Key Insights

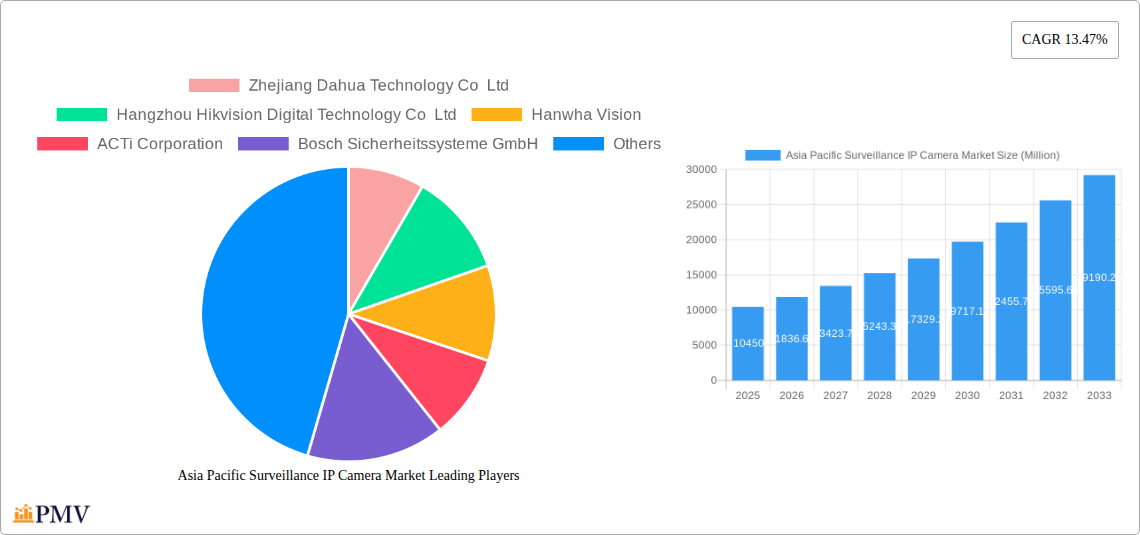

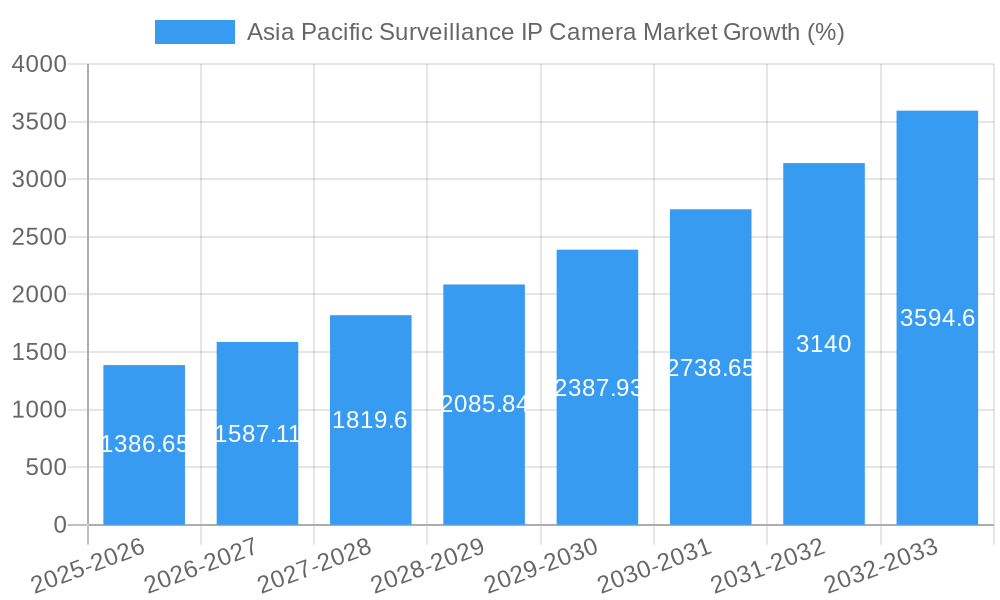

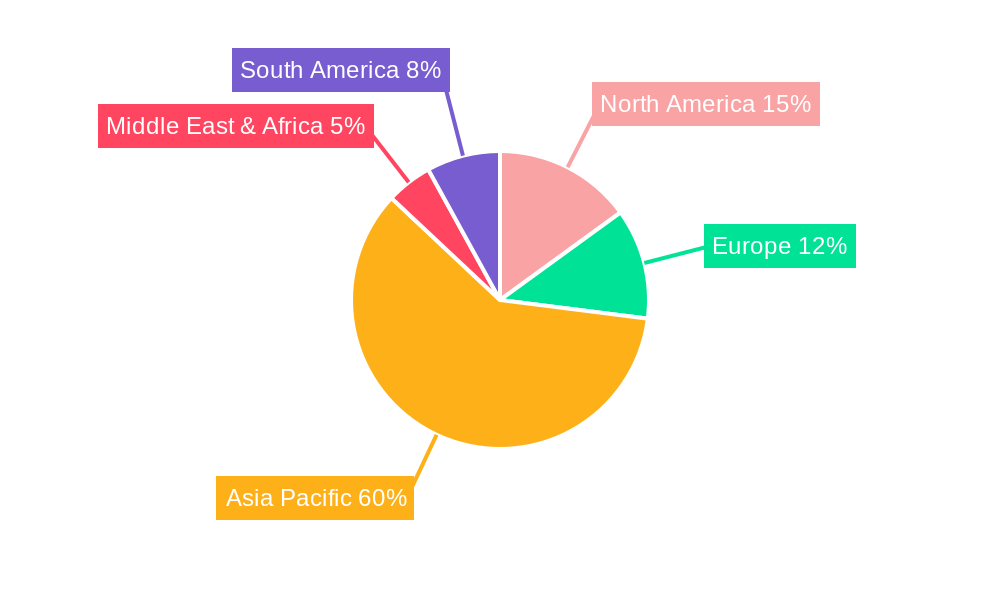

The Asia Pacific surveillance IP camera market is experiencing robust growth, projected to reach a market size of $10.45 billion in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 13.47% from 2019 to 2033. This expansion is fueled by several key drivers. Increasing urbanization across the Asia-Pacific region leads to a greater need for enhanced security measures in both public and private spaces. Furthermore, the rising adoption of smart city initiatives, coupled with the increasing prevalence of cybercrime and terrorism, necessitates sophisticated surveillance solutions. The demand for high-resolution cameras with advanced analytics capabilities, such as facial recognition and object detection, is also contributing significantly to market growth. Government initiatives promoting public safety and infrastructure development further stimulate market expansion. While supply chain disruptions and fluctuating raw material prices pose some challenges, the overall market outlook remains positive, driven by ongoing technological advancements and a heightened focus on security.

The market is segmented by various factors including camera resolution (e.g., HD, 4K), features (e.g., PTZ, analytics), application (e.g., commercial, residential, government), and technology (e.g., wired, wireless). Key players like Dahua, Hikvision, Hanwha Vision, and Bosch are aggressively competing through product innovation, strategic partnerships, and expanding their market reach. The competitive landscape is characterized by a mix of established players and emerging companies, fostering innovation and driving price competitiveness. The forecast period (2025-2033) anticipates sustained growth, propelled by continued technological advancements, increasing government spending on security infrastructure, and the expanding adoption of IoT-based surveillance systems. Regional variations in growth rates are expected, with countries experiencing rapid economic growth and urbanization likely exhibiting faster adoption rates.

Asia Pacific Surveillance IP Camera Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Asia Pacific Surveillance IP Camera Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The historical period analyzed is 2019-2024. The report encompasses market sizing, segmentation, competitive landscape, and future growth projections, with a focus on key drivers, challenges, and emerging trends. The market is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Asia Pacific Surveillance IP Camera Market Structure & Competitive Dynamics

The Asia Pacific Surveillance IP Camera market is characterized by a moderately concentrated structure, with a few major players holding significant market share. Key players such as Zhejiang Dahua Technology Co Ltd, Hangzhou Hikvision Digital Technology Co Ltd, and Hanwha Vision dominate the landscape, leveraging their established brand recognition, extensive product portfolios, and robust distribution networks. The market exhibits a dynamic innovation ecosystem, driven by continuous advancements in video analytics, AI-powered features, and cloud-based solutions. Regulatory frameworks, varying across countries, influence market dynamics, particularly concerning data privacy and cybersecurity. Product substitutes, such as traditional CCTV systems, continue to exist but are gradually being replaced by IP cameras due to their superior features and scalability. End-user trends point towards increasing demand for high-resolution cameras, advanced analytics, and integrated security solutions across various sectors, including government, commercial, and residential.

Mergers and acquisitions (M&A) activities play a role in shaping the market's competitive landscape. While precise M&A deal values for the specific period aren't publicly available for every deal, significant investments and acquisitions have occurred within the industry, impacting market concentration and technological capabilities. For example, xx Million worth of M&A activity was observed in 2023 within this sector. Several companies have increased their market share through strategic acquisitions of smaller companies specializing in niche technologies or specific geographical regions. The market share of top five players is currently estimated at approximately 60%, indicating a considerable level of market concentration.

Asia Pacific Surveillance IP Camera Market Industry Trends & Insights

The Asia Pacific Surveillance IP Camera market is experiencing robust growth driven by several key factors. Increasing urbanization and rising crime rates fuel the demand for enhanced security solutions. Technological advancements, such as the integration of Artificial Intelligence (AI) and Internet of Things (IoT) technologies, are transforming the surveillance industry, leading to the development of more intelligent and efficient camera systems. The adoption of cloud-based storage and analytics solutions offers improved accessibility and scalability. Consumer preferences are shifting toward user-friendly interfaces, high-resolution imagery, and advanced analytics capabilities. The market exhibits intense competitive dynamics, with leading players continually striving to innovate and expand their market reach. The market penetration rate is rapidly increasing, particularly in developing economies experiencing rapid infrastructure development. The overall market growth is projected to continue, reaching xx Million by 2033. The Compound Annual Growth Rate (CAGR) for the forecast period is estimated at xx%, driven by the aforementioned factors and the increasing focus on public safety and security.

Dominant Markets & Segments in Asia Pacific Surveillance IP Camera Market

Dominant Region: China holds a dominant position in the Asia Pacific Surveillance IP Camera market, driven by strong government support for smart city initiatives, substantial investments in infrastructure development, and a large and growing population. This is further compounded by the presence of several major manufacturers within the country.

Dominant Country: China's dominance extends to the country level within the region.

Key Drivers in Dominant Markets:

- Government initiatives promoting smart city development and public safety.

- Large-scale infrastructure projects driving demand for security solutions.

- Growing adoption of technology across various sectors.

- High population density and rising crime rates.

The dominance of China stems from a confluence of factors, including robust domestic demand, the presence of several leading manufacturers, and government policies that prioritize safety and security infrastructure. While other countries in the Asia Pacific region are experiencing significant growth, China's scale and strategic position within the market remain unparalleled. However, other countries such as India, Japan, and South Korea, are witnessing considerable market expansion due to increasing investments in security infrastructure and adoption of advanced technologies.

Asia Pacific Surveillance IP Camera Market Product Innovations

Recent product innovations in the Asia Pacific Surveillance IP Camera market are largely centered on integrating advanced technologies like AI and IoT. This includes features such as improved video analytics for enhanced object detection, facial recognition, and license plate reading. There's also a focus on higher resolution cameras with better low-light performance, along with the development of compact and versatile cameras suitable for diverse applications, including both indoor and outdoor use. The trend is towards smarter cameras with onboard processing capabilities, reducing reliance on separate servers for analytics and offering enhanced data security. These innovations enhance surveillance efficiency, improve accuracy of threat detection, and provide users with more comprehensive data for decision-making. The success of these new products hinges on their ability to meet specific market needs, such as cost-effectiveness, ease of installation, and seamless integration with existing systems.

Report Segmentation & Scope

The Asia Pacific Surveillance IP Camera market is segmented by various factors, enabling a granular understanding of market dynamics. These segments include:

By Product Type: This segment includes dome cameras, bullet cameras, PTZ (Pan-Tilt-Zoom) cameras, box cameras, and others. Each segment exhibits different growth trajectories, influenced by factors like application suitability, cost, and feature availability. The market size for each segment varies significantly, with dome and bullet cameras currently holding the largest shares.

By Resolution: This segment categorizes cameras by resolution (e.g., HD, 4K, etc.), reflecting the evolving demand for higher image quality and clearer detail capture. Higher resolution cameras command a premium price but offer superior image quality.

By Technology: This includes segments based on network technology (wired, wireless, etc.), video compression (H.264, H.265, etc.), and associated technologies. The market is seeing a shift toward advanced technologies like H.265 for improved compression and reduced bandwidth consumption.

By End-User: This segment encompasses various industries employing surveillance cameras, including government, commercial businesses, residential sectors, and more. Each segment has unique needs and priorities, affecting the type of cameras and features deployed.

Key Drivers of Asia Pacific Surveillance IP Camera Market Growth

Several factors contribute to the robust growth of the Asia Pacific Surveillance IP Camera market. Firstly, the increasing adoption of smart city initiatives across the region drives demand for advanced surveillance systems to enhance public safety and security. Secondly, the rising crime rates and concerns over terrorism are pushing governments and businesses to invest heavily in improved security measures. Thirdly, technological advancements, such as AI-powered video analytics and cloud-based solutions, are enabling more sophisticated and efficient surveillance systems. Finally, the declining cost of IP cameras and increasing availability of high-speed internet are making these systems more accessible to a wider range of consumers and businesses. These technological and societal factors are significantly influencing the market's growth trajectory.

Challenges in the Asia Pacific Surveillance IP Camera Market Sector

Despite strong growth prospects, several challenges hinder the Asia Pacific Surveillance IP Camera market. Data privacy and cybersecurity concerns pose significant hurdles, necessitating robust security measures and compliance with strict regulations. Supply chain disruptions and component shortages, especially exacerbated during recent global events, affect the availability and pricing of cameras. Furthermore, intense competition from established players and the emergence of new entrants creates pressure on pricing and profitability. Lastly, varying regulatory environments across different countries and regions add complexity for manufacturers seeking to expand their market reach. These challenges, while substantial, are not insurmountable, and industry players are actively developing strategies to mitigate these risks.

Leading Players in the Asia Pacific Surveillance IP Camera Market

- Zhejiang Dahua Technology Co Ltd

- Hangzhou Hikvision Digital Technology Co Ltd

- Hanwha Vision

- ACTi Corporation

- Bosch Sicherheitssysteme GmbH

- Lorex Corporation

- Zhejiang Uniview Technologies Co Ltd

- IDIS Ltd

- Honeywell International Inc

- Panasonic Coporation

- Revlight Security

- Prama India Private Limited

- Zicom

- Sparsh CCTV

- Secureeye

- CP Plus International

- Zosi Technology Lt

Key Developments in Asia Pacific Surveillance IP Camera Market Sector

February 2024: Consistent Infosystems launches a new series of 'Made in India' surveillance cameras, including 4G PT, 4G Solar, and Wireless Pan-Tilt Wi-Fi models. This expansion signifies a push towards domestic manufacturing and caters to the growing demand for affordable and reliable security solutions.

January 2024: Hikvision introduces its Stealth Edition Cameras, featuring a sleek black design, 24/7 full-color capabilities (ColorVu), and advanced AI detection (AcuSense). This highlights the ongoing emphasis on aesthetically pleasing yet technologically advanced products.

Strategic Asia Pacific Surveillance IP Camera Market Outlook

The Asia Pacific Surveillance IP Camera market is poised for continued expansion, driven by sustained technological advancements and increasing security concerns across the region. Opportunities exist for manufacturers to focus on developing innovative products incorporating AI, IoT, and cloud technologies to enhance security solutions. Companies should also prioritize strategic partnerships and collaborations to expand their market reach and cater to the diverse needs of end-users across various sectors. Furthermore, focusing on addressing data privacy and cybersecurity concerns through robust security measures will be crucial for building customer trust and achieving long-term success. The future of the market hinges on effectively navigating these technological and regulatory landscapes, positioning companies for sustained growth and profitability.

Asia Pacific Surveillance IP Camera Market Segmentation

-

1. End-user Industry

- 1.1. Government

- 1.2. Banking

- 1.3. Healthcare

- 1.4. Transportation and Logistics

- 1.5. Industrial

- 1.6. Other End-user Industries

Asia Pacific Surveillance IP Camera Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Surveillance IP Camera Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.47% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Advancements in IP Surveillance Cameras; Government Initiatives and Investments to Enhance Public Safety and Security

- 3.3. Market Restrains

- 3.3.1. Technological Advancements in IP Surveillance Cameras; Government Initiatives and Investments to Enhance Public Safety and Security

- 3.4. Market Trends

- 3.4.1. Government Sector Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Surveillance IP Camera Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Government

- 5.1.2. Banking

- 5.1.3. Healthcare

- 5.1.4. Transportation and Logistics

- 5.1.5. Industrial

- 5.1.6. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Zhejiang Dahua Technology Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hangzhou Hikvision Digital Technology Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hanwha Vision

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ACTi Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bosch Sicherheitssysteme GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Lorex Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Zhejiang Uniview Technologies Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 IDIS Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Honeywell International Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Panasonic Coporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Revlight Security

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Prama India Private Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Zicom

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Sparsh CCTV

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Secureeye

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 CP Plus International

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Zosi Technology Lt

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 Zhejiang Dahua Technology Co Ltd

List of Figures

- Figure 1: Asia Pacific Surveillance IP Camera Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Surveillance IP Camera Market Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Surveillance IP Camera Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Surveillance IP Camera Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Asia Pacific Surveillance IP Camera Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Asia Pacific Surveillance IP Camera Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 5: Asia Pacific Surveillance IP Camera Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Asia Pacific Surveillance IP Camera Market Volume Billion Forecast, by Region 2019 & 2032

- Table 7: Asia Pacific Surveillance IP Camera Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 8: Asia Pacific Surveillance IP Camera Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 9: Asia Pacific Surveillance IP Camera Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Asia Pacific Surveillance IP Camera Market Volume Billion Forecast, by Country 2019 & 2032

- Table 11: China Asia Pacific Surveillance IP Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: China Asia Pacific Surveillance IP Camera Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 13: Japan Asia Pacific Surveillance IP Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Japan Asia Pacific Surveillance IP Camera Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 15: South Korea Asia Pacific Surveillance IP Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South Korea Asia Pacific Surveillance IP Camera Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 17: India Asia Pacific Surveillance IP Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: India Asia Pacific Surveillance IP Camera Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 19: Australia Asia Pacific Surveillance IP Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Asia Pacific Surveillance IP Camera Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 21: New Zealand Asia Pacific Surveillance IP Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: New Zealand Asia Pacific Surveillance IP Camera Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 23: Indonesia Asia Pacific Surveillance IP Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Indonesia Asia Pacific Surveillance IP Camera Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 25: Malaysia Asia Pacific Surveillance IP Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Malaysia Asia Pacific Surveillance IP Camera Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 27: Singapore Asia Pacific Surveillance IP Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Singapore Asia Pacific Surveillance IP Camera Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 29: Thailand Asia Pacific Surveillance IP Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Thailand Asia Pacific Surveillance IP Camera Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 31: Vietnam Asia Pacific Surveillance IP Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Vietnam Asia Pacific Surveillance IP Camera Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 33: Philippines Asia Pacific Surveillance IP Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Philippines Asia Pacific Surveillance IP Camera Market Volume (Billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Surveillance IP Camera Market?

The projected CAGR is approximately 13.47%.

2. Which companies are prominent players in the Asia Pacific Surveillance IP Camera Market?

Key companies in the market include Zhejiang Dahua Technology Co Ltd, Hangzhou Hikvision Digital Technology Co Ltd, Hanwha Vision, ACTi Corporation, Bosch Sicherheitssysteme GmbH, Lorex Corporation, Zhejiang Uniview Technologies Co Ltd, IDIS Ltd, Honeywell International Inc, Panasonic Coporation, Revlight Security, Prama India Private Limited, Zicom, Sparsh CCTV, Secureeye, CP Plus International, Zosi Technology Lt.

3. What are the main segments of the Asia Pacific Surveillance IP Camera Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.45 Million as of 2022.

5. What are some drivers contributing to market growth?

Technological Advancements in IP Surveillance Cameras; Government Initiatives and Investments to Enhance Public Safety and Security.

6. What are the notable trends driving market growth?

Government Sector Driving the Market.

7. Are there any restraints impacting market growth?

Technological Advancements in IP Surveillance Cameras; Government Initiatives and Investments to Enhance Public Safety and Security.

8. Can you provide examples of recent developments in the market?

February 2024 - Consistent Infosystems has bolstered its Security & Surveillance product lineup with a new series of 'Made in India' Surveillance Cameras. The comprehensive range features cutting-edge offerings like the Smart Wireless 4G PT Camera, the 4G Solar Camera, and the Wireless Pan-Tilt Wifi 3MP/4MP Mini Wi-Fi P2P. This expansion further solidifies Consistent Infosystems' position in the surveillance market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Surveillance IP Camera Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Surveillance IP Camera Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Surveillance IP Camera Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Surveillance IP Camera Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence