Organization 2019 & 2032

- Table 16: Asia-Pacific Voice and Speech Analytics Industry Revenue Million Forecast, by End-user 2019 & 2032

- Table 17: Asia-Pacific Voice and Speech Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Asia-Pacific Voice and Speech Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Asia-Pacific Voice and Speech Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Asia-Pacific Voice and Speech Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: India Asia-Pacific Voice and Speech Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Asia-Pacific Voice and Speech Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: New Zealand Asia-Pacific Voice and Speech Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Indonesia Asia-Pacific Voice and Speech Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Malaysia Asia-Pacific Voice and Speech Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Singapore Asia-Pacific Voice and Speech Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Thailand Asia-Pacific Voice and Speech Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Vietnam Asia-Pacific Voice and Speech Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Philippines Asia-Pacific Voice and Speech Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Voice and Speech Analytics Industry?

The projected CAGR is approximately 22.50%.

2. Which companies are prominent players in the Asia-Pacific Voice and Speech Analytics Industry?

Key companies in the market include Micro Focus International PLC, Genesys Telecommunications Laboratories Inc, Verint System Inc, OpenText Corporation*List Not Exhaustive 6 2 6 3 6 4 6 5 6 6 6 7, Callminer Inc, Nice Ltd, Avaya Inc, VoiceBase Inc, Calabrio Inc, Raytheon BBN Technologies.

3. What are the main segments of the Asia-Pacific Voice and Speech Analytics Industry?

The market segments include Deployment, Size of Organization, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand of Speech Analytics in Various Industry Verticals; Growing focus on improving and enhancing overall customer experience.

6. What are the notable trends driving market growth?

IT and Telecom Sector is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

High Implementation Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Voice and Speech Analytics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Voice and Speech Analytics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Voice and Speech Analytics Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Voice and Speech Analytics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence