Key Insights

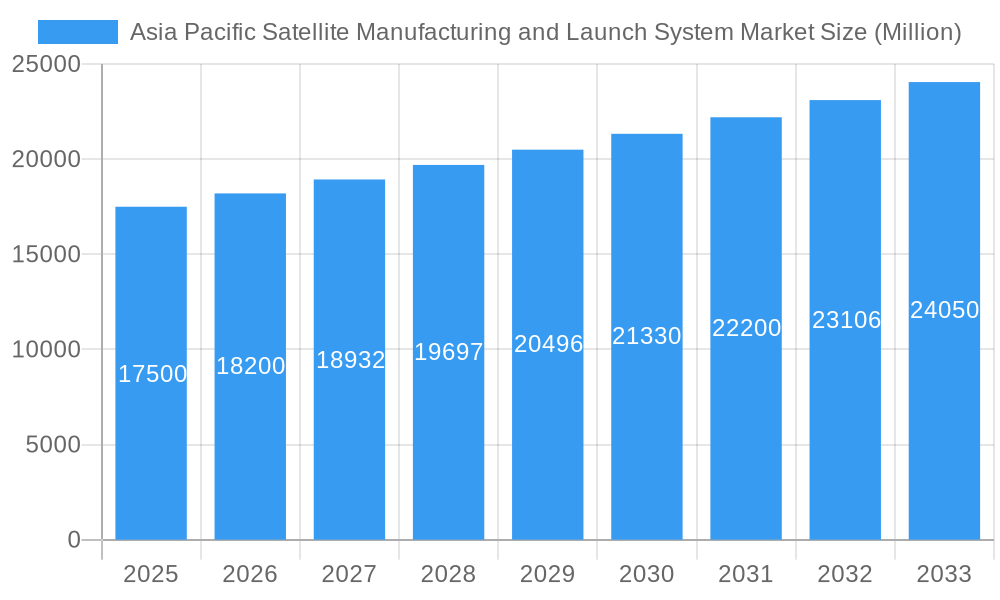

The Asia-Pacific satellite manufacturing and launch systems market is poised for significant expansion, fueled by escalating demand for satellite-based communication and Earth observation services across military and commercial applications. This growth is propelled by the region's dynamic economies and proactive government initiatives supporting space exploration and technological innovation. Projections indicate a robust Compound Annual Growth Rate (CAGR) of 31%, forecasting the market to reach $3.79 billion by 2025, a substantial increase from its current size. The market is segmented by end-user (military and commercial) and product type (satellites and launch systems). This projected market size reflects the increasing adoption of advanced satellite technologies, including high-throughput satellites and miniaturized payloads, thereby driving demand for both manufacturing and launch services. The growing privatization of space exploration further stimulates innovation and competition within this sector.

Asia Pacific Satellite Manufacturing and Launch System Market Market Size (In Billion)

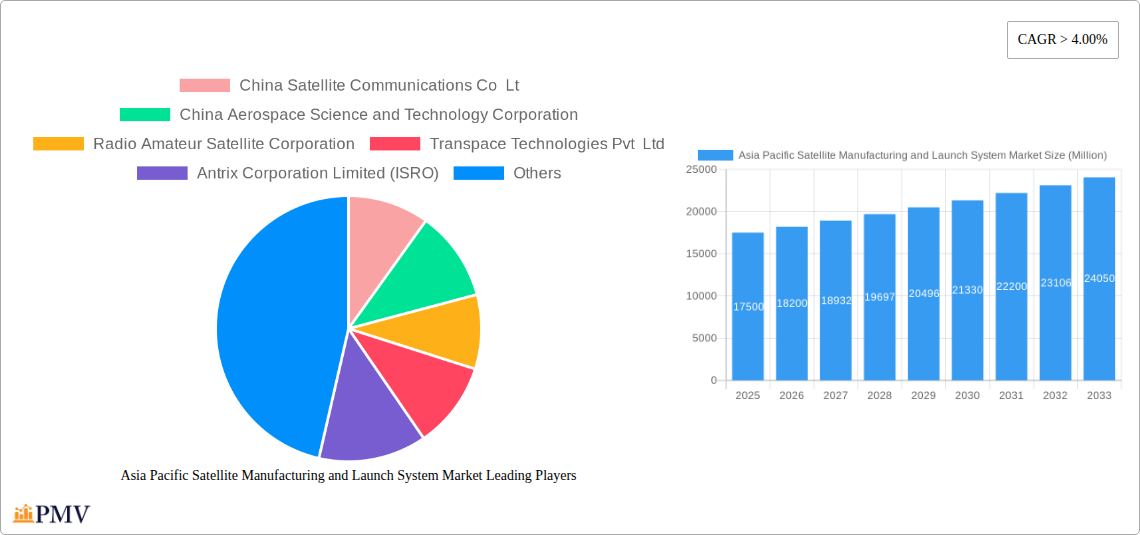

Despite the promising outlook, certain challenges persist. High development and launch expenses can impede market entry, particularly for emerging companies. Navigating regulatory frameworks and fostering international collaborations are also critical factors influencing market dynamics. Nevertheless, the long-term trajectory for the Asia-Pacific satellite manufacturing and launch systems market remains exceptionally strong. Continuous technological advancements, burgeoning demand for diverse satellite applications, and steadfast government support for national space programs across the region will drive future growth. Key growth drivers include the advancement of reusable launch vehicles, the proliferation of satellite constellations, and the deepening integration of satellite data into sectors such as telecommunications, navigation, and environmental monitoring. Prominent industry leaders, including China Satellite Communications Co Ltd, China Aerospace Science and Technology Corporation, and Antrix Corporation Limited (ISRO), are anticipated to significantly shape the market's evolution.

Asia Pacific Satellite Manufacturing and Launch System Market Company Market Share

Asia Pacific Satellite Manufacturing and Launch System Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia Pacific satellite manufacturing and launch system market, offering valuable insights for stakeholders across the entire value chain. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The forecast period spans 2025-2033, and the historical period encompasses 2019-2024. This report leverages rigorous research methodologies to deliver actionable intelligence and strategic recommendations.

Asia Pacific Satellite Manufacturing and Launch System Market Structure & Competitive Dynamics

This section delves into the competitive landscape of the Asia Pacific satellite manufacturing and launch system market, analyzing market concentration, innovation ecosystems, regulatory frameworks, product substitutes, end-user trends, and mergers & acquisitions (M&A) activities. The market exhibits a moderately concentrated structure, with a few major players commanding significant market share.

- Market Concentration: The top five players account for approximately xx% of the total market revenue in 2025, indicating moderate concentration. This is further influenced by the presence of numerous smaller, specialized firms.

- Innovation Ecosystems: Significant investments in R&D are driving innovation across the satellite technology and launch systems segment. Collaborations between private and public sector entities are also fueling advancements in miniaturization, cost reduction, and reusable launch vehicles.

- Regulatory Frameworks: Government policies and regulations significantly impact the market, particularly in areas like licensing, spectrum allocation, and space debris mitigation. Variations in regulatory environments across different Asia-Pacific nations create both opportunities and challenges for market participants.

- Product Substitutes: Emerging technologies, such as terrestrial and high-altitude platforms, present some level of substitution, but the unique capabilities of satellites, especially in remote areas, maintain their relevance.

- End-User Trends: The growing demand for high-bandwidth connectivity, coupled with increasing government spending on defense and surveillance, are major drivers of market growth. Commercial applications such as Earth observation and broadcasting are also substantial market segments.

- M&A Activities: The market has witnessed several M&A deals in the recent past, valued at approximately $xx Million in the period 2019-2024. These activities are primarily driven by consolidation, expansion into new technologies, and access to new markets.

Asia Pacific Satellite Manufacturing and Launch System Market Industry Trends & Insights

This section explores key industry trends and insights shaping the Asia Pacific satellite manufacturing and launch system market. The market is experiencing robust growth driven by several factors:

The market is projected to grow at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Increased demand from various end-users, including military and commercial entities, is a primary driver. Technological advancements, such as the development of smaller, more efficient satellites and reusable launch vehicles, are further contributing to market expansion. Market penetration of advanced satellite technologies is also on the rise, with xx% of the market adopting these innovations in 2025. Competitive dynamics are characterized by technological advancements, strategic partnerships, and increasing government support, all fostering market expansion. Consumer preferences are shifting towards higher bandwidth, greater reliability, and reduced latency, which are pushing innovation within the industry.

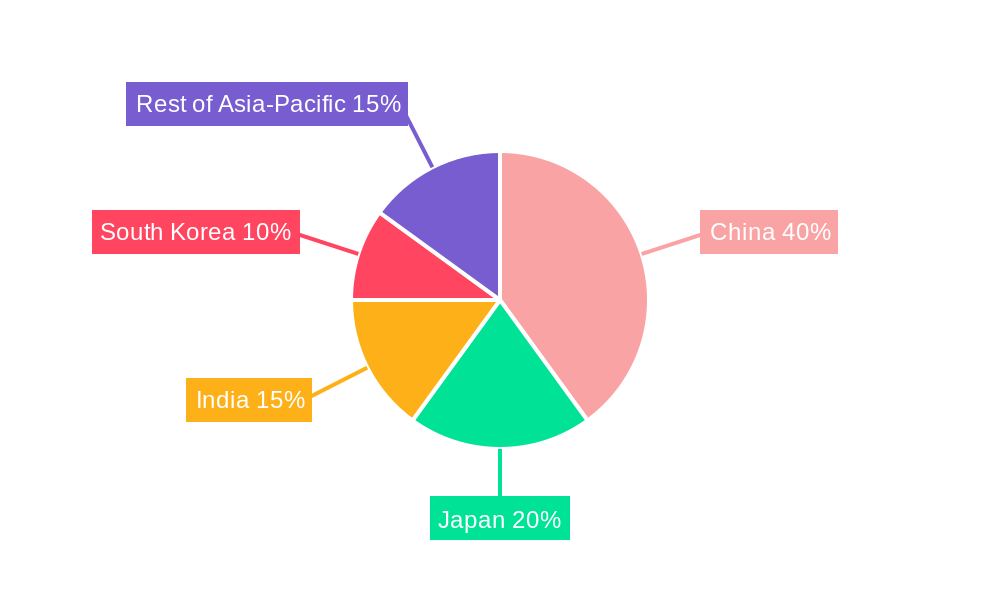

Dominant Markets & Segments in Asia Pacific Satellite Manufacturing and Launch System Market

China currently dominates the Asia Pacific satellite manufacturing and launch system market, holding the largest market share in both satellite manufacturing and launch system segments in 2025. This dominance is attributable to:

- Key Drivers in China:

- Massive government investment in space exploration and technology.

- Well-established domestic manufacturing capabilities.

- Strong focus on both military and commercial applications.

Other significant markets include India, Japan, and South Korea, each contributing substantial market share and demonstrating significant growth potential. The Military segment is currently the largest end-user segment, owing to substantial government investments in defense applications. However, the Commercial segment is anticipated to show faster growth in the forecast period. Similarly, the Satellite segment currently dominates over the Launch System segment, although both are projected to experience significant growth in the coming years.

Asia Pacific Satellite Manufacturing and Launch System Market Product Innovations

The Asia Pacific satellite manufacturing and launch system market is witnessing rapid product innovation, driven by advancements in miniaturization, improved propulsion systems, and the adoption of advanced materials. Smaller, lighter satellites are becoming increasingly prevalent, reducing launch costs and increasing deployment flexibility. The development of reusable launch vehicles is significantly lowering the overall cost of accessing space, opening up new opportunities for commercial and research applications. The integration of advanced sensors and communication technologies is enhancing the capabilities and market competitiveness of these systems.

Report Segmentation & Scope

This report segments the Asia Pacific satellite manufacturing and launch system market based on end-user (Military and Commercial) and type (Satellite and Launch Systems). Each segment is analyzed thoroughly, providing insights into its market size, growth rate, and competitive landscape. For example, the Military segment is projected to maintain steady growth due to continued government investment in defense capabilities, while the Commercial segment is expected to exhibit higher growth owing to the expansion of commercial applications such as broadband communication and Earth observation. Similarly, the Satellite segment will continue to drive substantial revenue, while the Launch System segment is expected to witness growth fueled by the increasing demand for satellite launches.

Key Drivers of Asia Pacific Satellite Manufacturing and Launch System Market Growth

The growth of the Asia Pacific satellite manufacturing and launch system market is driven by a confluence of factors. Firstly, increasing government spending on defense and space exploration programs provides significant impetus for growth, particularly in China and India. Secondly, the rising demand for high-bandwidth communication and data services in the region is driving investments in satellite-based infrastructure. Thirdly, ongoing technological advancements, such as the development of more efficient and cost-effective satellite platforms and launch systems, are further propelling market expansion.

Challenges in the Asia Pacific Satellite Manufacturing and Launch System Market Sector

The Asia Pacific satellite manufacturing and launch system market faces several challenges. These include high initial investment costs for satellite development and launch, the complexities of regulatory frameworks across different countries, and the ongoing risk of space debris impacting operational satellites. Supply chain disruptions and competition from established and new market entrants also pose considerable challenges. The lack of skilled workforce in specific technological areas can further restrict the market growth.

Leading Players in the Asia Pacific Satellite Manufacturing and Launch System Market Market

- China Satellite Communications Co Ltd

- China Aerospace Science and Technology Corporation

- Radio Amateur Satellite Corporation

- Transpace Technologies Pvt Ltd

- Antrix Corporation Limited (ISRO)

- Dhruva Space Private Limited

- Satrec Initiative Co Ltd

- IHI Corporation

- Mitsubishi Heavy Industries Ltd

Key Developments in Asia Pacific Satellite Manufacturing and Launch System Market Sector

- January 2023: Successful launch of a new generation of communication satellites by China Aerospace Science and Technology Corporation.

- March 2024: Strategic partnership between Antrix Corporation Limited and a private company for joint satellite development.

- June 2024: Announcement of a new satellite manufacturing facility in India.

Strategic Asia Pacific Satellite Manufacturing and Launch System Market Outlook

The Asia Pacific satellite manufacturing and launch system market presents significant growth opportunities in the coming years. Continued government investment, increasing commercial demand, and technological advancements are poised to drive substantial market expansion. Strategic partnerships, collaborations between private and public entities, and investments in R&D will be crucial for capitalizing on these opportunities. The emergence of new space players and growing adoption of NewSpace technologies will also shape the future landscape of the industry.

Asia Pacific Satellite Manufacturing and Launch System Market Segmentation

-

1. Type

- 1.1. Satellite

- 1.2. Launch Systems

-

2. End User

- 2.1. Military

- 2.2. Commercial

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. South Korea

- 3.4. Australia

- 3.5. Japan

- 3.6. Rest of Asia-Pacific

Asia Pacific Satellite Manufacturing and Launch System Market Segmentation By Geography

- 1. China

- 2. India

- 3. South Korea

- 4. Australia

- 5. Japan

- 6. Rest of Asia Pacific

Asia Pacific Satellite Manufacturing and Launch System Market Regional Market Share

Geographic Coverage of Asia Pacific Satellite Manufacturing and Launch System Market

Asia Pacific Satellite Manufacturing and Launch System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Military Satellites Account for a Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Satellite Manufacturing and Launch System Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Satellite

- 5.1.2. Launch Systems

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Military

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. South Korea

- 5.3.4. Australia

- 5.3.5. Japan

- 5.3.6. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. South Korea

- 5.4.4. Australia

- 5.4.5. Japan

- 5.4.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia Pacific Satellite Manufacturing and Launch System Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Satellite

- 6.1.2. Launch Systems

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Military

- 6.2.2. Commercial

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. South Korea

- 6.3.4. Australia

- 6.3.5. Japan

- 6.3.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. India Asia Pacific Satellite Manufacturing and Launch System Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Satellite

- 7.1.2. Launch Systems

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Military

- 7.2.2. Commercial

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. South Korea

- 7.3.4. Australia

- 7.3.5. Japan

- 7.3.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. South Korea Asia Pacific Satellite Manufacturing and Launch System Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Satellite

- 8.1.2. Launch Systems

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Military

- 8.2.2. Commercial

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. South Korea

- 8.3.4. Australia

- 8.3.5. Japan

- 8.3.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia Asia Pacific Satellite Manufacturing and Launch System Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Satellite

- 9.1.2. Launch Systems

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Military

- 9.2.2. Commercial

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. South Korea

- 9.3.4. Australia

- 9.3.5. Japan

- 9.3.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Japan Asia Pacific Satellite Manufacturing and Launch System Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Satellite

- 10.1.2. Launch Systems

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Military

- 10.2.2. Commercial

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. South Korea

- 10.3.4. Australia

- 10.3.5. Japan

- 10.3.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Rest of Asia Pacific Asia Pacific Satellite Manufacturing and Launch System Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Satellite

- 11.1.2. Launch Systems

- 11.2. Market Analysis, Insights and Forecast - by End User

- 11.2.1. Military

- 11.2.2. Commercial

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. India

- 11.3.3. South Korea

- 11.3.4. Australia

- 11.3.5. Japan

- 11.3.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 China Satellite Communications Co Lt

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 China Aerospace Science and Technology Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Radio Amateur Satellite Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Transpace Technologies Pvt Ltd

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Antrix Corporation Limited (ISRO)

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Dhruva Space Private Limited

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Satrec Initiative Co Ltd

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 IHI Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Mitsubishi Heavy Industries Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.1 China Satellite Communications Co Lt

List of Figures

- Figure 1: Asia Pacific Satellite Manufacturing and Launch System Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Satellite Manufacturing and Launch System Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Satellite Manufacturing and Launch System Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Asia Pacific Satellite Manufacturing and Launch System Market Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Asia Pacific Satellite Manufacturing and Launch System Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Asia Pacific Satellite Manufacturing and Launch System Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia Pacific Satellite Manufacturing and Launch System Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Asia Pacific Satellite Manufacturing and Launch System Market Revenue billion Forecast, by End User 2020 & 2033

- Table 7: Asia Pacific Satellite Manufacturing and Launch System Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Asia Pacific Satellite Manufacturing and Launch System Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Asia Pacific Satellite Manufacturing and Launch System Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Asia Pacific Satellite Manufacturing and Launch System Market Revenue billion Forecast, by End User 2020 & 2033

- Table 11: Asia Pacific Satellite Manufacturing and Launch System Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Asia Pacific Satellite Manufacturing and Launch System Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Asia Pacific Satellite Manufacturing and Launch System Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Asia Pacific Satellite Manufacturing and Launch System Market Revenue billion Forecast, by End User 2020 & 2033

- Table 15: Asia Pacific Satellite Manufacturing and Launch System Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Asia Pacific Satellite Manufacturing and Launch System Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Asia Pacific Satellite Manufacturing and Launch System Market Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Asia Pacific Satellite Manufacturing and Launch System Market Revenue billion Forecast, by End User 2020 & 2033

- Table 19: Asia Pacific Satellite Manufacturing and Launch System Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Asia Pacific Satellite Manufacturing and Launch System Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Asia Pacific Satellite Manufacturing and Launch System Market Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Asia Pacific Satellite Manufacturing and Launch System Market Revenue billion Forecast, by End User 2020 & 2033

- Table 23: Asia Pacific Satellite Manufacturing and Launch System Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Asia Pacific Satellite Manufacturing and Launch System Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Asia Pacific Satellite Manufacturing and Launch System Market Revenue billion Forecast, by Type 2020 & 2033

- Table 26: Asia Pacific Satellite Manufacturing and Launch System Market Revenue billion Forecast, by End User 2020 & 2033

- Table 27: Asia Pacific Satellite Manufacturing and Launch System Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: Asia Pacific Satellite Manufacturing and Launch System Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Satellite Manufacturing and Launch System Market?

The projected CAGR is approximately 31%.

2. Which companies are prominent players in the Asia Pacific Satellite Manufacturing and Launch System Market?

Key companies in the market include China Satellite Communications Co Lt, China Aerospace Science and Technology Corporation, Radio Amateur Satellite Corporation, Transpace Technologies Pvt Ltd, Antrix Corporation Limited (ISRO), Dhruva Space Private Limited, Satrec Initiative Co Ltd, IHI Corporation, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Asia Pacific Satellite Manufacturing and Launch System Market?

The market segments include Type, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.79 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Military Satellites Account for a Major Market Share.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Satellite Manufacturing and Launch System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Satellite Manufacturing and Launch System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Satellite Manufacturing and Launch System Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Satellite Manufacturing and Launch System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence